Who are dividend aristocrats and their differences from dividend kings and champions. Lists and examples of companies in the USA, Russia and Europe.

Investing in stocks is a great way to put your money to work. And it doesn’t all come down to trading. This method works, but with the help of shares you can also create a dividend portfolio that provides a stable income; this option is more profitable than a bank deposit.

For investment portfolios of this type, the best choice is Dividend Aristocrats , they provide stable dividends, with a payout probability approaching 100%.

- Europe's Dividend Aristocrats

- Where to see updated data and lists

US Dividend Aristocrats

The US entry criteria are clearly stated:

Take our proprietary course on choosing stocks on the stock market → training course

- Large company size. Capitalization on the stock market is at least $3 billion (included in the 500 largest US companies and traded on the S&P500).

- Regular dividend payments for more than 25 years.

- Annual increase in payments.

Companies that meet these conditions form the official “US Dividend Aristocrat Index” - the S&P 500 Dividend Aristocrat.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Dividend payment terms

The payment period for US dividend securities is published immediately after the board of directors meets where they discuss when and how much to pay out to security holders. No more than 45 days must pass after the meeting.

Dividends from US companies are paid every three months, six months or once a year. Payments generally occur once a year.

Register closing dates, cut-off dates

The closing date of the register is the date when the management of the organization calculates the number of its shareholders in order to pay them dividends in the future. The cut-off date is informed in advance so that the investor has time to buy the securities. If he has not purchased them, he is automatically excluded from the number of persons applying for payments.

List of 64 US Dividend Aristocrats by Industry

Below is a table of 64 American ↓

| Ticker | Name | Industry | Duration of payments | 10 year dividend growth | Profitability |

| ABBV | AbbVie Inc. | Healthcare | 47 | 13.99% | 5.65% |

| ABT | Abbott Laboratories** | Healthcare | 47 | 5.51% | 1.59% |

| A.D.M. | Archer-Daniels-Midland Co | Essential consumer goods | 44 | 9.60% | 3.16% |

