Good afternoon

Today I will talk about what time is best to trade binary options if someone is still interested in this gaming industry.

I’ll show you how to navigate the work of the world’s largest exchanges. When the main flow of important news that can affect the price of assets comes out, how should they be interpreted. In addition, I will consider the issue of determining the most profitable days of the week and month, as well as trading on weekends and holidays.

This short article will help beginners move as quickly as possible in understanding how real markets work and on what data it is better to build their trading system.

Now it's time to start!

How the foreign exchange market and trading sessions work

Trading is conducted 24 hours a day from Monday to Friday. But quotes can behave differently (this very much depends on the time within the day).

The day is divided into 4 trading sessions: Asian, European, American and Pacific. During each, exchanges operate in a certain part of the world, which set the tone for the market. For example, during the European period the financial centers of London, Frankfurt, Moscow and other financial capitals of Europe functioned.

During an active session, the liquidity of the currencies of countries that are traded on the market increases. When the exchanges of Zurich, Frankfurt, and London operate, the liquidity of currency pairs with the franc (CHF), euro (EUR), and pound (GBP) increases.

Session schedule:

| Session | Active Exchanges | Opening hours (Moscow time) | |

| Opening | Closing | ||

| Asian | Tokyo | 2:00 | 11:00 |

| Hong Kong | 3:00 | 12:00 | |

| Singapore | |||

| European | Frankfurt | 9:00 | 18:00 |

| Zurich | |||

| Paris | |||

| London | 10:00 | 19:00 | |

| American | NY | 16:00 | 1:00 |

| Pacific | Sydney | 1:00 | 10:00 |

What is the optimal trading time in Forex?

As such, there is no better time to trade. This is because each trader has his own trading style - some like the calm movement of quotes, concluding transactions within a narrow price channel, while others, on the contrary, prefer high volatility and catch “rebounds” and “reversals”. The best option is the ability to adapt to any market behavior at different times and make a profit from it.

“Night” traders who trade in the Pacific and Asian sessions note market calm. This is good for searching for trends with little dynamics and measured trading without sudden fluctuations in exchange rates.

With the appearance of Europeans on the Forex market, a more active movement of quotes begins. Business activity increases, and if you start trading on Monday, significant price gaps - gaps - are possible. These may be sharp rises or falls of the main currency instruments, which is a reaction to the news and events of the past week.

The most interesting thing in the Forex market begins with the arrival of the American trading session. US market participants wake up several hours before the start of national trading, study price movements during past sessions and market activity reaches its peak. Against this background, brokers often increase the spread. Because of this, many experienced traders advise against trading during adjacent Old and New World trading sessions.

Late in the evening, market activity drops, American players take profits and prepare to rest. As we've said, with Australia, Oceania and Asia awakening, significant volatility is rare.

Binary options trading time

Brokers allow you to speculate in cryptocurrency, stock indices, currency pairs, and stocks. Cryptocurrency is available 24/7. Currency - without interruptions, from Monday to Friday. Stock sector instruments are traded in accordance with the exchange schedule. Due to the variety of assets on the broker's platform, binary trading is available 24 hours a day.

On weekends, OTC instruments with over-the-counter quotes are also used. Their prices are provided by brokers, so it makes no sense to compare them with other sources.

How to effectively use your Forex trading time?

It will not be possible to achieve success in trading without understanding the principles of the Forex market, taking into account time. A trader must know when trading starts and ends in key countries for the market. Every little detail should be taken into account - national holidays, when the stock exchanges of individual countries do not work, as well as the shortened days preceding them.

The Forex economic calendar plays an important role. It will help you find out the release time of the most important news, publications of statistical data, speeches by country leaders and major shareholders. But even here you should be careful and not rely on fundamental forecasts.

You should not try to get ahead of the market, because price movements occur due to transactions by large players. The task of a retail trader with a small deposit is to catch the moment when the market gives a signal and follow it. Knowing what time Forex works, we get a significant advantage and can make more profitable transactions.

Dependence of profit on time

BO has a fixed return. It doesn’t matter whether the price changes by one or a hundred points, the trader will receive the same income or loss. But volatility has a different impact on profits. Brokers often reduce payments on assets with low liquidity. Therefore, as a rule, in terms of profitability, the best time to trade binary options is during the day.

The periods with the highest liquidity are the intersection of two sessions, especially the European and American ones. At this time, as a rule, the maximum profitability of options. But the higher the volatility, the greater the risk, because the likelihood of unexpected price shocks increases.

