Opening an account with an American broker gives a number of undeniable advantages to Russian residents. Firstly, they will not be affected by the new requirements of the Central Bank, which from 2021 will introduce restrictions for non-professional investors and increase the threshold for investments through Russian brokers.

Secondly, neither Russian nor offshore brokers provide investors with any bankruptcy protection. American brokers have SIPC protection up to $500 thousand, plus additional insurance. In the case of Interactive Brokers, this is $30 million.

Thirdly, the American broker gives access to absolutely all stock exchange instruments. A passive investor will not need various options, exchange commodities and other complex instruments. But to form a full-fledged portfolio, you need access to all ETFs and stocks, including small-cap companies. By the way, you can also invest in the Russian stock market.

Interactive Brokers (IB)

Interactive Brokers is the largest American broker working with non-residents, including Russians, website and support in Russian. Here is a list of allowed countries. To open an account, you don’t need to go anywhere or send documents by mail; the form is filled out on the broker’s website in Russian. Among the documents you will need a TIN number, a scan of your Russian passport and a document confirming your registration - a bank statement or a housing and communal services account indicating your residential address.

Interactive Brokers (IB) is a $22 trillion market capitalization broker with a net worth of over $7 billion. It has been operating since 1977, shares are listed on the stock exchange (ticker IBKR). IB is recognized as the best online broker of 2021 and is a long-time leader in the “low-cost broker” category.

On the broker's website you can download a demo version of the Trader Workstation (TWS) trading platform. It allows you to familiarize yourself with the interface and features of conducting transactions before opening an account. In addition, you can open an account and explore all the features of the platform within three months. If the account has not been replenished within this period, Interactive Brokers will close it automatically.

Standards and Poor's rating: BBB+. For comparison, this is higher than Russia's sovereign credit rating (BBB-).

Interactive Brokers is an insurance company of the Securities Investor Protection Corporation (SIPC). In the event of a broker's bankruptcy, client shares are protected for up to $500,000, and cash in a brokerage account is protected for up to $250,000. Additionally, client accounts are insured by Lloyd's for up to $30 million. This insurance protects investors from the bankruptcy of a broker, but not from a fall in the market value of securities.

Starting from May 2021, the broker has abolished the minimum threshold for opening an account; previously it was $10,000. But the monthly commission for small amounts in the account will be higher: $20 per month for an account of less than $2,000 and $10 for an account of less than $100,000. There is no commission above this amount. charged. Read more about tariffs here.

You can only withdraw money from your IB account to your bank account. Without a decision from an international authority, funds are not available even to bailiffs. Only the account owner can change personal information by answering security questions.

Countries of registration of transactions with securities

Based on the country of registration, foreign brokers are divided into American and European. Another classification is “pure” foreign brokers (for example, Interactive Brokers) and “subsidiaries” of Russian brokers.

The main difference between American brokers and European ones is the amount of insurance. Brokerage accounts in the United States are insured up to $500 thousand, and European ones up to $20 thousand. Brokers must have membership in organizations - SIPC for the United States of America; in Europe, the organization depends on the state of registration.

In addition, American brokers are required to be members of FINRA, which controls companies operating in the financial sector, including securities companies. You can check your membership on the organization's official website.

User registration

At the initial stage, you need to enter your email address, username, password (with confirmation) that will be used to log into the system, as well as your country of residence. After entering, click on the “Save and Continue” button.

After this, an email will be sent to the specified email address to confirm the following email address:

By clicking on the “Verify Account” button, you will follow a link to continue the procedure.

Enter the username and password specified at the beginning.

List of exchanges

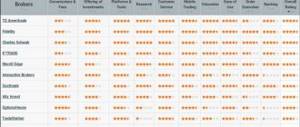

We recommend supporting the planned opening of a brokerage account with up-to-date information about brokers.

Let's consider the list of the most popular ones in Russia, their advantages and disadvantages.

Interactive Brokers

Among the advantages of this broker are:

- reliability due to belonging to the American economy - one of the strongest economies in the world;

- direct access to US stock exchanges;

- insurance of accounts up to 500 thousand dollars;

- Russian-language support;

- the ability to withdraw funds for free once a month.

