| Order form |

| If you have questions about this work or want to study the DEMO version (if it is not on the site), or require similar work for another company (bank) , or for another period (as reports are released), write a message to the author . |

Download demo version (RAS, 2018-2020)

Download demo version (RAS, 2017-2019)

Download demo version (IFRS, 2016-2018)

Download demo version (RAS, 2016-2018)

Investment idea

Surgutneftegaz is one of the largest Russian companies operating in the field of oil and gas production and processing.

| Surgutneftegaz a. O. | |

| Recommendation | Buy |

| target price | 41,1 |

| Current price | 35,7 |

| Potential | 15,1% |

| Surgutneftegaz a. P. | |

| Recommendation | Buy |

| target price | 51,8 |

| Current price | 45,0 |

| Potential | 15,1% |

We recommend “Buy” ordinary and preferred shares of Surgutneftegaz with a target price of RUB 41.1.

and 51.8 rub. respectively. Potential in the future 12 months. is 15.1% for ordinary shares and 15.1% for preferred shares. * The recovery in oil prices, the weak ruble and the gradual easing of OPEC+ restrictions will allow Surgutneftegaz’s financial results to recover in 2021. * Surgutneftegaz holds almost $50 billion in its accounts - more than the company’s capitalization. The target is unknown. * Dividends on preferred shares depend on the currency revaluation of the capital for the year. Thanks to this, the dividend yield on preferred shares at the end of 2021 will be 14.9%. * The lack of a strategy for using funds and, in general, transparency of the company does not allow the market to take into account the money in the valuation of Surgutneftegaz shares, which limits the potential upside.

Securities data

| Index | Meaning |

| Ticker | SNGS (ordinary), SNGSP (privileged) |

| Trading platforms and trading times | Moscow Exchange: 09:45 - 19:00 Moscow time London Stock Exchange (ticker SGGD): 10:00 - 18:30 Moscow time |

| Name | PJSC "Surgutneftegas" |

| Number of securities in circulation | 35,725,994,705 ordinary (JSC) +7,701,998,235 preferred (AP) |

| Denomination | 1 ruble |

| Dividends | Yes |

| Year of foundation | 1993 |

| Founded by | Vladimir Bogdanov |

| Headquarters | Tyumen region, Khanty-Mansiysk Autonomous Okrug - Yugra, Surgut, st. Grigory Kukuevitsky, 1, building 1 |

Industry Trends

Among the international trends affecting Surgutneftegas, it is worth noting the production limitation by OPEC+. Let us recall that at the moment, OPEC+ members are reducing production by approximately 7.3 million bpd, and Surgutneftegaz is also subject to these restrictions. Because of this, oil production in the 1st quarter of 2021 decreased by 13.2% y/y. At the same time, OPEC+ is gradually beginning to increase production, and therefore in the 2nd quarter we can expect an increase in production from Surgutneftegaz.

Source: company data

If we talk about the oil market as a whole, it is in the recovery stage from the pandemic. Prices have already fully recovered and are now trading higher than before the pandemic - close to $69 per barrel.

Source: finam.ru

It is important to understand that rising prices do not mean a complete recovery of the market from the effect of the pandemic. The main driver of price growth was the OPEC+ restriction, which currently removes about 8 million bpd from the market, taking into account the voluntary production reduction by Saudi Arabia. At the same time, since May, OPEC+ began to increase production by 350 thousand b/d, and in June and July it will increase production by another 350 thousand b/d and 450 thousand b/d, respectively. In addition, Saudi Arabia plans to gradually abandon its voluntary production cut of 1 million bpd by July. In the short term, oil prices are also supported by the proximity of the summer season, when demand for gasoline traditionally increases.

Given the explosive growth in coronavirus cases in individual countries, including India, the world's third-largest oil buyer, rising production in May will show the sustainability of the current balance in the oil market. At the same time, the US Department of Energy still expects a full recovery in demand only in the first half of 2022.

