In the article we will look at how the Sberbank depository functions. The depositary of Sberbank PJSC rightfully occupies a leading position in its market segment. However, despite the growing activity of the population in matters of exchange activity in 2021, many still do not know what it is.

In addition to the main activities of a credit and deposit nature, as well as maintaining current current accounts of its own clients, Sberbank provides a large list of other financial services. One of the most popular services is a depository. In this market segment, this financial institution occupies a leading position. Some clients have been using Sberbank's depository for a long time.

About the broker

Basic information about the service can be found in the table below.

| Name | Sberbank CIB |

| Year of foundation | 2012 |

| Regulator and license | Central Bank of the Russian Federation No. 04502894100000 dated November 27, 2000 |

| Requisites | OGRN: 1027700132195 INN: 7707083893 |

| Reliability rating | Highest reliability rating - AAA |

| Trading platforms | Stock market Currency market Derivatives market OTC market MB |

| Trading platform | QUIK platform Sberbank Investor application |

| Minimum deposit | No limits |

| Authorized capital | 239 million rubles. |

| Head office address | Moscow, st. Vavilova, 19 |

| Official site | sberbank-cib.ru |

| Hotline number | 8 |

| Free demo account | Yes |

| Minimum commission | 0,03% |

What is trust management from Sberbank

The financial institution offers its clients to arrange trust management of an individual investment account in Sberbank, the profitability of which will directly depend on the actions of the owner of the funds. With this form of money management, the principal remains the owner of the savings. The functions of the manager include the task of profitably managing the entrusted money.

The possibility of losing money is present in any investment. Therefore, the manager does not guarantee that a profit will be received from the funds transferred for placement. At the same time, the profitability from this type of investment can significantly exceed the rates of many bank deposits. IIS deposits can be managed through your personal account, which is available on the official resource. By logging into the system, the client can:

- choose mutual funds that are managed by a specific bank branch;

- carry out various transactions for the acquisition, exchange or redemption of shares online;

- carry out control functions in relation to the already formed investment portfolio.

Only a competent employee in this field who has the appropriate qualification certificates from the Federal Service for Financial Markets can become a capital trustee. Only in this case will the citizen be able to count on the safety of the transferred savings and on the increase in the entrusted amount.

Brief history of the broker and awards

The service was created in 2012 as a result of the merger of the investment and open joint-stock company Sberbank of Russia. The formation of the joint stock company Sberbank CIB (corporate investment business) occurred after the bank bought out IC Troika. Sberbank CIB includes Troika divisions:

- Analytics department;

- Department of Structured Products and Global Markets;

- Department of Investment Banking.

Initially, the company was created to attract key foreign and Russian investors.

The broker has repeatedly received the title of the best innovative investment bank in the Russian Federation and in Eastern and Central Europe. For several years in a row, Sber has received awards and taken top places in the “Dealer of the Year” competitions. In 2021, the competition received the main prize for the best bank of the year and the best bank in the derivatives market.

There were victories in the categories of the best brokerage house, the best broker with analytical support for stock transactions, the best broker in strategies in the gas, oil, and stock markets. There were victories in competitions for the best analytics.

The service took leading positions in the European rankings as the best dealer in Russia, MBK, and the best IPO in EMEA. Sberbank CIB received first places for the best transactions in bond placements and work with borrowers.

Evidence of professionalism

The depositary has been operating since 1997 and during this time has successfully serviced numerous securities accounts. This is the highest proof of the trustworthiness of the organization.

Extensive work experience

The company has been operating for 20 years, during which time it has opened hundreds of thousands of securities accounts and began cooperation with the largest Russian companies. The reliability of the Depository has been confirmed by many years of successful work.

Huge clientele coverage

The company works with 400,000 securities accounts. Due to this circulation of papers, the organization has accumulated an extensive knowledge and experience necessary to solve the assigned problems. In addition, in cooperation with clients, the Depository has developed simple and functional service delivery systems. When performing services, the individual characteristics of the issuer and its securities are taken into account.

