It is difficult today to meet a trader who has not heard of the Alpari brokerage company. Millions of users trade and invest on its platforms, and there are no obvious reasons to doubt the reliability of the company itself.

In addition, Alpari became the first broker to provide its clients with reliable PAMM accounts for investing free funds. Precisely free ones, otherwise you will be completely disappointed.

Alpari – PAMM accounts with a yield of 180%

If you are new to trading and are afraid to enter the market on your own through a dealing center, then investing in public accounts will allow you to minimize possible risks. In addition, this is an excellent opportunity to increase your capital several times over the year.

If a regular bank is able to offer you up to 15% per annum, here this figure can reach up to 180% and higher. But before registering on the brokerage company’s website, we recommend reading real Alpari reviews and comments from investors who invested in PAMM accounts for 2017-2020.

GO TO PAMM BROKER ALPARI WEBSITE

Risks of PAMM accounts

Investors should understand that PAMM accounts are instruments with a higher level of risk. No one here gives anyone any guarantees and sometimes it’s simply impossible to avoid losses. This means that when investing funds there is a possibility of losing them partially or completely. But such high risk comes with a price for high returns.

If the investor has chosen the right broker, then the main risk can be called the losses that the manager suffers when trading. In cases where the account is managed not by a professional trader, but by an amateur, the deposit may be drained.

You can view the history of your PAMM account. If the drawdown periodically amounts to 50%, then the investor should be prepared to lose 50% of all invested funds. This is a high risk, so it is worth risking at this level only if the trader has previously shown phenomenal profitability.

You need to be prepared for the fact that there will be periodic drawdowns. This is normal when working in the foreign exchange market.

Investors may notice that the account balance fluctuates. This is fine. The trader’s performance is calculated only after the set period has expired.

If, when making transactions, the profit is several times higher than the loss, then at the end of a certain investment period there will always be more money left in the account than there was at the beginning.

Despite the high risk that is typical for PAMM accounts, you need to understand that this is not a game of roulette. The trader manages risks. For his part, the investor can limit losses by setting an acceptable loss limit.

The investor must also take into account non-trading risks. The success of trading on small time frames depends on how quickly the broker executes the order received from the trader.

If the broker does not open the transaction immediately, the strategy may be violated, and this, in turn, may lead to losses.

But this risk, although not easy to control, is possible. To do this, it is enough to choose a large brokerage company that has earned good reviews from traders and investors.

If the manager does not work intraday, but holds transactions for several days or weeks, then the above factor will not affect the trading result. To clarify the strategy, you can write to the manager, or read the forum thread where he communicates with investors. If, after studying the information, no drawdowns were noticed, then there is no point in worrying about this problem.

Many people are interested in the issue of safety of funds; this is also a non-trading risk. To avoid losing your money, you should open an account with a large brokerage company.

The industry leader and founder of the PAMM investment system is, of course, ALPARI =>>

Human factor is another risk. When registering as a manager, traders often indicate nicknames instead of names. And investors do not know what kind of person manages their funds, whether he has work experience or relevant education.

Investors can study his tactics, read the description of the trading system, contact directly through the messenger, but this is not enough.

If you plan to place $10,000 or more under management, you need to be careful. Having such amounts, you need to trade with a licensed or at least verified broker.

You can also control trading risks. You should not place all funds in one PAMM account, but rather create a pool (portfolio) of several PAMMs. In this case, there is a chance not to lose all your money.

Alpari PAMM accounts profitability

Successful investing in PAMM accounts really helps not only to preserve, but also to increase your existing capital. Quite often, the profitability for individual managers is 100% for a month or more. Investors who have found the optimal strategy for cooperation with managers earn at least 30-50% of profit per annum in foreign currency.

Clients of commercial banks and credit and deposit unions cannot dream of such a level of income. The only, but serious, drawback of PAMM accounts is the lack of a guarantee of return of invested funds. The main task of a trader or investor when working with an instrument is not so much the ability to earn money, but the ability to assess the risks possible when investing.

Investing in PAMM broker Alpari accounts

The pioneer in the field of PAMM accounts was Alpari. It was formed in 1998, when there was a merger of several organizations that provided services to the population in the financial markets.

PAMMs were invented by Alpari analysts. Investors wishing to use the service must deposit a minimum of 90 rubles, $2 or 3 euros into their account. But the manager can independently set the amount of the contribution. Most often it is $10, but the minimum deposit can be changed to $100.

Various methods are used to replenish the deposit. This can be done via bank transfer or by making a payment from a card.

