I welcome everyone who is interested in the trading world or simply the domestic auto industry. In 2021, AvtoVAZ will completely come under the control of the Rostec Alliance.

The Franco-Japanese concern, which manages Renault, Nissan and Mitsubishi, has long owned AvtoVAZ. The Alliance announced that it was striving for sole management, and after several offers it actually became the sole owner, using a forced buyout for AvtoVAZ shares.

Let's figure out what lies behind these words and how legal the appropriation of someone else's property is in our country today.

AvtoVAZ's share is growing faster than the market

In August, the president of the company, N. Mor, spoke about plans to achieve operating profit in 2021, and today we are talking about net profit for the corporation in the new year. In the summer, there were statements in the press that shareholders refused AvtoVAZ dividends . The managing shareholder, Renault, and the main shareholder, Rostec (64% of shares), create an additional issue, invest cash and convert the company’s debt to them into shares. The pace of the company's development exceeded the summer expectations of President Nicolas Mora. The growth forecast for the automotive market in 2017-2021 ranges from 5 to 10%. And the growth in the share of AvtoVAZ products is 2-3 times higher than market growth.

Voluntary repurchase of securities from AvtoVAZ shareholders

The Renault-Nissan alliance announced its plans to delist securities and its goals of becoming 100% owner of the AvtoVAZ concern back in 2018. To this end, Rostec announced an offer and continued to increase its portfolio. As a result, Alliance Rostec Auto BV became the owner of 96% of the securities in September 2018.

Having such a large share, Rostec had the opportunity to buy out the remaining securities unilaterally.

Can they force me to sell AvtoVAZ shares?

Yes, and you won’t be able to set the price either. According to our laws, the price is determined by an independent appraiser: neither the seller nor the buyer can influence it.

Frankly speaking, the concept of forced redemption does not imply the participation of the seller, the transaction is actually one-sided, so the word forced is not very appropriate here.

How will the remaining minority shareholders buy back shares?

The repurchase procedure involves an offer of voluntary sale and a subsequent demand for compulsory repurchase. In response to the letter, the former owner must send information about his bank account, where the money for the sold shares is transferred.

If the minority shareholder does not respond, and the company does not have his bank details at its disposal, the buyer simply transfers the money to the notary, from which point the procedure is considered completed.

This means that you can only receive your money from a notary working at the place of registration of the company, that is, in Tolyatti. You can send your details with a request for translation to a notary by mail.

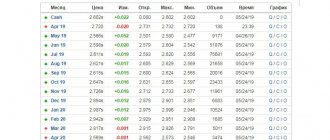

How much does it cost to buy back shares?

The cost of one PJSC share for this transaction was 12.4 rubles for ordinary and 12.2 for preferred. The figure is small, but over the past six months, AvtoVAZ shares have been even cheaper, so this cannot be called the minimum price.

Is there a tax on forced repurchase of AvtoVAZ shares?

Yes, income from the sale of shares, like any other income, is subject to personal income tax. PJSC AvtoVAZ, acting as the buyer, is not a tax agent. The format of the transaction in a specific situation does not matter.

You can reduce your tax amount by applying a tax deduction. To do this, you need to indicate the money spent on the purchase of the share and register their funds spent on generating income, that is, the current profit.

Buyback reviews

The majority of AvtoVAZ's former shareholders reacted negatively to the news of the sale. Many had owned the shares for several years and were seriously counting on some kind of dividends; others bought the shares, clearly seeing the company's recent progress.

Many perceived the notification letter as an attempt at fraud or simply did not know what to do next to receive their money. For obvious reasons, the telephone number indicated in the letter was constantly busy, and not everyone had the opportunity to come to the notary’s office in person.

The owners of electronic shares had more clarity about what was happening; the sale process took place instantly, with the next closure of the exchange, the money was immediately deposited into the account.

The price of the shares also caused a storm of criticism; the former minority shareholders were not satisfied with the listed 12 rubles, and there was and will not be an opportunity to set their own price.

Dividend payments for AvtoVAZ shares in 2021?