| ADP | Automatic Data Processing | IT | 45 | 10.61% | 2.05% |

| AFL | AFLAC Inc | Finance | 37 | 6.79% | 2.06% |

| A.L.B. | Albemarle Corp. | Materials | 25 | 11.14% | 1.81% |

| AMCR | Amcor | Materials | 25 | 3.50% | 2.29% |

| AOS | Smith AO Corp | Production | 26 | 21.50% | 2.11% |

| APD | Air Products & Chemicals Inc | Materials | 38 | 9.85% | 2.20% |

| ATO | Atmos Energy | Public utilities | 36 | 4.96% | 1.96% |

| BDX | Becton Dickinson & Co | Healthcare | 48 | 8.91% | 1.14% |

| BEN | Franklin Resources Inc | Finance | 40 | 14.02% | 4.28% |

| BF.B | Brown-Forman Corp B | Essential consumer goods | 36 | 8.03% | 0.98% |

| CAH | Cardinal Health Inc | Healthcare | 24 | 17.52% | 3.57% |

| CAT | Caterpillar Inc | Production | 26 | 8.45% | 2.93% |

| C.B. | Chubb Ltd | Finance | 26 | 9.92% | 1.97% |

| CINF | Cincinnati Financial Corp. | Finance | 59 | 3.51% | 2.11% |

| C.L. | Colgate-Palmolive Co | Essential consumer goods | 56 | 7.11% | 2.45% |

| CLX | Clorox Co | Essential consumer goods | 42 | 7.72% | 2.68% |

| CTAS | Cintas Corp. | Production | 37 | 18.43% | 0.90% |

| CVX | PBCT | Energy | 33 | 5.99% | 3.81% |

| DOV | Dover Corp. | Production | 64 | 8.58% | 1.67% |

| ECL | Ecolab Inc | Materials | 28 | 12.63% | 0.95% |

| ED | Consolidated Edison Inc | Public utilities | 46 | 2.29% | 3.27% |

| EMR | Emerson Electric Co | Production | 63 | 4.05% | 2.61% |

| ESS | Essex Property Trust | Real estate | 25 | 6.49% | 2.52% |

| EXPD | Expeditors International | Production | 25 | 10.89% | 1.35% |

| FRT | Federal Realty Invt Trust | Real estate | 52 | 4.65% | 3.24% |

| G.D. | General Dynamics | Production | 28 | 10.35% | 2.20% |

| GPC | Genuine Parts Co | Consumer goods of 2nd necessity | 63 | 6.58% | 3.11% |

| G.W.W. | Grainger WW Inc | Production | 48 | 12.30% | 1.75% |

| HRL | Hormel Foods Corp. | Essential consumer goods | 54 | 16.03% | 1.97% |

| ITW | Illinois Tool Works Inc | Production | 45 | 12.62% | 2.43% |

| JNJ | Johnson & Johnson | Healthcare | 57 | 6.87% | 2.56% |

| KMB | Kimberly-Clark | Essential consumer goods | 48 | 6.01% | 2.98% |

| K.O. | Coca-Cola Co | Essential consumer goods | 57 | 6.91% | 2.77% |

| LEG | Leggett & Platt | Consumer goods of 2nd necessity | 48 | 4.44% | 3.14% |

| LIN | Linde plc | Materials | 26 | 8.14% | 1.67% |

| LOW | Lowe's Cos. Inc. | Consumer goods of 2nd necessity | 57 | 19.39% | 1.83% |

| MCD | McDonald's Corp | Consumer goods of 2nd necessity | 44 | 8.72% | 2.37% |

| MDT | Medtronic plc | Healthcare | 42 | 10.23% | 1.81% |

| MKC | McCormick & Co | Essential consumer goods | 34 | 9.04% | 1.44% |

| MMM | 3M Co | Production | 61 | 10.94% | 3.23% |

| NUE | Nucor Corp. | Materials | 47 | 1.27% | 3.20% |

| O | Realty Income Corp. | Real estate | 25 | 4.68% | 3.62% |

| PBCT | People's United Financial | Finance | 27 | 1.54% | 4.48% |

| PEP | PepsiCo Inc | Essential consumer goods | 47 | 7.96% | 2.67% |

| PG | Procter & Gamble | Essential consumer goods | 63 | 5.56% | 2.38% |

| PNR | Pentair PLC | Production | 44 | 0.54% | 1.65% |

| PPG | PPG Industries Inc | Materials | 48 | 6.40% | 1.62% |

| ROP | Roper Technologies, Inc. | Production | 27 | 18.81% | 0.54% |

| ROST | Ross Stores Inc. | Consumer goods of 2nd necessity | 25 | 24.95% | 0.88% |

| SHW | Sherwin-Williams Co | Materials | 41 | 12.28% | 0.76% |

| SPGI | S&P Global | Finance | 46 | 9.74% | 0.77% |

| S.W.K. | Stanley Black & Decker | Production | 52 | 7.58% | 1.66% |

| SYY | Sysco Corp | Essential consumer goods | 50 | 4.97% | 2.18% |

| T | AT&T Inc | Communication services | 36 | 2.21% | 5.40% |

| TGT | Target Corp | Consumer goods of 2nd necessity | 52 | 14.35% | 2.31% |

| TROW | T Rowe Price Group Inc | Finance | 33 | 11.76% | 2.32% |

| UTX | United Technologies | Production | 26 | 6.68% | 1.92% |

| VFC | VF Corp | Consumer goods of 2nd necessity | 47 | 12.36% | 2.27% |

| W.B.A. | Walgreens Boots Alliance Inc | Essential consumer goods | 44 | 13.63% | 3.52% |

