Greetings!

Today I will review the Exante broker company. This is a controversial and even somewhat scandalous representative of brokerage. I will briefly talk about its history and stages of formation, hardware and software. What markets does this broker provide access to?

Are its tariffs profitable and are they commensurate with the quality of the services provided? Where is it registered and what current licenses does it have? And, of course, I’ll touch on the topic of its reliability.

After all, many have probably noticed that reviews about the Exante broker are very often unflattering, and sometimes they even accuse him of specific financial frauds. I will also try to figure this out and express my point of view on each of the questions raised.

About the broker

| Name | Limited Liability Company XNT LTD |

| Year of foundation | 2011 |

| Regulator and license | The company has licenses issued by the following supervisory authorities:

|

| Requisites | Not indicated |

| Reliability rating | No current ratings |

| Trading platforms |

|

| Trading platform | Own trading platform EXANTE, including its web and mobile versions |

| Minimum deposit | 10,000 euros for individuals, 50,000 euros for corporate clients |

| Authorized capital | 50,000,000 euros |

| Head office address | Portomaso Business Tower, Level 7, St. Julian's, PTM01, Malta |

| Official site | https://exante.eu |

| Hotline number | 8 |

| Free demo account | Eat |

| Minimum commission | Moscow Exchange – 0.01% of turnover US Stocks – $0.02 per share London – $0.05 per share Toronto – 0.02 CAD Metals – $3 Futures – $1.5 Cryptocurrencies – 0.5% |

| Rating | 4 out of 5 |

Review of brokerage firm exante.eu

Exante is an international investment firm founded in 2011 that offers global multi-asset financial services, including direct access to a wide range of financial markets in the United States, European Union and Asia Pacific. Exante is licensed by both authorities (MFSA and CySEC) to provide financial services to retail and corporate clients, including trading and investment. Their core values, according to company representatives, are innovation, transparency, safety and quality.

EMONEYHUB Comment: On the Exante website there is the following statement: “XNT LTD. does not provide services to citizens of certain regions, such as the United States of America." If you are interested in creating an account but are unsure of your eligibility, it is recommended that you contact customer service to find out.

There appear to be no educational or additional trading tools available here either. Many brokers these days strive to help their clients become better traders through education and other tools, so it would be nice if Exante followed the same path. But to make money with a Forex broker, demo accounts are available for beginners. These can be accessed by clicking on the demo account button and this will take you to WebTrader where you can test everything out. The demo account has a value of 1 million euros, other functions of the demo account are unknown, and it is not entirely clear how long demo accounts last. When you refresh the page, all trades and history are saved, but there is no telling how long this will last.

Terms of service and tariffs

There is only 1 service option in the list of tariff configurations. However, the broker provides access to more than 50 different financial platforms, but the table only takes into account tariff conditions for the most key markets. For more detailed information, you should visit a special section on the official website of the Exante broker.

| Account types | Single trading account |

| Broker commission | Stock platforms:

Futures and options: on major American exchanges – $1.5 per contract. |

| Exchange fees | All fees are inclusive of fees |

| Depository fee | No |

| Commission on over-the-counter market transactions | Not indicated |

| Fee for using the terminal | Exante's own terminal is provided free of charge. There is a fee for additional trading programs from TSLab |

| Fee for withdrawal of funds | Fixed fee – 30 EUR/GBP/USD depending on the payment currency |

| Deposit and withdrawal methods | Bank transfer only |

Trading sizes and commissions

Trade sizes are based on volume and price, not lot sizes, so to trade a micro lot (0.01 lot) you would need to trade 1000 worth.

EMONEYHUB Comment: There seems to be no limit to how much you can sell or buy at one time, meaning there is no minimum or maximum.

There is a mention of commissions on the site, but on the asset page the representatives talk about commissions in relation to spreads, so it may appear that there is a system based on spreads rather than an additional commission. However, it cannot be said with certainty that there are additional fees on various commodities and funds, such as gold, which has a $3 fee.

Swap fees are present - these are interest fees that are charged for carrying out trades overnight. These can be either negative or positive and can usually be viewed on your chosen trading platform. But a commission is added to all trades: when trading 100 euros, a commission of 0.25 euros is added to the transaction.

Whether Exante is a scam or not is difficult to say; there are many assets and tools available in the company. The brokerage says that if you want to add a new asset, you should contact them and they will add it within 24 hours. You can work with the following products:

- Currencies: There are currently over 50 different currencies offered, including AUD/USD, EUR/JPY, USD/CHF and EUR/GBP.

