Greetings!

Today I want to talk about public investment. I’ll tell you about the very concept of what this type of investment is. What are these investments mostly aimed at? What kind of return is expected from them and can they even be profitable?

I will show you the priority areas of investment for the state and what tools it uses. In addition, I will consider the specific features of government financing in our country and ways to achieve greater efficiency in this matter.

What are they and why are they needed?

Part of the monetary, material and other assets of the state that make up its budget constitutes public investment. Various funds belonging to other internal sources are also sent here.

Such cash injections help enterprises stay afloat, develop and maintain the economic power of the country, and solve social problems.

Countries are the largest corporations with huge financial assets, which are formed by borrowed and budgetary capital, and funds from extra-budgetary funds. The investment of this money in the domestic and foreign economy is called public investment activity.

What is the state investment policy based on?

Public investment is financed by taxes levied and net profits received by national companies and enterprises. To attract them, the government is developing targeted programs and projects that make it possible to receive a grant for the implementation of any activity.

Areas of public investment

Government investment is a necessary measure, especially in times of decline and financial instability.

Budgetary investments are needed for the development of all spheres of the country’s life, regardless of whether they have commercial interest or not.

The main characteristics of the state are the safety of life of its citizens, the development of the social sphere and economic well-being.

Accordingly, the most significant areas of public investment:

- environment protection

- development of the country’s scientific potential (development of education to train qualified specialists, advanced training of existing workers, creation of scientific centers for the development of new technologies, etc.)

- creating a prosperous social and cultural environment for citizens

- maintaining the defense capability of the state and the safety of its residents at the proper level

- ensuring sufficient levels of housing construction and infrastructure projects.

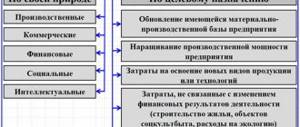

Public investment is, in essence, government spending on creating and maintaining the economic power of the country. It can be:

- capital investments in real estate, land, intangible assets.

- loans to individuals, organizations and government agencies for the implementation and development of private projects.

- investments in securities, shares and shares in various funds.

- transfers to departments and ministries for the implementation of government projects.

Any investment activity, even government, must be subject to some kind of plan. This means that a sound investment policy must be developed.

Public investment policy must include measures to improve the investment climate, increase investment attractiveness, increase investment activity and stimulate the efficiency of investments made within the country.

Characteristics and signs

Distinctive features of public investment: these are large amounts of investment required to launch an approved project. GIs have a certain cyclicity.

As a rule, these are open systems implemented by customers/developers and other counterparties (designers, contractors, banks, material suppliers, etc.). Assets are attracted to the real sector of the economy and allocated for specific purposes.

Main features

The main features of this type of investment, which distinguish this method of investing money from others, are:

- Budgetary funds are the main source of their education;

- They are performed on a return basis, i.e. with subsequent repayment of funds (for example, a loan);

- They are managed by the state, including the procedure for presentation and implementation;

- The amount of investment funds is subject to the adopted budget;

- The targeted expenditure of invested capital is carried out under the strictest control;

- Investments are protected by the state treasury. This is manifested in: protection of investor property rights; after paying all taxes, the ability to freely transfer funds to foreign accounts (in the case of foreign investors); the right to independently dispose of income received from investment activities, etc.

Funds are invested in economic development to equip production and develop the country's economy. Invested funds also play an important role in improving various kinds of government projects and programs. Examples of public investment in various areas are the following forms:

- Cultural – opening children’s and youth sports schools, financing tournaments and competitions;

- Social – maintaining a pension fund, transferring funds to medical, educational institutions, etc.;

- Scientific – construction of technology parks, investing in high-tech production;

- Infrastructure – construction and major repairs of roads;

- Defense - modernization of the military industry (development of the latest military equipment, weapons, uniforms, etc.);

- Construction – financial assistance in the construction of new houses (preferential loans for obtaining new housing);

- Ensuring internal security - financing all departmental structures (police, traffic police and others);

- Protecting the environment - creating nature reserves, recycling waste and others.

Public investment - where is it going?

