Lazy Investor Blog > Need to Know

What do you think: can a typical resident of a country with an average income in dollars just above Africa own a home, drive a foreign car and vacation abroad? The answer is yes, if this country is Russia. Read about what secrets economic statistics hide, what purchasing power parity (PPP) is and in what cases it should be used to estimate GDP.

Start learning with my video.

Purchasing power parity theory

The theory of purchasing power parity was formulated by Gustav Cassel , as well as five other representatives of the Salamanca school:

- Domingo de Soto;

- Pedro de la Gasca;

- Martin de Azpilcueta Navarro;

- Thomas de Mercado;

- Domingo de Bañes.

According to this theory, the natural meaning of exchange rates is the value corresponding to purchasing power parity.

If the exchange rate of the currency of country A to the currency of country B exceeds the parity value, it becomes profitable to buy goods in country B and export them to country A. This increases:

- supply of goods in country A,

- demand for goods in country B,

- demand for the currency of country B,

- currency supply of country A,

which returns the exchange rates of both countries A and B to parity.

For example, if the unit price of a product in Russia is 27 rubles, and in the USA it is 1 dollar, then the dollar to ruble exchange rate should be 27 rubles per dollar, right? If the dollar to ruble exchange rate is 55 rubles per dollar, then buying this product in Russia (for 27 rubles), selling it in the USA (for 1 dollar) and exchanging this dollar for 55 rubles at the current exchange rate, on each such transaction you can receive an income of 28 rubles per unit of goods (55-27=28). Accordingly, prices for this product in the United States will decrease, the price of the product in Russia will rise, and the dollar/ruble exchange rate will decrease.

Absolute and relative PPP

Absolute PPP demonstrates the equilibrium of exchange rates with the same cost of the consumer basket in the two countries being compared. PPP theory suggests that if national baskets are unequal, the exchange rate will change under the influence of market forces.

Let's say we need to compare two countries (St1 is the cost of a basket in the first country, St2 is the cost of a similar basket in the second), with the exchange rate represented by the Exc parameter. As a result, we get the following dependence:

St1=St2*Exc

So, the rate according to PPP theory is equal to the ratio of the cost of a set of goods (services) in one country to the cost of similar goods (services) in another. If the baskets are not identical, this rule does not apply. How to calculate the “real” exchange rate if it is not possible to select identical baskets of goods? In this case, relative PPP is used.

Relative PPP is considered as a dynamic version of absolute PPP, taking into account inflation rates and movements in exchange rates over certain periods of time.

Let's say country A uses currency A, and country B uses B. The cost of a basket of goods (P) in country A is equal to PA, and the cost of the same basket of goods (Q) in country B is C*PA, where C is unchanged in time value. Otherwise, the cost of a basket of goods in country B can be expressed as the product C*P*SB, where S is the amount of country B's currency (variable) that must be spent to purchase one currency unit of country A. That is, S is the actual exchange rate.

If we assume that (1) and (2) correspond to different dates, we obtain the following relationship:

Based on this formula, we find the ratio of rates for different periods:

After some transformations we get the following:

In simple terms, to determine the rate of decline in the nominal exchange rate, you need to find the difference between the inflation rates in two countries. Since absolute parity is only possible at C=1, it is a special case of relative PPP.

Tricks of GDP by Purchasing Power Parity

As a result, over time, equilibrium will be achieved at a new (parity) level of prices and exchange rates (for example, a product has fallen in price to 0.7 dollars in the USA, risen in price to 35 rubles in Russia, and the dollar exchange rate is not 55 as before, but now already 50 rubles per dollar).

Since the functioning of the purchasing power parity model is possible only in conditions of free movement of goods and money, in practice exchange rates usually deviate significantly from parity (the greater the customs duties, export and import restrictions, transportation costs, the greater the discrepancy between the nominal exchange rate and the parity value is necessary so that changes in the volumes and structure of exports and imports are economically justified). In addition to this, you need to take into account that the demand for a particular currency on the exchange depends on many other factors.

Exchange rate of the ruble: contradictions

Official exchange rates in a free market are formed on the stock exchange due to the balance of supply and demand. A shift in this balance in one direction or another is possible with a change in the foreign trade balance. The excess of exports over imports contributes to the growth of the exchange rate, and the opposite is also true. This rule works well in a diversified economy with a priority on production. If the economy is a commodity economy, fluctuations in world prices and dependence on imports force the state to manipulate exchange rates. This helps balance the budget and reduce foreign trade risks. A classic example of such manipulation is the ruble/dollar exchange rate.

