history of the company

The year of formation can be considered 1991. On November 25, according to Resolution No. 18 of the Council of Ministers of the then USSR on the creation of LangepasUrayKogalymneft, a state oil concern. Several processing companies were merged. In November 1992, a presidential decree on privatization was issued (No. 1403). According to this order, in the spring of 1993, OJSC Oil Company Lukoil appeared on the basis of the state concern.

A year later, with the start of privatization, shares were issued and began to be distributed on the market.

1996 – an important stage of strengthening. enters Shah Deniz, the largest oil production project in Azerbaijan. Now one of the subsidiaries has a 10% stake. The creation of its tanker fleet begins.

1997 - Lukoil Corporation begins production (and preliminary development) in West Qurna, after signing a contract with the Iraqi government. The project was later “frozen” due to the overthrow of Hussein. At the same time, the company is expanding through the acquisition of enterprises in the Russian Federation (Saratovorgsintez, Stavrolen). In subsequent years, several more oil refineries (oil refineries) were purchased.

In the 2000s, the organization turned its attention to overseas corporations and entered the US market. After the purchase of Getty Petroleum Marketing Inc., the Lukoil holding becomes the owner of a number of gas stations in America. And at home, a conflict arises with Sibur over the Kstovo Oil Refinery: Sibur claimed rights to the organization associated with this plant. Having abandoned what they wanted, Lukoil gets the Perm plant.

2002 – construction of a terminal in the port of Vysotsk (Near St. Petersburg) for pumping oil products.

In 2004, only 7.59% of Lukoil shares remained in state ownership, which were sold to ConocoPhillips (a company from the United States) for almost $2 billion. The corporation becomes completely private. Later, gas stations in Western Europe and the USA were purchased from this company, and it itself acquired several more percent of Lukoil shares.

2005 Lukoil becomes the owner of Nelson Resources from Kazakhstan. Puts a gas field in the Yamal-Nenets Autonomous Okrug into operation.

2006 Assets are acquired in Europe, production enterprises are opened in Russia: the northern part of the Caspian Sea.

Over the next three years, enterprises are created with foreign companies. 2007 - with Gazpromneft, 2008 - Italian ERG, 2009 - Norwegian Statoil, wins a competition for important work in West Qurna-2 for hydrocarbon production and returns to Iraq.

Petrochemistry

Oil Lukoil

Subsidiary specializes in petrochemicals and manages petrochemical plants (Budennovsk), Saratovorgsintez and Karpatneftekhim (Kalush, Ukraine). Petrochemical enterprises are also part of the Neftohim Burgas plant in Bulgaria. Lukoil is the largest producer of alkene and acrylonitrile in Eastern Europe. Together with Sibur, LUKOIL-Neftekhim owns a controlling stake.

In 2005, the petrochemical enterprises of LUKOIL-Neftekhim produced 1.8 million tons of commercial products, including 402,000 tons of polyethylene and 128,000 tons of acrylic acid nitrile. In addition, the Bulgarian oil refinery Lukoil Neftochim Burgas produced 372.5 thousand tons of petrochemical products.

One of Lukoil’s most important petrochemical projects is the construction of the Caspian gas chemical complex. The complex will produce a wide range of petrochemical products, including basic organic synthesis products, polyethylene and polypropylene.

Control

For 25 years, President of PJSC Neftyanaya Vagit Alekperov. He also owns about 20% of the company's shares.

The Board of Directors consists of 11 people who are independent directors. This allows you to create an objective opinion on emerging issues. The Council is responsible for determining the group's activities, priorities, long-term and short-term planning strategies.

Committees of the Board of Directors:

- On strategy and investments;

- On audit;

- Regarding personnel (including remuneration).

In 2021, the position of corporate secretary was introduced. It is occupied by Natalya Igorevna Podolskaya. Functions:

- Maintaining interaction between shareholders, the President, the Management Board and the Board of Directors.

- Ensuring the work of council committees.

The board is an executive body that is engaged in day-to-day management. It involves 13 people. Every year the Board of Directors forms the Management Board, taking into account the recommendations of the company's president. Meetings are held as needed; there is no exact schedule throughout the year.

Meeting of shareholders. It is considered the highest governing body.