Read more at: Bankigid.net

What services does it offer?

As a broker, Sberbank Kib provides the following services:

- execution of operations in global markets;

- demo account;

- margin trading;

- conducting transactions to obtain additional income from short-term placed securities (overnight repo).

The service keeps records of transactions for the sale and purchase of securities and depositary accounts.

Sberbank broker services include financing and placement of securities (bonds, derivatives market instruments, shares), transactions with commodity contracts and currencies.

The service offers structured products and specialized derivative instruments. These services are used for hedging transactions in commodities, currencies and interest rates.

The company provides financial advisory services, liability management, acquisitions and mergers, and mezzanine financing. Sberbank broker services also include restructuring and assistance in obtaining a credit rating. The broker conducts an examination of the placement of depositary receipts and shares on the market.

Why do you need a depository?

Dealers, brokers, and management companies deal with securities transactions, and the depository stores and records them. Its employees are responsible for the legal transfer of rights from one asset owner to another.

Anyone who plans to purchase shares, bonds or other securities opens DEPO-type accounts at the depository. They are used to make records of the enrollment and write-off of these material assets.

The main feature of the depository is that it has nothing to do directly with the transaction. Purchase and sale, donation, and redemption are carried out by non-depository employees. It provides only intermediary services for storage and transactions.

Trading and Investment Tools

The service from Sberbank broker provides a number of tools for investing and trading on Moex:

- stock;

- currencies;

- bonds;

- futures;

- goods;

- investment funds ETF and mutual fund.

On the derivatives market, Sberbank broker provides the opportunity to trade the following assets: options, commodity futures, indices, currencies. In the stock market - stocks, bonds, depositary receipts, exchange-traded and mutual funds.

In the over-the-counter market, traders can conduct transactions in shares of small companies (low-liquid assets). Qualified investors have access to Eurobonds and selected foreign shares for purchase.

Types of depository services

The Sberbank Depository performs the following functions:

- registration of new accounts for accounting of the Central Bank in national and foreign currencies;

- accounting and physical storage of emission and non-emission securities, such as bills, bills of lading, checks, shares, bonds and others;

- accounting and transfer of ownership rights to the securities after the conclusion of transactions between the parties;

- conducting transactions on transactions with the Central Bank using Sberbank correspondent accounts in international clearing centers of banks in Europe and the USA;

- registration of collateral transactions, imposition and removal of encumbrances;

- transfer and receipt of data between depositories of the world in the process of conducting operations;

- drawing up statements of depo accounts for their subsequent transfer to account holders;

- crediting profits from working with the Central Bank, interest, dividends;

- redemption of coupons and securities themselves;

- organizing work with issuers of securities, participating in shareholder meetings on the basis of a formalized power of attorney, conducting procedures for splitting, consolidating or converting securities.

In terms of its functions, the Sberbank depository assumes the mission of a custodial bank for international participants in depository transactions and storage of ADR/GDR depositary receipts.

Terms of service and tariffs

| Account types | Broker commission | Exchange commission | Depository commission | Commission on over-the-counter market transactions | Fee for using the terminal | Fee for withdrawal of funds | Deposit and withdrawal methods |

| Basic (brokerage); special (individual and investment) | 0.006–0.165% of the transaction amount without analytical support. Minimum rate from 100 million rubles. Maximum – with a turnover of up to 50,000 rubles. Tariff with analytical support - 0.3% regardless of daily turnover. | 0,002-0,01% | 149 rubles per month. Charged only if the balance of securities in securities accounts changes as a result of trading during a calendar month. | 0,03% | No | No | Sberbank cash desk, payment systems, ATM |

Correspondent relations

To carry out full-fledged work in the field of providing depository services, the Sberbank division has established correspondent relations with major representatives of the securities market: depositories and registrars. Among the main and most important partners it is worth noting:

- Clearstream Banking SA, NPO JSC NSD, Euroclear Bank SA/NV, etc.;

- JSC RO Status, JSC VTB Registrar, JSC Independent Registrar, etc.

