Previously, the most accessible and profitable way to buy currency for an individual was to come to the bank and, after paying a commission hidden in the course, exchange rubles. But since Russian citizens were given the right to independently enter exchange trading and buy or sell currency on the Moscow Exchange, exchange offices have become less relevant. Moreover, it has become possible to make money completely legally on currency exchange.

What you need to know before buying

Banks and other financial institutions set the exchange rate based on stock exchange performance. At the same time, they always add their percentage in order to earn money. They set the buying rate cheaper than on the exchange, and the selling rate - more expensive.

The banks themselves also purchase currency through currency exchanges.

The same method of purchasing euros or dollars can be used by an individual.

The Moscow Exchange provides the opportunity to trade. We are talking about setting the desired price for buying euros or dollars. If you need to buy quickly, you will have to agree on the current price of the selected currency. But even in this case, the price will be much more favorable than at bank exchange offices.

Many brokers have a minimum amount of $1000 to start a purchase. This is one lot. Other brokers provide the opportunity to open a single trading account - MMA. It allows clients to enter the Moscow Exchange and enter into transactions in amounts starting from $200.

What taxes will you have to pay?

The client will have to pay 13 percent taxes if he makes transactions with currency and makes a profit. For example, he will buy euros today for 89 rubles and in six months will sell them for 95 rubles. Then, on a profit of 95 minus 89 equal to 6 rubles per unit of currency, the broker will withhold personal income tax.

But if a client bought for himself, say, 100 thousand euros to buy a house in Montenegro, and withdrew or spent this amount, then he will not have to pay any tax at all.

Promotions for training from Tinkoff

Open an account

Cooperation with a broker

Individuals and legal entities cannot directly interact with the International Interbank Currency Exchange (MICEX). To do this, they need to work through an intermediary - a brokerage company. The list of such accredited organizations can be found on the official website of the Moscow Exchange.

Using the services of brokers, an individual can buy not only currency, but also securities on the stock exchange. Such organizations accept client funds, after which they connect them to the exchange and provide all information regarding trading. Brokers also carry out all client orders regarding the purchase or sale of assets.

What's the problem?

Coupon or dividend profits fall into your account - that’s good. Real money. Which can be reinvested again. Buy more securities. And receive additional income.

When you just start investing in foreign assets, you somehow don’t think about the possible pitfall.

Namely, the profit received may not be enough to purchase new securities.

When I first raised money to buy American stocks, I was incredibly happy. I purchased shares of several companies that consistently pay dividends every 3 months. And began to receive a constant cash flow.

Who doesn't know? Almost all American companies pay dividends quarterly.

And here a surprise awaited me. Where to put these “currency bits”? The initial investment was 1 thousand dollars (which I exchanged on the currency section of the Moscow Exchange at a favorable rate). The dividend yield on shares averaged 2-4% per annum. That is, you could count on $20-40 a year.

But I received money once a quarter. In the amount of 5-10 bucks. And where to put this little money?

There is definitely not enough to buy new shares. The average cost of paper is $50-100 and above. Of course you can find cheaper papers. But buying on the principle of “whatever you have enough money for” is not quite the right position.

In fact, the situation was even sadder. The company paid the divas in different months. As a result, the profit received was even more spread out throughout the year. Not 5-10 bucks quarterly, but $1-4 monthly.

And such a paradoxical situation arises. You receive profit in the form of divas regularly. But there is nowhere to put it.

With Eurobonds everything is much sadder. The cost of one paper is 10 times higher (from $1,000). Coupons are paid on average 2 times a year. Coupon yield is 3-6% per annum.

It turns out that from one bond we get $15-30 every six months. There definitely won’t be enough money to buy new paper. You need to have 30-50 pieces (or 30-50 thousand dollars) in your portfolio so that for every income received, you can immediately buy at least one more Eurobond.

If there is no such money, then we again get frozen foreign exchange profits. Which is problematic to use in investments.

What to do in this case?

How to choose a broker

To work with the exchange, it is important to cooperate with a reliable intermediary company. Therefore, before choosing a specific broker, you need to pay attention to the following nuances:

- Availability of permission to conduct transactions on the stock exchange.

- Reliability rating is not lower than AAA.

- The broker has his own bank with which he works.

- Suitable rates. We are talking about commissions that the client will have to pay when depositing and withdrawing funds, as well as concluding transactions.

- Conditions for withdrawal of funds.

- Minimum transaction size.

By comparing different financial companies, you can find the most profitable option. Therefore, you should not make a decision quickly. Sberbank became the most popular broker in 2021 due to the speed of opening an account, prompt deposit and withdrawal of funds.

How and where can you withdraw currency?

Currency can be withdrawn to your regular foreign currency account or to a card. The only thing you need to be careful is that the name of the currency must match the card or account. Because if you buy euros on the stock exchange and transfer them to a dollar card, the bank will convert at its internal rate.

