What are Alfa-Bank mutual funds?

Alfa-Bank Mutual Investment Fund (UIF) is a fund that is organized and exists through the investments of investors. Most often, mutual fund clients are people who want to increase their financial income passively, but do not want or cannot go into all the details and subtleties of buying and selling securities.

In essence, citizens entrust their savings to the Alfa Capital Management Company, which, in turn, uses these funds to carry out transactions on the stock market, as a result of which the private investor receives a certain profit.

Today, Alfa Capital Management Company boasts a wide branch network, which is represented by more than 400 points of sale throughout Russia. This is a significant advantage among similar companies.

All mutual investment funds, including Alfa-Bank mutual funds, can be divided by industry. Experts recommend investing finances in different directions. This approach will help minimize risks.

Bottom line. The main and main task of any mutual investment fund is to increase the return on investment of the investor. But, a potential investor should remember that the level of income declared by the Management Company is approximate. No one will give any guarantees that the profit will be exactly the same. In addition, you should understand that any highly profitable transaction on the stock market is accompanied by a high risk of losing money.

Mobile application for investments

By downloading the Alfa-Direct application, an investor has the right to count on access to a professional investment management tool:

- with online support;

- access to schedules and various types of orders;

- the right to “leverage”;

- portfolio composition analysis;

- control of an uncovered position.

In addition, the trader gets the opportunity to watch the change in quotes in the order book broadcast online and issue automatic notifications when the price reaches the required level.

To install the Alfa-Direct application, follow the link:

- ;

- .

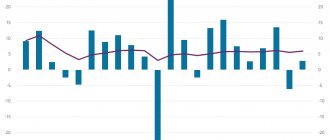

Profitability and dynamics

The profitability and dynamics of mutual funds are influenced by a number of factors, among which are:

- The general economic state of markets, both Russian and global;

- Level of profitability of investments;

- Professional qualification of management company.

Before choosing a particular mutual investment fund, an investor should familiarize itself with its return over the past period. It is recommended to analyze the dynamics over the past few years.

Attention! A fund's positive performance in the past is not a guarantee of a promising future.

The profitability indicator of some Alfa Capital mutual funds for 2021 is as follows:

- Moscow Exchange Index – 16%;

- Balance – 16%;

- Precious metals – 15%;

- Alfa Capital – 14%;

- Liquid shares – 14%;

- Bonds plus – 12%;

- Reserve – 11%;

- Eurobonds – 11%;

- Resources – 11%;

- Global balance – 10%;

- Technologies – 8%.

Attention. Analysts recommend that new investors invest small amounts at first, as some investments may not be profitable.

The table below shows the dynamics of existing Alfa Capital mutual funds for a certain period of time as of March 1, 2020:

| Name of mutual fund | Yield (percent) | |||||

| In 1 month | In 3 months | In 6 months | For 1 year | In 3 years | Since the foundation was founded | |

| "Liquid shares" | -9,8% | -4,5% | +0,5% | +13,7% | +57,8% | +485,5% |

| "Moscow Exchange Index" | -9,9% | -4,9% | +2,5% | +16,5% | +54,4% | +48,2% |

| "Balance" | -6,7% | -1,8% | +4,3% | +16,5% | +55,3% | +149,8% |

| "Bonds Plus" | -0,6% | +1,8% | +5,5% | +12,5% | +31,4% | +353,6% |

| "Reserve" | -0,6% | +1,6% | +5,4% | +10,8% | +29,6% | +303,5% |

| "Eurobonds (ruble)" | +2,1% | +5,9% | +6,3% | +11,1% | +35,7% | +405,3% |

| "Eurobonds (dollar)" | -1,9% | +3,5% | +8,1% | +11,3% | +19,8% | +119,5% |

| "Resources" | -11,6% | -7,5% | +1,3% | +10,8% | +67,9% | +215,9% |

| "Global Balance" | -4,1% | -1,3% | -1% | +10,2% | -2,7% | +59,7% |

| "Technology (ruble)" | -4,9% | +0,8% | +5,7% | +7,9% | +51,9% | +241% |

| "Technology (dollar)" | -8,6% | -1,6% | +7,5% | +8,2% | +34,1% | +37% |

| "Gold" | +3,1% | +8,8% | +0,9% | +15,4% | +25,7% | +8,1% |

| "Alfa Capital" | -7,1% | -2,4% | +2,8% | +14,2% | +32,6% | +443,4% |

AKMB

The fund tracks the composite index of all Moscow Exchange bonds, including state, municipal and corporate bonds of 1-2 tiers. At the same time, managers can arbitrarily change the ratio of assets within the fund in accordance with the market situation.

Thus, now the largest share in the fund is held by corporate bonds with a duration of 1 to 3 years, and of completely different quality. The TOP 10 in terms of volume are occupied by bonds of such companies as Cherkizovo, STLC, PIK, LSR, Samolet, Transkomplektholding, Settle Group, Tinkoff Bank, Rosneft and Home Credit and Finance Bank. The share of state and municipal bonds has been reduced de facto to zero.

