Investment attractiveness is not so much a financial and economic phenomenon as a model showing actual quantitative and qualitative indicators of the existing external environment within an enterprise, industry, federal subject or state as a whole.

In various economic sources you can find different definitions of this phenomenon. Until now, there has not been a consensus among academic theorists and practical investors.

Firstly, there is a position in which the assessment of investment attractiveness must clearly show which project the investor should invest in.

Secondly, the investment attractiveness of a particular asset can be understood as a set of heuristic assessment methods that are associated with ranking the investment objects being studied.

Thirdly, some financiers evaluate it solely in connection with assessing the effectiveness of the investment projects under consideration.

However, no matter what point of view the investor adheres, he, without a doubt, pays great attention to this financial and economic factor in his activities.

Investment attractiveness coefficient and indicators

Investment attractiveness is influenced by many factors. The concept is used to assess the feasibility of investments made by an investor. It is tied not only to a specific financial structure, but also to regions of the country in order to conduct research at the micro and macro level.

The assessment analyzes the financial and economic activities of the company. Competitiveness is studied as a factor in increasing investment attractiveness. The concept is also considered from the point of view of potential and risk for investment.

Formula for calculating the investment attractiveness coefficient:

Where:

- Si – investment attractiveness coefficient$

- Fi – resources of the financing object;

- N – value of the consumer order.

The accuracy of the calculated data depends on the correct formation of the consumer order.

To assess how profitable it is to finance in a particular region, the concept of investment climate is used. The indicator can be assessed based on the following parameters: capital inflow and outflow, inflation, interest rates on loans and deposits, natural resources, external debt, economic stability, infrastructure, tax system, legislation.

Factors of investment attractiveness:

- Risky. Before choosing an object, the investor resorts to common risk assessment methods and economic development forecast models. Such criteria as statistics on the sectoral economy, nuances of the regulatory framework, the share of foreign capital, commercial, budgetary and economic efficiency of the country as a whole are taken into account.

- The economic growth. The feasibility of investment depends on GDP growth.

- Political stability. It is almost impossible to attract large volumes of investment in the face of harsh, unpredictable changes in the country's politics.

- Level of infrastructure development. The decision to invest in a region depends on the transport system, electricity, and communications in the region.

- Natural resource factor. The investor analyzes the region's supply of natural resources. The geographical location of the investment object and its bioclimatic features are taken into account.

- Financial factor. The local budget, the structure of income and expenses, the profits of enterprises, the debt of the region, its budgetary independence, etc. are assessed.

The relevance of considering the mechanism of formation of investment attractiveness lies in determining the essence, content and properties of financing in the economy of regions, enterprises and projects. Existing shortcomings in the system for assessing indicators lead to the conclusion about the need to improve the institution of investment as a whole.

Investment return index

For small investment objects with a implementation period of about a year or a little more, a simplified formula for the investment return index is used, which looks like this:

where ICo is the initial investment.

So for the previous example we get:

For 1 object = 60.86 / 60 = 1.014.

For 2 objects = 71.45/60 = 1.19.

In this case, the profitability index confirms that object 2 is more profitable than object 1. The investor will prefer object 2, although the cost of capital of the investment object for object 1 is significantly higher and its financial stability is also higher.

Investment attractiveness of an enterprise: concept and criteria

The investment attractiveness of an enterprise is a set of characteristics that reflect the effectiveness of infusions of monetary assets into the further development of the company. Its main feature is the factor of obtaining a stable income over a long period.

Most organizations are in a state of fierce competition to attract capital for the development of their own projects. Therefore, it is important to carefully work out a business project in order to provide the investor with a complete picture of profitability when implementing the plan.

To assess investment attractiveness, the following financial indicators are used:

- Liquidity. Reflects the rate at which a company's assets are converted into cash.

- Property status. Shows what share is occupied by current and non-current assets in the enterprise's funds.

