According to statistics, as of July 2021, the highest rate on bank deposits in Russia does not exceed 9.5% per annum, which is not very much. There are also not many other “passive” ways to save and increase money - for example, the cost per square meter of real estate in the capital has not actually increased for many years.

Therefore, those who want to preserve their finances and, ideally, increase their capital at least a little, today have to turn their attention to the stock exchange. In a certain situation, with the help of investment instruments existing today, it is possible to solve the problem described above. Today we will talk about them.

Note

: the investment methods described in the article are available to people with little experience and do not have millions of assets, they do not imply quick enrichment in the shortest possible time, they have their own, although not very large, risks - this needs to be understood.In addition, to perform the operations described in the topic, you will have to open a brokerage account - this can be done online (it’s free, you can also open a test account with virtual money for experiments and studying trading software).

Making money on investments - traders' game

There are two approaches to making money from investments. There is no clear boundary between them; these are not official terms at all. Nevertheless, all participants can be divided into two groups: traders and investors.

Earnings from traders' investments are somewhat comparable, although they will be offended by such a comparison, with gambling. People come to the stock exchange and make something like bets, claiming, for example, that the price of oil will rise in the near future. And buying shares of oil companies.

Unlike analysts and consultants, traders rarely throw words to the wind; their ideas are confirmed by money, their bets. Another thing is that up to 99 percent of all traders lose sooner or later and leave the capital market forever.

How much can you earn? It depends entirely on the risk taken. If, for example, leveraged lending is used in a ratio of 1 to 10, then a change in quotes by ten percent will either double the capital or send the trader out onto the street to look for a calmer and more stable job.

At the same time, it is traders who ultimately perform a very important function for any trading platform - they provide liquidity.

What is real investment?

However, of course, in general, investment is not a casino or a slot machine hall. They are based on such a fundamental concept as the capital market. In a simple explanation it looks like this. Companies need money for development, on the one hand. On the other hand, there are investors who can provide them on certain conditions. Both come to the capital market and meet each other.

Thus, the investor does not simply invest money in the hope of guessing which securities will turn out to be reliable and will increase in price, but make money by selling their assets for a certain period. Of course, at the same time, choosing for yourself the most suitable offers from those that are on the market. That is, in our case, on the stock exchange.

The investor has a choice: spend everything he has here and now, put it off until tomorrow by placing it in a bank deposit for a certain percentage, or take it to the capital market. On the other hand, borrower-issuers also have the right to find financing that is more suitable. Either get it from the bank as a loan, or borrow it on the stock market by issuing bonds, or invite co-owners by organizing the issue of shares.

Understanding these extremely simple things answers the question of how much you can really earn from investments. This is determined by supply and demand in the capital market. And the money raised must at least be paid back by the real business for which it is raised.

And this means that there is no income of 100 percent per annum or 50 percent per annum, or even a guaranteed 10 percent per annum. Without risk, this will be the refinancing rate, the rest is a payment for the fact that the investor may receive a profit, or perhaps a loss.

Structured Products

Not everyone knows this, but in fact, the risk of stock investments can be managed, even made almost zero.

This can be achieved with the help of so-called structured products - that is, different financial instruments collected in a single portfolio. The brokerage company's analysts select them in a certain proportion to ensure either minimal or near-zero risk when investing on the stock exchange. It works like this: a structured product “collects” assets with low risk and small possible profit and riskier assets, which, under a successful set of circumstances, can bring higher income. The idea is simple - if a risky instrument “does not work” and there is a loss on it, then it will be compensated by the profit from a less risky asset - therefore its volume in the structured product is higher.

For example, 90% of a structured product may be federal loan bonds (OFZ), and 10% shares of a company. We wrote more about the parameters of structured products (terms, levels of capital protection, available instruments, participation rate) in this article.

Here we will briefly say that strategies with structured products are constantly updated, the most relevant ones are presented here. In July-August, you can use several strategies with a capital protection level of 100%.

An example of such a strategy:

It works like this:

- If at the time of redemption of the product the price of the underlying asset (Lukoil shares) is lower than the “Initial price” parameter, then the investor receives back the invested capital in full.

- If at the time of maturity of the product the price of the underlying asset is higher than the “Initial Price”, the investor earns participation in growth plus receives back the invested capital in full.

How to invest without losses

In general, it is impossible to invest without losses, but there is a chance to minimize their likelihood, to make investing a type of passive income rather than risky operations. The fact is that the country’s economy, with certain returns - crises and periods of stagnation, called recessions - nevertheless, as a whole, is growing and developing.

This means that the investor can gradually build a portfolio that will reflect the overall development of the economy, and along with it receive their share of the profits. There is a very simple way, and here is how to do it in practice.

Instead of collecting money, going to the stock exchange, opening an account with a broker and grinding all day long, buying and selling securities, you can do it differently. Decide for yourself, determine what part of your income to transfer into investments and build your portfolio time after time, month after month and year after year.

As a result, the investor will become the owner of assets purchased at the average market price over a long period. As we know, in general, no matter what happens to individual securities and in a given period of time, as a result, quotes will increase over a relatively long period of time. Everything, as they say, is “profit”.

