Serious investments in any securities imply that a person has nowhere to put money, of which he has too much. This popular opinion can often be heard even now.

Of course, among professional investors there are rich people, billionaires, owners of factories, newspapers and ships. And for them, investment is one of the ways to achieve self-expansion of capital. As Karl Marx once taught. And another prominent theorist of the now abolished Marxism-Leninism taught that one cannot live in society and be free from it.

This is also true for investments. The modern state is built in such a way that you have to take care of your future old age on your own. This means that it is necessary to make savings whenever possible and, preferably, to make them more efficient than pension funds. The only available option for this is investment.

Investor's goal

The main goal of any investor is to make a profit as a result of successful investments of their financial resources or other assets (real estate, cars, shares, etc.).

The bottom line is this: you have free money (surplus from funds allocated for current expenses) or other assets and you want them not only to be preserved, but to increase, you invest them in various projects from which you can get

- or a fixed percentage of income (bank deposit, bonds, treasury bills),

- or income/loss without any guarantees (business projects, investments in shares, precious metals, etc.

How to correctly assess investment risk

By properly assessing the risks, you can reduce the likelihood of their occurrence. All assessment methods are divided into two large groups: qualitative and quantitative.

Qualitative risk assessment methods include:

- The method of analogies takes into account the experience gained during the implementation of similar investment projects.

- The Delphi method involves studying the opinions of experts on specific issues.

- Method for calculating the appropriateness of costs - possible threats to investments are studied for each stage of investment, which allows you to promptly stop investments if difficulties arise.

Quantitative assessment involves the use of one of the following types of analysis:

- Monte Carlo method - building a risk-increasing model to study consequences.

- Analysis of possible options for the development of the project by changing its significant parameters.

- Determination of the maximum stability of the project.

- Analysis of the sensitivity of the project to changes in individual parameters.

To calculate investment risks as accurately as possible, several assessment methods should be used at once. In addition, risk analysis can be entrusted to experts - for example, financial advisors.

Investment objects for investors

Investment objects are assets in which an investor invests his funds . These traditionally include

- real estate (land, buildings, structures);

- equipment and vehicles that can be used to make a profit;

- precious metals (gold, silver, diamonds);

- works of art;

- intellectual property rights (for example, registered brands, patents, etc.);

- bank deposits;

- shares in ETF funds and investment funds;

- securities (shares with payment of dividends on them, bonds, bills, depositary receipts, warrants, etc.);

- investments in Forex (PAMM accounts, RAMM autocopy accounts, own trading on the Forex market and exchanges, etc.).

An important clarification in the form of a problem from the Masterforex-V wiki : is the purchase of an apartment an investment object:

a) no, if you bought it for personal residence;

b) yes, if you rent it out, receiving income that exceeds utility bills and other payments for its maintenance and upkeep.

Subjects of investments

These are the investors themselves, who are conventionally divided into

a) private investors managing personal funds;

b) institutional investors - a legal entity that has received a license from the state to accept funds from the population (contributions, shares) and manage them through investing them in securities and real estate in order to make a profit. In the modern world, these are investment banks and investment funds, mutual funds and pension funds, insurance organizations and credit unions. They do not operate with their personal (or not only their) assets. These are banks, investment and pension funds and other large players. Read more about institutional investors in the next section.

c) state and municipal authorities , which can invest funds from the state budget or municipality (city council, district council) in certain investment projects that are significant for the population (for example, a waste treatment plant, a wind power station, etc., which after launch would make a profit and carried a social burden within the framework of the development strategy of the state or its region).

An important clarification in the form of a problem from the Masterforex-V wiki : is the construction of “social housing” for state employees an “investment” on the part of the state or the city mayor’s office (as this construction is usually called in politics)?

Of course not, because... it does not provide a return for the investor.

How is it absolutely legal not to pay income tax?

There is a loophole that allows you to avoid income tax We are talking about an IIS (individual investment account), every resident of the Russian Federation can open it, and the state compensates for 13% of the tax. We are interested in this opportunity because with the help of IIS you can absolutely legally invest in bonds, receive income from this and receive tax compensation from the state. In this case, you will not be charged income tax. I have already talked about where it is better to open an individual investment account.

Among the limitations I would like to note:

- You cannot deposit more than 1,000,000 rubles per year . is no income tax and no limits on the amount, but a tax deduction can be obtained with a maximum of 400,000 rubles;

- an individual cannot open several individual accounts;

- your funds essentially frozen for 3 years, you cannot partially or fully withdraw the money early. Or rather, you can withdraw them, but you can forget about the tax benefit in this case; you will have to pay 13% on the profit received;

- money can be transferred to IIS only from your bank account;

- 3 years is the minimum period for which residents of the Russian Federation can open an IIS; if desired, the agreement can be concluded for a longer period. In the video below, the advantages of IIS are described in great detail.

The most important thing is that there are no restrictions on working with stocks, bonds and other types of securities. This practice has long been widespread in the world, for example, in the USA a similar scheme has been operating since 1974, in the UK since 1999, and in Canada since 2009.

Types and Types of Investors

Economists conditionally divide investors into the following groups:

- Strategic investor - an investor interested in acquiring a large block of shares in an enterprise to participate in its management;

- A portfolio investor is not interested in purchasing enterprises for the sake of control over them, but in acquiring blocks of shares in the most promising companies to receive dividends and profits on the bullish trend of its exchange rate fluctuations on the stock exchange. Read more about the types of portfolio investors in the “Investment Portfolio” section.

- A foreign investor has the right to engage in investments outside the country of his registration. This standard is determined for many offshore companies by financial regulators and their licenses in these countries - IFSC (Belize), FSC (Mauritius), Botswana IFSC (Botswana), etc.