Among the disadvantages:

- unstable political relations between Russia and the United States;

- commissions are higher than Cypriot ones;

- inability to make more than 3 day trades within 5 days when the account balance is less than $25 thousand;

- payment for inactivity.

Saxo Bank

Advantages:

- possibility of free withdrawal and deposit of money;

- insurance of accounts up to 20 thousand dollars;

- possibility of free account opening;

- Russian speaking support.

Flaws:

- commissions are higher than those of brokers in the USA;

- Inactivity fee: $100 for 180 days.

eToro

Advantages:

- small commissions;

- functionality and manufacturability of the platform;

- opening an account is simplified;

- insurance of accounts up to 20 thousand dollars.

Flaws:

- the exchange is not always available;

- economic insecurity of Cyprus;

- inactivity fee, $5 per month.

Just2trade

Advantages:

- Russian-language support;

- account insurance up to 20 thousand dollars;

- manufacturability and functionality of the platform.

Flaws:

- inactivity fee $5 per month;

- additional charges;

- paid withdrawal.

Choosing a foreign broker

Before opening a brokerage account abroad, you need to choose a reliable broker.

We recommend paying attention to:

- The amount of the minimum deposit.

- Russian-language support.

- List of exchanges and investment instruments available to the broker.

- The amount of the commission.

- Country of registration and insurance.

In general, it is impossible to unequivocally answer the question of which foreign brokerage account to choose, because everything is individual and depends on many factors, from the amount to knowledge of the English language. However, even if you choose the wrong broker, you can always change it without selling assets (you will still have to incur some costs).

Tools of the trade

One of the main ways to invest in a foreign economy is through ETFs (investment exchange-traded funds). The principle of operation is that, having purchased a certain volume of a diversified portfolio, it issues its own shares - thus you invest in several instruments simultaneously.

To explain more simply, let's use a simple analogy: let's say you want to eat an unusual, expensive dish. To buy the ingredients, you will have to spend a lot - in this case, it is much more profitable to try this dish in a restaurant. He collects an investment portfolio and sells a “piece”, which contains a share of all assets, to one investor.

Minimum amount to open an account in a foreign bank

To open a brokerage account in a foreign bank, a foreigner needs to have significant funds:

- The minimum deposit amount in banks in Europe and the United States is from 50 to 300 thousand euros. In offshore banks and Baltic banks the minimum amount is 100-200 euros.

- Chinese banks have democratic conditions - you need to deposit funds into an account in the amount of 200 rubles.

- The minimum account deposit at Interactive Brokers for people under 25 years of age is $10,000, and for people over 25 years of age the entry limit is $3,000.

- The minimum deposit in Saxo Bank is 10 thousand dollars, in Cap Trader - 4 thousand dollars or euros.

- In eToro only 50 dollars, in the American Just2Trade 2.5 thousand dollars, in the Russian subsidiary Just2Trade 10 thousand rubles.

Tariffs and terms of service

Interactive Brokers doesn't have complicated fees or confusing terms of service. Let's look at how to fund your account, how to withdraw money from it, how to trade securities and what commissions you will have to pay.

Complete information about current strategies that have already brought millions of passive income to investors

Transfer and withdrawal of money from the account

Regardless of which currency you chose as the base one when filling out the form, you can transfer money to your account in any currency. Some banks allow you to transfer rubles for free or with a minimal commission (for example, Tinkoff Bank, Avangard) to a brokerage account. Only then can they be converted into dollars through IB on the stock exchange at the current rate.

To make a transfer, you need to create a notification for replenishing your account:

- In your personal account, go to the “Payments and Transfers” – “Transfer of Funds” tabs.

- Select the currency and “Bank wire transfer”. The experience of many Russian clients shows that it is more economical to transfer money in rubles. For a transaction in dollars or euros, you will have to pay a commission of $15 per transaction (the amount depends on the paying bank).

- We enter information about the transfer of money: the sending bank, the account number from which the transfer will be made, the name of the bank and the planned transfer amount. It is better to save the created template so as not to enter it again each time.

- Next, the details that are needed to fill out an order to transfer funds to Interactive Brokers appear.