Contents of the concept “exchange”

Have questions about this topic? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

The concept of an exchange has long been rooted in economic literature. The first stock exchanges appeared in Europe back in the Middle Ages, during the formation of capitalist relations. Their appearance was associated with the need to quickly respond to the arrival of large quantities of goods.

Definition 3

An exchange is a regularly functioning and institutionalized wholesale market for homogeneous goods.

On exchanges, transactions are concluded for the purchase and sale of large quantities (usually wholesale) of goods, securities and foreign currency. There are such types of exchanges as commodity exchanges, wholesale exchanges, stock exchanges, labor exchanges.

How to start investing

First you need to choose markets and a broker. There are two approaches, and both of them are better in some ways and worse in others. The first is to open a single account for all instruments at once. Such services are offered by a number of Russian brokers who undertake to serve their clients both in Russia and abroad.

An alternative option is to use the services of local financial institutions. For example, in Russia - VTB, Sberbank and so on on the list. On the American stock market - Merrill Edge, Interactive Brokers, TD Ameritrade and others.

The second way is more reliable if you have knowledge of English. Although, as far as we know, more and more foreign companies speak with clients in Russian.

In order to start making money on investments, you can propose the following action plan.

- First, you need to get your financial affairs in order, pay off expensive loans, etc. Because loan payments will still exceed income from investments even in the most risky and profitable stocks, who would doubt it.

- Second, decide how much of current income an investor can afford to invest—month after month, year after year.

- Thirdly, you need to open a brokerage account. Moreover, proposals for so-called individual investment accounts, individual investment accounts that provide certain tax benefits, are exactly what is needed.

- Fourthly, you must maintain discipline and implement your own financial plan. And study economics so that you know which securities to invest in in the end.

Brokerage account

Open

Description of the official website investfuture ru

Official website investfuture ru Kira Yukhtenko

The functional service will be useful for both beginners and experienced traders. The sections contain news and analytics on the stock and commodity markets, forex, economics and cryptocurrency. The “Broker Rating” will also be useful, where you can find reviews and reviews of trading platforms; data on funds, calendars and quotes are also presented. The main emphasis is on commodity, stock and currency markets.

The educational material on investfuture deserves special attention, in this section “Books on investing” (huge list), dictionaries, topical articles and answers to the most common questions. The founder of the service is Kira Yukhtenko, who is an investor and teacher. He has four higher education degrees in economics and finance. The company was officially registered in 2021 and social media activities launched in 2021.

Which tools to choose

The choice of tools for making money on investments depends on your personal objective situation. The general rule may be this: for a guaranteed low income - bonds, for the prospect of growth, execution of the strategy of gradual formation of the portfolio in question - stocks.

Are there other options? As soon as an investor has money, a queue of people immediately lines up to receive it. Or, to put it mildly, attract. The securities market usually has one main quality: a lot of liquid instruments. If something goes wrong, you can limit your loss and exit.

Are there other good investment options? For example, in real estate. Yes, and this type of investment can bring stable passive income. But there is one thing: liquidity. How long will it take to sell a property during a crisis? What discount will have to be offered to the buyer so that he does not just look at the property, but makes a real deal?

Social media

The author has one of the largest investment channels on YouTube, investfuture, where there are as many as 737 thousand subscribers, and the videos get a good number of views. In the feed you can see thematic videos with market news and personal opinions on movements from the investor:

YouTube channel investfuture of Kira Yukhtenko

- “The Russian market is on the verge of sanctions”;

- “Yellen about the dollar exchange rate and incentives”;

- “Euclidean Window: History of Geometry”;

- “Warning signal for stocks, growth in energy sector”;

- “Where to invest to earn passive income?”;

- “Veon (VimpelCom) shares: is it worth investing?”

- “Trump on the verge of impeachment, WhatsApp drama”;

- “Hope for stimulus, seeing off Trump” and others.

53 thousand people subscribe to the personal Instagram page, 3 thousand participants on the company page (but it is inactive, there are no posts). Large and Telegram channels:

Do you want to look at the top best cappers that you can trust? Sites that pass my personal check and keep honest statistics

Fat Capper – telegram channelVerified

Review

SPORTS-BET24Verified

131

Review

GameSportVerified

Review

CYBER Betting – telegramVerified

Review

Dreambets.ru Passed verification

Review

HOCKEYLINEVerified

Review

STAVKI.CLUBVerified

Review

APEBET.RU Passed verification

Review

TETRABETTested

129

Review

TAIMAUTVerified

111

Review

- InvestFuture (general information on the market) – 184 thousand subscribers.

- IF Stocks (analytics and company reviews) – 99 thousand subscribers.

- IF News (market news around the clock) – 36.6 thousand subscribers.

Comments are open in the VK group (28 thousand members), users can freely communicate on the topic of investments. There are 5 thousand readers on the Facebook page. There are still few subscribers on the Yandex Zen channel (548 in total).

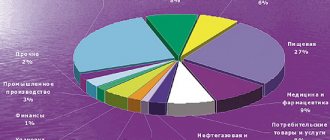

What can you invest in?

