It is generally accepted in the world that the start of industrial oil and gas production dates back to the 1860-70s. From the very beginning until the 80s, the total recoverable reserves of “black gold” and “blue fuel” literally grew exponentially. Having survived the oil shock caused by the Iranian revolution of 1979, people began to look for new deposits more than ever.

At that time, humanity had no idea that descendants would have to fight fiercely for the oil and gas market, solve the problem of depleting non-renewable resources and, to be on the safe side, look for alternative options so as not to be left with nothing when all reserves run out.

Over the years, dire predictions of the industry's impending death seem more than likely to be true. After all, the fact remains: someday there will come a time when hydrocarbon production will reach its peak, begin to decline and finally “die out.” How much oil and gas reserves are left, and when will they run out?

According to official data

First of all, it is worth noting that global analytical structures present scattered data regarding total hydrocarbon reserves, since resources can be accounted for based on different classifications. For clarity, let’s take as a basis the statistical review of global energy by the transnational company British Petroleum for 2021.

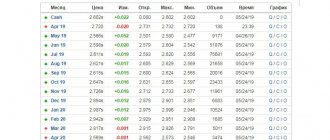

According to BP calculations, the world's proven oil reserves are estimated at 1.734 trillion barrels or 244.6 billion tons. The laurels of the absolute record holder for reserves traditionally go to Venezuela: 303.8 billion barrels lie in the country.

Oil giant Saudi Arabia is slightly inferior to Venezuela - the kingdom's reserves amount to 297.6 billion barrels. Canada closes the top three in terms of oil reserves, with 169.7 billion barrels. Russia, which has 107.2 billion barrels at its disposal, ranks 6th - after Iran and Iraq.

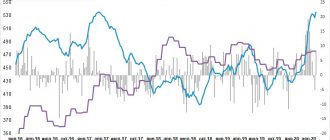

Based on the dynamics of oil reserves over the past 30 years, it is hardly possible to predict the imminent end of the industry. During this period, countries, on the contrary, gradually increased their reserves. According to BP data for 2011, proven oil reserves amounted to 1.653 trillion barrels or 234.3 billion tons.

Just 10 years ago, in 2001, the world resource was estimated at 1.267 trillion barrels. Thus, between 2001 and 2011, the total volume of reserves increased by almost 390 billion barrels. Note that at that time the largest increase in reserves was observed in South America (+226.6 billion barrels), North America (+106.9 billion barrels) and the Middle East (+96.3 billion barrels).

Now let's dig even deeper and look at the data for 1991. Exactly 30 years ago, global recoverable oil reserves amounted to 1.033 trillion barrels or about 145 billion tons. Over 20 years, countries have increased the figure by 620 billion barrels.

Photo: bp.com

The dynamics of proven natural gas reserves over a 30-year period shows a different picture. As of 2021, there are 196.8 trillion m3 in total in the world, while the distribution of “blue fuel” among countries has fundamental differences.

The palm in this segment belongs to Russia: our country contains more than 19% of the world's gas reserves - 38 trillion m3. Iran is almost on par with us with reserves of 32 trillion m3 (16.1%). Qatar was also included in the “Big Three” with reserves of 24.7 trillion m3 (12.4%).

Just like with oil, let's look at the indicators of previous years. In 2010, there were 208.4 trillion m3 of gas in the world. Compared to 2020, there is a clear decline, but in the early years the industry showed growth. Thus, in 1991, the volume of world gas reserves was 131.2 trillion m3, by 2001 the figure increased to 168.6 trillion m3.

Unlike oil reserves, gas reserves have been gaining momentum in other regions. In 1991-2001, the maximum increase was recorded in the Middle East (+28.2 trillion m3), Europe, North and Central Asia (+21.9 trillion m3).

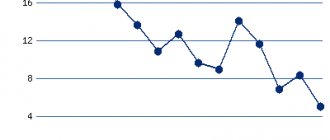

What is uncharacteristic for the oil industry, Russia’s share in the global gas balance is gradually decreasing. For example, if in 1991 the figure reached almost 39%, then by 2001 it dropped to 30%. By 2010, our country’s share fell to 23.9%, and by 2020 - to 19.1%.

How many years will oil and gas last?

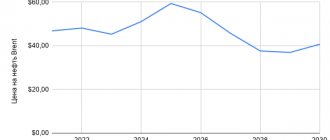

Exaggerating the problem of complete depletion of hydrocarbon raw materials has acquired new meanings in the context of the environmental agenda and the new pandemic reality. Companies are plunging into “green” alternative energy with growing interest; many are planning to completely abandon non-renewable resources. In addition, the quarantine crisis once again reminded the world how vulnerable the industry can be.