First, it’s worth understanding where the money from government investments goes. You need to understand that anyone cannot get money just because they wanted it. The state primarily invests in socially significant sectors. If you come to an official with a project that does not currently belong to this category, you will be refused. Indicative is the fact that the commercial component is paid attention to in the very last place. Let's now take a look at what industries are considered significant at the moment in Russia:

- Small business. One of the main priorities set by the state is the development of local business and small companies. According to the country's leaders, this will create a so-called middle class, and will also increase tax revenues.

- Agriculture. It is no secret to anyone that villages are gradually dying, primarily due to lack of finance. Public investment is designed to solve this problem. The development of agriculture is also one of the main priorities of the country's economic policy.

- Ecology . Various environmental programs have appeared relatively recently and projects are still poorly funded. As a rule, we are talking about the modernization of large industrial enterprises in order to reduce the release of harmful substances into the environment.

- Projects aimed at improving the quality of life of socially disadvantaged segments of the population. First of all, these are disabled people and orphans.

These are areas that are relevant throughout the country, but do not forget that at the regional and local level it is also possible to obtain funding through public investment.

If we consider directions for individual investments, then we should give preference to reliability and stability. Real estate, namely foreign real estate, combines these qualities. Now there are a lot of attractive apartments or houses, at low prices, but with enviable investment attractiveness. For example, we recommend that you read the material “BUY REAL ESTATE IN THAILAND”. By the way, speaking about Thailand, we can answer that this country can be considered for permanent residence, of course it has its own characteristics, but where they are not. “MOVING TO THAILAND FOR PERMANENT RESIDENCE – WAYS OF LIVING, PROS AND CONS” will tell you about the secrets and realities of this country.

Hayes' experience

When we first conceived of Hayes (more than three years ago), we had our own funds, team and capabilities.

Therefore, we initially focused not on raising money, but on finding a partner. Our product cannot exist without a banking license and infrastructure, so this was much more important. VTB competition - come up with a name for the voice assistant and win an Iphone 12

After negotiations with potential partners, we chose Modulbank: it suited our criteria more than others. After we decided, we had the first clear calculations: how much money is needed to launch.

The bank provided us with the infrastructure and its license. The technical readiness of the partner allowed us to calculate the costs of the team. We quickly determined what specialists were needed, how much it would cost to find them and how long it would take.

We calculated that about 100 million rubles are needed to launch the project. A significant part of this money is allocated for development, team, infrastructure, servers and support within the company. At first, you don’t make money, you just develop a product. After launch, team costs will only increase.

Our relationship with Modulbank has two sides:

- Affiliate. Together we want to earn money using the RevShare model - this is a model where a partner receives a percentage of the company’s income.

- Investment. Our situation is unusual: it doesn’t often happen that a bank is both a partner and an investor. If we are talking specifically about fintech, it is easier to get money not from a bank. You can receive money from anyone, and negotiate with the bank as with a partner.

Types and forms of government investment

The forms of public investment are:

- preferential investment loans

- tax breaks and benefits

- direct investment from the budget

- investments from state companies and institutions of various forms and levels (ministries, extra-budgetary funds, etc.)

Government investments in Russia

Today Russia has an unbalanced economy. The lion's share of all state budget revenues is profit from the sale of energy resources and raw materials.

This economic structure requires recovery.

In addition to the energy and raw materials sectors, others need to be developed. The way out of this situation will be to increase the overall investment attractiveness of Russia and improve its investment climate.

The development of leading sectors of the economy requires funds. The state urgently needs to develop measures to attract private capital into the economy by creating preferences and benefits for investors.

Today, public investment in Russia means financing the defense complex, resolving social obligations to citizens, and maintaining the salaries of public sector employees at the proper level. Blind investing in emerging sectors of the economy is in short supply.

The development of direct public investment in Russia is entrusted to the Direct Investment Fund, which it copes with with varying degrees of success.

The main problem is the restriction regarding the participation of at least one foreign investor in the project. In other words, the fund is not able to invest in an attractive investment project if foreign capital does not participate in its implementation.

Budgetary investments in Russia are sorely lacking, although there are plenty of sources of formation. The government of our country is reluctant to invest in the economy, if we consider the situation as a whole.

