Alor Broker regularly introduces innovative technologies in the field of software and customer service, this allows us to provide high quality services. A huge advantage is that even newbie brokers can start trading, as the most understandable tools and analytics are provided for this. Professionals can open brokerage accounts and invest. In order to evaluate all the capabilities of the Alor Broker service, it is recommended to create a personal account.

About the broker

| Name | ALOR+ LLC |

| Year of foundation | 1997 |

| Regulator and license | Current licenses: · number 077-10965-000100 (depository); · number 077-13011-010000 (dealer); · number 077-04827-100000 (brokerage). Member of SRO "NAUFOR" |

| Requisites | INN 7709221010 |

| Reliability rating | Does not have current ratings |

| Trading platforms | · Moscow Exchange; · St. Petersburg Stock Exchange; · foreign sites; · over-the-counter market. |

| Trading platform | QUIK / web version of QUIK / iQUIKX (for IOS) / QUIKAndroidX / ALOR-trade / TradingView / Alor-fast / Alor-webtrade / TSlab |

| Minimum deposit | No limits |

| Authorized capital | 87,796,600 rubles |

| Head office address | Moscow city, Shabolovka street, 31, building B |

| Official site | https://alorbroker.ru |

| Hotline number | 8 |

| Free demo account | EAT |

| Minimum commission | 1. From 0.03% - Russian securities, subject to a turnover of 10 million rubles. 2. Equal to the exchange fee - derivatives market instruments. 3. From 0.005% - foreign currency, subject to a turnover of 50 million rubles. 4. Minimal fees are charged for account servicing. |

| Rating | 3.5 out of 5 |

MyQuik

Short description:

- Interesting for programmers and those who want to add something of their own;

- There are interesting features in the functionality/indicators (accumulated income, average trade price, trade income, previous trade income, information about all completed transactions).

Supported platforms:

MyQuik can work with any version of QUIK. Both on 32 and 64-bit operating systems of the Windows family (including Windows 7).

Available exchanges:

Trading of any instruments on all available trading platforms is declared (tested only on the RTS and MICEX).

Price:

Free software.

Other description:

All source code of the program is open. The current version of the drive includes functionality that allows you to receive information from QUIK and quickly place orders.

The program provides standard scalping functions. In addition, MyQuik has a well-developed issue of analyzing trading information: the percentage change in position size, price change indicator, supply / demand indicator, money limit, accumulated income, average trade price, trade income, previous trade income, information about all completed transactions are automatically calculated, active orders and transactions.

MyQuik collects in one place all the information necessary to trade the selected instrument (quotes, current price, maximum and minimum, percentage change, price change indicator, supply/demand indicator, money limit, accumulated income, average trade price, trade income).

Brief history of the broker and awards

The group consists of several investment divisions that were created on the basis of ALOR Invest CJSC.

The brokerage direction for private investors is called ALOR+ LLC.

At the moment, the company does not have current ratings from reputable agencies. The last current rating from the National Rating Agency was withdrawn in 2021.

The group today provides a whole range of financial services in terms of brokerage, training, special investment products, etc.

According to the Moscow Exchange, ALOR broker ranks 19th in the number of active client accounts, 10th in the number of registered users.

The broker does not publish information about any awards.

Security and privacy rules

Security when making financial transactions is of utmost importance. ALOR BROKER company uses a multi-level protection system:

- Data transmission via an encrypted https channel, which prevents data interception by third parties.

- Setting/changing a password by receiving a one-time code, which is sent to the phone number specified in the client’s profile, which allows the client to be identified.

- Use of an electronic digital signature protected by a one-time code when carrying out transactions. The code is generated automatically and sent to the phone number specified in the application form.

You can change your phone number only by contacting the office in person.

Login and password information must be kept confidential. If you suspect your password has been compromised, you should immediately contact the company’s customer support.

