Tinkoff Investments allows anyone to open an individual investment account or a regular brokerage account to trade securities or currencies 24/7, instantly receive information about the rise or fall of a particular security, and so on. But transactions with shares and currencies, like dividends, are profits, and taxes must be paid on profits.

Below we will tell you how to pay tax on income from securities, from dividends, what taxes apply on shares and how you can save on all this.

Why you need to pay taxes

In short - for any income you received . There are 2 main types of income from securities: sales and dividends. Let's consider both options in more detail.

Earnings on securities

Making money on securities is when you bought some assets, waited for their prices to rise, and sold them. If you bought and sold securities on Russian stock exchanges, you need to pay 13% income tax (15% if annual income exceeded 5,000,000 rubles). The tax is calculated as follows: take the sales amount, subtract from it the purchase price, the commission for the sale and purchase, and from the resulting number we calculate 13% or 15%.

There is one caveat with securities purchased on foreign exchanges - you pay income tax of the country in which the exchange is located. Most often, this tax is 13% or lower, if it turns out to be lower, you need to pay the difference “in hand” to the Russian treasury. For US securities there is a separate condition - you must pay 30% income tax on profits from these securities.

You can get around this condition by filing Form W-8BEN, which we discuss below.

Dividends

With dividends, everything happens the same way as with the purchase and sale of shares - you must pay income taxes in the amount of 13%. If you receive income from shares purchased on the stock exchange of another country and pay less than 13%, you need to pay the difference in Russia. By the way, there is an interesting nuance - if you were engaged in the purchase and sale of securities, but somewhere between the purchase and sale you managed to receive dividends - tax will not be deducted from them, 13% of the income tax will be deducted only from the purchase and sale.

How to calculate tax in Tinkoff Investments

Tinkoff Investments allows you to pay taxes automatically, but there are some problems with calculating the amount. As we said above, there are 2 types of accounts: a regular brokerage account and an IIS. If you have an IIS, you will be able to find out the tax amount when you apply for withdrawal. To do this, you need to go to your accounts, select a ruble account, start the transfer and enter the amount - the approximate tax amount will be written at the bottom of the window.

If you have a regular brokerage account, or if you want to get a full report for the year, you can request a statement in the application or personal account, on the “About the account” tab.

Please note that the statement may take several days to be generated, because the statement is provided by the broker; the more transactions and exchanges are involved, the more time it will take to generate the annual statement.

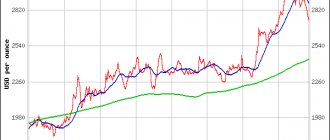

2021 SPO

In 2021, Tinkoff Group conducted an SPO (secondary public offering) on the London Stock Exchange. The bank needed additional capitalization to meet the requirements of the Central Bank of the Russian Federation - Tinkoff was growing too quickly, and part of the loan portfolio turned out to be unsecured.

During the SPO, the bank raised $300 million. Some of the shares were bought by TCS Group managers (for the amount of 780 thousand dollars) and Oleg Tinkov (for 10 million rubles). As a result, Oleg Yuryevich's share decreased from 43.8% to 40.4%, and he still remained the largest shareholder of the group.

In addition, to maintain its financial condition, Tinkoff froze the payment of dividends for 2 quarters, i.e. there were no payments for the 2nd and 3rd quarters of 2019.

In 2021, the group promised to resume payments - and now shareholders can receive dividends for the 4th quarter of 2021.

Automatic tax payment

Does Tinkoff Investments pay taxes for you? Yes, automatically – from the sale of currency, from dividends, and from the purchase and sale of shares. But there is one caveat - if you made a profit from a foreign exchange, and you transferred less than 13% of the profit to the treasury of the state that owns the exchange - the difference must be paid in Russia, and this must be done manually (about how to pay our taxes manually , we will cover in the next section).