Source: EIA

Additional threats to the balance in the oil market should be considered the possibility of an increase in shale oil production in the United States, where, due to consistently high prices, drilling activity has been increasing over the past few months, as well as the conclusion of a nuclear deal with Iran, the condition for which may be the lifting of sanctions from outside and the return of Iranian oil to the world market.

Summary.

Surgutneftegaz is a stable company. By buying securities of this blue chip, you can count on stable income in the long term.

However, some risks are still present. If you want to protect yourself as much as possible, it is better to find a more reliable tool that does not have the above risks.

Financial results

In terms of revenue and accor. EBITDA financial results of Surgutneftegaz for 2021 turned out to be expectedly weak - they decreased by 31.6% y/y and 46.3% y/y, respectively. This is due to both a decrease in average oil prices and a decrease in oil production by 9.9% y/y due to the OPEC+ agreement. Free cash flow, against the backdrop of falling EBITDA and growing working capital, went into negative territory.

At the same time, net profit increased 7 times and turned out to be significantly higher than EBITDA. This is a normal situation associated with a positive foreign exchange revaluation of the company’s money due to the weakening of the ruble. Against this background, the money box itself grew in ruble equivalent by 18.9% y/y, to RUB 3.7 trillion. In dollar terms, the company's cash reserves decreased by 1% YoY.

In 2021, we can expect a recovery in revenue and EBITDA as oil prices rise, refining margins normalize and production restrictions ease due to the OPEC+ agreement. However, the value of net profit, as usual, will be primarily determined by the dollar-ruble exchange rate at the end of the year.

"Surgutneftegas": financial results according to IFRS for 2020 (billion rubles)

| Index | 2020 | 2019 | Change, % |

| Revenue | 1075,2 | 1570,9 | -31,6% |

| EBITDA adj. | 262,1 | 487,8 | -46,4% |

| EBITDA margin | 23,1% | 29,5% | -6,4% |

| Net profit of shares | 742,9 | 106,2 | 599,8% |

| Net profit margin | 69,1% | 6,8% | 62,3% |

| Free Cash Flow | -41,9 | 260,1 | -116,1% |

| Cash (RAS) | 3703 | 3114 | 18,9% |

| Oil production, million tons | 54,8 | 60,8 | -9,9% |

Source: company data

"Surgutneftegas": historical and forecast financial indicators (billion rubles)

| 2017 | 2018 | 2019 | 2020 | 2021E | 2022E | 2023E | |

| Gains and losses report | |||||||

| Revenue | 1175,0 | 1556,0 | 1570,9 | 1075,2 | 1654,7 | 1674,8 | 1712,7 |

| EBITDA adj. | 338,2 | 512,8 | 487,8 | 262,1 | 424,6 | 398,3 | 386,2 |

| EBIT | 272,4 | 415,2 | 393,0 | 165,1 | 314,4 | 279,8 | 246,8 |

| Net profit of shares | 194,7 | 850,4 | 106,2 | 742,9 | 301,6 | 383,1 | 353,1 |

| Profitability | |||||||

| Adjusted EBITDA margin | 28,8% | 33,0% | 31,1% | 24,4% | 25,7% | 23,8% | 22,5% |

| Profitability of net profit of shares. | 16,6% | 54,7% | 6,8% | 69,1% | 18,2% | 22,9% | 20,6% |

