Investments in fixed capital are beneficial for both parties entering into a transaction. They are necessary to start a business and subsequently make a profit, which is both the goal of the entrepreneur and the goal of the investor. How to attract investment in fixed assets and what this concept includes will be discussed in this article.

The concept of fixed capital

Fixed capital is the totality of expenses necessary to start a business and begin its operation or to modernize it . Fixed capital assets include equipment for production, inventory, and transport.

For example, let's say you want to create a pizza delivery service. To do this, you will need baking equipment and a machine to deliver the product to customers. They constitute the fixed capital. Assets that are used to produce products and pay for themselves in one cycle of their life cycle are called working capital. In our example, these are costs for dough, filling, and more.

The components of fixed capital can be tangible and intangible, and their service life in business, unlike working capital, is several years. Fixed capital assets tend to wear out. A competent manager must calculate the level of depreciation and take it into account in the cost of production.

Formula

General formula for calculating the coefficient:

| Cree= | Profit before tax | *100% |

| Wed. cost of equity + Avg. cost of long-term liabilities |

Sometimes the formula may use Net Profit instead of Profit before Tax.

Calculation formula based on old financial statements

| Kri = | p.140 | *100% |

| 0.5 * (line 490beg + line 490end + line 590beg + line 590end) |

where line 140, line 490beg – at the beginning, line 490end – at the end of the reporting period, line 590beg – at the beginning, page 590end – at the end of the reporting period of the Profit and Loss Statement (form No. 2).

Calculation formula based on the new Balance Sheet and Statement of Capital Use

| Kri = | page 2300 | *100% |

| 0.5 * (line 1300beg + line 1400beg + line 1300con + line 1400con) |

where the parameters are the corresponding lines of Form No. 1 and Form No. 2 at the beginning and end of the reporting period.

Why invest in fixed capital

Beginning entrepreneurs are often full of ideas, but lacking money. For an investor, it’s the other way around: he’s looking for good ideas in which to invest his available funds. When these two people meet, there is a need to invest in fixed capital, which will be beneficial to both parties. Often, without such infusions of funds, an entrepreneur cannot start his own business for a long time.

Investment conditions may differ and are determined by the wishes of both parties. The general principles are:

- The entrepreneur receives money and the opportunity to start his own business, which he cannot yet financially organize on his own.

- The investor receives monthly passive income from someone else's business activities.

Similar articles:

- how to conduct an economic assessment of investments

- signs of the investment attractiveness of the enterprise

- what are investment risks

- investment project analysis

Adjustments

After determining the amount that needs to be invested to receive benefits, it is necessary to make some adjustments to take into account other possible income/expenses.

Off-balance sheet reserves

This includes assets that are not used under normal circumstances but may be needed.

For example, a reserve for doubtful debts - those that with a high degree of probability cannot be repaid by the enterprise. The amount of invested capital must be increased by the amount of such reserves.

Off-balance sheet assets

These include those that are not on the company’s balance sheet, but will be used.

For example, operating lease funds, assets held in storage or temporary service, pledges, guarantees given by the enterprise, etc. The amount of such expenses must be taken into account when calculating invested capital.

Assets held for sale

They do not generate income, but must be taken into account to avoid financial losses associated with their sale.

Other comprehensive income (loss)

Such items are not reflected in the enterprise’s reports, since they are impermanent: they depend on current circumstances. But when planning investments they must be taken into account.

Write-off of assets

When it becomes necessary to remove assets from the balance sheet of an enterprise due to loss of profitability, the write-off is made at the expense of income. Because of this, the amount of invested capital is reduced, but it is worth considering that in the next reporting period the income will be higher.

Deferred compensation assets

These are assets that do not participate in the formation of financial results. Therefore, the balance sheet of the enterprise must be reduced by their amount.

Deferred tax assets and liabilities

They arise if the enterprise’s income for the reporting period is less than the taxable minimum. They affect the size of the assets, but do not increase the actual income; they must be deducted from the investment amount.

Deferred liabilities are created when reportable income exceeds taxable income. It turns out that the company will have to pay the tax difference in the future, which means that their amount must be deducted from the invested capital.

How to attract investment

The structure of investments in fixed capital consists of the entrepreneur’s own funds, which he is able to invest in a future project, and attracted investments . The number of people who need money for business significantly exceeds the number of those who can give this money. A problem arises: how to interest an investor to invest free funds in your idea? To do this, the entrepreneur should:

- Create a business plan.

- Clearly determine the size of the required investment.

- Clearly define the nature of the benefit or the monetary value of the return for the investor from the investment made.

- Write down investment conditions that will be clear and transparent.

