Options on futures contracts allow you to effectively hedge (insure) risks in the derivatives and spot markets, carry out transactions with high profitability, low costs and moderate risks.

Since January 2021, the exchange has been trading weekly options on the RTS index, which are identical to monthly/quarterly options, but with a shorter period.

Main features of the options market:

- Lots of opportunities for investors.

- Maximum leverage effect.

- Opportunity to get unlimited profits with little risk.

- This type of trading is the most convenient option for risk management and hedging.

- The ability to build different trading strategies using options and futures.

- A chance to clear targeted trades.

- The costs of concluding transactions on the MICEX and any other exchange are much lower than in the case of trading shares.

- An option contract can be used by investors with minimal amounts and huge investments - the effectiveness of the instrument is equally high.

The most profitable assets for options

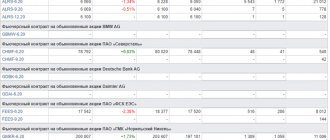

Dozens of options are traded on the Moscow Exchange. Futures contracts for stocks and stock indices act as the underlying asset; if you don’t understand this, the article on what futures are will help. But this abundance is an illusion ; in reality, there are not many instruments suitable for trading.

Options trading – working with volatility. To make a profit, the chart of the underlying asset ( BA ) must move and not stand still. You can create synthetic positions that even with low volatility give a profit, but good movements still give a greater profit.

When choosing an option, be guided by the popularity of the corresponding futures . The higher the activity on it, the better. Depending on this, I recommend:

- Options on futures on the RTS index and USDRUB . These are leaders in liquidity , be sure to include them in the list of traded instruments. BA codes – Ri and Si .

- Somewhat less popular are oil , EURRUB and the index of the Moscow Exchange itself , BA codes are BR , Eu and MIX, respectively.

- As for stocks, I recommend limiting yourself to blue chips of the Russian market; work with options on futures on securities of Gazprom ( GZ ), Sberbank ( SR ).

To get started, 7 assets are enough. The rest can also be worked on, but with large expirations; low volatility can become a problem. If you still have little knowledge of the theoretical basis, read the post on what options are. It focuses on the operating principle of this tool.

You can see for yourself the popularity of the listed assets. The Moscow Exchange provides its own statistics on traded volumes (futures and options). It can be seen that an order of magnitude more transactions are concluded on the RTS, the same situation with shares of Gazprom and Sberbank.

We see the same thing in currency pairs, with USD/RUB leading.

What is important for a trader to know

To make money on the stock exchange, it is not enough to know the definitions and types of options. You need to constantly monitor changes, read expert forecasts and give up trying to find a strategy that generates income constantly, or secret market signals. No experienced trader has yet succeeded in doing this.

The result is a consistent study of the market and the principles governing its operation.

How to make a deal through QUIK

This platform confuses beginners with its unusual appearance. You have to manually configure the location of all the elements needed for trading. First, we’ll briefly look at how to quickly set up Kwik for options trading, and later we’ll move on directly to work.

Setting up QUIK to work with options

We will need:

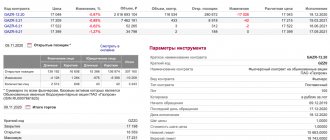

- A table of current trades is added through the “ Create window ” tab. For example, let’s select only the September 1 option on RTS index futures. The parameters can be limited to the price of the last deal and closing, as well as the change in contract value as a % of Close.

- Depth of glass and price chart .

- Options board , the same information is duplicated here as on the MICEX website, but without delays. It is more convenient to have it at hand, rather than constantly switching between the terminal and the Moscow Exchange.

To add an options board:

- Go to section "Create Window" and at the bottom of the menu select "All types" or just click F7.

- In the menu that opens, enter in the search bar "Options board" and select it.

- Next, you set the parameters of the options board and the information that will be displayed on it. You can limit yourself to the parameters set in the default settings. The chart is called up by double-clicking the right mouse button on the desired strike.

The QUIK setup is now complete. As a result, you should get something like the desktop that looks like the one in the picture below. As an option, you can add 2 tables of current trading for Puts and Calls. Kwik also has a function for linking the order book and chart to it, which makes the work more convenient. But this is not necessary; you can manually open the order book and chart.