| WMT | Wal-Mart | Essential consumer goods | 46 | 7.18% | 1.85% |

| XOM | Exxon Mobil Corp | Energy | 37 | 7.53% | 5.25% |

⇒

Rating of the best American companies with the maximum dividends 2019–2020

| Place | Company name | Ticker | Average dividend yield, % |

| 1 | Telefonica Brasil SA | VIV | 9,69 |

| 2 | Cato Corporation | CATO | 9,42 |

| 3 | Saratoga Investment Corp. | SAR | 8,78 |

| 4 | Landmark Infrastructure Partners | LMRK | 8,46 |

| 5 | Gladstone Investment Corporation | GAIN | 7,2 |

| 6 | China Mobile Limited ADR | CHL | 6,99 |

| 7 | ING Group NV ADR | ING | 6,63 |

| 8 | Macy's Inc. | M | 6,49 |

| 9 | Invesco Plc | IVZ | 6,18 |

| 10 | PacWest Bancorp | PACW | 6,18 |

How to invest in all US dividend aristocrats at once

To get immediate exposure to these reliable dividend stocks, you can buy the ProShares S&P 500 Dividend Aristocrat Index ETF, which includes 64 stocks. The second option is to invest in a broader ETF, which is built on the basis of the S&P 1500 Composite index and includes large companies that have been regularly paying dividends for more than 20 years.

| ETF name | Ticker | Description |

| ProShares S&P 500 Dividend Aristocrat | NOBL | Includes 64 diva stocks. Aristocrats from the S&P 500 index. Pay regularly for more than 25 years |

| S&P High-Yield Dividend Aristocrats | S.D.Y. | Includes 111 Dividend Aristocrat stocks from the S&P 1500 Composite Index. Pays over 20 years (includes 53 S&P500 companies) |

In addition to American indices from dividend aristocratic companies, there are others. For example, the S&P Europe 350 Dividend Aristocrats - which includes 350 European companies that have been consistently paying dividends for more than 10 years.

| Name | Ticker | Description |

| iShares S&P/TSX Canadian Dividend Aristocrats Index ETF | CDZ | Canadian companies paying dividends consistently for more than 7 years |

| S&P Europe 350 Dividend Aristocrats | SPYW | European companies paying dividends for more than 10 years |

Dividend Aristocrat stocks include many ETFs to increase their reliability and attractiveness. For example, there are target funds whose goal is to outperform the dividend yield of the S&P 500 index. Below are some of them ↓

| Name | Ticker | Description |

| CBOE Vest S&P 500 Dividend Aristocrats Target Income | KNG | In addition to dividend aristocrats, the ETF includes options and stocks from the S&P500. The goal is to create returns higher than the S&P 500 index |

| Vanguard International Dividend Appreciation ETF | VIGI | Stocks from the NASDAQ index do not include REITs. Dividend payments for more than 7 years |

Glossary

So that this material can be understood by people who are far from investing, I will define the basic terms below.

What are shares

Shares are securities that give certain rights to their owner.

Shares give the right to receive part of the profit from the economic activities of the issuer; shareholders take part in the management of the company: distribute funds (including dividends), determine the direction of development.

Why buy shares

People who have some savings often wonder: where to invest money so that it makes a profit? The most conservative instrument is a bank deposit. But it brings a small return, which is barely enough to compensate for inflation (and sometimes is inferior to it).

Another way to invest is to buy shares. These securities are capable of generating profits that significantly exceed inflation. Profitability is not limited in any way and is determined only by the professionalism of the investor. An outstanding achievement is considered to be a return of over 25%, maintained for many years.

What are blue chips?

Blue chips are securities of the largest and most economically stable companies. These shares have high liquidity, low spread (the difference between the buying and selling rates), and stable dividend yield.

What are dividends

A dividend is a portion of a company's profit for the previous period that is paid to shareholders.

It's important to know that not all stocks are dividend-paying!

Ordinary and preferred shares: what are the differences?

Ordinary shares give the right to receive dividends, as well as to participate in the management of the joint-stock company.