Terms of service and tariffs

ALOR broker provides many different tariffs aimed at specific market segments. To be honest, the breakdown of tariff offers is quite strange and a little misleading. To clarify information about each possible tariff plan, you can download a sheet with detailed tariffs from the official website of ALOR Broker: https://alorbroker.ru/company/tariffs/2019-06-27_Tariffs.pdf

The following table shows only the basic tariff plans that the broker publishes on its website.

| Types of accounts (tariff plans) | 1. “Welcome!” 2. "First" 3. “Derivatives market. Standard" 4. “Derivatives market. Active" 5. "Currency" |

| Broker commission | 1. Stocks and bonds: from 0.017 to 0.08%. 2. Stocks and bonds: 0.03 to 0.05%. 3. Futures and options: in the amount of the exchange fee. 4. Futures and options: in the amount of 0.5 exchange fees, but not less than 5,000 rubles monthly. 5. Currency: from 0.005 to 0.035%. |

| Exchange fees | From 0.00154 to 0.01% |

| Depository fee | 150 rub. per month |

| Commission on over-the-counter market transactions | 0.1% of the transaction amount for the purchase/sale of securities, but not less than RUB 2,000. |

| Fee for using the terminal | KVIK, KVIK Android X, webKVIK, ALOR-Webtrade, ALOR-FAST, ALOR-TRADE - provided free of charge. XTick Extreme — 650 rub. / month. TSLab — 3450 rub. / month. TSLab Plaza 2 — 4000 rub. / month. |

| Fee for withdrawal of funds | Depositing money through the cash register is free. In other cases, a fee may apply. |

| Deposit and withdrawal methods | · through the cash desk in the office; · Bank transaction; · via the Kwik terminal; · voice order. |

Alor broker personal account functionality

The main page of your personal account looks like this.

1 – client name, “Change password” and “Exit” button

2 – menu, including sections:

- contact with broker

- control center

- reports

- reference Information

3 – news banners

4 – desktop

5 – news and analytical reports

The office consists of sections and subsections. The enlarged functionality of the cabinet can be depicted as follows:

- Contact broker:

- Contact Information

- ombudsman

- agreement

- Products & Services

- orders

- special programs and promotions

- education

- Operations history

- documentation

- my requisites

- taxes

- FAQ

- trading calendar

- shareholders meeting and dividends

Basic operations that can be carried out through the account:

- entering/changing personal data

- opening trading portfolios

- change of tariff plan

- connection to the foreign securities market

- change in risk level

- connection/disconnection of services and products

- execution of non-trading orders

Broker Products

In addition to opening brokerage accounts and providing programs for online trading, the broker offers a number of ready-made investment solutions.

For example, these include Alor structured products, assistance from advisors, temporary placement of funds, etc.

I will tell you more about some of these services.

Structured Products

ALOR broker offers a number of its own structural instruments for purchase.

Structured products allow you to invest in diversified portfolios of assets with minimal investment.

The company divides its structural products into 3 groups:

- protective;

- profitable;

- for share holders.

The minimum investment amount for passive investments of this type is 100,000 rubles, and the investment period is from 2 weeks.

ipo

Information about participation in the initial placement could not be found.

More

ALOR broker provides several interesting additional features. Among these:

- "Advisor." Investment ideas from company experts, incl. and on short positions.

- “Placement of available funds at interest.” Conventionally, this is a deposit that can be withdrawn every day.

- "Education". This includes both face-to-face training and the purchase of webinars, training materials, etc.

High-speed scalping with Alor-fast

The collection of developments on the trading software market has been replenished with a new product presented. This time it is a scalper drive - an autonomously running Alor-Fast program with a convenient user interface, designed primarily for quickly entering orders and making transactions. It is worth saying that at the moment a lot of software has already been written specifically for scalpers (you can read about this in D' No. 1 dated January 30, 2011). Nevertheless, the Alor-fast drive has a number of distinctive features, which will certainly allow it to occupy its niche in the software development segment. And we will briefly describe our impressions of working with him.

Storm in a teacup

As you know, the main tool of a scalper trader is the “glass” of exchange orders. Of course, some also watch guides (financial indicators that demonstrate coordinated movements with the instrument being traded), but the greatest responsibility for decision-making lies precisely in its current state. Realizing this, the developers of Alor-Fast treated this part of the program very responsibly, providing it with almost all the gadgets available today. The active “order book” also includes a tick chart of the instrument being traded (see chart 1).

