Published: 05/13/2021

Updated May 2021

has been working in the Russian financial services market for more than 25 years and is one of the largest brokers in Russia. This organization differs from most of its competitors in that it specializes specifically in investment activities. Therefore, many professional traders and investors choose BCS. The features of cooperation with this brokerage company are discussed in today's article.

Selecting a tariff plan

When signing an agreement to open an individual investment account or brokerage account, the client immediately selects the appropriate tariff plan, so it is necessary to familiarize yourself with the conditions in advance.

In 2021, the BCS broker introduced new tariffs for individuals:

- "Investor". Commission 0.1% for each transaction and 0.125% for foreign exchange transactions. Suitable for investors who make few transactions and for portfolios of less than 500,000 rubles. No deposit fees.

- "Trader". Commission 0.015% (stock market 0.015 – 0.05%) per transaction. Suitable for active investors who regularly trade on several platforms simultaneously.

- "Investor PRO". Commission 0.015 – 0.3% (the larger the account, the lower the commission). The tariff is beneficial for portfolios starting from 900,000 rubles.

For beginners of exchange trading, we can recommend starting with the “Investor” tariff. The commission fee for it is the highest, however, you can start trading with any amount, even 500 rubles. There is no depository fee, so the commission is calculated only on the transaction amount. This option will help you get comfortable with the trading terminal in real conditions, without risking large sums.

More experienced investors choose rates for brokerage services at BCS based on their trading volume and the number of transactions per month, per day. When dealing with large sums, it is important to take into account even tenths of a percent, which is why depository service packages with low commissions are more profitable.

Ready-made trading strategies

Investors who do not have sufficient experience can use ready-made strategies from the best BCS analysts. It works like this: the user selects a solution taking into account his own needs and financial capabilities, after which he is regularly sent investment recommendations. The client himself decides whether to follow these recommendations or not.

As a rule, information comes via SMS or email. If the investor agrees, he needs to send the corresponding code in a response message, and the trade order is executed automatically. The service is provided on a paid basis.

Currently, the BCS broker offers more than 40 investment strategies. The most popular of them are discussed below:

- "BCS Dividend Basket". The best dividend stocks are included in the investment portfolio. The minimum investment amount is 125,000 rubles, the average return in rubles is 26.82% per year. The cost of auto-following the strategy is 2% of the amount of assets plus 20% of profits.

- "World ETFs in rubles." This strategy is characterized by maximum diversification of assets across sectors, markets and countries. The money is invested in various exchange-traded funds that invest in shares of large companies in the markets of the USA, China, Russia, Germany, Japan, Australia and the UK. The average annual return in rubles is 58.77%. You can start investing with 40,000 rubles. The cost of auto-following is 1% of assets plus 15% of profits.

- "Beat the S&P." The philosophy of this strategy is to obtain a financial result that is higher than the return of the S&P 500 stock index. This product is only available to qualified investors with a capital of $50,000 or more. The average annual return in dollars is 48.46%. The cost of auto-following is 2% of the amount of assets plus 20% of profits.

How to open an account - step-by-step instructions

There are two ways to open an IIS or a regular brokerage account with BCS:

Debit #Cashback card

Apply online

- Online, on the official website of BCS.

- In the service office.

When applying online, you must:

- Go to the broker’s website, click on the “Open account” button in the upper right corner, select the “Open online” method.

- Enter your mobile number and confirm it with the code from SMS. This must be a personal phone number registered to yourself - it is used to communicate with the manager and make transactions on the stock exchange.

- Fill out the form and upload a scan of your passport or enter the data manually. When filling out in print, all letters and numbers must be entered carefully, as in the document.

- Confirm your actions with an SMS code.

You will receive a login to your personal account via email, and a temporary password via SMS. The system will ask you to change it during the first authorization and the account will be automatically activated.

If the system cannot recognize your identity, a personal visit to the office will be required. Therefore, scanned copies of the passport must be of good quality, and when filling it out manually, typos must not be allowed.

The stated opening time is 5 minutes, but in practice it can take up to a day, since the account is registered on the Moscow Exchange.

To open a brokerage account at a service office, you only need a passport and a mobile phone. BCS employees will provide comprehensive advice, prepare all documents and answer any questions. This option is the best solution for novice investors.

When registering an account, it is recommended to immediately submit an application for the issuance of a BCS bank card. With its help you can top up your account without commission.

BCS is a broker. The largest Russian broker. Earnings on stocks and the stock exchange.

Many traders are accustomed to not trusting domestic brokers. They associate the word “foreign” with high quality, comfort and, of course, high income. Can the Russian financial segment offer something like this? It turns out that it still can. The real mastodon of the domestic market is BKS - broker . This trading platform has enormous experience in the field of trading, and still occupies a leading position not only in the Russian Federation, but also in many countries. The resource's policy of openness and honesty has earned great respect among exchange participants.