It is not yet clear whether there will be dividends; AvtoVAZ was unprofitable for almost 10 years and lived on subsidies from the state. Therefore, it is not clear whether payments will be made in 2021.

| Payment period | Dividend per 1 JSC, rub | Dividend per 1 AP, rub | Registry closing date |

| 2018 | ? | ? | |

| 2017 | 0 | 0 | |

| 2016 | 0 | 0 | |

| 2015 | 0 | ||

| 2014 | 0 | ||

| 2013 | 0 | ||

| 2012 | 0 | ||

| 2011 | 0 | ||

| 2010 | 0 | ||

| 2009 | 0 | ||

| 2008 | 0 | ||

| 2007 | 0,29 | 0,29 | 16.05.08 |

| 2006 | 0,1003 | 0,1003 | 06.04.07 |

| 2005 | 0,057 | 0,057 | 07.04.06 |

A little background and current situation

I won’t talk for a long time about the domestic pride of the automobile industry - you are already well aware. Let me briefly go over the key points:

- In 1966, by decree of the USSR government, an automobile plant was created.

- In 1970, AvtoVAZ produced the first classic Zhiguli.

- In 1977, the plant made a splash by spitting out the then super successful Niva onto the market.

- In 1993, AvtoVAZ successfully overcomes privatization and mutates into a joint-stock company.

- Since 2001, the company has been attracting foreign investment as part of the localization of production (Renault, GM, Ford).

During the 2000s, the plant more or less successfully developed and actively absorbed government subsidies, and in 2012, AvtoVAZ, a significant part of which belonged to Rostec, joined the Renault-Nissan alliance under the leadership of Carlos Ghosn.

The hybrid of a private concern and a state corporation was 76.25% owned by the already mentioned Alliance Rostec Auto BV, which (suddenly!) registered in the Netherlands.

Source: kolesa.ru

In general, the company seems to be Russian, owned by the French, and based in Holland.

In this form, the auto giant at the very least survived until 2021, suffering losses and devouring subsidized money, and in 2021, having reached decent figures for the first time since 2014, it announced delisting.

All securities in favor of the parent company were taken away from ordinary investors and it was announced that the company would soon return to the Russian market after a global reorganization.

Who, why and why

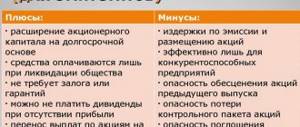

I saw many different versions, but two seemed the most plausible to me.

First: cutting dividends. The shares were divided among their own, so as not to share the divas. If anything, according to the charter, AvtoVAZ must pay dividends. But I didn’t do this because it was unprofitable.

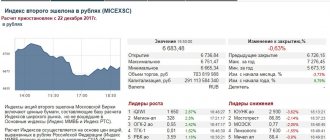

By 2021, the company began to emerge from the decline and increased sales very well. The statistics speak for themselves.

Source: vedomosti.ru

Moreover, the plant did not hesitate to regularly raise prices. He did this in 2021 and in 2021, and in 2021 three times. As you can see, prospects for making good money, and therefore dividends, are looming on the horizon.

It was here that the shares were seized according to a cunning scheme, so that more payments would go only to their own people.

The second version is insider movements. They want to make business a monopoly. To do this, it is necessary to modernize production and pump it up with money from Western investors and the Russian oil tanker.

Now both are happening. This explains AvtoVAZ’s desire not to publicly disclose its operating data. Outsiders should not know how much and who invests in the company.

The guys, apparently, no longer need the stock exchange to attract investments (and after all, they go to the stock exchange to get money). If so, then the financial issue has already been resolved.

And it's decided. AvtoVAZ and the Ministry of Industry and Trade of the Russian Federation signed cooperation agreements.

The composition of the Alliance of Automobile Manufacturers, which included AvtoVAZ (source: jarredbradford.blogspot.com)

This was done in the form of SPIC - a Special Investment Contract, with which you can pour public money into industrial enterprises without red tape and unnecessary reporting.

In return, the other side will restructure production and provide technology. For example, from next year the plant will not cut its own platforms, and almost 70% of the vehicle fleet will be riveted according to the CMF-B-LS stencil - Renault’s most popular modular platform, invented back in 2013.

According to the plan, the company will enter the market from a position of strength (see graph above), earn a lot of money and divide everything between Renault and Rostec.

Or maybe he’ll even hold a new listing to capitalize on its success. Although I won’t invent anything here, we’ll wait and see.

1. 06/14/2018 in pursuance of the requirements of Article 84.2 of the Federal Law of December 26, 1995 No. 208-FZ “On Joint Stock Companies” by the Alliance Rostec Auto B.V. (Alliance Rostec Auto BV) (Renault and Rostec holding) sent to the Central Bank of the Russian Federation a proposal to purchase equity securities of PJSC AVTOVAZ (posted at the link https://info.avtovaz.ru/index.php?id=5721) , based on the results of the placement of Alliance Rostec Auto B.V. acquired 96.64% of the shares of PJSC AVTOVAZ.