Through the pages of history

LUKOIL is almost a tenth of the oil industry of the Soviet Union. The structure of the industry was once determined by B. Yeltsin, who specifically for this purpose issued a corresponding decree in 1992, according to which Rosneft was assigned the role of the largest player, and private traders such as Lukoil, Surnutneftegaz and YUKOS should compete .

A little later, Vagit Alekperov in an interview spoke about his proposal at the beginning of 1990 to create his company as a huge corporation based on the USSR Ministry of Oil and Gas Industry, similar to the Gazprom concern created by Chernomyrdin.

Only the “oil Gazprom” did not work out. Officials from different ministries failed to reach an agreement among themselves.

And then the oil concern “LANGEPASURAIKOGALYMNEFT” (“LUKOIL”) was created, the RSFSR Government Decree No. 18 on the formation of which was issued on November 25, 1991, which united three oil producing enterprises from Kogalym, Langepas and Uray, as well as several oil refineries, including Perm and Volgogradsky.

The initial letters of the names of the cities Langepas, Urai and Kogalym gave the company the name that the whole world knows today. It was once proposed by Ravil Maganov, general director of Langepasneftegaz.

It was not easy for Alekperov to create an independent oil structure, and it was not without resistance.

“At that time, I was sharply criticized by various authorities for “destroying the industry.” But we survived." (V. Alekperov).

It must be said that the list of enterprises, from whose blocks of shares the authorized capital of the new joint-stock company was formed, was also determined by the Decree of the Government of the Russian Federation (dated November 17, 1992 No. 1403).

A year of work - and LUKOIL, whose oil production level has reached 1.14 million barrels per day, is already among the top three world leaders in oil production after Shell and British Petroleum.

According to the government document, it is now called the open joint-stock company Neftyanaya, and Vagit Alekperov is appointed its President and Chairman of the Board of Directors.

LUKOIL became the first domestic oil company to begin developing a single share. It was 1995. Two years later the transition took place.

The company is actively expanding the geography of its presence, including international expansion. This:

- in 1995

partnership with ARCO (USA);international projects Kumkol (Kazakhstan) and Meleya (Egypt);

- in 1996,

the international gas project Shah Deniz (Azerbaijan); - in 1997

international projects in Kazakhstan: development of the Karachaganak gas and gas condensate field in the Tengiz project;West Qurna-2 project (Iraq) (frozen in 2002 and resumed in 2010);

- in 1998

Petrotel Refinery (Romania);the Romanian refinery Petrotel in Ploiesti;

- in 1999

Odessa Oil Refinery;petrochemical enterprises “Saratovorgsintez”, “Stavrolen”;

Neftohim Refinery in Burgas (Bulgaria);

- in 2000,

the beginning of the development of the Caspian Sea - a Russian maritime project; - in 2002

joint geological exploration and production of oil in the promising Condor block (Llanos basin, Colombia) with the Colombian national oil and gas company Ecopetrol;participation in the WEEM concession in Egypt;

- in 2003,

the Anaran onshore project in Iran together with the Norwegian company Norsk Hydro; - in 2005

Naryanmarneftegaz is a joint project of Lukoil and ConocoPhillips;LUKOIL (LSE: LKOD) and ConocoPhillips (NYSE: COP) announce the creation of a large-scale strategic alliance, within the framework of which ConocoPhillips will become a strategic investor in the capital of LUKOIL (news from finam.ru).

- in 2006,

participation in geological exploration, development and production of hydrocarbons in an ultra-deepwater block near the recently discovered Baobab oil field, the largest in the Republic of Cote d'Ivoire; - in 2008,

a joint venture with the Italian company ERG SpA to manage a large ISAB oil refining complex.

One of the first Russian companies to place American Depositary Receipts (ADRs) on the international market, which since 1996 have been traded on stock exchanges in Germany and on the over-the-counter market in the United States. Bank of New York acted as the depositary bank. At the very first placement in 1997 on the MICEX and RTS, the shares of LUKOIL JSC were immediately included in the first-level quotation list; moreover, they are considered one of the oldest instruments on the Russian stock market. And with the completion of an international audit of reserves, LUKOIL is decisively promoting its shares on the world stock market.

At the turn of the century, an event occurred that meant the company’s unconditional global recognition - entry into the annual ranking of the world’s largest companies Fortune Global 500.