BCS

platform was created in 1995, which makes it one of the most respected resources on the Russian market. Since its launch to this day, the company continues to tirelessly improve and update its line of services. BCS is a broker that is maximally focused on creating the most comfortable conditions for trading.

Each user should have uninterrupted access to the trading terminal, manage their finances without problems and not fear for their safety. All this is guaranteed to every trader on the BCS-broker , because its activities are regulated by the Moscow Exchange. This implies full compliance with the norms of the Central Bank of the Russian Federation.

The official website of the platform meets all modern requirements. The user of the resource can carry out any type of operation without leaving home, online. A huge range of payment methods is available, which makes replenishing your account or withdrawing funds very comfortable. The cashback service works even if the deposit is replenished.

Work account overview.

After registering on the official website of the trading platform, the new user will have access to his personal account, as well as trading terminals. In addition to registration, you need to protect your profile using two-factor authentication.

BCS Online is an effective method to always have access to your profile and carry out various operations. To start using your profile, a new user needs to contact the office. Online, through his account, a trader will be able to replenish a deposit, withdraw funds, carry out trading transactions and much more.

After the visitor goes through the standard registration process indicating correct personal data, he will gain access to his personal account. Initially, it is advisable to change the temporary password to a safe and reliable analogue. This procedure will allow you to protect your profile from hacking in the future. After completing the preparatory procedures, it is time to begin trading activities. To do this, the user needs:

- make a deposit and top up your account balance. This can be done using online transfers, or in cash at the nearest broker's cash desk;

- the trader must choose the optimal terminal for trading and install it;

- start trading and concluding contracts;

- withdraw earned profits.

Go to the official website of BCS-Broker

Brokerage account - purpose and opening principle.

In order to function on the broker's exchange, you need money. Where can I put them? To a brokerage account. This will make it possible to make payments to various organizations. For each successfully completed transaction, the trader will receive a profit to his account.

Anyone can open a brokerage account on the BCS platform. This is a fast and, most importantly, free procedure. A new user can make a deposit either online or by coming to the company’s office. To open an account yourself, you will need to provide a scanned version of your passport or a photo of it, indicate your e-mail and phone number (for verification via SMS). To open an account through a broker's office, you will first need to fill out a special application form, which can be found on the official resource. Next, the user will need to wait for the call and then visit the company’s branch to confirm in writing the opening of the deposit.

The visitor will receive access to numerous trading terminals after his account is registered with the Moscow Exchange. This process may take a maximum of two days. The BCS resource does not provide additional fees for opening and maintaining an account. Everything is absolutely free. There is no subscription fee either. The recommended amount to open an account on the exchange is 50,000 rubles. This will allow you to assemble an effective portfolio of trading instruments.

Is it possible to close a brokerage account?

In addition to opening a deposit, the BCS broker provides its users with the ability to manage the availability of products - they can connect new ones or disconnect old ones. As a special privilege, the trader, depending on his preferences, can change the tariff plan and even close his brokerage account. You can do this yourself, online, or contact a broker’s office for help. But users should note that it is possible to close an individual investment account and withdraw all funds from it no earlier than three years from the date of opening .

Deposit replenishment.

As mentioned above , stock trading is only available if there are funds in the user’s brokerage account. The BCS trading platform, being the most trusted Russian broker , gives its visitors access to a wide selection of payment methods. You can top up your account balance using the following methods:

- by logging into your BCS Online personal account, make a bank transfer using your Broker card;

- by cash payment at the nearest broker's cash desk;

- You can make a non-cash transfer using the details from the accounts of various banks;

- online. Before this, the user must install the “My Broker” application on his device. When using this method, clients must understand that they will definitely face a 2.5% fee. For those who top up their balance every month with more than 50 thousand rubles, this option is not suitable. The program has a monthly replenishment limit.

Go to the official website of BCS-Broker

The implementation of a non-cash transfer is based on the provision of personal information. This means:

- number of the general agreement with the broker;

- the date on which the contract was signed.

All necessary information can be obtained through your own profile, in the “My Broker” mobile program, or in the account opening notification (issued to the user in the office).

If the account is replenished with the direct participation of a broker, then the incoming payment transaction is processed within one business day. If the transfer is carried out through third-party banks, then in this case BCS is not responsible for the period for crediting funds. Under standard conditions, bank transfers can take up to three working days. It is worth considering that banks may charge the user an additional commission when making a transfer.

Review of tariffs.

The BCS trading platform occupies a leading position thanks to a large selection of tariff plans that directly depend on trading instruments. This means that trading Russian shares implies its own tariffs, the use of international shares, currencies, options and other instruments - its own.

In order for anyone to be able to choose the professional tariff that suits them on the BCS-broker , they need to pass the test. It was designed specifically to prevent new users from making mistakes due to inexperience and wasting money. During the survey, the system receives the following information:

- what kind of trading experience does the trader have;

- how much he wants to invest in the project at the moment;

- whether he intends to use the service of trading robots and receive signals;

- Does the user have any trading instruments in mind?