| ROE | 5,6% | 21,3% | 2,4% | 14,5% | 4,6% | 6,2% | 6,2% |

| Cash flow, debt and dividend indicators | |||||||

| CFO | 356,1 | 350,5 | 476,3 | 129,1 | 453,1 | 382,9 | 387,1 |

| CAPEX | 160,2 | 151,3 | 159,2 | 171,3 | 174,7 | 189,4 | 199,6 |

| CAPEX % of revenue | 14% | 10% | 10% | 16% | 11% | 11% | 12% |

| FCFF | 195,9 | 199,2 | 317,1 | -41,9 | 278,3 | 193,5 | 187,5 |

| Net debt | -2538 | -3366 | -3365 | -3830 | -4033 | -4176 | -4314 |

| Net debt / EBITDA | -7,5 | -6,6 | -6,9 | -14,6 | -9,5 | -10,5 | -11,2 |

| DPS, rub. | 0,65 | 0,65 | 0,65 | 0,65 | 0,65 | 0,65 | 0,65 |

| Payment rate, % of profit IFRS | 12% | 3% | 22% | 3% | 8% | 6% | 7% |

Source: Bloomberg

Grade

Surgutneftegaz shares do not lend themselves to classical methods of valuation, since formally the value of the business is assessed by the market as a negative value - cash reserves in the accounts exceed the sum of debt and capitalization. If the market took these funds into account, Surgutneftegaz shares would cost more than 100 rubles. Typically, the market does not factor in missing treasury shares in its valuation, which could increase the potential target capitalization.

The logic of the market is clear - management does not share plans for using the moneybox, and it is unknown whether it will be used to increase capitalization in the foreseeable future. In this regard, we consider it appropriate to consider the valuation of Surgutneftegaz common shares as an oil company without debt and cash. In such a situation, capitalization will be equal to business value (EV).

For the assessment, we used a comparison based on the EV/EBITDA multiplier, since the P/E multiplier does not work in this case due to the dependence of Surgutneftegaz’s profit on the revaluation of the currency box. This assessment gives the target EV and capitalization of Surgutneftegaz in the amount of 1,785.5 billion rubles, or 41.1 rubles. per share. This equates to an upside of 15.1% and a Buy rating.

Estimation of target price for ordinary shares of Surgutneftegaz, billion rubles.

| Company | EV/EBITDA 2021E |

| Gazprom Neft | 3,9 |

| LUKOIL | 4,2 |

| Rosneft | 4,1 |

| Tatneft | 4,5 |

| Gazprom | 4,2 |

| Median by analogues | 4,2 |

| Indicators for evaluation | EBITDA 2021E |

| Surgutneftegaz, billion rubles. | 424,6 |

| EV of oil business, billion rubles. | 1785,5 |

Source: FINAM Group estimates, Reuters

As for the preferred shares, given their dividend yield of 14.9% for 2021 and another 7.8% for 2021, we consider their current premium of 26% to common shares to be fair. If it is maintained, the target price for preferred shares will be RUB 51.8, which corresponds to a “Buy” rating and an upside of 15.1%.

We note that the weighted average target price for ordinary shares of Surgutneftegaz based on a sample of analysts with historical forecasts for this stock not lower than the average, according to our calculations, is RUB 56.0. (upside - 56.9%), stock rating - 4.25 (a rating value of 5.0 corresponds to a Strong Buy recommendation, and 1.0 - Strong Sell.)

Including the target price estimate for ordinary shares of Surgutneftegaz by Renaissance Capital analysts at 140 rubles. (recommendation - “Hold”), Sova Capital - 48 rubles. (“Buy”), VTB Capital – 32.8 (“Sell”).

The weighted average target price for preferred shares of Surgutneftegaz based on a sample of analysts with historical forecasts for this stock is not lower than the average, according to our calculations, 73.9 rubles. (upside - 64.2%), stock rating - 3.75 (a rating value of 5.0 corresponds to a Strong Buy recommendation, and 1.0 - Strong Sell.)

Including the estimate of the target price for preferred shares of Surgutneftegaz by Renaissance Capital analysts is 140 rubles. (recommendation - “Buy”), BCS - 70 rubles. (“Buy”), VTB Capital – 36.6 (“Hold”).

About company

is a vertically integrated holding that includes the entire production cycle from mineral extraction to the sale of finished products.

Products produce:

- petrol;

- diesel fuel;

- jet fuel;

- electricity;

- gas processing products.

Main shareholders

The ownership structure of Surgutneftegas PJSC is quite complex and confusing. 11% of ordinary and 66% of preferred shares are registered to a nominal holder - the National Settlement Depository. This is the only shareholder that the company shows in its report.