- In your bank’s personal account, select the tab with transfers to legal entities and carefully fill out the required fields with the information received from the broker. If everything is done correctly, the money will arrive in your account in 2-3 days.

A few recommendations: make the first payment for a small amount, save the transfer template in your bank’s personal account and always contact the support service in case of questions or problems with replenishing your account (Russian-speaking support).

For all subsequent transfers of money to a brokerage account, you will need to notify the broker about this operation in advance or immediately after transferring funds. The created templates will significantly reduce the time it takes to fill out the form; all you have to do is enter the amount and click the submit button.

Withdrawal of funds is carried out in the tabs “Payments and transfers” – “Transfer of funds” – “Withdrawal of funds”. You need to select a currency and connect the bank where the money will go. Next, fill out the form with the details, which is saved as a template. IB allows you to withdraw funds once a month for free. Then the commission will be 330 rubles. when transferring in rubles and 10 $ when transferring in dollars.

Purchase and sale of securities

To start trading you need software. IB offers:

- Client portal. It is actively used by beginners. This is a client’s personal account, where there are all the necessary operations: trading, notifications, tools, etc. Viewing, trading and account management are in one place.

- TWS terminal for a personal computer. An analogue of QUIK, popular among Russian investors. The interface is in English, so it takes time to understand the peculiarities of making transactions. There is a demo version where you can practice before opening a brokerage account.

- IBKR TWS terminal for mobile phones on iOS and Android. An analogue of the TWS terminal for PC, only for those who are used to trading from their smartphone.

- IBot is a chat bot that is built into any of the programs listed above. It accepts voice and text commands, for example to buy securities.

- The IBKR API is a platform for professional traders that allows them to create their own trading application.

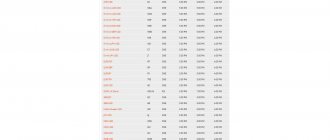

The investor must choose one of two tariff plans.

- Fixed

The commission per share, minimum and maximum rates per transaction are established. For example, for US stocks the rates will be:

Examples:

- Bought 100 shares at a price of $25 per share. The commission would be: 100 * 0.005 = $0.5. But there is a minimum amount of $1. Therefore, commission = $1.

- Bought 1,000 shares at $25 per share. Commission = 1,000 * 0.005 = $5.

- Bought 1,000 shares at $0.25 per share. The commission would be: 1,000 * 0.005 = $5. But there is a maximum amount: no more than 1% of the transaction value. Commission = 1,000 * 0.25 * 0.01 = $2.5.

- Multi-level

Includes brokerage commission, which depends on the volume of trades, exchange, regulatory and clearing fees.

In addition to the listed commissions, the investor pays:

- Account servicing fee (often called “inaction fee”). The size depends on the amount of capital. If less than $2,000, then $20 per month, from $2,000 to $100,000 – $10 per month, over $100,000 – $0. If the investor is under 25 years old, the commission is $3. The commission is reduced by the amount you pay for the transaction.

- Data subscription. For example, for online quotes. They are shown for free with a 15-minute delay. There are paid and free plans for news and analytics.

There is no minimum deposit at Interactive Brokers, so it is logical to advise opening and investing from any accumulated amount. But the minimum account maintenance fee of $120 per year makes this process ineffective for small amounts. Imagine you only have $5,000 in capital. For the year you will pay the broker 2.4%. It's too much.

The best brokers abroad

Schemes of work

It is important to avoid confusion in the definition of bank and brokerage accounts.

- If you open a bank account, you contact a financial institution to store investments or conduct settlement transactions with them.

- If you open a brokerage account, you are provided with an account in order to carry out trading operations on the stock exchange. The account status reflects information about assets and allows you to manage the account balance as and when you wish.

Foreign subsidiaries of Russian brokers. Most of them are registered in Cyprus. The advantages include Russian-language support and a lower commission than other foreign brokers. However, the Republic of Cyprus, whose Central Bank regulates the activities of these companies, is unreliable from an economic point of view.

In addition, brokers' subsidiaries act as sub-brokers, purchasing securities with the help of other brokers. It follows from this that in the event of bankruptcy or fraud of a broker, insurance payments are received not by the investor, but by the sub-broker, and he is also responsible for distributing the received funds to brokerage accounts. For the investor in this case there is a high risk of losing the invested funds.