According to the information received, the resource determines the degree of financial awareness of the visitor and offers him the most optimal tariff system:

- the following tariffs apply for stocks and bonds: BCS Start, Professional, BCS USA in basic and classic versions, Margin Turbo/Free night/Withdrawal, for an investment account;

- for futures – tariff plan for investment account, Start, Basic+, Driver+, BCS CQG;

- tariffs for currency.

Go to the official website of BCS-Broker

What are the methods for withdrawing funds?

To withdraw money, the trading platform offers users the following methods:

- You can withdraw funds through your personal profile account;

- using the “My Broker” application;

- using the QUIK system;

- in the case of individuals, withdrawal can be made by telephone;

- by fax;

- outgoing transactions can also be carried out at any of the broker's offices.

When withdrawing money from the balance, the user is not subject to any commissions, the only exception being currency withdrawal. If the outgoing operation is carried out during business hours, before 17:30 Moscow time, then the withdrawal will be carried out during the same day. When making a withdrawal using a phone call, the trader must provide the following information:

- full name;

- your account number;

- number and date of execution of the general agreement;

- name of the trading platform;

- amount for withdrawal.

Operating conditions for users.

to make money on stocks through BCS thanks to a huge selection of the most effective trading tools. Thanks to its experience and inexhaustible desire to always be better, the financial platform today provides its users with a line of the following tools:

- dual strategy;

- currency strategy

- broker on a personal basis;

- trading strategy;

- artificial intelligence;

- trainer at the stock exchange;

- IIS;

- insurance product;

- consultant for capital management;

- tax refund;

- “Broker” card and its PRO analogue;

- financial strategy;

- structural portfolio (products).

A separate advantage of trading shares on the BCS is the ability to carry out trading activities using standard and margin leverage. Leverage accounts range from 1:1 to 1:200. If a trader uses the margin lending service within one day without transferring his positions to the next day, then in this case the service is provided completely free of charge. In any other case, payment for the provision of services is charged according to the established tariff system.

To start trading activities on the BCS broker , you can use any amount as starting capital. However, leading resource specialists and experienced traders advise beginners to start with an amount of 50,000 rubles. With this money it will be possible to create a balanced and diverse portfolio of trading instruments.

Go to the official website of BCS-Broker

Current commissions.

BCS is a trusted Russian broker that pursues a policy of openness, so there are no unjustified commissions on the resource. The only exception is the commission, which is charged upon closing the transaction. As of today, the following types of commission obligations are presented on the platform:

- for the currency market - broker remuneration per transaction, for withdrawal of funds, for trading operations such as SWAP using leverage, for operations whose orders total less than 50 commodity units.

- for trading activities on the MICEX - brokerage remuneration, for the regulation of transactions, for organizing a DEPO account, for REPO operations using leverage.

- for trading activities on FORTS - brokerage remuneration, exchange commission for the contract and type of transaction, for owning an analytical account.

If the user closes a position forcibly, connects additional products, etc., then the platform may charge an additional commission in accordance with the current tariff policy.

What types of accounts are available on the BCS financial platform?

Each user has his own interests and his own budget. In accordance with this, on the BCS resource it is possible to use mainly three types of accounts: a single account, an IIS and a demo account.

Individual investment account (IIA).

IIS is a special type of brokerage account that is intended for individuals. Its main advantage is that the owner of such an account receives tax benefits. According to the state tax deduction program, an individual who has an IIS may have complete exemption of income from income taxes, or his tax deduction will be valid for the amount of the contribution to the account.

The individual investment account program was created in 2015. The validity period of this type of brokerage account is three years. An individual can open only one IIS, and it can only be replenished in Russian rubles. Restrictions also apply to the annual replenishment limit of one million rubles. It is possible to withdraw assets only if the general agreement is terminated. Using an IIS, you can only purchase securities that belong to the Moscow or St. Petersburg stock exchange. An account can be transferred from one brokerage platform to another.

Opening an individual investment account is ideal for beginners, as well as for experienced exchange participants. There is no set minimum for topping up your account balance. The user will receive a deduction even if the investor does not purchase anything. To open an ISA, a trader must provide a scanned version of his passport (or its photograph), TIN number and SNILS.

Go to the official website of BCS-Broker

Demo account.

For inexperienced traders who have just begun to study the features of trading on the stock exchange, opening a training account is the best solution. Firstly, it is completely free and a beginner does not have to worry about possible failures. Secondly, a demo account provides an opportunity to study all the nuances of trading, gain experience by assessing the reliability and convenience of a particular resource.

To open a free training account, the visitor must go through the registration process. It will only take a few minutes. You will need to provide your name, number and e-mail.

Single brokerage account

Single account - this type of account allows you to simultaneously trade in financial instruments that belong to the Russian and American derivatives and stock markets. A trader does not need to open several accounts, because this is a waste of time distributing funds between them. All domestic and American companies are collected in one space. The ability to trade currencies and accumulate all the money on one platform helps users achieve greater success.