I also recommend reading:

Return on assets ROA: what does it tell the investor

How to Use Return on Assets ROA When Picking Stocks

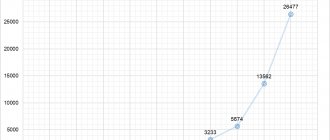

The graph shows that the official ruble to dollar exchange rate increased quite sharply in 2008 and 2014. It also changed according to the Big Mac index, but much more smoothly and over time. This indicates the artificiality of the official exchange rate and its separation from the real economy. This unnaturalness is even more clearly visible in the diagram of Russia’s GDP volume in 1991–2019.

The failure in 2015–2016 is clearly visible here: Russia experienced a collapse in GDP in nominal dollar terms. There was no mass shutdown of enterprises; it simply brought the amount of foreign exchange reserves and the money supply in circulation into line. Is it necessary to prove that this was the result of the printing press? The events had nothing to do with the real economy: the emission “plugging holes” in banks that fell under the so-called had an effect. reorganization in 2014–2016

There was no noticeable increase in retail prices for several reasons:

- “Counter-sanctions” against European suppliers blocked access to the Russian market for high-quality and expensive products;

- The high key rate of the Central Bank of the Russian Federation limited the operations of large importers;

- A number of foreign manufacturers have assembly facilities on Russian territory;

- Retail chains have reduced profit margins and began to practice sales more often.

Mainly exporters of raw materials benefited from the devaluation of the ruble. Due to tax and dividend revenues into the economy, the volume of money supply in circulation increased again, but not so significantly. In the graph below you can see a comparison of the official ruble exchange rate and its PPP rate, as well as their ratio.

The attentive reader must have already noticed that the ruble exchange rates for PPP and Big Mac are surprisingly close. The dynamics of the ruble exchange rate according to PPP follows the dynamics of the Central Bank exchange rate with some delay and a significant smoothing of the amplitude.

Examples of using PPP purchasing power parity in life

- Various international organizations (World Bank, Eurostat) publish economic indicators for different countries in a single currency (most often US dollars), using exchange rates calculated on the basis of purchasing power parity.

- A popular example of the use of purchasing power parity is the Big Mac Index, regularly calculated and published by the English weekly The Economist. The index is calculated based on Big Mac prices at McDonalds restaurants in various countries and represents an alternative exchange rate.

- Another lesser-known index, the iPod Index, is calculated by the Australian investment bank Commonwealth Securities based on the prices of Apple's popular MP3 player in different countries.

Word in the dictionary

What is parity? The definition of this word in the dictionary is given in two versions:

- The first of them is marked “bookish” and speaks of equality, mutual correspondence according to some parameter.

- The second is accompanied by the mark “financial and economic” and denotes the relationship that exists between exchange rates and currency units.

To better understand what “parity” means, examples of the use of this word will be given below.

Comparable price level

The price level in the US economy is taken as the base level, so for the US it is equal to 100%.

In the early 1990s in Russia, the discrepancy between the nominal exchange rate and the parity value was very large: the comparable price level in 1992 was only 7% (Russia was a very cheap country). But by 1996 the comparable price level had reached 43%.

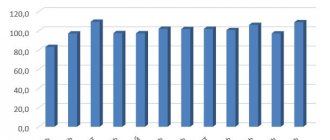

The correctness of calculations made on the basis of IMF data for some years (1996, 1999, 2002, 2005) is confirmed by international comparison data. This chart, starting in 2007, shows forecast values calculated based on IMF data.

Notes

- ↑ Purchasing Power Parity - Modern Economic Dictionary

- ↑ Cassel, G.

The Present Situation of the Foreign Exchanges. // The Economic Journal. - 1916. - T. 26, No. 101. - P. 62-65. - ↑ Cassel, G.

Abnormal Deviations in International Exchanges. // The Economic Journal. - 1918. - T. 28, No. 112. - P. 413-415. - ↑ Cassel, G.

The World's Monetary Problems. - London: London: Constable and Co., 1921. - ↑ Cassel, G.

The Restoration of the Gold Standard // Economica. - 1923. - No. 9. - P. 171-185. - ↑ Kadochnikov, Denis.

Gustav Cassel's purchasing power parity doctrine in the context of his views on international economic policy coordination (English) // European Journal of the History of Economic Thought: journal. - 2013. - T. 20, No. 6. - P. 1101-1121. - ↑ Kadochnikov, Denis.