- Determine cooperation for the period when the agreement will no longer be valid.

Remember: only the investor bears the risk in such a partnership .

If the activity turns out to be unprofitable, then he will not receive his income, but the entrepreneur will not owe him anything. This is why investors so carefully choose the project in which they want to invest. It must be financially attractive.

Special Considerations

The value in the numerator can also be calculated in several ways. The simplest way is to subtract dividends from the company's net income.

On the other hand, because a company may have benefited from a one-time source of income unrelated to its core business—for example, windfall gains from currency exchange rate fluctuations—it is often preferable to look at net operating profit after taxes (NOPAT).

NOPAT is calculated by adjusting operating profit for taxes: (operating profit) * (1 – effective tax rate). Operating profit is also called earnings before interest and taxes (EBIT). Many companies report their effective tax rates for the quarter or fiscal year on their earnings reports, but not all.

Where to invest

On the part of the investor, investments in fixed assets must be justified, and their attractiveness must be proven by figures and calculations. The most interesting investments in fixed capital are in the following areas:

- healthcare;

- construction;

- service maintenance;

- private and public services;

- sales and other areas.

The effectiveness of investments varies significantly in different areas of activity. In addition, the following factors influence the number of investments and their performance:

- country's tax system;

- social situation of the selected territory or state;

- economic forecasts that calculate risks for investors;

- government investment policies that attract or repel investors;

- characteristics of the project - competitiveness of the product, resources used, efficiency.

Government policy regarding investment activities plays a major role in making decisions about investment . The attractiveness of a country or a chosen region helps attract not only domestic but also foreign investors, which has a positive effect on business development.

In addition to government policy, investors carefully evaluate the entrepreneur's proposal and the effectiveness of his project. The performance indicators calculated by analysts are compared with the indicators of other projects, after which the most optimal option is selected. The index of physical volume of investment in fixed capital is also assessed.

Investments in fixed assets must be economically justified. You should not invest in questionable activities or without a clear understanding of the level of future profit. Although investments in fixed capital are long-term investments, after some time they will have to be repeated by updating the fixed assets. Information on investments in fixed capital must include an assessment of the efficiency of their distribution. To do this, experts evaluate the following parameters:

- wear rate;

- renewal date and expiration dates;

- fund capacity;

- real value coefficient.

Details

Ratio Analysis

The return on invested capital ratio also has its drawbacks. Being an indicator, when analyzing annual results, it needs to compare the results obtained in the same area of production, but only from other enterprises. When working with the results of one enterprise, an analysis of the dynamics over at least a three-year period is necessary.

There are certain difficulties when analyzing Return on Invested Capital:

- The indicator may be influenced by the enterprise's policy and its internal accounting.

- It is impossible to determine the path for generating income: either it is random or regular from the effective operation of the company.

- The artificial influence of the manager affects the profit indicators from the operations performed. This leads to an overestimation of the RIC, which is unjustified.

To calculate return on investment capital, you need to use the following indicators:

- Salaries of employees, costs of logistics services, costs of purchasing materials - all these costs of goods and services for the company’s activities add up to the concept of “cost”.

- You can invest in a business using different types of investments, taking into account all cost items. This indicator is the amount allocated for investment.

- Without subtracting the cost, the entire amount of income is taken into account.

- The final profit received from the sale of manufactured products or services. This indicator is income.

Calculation formulas

These indicators are used in the formula to calculate the return on invested capital ratio.

ROIC=NOPAT : invested capital * 100%

For a report in English, the formula looks like this:

ROIC=NOPAT : InvestedCapital ∗ 100%

— NOPAT is the profit from the operations carried out by the company after taxes

— Invested capital - includes data on the company’s owned assets and data on long-term liabilities.

Another formulation indicator is Net Operation Profit After Tax.

NOPAT is also calculated using the formula.

NOPAT= operating profit ∗ (1−TRP)

For a report in English, the formula looks like this:

NOPAT = o peration income ∗ (1− TRP )

TRP is the tax rate on profits received.

Another formulation of the TRP is Tax Rate Profit .

Sources of investment

Funds for a company can come not only from outside investors. The structure of investments in fixed capital includes the receipt of funds from:

- income deductions;

- depreciation payments;

- enterprise assets;

- charitable contributions;

- other instruments (company shares, patents, mutual funds).

The structure of investments in fixed capital is developed taking into account:

- economic sectors;

- source of financing;

- type of economic activity and fund.

Analysis of changes in the structure over the period of time under study allows us to draw conclusions about the level of investment activity and the predisposition of investors. For example, there may be an increase in investment in residential construction and a decrease in investment in non-residential buildings.