When using a single brokerage account, the trader has access to such platforms as:

- Derivatives, stock and currency markets based on the Moscow Exchange;

- Over-the-counter foreign securities market;

- LSE;

- American Nasdaq and NYse;

- XETRA exchange in Frankfurt.

Opening a single brokerage account is available in virtual mode, or by downloading the “My Broker” program. In the account opening block, you need to select the appropriate item. Next, you will need to top up your balance and this will be enough to start trading.

BCS platform terminals.

The official website of the trading resource has such clear and convenient functionality that even a beginner can figure it out in a short time. The user does not need to spend additional time searching for anything, everything is at hand and collected in his personal account. The most reliable and easy-to-use platforms have been created to help enter domestic and international markets. If the user passes a special test on the site, the program will be able to offer the most optimal option for choosing a platform. The test is designed in such a way that it allows you to identify basic consumer preferences, this minimizes the likelihood of error.

CQG terminal.

Go to the official website of BCS-Broker

The services of this terminal are paid, the cost per month is twenty-five dollars. In return, the user will receive access to the exchanges EUREX, CBOT, NUMEX and others. This terminal will allow traders to effectively respond to even the smallest changes, while remaining in an advantageous position. Working with CQG can be combined with additional external applications.

METATRADER terminal.

Go to the official website of BCS-Broker

This terminal has access to the domestic market, where it is very popular. The latest version of the terminal is MT5, which is most effective in the derivatives market. The advantages of METATRADER are as follows:

- accurate technical analysis;

- the ability to create advisors for trading;

- mobile app;

- individual interface settings;

- the ability to place orders in one click directly from the chart or order book.

To fill out an application for the purchase/sale of currency, you need to fill out the standard fields. The type of operation, cost, account number, volume in lots and, of course, client code are indicated. After confirmation, the application is completed and it is sent to the system.

QUIK terminal.

Go to the official website of BCS-Broker

This program has access to the Russian and international market. It features convenient functionality that allows the user to rearrange the entire workspace to suit their preferences. The trader himself decides what his portfolio will look like and which instruments will be there during the revaluation.

To use this terminal on the BCS-broker platform, you first need to download it in the software block. Next comes the installation of the terminal on a personal computer, during which keys will be generated. They need to be entered into BCS Online. You can launch the terminal a day after registration. To get started, you will need to specify the path to the keys and connect to the trading platform.

An additional service includes the ability to connect a WebQUIK terminal. Its operation can be either paid or free. If the brokerage commission for the month turned out to be more than 300 rubles, or the total value of assets at the working end of the month turned out to be more than 30 thousand rubles, WebQUIK is connected for free. In any other cases, terminal services will be paid, and their monthly cost will be 300 rubles.

Market overview.

BCS is a proven Russian broker that allows its visitors to use the most effective trading tools. Using them, traders are able to enter domestic and foreign markets of various types.

Derivatives market.

The BCS broker helps investors by giving them access to a wide range of operations in the derivatives markets. Here, people who want to invest can fix the future price of raw materials, currency, and formulate a strategy using various instruments, for example, options. The opportunity to invest in contracts for agricultural goods, raw materials, oil, bonds and other assets is also available.

Currency market.

For exchange participants who are looking for a reliable partner for currency transactions, the BCS platform will be an ideal option. This platform ranks first on the Moscow Exchange currency market, where you can sell currency on favorable terms and profit from changes in rates.

In the foreign exchange market, clients can purchase currencies and engage in foreign exchange trading. It is possible to carry out transactions in the following currencies: Russian ruble, EUR, USD and Chinese yuan. These highly liquid instruments, together with the unlimited possibilities of BCS, will allow anyone to make money.

Withdrawal of currency funds from the balance occurs without commissions, through BCS Bank. For platform visitors, it is more profitable to purchase currency on the exchange than in bank branches. Why? The thing is that the exchange rate for foreign currency is regulated on the currency market of the Moscow Exchange. It is here that all banks operating on the territory of the Russian Federation purchase currency, offering it with a markup. BCS gives clients the opportunity to purchase currency on the exchange at the same price at which banks buy it. For convenience, it is possible to receive an alert about a favorable currency price from the platform’s financial analysts.

Go to the official website of BCS-Broker

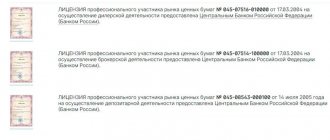

Stock market.

The BCS trading platform has five licenses as a professional participant in the securities market. These licenses belong to the Federal Service, which controls financial platforms in the country. License No. 1521 allows BCS to draw up exchange trading agreements, while acting as an intermediary.

The platform also has the appropriate licenses to operate as a broker, depository, dealer, and also to manage securities.

On the BCS platform, visitors will be able to find brokerage services with various vectors, which will give them access to Russian and global stock markets. The broker has absorbed more than six thousand shares that belong to Russian and foreign companies. Users can, without any restrictions, create a portfolio of any type that will fully meet their requirements and expectations.