Why do you need account insurance abroad?

Brokerage accounts abroad are usually insured against bankruptcy or fraud of the broker. Before you finally choose a broker, you need to find out who provides insurance, who controls the financial companies and financial markets of the state where you plan to open a foreign brokerage account.

Find out in advance how you can contact these organizations, what documents need to be submitted and what actions need to be taken to return the assets. This will help you not to panic and make mistakes in case of bankruptcy or broker fraud.

It is important to study this issue very carefully; there are many important nuances here. For example, companies owned in Cyprus are often sub-brokers, that is, intermediaries between investors and the broker.

In this case, for example, US laws protecting investor rights will apply only to subbrokers. If the broker goes bankrupt, then it is he, not the investor, who will receive the insurance, and he will decide how to distribute this money among the subbroker's clients.

Sending copies of supporting documents

At the final step, you need to send electronic copies of:

- document confirming identity and date of birth

- a document confirming the residential address indicated in the application

Documents can be sent either at the last step of the application (you can return to the page during the registration procedure by clicking on the link in the e-mail confirmation letter), or as attachments to a letter sent to

The following documents can be accepted as proof of identity and date of birth: passport, state identification card (ID), driver's license.

The following documents may be accepted as proof of residential address: a bank statement, a brokerage report, a real estate lease agreement, an invoice for the property owner or tenant for an insurance policy, an invoice for a security system, letters from government agencies, and a utility bill.

Handwritten documents will not be accepted. The following file formats are accepted: GIF, JPEG, JPG, JPE, TIF, TIFF, PNG, BMP, PDF, DOC, RTF.

(For more detailed information on the required parameters of supporting documents, you can download the relevant documents from the attached materials)

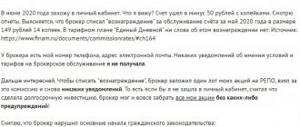

Brokerage commission of a brokerage account

Before you open a foreign brokerage account and start investing on the stock exchange, you need to carefully study the information about the commission on the broker’s official website. Very often, various fees, such as inactivity fees, are written down in small print at the bottom corner of the page.

In addition, brokers, some more often than others, periodically change the size of the commission. This means that even after opening a brokerage account, you must monitor changes in commissions.

There is also absolutely no need to pay for some additional services, such as up-to-date information on market data, since this information can be found for free.

Often foreign brokers charge a commission for transfers to another country, and the investor, regardless of the amount of funds he withdraws, is forced to pay up to $50. And yet, some brokers allow you to withdraw money without commission during a certain period (for example, once a month).

Types of brokerage accounts

When filling out the form, you will be asked to select the type of brokerage account. By default, you are prompted to fill out an application to open a private, joint, or IRA account. Private is suitable for most investors. If you are in doubt about your choice, you can read about the account structure on the broker’s website.

A private account has options:

- Spot. You can only trade with your own money. Proceeds from the purchase and sale of securities will be received by the investor in accordance with the trading mode (for example, in the “T+2” mode, the money will arrive only 2 days after the transaction is completed). There are no minimum capital requirements; the investor must be at least 18 years old.

- Marginal (or margin, as the Russian version of the IB website writes). Gives you the opportunity to trade on credit, borrowing money from a broker. There are restrictions on the account: age from 21 years and minimum capital from $25,000.

Currency banking control

When carefully approaching the question of how to open a brokerage account abroad, study the relevant legislation of the Russian Federation. In the legislative field of our country, there are differences between a brokerage account opened in a foreign bank that provides brokerage services, and a brokerage account opened with a foreign broker.

The first, that is, a brokerage account that was opened with a bank, is regulated by Article 12 of the Federal Law of the Russian Federation “On Currency Regulation and Currency Control,” and the second, that is, an account that is opened with a broker, is not regulated.

That is, when transferring money to a foreign brokerage account, explain to the bank employee that you are making a transfer to a brokerage account, and not to a bank account. We recommend preparing documents in advance that confirm the opening of this account.