The structure of investment in fixed capital by source of financing may show a change towards investment of own funds and a decrease in government loans.

Similar articles:

- where and how to find an investor –

Advantages and disadvantages

The ROI ratio has its advantages and disadvantages:

| Advantages | Flaws |

| Calculations are simple and quick | The method includes accounting profit, depending on different accounting methods |

| Percentage return measurement is used | ROI is a relative measure that does not take into account the volume of investment |

| Accounting profit can be calculated from financial statements | The duration of the project is not taken into account |

| Covers the entire duration of the project | Time value of money is not taken into account |

| The method is clear to investors and managers | The timing of receipt of income is not taken into account |

Investment volume index

An important macroeconomic indicator is the index of physical volume of investment in fixed capital. It indicates a change in investment activity and, consequently, the attractiveness and level of development of a country or region. The index of the physical volume of investment in fixed capital represents the ratio of the volume of capital inflows in different periods, usually current to the base one .

The formula that displays the index of the physical volume of investment in fixed capital is calculated without taking into account the influence of prices.

Thus, investments in fixed assets are long-term investments that are beneficial to both partners. The volume of investment in fixed capital, as a rule, is determined by the entrepreneur, based on the requirements for running a business and production needs. This can be either the initial stage of opening your own business or the period of expansion of an existing activity.

Before making a transaction, the investor must obtain information about investments in fixed capital (their size, terms of return or non-return), as well as find out the conditions for making a profit and other personal benefits.

Financing structure

A well-structured financing structure works to achieve the strategic goals of the entire business, and is also correlated with the characteristics of the industry in which it operates. Regarding the second aspect, it is time for financial managers to ask themselves the following questions:

- What assets do you own—mostly intangible or tangible?

- What kind of competition is it - hard or soft?

- Are the activities carried out primarily where - at home or in other countries?

The answers to these and other questions will have an impact on the optimal financing structure. It will also be affected by investment priorities, current activities, stakeholder needs, and more. A financing structure that is not aligned with the strategic goals of the business leads to high costs, low returns, more private transactions, and lower long-term value.

An unbiased analysis of current operations, the market, requests from key stakeholders, and business strategies will help you get closer to the optimal capital structure. This is best done proactively by analyzing how the characteristics and current needs of the business relate to the availability of capital instruments and the activity of markets. As an example, before the pandemic, the availability of tools that were not burdened with additional conditions was easier, which gave organizations space, freedom and ease. With the advent of the pandemic, everything changed dramatically, and there was a need for costly modifications to existing agreements.

Who can become an investor

Any person with free assets can invest funds. Therefore, investors can become:

- private individuals;

- companies;

- government agencies.

Investors are project founders, lenders or borrowers. The purpose of investing money is to make a profit.

Bank deposit

A bank deposit is the simplest and most accessible way to invest. To create a passive source of income you will need:

• select a bank; • open an account; • invest the required amount.

When choosing an organization, you should be guided by the terms of the program and the overall rating. It is recommended to give preference to banks that are ready to provide a savings system with interest accrued monthly. Some financial institutions provide the possibility of early withdrawal of funds. The average yield is from 6 to 10%. However, at the current level of inflation, the profit from the deposit will be insignificant.

Pros:

• The minimum entry threshold is 1 thousand rubles (depending on the program of a particular bank). • High level of reliability. • Pre-known result. • Low taxes.

Minuses:

• Low yield, which is slightly higher than the current inflation rate. • Low liquidity (not every bank provides deposit programs with early withdrawal of funds).

Carolina Kudelina, an expert at the Financial Health project, advises: “A bank deposit is the simplest and therefore the most popular type of savings. The chain of actions is primitive: you open an account in a mobile application or in person at a bank, deposit funds, and while the bank is using your money you receive interest.”

We talked in more detail about how to make a bank deposit correctly here.

Gold

Gold is always associated with stability, and for many, buying gold is the most reliable investment instrument. Indeed, during a crisis, the demand for gold increases.

Ways to invest in gold:

• Buy gold bars or coins from the bank, but you will also need to pay VAT for the gold bars. Moreover, if the bullion is stored in a bank, you will also need to pay for storage.

• Buy gold through the exchange. You can both speculate on the price and subsequently receive gold physically in the form of bars. But this is a big risk.

• The most modern option is to open an impersonal metal account. This account, and accordingly the income/loss on it, is directly related to the cost of gold. But there is no physical possession of gold.

• Invest indirectly in gold by purchasing shares of gold mining companies, gold futures, gold mutual funds, gold ETFs.

