Is the EUR/NZD exotic cross pair suitable for profitable trading?

The EUR/NZD currency pair belongs to the category of minor assets, as well as cross pairs.

The rate is calculated through a peg to the US dollar, therefore, it has a direct impact on the target pair.

The New Zealand dollar acts as a convertible unit, and the euro is the base unit.

The parka indicates the value of the European currency in terms of the equivalent of the New Zealand dollar. The island nation's economy is picking up pace of growth, driven by the agricultural sector and technological developments.

The trading asset “Euro-New Zealand dollar” can be characterized as a low-liquid instrument, and when predicting price movements, it is necessary to focus on those pairs in which the US dollar is present.

What does the EUR/NZD exchange rate depend on?

Statements by officials, or economic news on the New Zealand or European economy, do not affect the EURNZD rate, but are only a reason to “drive” the currency up and down, working out wave-sub-wave cycles much faster than on other days. The EUR NZD exchange rate depends on the movement of the euro and New Zealand dollar indices. So if you observe what if

- the trends of the EUR and NZD indices go in different directions, then for the euro-New Zealand dollar currency pair - either a bearish or bullish movement is formed;

- If these indices move in the same direction, then a flat will be observed in the EURNZD cross.

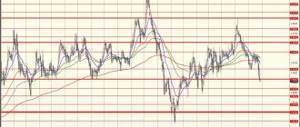

An example of a powerful trend in EUR NZD since March 2019: the euro and New Zealand dollar indices moved in opposite directions (highlighted on the chart with a green background).

NZD/USD dependence on commodities

According to the US Department of Agriculture, New Zealand is the world leader in the production of whole milk powder, which is why its national currency largely depends on the volume of milk exports. Traders who trade this pair carefully monitor trends in the dairy market.

Today you can find out the cost of this product from a variety of sources, but the main one is the international auction Global Dairy Trade. Milk trading results are updated on the official website every two weeks.

In the following figure you can see a graph of the cost of one ton of whole milk powder, which I posted as an example.

Now let's overlay this chart on the chart of the NZD/USD currency pair.

Even with the naked eye you can see that the chart of the currency pair repeats the movements of the milk price chart. Most often, the currency pair chart follows the price of milk, but in some cases this happens with a delay, sometimes even a whole quarter.

If you trade according to this scheme, you can make good money, but this method of trading is only suitable for lovers of long-term trading. But what about all other traders?

The best indicators for forecasting the EUR NZD exchange rate

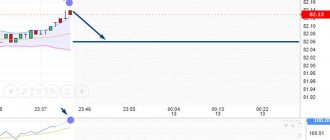

In addition to indices, the EUR NZD rate is also influenced by the levels of market maker order accumulations . The chart from the closed forum of the Masterforex-V Academy shows how the EUR NZD rate moves from one MF level to another. Moreover, note that only Masterforex-V Academy provides MF order levels not only for the main currency pairs, but also for their cross rates.

These MF levels are divided into important and secondary.

In addition to analyzing the euro and New Zealand dollar indices, price behavior at MF levels, Masterforex-V recommends installing the free AO_ZOTIK (Zotik) indicator and the WPR_VSMARK oscillator on the charts, which are given free of charge at the Academy.

This set of tools will already make it easier to understand the logic of the movement of the EUR NZD cross and other Forex currency pairs. You can learn about other tools during professional training in Forex and Exchange at the MasterForex-V Academy.

Euro New Zealand dollar exchange rate and a number of myths from the Internet

From year to year, from article to article, opinions wander that the EURNZD exchange rate is influenced by:

- changes in capitalization on national exchanges in Europe and New Zealand (more precisely Euronext and the New Zealand Wellington Exchange);

- various economic news that comes out on the EU or New Zealand economy (the EUR NZD exchange rate and the published news each live their own “life”);

- CAC 40, Euro Stoxx 50 or NZSE40 stock index quotes on stock exchanges in Paris or Wellington. Compare the charts of NIKKEI 225 and the euro New Zealand dollar, do you see that they are similar? So we don't.