Immediately o is continuous. It differs from the classic one in that it displays all prices in increments from the lower to the upper limit of the range. And if there is no order corresponding to a certain value, then it will still be “inserted” with zero volume (see Chart 2). Opposite each price you can see the so-called market profile, which shows the total number of transactions completed at a given level. The sequence of recent transactions on the instrument is also displayed there in the form of dots. The closer the time of their implementation to the present moment, the larger the dots.

If you want to place an order to buy or sell at a certain price, just select it in the “Order” field. Everything is extremely simple, and in principle this knowledge is already quite enough to start trading. But to ensure that it happens at maximum speeds and the trader does not experience any discomfort, there are a number of built-in functions.

Quick requests

Alor-fast provides the following options for working with orders: placing a specified volume of instruments for sale/purchase both at bid/ask prices (best buyer price/best seller price), and at market prices or specified manually; cancellation of previously submitted orders; placing/removing stop orders; the ability to cancel all unexecuted orders/stop orders; buying/selling “on the ladder”; possibility of “reversing” a position. “Hot keys” can be configured for each of these functions, which is simply irreplaceable in the trading process. The program also has automatic control over closing a position.

To make transactions using the drive, you must set the trading parameters. The settings are located at the bottom of the interactive glass panel (see chart 3). You must specify a non-zero value in the “Volume” field; the “Price” field is required for limit orders placed using the “Buy at price” / “Sell at price” commands; and in the “Indent” field, the distance from the spread (the difference between bid and ask) is specified, above or below which (by the amount of indent) orders of the type “Buy at an indent above bid” / “Sell at an indent below ask” are placed. The remaining fields relate to the “ladder” function, the operation of which is perhaps worth explaining.

Buying/selling “on the ladder” is placing a sequence of orders in the “glass”, while the interval and their number are specified by the user. For example, if we specify in the settings that the volume at one step will be one lot, the step between steps is ten points, and their number is four, then when you click the “Buy by ladder” button the following will happen: four purchase orders with a volume of one will be placed lot in each. In this case, the first of them will be at the bid price level minus ten points, and each subsequent one will be ten points lower than the previous one.

Another important point that we have already mentioned is automatic control of closing profitable and unprofitable positions. The “Automation Parameters” window (see graph 4) is divided into two parts. The first is for closing unprofitable positions, the second - for profitable ones. In fact, both are absolutely the same - after the price crosses a certain level (which is indicated either in points or as a percentage), the position is closed. The settings can be set so that this does not happen immediately when the price goes beyond the threshold values. In this case, you must specify the desired number of seconds to wait. Then, if the price exceeds the specified level, stays there for less than the specified time, and then returns back, the position will not be closed.

Alor-fast also has a built-in “Trailing Stop” function. He pursues any price movement and closes the position if the market moves in an unfavorable direction for us and crosses a pre-set stop level.

How we scalped

For a person who has never engaged in active trading and suddenly decided to try himself as a scalper, the process of working with the drive may seem quite funny. From the outside it looks like playing some kind of computer shooter, where you need to outwit everyone and not repeat Kolobok’s fate. The scalping algorithm itself (in a simplified sense) is extremely simple: buy above large demand lots (green part of the “glass”), sell below large supply lots (red part of the “glass”). Why is that? Because these lots are considered local support or resistance lines. And, as is usually believed, the price should be repelled from them in the opposite direction. That's all the rules.

Since human laziness did not allow “complicating” trading with “automation” functions, only two “hot keys” were installed: “Buy at market” and “Sell at market”. With the help of these simple devices, 67 points were “cut off” from the Sberbank share futures within 45 minutes, and over the next ten minutes the total profit fell by half and amounted to 37 points. But so many impressions! A nice cosmetic detail - in Alor-fast, all won “pips” (minimum possible price changes) in the “glass” are marked in green (see chart 1). If the position is unprofitable, the “glass” will be colored red.

In conclusion, we note that the speed of placing orders in scalping is, if not critical, then a very important factor. Therefore, in addition to the fast program, you should also have high-speed access to the exchange’s industrial server. However, at this stage of development, the Alor-fast drive does not use the Plaza II protocol (direct access to the FORTS market), which is, of course, its disadvantage. But, on the other hand, when working with Sber futures, we did not experience any particular problems with the time of placing and executing orders. So it’s probably pointless to fight here for just a few milliseconds. Apparently, the main essence of scalping is the correct assessment of the instantaneous state of the market. The rest is details. Although it’s worth training your reaction.