The BCS trading platform helps its users gain access to the following stock objects:

- Moscow Exchange - here you can carry out transactions with stocks, bonds, options, currencies, etc.;

- St. Petersburg Stock Exchange - trading in Russian and foreign securities;

- NYSE - trading in securities of organizations related to all business areas;

- NASDAQ - trading in securities of organizations such as Google, Facebook, etc.;

- LSE is one of the most important stock exchanges in the world;

- XETRA is an exchange located in Frankfurt where it is possible to carry out transactions in shares and commercial bonds.

Additional benefits.

In addition to the fact that the platform features advanced trading terminals, there is also a large selection of additional opportunities for users.

Training for Beginners

Training for beginners is one of the important areas in the work of BCS. This trading platform has existed for almost a quarter of a century, and continues to develop to this day. The company's priority is always expansion by attracting new users. The resource has taken on the mission of training everyone from scratch in order to later turn them into their regular customers. For this purpose, a virtual platform “Investing 101” was created, where a large amount of educational content is presented. Anyone can use it.

Go to the official website of BCS-Broker

The learning platform is completely free, allowing beginners access to over 20 trading and investing courses. The program provides for constant improvement of the level and tests to determine the success achieved. The Investing 101 platform is accessible from any device and at any time. Anyone can gain invaluable experience without any investment without leaving home.

Information and analytical support

BCS provides each of its users with the opportunity to always stay up to date with the latest news. To do this, the resource has free access to Investcafe, BKS Express, Reuters and Interfax. These news and analytical feeds always contain only reliable facts and figures.

Trust management

Trust management (FM) implies control of the investor's assets on the financial platform. This function is carried out on the basis of an agreement (declaration) between the broker and the investor. It covers all the nuances of cooperation, starting from the goal pursued by the client in the market and ending with the list of acceptable risks. Thus, the investor knows in advance where his money is invested and what instruments will be used in his portfolio.

The BCS platform also offers a consultation service with financial experts. Qualified specialists will help the investor determine the optimal goals that he can achieve taking into account his financial condition. Thanks to consultation, you can predict the most expected risks and develop a strategy to overcome them.

Piths.

This is what mutual funds are called. This is the most understandable and open tool for investing in the stock market. Any user can get access to Pifa. Due to its effectiveness, this tool allows you to make a profit with minimal risks.

Mutual funds are an ideal option for inexperienced investors. Without having an impressive starting capital for trading, new users can, with the help of Pifs, gain access to all professional management tools. This will allow you to get comfortable in the stock market without major losses and form your own financial behavior tactics.

The mutual funds presented on the BCS resource are considered leaders in terms of profitability in the Russian Federation. Since 2000, BCS has controlled more than $19 billion in mutual fund assets. The resource has a large agent network throughout the country, numbering more than 50 branches.

The broker's platform has all the conditions so that clients can choose the right mutual funds. It is possible to consult a financial expert for free, who will help you choose the most suitable mutual funds. Also, the platform has a special calculator to calculate the results of the activities of mutual funds.

Webinars and seminars

Additional training is available on the trading platform. To do this, you can use specific filters in a search engine to find all the necessary webinars and seminars. You can study according to your own schedule.

Experienced traders introduce new users to all the nuances of financial trading, immersing them in the process as they go. This method of “live” learning will allow you to quickly master all the material and get rid of the fear of failure. Yes, most often, the main obstacle for beginners can be precisely the fear that they won’t succeed. The learning process on the BCS platform is structured in such a way as to psychologically “liberate” a person and push him to take active action.

Training through webinars and seminars is also useful for experienced users. Financial instruments are constantly changing and improving, which is why the balance of power in the market changes accordingly. Continuous training will allow traders to always stay up to date with the latest news. This makes it possible to promptly correct errors and change the strategy depending on market trends.

What is a structured product?

A structured product implies a portfolio that consists of two parts: profitable and protective. The income part means investing in securities, currencies and instruments operating within the derivatives market. The protective part is investing in deposits and bonds that can bring stable profits to the owner.

It is worth noting that the protective part takes up up to 80% of the entire structural portfolio, while the income part received only 20%. From here you can make the choice that structured products work to generate a stable income that will not depend on financial market conditions.

If the income part of the structural portfolio suffers a loss, the protective part will compensate for it. By creating such a portfolio, the investor himself sets the level of capital protection. BCS broker offers its investors 100% protection. A financial advisor on the platform will help you choose the most suitable structured products, the number of which on the portal has exceeded 30.

Information and analytical feed "Express".

All information about the stock market and the economic situation in general is collected here. The data is always accurate. Here you can get acquainted with the latest events that took place on the BCS site, with assessments and forecasts from leading experts. Information with a market overview and technical analysis is also available. In the Express feed you can get new investment ideas for yourself, or get advice from experienced market participants. Here is an overview of upcoming financial events in the global economy. You can always check out the dividend calendar for free for analysts.

Premier service.