- Metals: Metals such as copper, gold, silver, palladium and platinum are also available and can be traded with Exante.

- Futures: There are over 30 different futures markets, including the Chicago Board of Trade, the Osaka and Hong Kong Exchanges, and the Eurex Exchange.

- Options: Available for trading on the Intercontinental Exchange and the New York Mercantile Exchange, as well as the Australian Stock Exchange.

- Funds and Bonds: Places available for trading include European Government, US Corporations and Euronext Bonds.

Broker Products

In addition to standard brokerage services, Exante provides a number of interesting investment solutions and additional services.

I will talk about them below.

Structured Products

Exante broker offers a huge number of different structured products for purchase. Among them there is a large selection of both ETFs and mutual funds.

For example, within the framework of mutual funds, the broker provides the opportunity to purchase a number of cryptocurrency assets.

IPO

Exante broker helps its clients participate in initial public offerings on the world's largest exchanges.

However, each specific case must be discussed with the broker's employees separately, and the minimum requirement for such a service will be the presence of 100,000 euros or an equivalent amount in another currency in the brokerage account.

More

It should be noted that the Exante broker has a single account from which you can make transactions on any market.

It is also necessary to say about access to the Forex market and the wide possibilities of algorithmic trading.

Top Forex brokers: is there a company called Exante?

The forex market is by far the largest and most liquid market in the world, covering a wide variety of currencies and trading around the clock.

To engage in forex trading, you need an online broker. Trading with a trusted forex broker is essential for successful transactions in the international currency markets. As a trader or investor, you may have specific needs based on which platform, tool or research requirements emerge from time to time. Understanding your own investment style can help determine which forex broker 2021 is best for you. Every year, new currency companies appear for trading on Forex at an enviable speed. But you can’t just go and register on the first platform you come across. You don't want to give your money to just anyone. To do this, it is better to thoroughly study all the intricacies of the work and services provided before plunging headlong into trading. Many brokers are ordinary scammers or fly-by-night companies that call themselves the best Forex brokers. For example, whether Exante is a scam or not is not immediately clear. So it's best to look at the services on offer to see if they align with generally accepted values so you can decide if they're right for you.

Software and mobile trading

As the main trading platform of Exante, the broker is ready to present to its clients its own trading program of the same name, EXANTE. Users can also use its web version and mobile application for iOS or Android.

The platform is intuitive and similar in functionality to MetaTrader. Due to the small number of functions, the terminal works quite quickly.

The advantage of the software is that through it you can work simultaneously on different financial platforms using a single account.

Projects, training, seminars, webinars, customer reviews

The company is implementing its own investment and technology project Exantech. As part of this project, the broker conducts seminars, open and closed meetings and much more.

Exantech's main activities:

- Organization of educational seminars, lectures and other similar events. For example, over the past year, many seminars, lectures and closed meetings dedicated to cryptocurrency have been held.

- Search for new projects at the intersection of financial technologies and IT.

- Development of new financial products and market research.

- Together with device manufacturers, it participates in the organization of many production processes.

The seminars are devoted not only to cryptocurrencies, but also to other interesting and useful topics. For example, over the past 2 years, the broker has conducted a number of seminars on investing for novice traders. For more professional investors there were also many relevant and interesting topics, for example about investing in art and many others.

For clients who are unable to attend seminars in person, webinars are held. The topics are varied, for example, an entire webinar was devoted to commodity futures trading. There is also a large number of training videos, including those on the nuances of working with the EXANTE platform. All free webinars and videos are published on the broker’s Youtube channel.

In addition to seminars and webinars, the broker conducts a large number of meetings, interviews, and master classes. At the same time, he manages to participate in social and political life, in charity events and dinners, in international conferences, competitions, and holds meetings with schoolchildren and students.

I would especially like to highlight the online course, the partner of which is broker Exante. The course was developed by the famous Russian financial analyst Sergei Golubitsky. The course includes video lectures (6 hours), practice, personal online consultation with S. Golubitsky.

A promotional video for this course can be viewed here.

Registration for the course is carried out on the website exante.eu.

Cost - 95 EUR.

When opening a brokerage account, the broker returns the cost of the course.