Make a deal

To enter the market:

- Double-click on the price you are interested in in the order book.

- In the window that opens, set the price of 1 option and volume in contracts, and also select the direction of trade. The maximum possible position volume is automatically calculated based on the current guarantee and direction of trade (GO for buying and selling does not match). If you don’t want to work with limit orders, oh, and the terminal itself will place an order at the current price.

- In the additional menu you can change the execution condition. Default the application is immediately sent to the general list and, if there is a counterparty, is satisfied. You can choose an option "Withdraw balance" or "Immediately or reject". The last option means that the order will either be executed instantly or deleted. GO is the amount that the broker will block on the account, and the price is the money that the trader is willing to give to the seller.

Technically, trading options in QUIK is no different from working with futures and other instruments. After entering the market, daily .

In the table of transactions you can see the trading history . Information on market entries is displayed here.

The table “Positions by Client Accounts” displays indicators for transactions. In particular, the variation margin, recalculated every day. Also, transactions and their direction are shown on the price chart.

When trading, I recommend taking into account the distribution of orders in the order book . If you want to buy a large volume at one time, you can choose all the liquidity at the nearest price levels and end up getting a not the best cost for executing the order.

Calculation example

Suppose you need to buy 100 Call options on RTS . With this version of the order book, as in the figure below, liquidity will be selected at several levels at once. First, the buyer will purchase 8 contracts at a price of 4,590 rubles. , then 25 - for 4630 each, and so on until there are 100 options. Due to a large transaction, the supply at the levels of 4590-4990 and partially at 5000 .

In this example, the option board lists the purchase price as RUB 4,590. But in this scenario, the average cost of executing an application will be equal to 4688.30 rubles. There may be more unprofitable options.

Also, I do not recommend specifying prices that are very different from what you see in the order book. Let’s assume that an upward trend is developing in the RTS index, the minimum cost of the Call is 4,590 rubles . The buyer wants to save money and places a limit order in the region of 4,000 rubles .

His application will be accepted, but the likelihood that it will be fulfilled is small. As a result, due to the desire to save money, you may miss the entry point.

If the trader waits until the contract expires, he will receive the corresponding futures to his account. But since working with options is carried out with the aim of making money on speculative operations, this makes no sense.

Start trading through BCS

The vast majority of traders close positions early . In the case of options trading, closing means taking current profits. That is, if you bought 1 Call option, then to close the position you need to sell the same volume with the same expiration. There is no point in describing the process step by step - the stages are the same as when entering the market.

American are traded on the MICEX , which means that they can be executed ahead of schedule .

A trader can call the broker and leave a corresponding request. At evening clearing, the option contract will be executed - this method is also suitable for exiting the market. Can be used, for example, when the glass is empty.

Specifics of American legislation

A little formal. Trading binary options on American platforms directly depends on current legislation. After the severe crisis that rocked America in 2008, the Dodd-Frank Act was passed.

It is aimed at ensuring high-quality and complete protection of the interests of investors. The main goal pursued by the law is to increase the level of transparency in financial transactions on markets within the state. The law was created to clearly regulate the following areas:

- Strengthening consumer financial systems.

- Reducing OTC risks.

- Close observation and the closest monitoring of the country's main financial institutions.

However, this seemed to them not enough. Therefore, a special council was created in the United States, which monitors financial stability. His responsibilities include identifying and eliminating risks in the financial system of the state. One of the components of this system is also binary options trading.

Brokers are subject to strict requirements. Brokers who hold licenses issued in other countries do not have the right to register American users on their trading platforms.

The principle here is simple: if you want to work, get an American license. Otherwise you are outlawed.

And such companies were found: they passed the appropriate licensing and started working, but this was not easy to do.

The main difficulty in obtaining a license from the regulator is that the procedure is too complicated . The regulator will issue a license only if the company fully complies with basic standards. The broker is obliged to fully guarantee the safety of all funds invested by clients.

The regulator is called CFTC . It is he who is responsible for issuing the licenses necessary to carry out the relevant brokerage activities.

Risk management in options trading

Let me remind you of possible scenarios for the development of events regarding options transactions:

- The price of BA moves in a direction that is beneficial to the buyer of the contract. He either executes it or closes it ahead of schedule (at the expense of the opposing position). Losses are equal to premiums, but profits due to the increase in the cost of BA cover them.