- Business activity. Characterizes the financial processes of production that directly affect profits.

- Financial dependence. Reflects the company's need for investment. The indicator demonstrates whether it can operate without debt and financing.

- Profitability. Indicates how efficiently the production manages its finances.

Having considered the concept and main criteria of investment attractiveness, it is important to take into account that the assessment uses the parameters of resource availability, product profitability, number of employees, production capacity utilization, equipment wear and tear, etc. It is also necessary to take into account the level of risk and its consequences.

The essence of the phenomenon under consideration

Investment attractiveness is a set of financial indicators that determine the assessment of the current situation, position in the markets, as well as the potential risks and profitability of the investment object under consideration.

There are a huge number of variables that influence this indicator. At the same time, the investor must be aware that in each industry the attractiveness factor should be assessed differently, based on its specifics. When planning to invest money, you need to remember the main thing; in each individual situation you must evaluate how profitable the investments in the investment projects under consideration will be.

In addition, you must always remember that investment attractiveness depends not only on financial structures, but also on regions, industries and countries.

Therefore, investors should consider the attractiveness factor on several levels. The macro level considers the state of affairs in the economy of the state as a whole. The meso level analyzes the situation that has developed in a separate subject of the federation and in the municipality. The micro level is associated with the analysis of the investment attractiveness of a specific operating company.

Methods and ways to increase the investment attractiveness of an enterprise

There are many effective ways to increase the investment attractiveness of an enterprise, but experts advise adhering to the following:

- Increase production stability. The key to the success of any company is the use of all resources. If four machines are working at an enterprise, and six more are idle, then the wear and tear of the working equipment in relation to the idle equipment will increase every day. At the same time, the released goods from the assembly line should immediately go for sale, and not to the warehouse. The company must produce exactly as much as they buy from it, adjusting daily to changes in demand.

- Increase the commercial success of the company. This method of increasing investment attractiveness can be considered one of the main ones. Companies that are in the TOP of successful ones can count on profitable investment.

- Ensure financial stability. To receive additional funding, you must confirm your stable position. For an investor, it is important that the company does not have large debts, while expenses should be kept to a minimum.

- Properly organize the work of the enterprise. It is important to assess the feasibility of certain production departments or management cells. Carry out constant monitoring of the activities of each structure.

- Develop a system of employee incentives. To get the most out of each employee, it is necessary to create a special incentive program that will allow them to climb the career ladder or receive bonuses.

- Introduce innovative technologies into production. It is important for consumers and investors that the product sold is of high quality, modern and advanced. To do this, the manufacturer must constantly update the equipment and hire only highly qualified specialists.

- Reduce taxes as much as possible. This measure to increase investment attractiveness will significantly reduce the company's costs. In this case, you can switch to a more favorable tax system.

- Find investors and expand your scope of activities. A qualified assessment will allow us to develop new ways to increase investment attractiveness.

- Take a leading position in a competitive environment. Marketing plays a vital role in the work of a company. It is required to assess the strengths and weaknesses of competitors and develop a plan for optimizing your own production.

- Provide material resources. It is important to keep all equipment in working order at all times. It is also more profitable to purchase your own premises than to pay rent.

Foreign experience in increasing the investment attractiveness of an enterprise proves that all of the above areas of development allow companies to become market leaders and attract a large amount of capital investment. At the same time, even unprofitable investments improve this indicator, creating new infrastructure and opening the way for effective injections.

Finding the answer

Total found: 71

| Question No. 242302 |

Please tell me. How to properly persuade: issue a license to the Open Joint Stock Company Nebankovsk. organization Financial and investment. fund. Manager and one more thing: accredit “Non-profit. organization "Fund" (closed joint stock company)" ? What is the rule for writing this? Thank you. Tatiana

Russian help desk response

That's right: to whom should the license be issued? – open joint-stock company, non-banking organization, financial and investment fund, manager. Accredit – who? – non-profit organization “Fund”, closed joint-stock company.

| Question No. 240514 |

Good afternoon, dear Smarties and Smarties! Help me please. What VERBS can be combined with the word “review”. For example, conduct a press review or on such and such sites you can get a brief overview of investment projects, etc.

