The securities market in 2021 was remembered for the rise in prices of many stocks to historical highs. However, not a single IPO happened in Russia. The bond market also experienced a decline in activity.

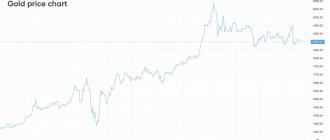

The Moscow Exchange Index, the main ruble indicator of the Russian stock market, reached 2,500 points in 2021.

This happened on October 3 and almost coincided with the annual maximum in oil prices. Brent oil was trading above $86 per barrel in early October. In Russian currency, the price of a barrel of Brent these days was a record in history - it exceeded 5,700 rubles, which had a positive effect on the income of both oil companies and the Russian treasury. You're welcome. The US Federal Reserve raised its base rate, “flicking on the nose” of President Trump Finance

State of the Russian stock market in 2019

The situation on the Russian securities market is reflected by several indicators.

- Index growth.

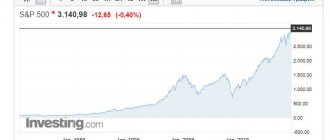

MSCI Russia grew by 33.8% from 12/31/18 to 10/30/19.

The increase in the RTS index over 10 months is 33.14% (from 1,068.72 to 1,422.92 points).

The Moscow Exchange Index (IMOEX) grew by 22.14% by October 31 (from 2,369.33 to 2,893.98 points).

Today it is approaching a historical high of 3,000 points.

- Shares of Russian companies remain among the most undervalued in the world in terms of price to earnings per share (P/E).

P/E multiple as of 04/30/19

Source: StarCapital

- Influx of private investors.

According to statistics from the Central Bank of Russia, based on the results of three quarters, the number of clients of professional securities market participants increased:

- in brokerage services by 53% from 2,222 thousand to 3,406 thousand;

- in trust management by 70% from 152.2 thousand to 259.4 thousand;

- those who opened an individual investment account – by 96% from 599 thousand to 1,175 thousand.

- The Russian securities market remains financial and oil and gas. The price of oil is stable and rising slightly. The forecast is positive until Brent breaks $70 per barrel in 2021.

- The ruble bond market grew by 11.8% and reached RUB 21.811 trillion. for 9 months of 2021 according to REGION Group of Companies.

- The share of the Russian securities market in the global market remains less than 0.5%. At the same time, the country’s GDP is 1.8% of the global one.

You're welcome. The US Federal Reserve raised its base rate, “flicking on the nose” of President Trump

530

Alexander Pirozhkov

Is it any wonder that many shares of the Russian oil and gas sector also reached price highs in 2021? Among them are papers of LUKOIL, Rosneft, Gazprom Neft, Tatneft, Novatek. However, the interests of buyers were not limited to them. Shares of metallurgists such as Severstal, NLMK, MMK, and MMC Norilsk Nickel also hit historical records. Quotes of Yandex and Sberbank also reached record levels during the year.

Towards the end of the year, however, optimism faded somewhat. The Moscow Exchange index ended the second ten days of December near the 2400 point mark. But the saddest circumstance should not be considered this at all, but the fact that investor interest was focused on the secondary market. Not a single initial public offering of shares, that is, IPO, occurred in Russia during the year.

How to make money from the stock market trend

There are two concepts: one from Mr. Trump, the other is incorrect.

What does Donald Trump want? He wants power, stability and prosperity. The maximum program is the growth of macroeconomic indicators and the stock market by the November presidential elections. The main tools are pressure on the Fed on the rate and a timely end to the trade war with China.

Alternative options. A crisis can be triggered by various factors:

- Bankruptcy of a large corporation.

- Aggravation of the conflict with China, protectionism and trade conflicts in general.

- Decrease in credit ratings of large corporations due to debt load. As a result, due to an increase in bond prices, capital may begin to flow out of the stock market.

- Panic of passive investors. For example, in the ETF market. This is unlikely to be the root cause in the short term. But a massive dump of securities can amplify any other reason.

- American debt crisis. They have been talking about this for the second decade. In fact, the lion's share of the Treasury market is money transferred from one pocket to another.

- A crisis in any developing securities market or a default on government debt.

- Exacerbation of military conflicts.

- Domestic political situation in the USA.

- Increase in interest rates.

Prediction: Trump is a good poker player. A stock market crash is not beneficial to anyone. Delaying the crisis and flooding the economy with “helicopter money” is in the interests of the majority of interested players (and then “either the donkey or the padishah will die”). However, in times of uncertainty, it is better to hedge.

