A step-by-step guide on how to buy shares on the stock exchange as an individual. Where shares are traded and how to purchase them, features of selection and time of purchase.

You've probably imagined many times how you're going to buy shares in a company and make enough money to travel the world and last you the rest of your life. This is not easy to achieve, but you have to start somewhere.

You don't need a ton of money to start your investing journey, some people start with $300 or less.

- Buying a share

- Conclusion

How to make your income passive using stocks

If you learn to do correct technical analysis of the stock market, you can constantly make profits. We advise you to study the combined method of technical and fundamental market analysis.

Isn’t it a dream to make your income completely passive? You will enjoy life, travel to different countries, and your income will grow at this time!

But for beginners it is always difficult to decide where to invest money so as not to make a mistake.

The first and most important advice: never invest the money that is intended to buy vital things: food, housing, medicine, clothing. Spend on stocks only what you will already live without.

Shares of companies that always make a profit

Of course, it’s quite difficult to say so unambiguously. Because even experienced traders know that any stock can collapse unexpectedly. And even the most reliable companies cannot guarantee stability and ever-increasing prices. The capricious market is so volatile that any investment is a big risk. And you must take this into account. We have selected for you a list of the most stable companies whose shares are always in price. And on which you can really make money.

As you remember, when planning to buy shares of a company in which you have trusted, you must consider:

- its position in the market;

- the trust of buyers and users, which you can read about or watch videos on the Internet;

- feedback from other shareholders;

- the percentage of dividends this company pays;

- prospects for its development, regarding the timing of its presence on the market;

- analytical forecasts of experts.

And this is not a complete list of the conditions that must be met in order to receive stable profits. But with experience, you will learn to determine which companies can be trusted and which cannot. Of course, losses accompany almost everyone. And you must be prepared for the fact that some of the money may not return to you. But only experience, technical knowledge and developed intuition will help you learn to do without losses.

Stages of alienation of rights

In open and closed types of joint stock companies, the algorithm for alienation of rights is slightly different.

In public or open joint stock companies, the transaction is carried out as follows:

- drawing up a purchase/sale agreement;

- calculations and verification;

- committing changes to the registry.

In closed or non-public joint stock companies there is a pre-emptive right to a proportional redemption of securities among other participants. In this regard, the step-by-step transaction procedure looks like this:

- official notification to the joint-stock company in order to inform other owners about the upcoming transaction;

- conclusion of a purchase/sale agreement;

- carrying out calculations and results of the implementation of the preemptive right;

- making changes to the register of holders.

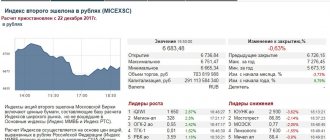

No. 3 - Mechel

The metallurgical industry also allows you to have no doubt about the profits from purchasing shares. The cost of one share is quite low and amounts to about 60 rubles. However, 2021 brought losses. Mechel's loss under IFRS for 9 months. 2021 amounted to ₽15.659 billion, against a profit of ₽13.427 billion in the previous year. Revenue decreased by 10.9% to RUB 196.197 billion versus RUB 220.113 billion a year earlier.

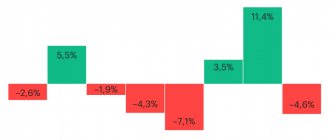

However, forecasts assure growth:

Russian securities brokers

There are only a few brokers in Russia licensed by the Central Bank of the Russian Federation, with whom you can open trading accounts and buy shares. Below I will provide a list of companies included in the top 10 largest brokers in the country in terms of trading volumes on the Moscow Exchange.

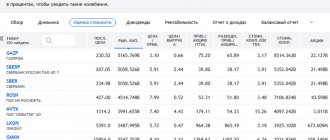

Rating of brokers where to buy company shares

| Platform/Broker | Number of open accounts* |

| Sberbank | 1.96 million |

| Tinkoff | 1.1 million |

| VTB broker | 0.5 million |

| BCS broker | 0.4 million |

| Opening | 0.2 million |

| Finam broker | 0.2 million |

*data presented as of the end of April 2021.