2. 09/28/2018 The Rostec Auto B V. Alliance, in pursuance of the requirements of Article 84.8 of the Federal Law “On Joint-Stock Companies,” has placed a demand for the redemption of the remaining 3.36% of the equity securities of the joint-stock company (posted at the link https://info.avtovaz.ru/pages/section_7 /5761.html).

3. Within the framework of the requirements of clause 2 of Article 84.8 of the Federal Law “On Joint Stock Companies”, the repurchase of securities is carried out at a price not lower than the market value, which must be determined by the appraiser, and not lower than the previous voluntary repurchase: for an ordinary share – 12.40 rubles ., for preferred – 12.20 rubles) (according to the valuation report, the market value of an ordinary share as of 06/30/2018 was 10.28 rubles, preferred – 10.24 rubles).

4. December 14 and 24, 2021 in pursuance of the requirements of clause 7 and clause 7.1 of article 84.8 of the Federal Law “On Joint-Stock Companies”, funds for compulsorily redeemed shares were deposited with the notary of Togliatti, Stanislav Yuryevich Sladkov (tel. 8 (8482) 72-42-21, place location: 445031, Samara region, Togliatti, Avtostroiteley str., 1a, email address) in proportion to the number of shares owned for each shareholder.

In accordance with paragraph 4 of Art. 84.8 of the Federal Law “On Joint-Stock Companies”, an owner of securities who does not agree with the price of the securities to be redeemed has the right to appeal to the arbitration court within six months from the day when such owner of the securities learned about the debit from his personal account (depo account) of the securities to be redeemed securities with a claim for compensation for losses caused in connection with improper determination of the price of the repurchased securities. The filing of the said claim by the owner of the securities with the arbitration court is not grounds for suspending the repurchase of securities or declaring it invalid.

5. December 29, 2018 notary of Togliatti Sladkov S.Yu. a notice was sent to each shareholder about depositing money with the notary.

ACTIONS OF SHAREHOLDERS (CREDITORS) TO RECEIVE MONEY FOR PURCHASED SHARES OF PJSC AVTOVAZ

Payment of funds contributed for the repurchased shares of PJSC AVTOVAZ is carried out by notary Sladkov S.Yu. based on the following documents: – an application submitted at a personal reception to a notary, according to the attached sample (location of the notary’s office: Tolyatti, Avtostroiteley St., 1a, working hours: Mon-Fri 8:00-17:00, break: 13 :00-14:00); You must have a passport or other identification document with you ; – an application sent in electronic form and signed with an enhanced qualified electronic signature of the applicant or notary ; – an application sent to the notary by registered mail with return receipt requested (the authenticity of the signature can be notarized by any notary of the Russian Federation); – an application from the heir , sent in one of the specified ways, with the attachment of a certificate of inheritance rights to shares or funds deposited with the notary, or its notarized copy.

In case of changes in the information about the applicant, in order to identify a person with the data of the register of securities owners, it is necessary to attach to the application a copy of a document confirming such changes: - last name, first name, patronymic - marriage certificate, change of name, registry office certificate of marriage, etc.; – passport data or information about another identification document – a certificate of previously issued passports (provided free of charge by the territorial bodies of the Ministry of Internal Affairs of Russia, including through the MFC); – addresses of permanent residence – a copy of the passport pages containing data on the last name, first name, patronymic, addresses of the place of residence or the corresponding certificate from the registration authority (migration department of the territorial bodies of the Ministry of Internal Affairs of Russia).

In order to exclude fraudulent activities, copies of documents must be notarized.

Funds deposited with a notary are kept in a public deposit account for 10 years from the date of deposit. When choosing an account to transfer funds, make sure that the account is valid and not blocked.

Sample application for transferring money for repurchased shares of PJSC AVTOVAZ

And this is what we have come to

AvtoVAZ shares ceased to exist in November 2021. By that time, 96.64% had already been collected in the hands of the French; Using its legal right, the company forcibly purchased the asset.

It’s interesting that the “redemption” process itself was a circus.

Source: lada.online

The conditions were written very strangely. For example, electronic exchange was prohibited. Minority shareholders were deprived of the opportunity to receive money directly into their brokerage account. To exchange money, you had to go to Togliatti to get cash in your hands.

Imagine that you live in Vladivostok and suddenly find out that you need to appear in Tolyatti in person. It’s only 8-odd thousand kilometers to cover so that it’s still unknown when to get to the notary.

In general, it is clear that the majority of small shareholders, whose share is worth less than 50K rubles, literally donated their money to the cunning people on the board.