The EUR NZD rate is also influenced by the presence or absence of volumes for sale (Sell) or purchase (Buy) on the New Zealand dollar (6N) and euro (6E) currency futures on the Chicago Mercantile Exchange CME . As a rule, a strong trend (impulse) in euro or New Zealand dollar futures is accompanied by an increase in volumes during a bullish or bearish trend, while during corrections volumes decrease. In the article Basics of Volume Theory, in addition to details about volumes, you will learn why this tool cannot be considered absolute.

For example, here is a chart for the New Zealand dollar 6N futures:

Interesting Facts

NZD is an abbreviation for New Zealand Dollar. The currency is used both on the main territory of the state and on its island possessions (Niue, Cook Islands, Tokelau).

In everyday life, NZD is usually called “kiwi”, after the symbol of New Zealand. Since 1999, thin plastic has been used to produce money in the country.

The New Zealand dollar appeared in 1967. One euro is equal to 1.68 kiwis. The stability of NZD is largely achieved due to the floating exchange rate. New Zealand is included in the list of developed countries of the world, the standard of living and development is at the top of the world rankings.

The main part of GDP is income from agriculture and food exports. More than half of the products produced are purchased by Australia, the USA, Japan, and China.

Gross domestic product is growing at least 4.8% per year, and inflation is kept at a maximum of 3.8%. The unemployment rate does not exceed 5.7% for the entire territory.

In an era of soaring energy prices, New Zealand is building more and more hydroelectric power plants, which allows it to eliminate some of its unnecessary imports and avoid transferring funds overseas.

The euro, in turn, depends on the economies of 19 European Union countries, which have recognized it as official on their territory, and therefore can influence it.

At the same time, the EU includes not only economically stable countries (Germany, France, Italy), but also weak ones (Greece, Slovenia). The average level of the economy determines the euro exchange rate; the Central European Bank regulates it by raising or lowering interest rates.

Trends for the EUR NZD currency pair

Movements in all currency pairs and in particular in the EUR/NZD pair can be divided into:

- LONG-term trends (defined on time frames from W1 to MN), the duration of which is calculated in years. These trends go from one reversal pattern to the next one of the same wave level (for example, patterns such as “head and shoulders”, “triple and double top or bottom or diamond”, or diamond, etc.). Also, before a reversal, divergences can be observed on the charts.

- MEDIUM-term trends ( defined, as a rule, on timeframes from H8). Such trends usually last for a week or more. These timeframes clearly show how the MF levels (clusters of market maker orders) are worked out: their real or false breakthroughs or rebounds from these levels. As for the classic trend continuation figures, here you can observe various triangles - a symmetrical triangle, ascending and descending triangles, an expanding triangle, as well as a flag, pennant, wedge, etc.).

What factors influence NZD/USD

Despite the fact that news about milk is published only once every 2 weeks, activity on the NZD/USD pair is observed every day. In addition to milk, the cost of New Zealanders is also influenced by the cost of sheep's wool. In this case, the influence is not so strong, but it is still present.

The main problem with this analysis is the lack of information about the price of sheep wool. The only source of information is publications from the IMF, but they are only useful to those traders who engage in long-term trading, since information appears with a slight delay.

The value of the New Zealander is also influenced by macroeconomic trends; for this reason, after the publication of data on GDP, employment and inflation, strong jumps are observed on the currency pair’s chart.

And, of course, we should not forget about the dollar, which still remains the leading currency in the world. This, perhaps, is the whole difficulty in the analysis, since in order to anticipate further movement on this currency pair, you need to follow all the world news.

And another very important factor that is also worth considering is tourism. About 3 million tourists come to New Zealand every year. This is not a large influx compared to other tourist countries, but given that New Zealand has a population of 4.5 million, this number of people significantly increases the demand for the national currency during the high season.

Trading and earnings in euros and New Zealand dollars

Unfortunately, working on only one EUR NZD pair will not bring the desired rate of profit, because about 20% of the entire movement of the euro/New Zealand dollar currency pair is in a trend, which gives the main profit to the trader, and the rest of the time the pair is in a complex flat-like movement.