As for reviews of the broker’s seminars and webinars, they were not easy to find. A fairly large number of comments can be found on the broker’s Youtube channel. Most often, people ask clarifying questions, which suggests that the video is insufficiently informative. Here are a few comments on the webinars “Algotrading and the FIX Protocol” and “EXANTE Terminal: fast trading on 50+ markets”.

Negative reviews, as a rule, reflect either a subjective attitude towards the lecturer or dissatisfaction with the quality of sound and picture:

Some clients are satisfied with the information and thank the authors of the webinars.

It is very difficult to find any reviews about seminars and conferences, which is most likely due to the fact that these are offline meetings, after which there is simply no thought of leaving any comments on the Internet.

Working with a broker

Interaction with Exante broker usually takes place online. Although in some cases you can visit the office, there is only one in Russia and it is located in Moscow.

Next, I will tell you step by step how to open an account and start trading through Exante.

Registration on the official website

The official website initially evokes the feeling of a “landing” page, where there is a minimum of information and a maximum of advertising slogans. But it should be noted that the navigation is quite clear, but the information content is very limited.

But you can figure out the points of interest after you get to the “Frequently Asked Questions” page. By the way, there is also up-to-date information on instruments, tariffs, accounts, minimum deposit size, etc.

There are two ways to register:

- in demo mode (without data confirmation);

- official account (with confirmation of data).

To do this, you just need to click the appropriate button on the main page of the site.

Instructions for opening an account

Opening an account in itself does not have high requirements and includes the following points:

- filling out the form (contact and user identification information);

- uploading documents;

- application approval process (within one day);

- account replenishment (minimum amount – € 10,000).

Demo account

The demo version of the account opens quickly and does not require confirmation, although you will have to provide some information. After filling out the form to open a demo account with Exante, the broker immediately takes you to the company’s web terminal page, where the current parameters of your account are already set.

The advantage of the demo version is that it is provided without a time limit for use and at the same time gives access to absolutely all the tools, just like on a real account.

The downside is the fact that trading in the demo version takes place with a 30-minute delay.

Account replenishment and withdrawal of funds

Deposits/withdrawals of funds from accounts with Exante broker are made exclusively by bank transfer. In this case, regardless of the transaction amount, the commission will be 30 EUR/GBP/USD, which is approximately equivalent to 2000–3000 rubles.

Technical support

Exante broker does not provide a large number of communication channels with technical support. There are only two ways to contact brokerage firm specialists:

- hotline: 8-800-707-2920,

Support is available 24/7 and is provided in three languages:

- Russian,

- English,

- Latvian

Trading platform ATP EXANTE

EXANTE is one of the few international brokers operating exclusively on its own trading platform. It exists in desktop, browser and mobile versions. The main advantage of the ATP EXANTE platform is its interface. It is as logical, simple and clear as possible. For those who have experience trading on Forex and are familiar with Metatrader, a quick acquaintance will be enough to figure it out.

To users of QUIK and TRANSAQ, the EXANTE terminal may seem frivolous, but here everything is thought out to the smallest detail. First of all, this concerns the classification of trading instruments, which are collected into groups: stocks, futures, bonds, etc. Each group contains instruments from different markets, since the broker provides access to all exchange platforms in the world, and trading is carried out on a single multi-currency account for all instruments. The selected instrument can be grabbed and dragged onto the chart (drag and drop) to monitor its price. To quickly place and remove orders, there is no need to even use dialog boxes: everything is done literally with one click:

For example, for a purchase order, just click in the “buy” column opposite the desired price. The application will immediately appear in the order book. You can delete it by clicking on the “x” symbol. Such “little things” allow a high-frequency trader to work almost on autopilot, without being distracted by routine operations. But interesting “features” are also offered to portfolio investors. For example, it is possible to make transactions with several instruments at once, grouped into a so-called basket. For fans of algorithmic trading, there is an integration module with the TSLab software package. To quickly view the results of any of the previous trading days, there is a calendar icon in the Account module. Here you can select any date and view a report on completed transactions. A unique feature of EXANTE ATP is support for the high-speed information transfer protocol FIX. Not all major brokers and terminals work with this protocol, and even fewer provide it for free. EXANTE is just one of them.

I also recommend reading:

Investing in stock indices: what is available to a private investor

Is it profitable to invest in a stock index?