An important point: to determine whether an organization is a bank, be guided by the first article of the Federal Law of the Russian Federation “On Banks and Banking Activities”, according to which the status of a bank must be recognized by the laws of the country where the bank operates.

The same 12th article of the Federal Law of the Russian Federation “On Currency Regulation and Currency Control” allows residents of the Russian Federation to open unlimited accounts in foreign banks. The latter are required to notify the tax authorities that they are opening, closing, or changing the details of these accounts.

personal information

In the “Personal Information” section we indicate your full name, date of birth, gender, marital status and number of dependents.

In the “Addresses” section, we recommend entering the address according to the registration indicated in the passport. If you were born outside of Russia, you will need to be informed about this.

In the “Contact Information” we indicate your phone number.

We recommend using your passport as proof of identity, but other options are also possible.

In the “Taxation Country” section, indicate the state in which you pay taxes and the TIN number.

We fill in the fields in the “Work Activity” section according to the nature and location of your employment.

In the “Account Information” section, select the account type “Cash”.

In the “Secret Questions” section you can choose the ones that are most interesting to you, in case of problems with access to your personal account.

Communication with a broker

One of the main concerns that hinders the opening of a brokerage account abroad is the language barrier, due to which the investor will not understand the foreign interface of the broker.

There are several options to make this process easier:

- With support in Russian. Certain foreign brokers have specialists who speak different languages.

- Communication via email or chat on the website. In this case, you can use an online translator.

Confirmation of tax information

It is necessary to check the specified foreign status of the beneficiary for the US tax authorities, identification data and indicate the country where you reside.

Confirm the above information by checking the box next to the word “Yes” under the paragraph confirming the data and informing about the penalty of perjury.

We recommend checking the box next to the word “Yes” under the paragraph asking you to agree to the collection and distribution of tax forms electronically.

After this, certify that all of the above information is correct with an electronic signature and click on the “Agree” button.

Platform (Russified trading platform)

Many foreign brokers translate their official website into different languages, including Russian, but most often they use regular machine translation.

To make it convenient for Russian-speaking users to carry out transactions, brokers are Russifying the foreign “Personal Account” and trading platform. In this case, the user himself chooses the instruments for investment.

We recommend that you use demo versions of brokerage platforms: they are completely identical to real platforms. Demo versions allow you to conduct virtual training before starting work, get acquainted with the interface, and study the system for making transactions.

Brokerage services are provided by PJSC Sberbank (Bank), general license of the Bank of Russia for banking operations No. 1481 dated August 11, 2015, license for the provision of brokerage services No. 045-02894-100000 dated November 27, 2000.

You can obtain detailed information about the Bank's brokerage services by calling 8-800-555-55-50, on the website www.sberbank.ru/broker or at Bank branches. This website also contains the current conditions for the provision of brokerage and other services. Changes in conditions are made by the Bank unilaterally.

The content of this document is provided for informational purposes only and does not constitute an advertisement of any financial instruments, products, services or an offer, obligation, recommendation, or inducement to engage in transactions on the financial market. Despite receiving information, you independently make all investment decisions and ensure that such decisions comply with your investment profile in general and in particular with your personal ideas about the expected profitability from operations with financial instruments, the period of time for which such profitability is determined, as well as the acceptable You are at risk of losses from such transactions. The Bank does not guarantee income from the operations with financial instruments specified in this section and is not responsible for the results of your investment decisions made on the basis of the information provided by the Bank. No financial instruments, products or services mentioned herein are offered or sold in any jurisdiction where such activity would be contrary to securities laws or other local laws and regulations or would subject the Bank to compliance with registration in such jurisdiction. In particular, we would like to inform you that a number of states (in particular, the United States and the European Union) have introduced a sanctions regime that prohibits residents of the relevant states from acquiring (assisting in the acquisition) of debt instruments issued by the Bank. The Bank invites you to ensure that you are eligible to invest in the financial instruments, products or services mentioned herein. Therefore, the Bank cannot be held liable in any way if you violate any prohibitions applicable to you in any jurisdiction.