- BA is moving in a direction that is unfavorable for the buyer . The contract may not be exercised after expiration; losses are limited to the premium or value of the option.

- Sellers of Puts and Calls are at a greater disadvantage in terms of potential losses. because in theory they lesion is not limited. The cost of BA can change in any range, strikes can even be negative. Under unfavorable circumstances, you can not only reset the deposit, but also incur a debt to the broker. We are talking about uncovered sales when the seller does not have the underlying asset.

Calculation example

For example, when buying a Call with a strike price of 130,000, the premium (option cost) is 4,590 rubles. per contract, in Kwik this data is indicated in the “ Call Offer ” column. Losses in the worst case will not exceed 4,590 rubles.

At the moment of entering the market:

- Upon purchase, a GO in the amount of 6856.83 rubles is blocked.

- When selling, GO increases.

When choosing the minimum capital, take into account the guarantee . It may increase, so you need a margin of safety for the deposit . In general, the RTS is a fairly expensive instrument; options on stock futures are cheaper. To start, I recommend at least 20-30 thousand rubles and careful work with minimal volumes.

As for the loss, if you see that the forecast is incorrect, fix the current situation by opening a reverse position. virtual stop position for yourself and record the loss manually. For example, when a level is broken or a certain distance in points is passed.

Reducing risks in options trading

When working on FORTS and selling uncovered options, insurance of such positions is required Without this, you risk getting caught in an unsuccessful change in the price of the underlying asset and losing at least all your capital.

When buying options there is no such requirement, but there are methods to reduce risks . Sometimes it is possible to make a portfolio risk-free with a small return. Below we will look at several examples of increasing the reliability of trading. The post about options analysis and strategies tells more about the tactics of working with these instruments; now we will limit ourselves to analyzing several tactics for reducing risk when selling uncovered contracts:

- Sell Strangle. The technique involves selling a Call and a Put with the same expiration date, but different strikes. Strike Call is higher than Put, this is a prerequisite, otherwise the meaning of the design is lost. As a result, we obtain the predicted risk of the portfolio and the price range of the underlying asset at which trading will be at least unprofitable.

- Sell Straddle. The tactic is similar to the previous one, but here not only the expiration dates, but also the strike are the same. Due to this, the shape of the curve of changes in the value of the portfolio depending on the execution price changes somewhat. Unlike the Strangle sale, there is no plateau at the top.

- Sell Butterfly. More complex designs, but the risk, unlike the previous 2 approaches, is not dimensionless, there is no chance of losing the deposit. Even when working with a minimum volume, you will have to deal with at least 4 contracts. If the deposit is small and you work, for example, with Ri, the capital may not be enough to sell the butterfly. There are 2 ways to build this model - using only Puts or Calls, as well as using both types of contracts. In the latter case, a combination of selling Straddle and acquiring Strangle is used. Due to the butterfly, a range of strikes is allocated when the portfolio of positions is unprofitable (losses are limited), the rest of the time we get a fixed profit.

- Sell Condor. The approach is similar to the butterfly, with the difference that the curve should have a plateau instead of a peak. As in the previous example, it is built using only Calls/Puts, and with different types of contracts.

If you sell without insurance, the loss will increase as the value of the underlying asset changes. The figure below shows the curve of the change in the result when selling an uncovered Call on RTS index futures.

Notice on the right side of the chart, there is no loss limiter . This is exactly how beginners lose their deposits, open positions without expecting a sharp movement in the BA chart, and lose all their capital in 1 trade.

What strategies to use in trading

In options trading, standard techniques are applicable, but there are also specific approaches. I consider typical methods:

- Graphic and candlestick patterns, graph analysis. Entry points can be determined, for example, using support and resistance levels. Trend lines, price channels, and candlestick patterns work.

- Indicator analysis. The same moving averages and instruments from the oscillator group can provide good entry points.

Trading from margin levels is possible. They are calculated for each option and act as guidelines for large players. reversals are especially often formed .