- The nominee investor is registered as the owner of the securities, but is not their owner. This scheme is also traditionally used in the network of offshore registrations to make it difficult to find the real owner of the company (for example, the owner of the securities according to the documents is offshore No. 1, which belongs to offshore No. 2, which in turn belongs to offshore No. 3).

- Institutional investor - a legal entity licensed by regulators to operate in a given country (Central Bank of the Russian Federation, SEBI, FSCL, MAS, ASIC, MAS, BaFin, CNMV, AMF, FINMA, FCA, ) and other regulatory authorities to work with clients and financial instruments THIS country. Feature: within the European Union, an institutional investor only needs to obtain a license from one country (for example, CySEC Cyprus) to operate throughout the EU)

- A Qualified Institutional Investor is the same institutional investor licensed by a US regulator (NFA, CFTC or SEC) to operate in the financial markets of the United States of America.

- A venture investor invests in innovative projects that have high risk but great potential (IT industry, Internet projects, biotechnology, nanotechnology, etc.).

- Anchor Investor - the first to invest a significant amount of money in capital, giving confidence to subsequent investors.

- “Angel” investor – provides not only financial, but organizational, technical, expert or any other support.

- Securities investors - invest in securities of stock exchanges (shares, bonds, derivatives, stock (exchange) indices, warrants, depositary receipts, forward contracts, etc.);

- Forex and cryptocurrency investors invest in PAMM or RAMM accounts and trade independently as traders through one of the Forex brokers as a trader).

Calculation of purchases using an example

Working with bonds and calculating future income is not very difficult. For example, purchasing a federal loan bond with a coupon income of 10% per annum will provide, according to the compound interest formula, an income of not 30% over three years, but 32%.

A difference of 2% may seem small at first glance. But if, for example, an investor invests an amount of 10 million rubles in OFZ, then his benefit will be at least 200,000 rubles. The amount, even by today’s standards, is considerable.

Securities investors

The richest group of investors in the world . Thus, as of April 1, 2019, the capitalization of all the largest stock exchanges in the world amounted to 84.1 trillion. dollars. The largest exchanges for investors are:

- New York Stock Exchange – 23.211 trillion USD.

- NASDAQ: No. 2 stock exchange in the world – $11.218 trillion.

- Tokyo Stock Exchange – $5.608 trillion.

- Shanghai Stock Exchange SSE – $5.013 trillion.

- Hong Kong Stock Exchange HKE – $4.307 trillion.

- Euronext exchange (Paris, Amsterdam, Brussels, Lisbon, Dublin) – $4.268 trillion.

- London Stock Exchange LSE – $3.965 trillion.

- Shenzhen Stock Exchange SZSE – $3.355 trillion.

- Toronto Stock Exchange – $2.216 trillion.

- Bombay Stock Exchange BSE – $2.179 trillion.

- National Stock Exchange of India – $2.156 trillion.

- Frankfurt Stock Exchange - $1.867 trillion.

- Swiss Stock Exchange - $1,603 billion;

- Korean Stock Exchange - $1,468 billion;

- OMX Nasdaq Nordic Exchange (Vilnius, Iceland, Copenhagen, Riga, Stockholm, Tallinn, Helsinki, Armenian stock exchanges) - $$1.432 trillion.

- Australian Stock Exchange ASX - $1.384 trillion.

- Taiwan TWSE - $1.041 trillion.

- Johannesburg Stock Exchange (South Africa) - $0.950 trillion.

- Sao Paulo Stock Exchange (Brazil) - $820 billion;

- Madrid Stock Exchange - $0.770 trillion.

- Singapore Stock Exchange - $0.715 trillion.

- Moscow Stock Exchange MOEX - $636 billion.

In the first place among investment objects among investors of stock exchanges are stock (exchange) indices - incl. Dow Jones 30 Index, DAX 30 Index, FTSE 100, S&P 500, Euro Stoxx 50, NASDAQ-100, NASDAQ National Market Composite, NASDAQ Biotechnology Index, S&P/TSX 60 (Toronto Stock Exchange's main index), SSE Composite (Shanghai Stock Exchange's main index) Stock Exchange), SSE 50 (Shanghai Stock Exchange Blue Chip Index), NIKKEI 225 Index (Tokyo Stock Exchange Core Stock Index), TOPIX Core 30 (Tokyo Stock Exchange Blue Chip Index), MDAX Index (explained why it is more attractive, than DAX-30?), TecDAX., Hang Seng Index (HSI) - the main index of the Hong Kong Stock Exchange, SZSE Component Index (SZI) - the main stock index of the Shenzhen Stock Exchange, BSE SENSEX 30 - the main index of the Bombay Stock Exchange, BSE SENSEX 30- the main index of the Bombay Stock Exchange, the Moscow Exchange Index (MICEX) - the main ruble stock index MOEX, the RTS Index - the main dollar stock index of the Moscow Exchange, MOEXBC - the blue chip index of the Moscow Exchange, SMI 20 (Swiss Market Index) - the main stock index of the Swiss stock exchange; S&P/ASX 200 is the main index of the Australian Securities Exchange; TAIEX is the main index of the Taiwan Stock Exchange; FTSE/JSE Top 40 (JTOPI) is the blue chip index of the Johannesburg Stock Exchange.

Next in popularity among investors are blue chips - issues of shares of the largest issuers of a particular stock exchange, bonds, derivatives, options, warrants, depositary receipts, forward contracts, etc.

Forex and cryptocurrency investors

Invest in trading forex currency pairs (EUR USD, GBP USD, USD JPY, USD CHF, USD CAD, NZD USD, AUD USD, USD RUB, EUR RUB, USD UAH, USD BYN, USD SEK, USD NOK, etc.) in PAMM or RAMM accounts.