There are many options for investing money, and investments differ in their profitability and risk. There is an immutable rule in finance: the higher the return, the greater the risk.

Stock

Investments are usually divided into different classes. Such as investing in stocks, shares and bonds. Shares are equity securities; by purchasing shares, the investor becomes a co-owner of the business and can claim a share in its income in the form of dividends and profit from the growth of quotes.

Bonds

Unlike stocks, bonds are debt instruments. They are the closest thing to a bank deposit. The investor can count on guaranteed coupon payments, if provided for by the issue, and receiving a certain amount at the end of the term. But unlike a deposit in a bank, an investor can sell a bond at any time and receive its market value.

Fund units

In addition to the independent purchase of securities, there are also collective forms of investment using mutual funds. A fund is a single pool of collected investor funds, which is ultimately managed by professionals and used to invest money in the same stocks, bonds and other assets.

Commodities, derivatives

Theoretically, investments also include investments in derivative securities, if they are made not for the purpose of actually buying or selling underlying assets - currencies, gold, oil, metals, etc., but with the aim of making a profit due to changes in quotes. However, this type of investment is one of the riskiest and is hardly suitable for private investors, especially beginners.

Brokerage account

Open

Gold

A separate type of investment with its own specifics is the purchase of precious metals. Unfortunately, while transactions with real metal are subject to value added tax, this type of investment remains undeveloped and not fully in demand.

Currencies, real estate

In the everyday sense, we call it an investment if we buy currency or real estate. Strictly speaking, this is not entirely true. From a theoretical point of view, investments in these assets are not considered investments. Currencies are a segment of money markets, not investment markets, and real estate is generally a completely independent concept. However, of course, from the point of view of an ordinary investor, these are also objects for placing money.

Art objects and more

Another, by and large, exotic area of investment is the purchase of works of art, antiques, etc. However, in order to engage in this type of investment, you need to understand it very well. This type of investment is clearly not for everyone.

Contacts:

- Official website: investfuture ru

- Telegram channels:

- InvestFuture: investfuture

- IF Stocks: @if_stocks

- IF News: @if_market_news

- YouTube channel: InvestFutureRu

- Instagram page investfuture: investfuture.ru

- Instagram page of Kira Yukhtenko: kirapronira

- Facebook: investfuture.ru

- VK Group: investfuture

- Investor’s personal page in VK: iukhtenko

- E-mail for cooperation issues: ru

- Yandex Zen channel: /id/600421c405966372927a1abe

Investment terms

The return on investment depends on the period for which the money is invested. The longer it is, the higher the return an investor can expect. This is due to the fact that we invest money by denying ourselves something right today, here and now. For this, from an economic point of view, some kind of compensation must be paid, depending on the time of our delay in realizing our desires.

The second point is that the longer the period, the higher, unfortunately, the risk to which our investments are exposed. Over a longer period of time, the likelihood of unfavorable developments increases - bankruptcy of the issuer, a change in its financial situation due to changes in demand for its products, the beginning of a recession or even a crisis in the economy as a whole, and so on.

As an illustration, we can cite the dependence of bond yields on the remaining maturities.

Real example of 2021. With a refinancing rate of 5.5%, the following situation has developed in the market. Bonds with a maturity of less than a year 5.2-5.3% per annum. One year 5.3-5.5%. With a maturity of five years 5.6-5.7%. For ten years 6.1-6.2%, and so on.

How much can you earn?

In general, we can say that the world economy is growing somewhere up to five percent per year. Of course, in foreign currency. If someone offers ten percent in rubles and says that this is wonderful, then I would like to remind you of the difference in the exchange rate at the beginning of last year and at its end. The result would be this: 10 percent was earned, but at the same time, due to the gradual decline of the ruble, more than 20 percent was lost. Where is the plus here?

The foreign exchange return from investments in bonds should be slightly lower, but their use is intended only as a reserve, and not for strategic growth.

Is it possible to earn more? Yes, if something important happens: technical progress, a breakthrough in new industries, and the investor finds himself at the very beginning. Those who were the first to appreciate the prospects of a transition from coal to oil in the past are some of the richest clans on the planet today, for example, the Rothschild clan. You don’t have to go far; it was enough to assess the prospects for the development of electronics and, in particular, computer technology thirty years ago - and one can say that a billion is already in your pocket.

Let's look at examples of how much you could earn from different types of investments, let's say, in 2021. The Russian stock market grew, judging by the index, by 13%. Thus, if an investor invested in his portfolio the same securities that make up the Moscow Exchange index, he would receive an income at least twice as high as on a bank deposit.

During the same period, credit institutions attracted deposits at 4-5 percent. And on the bond market for government securities the yield was, as we see from the previous example, 5.2% per annum. For corporate bonds, the yield was even higher - 6-10 percent, depending on the reliability of the enterprises.

Thus, by placing money through a broker on the stock exchange, an investor could count on the bond market, if not twice, but one and a half times more than in a bank . However, of course, such investments are not covered by deposit guarantees.

But, on the other hand, if you buy bonds of the largest Russian companies, then their existence is ensured at least by access to raw materials. Behind them, unlike credit institutions, as a rule, there are real productive assets that generate stable income.