The AUD/NZD currency pair is a commodity asset with an emphasis on the economies of Australia and New Zealand.

The AUD/NZD currency pair is a combination of the national currencies of Australia and New Zealand. It is formed as a cross rate pegged to the US dollar. The Australian currency is the base component, and the New Zealand currency is the quoted one.

Both Aussie and Kiwi dollars are commodity assets. The economies of states depend on commodity exports to other regions, so this directly affects the position of the currency pair.

The asset demonstrates its stability because both currencies are exposed to the same factors. Trend reversals are much less common here than when analyzing other pairs.

But this predictability does not prevent it from showing dynamics; for example, during a trading day it can reach 100 points or more.

Components of the AUD/NZD currency pair

AUD/NZD is the ratio of the Australian dollar to the New Zealand dollar. That is, how much Aussie (AUD) can be bought in the equivalent of kiwi (NZD). The close relationship between the economies of both countries determines the pair’s trading positions; most often the change occurs in the same direction.

Since the pair is formed as a cross rate through the US dollar, the movement of NZD/USD will be similar to the movement of AUD/USD. At the same time, price maneuvers are not characterized by high volatility.

The Australian dollar is the official currency of the Commonwealth of Australia, is one of the top 10 most popular currencies in the world, and is in 6th position in terms of trading volumes.

Aussie accounts for almost 5 percent of global foreign exchange transactions, and traders are attracted by the high interest rate and liberal policies of the foreign exchange market, as well as stable movements.

The New Zealand dollar replaced the pound and has been the official currency of the country since 1967. Because New Zealand is a global exporter of wool and gold, its currency is popular.

When trading AUD/NZD, it is important to pay attention to dollar dynamics and the fact that each currency may react to it to varying degrees.

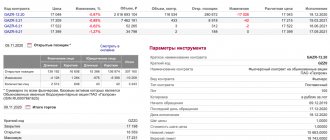

Deutsche Bank goes long NZD/USD

Deutsche Bank continues to hold a long position on the NZD/USD pair and even increase its volumes. On Monday, a position was opened from 0.7300 with a target of 0.7500 and a stop at 0.7210. The August 15 trade was opened at 0.7200 with a target at 0.7500 and a stop at 0.7000. The second deal is already making a profit.

Analysts claim that the carry-trade strategy in conjunction with the New Zealand dollar will be quite effective. The likelihood of a reduction in RBNZ interest rates is overestimated by the market by 100%. In addition, according to the futures market, prices are expected to rise during the next auction for the sale of milk powder. Dairy products are New Zealand's main export and rising prices are sure to support the national currency. Deutsche Bank analysts do not see any negative factors for the carry-trade strategy at the NZD rate.

Discuss trading on the forex forum

- Current situation, discussion and Forex forecasts (EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, NZDUSD)

Features of the behavior and analysis of each currency in the AUD/NZD pair

It belongs to the group of relatively highly liquid instruments, because both states are located close to each other and maintain close relationships. The asset is widely popular both in the Forex market and in the binary options sector, and the peak of trading activity occurs during the Asian session.

You can start trading profitably and comfortably with the Finmax broker, which offers favorable conditions and pleasant bonuses for all clients. Direct peg to the US dollar determines the fact of influence on AUD/NZD positions.

You can analyze AUD/USD and NZD/USD separately, and then combine them into a single chart. Consider key indicators of the US economy, in particular the unemployment rate, GDP, discount rate, etc., to correctly predict the movement of the asset.

The Australian Dollar-New Zealand Dollar has a high correlation rate, which gives traders certain advantages in trading. The relationship is determined by economic relations and the characteristics of monetary policy. Australia and New Zealand cooperate with Japan - if the exchange rate of one of the currencies changes, the positions of the other currencies will also shift.

How to trade the AUD/NZD currency pair correctly?