It is not surprising that oil and gas are beginning to lose their dominant positions at an accelerated pace. BP experts agree that the oil and gas industry may never return to pre-crisis levels, especially if the global environmental agenda reaches a peak level and the transition to renewable energy becomes a reality.

In one energy market scenario, BP predicts that by 2050, global demand for fossil fuels will fall by 85%.

So, the latest “lifespan” calculations show that even with current consumption levels, 1.734 trillion barrels of oil will last the world only 53 years, and 196.8 trillion m3 of gas will last about 60 years. However, humanity has a chance to delay the impending death of the oil and gas industry for quite a long time.

The lifeline can be the development of new and improvement of currently known technologies for extracting proven hard-to-recover reserves. In addition, industrialists need to develop geological exploration to find new deposits, as well as look for new ways to develop low/unprofitable deposits and oil and gas areas located in difficult geological conditions.

In fact, this is why many people look to the future with a positive attitude and are very skeptical about the growing panic, considering it premature. However, there is also a diametrically opposite point of view. Part of the expert community is confident that hydrocarbon production will become too expensive, and the industry will die before the available reserves run out.

Russian hydrocarbons. Is it worse than it seems?

Russian oil and gas companies are no less anxious due to the depletion of non-renewable resources. There is a good chance that our domestic supplies could run out faster than the global supply.

In 2021, the Accounts Chamber of the Russian Federation calculated that proven oil reserves will be enough for only 35 years of production. And, as depressing as it may sound, approximately 65% of the remaining oil in the Russian subsoil comes from hard-to-recover reserves, which are mainly located in the Arctic. If you don’t take TRIZ into account, our “black gold” will run out in about 20 years.

Photo: gazprom-neft.ru

Moreover, the department notes the high depletion of “mature” deposits, the critically low chance of discovering large deposits in already developed provinces and the inexpediency of production in underdeveloped regions due to the lack of infrastructure.

For natural gas, the forecasts are more optimistic: the “blue fuel” should last for another 50 years. The main risk factors in the gas segment, according to the Accounts Chamber, are the increase in costs of production and transportation to domestic and foreign markets due to the reduction of highly productive and shallow reserves.

The industry may also be negatively affected by the transition to developing fields with difficult natural, climatic and geological conditions, and the remoteness of new gas production areas from fuel consumption centers.

The presented assessment is based on official data. In a report on the state of the mineral resource base in 2015-2019, the Accounts Chamber sharply criticized the existing calculations:

“The increase in oil reserves practically coincides with its production, the increase in gas reserves is lower than the production rate. Hydrocarbon reserves included in the state balance are not confirmed as a result of revaluation, exploration and production. Over 5 years, almost 5 annual volumes of oil production and 9 nine annual volumes of gas production have been written off from the state balance sheet.”

Over a 5-year period, the department recognized 2.278 billion tons of oil and condensate, as well as 6.041 trillion m3 of gas, as non-existent. The effectiveness of geological exploration projects implemented at the expense of the budget is “unreasonably overestimated”: in fact, available reserves are converted into predicted resources with a probability of confirmation of 25-35% or lower.

In particular, the Accounts Chamber calculated that the only contractor for state orders, Rosgeologiya, failed to fulfill 96.2% of contracts in 2014-2019. So the above-mentioned opportunity to delay the collapse of the industry in Russia may turn out to be an impossible dream if the current mechanism for conducting geological exploration is not changed.

By the way: in 2021, the Ministry of Natural Resources calculated the total cost of mineral resources for the first time. The price of all oil amounted to 74.51 trillion rubles, gas - 14.11 trillion rubles.

Needless to say, the Energy Strategy until 2035 recognizes that the Russian oil and gas industry is already going through very difficult times. In the unallocated fund there are practically no large explored hydrocarbon deposits, and there are very few areas with small but economically effective reserves for development.

The 2021 crisis has destroyed hopes for a possible increase in oil and gas reserves. Many geological exploration projects were cut back, and investments were redirected to other purposes. So in the coming years, the oil and gas industry will have to solve the problem of restoring previous capacities, and the fight against depletion of reserves will be put on the back burner.

How long will the black gold of the Latin American sheikhs last?