Russian help desk response

For example: make a review, limit yourself to a review, read a review, prepare a review, offer a review, etc.

| Question No. 239622 |

How to correctly write about the beginning of the pre-Investment stage?

Russian help desk response

| Question No. 238912 |

Hello. Please tell me whether the cases in this sentence are coordinated correctly:

“Creation of investment projects in the field of construction that best meet the requirements and expectations of investors, owners of residential and commercial real estate.”

Russian help desk response

| Question No. 238565 |

How to spell correctly: pre-Investment or pre-Investment?

Russian help desk response

| Question No. 238519 |

Hello! For some reason I stopped receiving answers to my questions. Tell me which is correct: pre-Investment or pre-Investment? And one more question: not to pay attention or not to pay attention?

Russian help desk response

1. Correct with Y. 2. Preferable: ignore.

| Question No. 238356 |

Please explain the correct spelling of the word "pif". According to the rules for writing abbreviations (D. E. Rosenthal's Handbook), the word must be written in lowercase letters: this is an abbreviation, readable by sounds, formed from a common noun (mutual investment fund; that is, essentially the same as a university). However, I have never seen any other spelling other than in capital letters: PIF. What are your recommendations? Sincerely,

Russian help desk response

Only a very few abbreviations that have existed in the language for a long time and are no longer perceived by many as abbreviations, but as ordinary words are written in lowercase letters: pillbox (from long-term firing point), university, college, registry office (the spelling of registry office is also correct) and some others. The vast majority of abbreviations are written in capital letters. That's right: mutual fund.

| Question No. 237671 |

How to spell: investment but? attractive

Russian help desk response

| Question No. 236767 |

How to write correctly: “agreement on the implementation of investment projects” or “agreement on the implementation of investment projects”

Russian help desk response

| Question No. 235022 |

How to write correctly: pre-investment or pre-investment? The rules of the Russian language clearly give the first option, but most published works give the second option. Judge.

Russian help desk response

Correct: _pre-investment_. Writing with I is a mistake (albeit a very common one).

| Question No. 234772 |

Hello, I was a little confused by your answer to question number 234735. Let me immediately note that I am not a great specialist in the great Russian language. (Please tell me if the phrase “An investment fund is risky” is correct? / The phrase is incorrect. You can say: investments are risky. And the fund is a venture fund.) I believe that the adjective “venture” in this context does not quite correctly describe the above-mentioned fund. The fact is that a “venture” fund is a very specific formulation of a fund that implies the use of investors’ funds for the purpose of investing these funds in the development of projects from scratch, as well as investments in companies that have been assigned a very low credit rating or no rating at all. . In practice, venture funds are interval or closed-end funds that lend against a “business plan.” In a nutshell, not all funds with risky investments are venture funds, but all venture funds carry a high risk component. I think that classifying all funds with risky investments as “venture” may mislead your readers. As for the wording, I would like to suggest the following (please correct if this wording is incorrect): a fund with a high investment risk ratio. Best regards, Well-wisher

Russian help desk response

Andrey Alexandrovich, thank you for your valuable addition to the answer.

| Question No. 234735 |

Please tell me if the phrase “An investment fund is risky” is correct?