As for the owners of the remaining shares of Surgutneftegaz, there is no exact information on them. According to some reports, a significant share of the shares belongs to various non-profit partnerships and offshore subsidiaries of the holding.

Other sources claim that control of the company belongs to its CEO Vladimir Bogdanov. Some shares are traded on the stock exchange and belong to minority shareholders.

Key figure and her role

The general director of the company, Vladimir Leonidovich Bogdanov, is a Hero of Labor of the Russian Federation and an Honored Worker of the oil and gas industry. He has been working in various positions at Surgutneftegaz since 1976. According to some estimates, he owns a significant share of shares, but there is no exact confirmation of this. He is among the 200 richest businessmen in Russia (according to Forbes).

On April 6, 2021, US authorities added Vladimir Bogdanov to the sanctions list.

The subsidiaries are a vertically integrated holding. It includes a number of companies that are parts of a common mechanism. Some are faced with the task of extracting oil, while others are faced with selling gasoline to the end consumer.

Here are just some of the subsidiaries:

- Oil and gas production.

- Oil refining (Kirishinefteorgsintez).

- Sales enterprises: LLC Kirishiavtoservis, LLC Pskovnefteprodukt, LLC Kaliningradnefteprodukt, LLC Novgorodnefteprodukt and LLC Sales Association Tvernefteprodukt.

- Insurance company "Surgutneftegaz".

- JSC "Surgutneftegasbank".

Company plans for the future

In the future, the company plans to pay increased attention to the East Siberian region. Significant reserves of resources are concentrated here, which will last for decades. Moreover, Surgutneftegas has been investing in the development of the region’s infrastructure for several years. Thus, back in 2013, the company commissioned an airport at the Talakanskoye field in Yakutia.

The production level will remain at 61-62 million tons per year. This will allow for more rational use of existing fields and will provide Surgutneftegas with a stable position in the market.

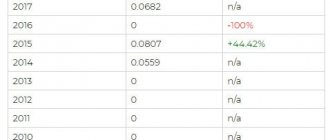

Dividend statistics

Statistics on payments are available on the company's website. Since 2013, the amount of dividends on ordinary shares has remained at the level of 0.6-0.65 rubles. For common stocks, the indicators are more varied. So, in 2014, 8.21 rubles were paid for one such paper, and after 2 years the payment amount was 60 kopecks.

Interesting facts about the company

In 2021, Surgutneftegaz became the most profitable oil company in the world. This was facilitated by the policy of the holding, which had been accumulating profits in its foreign currency accounts for years. And, despite the fall in oil prices, thanks to the accumulated reserves, the company provided a positive return to its owners (especially for preferred shares).

Shares on the stock market

Since the beginning of 2021, ordinary shares of Surgutneftegaz have looked significantly worse than the market, which is primarily due to the high base effect. At the end of 2021, there was a peak in the growth of ordinary shares associated with the creation. There was no continuation of the story with the subsidiary company, and therefore the ordinary shares of Surgutneftegaz were unable to recover to the level of the beginning of 2021.

Preferred shares turned out to be better than the oil and gas sector in terms of dynamics, although they were slightly behind the broad MICEX index. The strong performance of preferred shares is due to the weakening of the ruble in 2020, which led to a significant increase in profits and dividends.

Source: Bloomberg

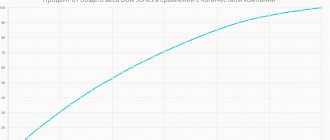

Exchange rate dynamics for all time

The chart clearly shows periods of rising and falling quotes. Over the past 20 years, 2 peak values can be detected, followed by a long-term correction. Thus, for the period from 1999 to 2006. the value of preferred shares (prefs) of Surgutneftegaz increased 100 times.

This was followed by a drop of more than 6 times. Then again an increase of 8 times. Even with passive investing, having invested 40 kopecks in 1999, we would now have 28 rubles. This means a return of 7000% over 20 years.