Payment systems and Internet wallets are available to investors. Withdrawals are available using the methods listed above.

ECN accounts

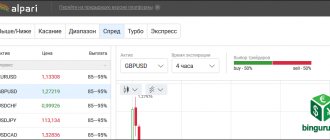

Alpari has 3 ECN accounts: ecn.mt4, pro.ecn.mt4 and ecn.mt5. On these accounts, transactions are carried out without the participation of a broker and are withdrawn directly to liquidity providers. Consequently, execution is much better here, orders are processed instantly.

Such accounts are suitable for experienced traders who trade large sums of money. It is also better to open an ECN account for those who plan to scalp or trade on news.

What features do the ecn.mt4, pro.ecn.mt4 and ecn.mt5 accounts have?

- ecn.mt4 – minimum deposit 300USD, trading in MT4, commission is already included in the spread (which is, on average, 0.4-1.0 for major pairs).

- pro.ecn.mt4 – the Metatrader 4 platform is also available here, the minimum deposit is $500, spreads are lower (from 0.1 points), but there is a commission of $3.2 per lot (opening and closing a transaction).

- ecn.mt5 – trading in Metatrader 5, the minimum deposit is $500, there is also a commission of $3.2.

Otherwise, the conditions on these accounts are the same - trading in 46 currencies, 2 metals, 5 cryptocurrencies, as well as commodities and indices, leverage up to 1:3000, market execution, accounts in dollars, euros and rubles.

Alpari PAMM account rating

Broker Alpari has compiled a rating of PAMM accounts, this is done for the convenience of investors. You can study the list of managers and their PAMMs by going to the “Investments” tab. Reviews are presented here and the conditions under which funds can be invested are described. PAMM portfolios, which consist of several accounts, are listed separately.

Investors get access to PAMM and portfolio ratings. They can collect their pool from several accounts.

There are Alpari PAMM accounts that are audited. This means that complete account information, such as profitability and other parameters, have been studied by specialists. Auditors make an opinion by confirming or refuting information.

In the rating you can see conservative and aggressive plans separately. When forming the list, Alpari takes into account the performance of managers, the age of accounts and total profit. Indicators of the strategy's effectiveness are published.

The broker has created a convenient search system for investors. Using filters, you can easily sort invoices by specifying the required criteria. You can select accounts that were opened 6 months ago or earlier. It is easy to sort PAMMs by the number of funds under management.

When choosing a manager, you need to pay attention to what kind of profitability he shows over the last 6 months. What matters is the amount that investors invested. If a trader has large amounts under management, this means that his work is stable and many users trust him.

The level of aggressiveness of the strategy is indicated by lightning bolts (stars). The highest indicator is 5. The more marks, the more risky the manager trades, the higher the likelihood of incurring losses.

Reviews from Alpari investors about investment coins

As a rule, I invest in this product for a long term (about several years). This is explained by the fact that the cost of silver and gold (namely, investment coins are made from these metals) if not growing, remains stable. Therefore, there are few reviews about Alpari investments in gold and silver coins - this service appeared relatively recently and investors have not yet been able to objectively evaluate its advantages.

Figure 5. Reviews of Alpari investments in coins.

One of the important questions that concerns many novice investors is how to make a profit from an investment in a coin. The answer to this can be found on the broker’s forum (Fig. 5) - in addition to selling coins, Alpari also buys them. In this case, there is a difference between the purchase and sale prices (equivalent to a spread in Forex). Therefore, in order to make a profit from an investment, you must wait for the corresponding metal to rise in price.

Alpari Invest app

Alpari Invest is an application that will help traders working with PAMMs, structured products and investment funds to make transactions. Using the service, you can select portfolios and PAMMs.

Installing Alpari Invest is easy . First you need:

- register in your personal account ⇒

- then go to the section containing trading platforms.

The Alpari Invest application will also be available here.

An alternative download method is the Google Play and AppStore application stores. When the smartphone owner starts the download process, the installation of the application will begin. Once the process is completed, Alpari Invest will be ready to go.

How to choose the right PAMM

In order for investments to generate income, you need to choose experienced managers. They manage investors’ funds and independently open and close transactions. But they cannot withdraw money, there is no need to worry about it.

You can test a trader’s work skills over a long period of time. Therefore, it makes sense to analyze PAMMs that were opened more than 1 year ago. During this time, beginners will already lose money, ineffective strategies will lead to losses, and professionals will show results.

Another selection criterion is the maximum drawdown. For conservative accounts it does not exceed 30%, aggressive strategies allow drawdowns of up to 60%.