International coordination of financial and economic policy: the scientific legacy of Gustav Cassel (Russian) // Questions of Economics: journal. - 2012. - No. 1. - P. 51-64. - ↑ Kadochnikov D.V.

Demand for money in structural models of the formation of exchange rates // Questions of Economics. - 2012. - No. 7. - P. 96-113. - ↑ Ksenia Kolkunova.

iPod

(undefined)

. Expert magazine (February 5, 2007). Access date: August 14, 2010. Archived August 26, 2011. - ↑ CIA - The World Factbook

- ↑ Report for Selected Countries and Subjects (unspecified)

. www.imf.org. Access date: January 17, 2021. - ↑ 123

imf.org - ↑ 12

Results of international comparisons of GDP of the Russian Federation based on data for 1996 - ↑ Results of international comparisons of GDP of the Russian Federation and other countries according to data for 1999

- ↑ About international comparisons of GDP for 2002

- ↑ About the results of the Global Round of International GDP Comparisons

Purchasing power parity

Today we are again returning to the study of such a macroeconomic indicator as gross domestic product (GDP). GDP is and what methods exist for calculating it. I hope that the previous information was useful to you, so let's talk about this topic again - in particular, I propose to consider how statistical services calculate GDP at purchasing power parity.

Last time I already wrote that statistical agencies calculate two types of GDP - nominal GDP and real GDP, while the gross domestic product of a country can be expressed in its national currency or converted into foreign currency at the exchange rate. But that’s not all - such a macroeconomic indicator as GDP at purchasing power parity, which allows for a more accurate comparison of the economies of the world, has gained wide popularity in the global financial market.

So, what is purchasing power parity (PPP)?

In scientific terms, purchasing power parity is the ratio between two currencies of different countries, which was calculated based on their purchasing power relative to a certain set of goods and services. Let me give you an example: if the same set of consumer goods and services costs 500 hryvnia in Ukraine, and 100 dollars in the USA, then purchasing power parity is 5 hryvnia per 1 dollar. This means that 5 hryvnia in Ukraine can buy the same amount as 1 dollar in the USA, or vice versa. It turns out that in its form PPP is similar to the exchange rate, because it shows how many units of one country's currency are needed in order to buy the same amount of goods and services that can be bought with a unit of another country's currency in that other country.

World GDP by Purchasing Power Parity – World Bank

At the same time, we must understand that purchasing power parity functions ideally only in conditions of free movement of goods, services and money, and as you understand, in modern conditions this is not realistic. At the same time, we should not forget that the market rate of a particular world currency is in most cases determined during exchange trading, and its final result is influenced by a huge array of various factors. It is because of this that most exchange rates deviate significantly from PPP. Therefore, you need to clearly understand that purchasing power parity is just a certain indicator used by international statistical organizations in their calculations, and the exchange rate is a real instrument of global macroeconomics.

Earlier, I already said that many reputable international organizations publish their statistical calculations on GDP , and even gave a list of countries with the maximum gross domestic product at the end of 2010. But at that time I took statistics on GDP that did not take into account purchasing power parity. Therefore, today I would like to provide statistics on the GDP of the largest countries in the world, which was calculated taking into account PPP. Once again, I will take the statistics that the World Bank kindly provided us with.

Russia's GDP by Purchasing Power Parity – World Bank

Ukraine's GDP by Purchasing Power Parity – World Bank

World GDP by purchasing power parity (TOP-10)

Data - World Bank (trillion dollars, 2010):

- USA - 14,582;

- China – 10,084;

- Japan - 4,332;

- India - 4,198;

- Germany – 3,071;

- Russia – 2.812;

- Great Britain - 2,231;

- France – 2,194;

- Brazil – 2,169;

- Italy – 1,908;

GDP of CIS countries by purchasing power parity (TOP-5)

Data - World Bank (trillion dollars, 2010):

- Russia – 2,812 (6th place in the world ranking);

- Ukraine – 0.305 (36);

- Kazakhstan – 0.196 (50);

- Belarus – 0.134 (53);

- Azerbaijan – 0.089 (65);

That's all for today, and next time we will look at such a macroeconomic indicator as GDP per capita. I hope that people who are interested in the world economy and the modern financial market will find it interesting.

PS To be continued!