To get acquainted with the full list of correspondents of the Depository, you need to visit the section of the bank’s main website dedicated to the disclosure of information about the bank as a participant in the securities market.

Broker Products

The broker provides the following products for investors and traders:

- trading strategies;

- IIS (individual investment account);

- trust management.

Structured Products

has developed a number of complex products, which include the following assets:

- structured bonds;

- loans;

- financing secured by the Central Bank and commodities;

- structural deposits;

- derivatives.

Investors with a minimum amount of 3 million rubles can enter into an agreement with the management company and purchase structured products of Sberbank for 2 years. At the same time, a capital protection strategy is provided.

An investor can invest in structured bonds for 2 years. The face value of one paper is 1000 rubles. Part of the risk-free component is placed on deposit. The risky part will be placed in depositary receipts. There are promotions here.

It is proposed to obtain investment income using another structured product - ILI (investment life insurance). At the end of the term, profit is paid. In the event of an accident, the heir or relative immediately receives payment.

Structural products are intended for a wide range of customers:

- individuals with high income;

- corporate clients;

- commodity traders;

- financial organizations.

The company receives commissions for the sale of structured products. The profitability of structured products is guaranteed above deposits. But in reality, clients of the Sberbank broker note a slight excess of profit compared to the deposit.

IPO

In 2012, there was a secondary (public) offering of Sberbank shares with listing on the London Stock Exchange and Moscow Exchange. The volume was $5.2 billion. This became the largest SPO in the Europe, Middle East and Africa region. Also in 2012, an initial placement of corporate bonds and bonds of the Novatek joint stock company was carried out in the amount of 20 billion rubles.

In 2021, the service issued convertible bonds for $250 million. Joint bookrunner with .

In 2017–2018, primary and secondary placements of securities of a number of companies were carried out:

- Rosneft.

- Megaphone.

- RUSSIAN RAILWAYS.

- PhosAgro.

- Child's world.

- Shoes of Russia.

- Ate.

- Nornickel.

- RusHydro.

- Rusal.

- Gazprom.

In 2021, its own ruble bonds were issued in the amount of $25 billion rubles.

More

Sberbank broker investors are given the opportunity to invest in risky instruments - barrier notes. When investing in this category of structured instruments, there is no guarantee of return. Investments are not divided into risky and risk-free parts.

Money is invested in different instruments:

- currency;

- stock;

- precious metals;

- futures.

If the price of one of the assets decreases (the barrier condition is triggered), the investor will not be returned money, but only the asset that has decreased in price. The terms of the Sberbank agreement provide for the receipt of a cheap asset for the full amount.

Risks, errors and problems

Despite its attractiveness, investing in the stock market has certain risks. And this should always be taken into account. There is always the possibility of financial losses in the desire to receive profits that significantly exceed the interest rates of deposits. The bank providing the service will not guarantee a certain level of profitability when placing assets transferred to it by the board. Do not forget that all risks associated with the securities market fall on the client. And in the event of an unforeseen development of the situation associated with a fall in quotes or other undesirable events, a negative effect of investment is possible.

An analysis of Sberbank's trust management shows that a client-investor can receive 300% per annum in some situations, and in others, lose significant amounts. If the client has no desire to take risks and monitor all the dynamics of investment processes, then he should pay attention to deposits.

Services are available only to Sberbank First clients

Software and mobile trading

Traders are given the opportunity to trade using the QUIK platform and from mobile devices based on the Android and iOS operating systems. The QUIK system is the main terminal for working on the stock exchange.

When the pocket QUIK service is activated, iQUIK-HD and iQUIK applications are available for iPad and iPhone mobile devices. Applications are available in the AppStore online store. The WebQUIK terminal and the free WebQUIK Mobile application for mobile devices are available to traders.