The goal of every person who starts buying or selling in the financial market is to make a profit. To do this, you need to understand exactly which direction you need to move in order to maximize your potential. If the goal is set incorrectly, then the assets will be wasted, and the only thing the market participant will receive is disappointment and loss. The BKS Premier service makes it possible to avoid such a fate.

A personal assistant will help the user of this service solve any difficulties online. If there is a solution to a problem, then it can be overcome and you can take a more advantageous position. When working, BKR Broker clients can use structured products, investment funds or the management service. You can trade on your own.

Go to the official website of BCS-Broker

Why choose BCS?

Firstly, BCS is a proven Russian broker. Occupying a leading position for almost 25 years is in itself a very powerful argument in favor of the resource. In conditions of fierce competition, companies have to make truly Herculean efforts just to stay afloat. Let alone how much effort first place will require.

The BCS trading platform is already a household name within Moscow Burma. The broker's clients can literally keep a pulse on the financial heartbeat of the entire country. For trading, the official BCS website contains the most effective tools. Constant support and feedback allow clients to feel calm. The speed of processing requests received by the technical support service is simply amazing. The client can be sure that his problem will be solved by real professionals in the shortest possible time.

The resource uses only high-quality software for its work. Regular BCS users are not at risk of freezing. The official website works properly at any time of the day. The functionality of the site deserves special mention. It is designed in such a way that it is accessible and understandable to users of any experience. Everything you need is always at hand. It is easy for beginners to navigate, which allows them to feel confident.

The BCS trading platform is constantly striving to expand. The most important tool is to attract new users. Training is an important part of the activity for the resource. All conditions have been created for beginners so that they can eventually become full-fledged participants in the financial market. The beauty is that training from BKS costs nothing. Absolutely free, anyone can use a variety of educational content, which includes many different courses, seminars and other materials. In order to gain real experience, a beginner can start trading using a demo account, or with a very minimal investment.

Users can always get support from leading experts. For any question you can get a free consultation. The BCS platform pursues a policy of maximum transparency, so there are no hidden commissions on the resource. But there is a varied system of tariff plans. Thanks to a large selection of payment methods, replenishing your account or withdrawing funds is always easy and fast. In conclusion, we can say that the presence of a mobile version makes the BCS broker truly accessible and ubiquitous, because users can make a profit whenever, wherever.

Go to the official website of BCS-Broker

| Read useful sections of the site for successful trading: |

learn more about Forex trading and binary options trading on our websites!

How to replenish your account and withdraw money

You can deposit money into a brokerage account in different ways:

- Through operating cash desks, no commissions.

- From an account or from a BCS Bank card, no commissions.

- From a card of any bank, through SBP. Commission 0.6%, minimum 39 rubles.

- According to the account details that are in the application or in your personal account.

Money is credited almost instantly; in rare cases, replenishment takes 10-20 minutes. Finance is immediately available for the purchase of exchange-traded assets.

Along with a brokerage account, it is worth opening a bank account at BKS Bank. The BKS card is a regular debit card that can be used for payments in retail and service networks. Plastic is replenished without commissions at our own ATMs, as well as through VTB and Otkritie devices. The bank's services allow you to open a current account in rubles or foreign currency and transfer them to a brokerage balance without additional fees.

Tinkoff Black debit card

Apply online

Before withdrawing money from BCS, you need to figure out which account receives dividends, coupon payments and proceeds from the sale of assets. Typically, the default deposit is to a brokerage account. In the personal account of the web version, you can reconfigure the transfer to a bank card, however, this method is not available for all securities.

Transfer of funds from a brokerage account is carried out in your personal web account, in the “Products” - “Brokerage” - “Withdrawal of funds from a brokerage account” section. Finance can be credited to a BKS Bank card and withdrawn in cash from ATMs.

A little about BCS Investments

The brokerage was founded in 1995. Its headquarters is located in Novosibirsk, the number of employees exceeds 5 thousand people, and its assets amount to almost 256 billion rubles. Owner – Oleg Mikhasenko. The company provides users with information support, posts news on the website, and offers analytics.

After 25 years, BCS opened an office in Moscow and started online trading. He also:

- Modernized mobile application

- Updated tariffs

- Carried out a small rebranding

Such changes have made BCS services more accessible to newcomers.

We will not talk about opening a brokerage account. This operation is discussed in detail in this article.

How to open an account in BCS

Here we will show you how to top up your BCS account. The company provides customers with several options.

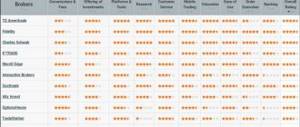

Advantages of BCS over competitors

Broker BCS is one of the largest on the Russian market, which means it is a reliable and experienced partner. The company provides a full range of financial services and provides high-quality technical support to clients.

Among the competitive advantages:

- Favorable commissions. Objectively, there are brokers with lower fees for non-depository rates, but the difference is not critical. Plus, BCS is a highly specialized company and working with investors is its main activity.

- Qualified information support. The BCS Express portal has online quotes for stocks, bonds and other useful news.