Investments in forex currency pairs go through forex brokers. In the Masterforex-V Academy rating they are conditionally divided into 3 leagues:

- Major league of proven and recommended brokerage companies for working in financial markets : 1. Nord FX, 2. Dukascopy Bank SA, 3. FXPro, 4. Interactive Brokers, 5. Alpari (Alpari), 6. Swissquote Bank SA, 7. OANDA ( Oanda), 8. FXCM, 9. Saxo Bank (Saxo Bank), 10. FOREX.com, 11. FIBO Group, 12. Fort Financial Services (FortFS), 13. Finam (Finam).

- 2nd league of popular but dubious companies with a large number of complaints from traders Masterforex-V - 1 Forex Club 2 RoboForex 3 InstaForex 4 Forex4you 5 eToro 6 TeleTrade (Teletrade) 7 MaxiMarkets 8 EXNESS 9 AlfaForex 10 DF Markets 11 NPBFX (Nefteprombank) 12 AMarkets 13 FreshForex 14 Grand Capital 15 BCS Forex 16 Larson&Holz 17 Market index 18 Weltrade 19 Forex Optimum Group Limited 20 ForexTime 21 Forex Trading22 World Forex 23 Key to Markets 24 LiteForex 25 FXOpen 26 FinmaxFX 27 Pepperstone 28 MTrading 29 Tickmill 30 GKFX 31 IC Markets 32 PROFIT Group 33 XTrade 34 XM.com 35 X-Trade Brokers 36 Admiral Markets 37 IG Markets 38 StreamForex 39 ForexStart 40 E-XUN Asia Company Limited 41 iFOREX 42 CapTrader 43 Real Trade 44 AxiTrader 45 IronFX 46 Easy-Forex 47 Kalita Finance 48 ActivTrades 49 TurboForex 50 HotForex51 IFC Markets 52 HY Capital Markets

- 3rd (minor league) of the Masterforex-V rating: dubious and little-known forex brokers: - 1 ForexMart 2 EverFX 3 JustForex 4 vtb forex 5 Real-Forex 6 FXCH 7 FX Primus 8 Corsa Capital 9 Vantage FX 10 AAAFX 11 GAINSY 12 FXDD 13 AGEA 14 PaxForex 15 Hotspot FX 16 ETX Capital 17 NSFX 18 TenkoFX 19 BMFN 20 FXall 21 GDMFX 22 ORBEX 23 vPE Bank 24 UFXMarkets 25 ICM Capital 26 Land-FX 27 FXFlat 28 Forex ee 29 Sucden Financial 30 Tallinex 31 FinFX 32 ATC BROKERS 33 Deltastock 34 Blackwell Global 35 Varengold Bank 36 FXCC 37 OneTrade 38 AccentForex 39 Squared Financial 40 Forex EuroClub 41 Finotec 42 Windsor Brokers 43 Renesource Capital 44 London FX 45 Nordhill Capital 46 FxGlory 47 Yadix 48 Hantec Markets 49 GCI Financial Ltd50 FBS Markets Inc. 51 NetoTrade 52 NTFX 53 TFI FX 54 YA-HI.com 55 GO MARKETS 56 Synergy FX 57 STRATO Markets 58 xCFD 59 AvaFX 60 Tradeview Forex 61 Corner Trader 62 FXGM 63 FXPremax 64 Profiforex 65 WH SelfInvest 66 FXTSwiss 67 RBC Forex 68 Royal Forex 69 STO 70 VINSON FINANCIAL

Why invest and how to start doing it

Brokerage services are provided by PJSC Sberbank (Bank), general license of the Bank of Russia for banking operations No. 1481 dated August 11, 2015, license for the provision of brokerage services No. 045-02894-100000 dated November 27, 2000.

You can obtain detailed information about the Bank's brokerage services by calling 8-800-555-55-50, on the website or at the Bank's branches. This website also contains the current conditions for the provision of brokerage and other services. Changes in conditions are made by the Bank unilaterally.

The content of this document is provided for informational purposes only and does not constitute an advertisement of any financial instruments, products, services or an offer, obligation, recommendation, or inducement to engage in transactions on the financial market. Despite receiving information, you independently make all investment decisions and ensure that such decisions comply with your investment profile in general and in particular with your personal ideas about the expected profitability from operations with financial instruments, the period of time for which such profitability is determined, as well as the acceptable You are at risk of losses from such transactions. The Bank does not guarantee income from the operations with financial instruments specified in this section and is not responsible for the results of your investment decisions made on the basis of the information provided by the Bank. No financial instruments, products or services mentioned herein are offered or sold in any jurisdiction where such activity would be contrary to securities laws or other local laws and regulations or would subject the Bank to compliance with registration in such jurisdiction. In particular, we would like to inform you that a number of states (in particular, the United States and the European Union) have introduced a sanctions regime that prohibits residents of the relevant states from acquiring (assisting in the acquisition) of debt instruments issued by the Bank. The Bank invites you to ensure that you are eligible to invest in the financial instruments, products or services mentioned herein. Therefore, the Bank cannot be held liable in any way if you violate any prohibitions applicable to you in any jurisdiction.

Information about financial instruments and transactions with them, which may be contained on this website and in the information posted on it, is prepared and provided impersonally for a certain category or for all clients, potential clients and counterparties of the Bank not on the basis of an investment consulting agreement and not based on the investment profile of site visitors. Thus, such information represents information that is universal for all interested parties, including publicly available information about the ability to carry out transactions with financial instruments. This information may not correspond to the investment profile of a particular site visitor, may not take into account his personal preferences and expectations for the level of risk and/or return and, thus, does not constitute an individual investment recommendation to him personally. The Bank reserves the right to provide website visitors with individual investment recommendations solely on the basis of an investment consulting agreement, solely after determining the investment profile and in accordance with it. The terms of use of information when carrying out activities on the securities market can be found at the link.