Products of world standards

At the same time, the new generation motor oils LUKOIL-Lux and LUKOIL-Synthetic for the first time received the API mark (American Petroleum Institute), which means they are recognized as products certified and licensed according to international standards.

At the beginning of the new century, LUKOIL was the first Russian oil company to begin large-scale production of LUKOIL Euro-4 diesel fuel and release it for sale. 10 years later, in 2012, it ceases, because all LUKOIL refineries in Russia are switching to the production of motor gasoline that meets only the Euro 5 class (AI-92, AI-95, AI-98). This became possible thanks to the implementation of a large-scale program for the modernization of oil refineries, which the company is actively implementing.

Energy assets of the company

With the acquisition of energy assets (95.53% participation in OJSC SGC TGK-8, with electric and thermal stations located in the Republic of Dagestan, Stavropol and Krasnodar territories, Astrakhan, Volgograd, Rostov regions) from the oil and gas company financial and industrial group (FIG) LUKOIL is transforming into an energy holding.

Tab. 1. Production of electric and heat energy

| 2014 | 2015 | 2016 | |

| Electricity, million kWh | 17 145 | 17 776 | 18 303 |

| Thermal energy, million Gcal | 14,1 | 12,8 | 12,4 |

Source: website today

The main activity of the holding is the search and development of oil fields. In addition, it includes processing plants that produce a wide range of petroleum products. The concern also has its own energy assets

LUKOIL is:

- enterprises on four continents, in more than 30 countries and in more than 60 constituent entities of the Russian Federation;

- geological exploration and production in 12 countries, mainly Russia, Central Asia and the Middle East;

- oil refineries and petrochemical plants in Russia and four European countries;

- production of high-quality oils in six countries;

- a developed network of gas stations in 18 countries;

- bunkering infrastructure for ships in four countries;

- aviation refueling complexes at airports in 30 Russian cities;

- generating and distribution facilities in the south of Russia, Bulgaria and Romania, gas power plants and renewable energy facilities.

LUKOIL today is:

- 1% of world and 12% of all-Russian proven oil reserves;

- 2% of world and 15% of all-Russian oil production;

- 2% of world and 15% of all-Russian oil refining.

If we talk about the main activities of one of the largest domestic oil and gas holdings:

Exploration and production

Oil and gas production is carried out by the company in 6 countries. But the main activity is concentrated in the Russian regions: the Nenets, Yamalo-Nenets and Khanty-Mansi Autonomous Okrugs, the Republics of Komi, Tatarstan, Kalmykia, the Astrakhan, Volgograd and Kaliningrad regions and the Perm Territory.

- Oil.

Among the company’s priorities is to ensure an increase in “black gold” production. The dynamics of total oil production across the Group were positively influenced by the increase in production in Timan-Pechora and the Urals, the launch of new large fields named after. V. Filanovskoe and Pyakyakhinskoe and 13 more new fields.

Rice. 1. Distribution of oil production by the LUKOIL group by region (map) (data for 2009-2010 are provided)By the way, the information was confirmed that the plans include participation in the privatization of such a significant asset as Bashneft. At the end of last year, Vagit Alekperov confirmed his holding’s interest in such an acquisition, but “not at any cost.”

- Gas.

The volume of its production was positively influenced by international projects: South-Western Gissar and Kandym-Khauzak-Shady in Uzbekistan, Tengiz, Korolev and Karachaganak in Kazakhstan. Half of the commercial gas production comes from the Nakhodkinskoye gas field. And with the launch of the Pyakyakhinskoye gas field, gas production in Russia will increase significantly.

Tab. 2. Main production indicators

| Production of commercial hydrocarbons, million barrels n. e. | Oil production, million tons | Commercial gas production, billion m³ (without share in dependent organizations) | |

| 2012 | 794 | 89,84 | 19,41 |

| 2013 | 804 | 90,81 | 19,82 |

| 2014 | 844 | 97,21 | 19,30 |

| 2015 | 868 | 100,70 | 19,64 |

| 2016 | 806 | 92,01 | 19,73 |

Source: company website

Processing, marketing and trading

The company's oil refineries operate in Volgograd, Nizhny Novgorod, Perm and Ukhta, in European countries (Bulgaria, Italy, Romania) and in the Netherlands (45% share). Their total capacity is more than 80 million tons per month.

Rice. 2. Oil refineries (map)

It produces high-quality petroleum products, petrochemicals and gas processing products, which are sold in 18 countries around the world.