In order to change this and the flow of budget investments to flow into our economy, the country’s leadership needs to develop priority directions for development and follow them using all available tools to attract capital.

How to calculate how much money you need

Decide on the global goal of the company. Do we want to sell it in 6 years? Or do we want to do this business and grow, capture markets? If these questions are answered, the next stage will immediately become clear - where the money will go and how much it is needed.

If you think you'll run out of money in six months, it's time to panic. Any business requires the ability to calculate and manage risks. If you admit that there are risks, then it will be easier to calculate the costs.

At a basic level, the cost structure consists of two parts: something to sell and something to sell.

At the first stage, money is needed to create the product. For this, as a rule, team and office expenses are considered. The most common mistake is to pay little attention to these calculations. Many people think: “We need 3.5 great developers with these salaries.” This is no longer true: to find these specialists, it can take 3 times more money than to pay for six months of their work.

In the second stage, the company incurs the costs of selling the product. You need to calculate how much money you need in order to reach operating profit and feed yourself, and not spend the investor’s money. Multiply the total amount by two: everything always doesn’t go as you planned. And based on this, you need to calculate the costs.

Objects of budget investment

The main objects of budget investments are state (municipal) unitary enterprises, autonomous and budgetary institutions. The state places investments on them in the form of a state order.

The object of public investment belongs to the state, so investments increase the capital of these objects, most often by increasing their authorized capital. These investments are made under the heading “Budget investments”. Ultimately, the state retains ownership of the invested capital and records the increase in state assets in the budget.

Subsidies in the form of investments do not legally relate to “pure” investments and are considered only as a form of state support for the investment activities of objects, which are state-owned enterprises and institutions.

State investments are also offered to non-state investment objects. Such investment, under the article “Budget investments to other legal entities,” has become widespread in connection with the emergence of public-private partnerships. In the case of investing in such objects, budget investments become part of the authorized capital of the new enterprise. This means that the state acquires the rights to manage the created enterprise and acquires the right to receive income from its activities. Management of such an enterprise may be transferred by the state to one of the lower-level government structures, regional or municipal.

When should you invest your own money, and when should you invest someone else’s?

You need to invest your funds if you have calculated exactly how much it costs to create and launch a product, and you know: these resources are enough to take market share at the initial stage. Or it may happen that attracting external money at this stage of development turns out to be a cheap sale of a share. In this case, you also need to use your money.

The advantages of using your own money: you are completely independent. Cons: your own money is always not enough, especially if you are building something serious.

As a rule, foreign investments are attracted at the stage of company scaling. For example, money is needed to capture market share from competitors. You will do this with your own money for 5 years, and if you attract investors - 2 years. But if you understand that scaling does not depend on money, but on other factors, and you feel good on your own, then you should not attract external funds. Pros - you can start/move to a new level faster. Disadvantages - you will have to be responsible for the money spent.

How to receive government investment - step-by-step instructions

Now let's talk about one very important factor - receiving government investment for small businesses. Any beginning entrepreneur has two options for obtaining them:

- Receiving subsidies from the state to open your own business. Employment centers do similar things in our country. Depending on the region, the amount ranges from 50,000 to 90,000 rubles.

- Receiving a grant for the development of your own company. The amount of these investments is already up to 300,000 rubles. The Ministry of Economic Development is dealing with this issue.

Of course, the second option is the most profitable for the entrepreneur. That is why we will look at it in more detail below.

Stage one - study of standards

The program is federal and operates throughout the country, but adjusted for regions. For the same reason, implementation is entrusted to regional bodies. And in detail, the program of one region will most likely differ from the program of its neighbor.

Be sure to study what types of business activities fall into this program before registering a legal entity. Otherwise, you simply will not be able to participate in the competition. As a rule, the following types of activities are allowed:

- construction;

- Agriculture;

- social and communal services;

- manufacturing industries.

Most often, the list is supplemented with several more items, but it is constantly changing in each region. Therefore, studying the current regulations is mandatory.

Stage two - collecting and submitting documents

The next step is submitting documents to the Ministry of Economic Development. Here it is necessary to take into account one very important factor - many documents really have a very limited amount of time. Therefore, they must be collected as soon as possible.

