Why is it necessary to issue bonds?

The main reason why organizations issue bonds is the lack of funds in circulation and the need for a loan to implement any projects. This can be very relevant for small and medium-sized businesses wishing to expand through commercial and legal changes. That is, in essence, the issue of bonds and their subsequent sale is a lending procedure.

Bonds issued by an LLC can be:

- Registered in documentary or non-documentary form.

- Secured are securities for which collateral is provided by the company or bank itself, as well as unsecured, i.e., those with increased risks due to the lack of property collateral.

- Convertible and non-convertible, i.e. with or without the possibility of investing them in shares.

Personal experience

On the recommendation of the organizer, we registered a program for 15 years for 10 billion rubles. The most difficult was the first issue, since it involved registering the program, and we did not have such experience.

About nine months passed from the moment I met the organizer to the moment of the first release - this is normal in a situation where the business is young and some of the documents needed to be put in order, as well as materials for the Roadshow to be prepared and the necessary registration steps to be carried out.

The issue took place in September 2021 for 300 million rubles, and we placed it in full, which indicates a well-conducted preliminary Roadshow. Currently, bonds occupy about 30% of the company's liability structure.

Basic Release Rules

It is important to understand whether an LLC can issue bonds. The entity issuing bonds can be a state or an organization. If we are talking about non-profit structures, then they are granted such a right only if they have security under state legal acts. An LLC also has such a right according to Art. 31 Federal Law No. 14 (dated 02/08/1998). Companies as issuers are subject to the rules set out in Federal Law No. 39 on the securities market.

If an LLC issues bonds, then the following conditions must be met:

- The issue is allowed only after full payment of the authorized capital.

- For each security, its par value must be determined.

- The total nominal value of all tranches in circulation cannot exceed the size of the authorized capital of the LLC.

- If the company’s own security of securities is not enough, then third parties can provide it.

- Subject to insufficient own security and the absence of such from other parties, bonds are allowed to be issued, but not earlier than 3 years after registration of the LLC in the Unified State Register of Legal Entities and only if there are no claims against the organization from the controlling tax authorities.

Regardless of the person issuing the bond, the main rules of procedure must be followed

Market risk

Both corporate and government bonds are susceptible to it. It is related to the dynamics of interest rates. If the Central Bank increases the rate, then the yield of securities and their value decrease. And in reverse order.

How market risk is realized

For example, an investor purchases OFZ at an interest rate of 10% per annum. After some time, the Central Bank raises the interest rate to 15% due to the crisis in the economy.

The benefit on bank deposits increases to 15%, but on bonds remains the same. Holding these papers becomes impractical. And in order to sell them, issuers have to reduce the cost.

Main stages

There are no standards that would determine the order of steps for issuing bonds from an LLC. Therefore, the general step-by-step order may be slightly shifted and is more advisory in nature, so that the interested person does not get confused in the sequence of actions.

The preparatory stage is associated with the mandatory payment of the authorized capital in full. The reason lies in the state's need to have security guarantees for securities.

The next step is to bring up the issue of release for discussion. In an LLC, decisions are made by a simple majority of votes of the general meeting of participants (more than 50% is required). True, if the company’s Articles of Association stipulate other conditions, then they will have to be adhered to. The solution contains the following information:

- Estimated number of securities in the issue and par value.

- Issue period and redemption procedure.

- Method of sale.

- Estimated cost of placement. So, for an open subscription you will have to pay a state fee. Its size is established in the Tax Code of the Russian Federation (Article 333.33) and is calculated based on 0.2% of the total face value.

Within six months, the intention to release must be confirmed by drawing up a written decision on release. The document should set out all the conditions relating to the future issue. To do this, a prospectus is drawn up for it, which must contain the following information:

- Description of the essence of the LLC’s commercial activities.

- Basic details of the enterprise (address, contact details, etc.).

- Presentation of a business plan. That is, the purpose for which borrowed funds are needed.

- Examples of financial statements must be provided. Moreover, they should concern the part that requires financial injections through the sale of securities.

- It is necessary to focus attention on possible economic risks (there is no need to hide them, anyway, experts will figure them out). This may be low liquidity of the services provided by the company, serious competition in the market, etc.

Then you should conclude an agreement with the depositary for the provision of services for the storage and placement of securities.

The process of issuing bonds has its own stages

Information about the issue

The next stage is registration with the Securities Department. This body is vested with the authority to issue a permit or refusal (necessarily motivated). The decision is made within one month.

Then a request is made to the Ministry of Finance to obtain consent to produce bond forms. It is necessary if they are intended to be issued in documentary form, since each paper falls under the category of strict reporting forms. If the issue is undocumented, then permission from the Ministry is not required.

The next stage is the publication of information about the future issue. The number of media sources is not limited. As practice shows, the more there are, the higher the percentage of securities sold in the future. A prerequisite is at least one publication in a printed publication whose circulation exceeds 10 thousand copies.

The main purpose of the issue is to sell bonds to obtain a loan. This will be the next stage. Papers must be released onto the market within one year after receiving permission.