Tab. 3. Key indicators of processing and sales

| 2014 | 2015 | 2016 | |

| Output of petroleum products, thousand tons | 64 118 | 60 900 | 62 343 |

| Refining of petroleum feedstock, thousand tons | 66 570 | 64489 | 66 061 |

| Gas processing, million cubic meters m | 3 221 | 3 660 | 3 901 |

| Oil production, thousand tons | 973 | 812 | 917 |

| Number of gas stations as of December 31 | 5 782 | 5 556 | 5 309 |

| Sales of petroleum products, million tons | 118,2 | 125,3 | 119,3 |

Source: company website

Rice. 3. Service at a Lukoil gas station in Barnaul

PJSC LUKOIL also means implementing key projects in order to increase production volumes. As a rule, they are associated not only with the development of new fields, but also with more intensive production of existing ones with the introduction of new modern technologies. So, projects of strategic importance:

- in Western Siberia

Imilorskoye, Zapadno-Imilorskoye and Istochnoye oil fields;gas fields of the Bolshekhetskaya depression, Nakhodkinskoye;

- in Timan-Pechora

The Yaregskoye high-viscosity oil field is one of the largest in Russia in terms of explored reserves of titanium ores, as well as the only one in the country where production is organized by the shaft method;Usinskoye field with Permocarbon oil reserves;

- in the Northern Caspian Sea (Russian marine project)

deposit named after V. Filanovsky at a depth of 7-11 m, one of the largest offshore oil fields in Russia;deposit named after Yu. Korchagina at a depth of 11-13 m;

The Rakushechnoye field is the next project planned for implementation in the Caspian Sea.

Rice. 4. At the field named after. V. Filanovsky in the Caspian Sea“The Northern Caspian, according to experts, in the medium term will become one of the key regions for the growth of oil and gas production. Currently, OAO LUKOIL is the first and only company developing the Russian shelf of the Caspian Sea.” ("Superleninka")

Find out more about the Caspian project here:

- in Uzbekistan

development of the Kandym group of fields - 6 separate gas condensate areas (Akkum, Western Khodzhi, Kandym, Kuvachi-Alat, Parsankul, Khodzhi);project "South-Western Gissar";

There are 7 deposits located in the Kashkadarya region of Uzbekistan.

Other productions

This is the third year since the commissioning of the mining and processing plant (130 km from Arkhangelsk) at the diamond deposit named after. V. Mushroom production continues.

Ukrainian question

In April 2015, LUKOIL announced the closing of the transaction for the sale of Lukoil-Ukraine between the subsidiary Europe Holdings BV in the Russian Federation and the Austrian AMIC Energy Management GmbH. We were talking about almost 240 gas stations and six oil depots on the territory of Ukraine. The Antimonopoly Committee of Ukraine gave its permission, and now Lukoil-Ukraine is officially called AMIC-Ukraine.

Social projects

- Since 2000, PJSC LUKOIL has been the general sponsor of one of the most popular Russian football clubs, Spartak-Moscow, of which Sergey Anatolyevich Mikhailov, a member of the board of directors of LUKOIL, became a member of the board of directors;

- from the 2011-2012 season. – women's volleyball club “Dynamo”, Krasnodar;

- “Fairytale City” has been “opening” the city of Nizhny Novgorod for citizens and guests since 2011 with the help of bright and positive drawings on the walls of houses;

- Formula Student is an international project aimed at creating and developing the racing car industry;

- “Your profession is your choice!”, aimed at introducing orphans to the basics of creative and media professions;

- “There will be sea vessels!” in Kaliningrad made it possible to build an analogue of the ancient fishing sailing vessel kurenas, which was widely used in the 14th-15th centuries.

And there are a great many similar projects. And the competition of social and cultural projects, annually organized by PJSC LUKOIL, became a laureate of the first National program “Best Social Projects in Russia”.

Activity

The activities of PJSC Lukoil are carried out according to the principle of vertical integration. This means that the holding owns the entire production process chain: development, extraction, processing, transportation, packaging, sales. The purpose of building a business in this way is to have a more stable position in the market.

Production

Oil development is carried out in 6 countries of the world. Main directions: Russia, Middle East, Central Asia. Lukoil accounts for 2% of global oil production. Also, hydrocarbon production is actively developing: 80% of them are liquid hydrocarbons.