The Bank cannot guarantee that the financial instruments, products and services described therein are suitable for persons who have read such materials. The Bank recommends that you do not rely solely on the information you have been provided with in this material, but rather make your own assessment of the relevant risks and, if necessary, engage independent experts. The Bank is not responsible for financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.

The Bank makes reasonable efforts to obtain information from sources it believes to be reliable. However, the Bank makes no representation that the information or estimates contained in this information material are true, accurate or complete. Any information provided in this document is subject to change at any time without notice. Any information and estimates contained herein do not constitute terms of any transaction, including any potential transaction.

Financial instruments and investment activities involve high risks. This document does not contain a description of such risks, information about the costs that may be required in connection with the conclusion and termination of transactions related to financial instruments, products and services, as well as in connection with the performance of obligations under the relevant agreements. The value of shares, bonds, investment shares and other financial instruments may decrease or increase. Past investment performance does not determine future returns. Before entering into any transaction in a financial instrument, you must ensure that you fully understand all the terms of the financial instrument, the terms of the transaction in such instrument, and the legal, tax, financial and other risks associated with the transaction, including your willingness to bear significant losses.

The bank and/or the state does not guarantee the profitability of investments, investment activities or financial instruments. Before making an investment, you must carefully read the conditions and/or documents that govern the procedure for its implementation. Before purchasing financial instruments, you must carefully read the terms and conditions of their circulation.

The Bank draws the attention of Investors who are individuals to the fact that funds transferred to the Bank as part of brokerage services are not subject to the Federal Law of December 23, 2003. No. 177-FZ “On insurance of deposits of individuals in banks of the Russian Federation.

The Bank hereby informs you of the possible existence of a conflict of interest when offering the financial instruments discussed in the information materials. A conflict of interest arises in the following cases: (i) the Bank is the issuer of one or more financial instruments in question (the recipient of the benefit from the distribution of financial instruments) and a member of the Bank’s group of persons (hereinafter referred to as the group member) simultaneously provides brokerage services and/or (ii) a group member represents the interests of several persons simultaneously when providing them with brokerage or other services and/or (iii) a group member has his own interest in performing transactions with a financial instrument and simultaneously provides brokerage services and/or (iv) a group member acts in the interests of third parties or interests another group member, maintains prices, demand, supply and (or) trading volume in securities and other financial instruments, including acting as a market maker. Moreover, group members may have and will continue to have contractual relationships for the provision of brokerage, custody and other professional services with persons other than investors, and (i) group members may receive information of interest to investors and participants the groups have no obligation to investors to disclose such information or use it in fulfilling their obligations; (ii) the conditions for the provision of services and the amount of remuneration of group members for the provision of such services to third parties may differ from the conditions and amount of remuneration provided for investors. When resolving emerging conflicts of interest, the Bank is guided by the interests of its clients. More detailed information about the measures taken by the Bank regarding conflicts of interest can be found in the Bank’s Conflict of Interest Management Policy, posted on the Bank’s official website: (www.sberbank.com)