Let's look at each one individually, in particular trading conditions, advantages and disadvantages.

Sberbank broker

The leading broker in Russia by the number of clients. This is due to the fact that the vast majority of the population has deposits in Sberbank and when the deadline expires, everyone is offered to open an IIS, promising higher returns. Sberbank provides the opportunity to form an investment portfolio independently or transfer money to trust management through packages developed by company analysts. From my own experience, I do not recommend taking these packages.

Service rates are not the most favorable compared to other brokers:

| Independent | Investment | |

| Transactions up to 1 million | 0,06% | 0,30% |

| Transactions 1-50 million | 0,03% | 0,30% |

| More than 50 million | 0,018% | 0,30% |

| Tariffs for transactions on the MICEX | ||

| Up to 250 thousand rubles. | 0,3% | 0,30% |

| 0.25 -1 million rub. | 0,06% | 0,30% |

| 1 – 50 million rub. | 0,035% | 0,30% |

| More than 50 million | 0,018% | 0,30% |

When making transactions on the foreign exchange market, the commission for all tariffs is 0.2%, for an independent tariff for a transaction amount of more than 100 million rubles – 0,02%.

Pros:

- Fast account opening,

- The minimum threshold is 1000 rubles,

- There is a Quik trading terminal,

- Wide coverage of offices throughout Russia.

Minuses:

- There is no St. Petersburg stock exchange, and therefore no access to foreign shares,

- There is no depth of market,

- To resolve most issues, a visit to the company’s office will be required. And knowing the technical support of Sberbank, this will have to be done constantly.

Tinkoff investments, where to buy company shares

One of the popular brokers for buying shares in Russia. Actively increases its client base by promoting to the masses:

- convenient application,

- quick access to all functions,

- instant withdrawal of funds to the card,

- Resolving all issues without visiting the office.

The account is opened within 3 business days. But first you need to leave an application and receive a bank card the next day. It will take another two days to open a brokerage account. After activating the account, we top up the card from a card of any bank and transfer funds to the brokerage account. That's it - you can buy shares.

Tinkoff tariffs:

| Operation | Investor | Trader | Premium |

| For opening a deal | 0,30% | 0.05%, from 200 thousand rubles per day 0.025% | 0.025%, up to 2% for some instruments |

| Account servicing | For free | 0 rub., under a number of conditions, or 290 rub. per month | 0 rubles, under a number of conditions, or 3000 rubles. under a number of conditions |

For beginners, I recommend the minimum “Investor” tariff. If you plan to actively speculate, then choose the “Trader” tariff. With a capital of 2 million rubles or more, look towards the “Premium” tariff.

Pros of Tinkoff:

- Convenient application

- Possibility of opening transactions with a pending order,

- Entering the St. Petersburg Stock Exchange, which opens up the possibility of purchasing foreign shares,

- Affiliate program,

- Glass of prices,

- Technical support solves all issues without going to the office.

Minuses:

- Commissions are higher than competitors

- At the beginning and end of trading, the terminal may freeze a lot,

- Technical support does not try to understand the question and provides template answers.

Read more about the broker in the article “Tinkoff Investments reviews“.

No. 5. "Lukoil"

Next on our list is the Lukoil concern. The cost of one share here is quite high and amounts to 5,265 rubles. The yield is 5.83%. On average, the annual increase in dividend payments is 15%. One of the distinguishing features of this company is the constant growth of dividends, which will increase no less than the rise in inflation.

This is one of the largest oil and gas companies in the world. Just think that it accounts for over 2% of global oil production. And about 1% hydrocarbons worldwide.

Possible risks

When carrying out transactions with securities of a joint-stock company, it is necessary to pay attention to the following factors:

- The correctness of the contract and the information specified in it.