In 2021, oil production amounted to almost 87.5 million tons, 5.5 million tons came from imported fields. This year, oil production began at 12 new fields. The main directions are the Volga region and Timan-Pechora. Most of the reserves (almost 45%) are in Western Siberia. 18.65% - Timan-Pechora, 17.5% - Cis-Urals, 11% - Volga region.

Gas production in 2021 increased by more than 10% and reached almost 29 billion cubic meters. This is 16% more than in 2016. Such indicators were revealed due to the active development of Uzbekistan projects and the new launch of fishing in Western Siberia (Pyakyakhinskoye field). 18.2 billion cubic meters of gas were produced in Russia.

Mining of oil and gas

Hydrocarbon reserves

Oil and gas reserves of Lukoil

The operating stock of oil wells of Lukoil as of October 1, 2005 amounted to 26,626 wells, the non-operating stock was 4,532 or 17% of the operating stock. Compared to the beginning of 2005, the operating stock increased by 124 wells, and the non-operating stock decreased by 209 wells. The operational stock of injection wells as of October 1, 2005 amounted to 8,079 wells (133 wells more than at the end of 2004), the operational stock - 6,238 wells (263 wells more than at the end of 2004).

The company's proven hydrocarbon reserves as of January 1, 2011 amounted to 17,255 billion barrels of oil equivalent, including 13,319 billion barrels of oil and 0.67 trillion. cubic meters of natural gas. Based on proven oil reserves, Lukoil is the sixth largest private oil company in the world.

More than half of Lukoil's oil reserves are concentrated in Western Siberia. The main production operator is located in the Khanty-Mansiysk Autonomous Okrug. About half of natural gas reserves are located in fields located on the Gydan Peninsula of the Yamalo-Nenets Autonomous Okrug.

Foreign projects of Lukoil

Lukoil is involved in the implementation of 16 projects for the exploration and development of structures and fields in the following countries:

- Azerbaijan (D-222 (Yalama) Shah Deniz);

- Venezuela (Junin Block 3);

- Ghana (Cape Three Points Deepwater);

- Egypt (Meleia, West Ash El Mallah, West Geisum, Northeast Geisum);

- Iraq (West Qurna-2);

- Iran (Anaran);

- Kazakhstan (Tengiz, Karachaganak, Kumkol, Karakuduk, Northern Buzachi, Alibekmola, Kozhasai, Arman, Zhambay South, Atash, Tyub-Karagan);

- Colombia (Condor project jointly with the Colombian state company Ecopetrol);

- Cote d'Ivoire (production sharing agreement on offshore block CI-205 in the Gulf of Guinea);

- Romania;

- Saudi Arabia;

- Uzbekistan (Kandym-Khauzak-Shady-Kungrad, Aral, Kungrad, South-Western Gissar).

Ecology

The company tries to adhere to high environmental standards. An environmental safety program has been developed. Since 2014, more than 600 events have been held, costing more than $4 billion:

- Reducing emissions of harmful substances into the atmosphere.

- Disposal of collected oil production waste.

- Prevention of land pollution.

- The use of water resources is rational to prevent their pollution.

- Biodiversity conservation.

Financial performance indicators of LUKOIL

The company continues to demonstrate effectiveness in the implementation of strategically important projects. At the same time, it maintains fairly high financial stability and demonstrates sufficient flexibility, without losing control over operational and financial factors and risks of primary importance in a difficult macroeconomic environment. Which only confirms the correctness of the chosen business model and management system.

Modern technologies, standardization of production processes and other initiatives have led to curbing the growth of operating costs for production and reducing operating costs for processing. Reductions in capital expenditures have not prevented the most important projects from being fully financed.

The implementation of a conservative scenario for oil prices and effective control over expenses and working capital had a positive impact on the financial stability of the company.

Tab. 4. Key indicators of the company’s financial condition (billion rubles)

| Consolidated revenue | Net income attributable to shareholders | |

| 2013 | ||

| 2014 | 5 504,86 | 205,79 |

| 2015 | 5 749,05 | 291,14 |

| 2016 | 5 227,05 | 395,53 |

Source: official website of LUKOIL

As a result of a study in which RBC established how much the largest companies pay to the treasury at the end of 2021, it is in the top three, along with the amount of taxes of 564.5 billion rubles, second only to Rosneft and Gazprom. According to RBC, the tax burden on the company is 11.9% (in 2015, these figures were respectively: 3 / 629.6 / 12.2).