Sberbank Asset Management JSC was registered by the Moscow Registration Chamber on 04/01/1996. License of the Federal Commission for the Securities Market of Russia to carry out activities related to the management of investment funds, mutual funds and non-state pension funds No. 21-000-1-00010 dated 09/12/1996. License of the Federal Securities Commission of Russia No. 045-06044-001000 dated June 7, 2002 to carry out securities management activities. Familiarize yourself with the terms and conditions of asset management, obtain information about Sberbank Asset Management JSC and other information that must be provided in accordance with current legislation and other regulatory legal acts of the Russian Federation, as well as obtain detailed information about mutual investment funds (hereinafter referred to as mutual funds) and You can familiarize yourself with the rules of trust management of the mutual fund (hereinafter referred to as the mutual fund trust management rules) and other documents provided for by the Federal Law of November 29, 2001 No. 156-FZ “On Investment Funds” and regulations in the field of financial markets at: 121170, Moscow , st. Poklonnaya, 3, bldg. 1, floor 20, on the website https://www.sberbank-am.ru, by phone: (495) 258-05-34. Information to be published in a printed publication is published in the “Appendix to the Bulletin of the Federal Service for Financial Markets.” The value of investment shares may increase and decrease, the results of investing in the past do not determine future income, and the state does not guarantee the profitability of investments in mutual funds. Before purchasing an investment share, you should carefully read the mutual fund's policy. The Mutual Fund PDU provides for premiums (discounts) to (c) the estimated value of investment units upon their issuance (redemption). Charging premiums (discounts) will reduce the profitability of investments in mutual fund investment units. The performance of the securities manager in the past does not determine the future income of the management founder. In relation to mutual funds, the Risk/Income levels are indicated based on the generally accepted understanding of how the specified investment objects are located on the risk-return scale. “Risk” and “Income” in relation to mutual funds do not mean the acceptable risk and expected return provided for by Bank of Russia Regulation No. 482-P dated August 3, 2015. Open Investment Fund RFI "Sberbank - Bond Fund "Ilya Muromets" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on December 18, 1996 under No. 0007-45141428. Open Investment Fund RFI "Sberbank - Share Fund "Dobrynya Nikitich" - the rules of trust management of the fund are registered by the Federal Financial Markets Service of Russia on April 14, 1997 under No. 0011-46360962. Open Investment Fund RFI "Sberbank - Balanced Fund" - the rules of trust management of the fund were registered by the Federal Financial Markets Service of Russia on March 21, 2001 under No. 0051-56540197. Open Investment Fund RFI “Sberbank – Small Capitalization Share Fund” - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on March 2, 2005 under No. 0328-76077318. Open Investment Fund RFI "Sberbank - Perspective Bond Fund" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on March 2, 2005 under No. 0327-76077399. Open Investment Fund RFI "Sberbank - Natural Resources" rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on August 31, 2006 under No. 0597-94120779. Open Investment Fund RFI "Sberbank - Telecommunications and Technologies" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on August 31, 2006 under No. 0596-94120696. Open Investment Fund RFI "Sberbank - Electric Power Industry" - the rules of trust management of the fund were registered by the Federal Financial Markets Service of Russia on August 31, 2006 under No. 0598-94120851. Closed real estate mutual fund "Commercial Real Estate" - the rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on August 25, 2004 under No. 0252-74113866. Open Investment Fund RFI "Sberbank - America" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on December 26, 2006 under No. 0716-94122086. Open Investment Fund RFI "Sberbank - Consumer Sector" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on March 1, 2007 under No. 0757-94127221. Open Investment Fund RFI "Sberbank - Financial Sector" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on August 16, 2007 under No. 0913-94127681. Open Investment Fund RFI "Sberbank - Active Management Fund" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on October 11, 2007 under No. 1023-94137171. Open Investment Fund RFI "Sberbank - Emerging Markets" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on September 28, 2010 under No. 1924–94168958. Open Investment Fund RFI "Sberbank - Europe" - the rules of trust management of the fund were registered by the Federal Financial Markets Service of Russia on February 17, 2011 under No. 2058-94172687. Open Investment Fund RFI "Sberbank - Global Internet" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on June 28, 2011 under No. 2161-94175705. Open Investment Fund RFI "Sberbank - Global Debt Market" - rules for trust management of the fund were registered by the Federal Financial Markets Service of Russia on November 30, 2010 under No. 1991-94172500. Open investment fund RFI "Sberbank - Gold" - the rules of trust management of the fund were registered by the Federal Financial Markets Service of Russia on July 14, 2011 under No. 2168-94176260. OPIF RFI "Sberbank - Eurobonds" - rules for trust management of the fund are registered by the Federal Financial Markets Service of Russia on March 26, 2013 under No. 2569. OPIF RFI "Sberbank - Biotechnologies" - rules for trust management of the fund are registered by the Bank of Russia on 04/23/2015 under No. 2974. Closed-end real estate mutual fund "Sberbank - Residential" real estate 3" - rules for trust management of the fund were registered by the Bank of Russia on 08/27/2015 under No. 3030. Closed-end real estate mutual fund "Sberbank - Rental Business" - rules for trust management of the fund were registered by the Bank of Russia on 02/25/2016 under No. 3120. Open-end mutual fund RFI "Sberbank - Global Engineering" — rules for trust management of the fund were registered by the Bank of Russia on 07/05/2016 under No. 3171. Closed-end real estate mutual fund “Sberbank – Rental Business 2” — rules for trust management of the fund were registered by the Bank of Russia on 09/29/2016 under No. 3219. Open-end mutual fund RFI “Sberbank – Denezhny” rules for trust management of the fund registered by the Bank of Russia on November 23, 2017 under No. 3428. Combined closed-end mutual fund "Sberbank - Rental Business 3" - rules for trust management of the fund were registered by the Bank of Russia on January 23, 2018 under No. 3445. BUIF of market financial instruments "Sberbank - Moscow Exchange Total Return Index "gross"" (BUIF of market financial instruments "Sberbank - MOEX Russia Total Return") - rules of trust management of the fund were registered by the Bank of Russia on August 15, 2018 under No. 3555. BUIF of market financial instruments "Sberbank" - Moscow Exchange Government Bonds Index" - rules for trust management of the fund were registered by the Bank of Russia on December 24, 2018 under No. 3629. BPIF of market financial instruments "Sberbank - Moscow Exchange Index of Russian Liquid Eurobonds" - rules of trust management of the fund were registered by the Bank of Russia on December 28, 2018 under No. 3636. BPIF market financial instruments "Sberbank - S&P 500" - the rules for trust management of the fund were registered by the Bank of Russia on 03/19/2019 under No. 3692. Open-end investment fund RFI "Russian dollar bonds" - the rules of trust management of the fund were registered by the Bank of Russia on 04/02/2019 under No. 3706.

Mobile application "Sberbank Investor" (0+). Available for free download from official app stores for use on iPhone® mobile devices (which are trademarks of Apple Inc., registered in the US and other countries) and Android® mobile platforms (which is a registered trademark of Google Inc.). The developer of the Sberbank Investor mobile application is ARKA Technologies LLC, OGRN 1055407002452, address 630007, Novosibirsk, st. Kommunisticheskaya, 2. Rights to use are granted by Sberbank PJSC under license. There is no commission charged for using the Sberbank Investor Mobile application. Please check the amount of commission for transactions.

The manager's mobile application is available for free download in official application stores for use on iPhone® mobile devices (are trademarks of Apple Inc., registered in the United States and other countries) and Android® mobile platforms (is a registered trademark of Google Inc.). The developer of the Sberbank Asset Management mobile application is Sberbank Asset Management JSC, OGRN 1027739007570, address 123317, Moscow, Presnenskaya embankment, building 10. Use rights are granted to Sberbank PJSC under a license. There is no fee for using the Sberbank Asset Management Mobile application. The amount of commission for transactions of trust management of assets can be found on the website of the management company: www.sberbank-am.ru

The information presented on this website is for informational purposes only, does not contain guarantees of the reliability of possible investments and the stability of the amounts of possible income or costs associated with these investments, and is not a statement of possible benefits associated with asset management methods; is not a promise of payment of income, is not a forecast of an increase in the market value of securities; does not constitute an offer of any kind. Investments in the securities market involve risk. The value of assets can go up and down. Past investment performance does not determine future returns. The Bank does not bear any responsibility for financial or other consequences that may arise as a result of investments made by you based on the information provided on this website. You must make your own assessment of the risks without relying solely on the information you have been provided with. We recommend that you obtain your own legal, tax, financial, accounting and other appropriate professional advice regarding the consequences of purchasing the financial instruments, products or services discussed herein. Brokerage services are provided by PJSC Sberbank (Bank), general license of the Bank of Russia for banking operations No. 1481 dated August 11, 2015, license for the provision of brokerage services No. 045-02894-100000 dated November 27, 2000.