Conclusion

There is no consensus on the best time to trade options. You can only minimize risks and trade more profitably. To do this you need:

- Determine for yourself the most convenient time of day for trading.

- Having selected a session, you need to select one or more instruments for trading.

- These instruments should trade at maximum volatility during this session only.

- Next, you need to identify all the nuances and pricing factors of this pair.

- It is necessary to find information about everything that can affect the price movement of the selected instrument. News, events, important holidays and unimportant ones, but still weekends. Having chosen a currency pair, you need to know as much as possible about it.

Options trading, in the eyes of an untrained trader, is very similar to playing in a casino. But only if you thoughtlessly open trades, relying on the notorious theory of probability. This will not bring profit. Having opened the terminal, first of all you need to know what to expect from the market. It will be unpleasant to lose money without knowing that some news has come out. The more information there is during the trading process, the better. But the information must contain processes that affect the price of the selected instrument. Another important point is your own psychological state. If for a certain group of traders a fast and sharp market is more convenient for trading, then for individual players this is simply not suitable. It is necessary to decide what speed is more convenient for making decisions and perceiving information. No one has become a trader and made a profit without a loss. You need to try options trading in each session in turn and find one or more pairs that are convenient for trading and analysis. This will help you determine what time to trade binary options. And in combination with a correctly selected trading strategy, it will lead the trader to success.

When is the best time to trade binary options?

The effectiveness of trading depends on the time of day, day of the week, time frame, important macroeconomic events and holidays.

Times of Day

There is no optimal time for all speculators. The market is most liquid in the European and American sessions and relatively calm in the Asian and Pacific sessions. Suitable periods may vary. It all depends on the trader’s strategy.

Days of the week

On Monday there is a revival. One of the most difficult days for traders, especially in the morning, when the price can alternately update lows and highs.

Market activity increases on Tuesday and Wednesday. This period is considered the most favorable for traders opening intraday trades.

Thursday is relatively neutral.

Friday is often an unpredictable day. Traders are closing positions before the weekend, so price spikes are possible.

Timeframe

Timeframe is the period of construction of one bar or candle. Its choice depends on the duration of the transaction:

- M1–H1 - for intraday trading;

- H1–H4 - for contracts with expiration no more than a few days;

- Н4–MN - for long-term contracts.

The lower the period, the less reliable the signals.

Choosing a time frame for trading

Traders who have not decided on a time interval and strategy are recommended to test different methods. The best option for starting is H1–H4.

Non-farm payrolls

NFP is a monthly report on changes in the number of people employed in the non-farm sector of the United States, which is published by the Department of Labor. NFP is one of the key macroeconomic indicators in the world. Data is released on the first Friday of the month at 15:30 Moscow time. A strong or unexpected change may have an impact on the quotes of dollar pairs.

On June 5, 2021, data came out significantly better than the forecast. After the news, the price of USD/RUB began to rise and did not fall until the end of the trading day.

Asset reaction to NFP publication

It is difficult to determine the market reaction to the news. It may not affect quotes at all, but it is important to monitor the event.

Nuances of the days of the week

Monday is a sluggish and mostly flat day of the week. The worst thing that can happen on Monday is opening the session with a gap. The reason for this is the recent weekend and the lack of macroeconomic publications. Good, active trading occurs over the next 3 days. A lot of news and optimism among speculators contribute to rapid price movements. Friday is characterized by sharp short-term price jumps, especially before the close of trading. This is facilitated by a large volume of closing orders before the weekend. Trading on Friday is highly discouraged because the market is generally unpredictable. The release of weekly reports, events at the beginning and middle of the week that received a response on Friday, macroeconomics and fixation of weekly profits - all this increases the risks for making a profit.

Weekend

Trading on weekends is usually unconditional. All trading platforms are closed, nothing affects the price. The only explanation for the ability to trade on weekends is simply a function given by the broker. Such trading is very questionable. But still many take advantage of this opportunity. The only nuance of such trading may be cryptocurrency. This is a new and fairly developing segment of trade. The only recommendation when trading on weekends is to strictly adhere to the rules of your own strategy and trading system. News cannot influence the market; the response will occur only on Monday. You just have to adhere to the rules of technical analysis and trade at your own peril and risk.