For many years now, the RiaRating agency has included LUKOIL among the hundred most valuable public companies.

With a capitalization exceeding $48 billion, it is one of the five largest domestic companies. Tab. 5. Position of LUKOIL in the ranking of the richest companies in Russia

| Capitalization at the end of the year | Place | |

| Millions of rubles | ||

| 2012 | 1706145 | 4 |

| 2013 | 1723581 | 4 |

| Millions of dollars | ||

| 2014 | 33525 | 3 |

| 2015 | 27457 | 4 |

| 2016 | 48076 | 4 |

Source: RiaRating Agency

For the last five years, this oil and gas holding has topped the list of two hundred largest private companies in the annual Forbes ranking.

Tab. 6. Position of PJSC LUKOIL in the ranking of the largest private companies in Russia

| Revenue, billion rubles | Place | |

| 2013 | 3917,9 | 1 |

| 2014 | 3799,9 | 1 |

| 2015 | 4740,2 | 1 |

| 2016 | 5173,5 | 1 |

| 2017 | 4743,7 | 1 |

Source: Forbes

Work in the holding

A major employer not only in Russia, but also abroad. The staff number is more than 150,000 people. Is an attractive employer. Conducts ongoing training of personnel using various modern means and teaching methods: seminars, workshops, internships (including in other countries), distance courses, etc.

Develops work with young specialists. About 40% of employees are under 35 years of age. Cooperation is underway with several educational institutions in order to attract new personnel. Excursions and talks are held. Students are actively involved in pre-diploma and industrial practice at the enterprises of the Lukoil group; they have the opportunity to start a career during their studies.

The young specialist is provided with an experienced mentor who will supervise the newcomer for several months. Competitions are regularly held to identify the best young specialist, stimulating the activity of young people.

Transportation of petroleum products PJSC "Lukoil"

Transportation of oil produced by Lukoil in Russia is carried out mainly through pipelines of Transneft PJSC, as well as by rail and water transport. Oil produced at the company's fields in Kazakhstan is transported through the pipelines of the Caspian Pipeline Consortium.

Lukoil owns a number of oil and oil products processing terminals used for the export of oil and oil products:

- Terminal in the port of Vysotsk on the Gulf of Finland with a capacity of 10.7 million tons of oil and petroleum products per year.

- The Varandey terminal near the Barents Sea has a capacity of 12.5 million tons of oil per year. Used for shipping oil produced in the Timan-Pechora basin.

- Terminal in the port of Svetly, Kaliningrad region, with a capacity of 6 million tons of oil and petroleum products.

- The Astrakhan terminal in the village of Ilyinka, Astrakhan region, with a capacity of 2 million tons of oil and oil products.

Sales of petroleum products

Lukoil sells gasoline in 59 regions of Russia and in 17 foreign countries: Azerbaijan, Belarus, Belgium, Bulgaria, Georgia, Italy, Luxembourg, Macedonia, Moldova, the Netherlands, Romania, Serbia, Turkey, Finland, Croatia, Montenegro and the USA. As of January 2014, there were 166 oil depots and 5,867 gas stations in the country.

Retail sales of petroleum products are carried out mostly under the Lukoil brand. In the US, part of the company's gas stations operate under the Getty and Mobil brands.

Criticism

In addition to positive reviews about the Lukoil company, there are also negative aspects in the company’s work:

- In Komi, tax breaks were provided to those enterprises that could produce at least 7 million tons of oil per year or process at least 3 million tons. There were two such enterprises. Both of them were subsidiaries of Lukoil. Based on a complaint from associations, which included small oil refining organizations, an inspection was carried out, and in 2007 a case was opened by the Russian antimonopoly service.

- in 2011 problems arise with the Bulgarian authorities. According to their information, sensors were not installed in time at the plant, owned by Lukoil, to accurately count the amount of fuel that was produced. Because of this, suspicions arose that about 250 million euros were not allocated to the Bulgarian budget. The license was revoked and the plant was shut down. A month later, the conflict was resolved, and the plant continued to operate.

- At the beginning of 2021, information appeared about the illegal purchase of part of the Massandra vineyards in Crimea.