For Alor clients the drive is provided free of charge.

Software and mobile trading

The broker provides a fairly wide selection of broker terminals. Among them are:

- Kwik (including mobile and browser versions);

- ALOR TRADE (as well as fast and web trader versions).

Programs for stock analysis:

- ALOR-RADAR;

- XTICK EXTREME.

In addition, Alor has paid software for building algorithmic trading strategies:

- TSLab;

- TSLabPlaza 2;

- XTickExtreme.

As well as various additional gadgets for these terminals.

Alor Broker personal account mobile application

Most of the operations available to clients in the ALOR-Trade trading terminal can be performed in the mobile application. The application is developed for mobile devices running on the Android platform.

Application features:

- connection to trading platforms SR FORTS, “Main Market”, SR FORTS, Standard

- viewing exchange rates and index data

- execution of trade transactions

- viewing information on instruments

- loading information, generating charts of financial instruments, analyzing them

- viewing information about completed transactions

- getting to know financial news

Working with a broker

You can start working with a broker by registering and opening an account online on the official website, as well as by personally visiting the company’s office.

Next, I’ll tell you about all the stages of interaction with a brokerage firm.

Registration on the official website

The site looks rather mundane and you won't find much information on products or customer service, but in terms of registration, its interface is quite simple and clear.

To register, you must click on the “Become a client” button. Next, you will need to enter standard identification and contact information.

There you can also get acquainted with tariffs, products or see the nearest office of the organization.

Instructions for opening an account

To open a brokerage account online, you will need to enter identification data, as well as confirm your phone number and e-mail.

If you open an account through a personal visit to the company, you must have your passport with you. Before visiting the office, you should fill out an application on the website, after which an employee will call you back and make an appointment at a company branch that is geographically convenient for the client.

Demo account

The broker provides the opportunity to open a demo trading account. To do this, go to the “Training” section on the company’s website and select the demo account service.

In this case, the investor will have a somewhat limited toolkit (about 350 tools are provided in total). And only ALOR and TSlab terminals are available for making transactions. The standard KVIC for trading is not available on the demo version.

Account replenishment and withdrawal of funds

The following transaction methods are available for depositing and withdrawing funds from a brokerage account:

- through the cash desk in the office (free);

- by bank transfer (including bank commissions).

Technical support

To communicate with technical support, the broker allows you to use the following means of communication:

- telephone;

- office visit;

- Email.

ALOR broker does not provide any additional quick chats.

Registration in the account

To work with your personal account, it is recommended to use Yandex.Internet or Google Chrome browsers that support cookies and use JavaScript scripts. These settings must be enabled.

The personal account is available to clients after opening a brokerage account. Access is granted automatically 5 minutes after opening an account. In this case, the client is given a Memo containing a login and password. For security purposes, login and password are issued only after personal identification.

To log in, you need to open the “Client Account” tab on the main page of the site. In the new page that opens, enter your username and password. On your first visit, the system will prompt you to change your login and password.

If the password is lost, it can only be restored after personal identification. This is done for the safety of clients and to prevent fraudulent transactions with their assets.

Pros and cons of the company

Speaking about the strengths of the ALOR broker, we can highlight the following advantages:

- the ability to open a demo account;

- availability of a large number (including our own) brokerage software;

- customer training;

- availability of ready-made investment solutions.

The company's disadvantages include:

- insufficient information content of products and the site as a whole;

- a small number of means of communication;

- no trust management services;

- no forex dealer license;

- high service fees.

Peculiarities

The Alor Trade terminal combines full-fledged functionality focused on trading and technical analysis. This is a very effective program to use, which is endowed with simple functionality, is convenient and efficient in operation. The use of the Alor Charts module is the basis of the terminal, and the Alor Tick module also plays a large role here. Both of them provide complete market technical analysis. Another special feature of the program is that it interacts well with external technical analysis modules, due to which its functionality can be significantly expanded.