Holidays

As a rule, the market on holidays is sluggish and mostly flat. This is especially true for the New Year and Christmas holidays. Many traders advise not to trade on such days and just wait them out. This is due not only to “boring” movements. But also sharp jumps in quotes. This happens due to large and often one-time injections of large volumes. It is impossible to predict this. News and reports are often released the day before the holiday, and cannot influence the rapid growth of quotes.

Non-farm

Every first Friday of the month, the most important report on the performance of the American labor market is published. It provides statistics on job vacancies. This indicator also affects unemployment data. On Non-Farm Friday, all currencies quoted against the Dollar fluctuate greatly in one direction or another depending on the reporting data. Many traders do not trade on this day. But these indicators often influence exchange pricing throughout the month. Only news that has a more significant impact on the dollar can balance the response to these indicators. Since Friday is not the best day for trading anyway, you don’t have to trade at all. But you can also base your trading on anticipation of Friday's reports from the American labor market.

News

Trading on economic news has both supporters and opponents. Many people consider such trading to be very risky. The main risk is the unpredictability of the market reaction before the news is released, and the immediate reaction to the information received. But you can build proper and profitable trading here too. There are certain indicators that affect the pricing of the currency of any country in relation to major currencies. You just need to select a currency pair and wait for such news to come out. These could be reports on employment, unemployment, GDP indicators, and wages. Some news comes out once a week, month, quarter or year. During the period when such fundamental news is released, the market is either calm or panicked. Many news sites offer a free news calendar and include their forecasts for previous data. All this information can be used to make a profit.

Example of market interest

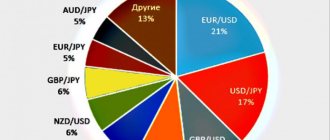

Using the example of the EUR/USD pair during a trading period of one day, certain conclusions can be drawn. These conclusions are similar for most currency pairs. The figure shows that during the Asian and Pacific sessions traders were not interested in this pair. This is due to the fact that trading was mainly carried out in local currencies, and the EUR/USD pair remained in a sluggish narrow corridor throughout the entire session. After the opening of the European session, not only the increase in demand is noticeable. Also noticeable is the Euro's attempt to increase the price of the Dollar relative to itself. This continues exactly until the American session opens. America's disinterest in such a price for the euro is already visible here. The price is going down a bit. This is a battle over pricing. Next, you can see a breakdown of the support level and a deep price drop. There was only one dollar left. The European session has closed. America is interested in paying less for one euro. This is a simple example of the complete disinterest of Asia and Australia and the struggle of Europe and the United States over the price of their currency. It turns out that when trading the EUR/USD pair during the European session at the beginning of its opening, you need to be prepared for the Euro’s desire to increase its price. Next come more serious and frequent movements due to the struggle over pricing, since America, having opened the session, does not agree with such a price for the euro. This is a simple example of why a currency pair moves in a particular direction.

What is the best time to open trades?

The optimal time to trade binary options varies. It usually depends on the underlying asset.

For stock assets

Instruments of the stock section are available during the operating periods of the exchanges on which they are traded. For example, Gazprom shares are traded on the Moscow Exchange from Monday to Friday from 10:00 to 18:45 Moscow time during the main session, and then until almost midnight in the evening.

Opening hours of the world's major exchanges

Average trading volumes are approximately the same throughout the day and week. But by the end of the session and on Friday, many traders close positions, which may lead to an increase in volumes and a decrease in the prices of some instruments.

For cryptocurrency transactions

Cryptocurrencies are traded on exchanges seven days a week. But on Saturday and Sunday trading volumes drop noticeably. Large players can take advantage of this and manipulate the price to their advantage. Therefore, it is dangerous for private traders to open trades on weekends.

Other assets are characterized by a dependence on the time of day, for example, currency pairs with the euro become active when the exchanges of Paris, Frankfurt, and Zurich open.

The impact of holidays on a trader’s chart

There are periods when trading binary options is strictly not recommended . We are talking about pre- and post-holiday periods of time.

For example, about a week before the New Year, the difficulty of predicting price behavior increases sharply. Towards the end of the year, large players close positions or, on the contrary, gain volume; sudden, unpredictable jerks in both directions are possible. Payouts from brokers are not reduced, but the strategy’s win rate is deteriorating, so it’s better to play it safe and take a vacation.

The same thing repeats itself after the New Year; in the first 1-2 weeks the markets come to their senses. The same analogy applies to other global holidays.

There are also local holidays that affect trade. For example, in the USA they celebrate the 4th of July; on this day the US stock exchanges do not operate.