Preferred shares are deprived of the last point (although everything depends on the company's charter), but they guarantee, first of all, the receipt of dividends and repayment of the cost in the event of bankruptcy of the enterprise.

How to buy shares as an individual

In 99% of cases, it is enough to open an account with a broker - an intermediary company between traders and the exchange. The broker charges a commission for its services: about 150–200 rubles monthly and 0.002–0.005% of the player’s trading turnover. When buying US stocks, this commission is slightly higher.

How to choose a company with high dividend shares

There are quite a large number of sites on the Internet that provide analytical information. All you have to do is type “Russian/US dividend papers” into a search engine and follow the links. In the Russian-language segment of the Internet there are statistics on American stocks.

How to make money on dividends

To make money on dividends, there is no need to hold them for a long time; it is enough to have them in your terminal on the cut-off date. Then you should wait a little: after the payments, the share price decreases by the amount of the dividend yield (this “failure” is called a gap). When the quotes return to the original level, closing the dividend gap, you can sell.

How to make money from rising prices

You can make money on rising prices even within 5 minutes. There is no need to wait for the cut-off date, the closing of the dividend gap, or the fulfillment of other conditions.

All that is required is to buy cheaper and sell more. For example, buying shares of GameStop Corp. at $4.26, we can already sell this US dividend asset if the price rises to $4.27 or higher.

TOP 10 US Dividend Aristocrats by Yield

Unlike Russian companies, American companies try to pay increasing dividend payments to maximize their value and investment attractiveness. Thus, AbbVie Inc. makes maximum dividend payments. (ABBV) – 5.65% per annum, which is slightly less than what domestic ones pay.

US Dividend Aristocrats Yield Ranking

Another important aspect of American companies in relation to Russian ones is the regularity of payments, which are prescribed in the dividend policy.

Pros and cons of investing in US dividend stocks

The main advantage of high-dividend US stocks is that you will receive a profit that does not depend on the ruble and the imposed sanctions.

There are other positive aspects of investing in American dividend stocks:

- payments are made quite often - at least once a year, maximum - once every three months;

- stability. The investor receives money annually;

- brokerage account insurance, which is not available in Russia.

As for the cons, I can only say one thing here. Often, novice investors are lured by high-risk US dividend stocks, which is a mistake.

High risks mean that the company does not invest money in development, but uses it for payments. As a result, the price of shares of such organizations will not grow, so it will not be possible to buy securities at a lower price and sell at a higher price.

Taxation

Initially, the investor’s account receives the amount already with 10% tax deducted, since this rate on dividend shares is valid for residents of the Russian Federation in America. Since the rate there is 10%, and here it is 13%, you must pay an additional 3% of the profit to the tax service of the Russian Federation. Thanks to the agreement between the United States and Russia, this approach avoids double taxation.

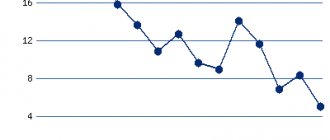

S&P 500 vs Dividend Aristocrats Portfolio

If you compare the growth in profitability of an investment portfolio of dividend aristocrats and shares from the S&P500 index, you will notice that a significant difference will accumulate over time. Investing in Dividend Aristocrat stocks not only provides exchange rate growth, but also dividend payments. The figure below shows the dynamics of changes in profitability over 30 years.

Comparison of investment portfolios

Western Midstream (WES) – 11.49%

Western Midstream is a Canadian oil carrier listed on the New York Stock Exchange. Transports both crude oil and finished products.

The oil carrier's shares have fallen sharply as demand for oil transportation has fallen and the company is suffering heavy losses. Dividends in 2020 fell 2 times - from 0.62 in 2021 to $0.311 (and 3 times from 0.98 in 2021). Quotes have collapsed even further, now one WIS share is selling for $13.53, and the yield is 11.49%.

Here's another interesting article: What is FAANG?

Which sectors of the US dividend aristocrats are the most profitable?

