Securities data

| Ticker | MCX:PRFN |

| Trading platforms and trading times | Moscow Exchange. 10:00 – 18:40 Moscow time. |

| Name | PJSC "CHZPSN-PROFNASTIL" |

| Number of securities in circulation | 838 287 450 pcs. ordinary shares. |

| Denomination | 0.1 rub. |

| Dividends | No |

| Year of foundation | 1974 |

| Founded by | Holding JSC "Stroysistema" |

| Headquarters | Russia, Chelyabinsk |

About company

ChZPSN, along with Chelyabinsk Promstroyproekt and the construction and installation organization SoyuzStroyKompleks, are part of the Industrial Engineering Group of Stroysistema JSC. The company deals with construction materials. It is the largest manufacturer of rolled metal structures and materials in the Ural region.

The production base of the joint-stock company occupies 30 hectares. Today, the market offers several of its own retail stores of a new format. Among the organization’s clients there are the following, as well as large representatives of the region’s construction industry.

Production of the company

ChZPSN produces various types of corrugated sheets, sandwich panels, metal profiles and block containers. Today the company also deals with rolled steel and produces metal tiles, roofing structures of various types and costs, as well as painted rolled steel for standard and complex coatings.

Main shareholders

Today, the main shareholder of ChZPSN is Igor Nikolaevich Svezhentsev, who owns 82.97% of ordinary shares through the parent company. The remaining papers are in free circulation.

Key figure and her role

The position of General Director of ChZPSN is occupied by its main owner Igor Nikolaevich Svezhentsev, who is also a deputy of the Legislative Assembly of the Chelyabinsk Region. Today he is solely responsible for the development of the entire holding and holds a similar position in all enterprises of the group.

Affiliated companies

The plant is part of a holding company; its structure does not imply the creation of a large number of subsidiaries with the exception of the production enterprise Stalkonstruktsiya LLC.

Company plans for the future

Today, the Chelyabinsk plant is implementing a modernization program “2016–2019”, which will allow in the future to increase the production capacity and shareholder value of ChZPSN. During the program, a new workshop for light profiles for the production of lightweight steel frames and a workshop for the production of polyurethane foam have already been built and put into operation, and a new warm warehouse for rolled metal products with equipment for shot blasting metal has been put into operation.

According to the forecast of ChZPSN, the completion of the construction of a new large metal structures workshop is scheduled for 2021. In the future, the company hopes to expand beyond the Chelyabinsk region and continue the development of a new format retail network - with convenient display and visualization of the products offered.

Dividend statistics

CHZPSN does not pay dividends.

Interesting facts about the company

In 2021, in order to support a large-scale modernization program and increase value, the majority shareholder in the joint-stock company carried out additional capitalization worth RUB 800 million.

It is no less interesting that ChZPSN was involved in the case of the plant receiving unjustified tax benefits for 2012–2013. The fine that was to be collected reached 420 million rubles.

This is a very serious figure for such a business. Subsequently, already at the beginning of 2021, the company was able to prove that it was right. The decision of the tax service was declared invalid, and the claims of Profnastil were partially satisfied, leaving the penalty in the amount of 1.5 million rubles in force. Today the organization has already fully repaid the debt.

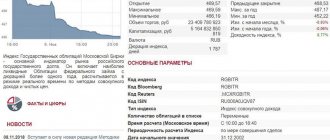

Federal loan bonds

What other bonds should be included in the investment basket? OFZs, despite their low yield, can become a profitable investment at the current moment in time. The fact is that their value may decrease due to the difficult economic situation, and now it is possible to buy bonds at a favorable price. The average amount of income that an investor will receive is 6%-7%.

Having made a selection, we obtain the following rating of Russian government bonds:

- OFZ-26221-PD. Rate 6.77%, price 1,088 rubles, maturity date 03/23/2033;

- OFZ-26225-PD. Rate 6.77%, price 1,051.90 rubles, maturity date 05/10/2034;

- OFZ-26218-PD. Rate 6.73%, price 1,149 rubles, maturity date 09/17/2031;

- OFZ-26224-PD. Rate 6.69%, price 1,024.90 rubles, maturity date 05/23/2029;

- OFZ-26212-PD. Rate 6.58%, price 1,034.20 rubles, maturity date 01/19/2028;

- OFZ-26219-PD. Rate 6.56%, price 1,066.70 rubles, maturity date 09/16/2026;

- OFZ-26226-PD. Rate 6.52%, price 1,080 rubles, maturity date 10/07/2026;

- OFZ-26207-PD. Rate 6.48%, price 1,095.30 rubles, maturity date 02/03/2027;

- OFZ-26223-PD. Rate 6.36%, price 1,006.60 rubles, maturity date 02/28/2024;

- OFZ-26222-PD. Rate 6.36%, price 1,032.40 rubles, maturity date 10/16/2024.

The par value of all presented bonds is 1,000 rubles. On average, the return on investing in OFZs is slightly higher than on bank deposits, but is also reliable. It is worth noting that experienced investors can receive income not only from coupons, but also from the difference in the cost of bonds.

