Lazy Investor Blog > Interesting

In recent years, many economists have predicted the complete depletion of Russian reserves. Readers probably remember reports that the Russian Reserve Fund has ceased to exist. Foreign and domestic investors reacted differently to this news background. In this review we will look in detail at:

- what is the National Welfare Fund and how does it affect the investment climate;

- what happened to the Russian Reserve Fund;

- what is the safety margin of the National Welfare Fund and what to expect from it in the future.

National Welfare Fund of Russia

The National Welfare Fund of Russia (NWF) was created in 2008. At that time, there were two similar, but slightly different funds in the country - the Reserve Fund and the National Welfare Fund. From the beginning of 2021, the Reserve Fund was liquidated, and its balance was transferred to the National Welfare Fund. At the moment, there is only one state reserve fund in Russia - the National Welfare Fund.

The National Welfare Fund (NWF) is a state reserve fund created with the aim of stabilizing the pension mechanism for the long term. The main purpose of the creation and operation of the National Welfare Fund is to co-finance the budget of the Russian Pension Fund to cover its deficit.

The funds of the National Welfare Fund are managed by the Ministry of Finance in the manner established by the Government of the Russian Federation. Also, certain functions for managing the National Welfare Fund are performed by the Central Bank.

The National Welfare Fund is partly included in the gold and foreign exchange reserves of Russia, and partly is not included, since part of the assets of the National Welfare Fund is unacceptable for gold and foreign exchange reserves in terms of risk and liquidity.

As you already understand, the National Welfare Fund consists of different assets with different levels of risk, and these assets are not only stored, but also generate a certain income, and if they fall in price or have a negative return, they can also generate a loss. The entire process is managed by the Ministry of Finance and the Central Bank.

What is NWF

The National Welfare Fund (aka NWF) in its current form has been operating since 2021. It was then that it was merged with the no longer functioning Reserve Fund of the Russian Government. The National Welfare Fund can be called an integral part of the country's budget. Officially, the NWF has three goals :

- stabilization of the budget of the Pension Fund of the Russian Federation (PFR);

- ensuring co-financing of voluntary pension savings of the population;

- covering the federal budget deficit.

In general, the FNB is something like a spare (fifth) wheel in a car.

If suddenly hard times come to the Pension Fund and there is no longer enough money, it is allowed to call on funds from the National Welfare Fund. The law on the National Welfare Fund clearly states: for co-financing purposes. Co-financing is a Pension Fund program where you, the employee, yourself contribute additional money to your pension (in addition to what the employer already does) to the Pension Fund, and the state doubles your funds. The maximum amount for such doubling is 12,000 rubles.

Let's say you work in a bank. The employer pays insurance contributions to the Pension Fund for you. You decided to contribute 2,000 rubles to your “voluntary pension”. The state will add another 2,000 rubles. Thus, your individual pension account will increase not by 2,000, but by 4,000 rubles. The next year you voluntarily transferred 12,000 rubles, and the state doubled your contribution again. In the third year, you voluntarily transferred 18,000 rubles, but here the authorities added only 12,000 rubles to you (since this is the maximum).

By the way, you cannot join the co-financing program now. The reception ended on December 31, 2014.

As for the budget deficit, everything is simple. When expenses exceed income and there is nowhere to get money, the National Welfare Fund can come to the rescue.

How to spend and not eat: what is a budget deficit

So, we found out what the fund's money is used for, but where does it come from?

Formation of the National Welfare Fund

How is the National Welfare Fund formed? The main source of formation of the National Welfare Fund is federal budget revenues from the oil and gas industry. They include:

- Tax on the extraction of mineral resources in the form of hydrocarbons (oil, natural gas, gas condensate).

- Export customs duties on oil, natural gas and goods produced from oil.

The second source of formation of the National Welfare Fund is income from the placement of funds of the fund itself in assets. However, from 02/01/2016. until 02/01/2022 income from the management of the National Welfare Fund does not go to the Fund, but to the federal budget to ensure its expenditure side.

Budget rule

When forming the National Welfare Fund at the expense of oil and gas revenues, the following budget rule is applied:

Part of the income in the form of taxes and duties from the sale of hydrocarbon raw materials is sent to the National Welfare Fund when the price of URALS oil is from $40 per barrel and above. This is as of 2021, then each subsequent year the “cut-off price” of URALS oil is indexed by 2% according to the budget rule. Thus, for example, in 2021 this price is already $42.45 per barrel.