Moreover, often credit institutions in this case can even make a double conversion: first they exchange dollars for rubles, and then buy euros back for crediting. Moreover, both of these operations will be carried out at their own rate, and then the initial purchase of currency through a broker completely loses its meaning.

It is important that the currency must be withdrawn immediately to the account from which it is planned to be used. Because otherwise you will have to pay for additional transactions. You need to understand that currency transfers cost money, usually at least 15 dollars or euros for each interbank payment via SWIFT.

Agreement and account registration

The opportunity to trade on the stock exchange will become available after concluding an agreement with a broker. You can do this in two ways:

- Find the nearest branch of the selected broker and visit it. You must have your Taxpayer Identification Number, passport and SNILS with you.

- Open a trading account directly on the broker's website. To do this, it is not necessary to have a verified account on the Public Services portal.

The account opening process can take up to 3 days. The client is notified of its completion via email or SMS.

The contract must specify the services that the company provides, as well as the responsibilities of the parties. Before signing this document, it is worth studying the proposed conditions and making sure that all points are clear.

It is important that the contract contains the following information:

- Minimum and maximum amount for depositing funds;

- Available tariffs and all information about commissions;

- Possibility of using additional services and platforms.

After concluding the contract, you will need to top up your balance with the required amount. This can be done in one of the following ways:

- By transfer from a card or bank account;

- Cash in the office;

- Through payment systems.

Funds can be credited to your account in a period from a few seconds to several days. This depends on the terms of the broker and how the transaction is carried out. After replenishing the balance, an individual gets the opportunity to trade on the stock exchange.

To withdraw funds, you can also use bank accounts or payment systems. As a rule, brokers allow you to withdraw money in the same way as the deposit was made.

How profitable is currency exchange on the stock exchange?

Let's look at a simple example. You need to sell 10 thousand euros, earning rubles. The exchange rate of the Central Bank of the Russian Federation as of July 31 is 70.46 rubles per 1 euro. For comparison, let’s take the Sberbank rate for the same date in offices - 69.36 rubles. Let’s take the average broker commission for an operation - 0.04% (in BCS Premier it is even lower) and free withdrawal of Russian rubles to a bank account.

When selling through a broker you will receive: 704,600 - 281 = 704,319 rubles. If you use the Sberbank exchanger - only 693,600 rubles. Your savings when exchanging currency through the exchange will be 10,917 rubles, which is by no means a lot.

Buying currency

To conveniently convert dollars, you will need to install a trading terminal. This program must be provided by the broker. The most common options are Quick, Transaq and MTS. Using the terminal, the client places orders to purchase the required currency.

You can also make transactions using a call. But all companies charge an additional commission for this function.

This option is suitable for those who for some reason were unable to log into their work terminal (no Internet access). But, if you don’t want to waste time exploring the terminal and studying the material on your own, then this option will not save you.

To carry out a transaction via a phone call, you need to go through identification - confirm your number and say the code word.

Thus, in order to buy currency on the exchange, an individual must complete the following steps:

- Open a bank account.

- Conclude an agreement with a broker.

- Top up your brokerage account in rubles (if necessary, you can also add dollars or euros).

- Download a special program or application to your PC or smartphone.

- Before conducting a transaction, you must select the desired currency pair. If the user makes an exchange on the Moscow Exchange, then to buy a dollar, you must select the ticker USDRUB_TOD, for the euro – EURRUB_TOD, etc.

- You can carry out a transaction instantly, at the current market rate. You can also place an order indicating the desired price, in which case you will have to wait until the rate reaches the desired value.

- After the transaction is completed, rubles will be debited from the account and dollars (or euros) will be credited.

- If the user purchased currency for the purpose of storing it, he may not withdraw it, but leave it in the brokerage account.

- If necessary, you can convert your currency back into rubles at any time. Selling currency on the exchange is done in the same way as buying it.

- If currency (dollars, euros, etc.) is stored in a brokerage account, the user can create a withdrawal request at any time. After the money is transferred to the external account, the user can dispose of it at his own discretion, including cashing it out.

When working with the terminal, you need to remember that there are two types of transactions - TOD and TOM. In the first case, the currency is purchased during the day (until 15-00), in the second - the application can be transferred to the next day.

We calculate commissions and other expenses

The chain of buying currency on the exchange turns out to be too long and takes several days. If you do everything from scratch.

With an active brokerage account - a few hours minimum.

How much can we save on this? And is it worth the bother? Wouldn't it be easier to exchange money at a regular bank? Simple and fast. No loss of personal time.

On the stock exchange, the purchase and sale of currency occurs in lots. 1 lot - 1000 USD Dollars or euros. Accordingly, the minimum transaction amount is 1,000. And it must be a multiple of this number: 2000, 3000, 5000.

You won't be able to buy or sell for $1,200 or $1,999.