Where and how to buy shares today

All rights to shares today are recorded in the depository, so you can buy them in different ways, from an agreement with a private person to using the services of a specialized broker. The price of the shares will be the same in all cases, but the costs associated with fees and commissions may differ.

Through a Russian broker

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

CHZPSN shares are traded on the MICEX, so today the simplest and most common option is to purchase them through a Russian broker. To do this, just open an account (you can even do it online if you have a verified account on the State Services website) and download the trading terminal. Today, the Quik program is used to trade shares on the Moscow Stock Exchange. It provides the ability to track the value of securities and make transactions with them.

Via bank

You can open a position on ChZPSN shares through a bank. To do this, you must contact the investment department of the financial institution.

Directly from a company, individual or firm

Buying a share is, first of all, acquiring a share in a business, so you can buy it from an individual or legal entity by filling out an agreement and submitting an application to the depositary.

What affects the stock price

Since the company is engaged in the production of metal products, today the price of its shares is mainly influenced by the cost of steel. At the same time, it is important to understand the general state of the construction industry, since representatives of this particular segment are the key clients of ChZPSN.

The issuer has a very large debt, so its shares are sensitive to this parameter. Reducing the debt burden and refinancing at lower rates will be a catalyst for an increase in the price of securities. On the other hand, news of an increase in debt, even if only slightly, will put pressure on shares.

Company prospects

In order to reduce costs, most of ChZPSN's regional competitors today try to use used machines of previous generations of European or Soviet/Russian production. The plant, contrary to this trend, purchases exclusively new capacity in the UK, Germany, Italy and Finland.

In the future, this fact will undoubtedly have a positive effect on the competitiveness of the enterprise and, as a consequence, the value of its shares.

In the future, if ChZPSN moves according to its own development plan without failures, it will be able to seriously increase its production capacity. This will contribute to an increase in sales revenue by 2021 to 16.3 billion rubles, which is approximately 4 times more than current indicators. If profitability is maintained, a corresponding increase can be expected in the operating profit of ChZPSN, and therefore in shareholder value.

Analytics and forecast for the security

Since the overhang has gone away (a fine of 420 million rubles), today ChZSPN shares look quite attractive. The plant's plans provide motivation for purchasing these securities. However, it must be taken into account that the organization today has quite a large debt, which is also expensive to service. But if the company's development model is successful, cash flows from the commissioning of new production equipment will be able to cope with this problem, and the share price will make another rally.

Alternative in this industry

Today, the competitors of ChZPSN on the stock exchange, albeit indirectly, are metallurgical companies, MMK, NLMK, Mechel, Ashinsky Iron and Steel Works, TMK, etc.

Conclusion

Today I want to emphasize that ChZPSN shares can be attractive in terms of price and prospects. But you need to clearly understand that they fall into the category of rather risky investments. When buying shares today, you should not expect any dividends in the near future, since the company's main task now is the balance between a large debt load and the development of its production base.

Its debt is more than 900 million rubles, so deleveraging processes in the organization will continue for many years, but such investments often pay off many times over in the long term.

I hope today was interesting, and most importantly, useful. Be sure to subscribe to articles and share them on social networks.

Criterias of choice

A bond is a debt security. It is purchased by the investor for a certain period, after which he receives interest. Issuers can be the state, individual regions of Russia or commercial companies.

HDOs are high-yield bonds, they are also often called “junk”. They received this name due to the low reliability of issuers and too high risks. Companies have difficulty obtaining bank loans, so they attract investment by issuing securities. It is dangerous for novice investors to invest in them; to do this, you need to have sufficient experience in working on the stock exchange and knowledge. At the same time, this is one of the opportunities to get high income from investing.

Bonds are not the easiest tool for generating income, but they are often recommended for beginners just taking their first steps in the stock market. First you need to decide what features of bonds you should pay attention to:

- Profitability . Ultra-high profitability is not the best indicator, no matter how much you want to earn money. Too high a percentage indicates that the issuing company has serious problems and there is a high risk of default. A reliable yield on bonds is around 8%-10%, securities with a little more risk claim 11%-14%. Over 15% are already high-risk transactions; you need to choose such bonds extremely carefully and only if you have experience playing on the stock exchange.

- Maturity . Choosing long-term bonds is risky because it is impossible to predict their price. And the company may go bankrupt. The optimal repayment period is up to 3 years.

- Liquidity , that is, how quickly these bonds can be bought and sold. Reliable securities are valued on the stock market, so there will be no problems with their sale in the future. To understand how liquid they are, it is worth assessing the turnover of their transactions per day. Traditionally, the most popular are government debt securities and “blue chip” securities (that is, the most reliable companies). And only half of the bonds on the stock exchange are liquid; for the rest, the turnover of transactions per day is zero.

Based on the above criteria, we will consider the TOP most attractive bonds of 2021. We will also give examples of high-risk assets, although their stated high returns are not at all guaranteed. So, what kind of debt securities can you invest in?