The pair NZD (New Zealand dollar) and USD (US dollar) is considered quite exotic in the Forex market.

In total, about 7% of financial transactions are carried out with it, which makes it the so-called “major”. This asset is not popular among Russian traders (many simply do not know how to handle it). NZD/USD has a second name in honor of the symbolic bird of New Zealand - the kiwi.

Important! New Zealand is a market economy. The basis of the economic system is goods obtained through agricultural production. New Zealand's leading partners are the USA, Australia, Japan and China. Accordingly, a trader trading the NZD/USD pair needs to follow the microeconomic news of these countries.

New Zealand dollar/US dollar: forecast and analytics

If you look at the price movement chart, you will notice that a new trend cycle has formed since the spring of 2021. The price began to rise in mid-summer, according to the theory of wave analysis. After which, the trend cycle was also completed according to the classical principle - three wave declines.

When working with this asset, you can use Elliott's theory. But what explains the ideal movement of the pair, which is characteristic of the stock market rather than the foreign exchange market? Everything is easy. The dependence of the New Zealand dollar on the position of raw materials exported by New Zealand - these are minerals and agricultural products.

Characteristics of a currency pair

- High volatility, trendiness.

- Ease of forecasting . A particularly effective forecast can be made using those. analysis.

- Correction with AUD/USD allows the investor to reduce risks through hedging.

- Fundamental analysis of an asset is not overly complex.

ANZ analysts forecasts

We expect the RBNZ to be just as calm about the apparent increase in inflation pressures here in New Zealand, as they have made it clear that from this starting point they would rather err on the side of risking too much inflation than too little. There is new upside (the trans-Tasman travel bubble) and downside (the housing tax change) but we expect the RBNZ to move confidently through a balancing act and a sweet spot. We expect the RBNZ to keep both its policy levers and its "wait and see" tone unchanged, reiterating that easy monetary policy will be needed for a long time to come, and that they have the ability to add further stimulus if required, but are not expected to that they expect to have to do it.

Fundamental and technical analysis of the NZD/USD pair

As for trading recommendations for NZD USD, you should take into account the cost of such commodity items as: oil, metals, agricultural products, coal. Every change in price affects the movement of the pair.

The speculator will have to monitor the interest rates of the banks of the two countries. Fluctuations in macroeconomic indicators also affect trend movements.

Forecast for today

The NZD/USD forecast for today is based on the results of technical analysis. Recommendations differ in timeframe (5 m, 15 m, 1 hour, 1 day) and gradation of strength. In the NZD/USD forecast for today, you should take into account only the “strongest” trading recommendations “Active Sell” and “Active Buy”.

Pay attention to the forecast time (on the right above the table). Recommendations are not updated automatically; to do this, you need to reload the page!

A narrow fluctuation corridor distinguishes this quote from other currency instruments. Long trends and low volatility make it predictable. The probability of large profits is small, but the risk of losses is minimal. Thanks to this, NZD/USD is considered a reliable instrument even for inexperienced traders.

(

2 ratings, average: 4.50 out of 5)

What factors influence NZD/USD

- Cost of export products (oil, metals, meat, wool, etc.) of New Zealand.

- Weather conditions affecting agricultural productivity.

- Economic indicators within countries , from the level of gross product to interest rates charged by banks, inflation and other things.

- Additionally, a trader can monitor the dynamics of the pair through the CRB index , which takes into account export positions and their changes.

Expert opinion from TD Securities

We expect the RBNZ to keep all current monetary policy parameters unchanged from the March MPR meeting and see no reason for the Bank to deviate from its message that achieving its inflation and employment targets will require "considerable time and patience" . The positive news is a surge in global economic activity and the resumption of the trans-Tasman bubble well ahead of 2022, while the negative news is the faltering global vaccine rollout, weaker-than-expected economic activity and changes to New Zealand's housing construction. We expect the Bank to overcome growing price pressure. The statement must be at worst neutral and at best dovish in tone.

How to trade options on NZDUSD

It is recommended to set medium-term and long-term expirations in the selected NZD USD strategies. Trading is carried out at any time. But, the maximum volatility indicator occurs at the intersection of the Asian and European sessions. But traffic is very high from Monday to Friday. You should be extremely careful when publishing Friday news.

Having studied information on an asset using a fundamental approach, a speculator can place a couple of indicators on the terminal to check the news background. The range of strategies is quite large, since tactics developed for the Forex market show high results.

Recommendations for trading the NZD/USD pair

If a trader works with this currency pair, then hedging can be used using a correlating asset in the form of the AUD/USD pair. Why this couple? It’s simple, the correlation indicator has almost reached one – this is a signal of powerful interdependence.

At the moment when a speculator, after purchasing a contract with the New Zealand and American dollars, sees that the price has begun to move in the wrong direction, it is recommended to open an operation with AUD/USD, but in the other direction.