The high speed of the Alor Tick terminal is another tangible advantage of its use. This way, a trader can receive information that is useful at the moment about the current market state, as well as make quick transactions and conclude profitable deals.

An important advantage of the terminal is the clarity of the interface. This provides the trader with an instant understanding of what its main functions are, as well as how best to use it. The menu allows the client to perform a variety of actions and operations. The fixed position of the menu is quite convenient when working.

Real reviews

I looked through a lot of comments about the broker and will further tell you what they think about ALOR:

- active traders;

- clients;

- employees.

Traders

In general, traders speak well of this brokerage company. True, there are those who do not like the service and quality of the services provided. Among the constructive things, one can note a huge number of comments about high commission costs and various kinds of additional write-offs of funds.

Clients

Clients of a brokerage firm who are not active participants in financial markets, in most cases, remain dissatisfied with the services provided to them. Users note low-quality support, incompetent employees, unjustified debits from the account and problems with delays in transferring money from the brokerage account.

Employees

We can say that the majority of the organization’s employees remain satisfied with the working conditions, salary and corporate practices provided to them in the team.

Using the Client Account you can:

- View daily and monthly brokerage reports.

- Connect, configure and disconnect products/services/services.

- Submit orders for non-trading transactions with funds and securities.

- Submit applications (order a 2-NDFL certificate, etc.).

- Create requests to the broker and receive responses to them.

- Sign up for training.

Before using the service, we recommend that you read the User Guide.

Hotline,

Open an account Ask a question

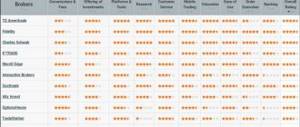

Alternatives

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Here you can see alternative brokerage companies. All of them have competitive commissions, good quality of service and high reliability.

ALOR.Trade APK

ALOR.Trade content rating is Unrated. This app is listed in Finance category of app store and has been developed by https://www.alorbroker.ru/pr…. You could visit ALOR PLUS CORPORATION's website to know more about the company/developer who developed this. ALOR.Trade can be downloaded and installed on android devices supporting 7 api and above.. Download the app using your favorite browser and click on install to install the app. Please note that we provide original and pure apk file and provide faster download speed than ALOR.Trade apk mirrors. . You could also download apk of ALOR.Trade and run it using popular android emulators.

More

Enable push notifications

Investigation block

The company's reliability was analyzed based on key points.

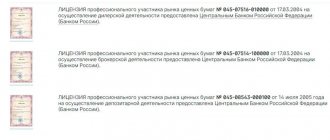

Licenses

The company's management received 3 licenses from the Central Bank, which are valid to this day. Alor has the right to enter the stock market, exchange, and conduct depository, dealer, and brokerage activities. The client understands that the broker is a direct participant in the financial market, over which there is control by the Central Bank, potential risks are excluded.

License

But having licenses is not a sufficient condition for checking reliability. They can be revoked at any time and the company will be prohibited from operating. This is not a panacea for bankruptcy.

Rating

The broker has not been researched by any reputable agency. The Moscow Exchange announces that Alor took 10th place in the number of registered clients, plus 19th place in the number of active user accounts.

The organization is not included in the objective rating of Forex brokers based on traders' votes. It is impossible to judge the actual fulfillment of financial obligations, stability, and reliability using a rating scale. There is also no data on domestic and international awards on the website.

Information disclosure, analytics, customer service

It is indicative to study the figures disclosed by the broker. The company's capital cannot be less than 2% of its liabilities. The site does not provide explanations of the balance sheet. The client is limited in his ability to understand exactly who he is dealing with. This information about Alor Broker cannot be obtained even after authorization in your personal account.

Other:

- a report on daily operations no later than 2 days during the reporting period – yes;

- details – yes;

- information about the corporate actions of the issuer (as the holder of a license for the right to see depository activities) - no access;

- withdrawal of funds upon client’s request no later than the next business day – stated, but not always implemented.

The website states that client issues are resolved promptly, but reviews of Alor Broker say that this is not the case.

See also: TOR Corporation: reviews, review of the tor-corporation.com resource, “TOR Corporation” - a scam or not?