When planning to choose this asset for trading, it is important to consider the following features:

- Both countries are rich in natural resources and minerals, so this factor plays an important role in the assessment of each currency and the pair as a whole; the Aussie and the kiwi belong to the group of commodity assets;

- The New Zealand $100 note features the profile of Lord Rutherford, who was the founder of nuclear power;

- Australia ranks third in the world in gold production, so the exchange rate of its currency depends on the value of the precious metal on the world market;

- New Zealand has a strong agricultural sector, exporting up to 24 percent of the world's dairy and agricultural products;

- Due to direct correlation, both currencies will benefit from strong positions in the commodity market.

Australian dollar

The official exchange rate of the Australian dollar to the ruble as of May 26, 2021 is 57.1846 rubles.

Forecast for tomorrow week and next month

| date | Day | Well | Changes |

| 27.05.21 | Thu | 57.5720 | +0.3874 ↑ |

| 28.05.21 | PT | 57.0310 | -0.5410 ↓ |

| 29.05.21 | SB | 57.0310 | |

| 30.05.21 | Sun | 57.0310 | |

| 31.05.21 | Mon | 57.1001 | +0.0691 ↑ |

| 01.06.21 | VT | 57.1949 | +0.0948 ↑ |

| 02.06.21 | SR | 57.2694 | +0.0745 ↑ |

| 03.06.21 | Thu | 57.3340 | +0.0646 ↑ |

| 04.06.21 | PT | 57.6948 | +0.3608 ↑ |

| 05.06.21 | SB | 57.6948 | |

| 06.06.21 | Sun | 57.6948 | |

| 07.06.21 | Mon | 57.7818 | +0.0870 ↑ |

| 08.06.21 | VT | 58.0542 | +0.2724 ↑ |

| 09.06.21 | SR | 57.8618 | -0.1924 ↓ |

| 10.06.21 | Thu | 57.7080 | -0.1538 ↓ |

| date | Day | Well | Changes |

| 11.06.21 | PT | 57.4235 | -0.2845 ↓ |

| 12.06.21 | SB | 57.4235 | |

| 13.06.21 | Sun | 57.4235 | |

| 14.06.21 | Mon | 57.3285 | -0.0950 ↓ |

| 15.06.21 | VT | 57.3862 | +0.0577 ↑ |

| 16.06.21 | SR | 57.4607 | +0.0745 ↑ |

| 17.06.21 | Thu | 57.6349 | +0.1742 ↑ |

| 18.06.21 | PT | 57.5602 | -0.0747 ↓ |

| 19.06.21 | SB | 57.5602 | |

| 20.06.21 | Sun | 57.5602 | |

| 21.06.21 | Mon | 57.0779 | -0.4823 ↓ |

| 22.06.21 | VT | 57.1620 | +0.0841 ↑ |

| 23.06.21 | SR | 57.0131 | -0.1489 ↓ |

| 24.06.21 | Thu | 56.8605 | -0.1526 ↓ |

| 25.06.21 | PT | 56.6277 | -0.2328 ↓ |

Australian dollar exchange rate forecast for 2021 and 2022

| Month | Year | Well | Min. | Max. | Change |

| May | 2021 | 55.4291 | 54.6466 | 56.2116 | -1.7555 ↓ |

| June | 2021 | 55.5445 | 54.7620 | 56.3270 | +0.1154 ↑ |

| July | 2021 | 55.6058 | 54.8233 | 56.3883 | +0.0613 ↑ |

| August | 2021 | 57.2111 | 56.4286 | 57.9936 | +1.6053 ↑ |

| September | 2021 | 57.0486 | 56.2661 | 57.8311 | -0.1625 ↓ |

| October | 2021 | 55.5133 | 54.7308 | 56.2958 | -1.5353 ↓ |