It is necessary to look at how loaded the deposit is. This parameter means what lot the trader enters into 1 trade. The higher it is, the more money you can lose at one time.

Investors should pay attention to intraday volatility in returns. For conservative accounts it is less than 3%, for moderate strategies this figure ranges from 3-6%, and for aggressive ones it is more than 6%.

The amount under management will say a lot about the manager's working style. A large one indicates that the specialist’s work is highly appreciated by investors.

The last criterion to consider is profitability. You can open the chart and see how the manager works. If the curve grows progressively, there are no strong jumps, this indicates stable trading.

Instructions on how to create a PAMM account with Alpari and become a manager

Many people are interested in how to open a PAMM account with Alpari. If a trader has an effective strategy and wants to try himself as a manager, he needs to:

Go to the broker's website ⇒

Here in the section called “Start Trading”, he should study the information.

When filling out the registration form, you need to ensure that the data completely matches those indicated in the passport.

The Alpari administration will ask the candidate for manager to send scans of documents. This is necessary to confirm your identity.

After registration, the trader downloads MetaTrader 4. He invests his own funds. At the next stage, he publishes an offer and begins trading. Investors, seeing the work of the manager, invest funds.

Comments and reviews about the forex broker Alpari

Advantages: International brand

Disadvantages: Suspicious activities of the company in Russia

Comment: This review will be useful for those who are already working with Alpari in different countries, and for those who are at the stage of choosing a broker. I worked with the company until the central bank revoked their license to operate in the Russian Federation. After that, I repeatedly contacted the company with a request to provide documents that would confirm the right to continue activities in the territory of this country. I have not received a response to any letter. TID#101255303 TID#101243990 The Alpari brand operates in different countries under different legal entities, but the ultimate owner of all organizations is Andrey Dashin, who is the founder of the company. A legal entity whose license to operate in the Russian Federation has been revoked continues to operate but under a different name (TIN 9717003523) Why might this be important? When choosing a company to work with, it is important to check the country of registration and the availability of permission to operate on the securities market in your country. Since the end of 2021, Master Card and Visa payment systems have tightened the requirements for brokers with offshore registration. Now, they can request documents confirming the company's right to operate in your country. I also did not receive a response from Alpari about the availability of such documents. If you work with Alpari from Russia, then one day you may even encounter the problem of blocking the company’s website. This issue is now being discussed jointly with the central bank in order to suppress the activities of brokerage companies without a license in the Russian Federation. If this appeal does not go unnoticed by Alpari on this site, I ask you to once again answer the questions for me and the readers of this comment: 1. On the basis of what license does the company continue to operate in Russia? 2. Comment on your relationship with the MasterCard and Visa payment systems. Do you have the necessary documents confirming your right to work in each region where the company operates? For existing clients of the company from other countries, I would recommend contacting the support team in your country so that you can also be provided with the necessary documents confirming the company's right to operate in your country. After all, if you have a controversial situation, as in the case of the bankruptcy of a branch in the UK, or the termination of Alpari’s activities in Canada, the local court will not always be able to help resolve the conflict. All the facts presented in this review can be easily verified via the Internet, but if necessary, I can provide supporting documents for interested parties. I duplicated this review in two languages on websites where company representatives are present.

The best PAMMs Alpari

If you examine all Alpari accounts that are older than 1 year, you can identify the following managers (these are accounts at the time of publication of the article, they may change over time):

- Lucky pound. It has been operating for more than 5 years, more than 1,500 investors have invested in it. The trader manages more than $300 thousand. The profitability has exceeded 2500%.

- Moriarti manages an account that was opened more than 4 years ago. 2900 investors invested in it. The trader manages more than $1.4 million. He showed an increase of 104,797%.

- Manager Sam shows good results. He opened PAMM 2 years 9 months ago. The profitability was about 300%, $78 thousand was invested into the account.

A more current rating of Alpari PAMM accounts at any time can be found here ⇒

Please understand that the situation may change over time. Those managers who showed good results may lose leadership to others or disappear from the rankings. Investors should study reports, deposit and withdraw funds, distributing them among accounts.

Adviсe

- It is advisable to create a portfolio of diverse accounts. That is, they should contain not only managers who enter into transactions with different currency pairs, but also different in philosophy, tactics or styles. This will allow you to diversify your assets and reduce risks.

- For economic modeling it is necessary to use an investment calculator. Do not allow a situation in which the yield drops to 2%. It is necessary to rehabilitate this situation by adding a list of aggressive pamm. But even in this case, you need to ensure that the profitability does not exceed 10% to eliminate the possibility of draining any account.