What you need to collect:

- First of all, a certificate of registration of a legal entity. It is best to register as an individual entrepreneur, as this will simplify the issue of obtaining further documents. Plus, not all regions allow LLCs to participate in the competition.

- Identity card and individual taxpayer number. There should be no problems with this; if for some reason the latter is not available, then you need to contact the tax service to obtain it.

- Extract from the Unified State Register of Legal Entities. It is worth noting that it is valid for 30 days.

- Certificate from the tax office confirming the absence of debts. This document is valid for only 10 days.

- Certificate from the pension fund confirming the absence of debts. It is recommended to take this document on the day of application.

- Business plan. We will talk in more detail about what it is and what it should look like a little later.

- Bank details. The money needs to be transferred somewhere.

Since your legal entity has only just been opened, there should be no problems with obtaining certificates and documents.

Stage three - consideration of the application

So let's look at the process of selecting applications that will receive funding. Again, the process may proceed differently in different regions, but the main criteria can be identified:

- Job creation. The more workers you can employ in your enterprise, the better for the state. This means that you have more chances to receive a grant.

- Age. Preference is given to entrepreneurs under 30 years of age.

- Own financing. The more money you invest in the project, the greater the chance of receiving a grant.

And in fact, these are all the main criteria. Some regions may have priority areas for action, but this needs to be determined locally.

The financing process itself can take up to six months, it all depends on the work of specific people on the ground.

How to choose a country for international foreign investment

Why do international investments bring significant returns? Firstly, they provide a fairly wide choice of where to invest money, which means you can always find the most profitable option. Secondly, it is always possible to direct international investments to places where the risks are lower and the probability of currency growth is greater. Because different countries develop unevenly, well-targeted international investment can bring different returns, and at different speeds.

Of course, when planning international investments, it is important to understand that in this way money from the country is sent abroad, and therefore it is very important to choose a reliable option that can definitely return and increase the amount invested. In this regard, there have long been criteria that allow us to assess how reliable international investments are in a particular case.

Among such criteria for international investment, the following are common:

- optimal balance between income and risk prospects;

- high level of profitability with certain risks;

- minimal risks at a specific level of profitability.

Having studied these criteria, an international investor is already able to draw the first conclusions about how promising foreign investments are in a particular country. But to make a final decision, a more in-depth analysis will be required, where it is worth paying attention to the following:

- what is the interest rate;

- for how long will the investments be made, given that long-term projects are more profitable;

- what is the required minimum investment amount;

- what is the liquidity of assets;

- are there any risks associated with currency dynamics;

- are there any interest rate risks;

- Are there any risks in dealing with securities?

- what costs the transaction may bring;

- how much the applied tax system will affect income;

- whether international investments may suffer from government inflation.

The next step required to decide on international investment is to assess the prospects of the company itself. It is important to analyze how likely the following scenarios are:

- The "cannibalization" effect. It lies in the fact that the goods of one manufacturer begin to compete with each other. This leads to a decrease in supplies to international markets. Investments will be used to cover financial damage.

- The effect of additional sales. May be caused by additional demand arising from international investment.

- The effect of commissions and royalties. It is important to take into account here that they will be positive flows for parent organizations and negative flows for international investments. The amount of commissions and royalties should be taken into account as a positive value in the analysis.

Only by considering all these criteria can an international investor come to a conclusion about how profitable international investment is for him. But it should be borne in mind that all these factors are far from the only ones worth paying attention to.

International investments may not be profitable at all due to the difficult political situation in a particular state, and unstable currencies may collapse. Therefore, in each situation, before making international investments, it is worth taking a comprehensive look at the situation, making forecasts and deciding for yourself how profitable this activity is in this case.

Read the article: Foreign trade risks

Can government investments be profitable in principle?

A significant part of the funds is invested in promising and profitable projects, which also provide for a certain share of state ownership. These are military developments, economic transformations, agricultural development, and real estate construction. Such public investments pay for themselves in 5–10 years and can generate profits in the future.

Examples include the Talvar naval frigates supplied to India, the Fuzhou destroyers for China (each costing $500–700 million), and the exported Be-200 amphibious aircraft. This is the construction of the Nokian Tires and Toyota factories in the St. Petersburg region, the international business center, the Bureyskaya hydroelectric station, the Amur and M11 highways, high-speed railways and the Crimean Bridge.