Those traders of the Masterforex-V Academy who have entered into successful profitable trading prefer to choose not ONE specific market or instrument, but different ones: be it the Forex currency market, futures or stock market, commodity market, cryptocurrency market, and so on. . Thus, a successful trader does not care what market or instrument to trade on, but the presence of a trend is important, which could be for the euro and New Zealand dollar this month, gold or silver the next, cryptocurrencies in the third, etc. and so on. Got the idea?

It is work on DIFFERENT markets and instruments that will bring constant earnings of 300%-700% for several years, which is confirmed by the statistics of our Rebate - auto-copying service pro-rebate.com.

NZD/USD for short-term trading

As a result of numerous observations of the NZD/USD pair, it was noticed that it makes significant jumps (by 50-80 points) immediately after the publication of the news on the official website of Global Dairy Trade. By clicking on the following link: https://www.globaldairytrade.info/en/calendar/, you can find the news publication calendar.

These publications affect this currency pair in the same way as the “non-farm” on the US dollar. This news has a significant impact on the country’s macroeconomics, which allows us to predict the future direction of the NZD/USD pair chart. At the same time, it is not at all necessary to wait for the emergence of a strong trend; you can simply open the trading platform once every 2 weeks, withdraw your profits and relax.

If you decide to try your hand at this currency pair, then you should pay attention to another equally important indicator, namely US statistics on the production of dairy products, which has a significant impact on the dairy market. The fact is that the American economy correlates with the world market, so its statistics are also worth paying attention to.

As a rule, after the publication of these two news, high activity appears on the currency pair. If you can't yet make any predictions based on milk prices, I advise you to keep an eye on the price of US milk, the futures of which are traded on the CME.

By following this link: https://www.cmegroup.com/trading/agricultural/dairy/class-iii-milk.html, you will find milk futures quotes.

Recommended brokers for trading and investing in the euro New Zealand dollar pair

The broker rating of the Masterforex-V Academy, which has existed for more than 10 years, notes that the TOP 5 brokers have all the financial instruments necessary for investing and trading, and in particular the EUR NZD currency pair.

About 50% of successful traders of the pro-rebate.com free autocopy rebate service trade with the NordFX broker, which can provide traders

- 33 currency pairs for trading, including AUD USD, NZD USD, USD CAD, USD CHF, USD JPY, EUR USD, EUR CHF, USD NOK, USD SEK and others;

- stock indices (DAX 30 Index, S&P 500, Dow Jones 30 Index, FTSE 100, etc.), as well as cryptocurrencies, CFDs on oil, gold and silver.

Traders will love it

- the presence of popular trading platforms MetaTrader 4 and MetaTrader 5 with ready-made indicators and oscillators for technical analysis of charts;

- opportunity to open an account from $10;

- the ability to trade various strategies - scalping and day trading or swing trading, etc.;

- providing low spreads (from 0.2 points) and high swaps (up to 5-6 dollars per day for one standard lot).

Analytics for EUR/NZD – Moving Averages

| EURNZD | M30 | H1 | H4 | D | W | M |

| MA5 | trend down 1.6609 | trend down 1.6607 | trend down 1.6607 | trend down 1.6616 | trend down 1.6653 | trend down 1.6825 |

| MA10 | trend down 1.6613 | trend down 1.6617 | trend down 1.6617 | trend down 1.6607 | trend down 1.6755 | trend down 1.7231 |

| MA20 | trend down 1.6617 | trend down 1.6607 | trend down 1.6638 | trend down 1.6634 | trend down 1.6985 | trend down 1.7371 |

| MA50 | trend down 1.6607 | trend down 1.6624 | trend up 1.6596 | trend down 1.6773 | trend down 1.7435 | trend down 1.6945 |

| MA100 | trend down 1.6624 | trend down 1.6636 | trend down 1.6651 | trend down 1.7012 | trend down 1.7313 | trend up 1.6469 |

| MA200 | trend down 1.6636 | trend down 1.6621 | trend down 1.6750 | trend down 1.7322 | trend down 1.7040 | trend down 1.7643 |

| Sales | 6 | 6 | 5 | 6 | 6 | 5 |

| Purchases | 0 | 0 | 1 | 0 | 0 | 1 |

| Bottom line | sale | sale | sale | sale | sale | sale |