Great traders and investors of the stock exchange and forex

The names of the most significant figures among forex and stock exchange investors are inscribed in gold letters: Warren BUFFETT, George SOROS, Jesse LIVERMORE, Ingeborge MOOTZ, John BOLLINGER, Larry WILLIAMS, Case Cynthia, Bill WILLIAMS, James SIMONS, Ken Griffin, Paul JONES, Hetty GRINN, JOHN DOUGLAS ARNOLD, William GUNN, Laura PEDERSEN, Alexander Elder, Alexander Gerchik (until he created a “kitchen broker” operating without licenses), Charles Dow, Thomas DEMARK, Steve NEESON, Glenn NEELY, Robert PRECTER and others.

Investment portfolio

To reduce the risk of going broke from investing in one asset , all experienced investors make up an investment portfolio in which they accumulate different currencies and securities. In a broad sense, an example of an investment portfolio can be called ETF funds.

Portfolio investors are divided into three characteristic types:

A) Conservative . Prefers not to take risks, investing in ultra-reliable securities with high security but low profitability. For example, debt securities of the USA, Switzerland and other countries with the maximum credit rating. B) Moderately aggressive . Prefers not to play on exchange rate fluctuations. Invests for a long term, allowing you to receive higher returns. Dilutes risky securities with less profitable but safer ones. B) Aggressive . Invests in risky securities and speculates on price fluctuations. Investments are not long-term, they are aimed at obtaining the fastest possible results.

What are they and why are they needed?

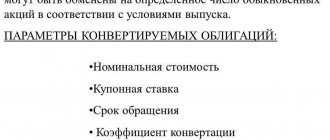

Bonds in a general definition are special debt securities that are issued (issued) by a company or state in order to attract money from investors (creditors). They are needed to implement some investment projects, as well as to cover the state budget deficit.

The person who bought the bonds is the debt holder or creditor. For the fact that he purchased bonds, i.e. has actually lent money to the person who issued the bond, the issuer is obligated to pay interest on the debt. Plus at the end of the term - the entire principal debt.

Generally, interest is paid on a bond over the life of the bond. Interest is paid periodically - every month, quarter or once a year. Upon expiration of the bond, the creditor receives from the debtor the entire amount of the debt and interest for the entire period of the bond.

Until recently, bonds were issued only in paper form. For example, “OFZ - People’s” still have a paper format in order to expand access for individuals to this debt investment instrument.

Currently, most securities, including government and corporate bonds, are electronic. Those. all characteristics and parameters of the security are encoded with a special digital code.

Figure 1. General view of paper OFZs - folk ones.

Purchased bonds, in addition to bringing profit to the investor in the form of interest, can also be sold on the market (for example, on the Moscow Stock Exchange MOEX) when their price rises. Those. The owner of an OFZ or any other bond receives two types of profit:

Figure 2. Components of profit factors from holding OFZ.

- Interest or coupon income. It is similar to a bank deposit.

- The amount of profit is also the difference between the purchase price of a bond and its sale price on the financial instruments market.

It should be noted here that each of the 2 components of the profit parameters from owning OFZs can be significantly higher than the yield on the same bank deposits. For example, interest income can be increased through the use of special techniques or bond strategies.

Scheme of work of invested capital taking into account compound interest.

They are based on the mathematical function of compound interest (geometric progression). The income from the sale can be a decent amount if the demand for OFZ in the market exceeds the supply. In some cases, the income from the sale of OFZ on the market can amount to tens of percent.

State goals

Since the issuer of OFZ is the state (directly represented by the Ministry of Finance of the Russian Federation and the Central Bank of the Russian Federation), by distributing these debt securities, it pursues its specific goals. This:

- replenishment of the state budget by attracting money from private investors;

- obtaining funds for the purchase of foreign currency;

- creating conditions under which the base of retail investors expands at the expense of individuals. Thus, the state, in addition to borrowing money, involves a considerable part of ordinary people in the investment process, expanding its social support base.

In addition, the government's issue of bonds is often associated with the task of increasing the money supply in the country's economy, but without using the issue of unsecured money (non-inflationary issue).

Validity

OFZ - folk or “OFZ-N” have a validity period of 3 years.

This period is optimal from the point of view of capital performance and at the same time, the investor can periodically change the securities in his portfolio without fear of tax consequences. Coupon payments - every six months (6 months).

Investor rights

The rights of investors are legally protected in each state, because this is a mandatory and necessary condition for receiving investment. Thus, in Russia, these rights are spelled out in Article 6 of the Federal Law “On investment activities in the Russian Federation, carried out in the form of capital investments.” In particular,

- the investor has the right to carry out investment activities in the form of capital investment, with the exception of cases established by the laws of the Russian Federation;

- the investor has the right to independently determine the volume and direction of investments, enter into agreements with other subjects of investment activity, while adhering to the provisions of the Civil Code of the Russian Federation;

- transfer your rights to investments and their results to other individuals or legal entities, municipal and state bodies, while adhering to Russian legislation;

- control the intended use of funds allocated as investments;

- combine own and borrowed funds with the assets of other investors to make joint investments;

- exercise other rights that are provided for in the investment agreement, if they do not contradict the legislation of the Russian Federation.

For example, transferring assets into trust management is highly popular among investors who want to make a profit from their assets, but do not have enough experience and time to develop strategies and understand the essence of the terms bears, margin, TIC, Lot, Spread, Ask, Bid, etc.

Advantages of corporate bonds

Corporations need money too.