Funds allocated to the National Welfare Fund according to the budget rule are considered excess income.

If the price of URALS oil is less than that established by the budget rule, revenues from the oil and gas industry are not sent to the National Welfare Fund.

NWF is...

NWF is an abbreviation for National Welfare Fund. This is a special reserve monetary fund created by the state to stabilize the federal budget in the event of unfavorable circumstances for the economy.

You don’t have to look far for an example: the current situation, when the entire population of the country is in self-isolation and only continuous cycle production, institutions and enterprises are operating to ensure the livelihoods of the population.

In simple words, the National Welfare Fund is a “safety cushion” for the residents of the country and its economy. The fund is part of the federal budget, but with separate accounting and management.

Reserve funds are created mainly in those states whose budget funding depends on unstable sources of income, for example, on world prices for hydrocarbons, which are constantly “jumping”, i.e. subject to volatility.

Due to the high volatility of world oil and gas prices, income from hydrocarbon exports can be characterized as follows: “sometimes empty, sometimes thick.” At the moment when it is “empty”, funds for urgent needs (social obligations of the state) are taken from the National Welfare Fund.

In Russia, the share of oil and gas revenues in the federal budget for 2019 was 40.8%. Agree, it's a serious addiction. Note: Analysts predicted (before the pandemic) that in 2022 the share of budget revenues from hydrocarbons would be 35%. How the situation will develop “in fact” after the end of the pandemic, time will tell.

The functioning scheme of any reserve fund (including the National Welfare Fund) is simple:

- there is income → funds are accumulated in the fund;

- no income → accumulated funds are spent on urgent needs.

The National Welfare Fund was created as one of the mechanisms for providing pensions to citizens of the Russian Federation. This means that NWF funds are used, among other things, to pay pensions.

The fund is managed by the Ministry of Finance of the Russian Federation. The purpose of management is to ensure the safety and increase of the funds of the National Welfare Fund.

The activities of the National Welfare Fund are regulated by law by the Budget Code (BC) of the Russian Federation as amended on April 22, 2020, by Articles 69.10 – 69.12.

Structure of the National Welfare Fund

What assets does the National Welfare Fund consist of? The structure of the National Welfare Fund's assets includes:

- Foreign currency.

- Debt obligations of foreign states.

- Debt obligations of foreign government agencies and Central banks.

- Debt obligations of international financial organizations.

- Debt obligations of legal entities.

- Shares of legal entities.

- Investment fund units.

- Deposits in the Central Bank and in the banking system.

The placement of NWF funds in debt obligations of the state and organizations is allowed only if the assets are issued in the following countries:

- Austria;

- Belgium;

- Great Britain;

- Germany;

- Denmark;

- Spain;

- Canada;

- Luxembourg;

- Netherlands;

- USA;

- Finland;

- France;

- Sweden.

At the same time, there are requirements for the credit ratings of issuers of debt obligations (for foreign issuers they must be no lower than AA-Aa3, for Russian issuers - no lower than BBB-, Baa3), as well as a number of other parameters: maturity dates, issue volume, par value, rate coupon income, etc.

There are also restrictions on the maximum shares of different assets included in the structure of the National Welfare Fund; they are presented in the following table:

The maximum share of foreign currency in the assets of the National Welfare Fund can reach 100%, and Russian rubles should not exceed 40%. In this case, the structure of the NWF’s foreign currency assets should be as follows:

- US dollar - 45%;

- Euro - 45%;

- British pound sterling - 10%.

How is the National Welfare Fund formed?

The fund is formed from several sources.

- Income received from the sale of Urals oil at a price of over $42.4 per barrel.

Clarification: this is the so-called “cut-off price” for 2021, from which “extra income” begins. It is planned that by 2023 it will be equal to $45 per barrel. The introduction of the rule on the cut-off price makes it possible to reduce the dependence of the Russian economy on the volatility of oil prices.When the price of oil increases above the cut-off price, foreign currency is purchased with these “additional” funds. This restrains the growth of the ruble exchange rate. When the oil price decreases below the cut-off price, the mechanism works in the opposite direction: currency from the National Welfare Fund is used to purchase the ruble to maintain its exchange rate.

- Income received from investments of the National Welfare Fund's own funds.

At the same time, the fund’s funds invested in foreign financial assets are at the same time international reserves of the Russian Federation (i.e., these are foreign investments of the Russian Federation, mainly securities of foreign countries). In 2021, 95.2 billion rubles were earned from placing funds from the National Welfare Fund.