Additional costs and commissions

The broker charges a commission for each transaction. Rates may vary depending on the broker. For Otkritie it is 0.035% of the amount.

The exchange takes 0.01% of each transaction.

You will also have to pay 0.02% for withdrawing funds.

Advice. When withdrawing foreign currency to someone else’s bank, brokers have “wild” commissions. $15-25 (or euros) - regardless of the amount. There is no such thing in the “native” bank, under whose wing he works. Therefore, you first need to open a current account or get some kind of free plastic card (debit card, of course).

Total: on top you will have to pay 0.035 + 0.02 + 0.01 = 0.065% of the current exchange rate.

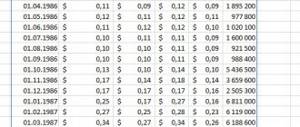

Now let’s compare the profitability of buying on the exchange compared to profitable exchangers using the example of buying $1,000.

On the stock exchange, in the order book, the best offer for sale is 64.1575 rubles for 1 dollar. Buying a thousand dollars will cost 64,157 rubles 50 kopecks.

Plus the commissions in total will take 41.7 rubles.

Total: our total costs for the purchase and withdrawal of $1000 will be 64,199.2 rubles. Or 64.2 rubles for 1 dollar.

We compare with the best offers from banks. We look at the Bank Ru website.

And then a surprise awaits us.

The exchange rate for the best 8 offers is not much different from our costs on the exchange. And even for some it is lower.

How so?

The problem is monitoring. Sometimes it shows irrelevant data. I don't know what this is connected with. Either there are problems with the update, or some banks simply pay extra to show “favorable” rates. Attract customers with tempting offers.

But if you switch on your own to any of the above “profitable” banks. There will be completely different exchange rates. Naturally less profitable.

The most profitable among all banks is an exchange at BKS Bank for 64.27 rubles. The difference with our costs when purchasing through the exchange is only 7 kopecks. And then it goes upward. + 10, + 20, 25 kopecks.

For example, the difference in the exchange of dollars with the stock exchange compared to the largest banks (Sberbank - 65.88, VTB - 65.10, Otkritie - 65.65 rubles per dollar) is 1.68; 0.9; 1.45 rubles respectively.

Purchasing partial lots - list of brokers

I’ll say right away that I don’t have accurate information about everyone.

I’ll tell you which brokers I work with using this scheme.

Tinkoff investments. I switched to him several years ago precisely because of this opportunity. In principle, I only buy foreign assets through it.

VTB broker. I just recently found out about the opportunity.

When you subscribe to a new favorable tariff “My Online”. Using the “My Investments” mobile application as an example.

In the “Currency” tab, select USDRUB_1$ . And we perform the operation.

The rate is less favorable. Differs from the exchange one by 2 WHOLE KOPEYKS.

As you can see below, the system allows transactions starting from $1.

Opening broker. The markup to the exchange price is on average 1.5 - 3 kopecks per 1 CU. You can find it in QUIK (or WebQuik) in the “OTC Currency Trading” section. Or the exchange can be made by calling the broker - you call and say I want to exchange 100 (200, 300 bucks) at the current rate. The broker will do everything himself.

Change large amounts

If the street sign of an exchange office promises a good rate, this does not mean that it will actually be possible to convert currency profitably. The preferential rate can only apply to large amounts. Therefore, before buying/selling, you must definitely ask the cashier at what rate your transaction will be processed.

Most often, banks give discounts for transactions from $5,000-10,000, says Vladimir Kushchev, head of the treasury risks and transfer pricing department of VTB 24.

“In large banks, the exchange rate on the display board is usually set based on one unit of currency. The described practice is more typical for “gray exchangers,” comments Stanislav Makarov, head of the corporate conversion and regional development department of B&N Bank.

Therefore, experts recommend using only bank branches when exchanging, where gradations in the transaction amount are also often found, but all conditions are transparent.

Checking settlements on account 57.02 “Purchase of foreign currency”

If all transactions for the purchase of currency are reflected correctly, then account 57 will not have a balance. You can check your calculations in the Account Analysis report in the Reports – Standard Reports – Account Analysis section.

Test yourself! Take a test on this topic using the link >>

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Advantages and disadvantages of the operation

Buying currency on the exchange has the following advantages:

- minimal difference between purchase and sale, while at exchange offices the amounts may differ significantly from each other;

- security and transparency of the operation;

- purchases can be made remotely;

- no risk of buying counterfeit banknotes and no risk of theft when transporting currency.

Disadvantages of the operation:

- to complete the operation, you need to complete many additional procedures - find a broker, open an account and others, when you just need to come to the exchange office, provide your passport and funds;

- you need to pay a fee to the broker and pay a bank commission;

- There is a risk of choosing an unscrupulous broker if you contact a private person rather than a bank.

After assessing the advantages and disadvantages of purchasing currency on the exchange, you can decide whether to carry out the procedure.