Pros:

• More suitable for portfolio diversification. • Can save funds, but not increase them.

Minuses:

• Low profitability. Precious metals have underperformed over the past five years. • Deposits in an impersonal metal account are not insured by the state.

“An increase in the price of gold occurs during a crisis period, when there is a decline in the financial market. Conservative investors at such a moment get rid of other financial assets, giving preference to stable gold. For Russia, the success of investing in gold is associated, among other things, with the devaluation of the ruble, since the price of gold is set in US dollars,” says Tatyana Polteva, senior lecturer at the TSU Department of Entrepreneurship.

Tatyana Saprykina, economist, adds: “Precious metals, like any market instrument, are subject to their ups and downs. Despite the stable industrial demand for gold, its price is regularly subject to technical correction. It is very difficult for an ordinary individual to obtain income from investments in gold. The gold bullion market is too cumbersome, and the organizations that provide access to metal accounts are quite clumsy. The period of investment in gold is a significant number of years, usually at least 5, to make a profit.”

Mutual investment funds (UIF)

A mutual fund is a management company that specializes in the purchase/sale of stock market assets. You invest money in a mutual fund, whose managers distribute it among different securities. This is called trust management. You do not independently select assets and investment instruments, but simply wait for income.

There are many similar financial organizations with different profitability indicators. When making a contribution, the investor becomes the owner of the UNIT - a share in the company’s property. Earnings depend on the increase in the value of assets owned by the fund. Profitability statistics can be found on the website of the organization chosen for investment.

Pros:

• A large number of profitable strategies. • Your capital is managed by experienced experts. • Relatively low level of risk. • Low entry threshold (from 1000 rubles). • Suitable for beginners.

Minuses:

• Mutual funds do not provide a guarantee of income. • Basic knowledge is required to select a mutual fund.

Tatyana Saprykina, an economist, recommends: “A mutual fund can be imagined as a large money bag in which the funds of thousands of small investors are stored - shareholders, which the management company invests in various assets. As a result, the funds of each shareholder are distributed among different securities. In exchange for his money, the investor receives an investment share, which certifies the owner’s right to a share of the fund’s property.

A mutual fund is not a bank, so you can’t count on interest or dividends. Money can only be obtained by redeeming the share, that is, by selling it to a management company (which is legally obligated to buy it back). The positive difference between the purchase price and the sale price will be your income. However, the difference can be negative - all risks fall on you.”

Average statistical values by year for Russian enterprises

| Revenue amount | Values by year, rel. units | ||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

| Micro-enterprises (revenue) Why does an investor need this? | |||||||

Investment is not a magic wand that will constantly bring you profit without requiring anything from you. It is important that accounting should be constant, but control should not. Anyone can keep track of investments, even if you had big problems with math at school and you never remember how much money you have on your cards and in your wallet in the form of cash. In fact, there are 2 methods by which each of your investments will be under strict control:

- In writing - the old fashioned way in a notebook based on several formulas;

- Using special programs or a basic office Excel program, proprietary calculators of organizations or projects.

I would like to note that for the convenience of monitoring each investment and assessing its profitability, there is an investment portfolio on the GQ Blog Monitor, which allows you to assess the situation in detail and without unnecessary hassle and see how much you have earned for a specific period or with a specific project. At the time of writing, the services and simplicity of the crypto portfolio were experienced by 460 investors.

From my own experience, I can say that this is extremely convenient, since investments from various HYIPs are tied into it, plus you can also take into account work on the cryptocurrency exchange. And if you are new to this financial area, the material on the blog will help you familiarize yourself in detail with the intricacies of the work.

Don’t let money go to waste, but don’t control every penny. Money loves accounting, but it doesn't love fear. And not only fiat, but also cryptocurrency.

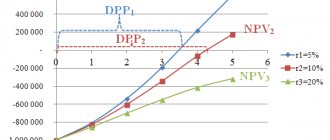

If you are a connoisseur of classical work with money, then it’s time to replenish your body of knowledge with certain formulas that help you calculate in advance whether it is profitable or not profitable to invest in a project.

Indicator analysis

After obtaining the desired indicator, an analysis is carried out to assess the feasibility of investing money. When studying the influencing factors, the validity of the investment is assessed. Investments must produce a profit, which ensures an increase in capital.

During the analysis, it is taken into account what factors influence profitability. Therefore, important decisions are made:

- the possibility of reducing labor intensity or capital costs;

- it is advisable to increase labor productivity, for which new methods of rewarding employees are being introduced;

- the need to change the business model.

Attention! If you independently change some factors that affect profitability, this allows you to accurately assess the effectiveness of the project.