No later than one month, the issuer should submit a detailed report on completed transactions for the purchase and sale of its bonds to the Department.

If the yield from the sale of a bond issue is at a high level, then a subsequent issue of a new group of securities is possible. In this case, all stages associated with the release must be carried out in a new way.

Accounting requires special attention when issuing bonds from an LLC. Thus, all expenses incurred as a result of coupon payments, and as costs associated with placement, should be attributed to payments on obligations.

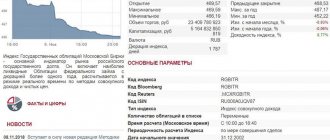

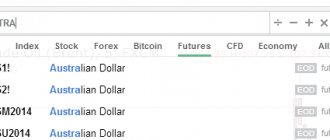

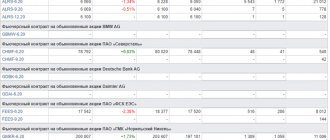

Quote on MICEX

As mentioned above, all bonds in Russia (federal, corporate, euro) are traded on the Moscow Exchange. Bond quotes on the MICEX can be seen in two ways:

- personal presence;

- on the website in the “trading progress” section.

To access all information, you will need to register or have a valid agreement with the broker. Only in the case of a contract (or if you take part in the auction) can you see real data. In other cases, information is posted on the website with a 15-minute delay (this is mandatory for any exchange platform).

All information on the market value of bonds is presented in the form of a table. You can view both the full version and the “short view”. At the bottom of the table you can download data in various formats (xml, csv, dbf).

The site has an additional tool for detailed analysis.

Issue registration

Special requirements apply not only to the issue of bonds. It is necessary to strictly follow the procedure for registering papers. You can't ignore it. This function is assigned to the Department.

You should be aware that you will need to pay a state fee for registering a prospectus. The calculation must be made in rubles, but it is correlated with the dollar exchange rate. On average, you need to pay about 400 dollars (approximately 26 thousand 250 rubles at the end of 2021 beginning of 2019).

At the final stage, the bonds must be registered and then will be released to the market

The Department’s responsibilities also include certification of information about the issue, which should be sent to specialized media.

After submitting an application for registration, Department employees are required to provide a response within 15 days. If it is necessary to collect additional information from other structures, the period can be extended to 1 month.

Three pillars of initial placement

Step 1. Indicate the period and volume

A bond program can be registered on the stock exchange for a large amount at once, so it is important to determine its duration and volume at the initial stage.

The most common scenario is to register a program worth tens of billions of rubles for a comfortable period of 10 to 20 years and, within the framework of the program, make issues in the volume that the business needs at the moment, and if you really want to, you can enter the market within 2-3 weeks.

Step 2. Set the denomination

In the case of an initial placement, it is better to set a small nominal value of the securities - for example, one thousand rubles. This will make the tool available to all kinds of investors - from private ones with a minimum check to institutional ones (large credit and financial companies that act as intermediaries).

When placing for the first time, it is very important to interest the maximum number of investors, and the minimum denomination will allow this to be done.

Step 3. Determine the regularity of coupon and debt payments

Payment of coupon (interest income) can be made monthly, quarterly and semi-annually, which is very convenient, since each business has its own specifics and the ability to plan cash flow is a big advantage.

As for the principal, it can be paid either during the life of the bonds (usually during the coupon payment period) or at the end of the issue period.

Credit rating

Not mandatory, but an important point is to obtain a credit rating of the issuer. There are many rating agencies, the Russian ones are Expert RA and ACRA - their rating will be enough for the first placement.

The agency will request a list of financial and legal documents from the company, and will also conduct interviews with owners and top managers. The rating period is from two to three months.

This is a simple procedure that will confirm the reliability of the company and give additional confidence to investors.

Let's sum it up

What are the advantages of the BCS SME High Yield Bond fund?

- Strategy. I won’t say that it is better than others, it is different and gives the investor the right to choose: take low-yielding (but more reliable) securities, or take a risk and try to increase profitability through VDO.

- Tax benefits. The Fund does not pay taxes on coupons. Therefore, all profits are reinvested without loss. Let me remind you who forgot: starting from 2021, coupon income on bonds is subject to a 13% tax. Plus the ability to buy on IIS and apply LDV (this point applies to all similar exchange-traded funds).

- Low cost of 1 share of the fund (trading starts from 10 rubles) - for little money we add 30 bonds to the portfolio. Although when trading through some brokers, the minimum price per share will not be very good (minus penny funds).

Disadvantages of BCSB mutual fund:

Commission, commission and more commissions. In an environment of already low rates (and bond yields), a management fee of a few percent looks like a mockery of investors. Although maybe the guys from BCS are testing the waters. They are looking to see how many idiot investors will be interested in their product.

There has been a trend recently. At first, Otkritie Management Company with its All-Weather OPNW charged 3.8% of commissions - now it’s a little more than a percent. Then the Dividend Aristocrats fund FMUS from Finam Management Company with its phenomenal commission of 6.25%. Which, by the way, literally a couple of days after the fund went public on the stock exchange, was reduced by almost 6 times.

We are expecting a similar step from BCS.