The fund’s benchmark is its own AKMBA index, but the Moscow Exchange Corporate Bonds Index 1-3 can be used as a guide, since now it corresponds as closely as possible to the set of assets in the fund.

All coupons are reinvested within the fund, increasing the value of the share. Management fee – 1.41%: this high fee is typical for all managed funds. The price of the fund is only 1.07 rubles.

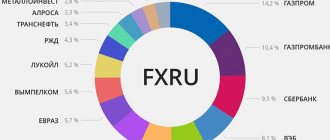

What mutual funds does Alfa Capital have?

For the convenience of its clients, Alfa Capital has divided all its mutual investment funds into three categories, which differ from each other in the level of income and set of investment instruments. The three types of mutual funds include classic, industry and specialized funds. Let's take a closer look at each of them.

Classic mutual funds

Mutual funds in this category purchase shares and bonds of well-known companies. Alfa Capital's classic mutual investment funds are represented by the following funds:

- Liquid shares. This fund is engaged in the purchase and sale of shares of Russian and global companies. The return from February 2021 to February 2021 was 14%.

- Moscow Exchange Index. The name speaks for itself. The mutual fund completely duplicates the indices of Russia's largest exchange holding company, MICEX. Profitability for last year was 16%.

- Balance. The investment portfolio contains both stocks and bonds equally. Thanks to this composition, the mutual fund remains afloat even in times of crisis. The return over the last year was 16%.

- Bonds plus. Using investors' money, the fund purchases Russian bonds, which have a low level of risk and, as a rule, low yield. Although in the period from February 2021 to February 2021, the profit of this mutual fund Alfa Capital Management Company increased by 12%.

- Reserve. It is very similar to the previous mutual fund. The investment portfolio contains mainly government securities of the Russian Federation, as well as bonds of large Russian organizations. The return for the year was 11%.

- Eurobonds. Most of the fund's assets are bonds denominated in foreign currencies, most often in US dollars. The mutual fund's profitability is quite high; the dynamics over the past three years amounted to 11%. But the risks are also considerable, since sharp fluctuations in exchange rates have become a frequent occurrence today.

Industry mutual funds

Industry mutual funds invest all funds in the purchase of securities of a particular industry. Among Alfa Capital's mutual funds, as of March 2021, three industry funds are available to clients for financial investments:

- Resources. The funds from the mutual fund are aimed at purchasing shares of Russian companies, which can safely be called the basis of the Russian economy. These include oil and gas, petrochemical and mining and metallurgical corporations. The fund's return over the past year was 11%.

- Global balance. Investors' investments are spent on the purchase of shares and bonds of companies related to the consumer sector. Investments are also spent on securities of financial organizations. The main advantage of this fund is that settlement transactions are carried out in $ or other hard currency. In addition, diversification of assets significantly reduces the level of possible risks. The profitability of the mutual fund from February 2021 to February 2021 is 10%. Previously, the Alfa Capital Global Balance fund was called the Trade fund.

- Technologies. This fund invests in shares of the largest corporations engaged in the development, production and sale of high-tech products. The majority of the investment portfolio is occupied by securities of companies such as Apple, Microsoft and other similar world-class IT giants. The mutual fund's profitability for the year is 8%.

Specialized funds

Today, Alfa Capital offers citizens to invest their savings in two specialized mutual funds:

- Gold. Investments in gold have been considered profitable for many years. It's always valuable. Investments of this fund are directed to the acquisition of shares of gold mining companies and its own to the purchase of the most precious metal. Over the last year, the mutual fund's return was 15%.

- Alfa Capital. One of the first mutual funds of this Management Company. His investment portfolio includes highly liquid stocks, stable and most reliable bonds and other promising securities. This fund is characterized by moderate risks and good returns, which for the period from February 2021 to February 2021 amounted to 14%.

AKSP

Another fund of funds (or matryoshka fund, as investors call it). AKSP acquires shares of the foreign fund iShares Core S&P 500, which tracks the main index of the American economy - the S&P 500. At the same time, in accordance with the strategy, the fund may include other ETFs in its composition.

The AKSP commission is 1.05%, the iShares fund commission is another 0.2%. The fund is traded only in dollars, its price is $12.91.

Like AKEU, AKSP is a Russian asset.

Conditions for investing in Mutual Fund Alfa-Bank

A citizen who has reached the age of 18 can become an investor and invest their savings in mutual funds of Alfa Capital Management Company. The management company offers the following conditions for its potential investors:

- The minimum investment amount is from 100 rubles.

The optimal investment amount is ₽3000 - ₽5000 . This will allow the investor to assemble his investment portfolio from several funds, which will reduce the level of risk and increase profitability.

- The additional purchase amount is at least 100 rubles.

- The investment period is at the discretion of the investor.

Experts recommend investing money in mutual funds for at least 1 year. Please note that when investing for more than 3 years, the client is entitled to tax benefits.