- Convenient application BCS "World of Investments". The ease of making transactions is an important plus for a broker; BCS software is recognized as one of the best.

- Quality service. Opening an account and becoming a BCS client is very simple, as is replenishing, withdrawing money, and moving it between your own accounts.

Customer reviews speak in favor of the BCS broker. In 2021, it is chosen by both beginners and experienced investors. The trend will not change in subsequent years, because there is no doubt about the reliability of the financial partner.

Review of feedback from investors in IIS BKS

Often the decisive argument in favor of making a particular decision on a particular service is the opinions of people who have already used it. The BCS individual investment account is no exception - reviews from investors who use or have used it provide valuable and, most importantly, objective information. Therefore, below are some of them taken from the website brokers-rating.ru.

Figure 2. Review of the BCS individual investment account.

Figure 3. Feedback from a BCS IIS investor – he was unable to open an online account correctly right away, but the managers corrected his mistake.

Figure 4. Feedback about the conditions of the IIS BKS.

Figure 5. Feedback about the tariffs of the IIS BCS broker.

Figure 6. Another review of the BKS IIS.

From them it is easy to draw a conclusion about the integrity of the broker and his attentive attitude towards clients - specialists try to solve any problems as soon as possible. But if you are still in doubt, you can visit the specified review site yourself and study other reviews about the BCS IIS, which will allow you to make an informed decision that you will not have to regret later.

Main functions of the system

The main functions of the BCS Online system are related to the provision of various tools for trading on stock and currency exchanges. You can also download software on the platform to control quotes and independently invest in various securities and speculate in currencies.

Each participant who registers a personal account automatically becomes a partner. In your account you can:

- Open and close accounts.

- Issue cards, including credit cards.

- Control the balance of your accounts.

- Exchange currency at a favorable rate.

- Make money transfers to any financial institution in the world.

- Pay for services from more than 2,300 companies without charging commissions, as well as make payments on taxes and fees.

- Find favorable conditions for deposits.

Three additional services are available on the BCS Online platform: BCS Express, BCS Premier and BCS Broker. Each of them has its own focus and functionality. Free and paid training through webinars, seminars, and also in individual format is available to all participants. You are given the opportunity to conduct your own analytics based on market reviews, investment ideas and other material.

Reference! The most analytical information is presented on the BCS Express .

The BCS Premier service provides an individual approach to each investor, which makes it possible to find the optimal solution in generating income from currency quotes and investments in shares. After registering a personal account on this resource, an advisor is assigned to each participant. He helps you navigate the financial instruments of the exchange and advises on all questions that arise. Here are several options for cooperation:

- structural products;

- investment funds;

- trust management;

- independent trade.

BCS Express includes analytics and investment tools and is of interest to those who are actively immersed in this topic. Here you can use:

- analytics from BCS experts;

- dividend calendar;

- read financial and stock news;

- learn more about technical analysis and investment ideas.

Attention! You can tell BCS analysts and if they think it is interesting, they will answer it .

BCS Broker provides access to trading on the world's leading platforms. Here a trader can enter into an agreement with a broker and trade by submitting orders.

Nuances of replenishing your BCS Investments account

In all options, deposits are instant. Sometimes you have to wait a quarter of an hour. The maximum period is one day, for a bank transfer – 72 hours.

The maximum amount for a one-time replenishment through the BCS application is 600 thousand with commission. The platform allows you to top up your account up to 1 million rubles per year.

Now you know how to replenish your account on the BCS trading platform.

We wish you profitable investments!

How to withdraw funds?

Clients have access to two channels for withdrawing funds: a bank account and a card from any bank. Withdrawals are made only in Russian rubles. The average processing time for withdrawal transactions is 3 business days. There are no restrictions on amounts. Applications are accepted around the clock. There is also no withdrawal fee.

When withdrawing to a bank account, the duration of the transaction depends on the conditions of the issuing credit institution. In some cases, transaction processing takes up to 5 business days. A third-party bank may charge a fee for withdrawing funds. You can minimize expenses by using BCS Bank cards and accounts.

Opening an account

Clients can open an individual investment account in two ways:

- on the website broker.ru;

- in the company's offices.

Remote execution of an agreement is possible if the investor is an existing client of the broker. To register an IIS, you need a passport and TIN or SNILS number.

However, in fact, upon application sent through the website, the new client only receives access to a personal account with limited functionality and a brokerage account. To open an IIS, you need to visit the nearest office and complete the paperwork offline.

Offers for new clients

When opening investment accounts, clients can take advantage of free services:

- "Stock Trainer";

The “Stock Trainer” option is assistance in forming an investment portfolio, obtaining initial knowledge on trading, and receiving personal advice on investing. “Trading strategies” – offering a ready-made solution for investing funds based on a given level of risk and starting amount.

Features of the personal account of the BCS Online Internet bank

The capabilities of a personal account from BCS Online allow traders to trade on world exchanges remotely from home or office and receive income from investments. In addition, specialist consultations, currency exchange at favorable rates and much more are available here. In order to get a complete picture of how a client’s personal profile works, we will consider in detail all its main capabilities.