Maintenance of depository receipt programs

Another priority area of activity for Sberbank PJSC is participation in depository receipt programs. Today, the portfolio of services includes 55 active programs maintained by Sberbank, presented by 32 Russian companies.

The most common programs are subsidized. This type of program is incredibly beneficial both for the issuer of shares and for the buyer. With the help of custody accounts, clients can easily create and redeem ADR/GDR.

Working with a broker

To work with a broker from Sberbank, an individual must agree on a time and meet with the manager of the client department. Submit documents (copy of passport, TIN), fill out a form with a service option and an application.

To open a brokerage account, you must enter into a brokerage services agreement and a depository agreement. The list of documents is different for legal entities and non-residents.

After signing the documents, the client is provided with the details of the Sberbank broker for replenishing the account and contacts.

The client can carry out trading operations using

- Internet trading in the installed QUIK program;

- via mobile devices;

- in the browser (WebQUIK);

- by phone.

Registration on the official website

To register a broker in the Sberbank system, you must enter your phone number and agreement code in the dialog box. After sending the message, you will receive an SMS with a password generated by the program. Before this, the client is not connected. After launching the application, you must enter the contract code as a login and password.

Instructions for opening an account

To open an account, a client of a Sberbank broker must contact a bank branch, provide a copy of their passport and TIN, fill out a form, sign an agreement and a contract. After opening an account, the client is given details, tariff plans, an investor code table map, a copy of the application for brokerage services, and a list of commissions.

Demo account

A Sberbank broker client can use a demo account after logging into the system. Availability period: 1 month. The demo version allows you to place orders, view quotes, and read investment ideas.

Account replenishment and withdrawal of funds

The following methods of replenishing your account are available to work with the broker:

- payment systems;

- ATM;

- mobile operators;

- cash register;

- payment terminal;

- mail;

- office of another bank.

The following methods are available to withdraw funds:

- cash desks of third-party banks;

- ATM;

- Sberbank cash desk;

- payment systems.

To withdraw an amount exceeding 100,000 rubles, you must additionally confirm the withdrawal by phone.

Technical support

According to the majority of network users, the broker's technical support is not up to par. Often, Sberbank broker traders cannot get clear answers using the Quik program, about server failures, or how to play forex.

Special depository of Sberbank

In addition to servicing individuals, the bank's priority clients are large companies that want to use. It should be immediately noted that the maintenance and servicing of accounts opened by legal entities is carried out in accordance with other tariffs, which differ significantly from the tariffs for the provision of services for individuals.

The list of Sberbank services provided to legal entities is almost identical to that of individuals. In addition to the main services, services are also available for insurance organizations, organizations that carry out independent regulation, the whole range of services related to maintaining a register of mortgage coverage, storage, and accounting of mortgages.

It should be noted that currently there is also a special mobile application that allows you to carry out remote activities with your depo accounts. At the same time, the security and quality of service of the application fully complies with the standards of the Russian Federation provided for conducting such activities.

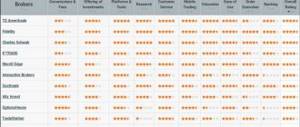

Pros and cons of the company

The main advantages of working with a broker:

- Reliability.

- Free programs.

- Several tariffs and investment portfolios.

- There are no limits when opening an account.

- Simple withdrawal and replenishment.

Disadvantages of a broker from Sberbank:

- Not the most profitable commissions, unlike other intermediaries.

- There is no access to the St. Petersburg stock exchange.

- Limited set of services and tools.

- Frequent connection interruptions and server freezes.