Today, the main indicator of economic development of a country or region is gross domestic product (GDP). And one of the ways to calculate the gross world product is based on the use of coefficients for comparing the purchasing power of currencies, determined by the ratio of the prices of a set (basket) of identical goods from different countries.

Purchasing power parity is the amount of one currency, expressed in units of another currency, required to purchase the same good or service in the markets of both countries. For example, the cost of one loaf of bread in the USA is 1 dollar, and in Russia bread of the same quality costs 10 rubles. Consequently, the PPP of the dollar for bread will be equal to 10 rubles, and the PPP of the ruble for bread will be equal to 0.1 US dollars. In its form, purchasing power parity is similar to the exchange rate; it shows how many units of a given country's currency must be used to buy the same amount of goods and services.

In international comparisons they take:

— 600-800 basic consumer goods and services; — 200-300 basic investment goods; — 10-20 typical construction projects. Then they determine how much this set costs in the national currency of a particular country at the prices of that country and in US dollars at US prices.

In 2002, the purchasing power parity of the ruble was 9.27. This means that 100 dollars in the USA can buy approximately the same amount as 927 rubles. in Russia. According to some experts, in 2005

Both approaches are important, but each for its own purposes

Despite the more than two-fold undervaluation of the ruble at PPP relative to the official exchange rate, both approaches are equally important. Moreover, each of them has its own limited area of application. The Central Bank exchange rate is used in foreign trade; there can be no alternative to it. For the domestic market it is not just useless, but rather harmful. Here's a classic example of how this happens.

In the United States, energy costs for consumers (both corporate and private) account for approximately 2% of GDP. At the same time, in Russia they are close to 5% of GDP. If we calculate the cost of tariffs in PPP dollars, then in Russia they will be: for industry more than two times higher than in the United States, and for the population – 20% higher. At the same time, in dollars at the Central Bank exchange rate, tariffs for the population in Russia are 2 times lower than in the USA. This is mainly explained by subsidizing the population through high tariffs for corporate consumers. It is characteristic that Russian officials arbitrarily operate with both courses, depending on how it helps in the argument. A. Novak, referring to the official ruble exchange rate, has repeatedly stated the need to increase electricity tariffs for the population in order to facilitate payments for large companies. According to him, electricity in Russia for the population is the cheapest in the world, and this is wrong.

I also recommend reading:

Real interest rate as a measure of investment success

Real Interest Rate: How Much Your Investment Will Be Worth

On the other hand, the Russian leadership has recently increasingly used the concept of GDP in PPP terms, according to which Russia ranks quite honorably sixth in the world, right after Germany. Older readers probably still remember that in the early 2000s, the goal was to double nominal GDP in dollars. Today, according to this indicator, Russia is in 11th place. The question of doubling GDP has not been raised for a long time.

The graph shows that the dynamics of GDP at PPP (blue curve) is fundamentally different from GDP at par (dashed line). While the first indicator shows steady growth, the second does not inspire optimism. On the one hand, this is a consequence of a softer and delayed weakening of the ruble at PPP than at the Central Bank exchange rate. On the other hand, this means that the Russian financial system is moving further and further away from the real sector.

Attempts to launch a “quantitative easing” program did not lead to an acceleration of economic growth. Russia's GDP growth in PPP terms for the period 2008–2018 did not on average exceed 0.75% per year.

And for dessert, a curiosity illustrating the contradictory nature of the concept of nominal GDP. Thanks to the record strengthening of the Ukrainian hryvnia against the dollar (+16.2%), in 2021 nominal GDP growth amounted to approximately 20%. The growth in hryvnia, although not bad, is much more modest: a little more than 4%.

What is purchasing power parity?

this coefficient was equal to 14-15, that is, the market exchange rate of the dollar ($1 = 26 rubles) was almost twice as high.

Below is a graph of changes in the purchasing power parity of Russian rubles.

Based on the statistics of purchasing power parity and the ruble exchange rate, we see that the ruble is undervalued or the market rate of the dollar is overvalued. Thus, you should not directly link the dollar/ruble exchange rate with purchasing power parity, because There are a number of factors that influence exchange rates.

back to list of terms

— settlement rate in international payment turnover, based on currency parity.

See the meaning of Parity Course in other dictionaries

Course - M. French.

Etymology

The lexeme under study takes its origin from the Latin language, where there is a noun paritas, the meaning of which is “sameness”, “equality”. It is derived from the Latin adjective pār, meaning “same”, “equal”.