Apply for a consultation

Many novice traders, after creating a personal account, try to select investment instruments in such a way that they have the least risk of losing money, but at the same time receive income. In this case, it is better to start with a consultation. Online or by phone, an experienced BCS employee will help you find your investment instrument and explain how it works.

In the top field of your personal account on the right, click on the headset sign and in the list that opens, follow the “Online consultant” link. Here you can also use Skype for video messages. If you want to submit a request and have a specialist call you, then select the “Contact information” link. On the page that opens, fill out the form in which you indicate your telephone number, describe the essence of the question and indicate the date and time of the call.

Customer support via account

In the personal account, the trader is provided with several options for customer support. Therefore, you can choose the most convenient method for yourself and use it at any time, since specialists work around the clock and even on holidays.

When you select an online consultation, a chat opens in which you can correspond with the manager. You can ask any questions regarding the operation of your personal account and the choice of investment instruments, as well as about tariffs and the transition between service packages.

If you select the “Contact Information” section (the transition method is shown in the previous section), then several options open here:

- Communication via Skype.

- Number of your personal advisor.

- Form for requesting a call back.

Online currency exchange

The capabilities of your personal account include services for exchanging world currencies at exchange prices. To do this, go to the “Payments and Transfers” section in the top menu bar. In the list that opens below, find the line “Currency exchange”. In the form, first select the debit and credit account. The current exchange rate will appear below. In the “Exchange Amount” line, enter the value of interest.

Attention! Conversion is carried out only by internal transfer across client accounts. At the exchange rate, exchange is available only on weekdays from 10 to 19 hours Moscow time. The rest of the time, conversion takes place at the BCS Online bank rate.

Additional features of your personal account

On the BCS Online website in your personal account, you can open a deposit by selecting the most advantageous offer in terms of conditions and terms. In the top menu on the left, select the “Products” section and on the page that opens, find the “Deposits” block.

Read the information and transfer the required amount of money to deposit. You can track capitalization and profitability through your personal account.

You can deposit money into deposits or accounts in different ways:

- at branches or at BCS cash desks and ATMs located in your locality;

- by online transfer from another financial institution, indicating the details of the crediting account;

- transfer from your brokerage account.

If you decide to use a type of strategy such as “Trust Management”, then you can deposit money into your account in two ways.

In the top menu, go to the “Products” section and in the list that opens, in the “Trust management” block, click on the “Add to strategy” link.

In the second option, you need to go to the “Payments and Transfers” section, where you select the “Transfer to the account of the BCS company” block and click on the link “Add to the remote control strategy”.

After that, in the form that opens, you need to select the debit account in the upper field, and indicate the transfer amount in the lower field. The contract number is selected from the list if there are several of them. At the end, be sure to indicate the name of the strategy so that the enrollment is completed correctly.

How to disable your personal account?

The question of disabling a personal account is usually asked by those users who no longer conduct financial transactions on this platform. Therefore, before this procedure, you should withdraw all your money from your accounts, close loans and other debts. You cannot deactivate your personal profile on the BCS Online website. To do this, you need to come with your passport to any nearest branch of the organization and write an application to close accounts and disable the personal account service.

What parameters to consider when choosing

Despite their apparent simplicity, bonds, like any other instrument, require careful selection and analysis.

Below I will briefly describe some criteria that you should be aware of when choosing a security:

- Price . The initial issue of a bond occurs at a nominal price of 1,000 rubles. By purchasing paper at face value, at the end of the term you will receive the same amount. But most investors make a purchase at the market price, i.e. the one that has formed by this moment in the market. It can be either lower or higher than face value. This is influenced by the key rate, which creates increased or decreased demand for a particular security. In addition, when buying a bond on the stock exchange, the investor will pay not only the market value, but also the coupon income that has accumulated at the time of purchase.

- Types of coupons . A coupon is the profit that an investor receives during the period of holding the security. It comes in several types: constant (when the amount of accrual is known in advance for the entire term of the bond), variable (depends on the key rate of the Central Bank and can change), floating (tied to a specific indicator) and fixed (also known for the entire period, but can change).

- Offer . The ability to sell a bond at par before maturity.

- Depreciation . This is a special regime for repaying a security, when the debt is repaid not all at once at the end of the term, but in parts during the life of the bond. At the same time, the coupon size will decrease, because... it is calculated from the face value. This option may be convenient when profits are planned to be reinvested.

- Profitability . It can be current (taking into account the market value and coupon), current modified (calculated on the basis of the “dirty” price, i.e. taking into account the accumulated coupon income), simple for redemption (includes profit from coupons and discounts, as well as the redemption price) , effective for redemption (takes into account the reinvestment of coupons). It is important to take into account that all sites and terminals show data on effective profitability, and not real one. In fact, the result is always a lower profit. If we also take into account that from 2021 a tax will be charged on coupons, this will further reduce bond yields.