Opening and maintaining a securities account

- Conditions for the implementation of depository activities of Sberbank PJSC (zip) Archive contents: 966-р_22_Conditions for the implementation of depository activities (docx);

- 966-r_22_Conditions for carrying out depository activities (pdf);

- PR_1 966-22_Application for depository services (docx);

- PR_1 966-22_Application for depository services (pdf);

- PR_2 966_22_Instruction for opening a securities account and a list of documents for opening a securities account (docx);

- PR_2 966_22_Instruction for opening a securities account and list of documents for opening a securities account (pdf);

- PR_3 966_22 (pdf);

- PR_3 966_22 (rtf);

- PR_4 966_22_Forms of forms, reports and rules for filling them out (docx);

- PR_4 966_22_Forms of forms, reports and rules for filling them out (pdf);

- PR_5 966_22_Forms of powers of attorney (pdf);

- PR_5 966_22_Forms of powers of attorney (rtf);

- PR_6 966-22 (pdf);

- PR_6 966-22 (rtf);

- PR_7 966-22_Agreement with the trustee of the securities account (pdf);

- PR_7 966-22_Agreement with the trustee of the securities account (rtf);

- PR_8 966-22 (pdf);

- PR_8 966-22 (rtf);

Complaints about the broker

There are positive reviews about the broker on forums and rating sites. But most of the opinions of ordinary traders about the Sberbank broker are given in a negative way.

Initially, sberbank KIB was created for large businesses. This position is still relevant today. With small amounts, traders mostly go into the red.

Users note inflated commission fees for closing and opening transactions, taxes. You also need to pay tax on losing trades and withdrawals of your funds.

There are often cases of unjustified account blocking and server freezing at the wrong time. It is not possible to re-open an account quickly - you have to wait several days.

Experienced traders note frequent freezing of the broker's Sberbank system and subsequent loss of communication during times of strong volatility.

Investors often complain about the low competence and rudeness of consultants and managers. The recent dismissal of employees of the analytical department does not add confidence to the Sberbank service on the part of institutional investors.

Employees wrote a truthful report on Forex investments, and senior management didn't like it. In financial circles, such an action did not meet with approval, since it is not customary to fire analysts for their opinions on investment issues.

Next, I present real complaints and reviews about working with a broker from Sberbank.

(from card to card, from card to account)

Each Sberbank card owner has his own account in which money is stored. The card only acts as an access key to this account. Therefore, when making a transfer from card to card, you are actually making a transfer from account to account, but you are using the card details as a key.

To accounts (cards) of individuals

Are common:

- Transferring money within the system and within the same city is free.

- Transferring money to an account in another bank : through a branch - 2% of the amount, online - 1% of the transfer amount.

- Transfer of rubles outside the city (region) : at a bank branch - 1.5% of the amount, online - 1% of the transfer amount.

Real reviews from traders

Clients

Employees

Sberbank premium service packages

There are standard products that are available to the majority of the population; they can be purchased at any Sber office. And there is Sberbank’s premium service, which includes services of a higher level. But even in the premium segment there is a division into levels.

All packages are aimed at wealthy clients who need the highest quality and efficient banking services. And we are talking specifically about individuals; separate packages have been created for legal entities.

Sberbank's premium services are provided within the framework of the Sberbank Premier, Sberbank First and Private Banking packages.

Sberbank Premier service package, its cost

The Sberbank Premier package is one of the most popular in the privileged segment. We can say that it follows immediately after standard services and opens up new dimensions for customers who want to receive more than classic banking services.

It is clear that an upgrade in service class also provokes increased maintenance costs. The bank is ready to provide an expanded range of services and premium financial products. But in general, the fee cannot be called high - using the package costs 2,500 rubles monthly.

But you can use the Sberbank Premier package for free if you meet one of the following conditions:

- the total balance on all client accounts opened with Sberbank is more than 2,500,000 rubles;

- the account balance is more than 1.5 million rubles and, at the same time, non-cash turnover on cards issued as part of the package is from 100,000 rubles;

- non-cash turnover by cards - from 150,000 rubles;

- using a card issued as part of the package to deposit salaries, and receiving income from the place of work of more than 200,000 rubles.

If necessary, the commission is debited automatically on the 5th of each month. If the required amount of 2,500 rubles is not in the account, Sberbank disconnects the premium tariff plan.