On the dependence of changes in asset prices relative to news releases

The market for financial instruments has always been greatly influenced by the news background. News should be understood as a change in the market situation, which will definitely have an impact on volumes, prices and other parameters of specific currencies, metals, commodities, stocks, and indices.

The release of financial news is followed not only by traders, but also by the entire category of people who are directly related to business processes.

For novice traders, it is not so much the news itself that is important, but the exact time of its publication. After all, some market participants may perceive individual news very ambiguously, which naturally causes some panic in the markets.

Trading by the hour

The level of volatility and trading volume for different currency pairs varies depending on time. You can trade more effectively if you have information about which currency pairs are currently most in demand. Timing plays a significant role during foreign exchange trading. The foreign exchange market operates around the clock and a trader is able to adequately assess every market change and make the right decision in a timely manner. To successfully put into practice a profitable trading strategy, you should take into account the dynamics of different currency pairs, at different time intervals. This will make it possible to make the most of exchange trading opportunities in your chosen hourly interval.

Learn the best Forex strategies.

We should not forget about the liquidity of currency pairs, which varies depending on macroeconomic factors and geographic location. Having accurate information based on a competent analysis of the foreign exchange market, indicating the dynamics of the results of the currency pair and the estimated trading range, you can significantly improve the possibilities of placing your capital.

This article examines the optimal trading activity for popular currency pairs over different time periods, which will help determine when currency pairs have the maximum period of volatility. The proposed table contains results for the studied average ranges, in points, for selected currency pairs in different time periods.

Tokyo Asian session. Opening hours from 00.00 to 09.00 UTC

Forex trading activity in Asia takes place in selected regional financial centers. The largest number of financial transactions are concluded in the capital of Japan - Tokyo, as well as Hong Kong, Shanghai and Singapore. Currently, Tokyo continues to hold its position as the world's leading financial center, and this despite the fact that recently the position of the Central Bank of Japan has somewhat weakened.

Quite often, currency trading in Tokyo has a narrow focus. Wealthy investment banks and numerous hedge funds step up during the Asian session to steer the market toward attractive stops and option stops.

The table below shows the volatility “rating” of the most active currency pairs during the Asian trading session.

For cautious, risk-averse traders, the following currency pairs are suitable: GBP/CHF, USD/JPY and GBP/JPY. The impressive trading range for these currency pairs (more than 80 pips) will provide excellent trading opportunities in the short term.

During the Asian session, most foreign exchange trades on the USD/JPY pair are carried out by institutional investors and investment banks that have high dollar denominated assets. Among them is the Japanese Central Bank, which owns $800 billion in United States government bonds.

Learn Forex strategies without indicators. They are easy to understand and, most importantly, effective.

Supply and demand for USD/JPY are quite strongly influenced by transactions in the Japanese bond and stock markets. In addition, Japanese exporters often sell their profits in US dollars for yen, which stimulates additional movements in the currency pair. The high volatility of the GBP/JPY and GBP/CHF pound currency crosses is directly related to the following processes: during the trading process of the Japanese Asian session, large banks and exchange players change the volume of transactions before the opening of currency trading in Europe.

The most unpopular rating pairs are: GBP/USD, AUD/JPY and USD/CHF. They are more suitable for stock market players who are terrified of risks. The fairly moderate level of volatility of such pairs will interest cautious traders.

The European session is active from 7.00 to 16.00 UTC

The capital of Great Britain, London, is the largest and most important dealing center in the financial world. Only the volume of transactions in shares, according to statistics from the Bank for International Settlements, exceeds 30% of the world volume. The main trading offices of large banks are concentrated in London due to the high liquidity and efficiency of the financial market; most investors work during the European session.

The London foreign exchange market is considered to be the most volatile of all financial markets in the world due to the huge transactions taking place and the participation of a large number of market participants.

Consider the volatility rating posted in the results table for the defining currency pairs during the European session . Here you can clearly see that out of 12 popular currency pairs, the trading range for a good half of the participants is above 80 points. The maximum average ranges are observed for GBP/JPY - 140 points, GBP/CHF -146 points. The GBP/JPY and GBP/CHF currency pairs are most suitable for high-risk transactions.

In fact, the maximum level of volatility expresses the peak of trading activity in the daytime, since large participants in exchange trading complete the asset restructuring cycle during this period of time. The European trading session partially overlaps the American and Asian sessions.