Information about financial instruments and transactions with them, which may be contained on this website and in the information posted on it, is prepared and provided impersonally for a certain category or for all clients, potential clients and counterparties of the Bank not on the basis of an investment consulting agreement and not based on the investment profile of site visitors. Thus, such information represents information that is universal for all interested parties, including publicly available information about the ability to carry out transactions with financial instruments. This information may not correspond to the investment profile of a particular site visitor, may not take into account his personal preferences and expectations for the level of risk and/or return and, thus, does not constitute an individual investment recommendation to him personally. The Bank reserves the right to provide website visitors with individual investment recommendations solely on the basis of an investment consulting agreement, solely after determining the investment profile and in accordance with it. The terms of use of information when carrying out activities on the securities market can be found here.

The Bank cannot guarantee that the financial instruments, products and services described therein are suitable for persons who have read such materials. The Bank recommends that you do not rely solely on the information you have been provided with in this material, but rather make your own assessment of the relevant risks and, if necessary, engage independent experts. The Bank is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.

The Bank makes reasonable efforts to obtain information from sources it believes to be reliable. However, the Bank makes no representation that the information or estimates contained in this information material are true, accurate or complete. Any information provided in this document is subject to change at any time without notice. Any information and estimates contained herein do not constitute terms of any transaction, including any potential transaction.

Financial instruments and investment activities involve high risks. This document does not contain a description of such risks, information about the costs that may be required in connection with the conclusion and termination of transactions related to financial instruments, products and services, as well as in connection with the performance of obligations under the relevant agreements. The value of shares, bonds, investment shares and other financial instruments may decrease or increase. Past investment performance does not determine future returns. Before entering into any transaction in a financial instrument, you must ensure that you fully understand all the terms of the financial instrument, the terms of the transaction in such instrument, and the legal, tax, financial and other risks associated with the transaction, including your willingness to bear significant losses.

The bank and/or the state does not guarantee the profitability of investments, investment activities or financial instruments. Before making an investment, you must carefully read the conditions and/or documents that govern the procedure for its implementation. Before purchasing financial instruments, you must carefully read the terms and conditions of their circulation.

The Bank draws the attention of Investors who are individuals to the fact that funds transferred to the Bank as part of brokerage services are not subject to the Federal Law of December 23, 2003. No. 177-FZ “On insurance of deposits of individuals in banks of the Russian Federation.

The Bank hereby informs you of the possible existence of a conflict of interest when offering the financial instruments discussed in the information materials. A conflict of interest arises in the following cases: (i) the Bank is the issuer of one or more financial instruments in question (the recipient of the benefit from the distribution of financial instruments) and a member of the Bank’s group of persons (hereinafter referred to as the group member) simultaneously provides brokerage services and/or (ii) a group member represents the interests of several persons simultaneously when providing them with brokerage or other services and/or (iii) a group member has his own interest in performing transactions with a financial instrument and simultaneously provides brokerage services and/or (iv) a group member acts in the interests of third parties or interests another group member, maintains prices, demand, supply and (or) trading volume in securities and other financial instruments, including acting as a market maker. Moreover, group members may have and will continue to have contractual relationships for the provision of brokerage, custody and other professional services with persons other than investors, and (i) group members may receive information of interest to investors and participants the groups have no obligation to investors to disclose such information or use it in fulfilling their obligations; (ii) the conditions for the provision of services and the amount of remuneration of group members for the provision of such services to third parties may differ from the conditions and amount of remuneration provided for investors. When resolving emerging conflicts of interest, the Bank is guided by the interests of its clients. More detailed information about the measures taken by the Bank regarding conflicts of interest can be found in the Bank’s Conflict of Interest Management Policy, posted on the Bank’s official website: (https://www.sberbank.com/ru/compliance/ukipk)

Filing a tax return

We list the main rules for declaring income when making transactions through an account with a foreign broker

- The declaration should be submitted based on the results of the year in which the income was received in a foreign brokerage account, even if this money was not withdrawn from the account to the Russian Federation.

- All income and expenses received must be recalculated in rubles. Keep in mind that while having losses in foreign currency, an investor can make a profit in rubles, and taxes will still need to be paid.

- The declaration must be completed if income was received. Assets purchased but not sold are not reported and are not subject to taxes.

- If an investor opens accounts with several different brokers, he still submits one return.