The latter goes back to the Proto-Indo-European basis par meaning "equal". According to linguists, the word “parity” came into the Russian language by borrowing from German, formed from the noun Parität.

1. Purchasing power parity (economic meaning, where used).

move, run, circle. ship, path, direction of travel. | Currency exchange rate, comparative value of various coins and their symbols. | science, teaching, treatment, full circle, revolution,…….. Dahl’s Explanatory Dictionary

Parity - parity, parity (book). On the basis of parity, equality, equal representation of the parties. Parity representation. On a parity basis (in equal shares). Ushakov's Explanatory Dictionary

Course M. - 1. Direction of movement, path, route (ship, plane, etc.). // transfer The main direction of political, social, etc. activities. 2. Line marked on navigation........ Efremova’s explanatory dictionary

Parity Adj. — 1. Correlative in meaning. with noun: parity associated with it. 2. Inherent to parity, characteristic of it. 3. Based on the principles of parity. Explanatory Dictionary by Efremova

Course - course, m. (from Latin cursus - run). 1. The direction of a ship, airplane, or airship on its way. go on course. (see lie down). Set course for Novaya Zemlya. head south. 2. transfer Direction,…….. Ushakov’s Explanatory Dictionary

Course - 1) Direction of movement or activity, path (for example, K. ship, K. foreign policy of the state). 2) Exchange K. - price, cut on a given day were quoted, sold........ Political dictionary

Course - -a; m. 1. Direction of movement, path (ship, plane, etc.). Change to. Follow the given course. Keep (take) to the north. 2. Direction,…….. Kuznetsov’s Explanatory Dictionary

Basic Course - See Basic Course Economic Dictionary

Bank rate is the rate at which the bank purchases or sells securities. Economic dictionary

Exchange Exchange Rate - the exchange rate established at exchange trading. Economic dictionary

Exchange Rate - the selling price of a security on the stock exchange. Economic dictionary

Stock Price Local - SPOTTEDThe term describes stock market prices when the prices of a few securities rise or fall while most prices remain unchanged. About…….. Economic Dictionary

Exchange Rate - - the ratio of the exchange of two monetary units or the price of the monetary unit of one country expressed in the monetary unit of another country Economic Dictionary

Exchange Rate - The ratio of the exchange of two currencies. Economic dictionary

Exchange Rate Multiple - See Exchange Rate Multiple Economic Dictionary

Currency Rate as of the Reporting Date (closing Rate) - Current exchange rate as of the reporting date. Economic dictionary

Bill Rate is the price of a foreign bill expressed in the currency of a given state. Economic dictionary

Flexible Exchange Rate is an exchange rate determined by market factors operating in the foreign exchange market. A flexible exchange rate is often called a floating exchange rate. Economic dictionary

Flexible Economic Course - a mode of action of a state, enterprise, firm, in which they abandon a rigid, pre-determined line of economic behavior in favor of “soft”...... Economic Dictionary

Dirty Float Exchange Rate - (dirty float) fluctuation in the exchange rate of a country, in which the state, although publicly denies interventions in the foreign exchange markets, actually secretly carries them out…….. Economic Dictionary

Exchange Rate Pressure is the influence of significant factors, such as central bank policy, on exchange rate fluctuations. Economic dictionary

Double Exchange Rate - See Double Exchange Rate Economic Dictionary

Double Rate is a method of state regulation of foreign exchange transactions, consisting in double quotation of the national currency rate: establishing different rates for financial........ Economic Dictionary

Unified Rate - the rate at which the purchase rate and the sale rate coincide when conducting trading with the establishment of fixing. Economic dictionary

Inflated Exchange Rate - an exchange rate established on the basis of the ratio of domestic and external prices for certain groups of goods with high export-import efficiency……… Economic Dictionary

Overvalued exchange rate is the exchange rate of a national currency at which its parity to other currencies is higher than the average price level in a given country in relation to the average level…….. Economic Dictionary

Final Course - See Final Course Economic Dictionary

Undervalued Exchange Rate - the exchange rate of a national currency at which its parity to other currencies is lower than the average price level in a given country in relation to the average level...... Economic Dictionary

Asking Rate is the initial price of a share announced by the seller when selling it. Economic dictionary

Inventory Rate - the rate at which currency, securities, gold are taken into account in the balance sheet. Economic dictionary

View Wikipedia article for Parity Course

We often hear words about this or that value or change in GDP in economic news. “The World Bank predicts a decline in Russia’s GDP by 3%” or “Russia’s GDP per capita at purchasing power parity decreased by $500.” What does this mean for ordinary people in simple terms?