Please note that it is recommended to check with technical support before surgery. instruments the impulse of a new movement. When the power of the trend is sufficient, the speculator can increase the bet, thereby covering the first losing trade. Here it is important to monitor the news and not enter into transactions if sudden changes are possible in the market due to the publication of news in the field of economics and politics.

05/26/202108:17 Analytical reviews Forex: NZD/USD: will the Kiwi spread its wings after the RBNZ meeting?

Many analysts are confident that the New Zealand dollar will rise after the regulator's meeting. Experts point out significant room for growth for the Kiwi, which could take advantage of the opportunity.

At the beginning of this week, the New Zealand dollar grew on strong macro statistics and successfully continued the positive trend. According to a report from the New Zealand Bureau of Statistics, total retail sales increased by 2.5% in the first quarter of 2021, with the figure excluding vehicle sales soaring to 6.8% quarter-on-quarter. Experts were also pleased with the reduction in the unemployment rate in New Zealand (to 4.7%) and the increase in inflation (to 1.5%), which is approaching the target level of 2%.

According to the observations of experts, the dynamics of the New Zealand dollar looks more advantageous than the positions of its American rival. The long-term weakening of the greenback could not but affect its dynamics, experts emphasize. Against this background, many commodity currencies, including NZD, benefited. The Kiwi is supported by positive dynamics in the global hydrocarbon market, which favors New Zealand's export-oriented economy. According to economists, commodity currencies have sufficient room for growth. This is facilitated by factors such as a strong recovery in the global economy, rising oil prices and the maintenance of a loose monetary policy by most central banks.

Significant support for the New Zealand dollar is provided by experts' expectations regarding the continuation of the current monetary policy (MCP) by the Reserve Bank of New Zealand (RBNZ). Market participants believe that the regulator will leave the interest rate at 0.25%. According to currency strategists at Citi Bank, they do not expect any special surprises from the RBNZ. Analysts expect the weak USD to persist in the medium term, against which the NZD/USD pair will strengthen its position. This year the tandem will grow to 0.7500 and higher, Citi believes. On the morning of Wednesday, May 26, the NZD/USD pair was trading at $0.7307, trying to break through the boundaries of the current range.

Following the meeting of the Reserve Bank of New Zealand, experts expect that the target for a large-scale asset purchase program will remain at around 100 billion New Zealand dollars. As for the timing of the procurement program, it will last until June 2022, experts believe. At the upcoming meeting, the regulator will provide updated economic forecasts, which will include strong GDP data and an improved forecast for inflation. Experts admit that there may be a “hawkish” bias in the RBNZ’s rhetoric.

According to representatives of the central bank of New Zealand, for a stable economic recovery and an increase in inflation, the NZD exchange rate will need to be slightly reduced. It is possible that Adrian Orr, head of the RBNZ, will confirm the bank’s commitment to soft monetary policy. In such a situation, the pressure on the Kiwi will increase, analysts warn. If hawkish rhetoric about the prospects for monetary policy intensifies, the New Zealand dollar will take a turn and strengthen sharply.

Currency pair trading strategies

NZD USD asset forecast requires the use of fundamental analysis, complemented by a technical approach. So, with competent trading and application of the information received, the asset can provide high profits.

In particular, you can pay attention to the “Yesterday” tactic. Let's look at this approach in more detail.

But, before you start trading, go to the investing service. NZD USD on the economic calendar, a speculator can become familiar with key events that can affect the movement of the asset.

We set H1 for analysis. To study the market, you can use MT4, or an online chart, then complete the transaction on the broker's terminal. For contracts we set expiration, which includes up to 5 candles.

- We transfer the Relative Strength Index with indicators of 30 and 70 to the chart.

- We analyze the course of the candlestick chart for yesterday, and based on it we draw 2 horizontal bars.

- When the price moves down, reaching the minimum level, starting from it, the Index leaves the oversold zone and goes up - we complete the call deal.

- When the price moves up , reaching the maximum level, starting from it, the Index leaves the overbought zone and heads down - we complete the put deal.

You cannot open an operation unless two conditions are met.

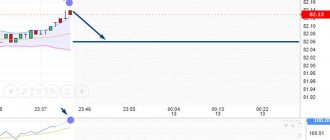

Interactive graph

The NZD/USD online chart allows you to track current changes in the New Zealand dollar to US dollar exchange rate. With its help, you can perform technical analysis by adjusting price lines, time frames and chart indicators. The chart settings allow you to set the minimum and maximum marks for the NZD/USD movement. These are guidelines for forecasting the dynamics of the New Zealand dollar against the US dollar. They help you see trends over the long term. You should choose the right time to enter within the daily or hourly interval of the live chart.