| November | 2021 | 55.6973 | 54.9148 | 56.4798 | +0.1840 ↑ |

| December | 2021 | 55.0525 | 54.2700 | 55.8350 | -0.6448 ↓ |

| Month | Year | Well | Min. | Max. | Change |

| January | 2022 | 56.6965 | 55.9140 | 57.4790 | +1.6440 ↑ |

| February | 2022 | 57.0360 | 56.2535 | 57.8185 | +0.3395 ↑ |

| March | 2022 | 54.9096 | 54.1271 | 55.6921 | -2.1264 ↓ |

| April | 2022 | 54.9647 | 54.1822 | 55.7472 | +0.0551 ↑ |

| May | 2022 | 54.9955 | 54.2130 | 55.7780 | +0.0308 ↑ |

| June | 2022 | 55.1750 | 54.3925 | 55.9575 | +0.1795 ↑ |

| July | 2022 | 55.6291 | 54.8466 | 56.4116 | +0.4541 ↑ |

| August | 2022 | 57.2473 | 56.4648 | 58.0298 | +1.6182 ↑ |

| September | 2022 | 57.4006 | 56.6181 | 58.1831 | +0.1533 ↑ |

| October | 2022 | 55.4823 | 54.6998 | 56.2648 | -1.9183 ↓ |

| November | 2022 | 55.8450 | 55.0625 | 56.6275 | +0.3627 ↑ |

| December | 2022 | 55.1723 | 54.3898 | 55.9548 | -0.6727 ↓ |

Australian dollar exchange rate forecast for 2023 and 2024

| Month | Year | Well | Min. | Max. | Change |

| January | 2023 | 57.3835 | 56.6010 | 58.1660 | +0.1989 ↑ |

| February | 2023 | 57.3962 | 56.6137 | 58.1787 | +0.0127 ↑ |

| March | 2023 | 55.5943 | 54.8118 | 56.3768 | -1.8019 ↓ |

| April | 2023 | 55.4312 | 54.6487 | 56.2137 | -0.1631 ↓ |

| May | 2023 | 55.4291 | 54.6466 | 56.2116 | -0.0021 ↓ |

| June | 2023 | 55.5445 | 54.7620 | 56.3270 | +0.1154 ↑ |

| July | 2023 | 55.6058 | 54.8233 | 56.3883 | +0.0613 ↑ |

| August | 2023 | 57.2111 | 56.4286 | 57.9936 | +1.6053 ↑ |

| September | 2023 | 57.0486 | 56.2661 | 57.8311 | -0.1625 ↓ |

| October | 2023 | 55.5133 | 54.7308 | 56.2958 | -1.5353 ↓ |

| November | 2023 | 55.6973 | 54.9148 | 56.4798 | +0.1840 ↑ |

| December | 2023 | 55.0525 | 54.2700 | 55.8350 | -0.6448 ↓ |

| Month | Year | Well | Min. | Max. | Change |

| January | 2024 | 56.6965 | 55.9140 | 57.4790 | +1.6440 ↑ |

| February | 2024 | 57.0360 | 56.2535 | 57.8185 | +0.3395 ↑ |

| March | 2024 | 54.9096 | 54.1271 | 55.6921 | -2.1264 ↓ |

| April | 2024 | 54.9647 | 54.1822 | 55.7472 | +0.0551 ↑ |

| May | 2024 | 54.9955 | 54.2130 | 55.7780 | +0.0308 ↑ |

| June | 2024 | 55.1750 | 54.3925 | 55.9575 | +0.1795 ↑ |

| July | 2024 | 55.6291 | 54.8466 | 56.4116 | +0.4541 ↑ |

| August | 2024 | 57.2473 | 56.4648 | 58.0298 | +1.6182 ↑ |

| September | 2024 | 57.4006 | 56.6181 | 58.1831 | +0.1533 ↑ |

| October | 2024 | 55.4823 | 54.6998 | 56.2648 | -1.9183 ↓ |

| November | 2024 | 55.8450 | 55.0625 | 56.6275 | +0.3627 ↑ |

| December | 2024 | 55.1723 | 54.3898 | 55.9548 | -0.6727 ↓ |

The value of the Australian dollar in one week on Wednesday June 2 will be 57.27 rubles. Maximum value 57.57 rub. will be on Thursday, May 27th. Minimum value 57.03 rub. will be on Friday May 28th.