Russian help desk response

The phrase is incorrect. We can say: investments are risky. And the fund is a venture fund.

| Question No. 234242 |

Please tell me how one tends to “put emphasis on something/on something”? For example, during the discussion, the emphasis was placed on the huge investment resource of the region and on related issues. Thank you

Russian help desk response

As a rule, it is used to _put emphasis on something_.

| Question No. 232049 |

Hello, I am interested in the commentary on question No. 206677. Is it correct to use names without quotation marks (meaning that they are not written in the text, but for example in a specially designated column for trademark registration) Name. ) Name: “Russian Investment Group” (RIG) or Name: Russian Investment Group (RIG) Thank you very much

Russian help desk response

In this case, it is better to write without quotes.

| Question No. 231170 |

Experts believe that such an initiative will have a negative impact on the country’s image, and (?) therefore, on its investment climate. Is a comma necessary before “means”? Thank you.

Russian help desk response

A comma before _means_ is not required.

Investment attractiveness of the project: factors and indicators

The concept of investment attractiveness applies to all projects that require financing. The main requirement for the investor is confirmation of the company’s ability to fulfill its obligations to return funds invested in the project and pay accrued interest, and for the partner - the opportunity to increase the value of the stake.

Project attractiveness indicators:

- Net present value (NPV). Reflects the utilization rate of capital investments. A positive indicator allows you to continue financing, but a negative indicator indicates that the project is not investment-attractive.

- Internal rate of return (IRR). Reflects the profitability of injections or the maximum allowable level of expenses. IRR characterizes the rate of return at which net present value is zero. A project can only be considered if the parameter exceeds the cost of investment.

- Discounted Pay-Back Period. The period from the launch of the project until the moment when the NPV becomes positive. This is the most important indicator that you should rely on when choosing an object of financing.

- Pay-Back Period. Characterizes the period from the start of the project until the moment when accumulated net cash receipts become positive.

Factors influencing the investment attractiveness of the project:

- Feasibility study.

- Legislation regulating the activities of investors.

It is important not to forget that initiation also plays a special role, which is understood as the process of making a new project investment attractive. A businessman must decide whether an idea can be realized, how to make it attractive to an investor, and choose a manager and a partner for financing.

Investment attractiveness of different areas: education, medicine, livestock farming

According to 2021 data, the activities for the production of dairy products had the maximum investment attractiveness, even in the face of declining retail prices for products.

A significant factor in favor of the industry is considered to be its profitability; last year it was at least 10–20%. Per capita consumption of dairy products accounts for up to 180 kg per year.

The economics of dairy farming are determined not only by market price, but also by volatility. In the long term, in the absence of dumping, the growth potential will be 25–30%. Despite the increase in production costs, companies maintain the average purchase price per liter within the previous limits - 20 rubles, due to which demand does not fall, but is gradually growing.

State aid is also considered an important factor in investment attractiveness. Manufacturers can receive several types of subsidies to further attract investors to the region. Preferences vary by region, but on average they are 60–70 kopecks per liter.

If we consider education and educational institutions as an object of financing, then we should recall the Federal Target Program created in 2006 to increase investment attractiveness. Thanks to the developed and implemented set of measures, material, intellectual and other resources were attracted.

Signs of investment attractiveness of the education system:

- interested investors;

- long-term financing;

- profit from the development of investments;

- positive effect from investment.

Of the three types of activity under consideration, the health care system has the lowest investment attractiveness. Capital does not flow into medicine due to the lack of a mechanism for its reproduction. The fact is that the invested funds do not go beyond the boundaries of state ownership, since they are intended for budget consumption. For comparison, in the USA, the opening of a clinic is associated with the production of a product that can generate income for its investor; in Russia, only private institutions have this ability.

Conclusion

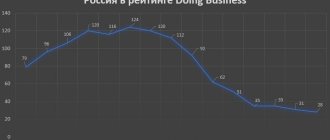

Russia has all the resources necessary for rapid economic development. Nevertheless, in order to increase the rating of investment attractiveness in the country, it is necessary to carry out serious reforms in the area:

- fight against bureaucracy and corruption;

- corporate culture and labor productivity;

- improvement of investment legislation.

The development of our country over recent years has generally had a positive trend. We have every reason to look into the future with optimism. According to existing expert estimates, all the positive processes described above will develop in 2017.