And, which is typical, also constantly. A company's capitalization directly speaks to its effectiveness. They can borrow money from a bank. Or maybe from investors. Bonds are a type of “IOU.”

Corporate bonds of large companies are almost always redeemed according to the terms specified in the purchase agreement. Corporations almost never disappear without a trace or appear out of nowhere. As a result, there is always “someone to ask for money.” Interest on corporate bonds is low but pays consistently and consistently.

It is recommended that you read the terms of purchase (including the fine print).

Investor Rules

Making a profit from investments only at first glance seems like a simple task. In order to steadily increase capital and not go broke as a result of one failed deal, investors need to adhere to the basic rules.

- Create your own informal investment fund . Set aside part of the profits received from various sources - wages, bonuses, birthday gifts, inheritance, lottery winnings, etc.

- Learn to distribute income wisely, and you will be surprised how much free money you will have left when you eliminate many expenses that you can completely do without. At the first stage, you may have to deprive yourself of some of the joys of life, but properly invested savings will allow you to more than compensate for everything in the future.

- Be careful when investing with borrowed funds. By investing your personal capital, you only risk your own savings. If you lose borrowed funds on a failed investment, you will find yourself in a debt trap. This does not mean that you cannot invest borrowed funds, you need to understand all the risks and have a plan for all cases. For example, governments often borrow by issuing government bonds to invest in creating new jobs, improving infrastructure, and other projects.

- Find an effective strategy , develop a plan and stick to it (as Masterforex-V trading strategies are described above).

- Don't panic when faced with losses . In the investment market, it is difficult to make a profit from absolutely all trades, but if you are confident in your strategy, stick to the plan and successful trades will cover the losing ones.

- Stick to money management and diversify risks . A famous saying goes: “Don’t put your eggs in one basket.” Distribute funds among different investment projects, if one turns out to be a failure, in the worst case you will not lose all your funds, in the best case you will still be in the black.

- Avoid deals based on emotions . They can lead to very high profits, but this is a matter of pure luck and luck. In the long term, this approach results in losses.

- Invest in an industry that you are well versed in , or hire people who are knowledgeable about it for the project.

- If you yourself have little understanding of the financial market, transfer your assets to trust management or invest in a Mutual Investment Fund (UIF).

- Choose your partners responsibly - brokers , market makers, trustees, partners, etc.

Strategy

There are two main investment strategies: passive and active (active).

When choosing a passive strategy, the investor buys shares and holds them for a significant period of time. This strategy is sometimes called "buy and hold." In this case, the investor is not interested in short-term fluctuations in the stock price. He waits out the ups and downs of stocks because he believes in their growth over the long term. With this strategy, the investor usually carefully selects the company whose shares he is going to buy.

Today, shares of more than 800 companies are traded on the Russian market. Among them there are companies that are very positively assessed by the market; their shares are quite expensive. These include blue chips. The shares of these companies will continue to rise in price, but the growth rate will be small.

Along with this, there are young companies on the market that are undervalued and have significant growth potential.

When choosing an active strategy, the investor tries to predict price changes in the near future. When prices rise, he sells them, receives money and waits for the price of shares to decrease in order to buy them cheaper. Through active operations, an investor can significantly increase the profitability of their investments.

Many investors try to carry out such operations, but they are not always successful, since this requires certain knowledge and skills. Those who know how to do this are far ahead in terms of profitability of investors who have chosen a passive strategy.

Investments in the securities market always involve risk.

Risk refers to the likelihood that a person will not receive the expected return or will lose his money. Even when buying shares of successful companies, an investor can make a loss.

Each person has his own attitude towards risk. Some people are ready to take risks in order to receive the high income that stocks can bring, while others are not ready to take risks and prefer to keep their money in a bank deposit with a low but guaranteed return.

Investor risks

On the financial path of investors, a huge number of risks lie in wait, which analysts will conditionally divide into the following categories:

- Systematic risks - these are global crises and changes in the economic cycle, a drop in solvency due to economic recession or political instability in the state, sudden changes in the tax base and others that an investor cannot influence when choosing an investment object.

An investor is able to factor in the likelihood of such risks when making a decision, but it is extremely difficult to calculate everything with absolute accuracy. For example, a change in political course can result in significant reversals in economic activity – sanctions, trade wars, devaluation of the national currency and other political risks.Another example is man-made risks. The accident at the Fukushima nuclear power plant in 2011 led to the emergence of many kilometers of exclusion zones; any business in that zone was stopped.

- Unsystematic risks - fierce competition, unqualified selection of personnel and management, irrational capital structure and others, which an investor can influence by diversifying projects or creating an optimal investment portfolio.

Basic principles of investing

First you need to decide on an investment strategy:

- Moderately conservative. Among the bonds in the portfolio there is a certain proportion of shares of large corporations. The risk is relatively low. Profitability is below average.

- Conservative. Suitable for investors seeking to minimize risks when investing in securities. The downside is low profitability. It is also used in conditions of strong fluctuations or decline in the stock market.

- Moderately aggressive. Among the shares of large corporations there are government bonds. Second-tier companies may be included in the securities portfolio. The risks are above average, as are the returns.

- Aggressive. There are no government bonds in the investment portfolio. It consists of securities of companies of the 2nd and 3rd echelons, as well as venture enterprises. The risks are very high, as are the possible profits.

Depending on the level of knowledge, an investor can:

- Trade securities yourself (you have certain knowledge, experience and time to monitor market changes).

- Use the services of third-party organizations - trust management of banks or investment companies, mutual funds (lack of knowledge if there is a sufficient amount of funds).

How to invest money in securities without knowledge

According to current legislation, not all organizations can manage an investment portfolio. To do this, they must have the appropriate license. When choosing, also pay attention to the experience and reliability of the organization, the investment options offered, as well as reviews on the Internet.