Check list

- Determine what kind of help you need from an investor.

- Create a portrait of a suitable investor.

- Analyze the market and choose an investor who fits your profile.

- Calculate the costs needed to launch a product and first sales

- In your project presentation, show your ambitions: tell us how you will conquer the market.

- Calculate three scenarios for the development of events: pessimistic, normal and optimistic.

- Present the team, not the idea.

Photo: Billion Photos, Shutterstock

Procedure for receiving state assistance

Investment from budgets of all levels is carried out after the conclusion of government contracts. The state, acting as an investor, is interested in the effectiveness of the project it finances. The effect does not have to be to make a profit.

The effectiveness of investments can be proven with the help of a feasibility study - a serious document with detailed calculations of where each ruble is sent (directions of investment), what effect it will bring (social, economic, environmental, budgetary, etc.) and when it will come back (payback period of the project ). Without such justification, it is impossible to receive government money.

Government contracts are concluded for:

- design and survey work,

- construction,

- reconstruction,

- restoration,

- technical re-equipment,

- acquisition of an object.

Funds from the budget are sent to government customers (government bodies) or organizations to which government agencies have transferred their powers as part of concluding a special agreement or decision (act). These authorized persons are:

- State corporations and companies that will invest budget money in facilities. And the latter will then become the property of the Russian Federation.

- Legal entities whose share in the authorized capital belongs to the Russian Federation. Objects financed by the state will then be transferred as a contribution to the authorized capital of such an enterprise.

For example, under a government contract for the construction of a launch complex at the Vostochny cosmodrome, the customer is the Directorate of the Vostochny cosmodrome, and the contractor to whom the authority to carry out the order is transferred is the Kazan production and construction association.

The agreement must contain:

- investment purpose;

- the volume of investments distributed by year and for each financed object;

- name of the object, its capacity;

- period of construction (reconstruction) or acquisition of the object;

- rights and obligations of the parties to the transaction;

- responsibility;

- the procedure for conducting inspections by the customer (government agency).

How to look for investors who will give money to start a project

The easiest way to search is through social networks or through friends. This is not as difficult as it seems if you approach the search systematically.

Step 1: Prepare. You need to understand what you need and understand the global goals of the company. Then you will know what to ask the investor. For us, the most important two points were:

- Readiness of technological infrastructure. The longer it took us to integrate with the bank, the more money we would need.

- The second is the serviceability and quality of financial monitoring. It is important that the bank is reliable and the license is not revoked.

Step 2: create a portrait of an investor that is right for you. Typically, entrepreneurs believe that investments in a company can only be financial. In fact, investments can be different.

There are two main types of partners: those who can become a key customer for the business, and those who can help technologically.

It is necessary for the investor to accompany you and provide legal/personnel support. Look for someone who has invested in relevant companies. If you understand that you need help with your first sales, see if the investor has companies in his portfolio that can become anchor clients of your startup. For example, you create a logistics automation service that calculates routes. It would be great if the investor’s portfolio includes a project that is engaged in large-scale delivery or is already providing services using such technology.

If an investor is ready to give you money, then he will share his experience. Here it is important not to cross the line: on the one hand, you need to work on trust, on the other hand, the investor should not get involved in your business.

Step 3: Analyze the market. What funds and business angels are there, who invests and where? You need to choose the investor that suits you best. Most often, either they found us themselves, or we reached out to the right people through personal connections. If there are no connections, there are specialists on the market who can help you find an investor for a percentage of the deal. These are those who are on close terms with business angels and funds: they will introduce you to a potential investor or recommend a project to him.

Budget financing from tax revenues

Up to 40% of the gross domestic product passes through the budget of developed countries. In Russia, the majority of budget revenues come from tax payments. They account for 84% of all receipts.

Taxes are gratuitous mandatory payments made by business entities through the alienation of part of their property in favor of the state.

Different types of taxes go to budgets of different levels. If there is a surplus of funding, funds can be distributed between budget levels in the form of subsidies.