Start trading through BCS

Methods of working with one expiration date

Above, we have already discussed a number of strategies in which the emphasis was on reducing risk and controlling losses. Now I’ll supplement this list with a number of simple techniques:

- In a bull market shows himself well bull call spread. Work is carried out with Call contracts, one is bought (its strike is lower), the second is sold. If the value of the underlying asset increases, so does the profit. But due to the fact that the design includes Call sales, at a certain point in time the profit growth stops. In that lack of strategy: If the upward movement is strong, the profit will be relatively small.

- Simple purchase of a Put or Call . Everything is simple here - if the direction of movement of the BA is predicted correctly, the profit grows. If not, the premium or value of the option is lost.

- Strap. If in other methods the designs were symmetrical, then in Strap the approach is different - 1 Put + 2 Calls are bought. Contracts must expire at the same time; there are no restrictions on strikes; they can coincide, but this is not necessary. The strategy is interesting in that after a certain point, due to the presence of 2 Calls in the portfolio, profits begin to increase sharply. Strap is good in situations where a sharp increase in the underlying asset is likely, and Put here acts as a safety net.

- Strip. This is the exact opposite of Strap. A bet is made that the price of the underlying asset will decrease. 2 Puts are bought, and 1 Call acts as a safety net if the BO does start to rise. As the price of BA decreases, profits increase sharply.

The trading techniques listed above used contracts with the same expiration date, but different strikes .

Methodology for working with a calendar spread

There is also a mirror approach - calendar spreads . Example:

- A put with expiration, for example, in September is sold.

- The same contract is purchased, but expires in a month . The strike is the same.

- As a result, closer to the expiration of the first contract, time decay begins to affect. There is no need to wait for expiration; closer to this date, the sell trade is closed with a counter position.

- At the same time, we are getting rid of the second transaction.

In this scheme, earnings are made on the time value of options. Under normal conditions, the temporary value will be preserved for the 2nd position, and this will constitute the trader’s profit.

Which broker to choose to work with options

Among Russian companies with local regulation, I give preference to BKS . The broker has been working for several years, there are a lot of tariff plans. If you decide to work in other markets in addition to options, this will not become a problem. If you are interested, for example, in investing in securities, the article on how to invest in stocks for a beginner will be useful.

Of the companies with offshore registration, Just2Trade deserves attention . The entry threshold for options here is quite high, but other conditions are not bad.

| Company | Just2trade | BKS |

| Minimum deposit | From $3000 | Recommended from RUB 50,000, without strict restrictions |

| Commission per cycle (buy + sell trade) | At the base rate, $2.15 per contract. If turnover increases, a reduction of up to $0.4 is provided | At the “Investor” tariff – 0.1% of the transaction amount, at the “Trader” tariff it is reduced to 0.015% |

| Additional charges | $39/month for access to ROX, $8 for executing a voice request | If the account has less than 30,000 rubles - 300 rubles/month. for access to QUIK and 200 rub./month. for access to the mobile version of QUIK, |

| Account maintenance cost | $5/€5/350 rub. reduced by the amount of the commission paid | 0 RUR/ month on the “Investor” tariff. On other tariffs, funds are debited only if there was activity on the account this month |

| Leverage | Depends on the instrument, starts from 1 to 3 – 1 to 4 | Calculated for each share, within the range of 1 to 2 – 1 to 5 |

| Margin call | -90% | Calculated based on the risk for each security |

| Trading terminals | MetaTrader5, ROX | My broker, QUIK, WebQUIK, mobile QUIK, MetaTrader5 |

| Available markets for trading | Options available on US stocks and ETFs | All types of Russian markets + access to foreign markets |

| License | CySEC | TSB RF |

| Open an account | Open an account |

Advantages of the Russian market

Trading options on the MICEX has a number of advantages compared to Western counterparts. Main advantages:

- High reliability.

- Negative balance protection.

- There are no territorial restrictions.

- Floating investment portfolio.

- Margin trading with leverage up to 1:10.

- There are no income taxes.

- The minimum commission is 0.2%.

- There are no pitfalls in the form of costs and leverage fees.

- Money is protected from trade risks, diversification is implemented.

- High performance of underlying assets.

- The list of available contracts on the MICEX is constantly updated.

An investor can make money on the difference in the value of an asset according to pre-agreed transaction parameters.