The type of automatic tax payment depends on what kind of account you have - a regular brokerage account or an IIS. If you have a regular brokerage account, the broker will bill you the tax amount at the end of the year, and the bank will notify you by SMS. If there is money in the account, it will be immediately withdrawn; if there is no money, the bank will persistently ask you to top up the account in order to write off taxes from it.

If you have an individual investment account, taxes will be written off each time you transfer profits from the investment account to a regular account.

Bank positioning: breaking stereotypes

Why is a trip to a bank branch on duty worse for most people than a visit to the dentist or meeting the parents of the bride/groom? You don’t need to delve into consumer psychology to understand this; just remember real experiences—your own or those of your loved ones. Gray offices in unprepossessing buildings, sparse interiors, employees with forced smiles (although some do not hesitate to be rude to visitors almost from the threshold). A pile of papers, among which it is easy to get lost, like Alice in the rabbit hole. But the most “favorite” thing is, of course, the endless queues in the best traditions of Kafka’s novels.

Tinkoff and Rocketbank played on this stereotypical idea, and quite successfully. The first one set up a direct marketing system, sending out offers to get a credit card by mail. The second offered full-fledged mobile banking - to use a range of standard banking services, you just need to install an application on your phone. At the same time, neither Tinkoff nor Rocketbank have physical branches. Customer service has moved completely online.

So, banks position themselves as follows:

- Tinkoff is an online provider of retail financial services - a simple mobile bank.

Manual payment to the Russian tax office

If you made a profit from foreign securities and paid less than 13% tax, you are required to file a tax return, which will record the profit and the underpaid tax. After this, the remainder will have to be paid to the Russian treasury.

To pay the tax yourself, you need to do 4 things:

- Go to the tax office with your passport and set up a taxpayer account. The nearest tax office can be found here: https://www.nalog.ru/rn77/apply_fts/

- Calculate your tax yourself or request a bank statement. We recommend requesting a statement, especially if you received income in foreign currency. The fact is that such income must be recalculated at the Central Bank exchange rate at the time of the transaction, and it is very easy to get confused in this. Request an extract and wait a little so that you don’t end up owing money to the state or having to issue a refund for what you overpaid.

- Submit your income tax return. This must be done between January 1 and April 30. Go to your personal account, which you created in step 1, request an electronic signature, fill out the declaration, and send.

- Pay income tax. This must be done after filing the declaration, but no later than July 15. You can pay directly from your Tinkoff card in the app.

How to Save Tax on US Stocks - Sign Form W-8BEN

As we said above, if you receive income from foreign investments, you must pay taxes in the country in which you purchased the securities. And there is a problem with the USA - there income is taxed at 30%. But there is a way out - form W-8BEN. This form confirms that you are not a US tax resident, and then your tax is reduced to 10%.

If you have an account with Tinkoff Investments, you can download the form here: https://www.tinkoff.ru/invest/broker_account/about/. You can send it here after filling it out. Please note that the review process takes up to a month, because the broker will send the form to the exchange, the exchange will make a decision, after some time it will come into force - and only then will you receive a reduced tax rate, which the bank will notify you about in your personal account. Please note that if you have already paid 30% tax, the form will not help you, this money cannot be returned. The form must be submitted every 3 years.

After you submit the form and receive a tax rate reduction, you will need to manually pay an additional 3% tax to the Russian tax office.

We wrote about how to do this in the previous section.

Bank brand marketing strategy: are all techniques equally good?

TV advertising

The promotion strategy of Tinkoff Bank consists of many elements, and television ranks first in the hierarchy of marketing tools. In 2021, Tinkoff became the most advertised brand on TV - not a single financial organization in Russia can boast of such a scale of TV advertising.

A typical advertising video looks like this:

statement of the problem (no money for vacation) → simple solution (order a Tinkoff card) → additional benefits (cashback, no commission, discounts, etc.)

Also, famous personalities are involved in advertising campaigns, for example, cyclist Peter Sagan, TV presenter Ivan Urgant.

There is no need to say that the bank uses innovative techniques in TV advertising. Nevertheless, due to simple plots and the use of typical images, it has the necessary impact on the mass audience.