- An investor can purchase fund shares without leaving home, on alfacapital.ru or through a mobile application.

- The premium for purchasing shares of any of the Alfa Capital mutual funds directly depends on the amount of investment:

- Up to ₽500000 – 1,4%;

- From ₽500000 to ₽2999999 – 0,9%;

- Over ₽3000000 – 0,5%

- The sales premium depends on the investment period:

- Less than a year - 1,5%;

- From one to two years - 1%;

- More than two years - 0%.

The commission fee of the management company cannot exceed 3.8% of the average annual net asset value (NAV) of the fund. Other commission paid to the depositary, etc., but not more than 0.68% of the NAV. The amount of expenses due to ownership of a share is 0.5% of the NAV.

AKNX

This fund, like its brothers, is also a fund of funds. In fact, AKNX offers investing in high-tech companies. It works by purchasing the Invesco QQQ fund, which tracks the Nasdaq index.

At the same time, AKNX is taking a step towards full replication by acquiring individual assets. So, now the share of QQQ is 87.5%, the rest are shares of Facebook, Tesla, Alphabet, NVIDIA, Adobe, PayPal, Intel, Netflix and some others. Theoretically, over time, the fund could become fully replicative rather than a fund of funds.

Currently the AKNX management fee is 1%, the QQQ fee is 0.35%. The fund is traded in rubles and dollars and costs 1,408 rubles / 17.5 dollars.

How to buy mutual fund Alfa Capital?

You can buy shares of any of the Alfa Capital mutual funds in several ways:

- In the office of the sales point of Alfa Capital Management Company;

- At the agents' office (Alfa-Bank, KB Vostochny);

- On the website alfacapital.ru or in the mobile application. The easiest and fastest way. To do this you need:

- Select the “MUTUAL FUNDS” , then the mutual fund you like and click “BUY ONLINE” ;

- Fill out the form that appears on the screen indicating your personal data;

- Fill out an online application in which the future investor must indicate the amount of investment, payment details and a code that will be sent to the previously specified contact phone number;

- Make payments for shares using a bank card.

As soon as the payment is received, the client automatically becomes an investor in the selected mutual fund.

basic information

- Full name: Alfa Capital;

- Official website: https://alfacapital.ru/;

- Legal address: Moscow, st. Sadovaya Kudrinskaya, 32, building 1. BC "BronnayaPlaza";

- Contacts: +74957973152, +74957973151, 8 800 2002828, , ;

- License: License to carry out financial activities No. 21-000-1-00028 dated September 22, 1998, issued by the Federal Financial Markets Service of Russia, for an unlimited period;

- Services: mutual funds, investments, trust management, analytics;

- Terminal: no;

- Minimum deposit: 100 ₽;

- Financial instruments: currencies, securities, indices, precious metals, commodities.

Advantages and disadvantages

Like any financial product, investing in mutual funds has its advantages and disadvantages. Let's take a closer look at the pros and cons of investing in mutual funds of Alfa Capital Management Company.

Advantages

- Profitability. When investing in mutual funds, the main goal of each client is to make a profit. Today, citizens have become convinced that such investments are more profitable than a regular bank deposit. And the interest rate is significantly higher.

- High level of reliability. The largest rating agency in Russia, Expert RA, assigned the Alfa Capital Management Company the maximum level of reliability class A++. Also, the national rating agency rated the reliability of the management company at the AAA level, which is a high rating and not every company receives it.

- Accessible and understandable purchasing methods. The investor can invest his savings in any mutual fund of Alfa Capital Management Company online.

- Qualification of company specialists. An extremely important advantage, especially for beginners. The investor’s profit or loss depends on the correct strategy of the management company and the professionalism of its employees.

- Small amount for investment. Not everyone is ready to make large investments in shares. The minimum threshold for investing funds in mutual funds of Alfa Capital Management Company is only 100 rubles.

- Despite recommendations on investment periods, the client has the opportunity to independently choose the period of his investments.

- Receiving tax benefits in the form of deductions , provided that the investment period is more than 3 years.

Flaws

Among the disadvantages of investing in the Alfa Capital Management Fund, several points can be highlighted:

- Payment of various commissions;

- High level of risks with high profitability;

- A tax deduction is only available for investment periods exceeding 3 years;

- The profitability of a mutual fund for the past period does not guarantee the same situation in the future. It is quite possible that the investment will turn out to be unprofitable.

All of the above disadvantages are typical not only for the mutual investment funds of Alfa Capital Management Company, but also for all similar companies involved in the purchase and sale of securities on the stock market, such as Sberbank, VTB and Gazprombank.

Alternatives

From the point of view of the size of the entrance threshold, the only competition for Alfa Capital shares can be a deposit in a bank and a cent on Forex. In the first case, you will have very low but guaranteed interest on your deposit, in the second - an unforgettable experience from draining your account.

You can invest in a PAMM account by analyzing the ratings of managers.

As an option for collective investment management, you can consider ETF funds: their shares are traded on the exchange, commission costs are lower and there is the possibility of opening short positions.