- Monitoring and checking the transaction for compliance with legal requirements, including antimonopoly legislation.

- Absence of counterparty risks (whether financial instruments are not pledged, whether they are registered in the register of holders, etc.).

If at least one of the points does not meet the established requirements, the transaction may be invalid.

No. 7. "Surgutneftegaz"

The share price is about 40 rubles.

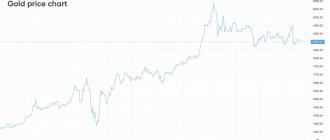

Estimate the size of dividends:

№ 8.

The cost of these shares is perhaps the highest: 21,526 rubles.

Take a look at analyst forecasts:

Also note the steady increase in dividends:

Analysts advise investing in a company that produces nickel and palladium. The dividend amount increased by 43%!

No. 9. NLMK Group

The price of shares of the NLMK group is about 200 rubles. But dividends are constantly growing.

But, I would like to note that the company’s debt has grown to 900 million rubles. On average, due to rising debts, stock prices fell by 3%. By 2023, the demand for launching new enterprises is expected to decrease. Therefore, it is planned to reduce the cost of coal and steel.

No. 10. Chain of stores "Lenta"

It is impossible not to note the stable growth in the share price of everyone’s favorite Lenta chain of stores.

The cost of one share is relatively inexpensive (about 200 rubles). Therefore, everyone, even a novice trader, can afford to buy several. According to experts, stock prices will rise.

However, it is worth comparing the price of these shares with the shares of other stores. For example, shares of Magnit cost 4,893 rubles and the X5 Retail group of stores cost 2,841 rubles.

Magnit shares have lost a little value due to a change of owners in 2021. But since then, momentum has picked up. Now the management of Magnit has expressed a desire to buy 100% of the shares of Lenta. At the same time, a fall in Magnit's quotes and an increase in Lenta shares are predicted. If the deal is successful, the level of income of the combined companies will exceed the total income of the X5 Retail group. This will allow the company to become a leader among all similar chain stores.

This review only gives you a rough idea of which stocks are worth paying attention to. Of course, everyone will prefer to invest money in what they trust. But before you buy shares of any company, be sure to study the market. Read analyst reviews and forecasts. And then your income will always be consistently high.

Your decision

– How did the development of the project begin in Kazakhstan, if you did not use Russian developments?

– Indeed, technically the projects are almost completely different. Russian Freedom24.kz is a separate project, which was initially built on a separate platform. In addition, you need to take into account that in Russia there are no problems with the range of securities - securities of an impressive number of foreign issuing companies are available on the Moscow and St. Petersburg exchanges.

Freedom24.kz is a project of Freedom Finance JSC, which operates on the Tradernet platform.

We were faced with the task of simplifying and digitizing entry and work on the stock market, we studied and researched our market and decided to use a Russian format that was ideal for our market - an online store. E-commerce in Kazakhstan is growing every year. For example, the growth over the last year was about 23%, and the market volume was about 300 billion tenge. Having studied the Russian product, I had an idea of what key advantages and functionality we should provide to our clients. But, unfortunately, it was impossible to simply transfer the Russian product to Kazakhstan, given the different legislation and requirements. As a result, over the course of a year we built processes, tested hypotheses and found solutions. Almost everything is done from scratch, taking into account Kazakhstani requirements and modern tools; We decided to package all this into the user’s usual format – an online store.

– Which stage in creating Freedom24.kz turned out to be the most difficult?

– Creating a startup in itself is not an easy process. There is always uncertainty and the absence of ready-made solutions - you have to look for them in the moment. As I said, there were a lot of unanswered questions. We searched and found answers, but then it turned out that these solutions were not suitable - due to Kazakhstani requirements or for technical reasons. For example, we are tied to the Tradernet platform, therefore we are dependent on it and do not control many external factors. It turns out that you work, create solutions, but at the same time you don’t know what will happen next. And all that drives you is belief in a big idea.