Social networks and other Internet channels

Both banks maintain pages on Vkontakte, Instagram and Facebook, as well as channels on Telegram. In addition, Tinkoff is on the Viber messenger and the Odnoklassniki social network. As for video hosting, banks are presented on YouTube, and Rocketbank is also on Vimeo.

Conventionally, the materials that banks post can be divided into three areas: content, advertising and customer support. On social networks and messengers, companies share news, blog articles, organize contests and sweepstakes (for example, the Tinkoff Girl beauty contest and the Rocketbank photo marathon), and also respond to user comments, both positive and negative.

Social networks are ideal for situational marketing, when a company quickly responds to current news events. For example, “Rocketbank” played on the theme of spinners (“Rocket is spinning - cashback is muddy”) and the Pokemon Go application (bonuses for each Pokemon caught in the branches of the current partner bank “Otkritie”).

Tinkoff also responds to news events, but sometimes the appropriateness of the reaction remains in question, as in the case of the beating of an NTV correspondent on air.

If Rocketbank embodies the principles of content marketing only in a blog and social networks, then Tinkoff has launched an interesting project - Tinkoff Magazine. The online publication regularly publishes interesting topical materials, united by the topic of finance.

Gamification

An interesting technique that has become a marketing trend in recent years is gamification, that is, the application of gaming principles for non-gaming purposes.

Tinkoff periodically organizes quests in big cities. For each completed task, participants receive bonuses, and winners receive valuable prizes. Instructions come in the form of SMS messages.

“Rocketbank” managed to successfully beat what critics consider to be its shortcoming. It is called a “bank for hipsters”, because the bank’s positioning strategy is aimed at a young target audience. In this regard, the company launched the “Hipsteriad” competition. According to the rules, it was necessary to complete tasks - this increased the chances of winning.

In addition, the Rocketbank website has several game projects, for example, “Space Cleaning”. After completing the mini-game, the user learns about the benefits of the rocket card and receives bonuses. He can also share the results on social media pages.

Cross marketing

Increasingly, the creation of a bank’s brand strategy involves cooperation with partners: online stores, retail chains, airlines, shopping centers. In this way, the bank attracts a new audience and increases the level of customer loyalty. For example, if you pay with a card for products or services from a specific manufacturer, the buyer will receive cashback, bonuses or a discount. This technique is used by both Tinkoff and Rocketbank.

FAQ

- On what day is the tax written off if I have a regular investment account? 31th of December.

- If I buy foreign currency on the stock exchange and then transfer it to an account in the same currency, will the tax be written off? No.

- If the shares I bought go up in price, do I have to pay? No, you only pay when you sell them. No sale - no tax.

- If I received income on one securities, withdrew money and paid tax, and then went into the red on other securities, will I be reimbursed for part of the tax? Yes, at the end of the year the broker will compile annual reports, and if it turns out that you overpaid, the overpaid amount will be returned to your account.

Instead of output

Tinkoff does everything to make it as convenient as possible for clients to pay taxes - the broker himself collects the debt, the money is written off automatically, if you have set up an IIS, the tax will be written off with each withdrawal. This allows you not to be distracted by trifles and focus on the main thing - finding profitable investments. If it turns out that you need to do something yourself (pay an additional 3% tax, for example), do not delay, go to the tax office and pay, otherwise problems await you.

Where did it start

The unrest of clients of a financial organization is connected with the name of the creator of Tinkoff Bank, the famous businessman Oleg Tinkov.

During 2021, it was subject to tax claims from the United States.

The media reported that United States tax officials initiated court hearings with Oleg Tinkov.

The entrepreneur is the founder and chairman of the board of directors of the country's largest online bank.

The hearings took place in London. This information was confirmed by TCS Group, which includes Tinkoff Bank, Tinkoff Insurance and Tinkoff Mobile.

Tinkov was brought to the hearings as a private citizen. That is, the hearings had nothing to do with the bank itself.