In terms of quantity and volume of oil production, in tenth position among all powers according to the Bloomberg news resource. The economy of this Latin American “abode of socialism” depends almost entirely on the export of pure raw materials. As reports by local economists show, this income item accounts for ninety-six percent of all Venezuelan profits to the state treasury. It is worth noting that in terms of the amount of raw material in the deposits, the country in question is ahead of the rest - it can boast of forty-six billion tons of raw materials. Every day in Venezuela, the mines produce 2.5 million barrels per day.

Rich people from the shores of the Persian Gulf

in ninth place in the ranking. Their share of global oil sales as a whole is almost four percent. The main consumers of raw materials from the UAE remain the countries of Southeast Asia, India and Japan. As a government report on oil reserves shows, the vast majority of oil produced comes from the emirate of Abu Dhabi - almost 95% of everything produced from rigs throughout the country. The UAE is in no hurry to increase the pace of development of its sources, and therefore produces only two hundred thousand barrels more daily than its previously mentioned South American competitor.

Eighth place in the list of largest oil producers is occupied by another state in the Middle East region - Kuwait. Its oil industry was almost completely destroyed in the early 1990s. Then the state was occupied by Iraqi troops. After the armed intervention of the US military, Iraqi dictator Saddam Hussein ordered a retreat and the accompanying destruction of all Kuwaiti pipelines and drilling rigs. Now this power has been able to fully recover from the terrible damage - to date, 2.8 million barrels of “black gold” are produced here every day.

Purchase of oil and petroleum products: foreign economic supplies

Many countries rich in petroleum products export them to other countries. The main countries carrying out foreign economic supplies are:

- Venezuela. The country, which is a leader in oil production and export, has its own technical problems. The main one is poor quality, the same as that of “black gold” in Syria. In order to use Venezuelan or Syrian oil for the needs of the population, it must be mixed with another - cleaner and of better quality. The second problem is the high cost of production and transportation. The cost of “black gold” is almost $30 per barrel.

- UAE. Global oil sales account for about 4%. The main consumers of oil are the countries of Southeast Asia.

- Saudi Arabia. The export of petroleum products is the country's most important source of income, which ensures the well-being of its citizens. Saudi Arabia mainly exports the product to the USA and China.

The Russian Federation also falls into this category. The main consumers of Russian oil exports are China and Belarus.

Potential leader in oil reserves – USA

The top three largest oil magnates are opened by the United States of America. Three regions are considered the most important for the state’s oil industry: Alaska, Texas and California, where the main production of raw minerals takes place. Like China, the United States also purchases a certain amount of oil in order to create a strategic reserve in case of force majeure. Every day, 8 million barrels of raw materials are extracted here, but with Donald Trump coming to power in the country, progress began towards increasing the daily development of deposits.

East Asian hegemon

China is the country that ranks fourth in the world in oil production. Due to the huge number of residents of the country and the industrial production operating on the territory of the state, the bulk of the extracted raw materials goes to satisfy the country’s own needs. Moreover, the Chinese have to additionally purchase “black gold” from other countries. It is quite logical, given the fact of the immediate neighborhood, that the main partner of the Celestial Empire in this matter is Russia (see Russian-Chinese investment cooperation). China manages to produce 4 million barrels per day.

How much oil does the North American supplier have left?

The seventh position in the ranking is in the hands of Canada, a country that most effectively combines the search and production of oil, both on land and at the bottom of water bodies. The main resource reserves of this state are concentrated in one of its many provinces, Alberta. Active development of the wealth of these places began in those days when the territory was a dominion under the protectorate of the British Empire. Nowadays, Canadian positions in the global energy market have been strengthened due to the exploration of new deposits and the use of innovative methods of mining. An average of 2.9 million barrels are lifted to the surface per day.

Amount of oil and petroleum products in the Russian Federation

Russia is one of the countries with quite large oil reserves. If at the end of 2021 “30.2 million tons of black gold were mined, then in 2021 this figure was already 46.2 million.

Production is mainly carried out in the West Siberian basin (70%), the Volga-Ural basin (20%), and the Timan-Pechersk basin (10%).

Oil exports account for 27.6% of all-Russian supplies and 40% of exports of all minerals. But in general, there is not a very significant decrease in supplies. Thus, the document on the supply of petroleum products to the Republic of Belarus notes that Russia will ship there in 2021 43 million tons of fuel oil, 80 million tons of diesel fuel and 43 million tons of gasoline. But at the same time, the volume of duty-free supplies of light petroleum products will decrease by 6 times.