For example, use the inverse ratio of the securities portfolio of institutional investors: 40% in highly liquid stocks, 60% in reliable bonds and gold. And after the recession and the beginning of the correction, a maximum of investments in shares that have fallen in price with a gradual transition to a standard “institutional securities portfolio” of 60:40 in favor of shares as the market recovers.

Small amounts can be invested through index ETFs. They are filled with underlying assets - index securities, and cost hundreds of rubles apiece.

New sanctions and the financial market

Contrary to the statements of optimists, international sanctions are increasingly affecting the Russian financial market. In August, it became known about a whole series of new sanctions - both those that have already become a reality and those that are only possible in the foreseeable future. The bill on new sanctions against Russia concerns not so much Russia as US President Donald Trump . He is required to combine all previously imposed sanctions against Russia into a single system, create a “sanctions coordination office” in the US government for agreements with the EU to support sanctions, block dollar settlements of Russian banks, and prohibit transactions by US residents with the new Russian government debt. Basically, all this looks like an American domestic political project. However, if some tough measures are taken, the Russian financial market could shake up greatly.

While the adoption of the above-mentioned bill may not happen, some sanctions have already come into force on August 27. The US State Department intends to stop foreign assistance to Russia, lending to arms deals, and the sale of weapons, products and technologies related to the sphere of national security.

After the publication of details of the bill on sanctions against Russia, investors staged a sale of Russian assets. The dollar rose to a two-year high, stock prices of state banks fell, and OFZ yields rose.

Why are new US sanctions dangerous? The main thing on the list of sanctions is a ban on the purchase of new Russian government debt and transactions with the dollar for Russian state banks. The list includes Sberbank, VTB, Bank of Moscow, Gazprombank, Rosselkhozbank, Promsvyazbank and VEB. It is possible, for example, to ban transactions in dollars in banks that will be subject to new sanctions.

Origin

The emergence of trade interaction between people began in primitive times. At that time, such useful assets as stones and animal meat were available to people for exchange. Today these possibilities have expanded. Although the basic principles remain the same. In the Middle Ages, people began to expand their market relations not only for material objects, but also for some documents, charters, securing the right to own one or another asset. Considering that those times were not particularly humane and fair, a paper that confirmed that a certain item was obtained by you legally was very useful. Since anyone could be slandered as a thief and immediately punished. Punishments in those days, as is known, were very brutal. So getting a document confirming that the horse under you is really yours was the sacred duty of every respectable citizen.

Such documentation of all rights became fertile ground for the emergence of direct market relations, within the framework of which not only material values, but also intangible ones, such as permits and rights, began to be considered goods. This is how the first documents appeared that confirmed the rights to own one or another good. Then these documents themselves became direct goods, while the goods themselves could remain without being used for their intended purpose.

Banks and regulation

In August 2021, the Bank of Russia continued its bank sweep and revoked the licenses of K2 Bank, Central European Bank, Moscow Veksel Bank, New Industrial Bank, as well as the settlement non-bank credit organization Innovative Settlement declared voluntary liquidation and surrendered the license itself. The temporary administration for the management of Bank Taatta JSC, during a survey of its financial condition, established that bank officials carried out transactions that had signs of theft of funds in the amount of more than 4.2 billion rubles. Let us remind you that the Central Bank revoked the license of the Yakut bank Taatta, which ranks 220th in terms of assets, in July. The main irregularities in the bank were revealed, as usual, shortly before this event.

The Central Bank also reported on the results of an audit of the financial condition of two banks - Russian Trade Bank and OFK Bank. In total, signs of withdrawal of assets totaling 15.5 billion rubles were discovered. At OFK Bank, the withdrawal of assets amounted to 11.3 billion rubles. Of these, 8 billion rubles were withdrawn by lending to companies with questionable solvency. Another 3.3 billion rubles of damage to the bank was caused in the form of guarantees and the conclusion of factoring agreements with companies associated with bank employees. The temporary administration of the Russian Trade Bank discovered operations to replace liquid assets with low-liquidity securities; the damage amounted to 2.5 billion rubles. Another 1.7 billion rubles could be withdrawn through loans issued to clients with an unsatisfactory financial situation and through real estate transactions.

Exactly a year has passed since the beginning of the reorganization of Otkritie Bank, which was one of the ten systemically important credit institutions. The regulator was the first to save this bank under a new scheme through the Banking Sector Consolidation Fund, allocating an unprecedented volume of loans worth 1 trillion. rubles Mikhail Zadornov was appointed Chairman of the Board of Otkritie . He spoke about the main results of the “rescue operation.”