The federal budget receives taxes from the real sector of the economy in the form of income taxes. This includes excise taxes on alcohol, alcoholic products, tobacco products, as well as cars, excise taxes on gasoline, and so on. The federal budget receives one hundred percent of the indirect tax on the sale of products and services. Mineral extraction tax is also assessed, including mandatory payments related to this activity. One hundred percent of the water tax goes to the federal budget. All mandatory payments related to the use of public services by citizens and business entities of the country are sent to the general state budget.

Regional budgets receive funds from income taxes, gambling, and transport. One hundred percent tax on the income of foreign citizens and eighty-five percent taxes on the income of residents of the country. Excise taxes on certain types of products, taxes on the extraction of minerals in the form of diamonds, and more.

Local budgets are mainly financed from the federal and regional budgets, as well as from state duties and direct tax deductions intended to finance them. These include land tax, advertising tax, gift and inheritance tax, and mandatory license fees.

Government investment in industry

The main objectives of investing financial resources in the industrial sector of the economy of the Russian Federation are import substitution, the production of our own expensive products that will be able to satisfy the needs of the citizens of our country, and, as a result, the creation of new jobs. The main strategic objective of the state is to ensure direct investment, because They are the ones who are able to eliminate the most important problems in the state’s economy.

An example is Russian-Chinese cooperation in the Far East, where the development process is quite active. To date, 22 projects are being implemented there, in which Chinese support amounted to $3 billion. If translated into percentage terms, the share of Chinese investments in their total volume is 22%.

As for small and medium-sized businesses, demand is created with the help of government investments. Thanks to long-term lending to the private sector, it is possible to accomplish the following tasks:

- Raise the standard of living of the people;

- Ensure sales of manufactured products (with the help of investment funds);

- Satisfy citizens' demand for expensive goods.

How to understand that an investor will not take you as a slave

The recipe is very simple. First get into slavery, then draw conclusions and learn to understand people.

You must be able to negotiate. If you don’t have such a skill, the likelihood that you will recruit a good team, be able to rebuild your work, and even more so find a good investor, is close to zero. For me and most of my friends, the ability to determine who is worth working with and who is not came from sad experience.

We didn't run into those who enslaved the team. There were cases when the investor and I did not have the same goals and expectations: the partner was ready to give money, but we needed non-financial help from him.

Everything is learned through communication. Trust is created by results, actions and actions. Most often, disappointment occurs when people talk very nicely, but then do nothing.

Public investment in agriculture

One of the main issues in the development of the country's economy as a whole is attracting investment funds to agriculture. After all, this is a key area of activity on which economic growth and the development of the state as a whole directly depend. However, it is completely unattractive for investment due to the fact that it brings little profit. In addition, this industry has its own characteristics, which also repel potential investors: long payback periods and high risks of losing invested funds due to direct dependence on natural conditions.

One of the key sources of financing for agriculture is public investment, with the help of which new factories, greenhouse structures and complexes are built, as well as the general infrastructure in the regions of the country is improved. Funds invested by the state go to environmental protection, ensuring an optimal standard of living in rural areas, providing farms with working resources and important issues of the agro-industrial complex.

So how do you get government assistance? The state provides subsidies to improve its own economy: the construction of necessary buildings, infrastructure, and in some cases even helps with the acquisition of land - all this is provided by state programs and development funds, which private businesses must qualify for.

And in conclusion, it is worth adding that public investment is of the following types: preferential loans, tax breaks, direct government investments and investments from state enterprises and large organizations (it is engaged in improving direct public investment in Russia. However, its main drawback is that it is not at the legislative level can invest in even the most promising project if there is no foreign cash flow in it.

On public investment using the example of farming:

What are the characteristic features of investments?

Investments play a stabilizing and strengthening role in economic development. The characteristic features of such investments are:

- potential ability to be profitable;

- investment of funds in one form or another by persons (investors) who have their own goals, which may not always coincide with general economic benefits and benefits;

- in the process of investment, the use of various investment resources, characterized by price, supply and demand;

- targeted investment of capital in instruments and investment objects;

- there is always an individual investment period;

- potential risks.

The given characteristics allow us to consider investments as capital investments in all forms with the aim of generating income and achieving other benefits in various objects or instruments.