The value of the Australian dollar in two weeks on Wednesday June 9 will be 57.86 rubles. Maximum value 58.05 rub. will be on Tuesday June 8th. Minimum value 57.03 rub. will be on Friday May 28th.

The value of the Australian dollar in three weeks on Wednesday June 16 will be 57.46 rubles. Maximum value 58.05 rub. will be on Tuesday June 8th. Minimum value 57.03 rub. will be on Friday May 28th.

The value of the Australian dollar in four weeks on Wednesday June 23 will be 57.01 rubles. Maximum value 58.05 rub. will be on Tuesday June 8th. Minimum value 57.01 rub. will be on Wednesday June 23rd.

Average exchange rate of the Australian dollar/ruble pair for six months

May 2021

The value of the Australian dollar at the end of May will be 57.1001 rubles. The exchange rate will change to -1.76 rubles. from the current one.

June 2021

The weighted average exchange rate in June is 55.54 rubles. Maximum value 56.33 rub. The minimum value at the auction is 54.76 rubles. The exchange rate change will be +0.12 rubles.

July 2021

The weighted average exchange rate in July was 55.61 rubles. Maximum value 56.39 rub. The minimum value at the auction is 54.82 rubles. The exchange rate change will be +0.06 rubles.

August 2021

The weighted average rate in August was 57.21 rubles. Maximum value 57.99 rub. The minimum value at the auction is 56.43 rubles. The exchange rate change will be +1.61 rubles.

September 2021

The weighted average rate in September is 57.05 rubles. Maximum value 57.83 rub. The minimum value at the auction is 56.27 rubles. The exchange rate change will be -0.16 rubles.

October 2021

The weighted average rate in October is 55.51 rubles. Maximum value 56.3 rub. The minimum value at the auction is 54.73 rubles. The exchange rate change will be -1.54 rubles.

Average annual value of the Australian dollar

The average annual exchange rate for 2021 will be 55.89 rubles. The average annual exchange rate for 2022 will be 55.88 rubles. The average annual exchange rate for 2023 will be 56.08 rubles. The average annual exchange rate for 2024 will be 55.88 rubles.

Trading recommendations when working with the AUD/NZD currency pair

Refers to liquid instruments; the greatest activity in trading transactions occurs during the Asian session. The New Zealand economy is focused on the export of sheep wool and products made from it. There are close trade relations with the USA, Australia and the countries of the Asia-Pacific region.

The key factors when analyzing the positions of a currency pair are the following data for each country and its partners:

- GDP level;

- discount rate;

- unemployment;

- new workplaces.

The dynamics of the US dollar and economic activity from China have a direct impact.

In terms of monetary policy, in New Zealand the Central Bank regulates the money supply for all individuals and businesses to manage inflation and economic growth.

In Australia, the situation is similar, with news coming out at almost the same time - the market begins to revive and form carry trades.

In other time periods, it makes sense to trade on price differences in commodity markets. Australia is also experiencing the effects of a gold rush when international banks announce their first quarter financial results. During this period, the precious metal is in greatest demand.

In general, the Aussie-Kiwi exchange rate is stable, with occasional slight exchange rate fluctuations. Suitable for trading for beginners and experienced traders, you can operate with both small and large amounts of capital and get a good margin with minimal risk.

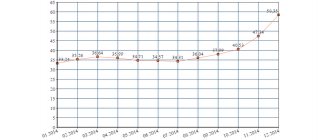

AUD/NZDF chart

A live chart for the AUDNZD currency pair is an ideal solution for those who do not want to install MT4 for analysis.

How to work with pair options

The profitability of working with options on AUDNZD largely depends on the broker, or more precisely, on trading conditions (broker FiNMAX provides good conditions for currencies). When choosing a broker, you need to make sure of his solvency, check the availability of licenses; the operator must have a CYSEC license, or better yet, a CROFR certificate.

When trading options with a long expiration period, you need to pay attention not only to news in Australia and New Zealand, but also to the state of the economy of highly developed countries. For example, the Dow Jones index will tell you how things are going in the United States.