Dynamics and volume of the National Wealth Fund for today

Dynamics of the National Welfare Fund

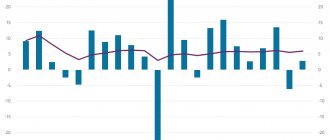

From its creation to the present day, the volume of the National Welfare Fund has grown, both in dollar and ruble equivalents, as well as as a percentage of GDP. In dollar terms, in some years there were declines, which were then offset by further growth.

If we consider the volume of the National Welfare Fund in dollars, the most noticeable growth spurts occurred:

- In 2008 - growth from 32.0 to 87.97 billion dollars;

- In 2021 - growth from 58.10 to 125.56 billion dollars.

The growth of the National Welfare Fund is also observed in the current crisis year of 2021: from 125.56 to 167.63 billion dollars as of November 1. In 2021, the ratio of the volume of the National Welfare Fund to GDP as a percentage became double-digit for the first time.

The volume of funds of the National Welfare Fund today

As of November 1, 2021, the volume of funds of the National Welfare Fund amounted to 167.63 billion US dollars or 13298.63 billion rubles or 11.7% of GDP .

This does not mean that all this money can be withdrawn and used at once. They are invested in assets, many investments are of a fixed-term nature (invested for a certain period), therefore, part of the Fund’s instantly available funds is significantly less than its full volume.

Official statistics and dynamics of the volume of funds of the National Welfare Fund can be viewed on the website of the Ministry of Finance (updated monthly).

Interesting fact: if the funds of the National Welfare Fund are divided by the number of residents of Russia, it turns out that for each resident there are more than 90 thousand rubles in the National Welfare Fund!

If we take into account only pensioners for the calculation (after all, the Fund serves to co-finance pensions), the amount will be several times larger.

The current funds of the Fund would be enough to pay each pensioner an average pension for 20 months!

So as not to be arrested. The Ministry of Finance proposed to distribute the National Welfare Fund to other countries as loans

Olga Pridacha:

TEXT OF THE LETTER: Alternative to the Proposal of the Ministry of Finance of Russia 1. Why this proposal of the Ministry of Finance of the Russian Federation will not work positively under the sanctions of the United States and Western Europe: 1.1. Sanctions provide for a ban on imports, exports, and financing for the country on which sanctions are imposed. Issuing “tied loans” to foreign governments violates import and export restrictions for the Russian Federation. 1.2. If earlier, under the “collateral” of the NWF (“preferential” financing of the Russian Federation, minus the interest on the NWF contribution, which no longer exists, in kind, according to the procedure for sterilizing “surplus income” from oil supplies), it was carried out without sanctions, now this is impossible, and extending this “benefit” of financing to the Governments of other states means partially financing the interests of the Russian Federation, which is subject to sanctions of the Russian Federation. 1.3. The sanctions are aimed at moving “Active” to “Passive” of the Russian Federation, and not transforming “Active”, in monetary terms, into “Active”, in the form of sales of Russian products, according to the sanctions scheme “Export”. 2. What are the negative consequences of these proposals from the Ministry of Finance of the Russian Federation 2.1. For the above reasons of the sanctions procedures, the Governments of other states will not be able to obtain these “preferential” loans secured by the National Welfare Fund, which, in physical terms, does not exist, under the procedure for sterilizing the “surplus income” of the Russian Federation from oil supplies. If this is allowed, then the return of these loans or the import of Russian products will be impossible due to the sanctions areas: import, export, financing, as well as violations of the goals of any sanctions, the movement of “Asset” to “Passive”. This means that the Russian Federation will expand its confrontation with these Governments and its conflict in the World will only intensify. 2.2. The National Welfare Fund, in a simple version, will simply be “cancelled”, just as all its money is automatically cancelled, with the “sterilization” of the Russian Federation’s excess income from oil supplies. 3. Alternative constructive proposals for the use of the National Welfare Fund 3.1. According to the brief information under the video