After choosing an organization, a trust management agreement is concluded, after which the investor transfers the funds and waits for profit.

Advantages:

- Professional management.

- Possibility of diversification.

- State control.

- Possibility to choose the level of risk and return on investment.

Let's move on to consider the shortcomings. The high cost of such services must also be taken into account. charges 0.5-5% of the value of assets annually for its services The cost of services of investment companies and banks is higher - 10-25% of the profit received.

Another disadvantage of such investments: investment decisions are made by the manager, but all responsibility lies with the investor.

Independent management often turns out to be more effective than trust

How to invest in securities yourself

To trade securities, you must use the services of a broker.

When choosing, you need to pay attention to:

- reliability;

- level of professionalism;

- availability of an unexpired permit;

- the amount of commission when making transactions and withdrawing funds;

- broker membership on the MICEX, RTS and other exchanges;

- the ability to manage auctions remotely;

- Having your own analytical service will be an additional advantage, but is not at all necessary.

Search for an investor

Popular ways to find investors:

- Issue shares of your own enterprise and, after listing on the stock exchange, sell them to investors. Restrictions are specified in the terms and conditions of each exchange. Thus, according to the conditions of listing on the Moscow Exchange MOEX, in order to place shares with it, the company must have 3 billion rubles ($45 million) of its own assets, work experience of at least 3 years, publish reports on microfinance organizations for the last 3 years, conclude a minimum agreement with 2 market makers of the Moscow Exchange, etc. For large capital, this is a direct path to big investments. For example, in 2014, the Chinese company Alibaba, through an initial public offering (IPO), attracted investments in the amount of $25 billion in just one day of trading on the New York Stock Exchange NYSE!

- Registration on specialized platforms on which investors look for interesting projects for investment. In Russia these are AngelList, Napartner, PitchBook, StartupPoint, Wanted Venture Capital, PitchBook.

- Independent search via the Internet , in particular, through social networks Facebook, Vkontakte, Odnoklassniki, etc. Suitable for finding investors for small projects. It is difficult to interest large investment funds in this way. But you can if you promote your page on Instagram, YouTube or other social networks. If your account has millions of subscribers with millions of content views, interested people will contact you;

- Applying directly to an investment fund with a well-prepared business plan;

- Crowdfunding platforms allow you to start raising funds for interesting projects . It is interesting that people actually donate to projects that interest them, because they do not receive any share in exchange. The most famous platform is Kickstarter, famous Russian platforms are “Planet”, Starttrack.

What to remember

- When choosing investment methods, you should pay attention not only to their profitability, but also to the risks. For example, when investing in stocks, it is important to take into account that quotes are influenced by many factors: from the state of the global economy to the financial results of the company.

- Risk analysis will allow you to better understand what potential losses you are willing to accept for the sake of high profitability, and will help you choose the optimal investment instruments.

- It is almost impossible to reduce risks to zero, but you can significantly reduce them through proper diversification of investments, strict adherence to the chosen strategy and careful study of investment instruments.

- #Stock

- #Tips for beginners

Was the article helpful?

Thanks for the answer!

The "Big Three" investors control 88% of investments in the 500 largest US companies

The three largest American investment companies control 40% of American investments and 88% of investments in the S&P 500 stock index, i.e. into the shares of the 500 largest American and world corporations, and through them into the entire stock market. This

- BlackRock (USA) - $6.789 trillion. assets under management (as of September 14, 2021). The largest shareholders are the American PNC Bank, NA, Norges Bank, Merrill Lynch Mizuho Financial Group, etc.);

- Vanguard (USA) - $5.8 trillion. under management as of October 16, 2021

- State Street Corporation (USA) - $2.511 trillion at the end of 2021.

The activities of institutional investors are important for the country's economy. They not only provide an influx of capital, through their work they encourage citizens not to keep their savings “under the pillow”, but to invest them in the economy and receive additional profit to their basic income. For example, in the USA the words dividends, stock exchange, bills..., without exaggeration, are well known to almost every housewife. As traders joke: “In the States, they prepare you for investing from the cradle.” Statistics show that every second American owns assets in the form of stocks. For example, in China this figure is 10%, in India it is only 1.5%, and in the Russian Federation it is less than 1%.

Conclusions Masterforex-V

Becoming a successful investor is a direct path to wealth and independence in our lives.

- You can never invest intuitively; each market has a trend and moves sequentially from one Masterforex-V reversal pattern to another pattern of the same wave level in the opposite direction.

Without this knowledge, any investment will end very, very badly. - Your “investment portfolio” should consist of financial instruments from DIFFERENT markets

- stock - stocks, bonds, indices, incl. ETF;

commodity (gold, oil, etc.);

- Forex currency market;

- cryptocurrency,

- In addition to passive investing in preferred stocks, bonds, ETFs, use “active investing” by copying the transactions of successful market traders . It is by working in DIFFERENT markets that you can earn 300%-700% in a few years, like Masterforex-V traders according to the statistics of our Rebate - auto-copy service pro-rebate.com. Agree, not a single stock, not a single index, ETF or ETP fund is able to show such returns for investors over any period in the history of their trading.

and not just one, as examples of mutual funds and ETFs taught 90% of investors in the world to gain access to managing their money only on the stock market.

Let me explain the harmfulness of this strategy of compiling an investment portfolio in ONE market. Replace the term stock market broker with the word realtor, who, in order to “diversify your portfolio,” recommends that you buy a one-room, two-room, three-room, four-room apartment, villa, mansion, “country plot,” etc., “forgetting” each time about OTHER markets, from which he will not receive commissions from you.

Many careless stock market brokers do the same thing, limiting the investor to a vicious circle of only those ETF financial instruments that are both falling and rising at the same time. He simply lives from your commissions and is absolutely indifferent to the profit or loss on your account.