Once major banks and investors have completed the repositioning of their financial portfolios, they will begin converting European liquid assets into US dollar-denominated assets before the opening of foreign exchange trading in the United States. The combination of both restructurings during European trading characterizes the high level of volatility in the studied period of time.

Traders who prefer risky transactions can try using other currency pairs during this period: USD/CAD, GBP/USD, EUR/USD and USD/CHF. For the listed pairs, the average range is more than 80 points. Very often, a high level of volatility provides good opportunities to enter the market.

It should be recalled that activity in the dollar and European currencies is growing significantly due to the reshuffling of their portfolios by large participants in exchange trading just before the opening of the American session.

Traders who prefer to be cautious in everything should deal with the following pairs: AUD/USD, NZD/USD, AUD/JPY and EUR/CHF. For such pairs, the average range is equal to 50 points and, along with the potential profit, you can expect a good interest income from them. Trading on such pairs is more productive and has a low probability of losses.

American session from 13.30 to 20.00 UTC

The second largest financial market, with more than 19% of turnover in the Forex market, is New York. Trading time in New York characterizes a dubious period of various hidden affairs and dark intrigues of large market entities, since, from the afternoon in the United States until the opening of trading in Japan, the main activity in the stock market declines, which contributes to various veiled operations.

The maximum number of transactions during the American session is made between 13.30 and 17.00 (UTC). This period also has the highest daily liquidity, since European players continue to be on the market. During trading in the United States, risk traders may be interested in the following pairs: USD/CHF, GBP/USD, GBP/CHF and GBP/JPY.

According to the table results, the average range of currency pairs does not exceed 100 points. At the same time, high activity was recorded here, since trading is directly related to the US dollar. When the US bond and stock markets operate, foreign investors prefer to convert the yen, pound and franc into US dollars in order to effectively allocate them to the markets in question.

At the moment of “crossing” the market hours, the maximum ranges are GBP/CHF and GBP/JPY.

Most currencies on Forex are quoted in US dollars. If we consider GBP/JPY, then in order to convert the British pound into the Japanese yen, trading is initially carried out against the dollar, and then against the yen. It turns out that an exchange transaction for the GBP/JPY pair includes two different currency transactions: GBP/USD and USD/JPY, and the high level of volatility of the main currency pair is determined by the adjustment of the results of the constituent currency pairs. Since these currency pairs are negatively correlated, or in other words - moving in mutually exclusive directions, the level of volatility of GBP/JPY as a whole is increasing. A similar conclusion can be drawn for the GBP/CHF pair, whose volatility level is even higher.

In general, trading currency pairs with a high level of volatility is quite profitable, but we should not forget that there are also great risks here.

Traders who prefer risky operations constantly change their tactics to avoid triggering stop losses. In addition, they often receive losses on long-term strategies. For traders who are cautious and work on long-term strategies, the following pairs are recommended: EUR/USD, USD/JPY and USD/CAD. These pairs are characterized by lower risks when used in exchange trading. In addition, such currency pairs have high liquidity, which allows exchange players to reduce losses and maintain profits.

Overlap of the American and European sessions from 13.30 to 16.00 UTC

During this period of time, the foreign exchange market is characterized by high activity, where 70% of all transactions occur in the European session and 80% of the main transactions in the American session. This period of time is the most favorable for making transactions.

Overlap of the European and Asian sessions from 07.00 to 09.00 UTC

The most passive period of time in the foreign exchange market, where there are cautious and risk-averse traders.

An important strategy for trading days in UTC/GMT (winter time is indicated in brackets)

- Sunday 21:00 (22:00) – start of trading (note: in the European DC there is a rollback after Friday, it is better to be at the terminal).

- 21:00 (22:00) – The trading session has begun in Wellington (N. Zealand), nothing special is happening, trading is inactive.

- 23:00 (24:00) – The trading session has begun in Sydney, trading is slowly starting to gain momentum, because Tokyo opens in an hour. Before Tokyo, you can safely make a couple of bets with profits of 5–10 points, only in different directions.

- 24:00 – Tokyo opens. Trade is becoming more dynamic. We must take into account the fact that the corporation has relations with Asian investors; they act harmoniously, clearly, and if they move, they all move in the same direction at once.

- 01:00 – Singapore opened. The dynamism is increasing due to the fact that two giants will soon open - in Hong Kong and Shanghai. The Euro tends to decline almost until Hong Kong and Shanghai open.