Let's consider what kind of profitability is obtained by industry. Thus, the maximum payments are made by the utilities, energy and real estate sectors. Sectors such as IT, industry and raw materials - most of the funds received are reinvested in production and development.

| Name | Average yield |

| Public utilities | 5,4% |

| Energy | 4,5% |

| Real estate | 3,1% |

| Healthcare | 2,7% |

| Public utilities | 2,6% |

| Finance | 2,6% |

| Essential consumer goods | 2,4% |

| Consumer goods of 2nd necessity | 2,3% |

| IT | 2,1% |

| Industry | 1,9% |

| Primary sector | 1,8% |

conclusions

Dividend payments directly determine the investment attractiveness of a company in the eyes of investors and stimulate the growth of share prices on the stock market. Investing in dividend aristocrats is profitable for a period of 20-30, since constant dividend income will result in greater profits regardless of crises.

It is also necessary to remember that high dividends paid by companies can signal the stagnation of the company, because they spend most of the net profit received to satisfy the interests of investors and shareholders, and do not direct it to development. Over the entire history of the S&P 500, more than 30% of the companies that were included in the index were either acquired or went bankrupt. Therefore, you should not just passively invest even in companies of dividend aristocrats, but it is recommended to constantly monitor their financial condition.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Advice for a novice investor

Past performance guarantees nothing - the main rule of any investor. Even if a US company pays large dividends for 5 years, there is no 100% probability of payments next year. An economic crisis, a drop in sales, corporate risks, an unsuccessful new product - all this can cancel out initial forecasts and lead to losses.

The easiest way to get started investing in US dividend stocks is to buy an 80/20 split. The majority of the portfolio should be occupied by blue chips, and the remaining resources can be distributed among high-risk issuers. Even at the expense of maximum profitability. At first, you need to hold out, gain self-confidence, and gain the necessary experience.

Management of risks

A trader will never know in advance whether the initial forecast will come true or not, but the best thing that can be done is to reduce risks.

This is achieved through diversification (purchasing assets from different sectors of the US economy) and reasonable capital management. And also developing a trading plan if something doesn’t go according to plan.

Kinder Morgan (KMI) – 7.37%

The largest US energy company, transporting about 40% of all natural gas in America. It stores and processes crude oil, fuel, petroleum products, gas, gasoline and other useful flammable things.

Like other gas and oil companies, KMI suffered significant losses in 2021, which affected quotes. Hence the extremely high dividend yield in 2021 - 7.37% with a share price of $14.25. It pays dividends quarterly, seeking to increase them after a rapid decrease in 2015.

TC Pipelines (TCP) – 8.51%

Another gas pipeline company engaged in the storage, processing and transportation of natural gas. An unremarkable, stable company that suffered due to the energy crisis. True, she began to have some financial difficulties even before the crisis: in 2021, she increased loans for the construction of new gas pipelines, which were not in demand during the 2020 lockdown.

As a result, the growing dividends had to be sharply reduced. The company now pays 65 cents per share quarterly. With a TCP price of $30.54 and the same dividends, you can earn up to 8.51% per annum in 2021.

Altria Group (MO) – 8.61%

Spun off from Philip Morris Companies, Altria Group is one of the largest tobacco companies in the world. In 2018-2019, it experienced a certain pressure on profits due to the development of healthy lifestyle ideas and the decline in interest in tobacco, but the invention of “ecological” methods of smoking contributed to its return to the ranks of the leaders of the “tobacco industry.”

The company pays dividends every quarter and tries to increase them regularly. The last increase to $0.86 took place literally in September 2021. What it will be like in 2021 is unclear, but clearly not lower than the current level. By purchasing an Altria Group share at $39.94, you can expect a dividend yield of around 8.61-8.8% per annum. If, of course, you are ready to invest in so-called “sin stocks” =)

And here’s another interesting article: Investing in stocks: strategy and tactics for buying securities