- In the same year, claims arose from the Kama region that Lukoil was supplying its residents with low-quality gas at a price higher than the market price.

- In 2021, two company employees were detained because they were suspected of underfilling gasoline at gas stations in southern Russia. A fraudulent scheme was invented and developed. A hacker program was created that was embedded in the software and showed incorrect results on the display when refueling. As a result, the end consumer did not receive 7% of the fuel he paid for.

Oil and gas processing

Lukoil owns seven oil refining companies in Eastern Europe with a total capacity of 82.1 million tons per year. In Russia, it owns large refineries in Volgograd, Perm, Nizhny Novgorod, Ukhta, as well as mini-refineries in Urai and Kogalym. It also owns oil refineries in Bulgaria, Romania and Italy, and has a 45% stake in an oil refining complex in the Netherlands.

The company owns the Korobkovsky, Usinsky, Perm and Lokosovsky gas processing plants, as well as several petrochemical plants in Budennovsk, Saratov and Kalush (Ukraine), which are managed by Lukoil-Neftekhim.

In 2005, the company's gas processing plants processed 2,261 million cubic meters of gas feedstock and 479 thousand tons of a wide fraction of light hydrocarbons. In 2007, Lukoil refineries processed 52,164 thousand tons of oil, including 42,548 thousand tons at Russian plants.

Contacts "Lukoil"

The company is aimed at dialogue with both consumers and suppliers. The website www.lukoil.ru has a large section with contacts: telephone numbers of PJSC Lukoil , faxes, electronic mailboxes for letters for various purposes. The press service section has been highlighted. If you have a question or are at a loss as to where to turn, you can call the Lukoil hotline .

Phone number: 88001000911 (for consumers).

You can contact the help desk: 8(495)627-44-44 or.

INN Lukoil PJSC:

7708004767.

Electricity production by Lukoil

The total capacity of electricity produced by Lukoil is 5,800 MW, of which 73% is intended for commercial use. Lukoil produces about 99% of the electricity in the Astrakhan region and 62% of the electricity in the Krasnodar region. The main subsidiaries for electricity generation are Lukoil-Volgogradenergo, Lukoil-Rostovenergo, Lukoil-Kubanenergo, Lukoil-Astrakhanenergo, Lukoil-Stavropolenergo.

Lukoil operates two solar power plants at its own oil refineries in Romania and Bulgaria with a capacity of 9 MW and 1.3 MW. A solar power plant with a capacity of 10 MW is being built at the Volgograd Oil Refinery. Lukoil also owns an 84 MW wind farm in Topolog, Romania.

Shares and shareholders

Currently, shares and depositary receipts of the oil and gas holding LUKOIL are successfully traded on the Moscow Currency Exchange (code LKOH), London (LKOD), Frankfurt (LUK), Munich and Stuttgart stock exchanges and on the US over-the-counter market (LUKOY). The Company's depositary receipts are among the most liquid instruments among receipts of other issuing companies from Eastern European countries. They belong to the “blue chips”, like such monsters as Gazprom, Sberbank, Magnit, etc.

Blue chips - this expression is used for securities or shares of the most reliable, liquid and large companies.

The ordinary share reached its first heights in 2008, when it reached the level of 2520.42 rubles. It reached its maximum price in January 2017, when on January 10 it was sold for 3,399 rubles. It also crossed the three thousandth price threshold in February 2015.

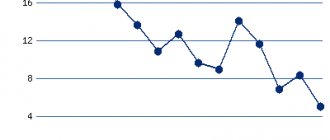

Rice. 5. Dynamics of the Lukoil share price on the MICEX (rubles, MOEX)

Currently, the head of the company, Vagit Alekperov, is the largest shareholder of LUKOIL (22.98%), 9.88% belongs to the vice-president of the company Leonid Fedun (6th and 22nd place in the Forbes ranking of the richest businessmen in Russia). By the way, Vagit Alekperov’s wife Larisa (21st place) owns 0.175% of Lukoil shares.

Both in the distant 90s and today, when rumors about the sale of his holding to Rosneft are being discussed more and more often in the media, the constant head of LUKOIL is deeply convinced that competing oil companies must exist. He never tires of arguing in favor of this statement and explaining to everyone that his company will continue to remain private.

“There is no other buying mechanism if we are not selling.”