- 01:00 – 01:30 – before the start of the Chinese session, the Euro usually goes down, although there are also exceptions: you should be careful.

- 01:30 – opening of Hong Kong and Shanghai, as a rule, is the beginning of large-scale trade. The Asia-Pacific region is almost entirely traded. A special word about China (the Hong Kong and Shanghai stock exchanges have the same working hours). The structure of China's exports is as follows: the bulk of Chinese goods are paid for in dollars. Based on this, we can assume that China has no need to buy dollars; the Chinese have nowhere to put them anyway. Because of this, EUR/USD is growing during the Chinese session. China has the largest gold-currency potential on the planet, so as soon as you hint that China has decided to get rid of any part of the dollars, panic will begin and the euro will rise. On top of that, China is one of the largest creditors to the United States. It is obvious that for now it is not profitable for China to get rid of dollars. Threats towards the diversification of foreign exchange reserves are more like speculation. The actions and performances of the Chinese are worth following. As soon as the Chinese start buying the dollar en masse, the day becomes akin to a casino. When they buy euros, you can predict everything.

- 01:30 – 02:30 – the euro usually rises within an hour.

- 02:30 – 06:00 – transactions on EUR/USD are multidirectional, Asian exporters convert part of their profits into both Euros and dollars.

- 06:00 – Tokyo closes, and if before this the Euro was falling, then when Tokyo closes, the Chinese are rapidly raising the euro up.

- 06:00 – 07:00 – one might say – “China hour” on the stock exchange. Singapore and China do whatever they want. Usually at this time there is a rise in the Euro. Asia is a huge commercial and industrial region, characterized by an abundance of inexpensive, high-quality goods and, accordingly, huge financial turnover. Therefore, of course, there are a lot of bets on the exchanges. In such circumstances, bets that were placed at the London open need to be monitored once the Asian region has already exited trading.

- At 7.00 (8.00) London and European stock exchanges open. As observations show, the sale of euros prevails in the first hours.

- At 9.00 Singapore closes and the Asian session ends. At this moment (or within an hour), the euro makes a breakthrough and, most often, the trend changes. The process lasts until 11.30.

- At 9.00 – an immediate or delayed jump in the euro. No one bothers the Europeans; it is usually the Asians who get in the way.

- From 10.00 to 10.30, as a rule, the trend changes during the European session.

- From 11.00 to 13.00, trading turnover ends on oil trading platforms located in Dubai, the Emirates, Qatar, etc. One gets the impression that they do not need dollars, because oil is sold for dollars. The euro is rising. The last hours of open spaces in the Middle East are worth mentioning separately. The region is oil-rich, the exchange hours are short, trade volumes are very large, and there are plenty of petrodollars. It may not be reasonable for them to buy dollars.

- In the period from 13.00 to 13.30 (14.00-14-30) you need to close all unreliable positions or block losses. As American mayhem approaches. At this time, the euro most often falls. Also during this time period there is a rush and planned confusion. Since the opening of major exchanges is approaching - Toronto, New York and Chicago. It's time to make your positions safe!

- At 13.30 the stock exchanges of Canada and America open. At the same time, we should not forget that Europe continues to participate in the auction. This is the time of the beginning of the largest-scale trade. It is very difficult to make predictions or interpret news. There is complete speculation going on. Rapid formation of trends.

- Time 13.30 (14.30). American stock exchanges are starting to stare and flatten everyone! It is not possible to predict the direction of the trend. But by the time the exchanges in London, Zurich, Frankfurt close, as a rule, the established trend changes to the opposite.

- By 15.30 (16.30) the European session closes and, quite often, the trend in the euro changes.

- The period from 19.00 to 20.00 (20.00 -21.00) is the end of the American session, very often the existing trend is resumed. The first and last hours of operation of any exchange are times of particularly high activity for institutional clients with huge amounts of money and large funds. However, they do not sit idle throughout the session, but analyze the situation. But transactions are made, as a rule, at the specified hours. This makes it possible to predict price movements when large exchanges open and close. Bets must be placed 1-2 minutes before the opening of the exchanges. In the early hours of the night, the euro-dollar often pulls back down until Tokyo opens. This applies to those cases when the price rose to 21-22 UTS. On Friday, feet get knocked out en masse.

- Friday 21.00 GMT/UTS. Trade stops.