The bank being rehabilitated, FC Otkritie, has completed the merger of its three pension funds on the basis of NPF LUKOIL-Garant. NPF LUKOIL-Garant was joined by NPF Electric Power Industry and NPF RGS. The combined NPF with assets of 586 billion rubles will be the second largest after Sberbank NPF. The new fund will serve 7.9 million people. True, this rescue operation was not cheap for the state.

In September, the Bank of Russia will announce a tender for the purchase of the Asia-Pacific Bank, one of the largest banks in Siberia and the Far East. The regulator took the bank into reorganization in April. The regulator plans that ATB will be sold by the end of 2021. All 100% of the bank's shares will be offered for purchase. The bank may be interested in large Russian financial organizations that previously did not have a network of branches in the East of Russia.

A unique project is being implemented in Russia - the Central Bank is collecting bad and non-core assets of large banks being rehabilitated into a special bad debt bank. It is being created on the basis of Trust Bank. By the end of the year, the Trust will accumulate more than 2 trillion. rubles of problem assets. Alexander Sokolov, told how to work with them, what part of the money he expects to return and who will help him with this .

The Bank of Russia has prepared amendments that tighten the standards for subsidiaries of foreign banks operating in Russia. The amount of funds that banks will be able to place in parent structures abroad may be limited. The regulator believes that a threshold of 20% of capital should apply.

For several years now, the Central Bank has been purging not only banks, but also other financial market companies. Experts have different opinions both about the results of this work of the regulator and about their impact on the country’s economy.

The divorce of entrepreneurs Alexey Golubovich and Olga Mirimskaya threatens to result in a loss of pocket money for the latter. The court refused to grant her a deferment to pay 170 million rubles in debt to her ex-husband. As a result, bailiffs will soon begin the process of selling four companies owned by Mirimskaya, which own almost 80% of BKF Bank.

The Council for Professional Qualifications of the Financial Market and Rosfinmonitoring signed a cooperation agreement and began working together on professional standards in the field of compliance. Vladimir Glotov talks about the content of this work .

Historical development

The era of Great Geographical Discoveries that occurred later expanded the scope for the activities of paper tycoons, which was helped by the realities of those years. By sponsoring the next naval expedition, a wealthy man of that era expected to receive some benefit from his investment. Therefore, the naval team that received a loan from him began to engage not only in scientific research, but also in financial research. Rich, previously unseen places were discovered in India and Central America, and the treasures found there in the form of plant crops and precious metals were often so huge that they could not be transported. Then the ship's accounting department registered the discoveries for itself, and the right to dispose of them was transferred to the sponsor. The team could keep some of it for themselves. A similar model still works today, where a wealthy sponsor has turned into an investor, a ship's crew into a broker, and treasures into securities and assets.

Entire meetings of wealthy people were born with the goal of sending ships to distant lands, and their legal entity consisted of several individuals united in joint-stock funds. To attract big money, such funds put up for sale the right to own part of the treasures found by sponsoring the next voyage. Ownership rights were sold on separate sites. This is how stock exchanges appeared.

Forex

Sergei Romanchuk believes that the main short-term factor in the formation of the ruble exchange rate now is the purchase of foreign currency by the Central Bank for the Ministry of Finance as part of the implementation of the budget rule. The situation on the foreign exchange market will largely depend on the actions of the regulator.

As a result of strong fluctuations in the ruble exchange rate, the Bank of Russia decided not to purchase foreign currency on the domestic market as part of the implementation of the fiscal rule mechanism from August 23, 2018 until the end of September 2021. The decision was made in order to increase the predictability of the actions of monetary authorities and reduce the volatility of financial markets. The decision to resume the purchase of foreign currency will be made taking into account the actual situation in the financial markets, which will be observed during September 2021.

However, many experts say that the weakening of the ruble may continue. Yaroslav Kabakov , Deputy General Director of Finam Investment Company, spoke about the high probability of further weakening of the ruble, why non-residents are important in our market, as well as a possible rally in the gold market.

, the head of the Association of Forex Dealers, Evgeny Masharov, personally listened to citizens who contacted the AFD with questions regarding trading on the Forex market. The tradition of holding personal receptions for the population arose in the AFD last year. This format for processing appeals has proven its effectiveness. It allows you to establish maximum mutual understanding with consumers of financial services and build a system for protecting their rights.

The Moscow International Monetary Association held its annual meeting of its members at the Stanislavsky Electrotheater. There were jokes about the connection between the market and the theater. But when it came to economic forecasts, no one was laughing. The invited experts considered the current situation in the markets extremely alarming.

However, not all experts see the future of the country’s financial market in a negative light. Some experts believe that the sell-off in the Russian financial market is driven by emotions. But there are no fundamental factors for the depreciation of the ruble and Russian shares.