GDP or gross domestic product is the value of all goods and services produced by a country. It is usually calculated per year. GDP can be expressed either in a country's national currency or, for comparison purposes, in US dollars. They add up everything: the cost of sold gasoline, cars, tour packages, etc.

For ease of understanding, in the future we will calculate the GDP indicator for the Ivanov family, consisting of 3 people - mother, father and child. For example, such a family earned 900 thousand in 2013, and in 2014 already 1 million rubles.

There are 3 types of GDP. The first of them is quite formal and is called nominal GDP.

Currency parity and its evolution: chronology of changes

Until 1978, states determined currency parity based on pegging currencies to gold. Then the countries that are members of the IMF began to use for calculations the international currency issued by the fund for payments between governments - the SDR.

A year later, the EMU consolidated and maintained currency parity, and its evolution ended in 1979. The European Union began to monitor the fulfillment of countries' obligations to maintain currency parity within the designated limits.

Today, currency parity is affected by the trade balance of states, the volume of funds, rising inflation, and regulatory intervention. If the national currency rate falls, it means that any factor or their combination is deteriorating.

Real GDP

Real GDP takes inflation into account. According to official data for 2014, it was 11.4%. For the Ivanov family, real GDP will be 11.1% 11.4 = -0.3%. That is, in reality, they began to live worse by 0.3%, even despite the increase in income.

Until now, we have compared ruble prices, but if we want to understand how the well-being of the Ivanov family has changed on a global scale, we will have to recalculate GDP in dollars. Let's get the so-called GDP per capita purchasing power, which is considered the most adequate value for assessing the level of wealth of citizens of a particular country.

Synonyms

Among them are the following:

- balance;

- correspondence;

- equivalence;

- correlation;

- ratio;

- equality;

- adequacy;

- community;

- equality;

- consensus;

- equivalence;

- parity;

- equilibrium;

- equi-armed;

- equivalence;

- analogy;

- similarity;

- equal size;

- equivalence;

- identity;

- similarity;

- identity.

Continuing to consider what parity is, it would be advisable to cite phraseological units that include this lexical unit.

GDP at purchasing power parity per capita

GDP per capita purchasing power parity simplified = the value of all goods and services produced by the inhabitants of a country, expressed in US dollars / the total number of those inhabitants. For the Ivanov family it will be:

- Purchasing power parity in 2013 = 900,000 / 32.7 = $27,523 (at the dollar exchange rate as of December 30, 2013);

- Purchasing power parity in 2014 = 1,000,000 / 56.4 = $17,730 (at the dollar exchange rate as of December 30, 2014).

As we can see, the Ivanovs’ GDP purchasing power in 2014 decreased by almost $10,000. In percentage terms, the change was 64%. At the same time, the GDP value at purchasing power parity per capita for this family of 3 people was $5910. A basket of goods may also be involved in calculating GDP according to PPP, but for the first acquaintance with the concept of purchasing power, the given simple mechanism is sufficient.

GDP is considered the most important indicator of the success of a country’s economy and the prosperity of its residents. It is clear that when it grows (real or GDP per capita), the country’s economy and its population are good.

A decrease in GDP means problems in the economy and a decrease in the well-being of citizens.

In 2013, Russia ranked 45th in GDP per capita at purchasing power parity with an indicator of $24,298 per capita (ranking of countries by GDP). Of course, it is higher than the formal GDP of the Ivanov family, because GDP also includes the price of sold oil, gas, weapons, technology and other things. GDP for a country is considered much more complex than in the example presented, but the explanation of the economic essence of gross domestic product in simple words looks exactly like this.

Oleg Kozhevnikov, Investor School.

ECONOMY

Example sentences

The following can be cited as such:

- As the German general Heinz Guderian wrote in his memoirs, in theory, the goal of the accelerated armament of Germany was to achieve parity with its heavily armed partners.

- In order to maintain arms parity, the Soviet Union required enormous expenditures during the Cold War.

- In a bipolar political world, the necessary balance was ensured with the existing power parity.

- To maintain parity between urban and rural areas, a more reliable mechanism is required.

- A parity of mutual trust was established between the cybernetic system and man. Which frees up the mind to interact most effectively.

To better understand what parity is, you should familiarize yourself with the origin of the word you are studying.