ISKR – International System of Quality Development. — YouTube Russia needs to switch from its conflict activity of seizing control of someone else’s “Quantitative Growth” system to a leading role in the global construction of an alternative “Qualitative Development” system, according to the ISKR algorithm, in which Russian participants (among more than 100 thousand, in 50 countries World), account for 47.46%. It is necessary to change the logic of war, with its second Caribbean conflicts, to the logic of peaceful, more constructive creation. The Russian Federation urgently switches to the ISKR algorithm, creates an updated “Union of Perfectly Equitable Development” (USSR), on the territory of Russia, builds a new, seductive, for all peoples, economy of “Quality Development”, according to the new “Quality-Balanced” model. But this requires the activity of the Government of the Russian Federation in the financial “push” of self-sufficiency,” after that, the algorithms of HRIS, which do not provide for import, export, financing, which are sanctioned areas of economic activity. 3.2. The Russian Federation is the successor of the former USSR in terms of debts, therefore, paying off all the debts of the former USSR is its international obligation, according to the scheme of moving its “Assets” to “Liabilities”, the purpose of which is any sanction of countries. Therefore, it is advisable for the Russian Federation to move its “Asset” - into “Passive” for the purchase of the Rights of Claim that were born in Kazakhstan, during the old USSR, according to the ISKR procedure, thereby providing the necessary “push” of the “ISKR trailer”, supporting its citizens in active work to create an alternative to the now dying “Quantitative Growth” system, which urgently needs to be changed to a new “Qualitative Development” system. Thus, Russia is not subject to conflictual confrontation under the sanctions regime. It would be more constructive for the Russian Federation to engage in a new system of “Good Globalization” than to try in vain to seize control of the old, “Bad Globalization,” especially one that is objectively dying. 3.3. During the transition period, in the near future, it is possible to create “alternative information carriers of exchangers” DRIMEXs, according to the ISKR algorithm, according to the procedure shown in the video

?t=2394 SPARK. Questions - Answers from 03/21/2021 - YouTube, from the 40th minute. Launch effective means of economic motivation for Russian citizens in the development of a proper economy, in the form of “Information carriers of Exchangers”, called ISKRs, regularly strengthening in their consumer potential, based on a new non-cost “energy component”. 3.4. The corresponding Agreement has already been signed on 03/08/2021 with a citizen of the Russian Federation, who is the head of the group of Buyers of the “Rights of Claims” and with whom, within Russia, under additional agreements, it is possible to resolve all constructive issues regarding our proposals. Participants of the “International System of Quality Development” (ISQD) On March 23, 2021, this letter was sent to the Ministry of Finance. answer: “your proposal will be considered in the near future”... let's see...

Is there really money in the National Welfare Fund?

Recently, one can come across many opinions that the official statistics of the volumes of the National Welfare Fund do not correspond to reality, that in fact there is not such a lot of money there, the Fund has long been “plundered”.

In my opinion, this is unlikely. NWF statistics, which are publicly available, are closely monitored by analysts and investors internationally. The structure of the fund's assets primarily includes foreign assets that are included in the statistics of other countries. Funds placed in domestic assets are included in the statistics of the Central Bank and other banks in which the fund's accounts are opened. These banks periodically undergo international audits. In such a situation, it is virtually impossible to provide false information - the deception would be immediately exposed. Therefore, the declared volume of the National Welfare Fund is actually available.

Where is the money, Zin?

What then causes the “pod” to grow? “This year, Sberbank shares were transferred to the National Welfare Fund, and this is more than 3 trillion rubles. There is also income from deposits, but the amounts are small. And the main growth of the “stash”, calculated in rubles, is associated with exchange rate differences, says Yakov Mirkin, professor, head of the department of international capital markets at IMEMO RAS. — There was an explosive devaluation of the ruble by 25–30%, and the National Welfare Fund found itself in profit. Look at its currency structure (see infographic) - the basis is dollars and euros, there are some pounds and only 500 million rubles. It is clear that an increase in the price of a currency leads to an increase in the value of the money.

“33% of the National Welfare Fund’s funds are now invested in illiquid assets. What it is? These are the same shares of Sberbank (they are liquid, but you can’t sell a block of shares right away), loans to banks (VTB, Rosselkhozbank, Gazprombank), as well as deposits in VEB, which are used to invest in infrastructure facilities, etc., says A. Abramov. “At the same time, 67% of the National Welfare Fund is in liquid assets, that is, stored in cash currency.” Where is this amount of cache located? “In fact, Russia’s entire gold and foreign exchange reserve is much larger and amounts to $583 billion. This is as much as 41% of GDP,” the economist answers. — Of this, $172 billion is the National Welfare Fund, and another $411 billion is the reserve of the Bank of Russia. The Central Bank takes the liquid funds of the National Welfare Fund, adds its billions there and invests them in foreign markets. At the same time, there is a strategy to exit the dollar - the yuan has already become the third currency for investment, and there are also reserves in gold.”

What will happen to the ruble, euro and dollar in November? Currency forecast Read more