Some tips for traders

13:25 – 13:29 (14:25-14:29 – winter time)

UTC – before the opening of American trading, you can conclude two transactions in different directions with a profit of at least 10 points (minimum) and two more transactions (for a profit of approximately 170 points) from one direction of movement of the currency pair. The second trade will close with a small profit in case of a rollback, or will bring a small loss. A positive balance of concluded orders must be achieved if the direction of the trend is unknown.

If the chart is at the lower border of the corridor marked by support and resistance lines, we enter a buy order. If it is at the upper border, therefore, we enter into a sell order. In the middle we place orders in different directions (at least 10 points). These orders can be opened with a larger size - it depends on the trader’s risk appetite. It should be kept in mind that all orders causing a loss must be closed. With this method of trading, greed can play a cruel joke and bring a huge loss. It is necessary to close orders with a small profit.

You should take into account the fact that stock exchange news is very often misinformation. Only 10% of news is reliable. And no one has any idea how to separate the “wheat from the chaff” in this case. The market often behaves extremely unpredictably when news arrives. And it is not possible to accurately predict the movement of a currency pair.

On Wednesdays and Fridays, it is better for owners of small deposits not to start trading, as currency jumps in different directions of the trend are possible. It is generally better to never trade large lots. You can drain your entire deposit in a few minutes. Without the ability to constantly monitor the progress of trading on the market, the optimal solution would be to trade in small lots or stop trading.

Traders are money hunters. Sitting patiently in ambush and shooting if there is a 100% hit is the best strategy.

Fatigue is the trader's enemy

When trading on the foreign exchange market, extreme concentration is required. Inattention may result in the loss of your funds. It should be borne in mind that if the value of a currency moves 200 points from the price at which you entered into an order, the best solution would be to close the order, since there is a high probability of incorrectly determining the trend movement.

You must be extremely careful when dealing with different types of indicators and trading robots. Very often they do not help, but harm successful trading. The best way to increase your capital in the foreign exchange market is to slowly increase your deposit by trading small lots without significant losses.

Drawdown is also not a good indicator of a trader's trading.

There is a safe lot rule

To fulfill this rule, you need to divide the deposit by 20 thousand - the remainder will be the lot for concluding the order. This balance guarantees the trader security when concluding transactions, including in different directions.

When placing a buy order lower than a sell order, you must use a pending order at a distance of 6-10 points. In this case, with any movement of the currency pair, the trader remains with a profit. In the case when the majority is actively selling or buying, there will be an adjustment in the movement in the opposite direction. In case of equal positions (orders in different directions), it is necessary to close the order with a small take profit. An increase in lot sizes is possible with an increase in the deposit. It is not recommended to replenish the deposit itself. This statement is related to the psychology of the trader. A trader's quick adjustment to large sums when replenishing a deposit disorients the owner of the deposit. Most market trends follow a weekly cycle, with the exception of a few percent.

Going against the trend is extremely unwise. A trader would be wise to become familiar with technical analysis. The trend line most often returns to where the largest number of stop losses are located. But a trader should not forget about fundamental analysis. A completely natural phenomenon is incredible currency jumps when any news is released.

When trading, it does not hurt for a trader to have a spare trading terminal with him. An option is a terminal installed on the communicator. This is necessary in case the computer freezes or there is a power outage. Since in both cases, without a spare terminal, the trader ceases to control the situation on the market.

This can lead to unpredictable consequences.

Next, we recommend studying the “Fibo limit trading” strategy.

Choosing a strategy

So, what is the best time to trade binary options? Depends on what strategy you choose. First, if you are trading based on technical analysis, you should keep an eye on the economic calendar (available on the largest portal Investing.com). The release of important news may lead to a sharp rise in price. Therefore, 15–20 minutes before the release and 20 minutes after the publication, you need to refrain from trading.

Fans of short-term trading who trade using the Scalping strategy do not need high market volatility, but a prolonged flat will not bring profit either. Therefore, you need to choose an asset that shows smooth price movement. To do this, during the European session, it is better to choose an asset with the yen or another currency whose exchange is closed at the time of trading.

Accounting for news background

Since the price of an asset, especially in the foreign exchange market, moves constantly, the formation of trends, channels, TA figures and other things is possible, in principle, at any time.

With fundamental analysis the situation is somewhat different. Important macroeconomic statistics are released during the trading session to which this asset geographically belongs. Therefore, when choosing a trading time, it is necessary to take into account the release time of news that affects the instrument you have chosen.

Stock news and their release time