Finally, there is a unique feature that sets the platform in question apart from its competitors. This is an options board with the calculation of the so-called Greeks. The simplest explanation is coefficients that relate changes in the value of an option to the price of the underlying asset and its volatility, as well as to the maturity date of the option. The name “Greeks” was not chosen by chance, since Greek letters are used to designate these coefficients. Standard methods for calculating “Greeks” are based on the history of quotes and lookup tables from specialized websites. EXANTE has a proprietary algorithm for which current market data is sufficient. This complicates the calculations, but at the end the trader receives a more accurate forecast.

Pros and cons of the company

The advantages of Exante broker include:

- single multicurrency account;

- the ability to trade on a large number of financial markets;

- a large number of investment instruments;

- demo version of trading.

Flaws:

- there are no Russian licenses to carry out activities;

- no standard software;

- limited number of communication channels with technical support;

- insufficient information on products.

Commissions, fees, trading conditions of broker EXANTE

The broker charges commissions only for completed transactions. The commission includes:

- exchange fee;

- clearing fee;

- execution cost.

Wherein:

- There is no application fee;

- There is no fee for using the account;

- The initial payment is 10,000 euros.

Additional terms:

- there is no minimum transaction size;

- the ability to trade any amount (starting from one lot);

- the ability to use any number of financial instruments.

It is quite obvious here that the size of the commission is not fixed, but depends on many factors (exchange, financial instruments and trading volumes). The trader can view all information about the current commission amount in his personal account.

The maximum exchange commissions for different types of instruments are summarized in very convenient tables, which can be viewed on the broker’s website. As an example, we provide tables for stocks and ETFs.

Complaints about the broker

In 2015, the US Securities and Exchange Commission officially accused the Exante broker of participating in hacker attacks to steal financial press releases of various companies from the servers of news agencies.

According to the regulator, the information obtained illegally was then sold for large sums to stock speculators, who subsequently used it to enrich themselves.

So over 5 years, about 150,000 financial reporting documents were stolen. The amount of benefit that Exante received from this scam was stated to be $30 million.

However, at the end of 2015, all charges against the Exante broker were dropped.

Margin. Calculation procedure

Margin is calculated using a risk management system, which was developed by company specialists based on the SPAN® system.

The trader is required to independently monitor the margin level in his personal account or in the trading terminal. When the level reaches 100%, company employees warn the trader and, in extreme cases, forcefully close positions. If the margin level exceeds 100%, a daily commission of 100% per annum is charged on the excess amount.

The procedure for calculating rollovers and overnights

Overnight:

- commissions are charged on short positions and FX;

- the commission is not fixed, it depends on market conditions.

Rollover:

- commission is charged for overnight positions;

- daily charge for the previous night at 4 o'clock GMT.

Information on overnight and rollover commissions can be viewed in detail in your personal account. Data is updated daily.

Leverage and spreads

Leverage is not provided for:

- exchange-traded funds;

- options;

- futures;

- hedge funds.

The shoulder is provided for:

- currency (from 5 to 15% depending on the type of currency);

- liquid shares (20%);

- fixed income securities (1:3);

- bonds (1:3).

Spreads are available starting from 0.2 pips per currency pair.

In our opinion, the tariffs are not the lowest, but quite reasonable. Clients also note the adequacy of tariffs and are often satisfied with the amount of fees. We noted earlier that many potential clients are put off by a high minimum deposit, but at the same time, there are traders who are quite satisfied with such a deposit and are more than pleased with the commissions.

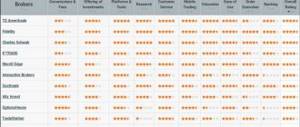

Quite often, more experienced traders conduct a comparative analysis of the tariffs of different brokers, and on many points they are more satisfied with the EXANTE tariff plans than the tariffs of other brokers. An example of such a review (source capitalgains.ru):

Here, however, it is worth noting that the author of this review noted some differences not in favor of the broker:

For greater objectivity, we note that not all clients are satisfied with the size of the commission and believe that the commissions of this broker are higher than those of others. Such disputes usually arise on professional Forex trading forums. Some traders are outraged by the volumes and commissions, while other traders argue that such commissions are the norm and are fully compensated by the lack of additional fees that other brokers have.

The broker himself, in his comments on emerging disputes, notes that the company does not strive to be a broker with the lowest commissions. Exante is focused on providing clients with other benefits such as trading from a single account, access to a large number of markets, full protection of funds and legality of transactions, which allows traders to have more time for their own trading and be as free as possible in choosing their own strategies.

Divorce or not

It is more likely that there is no divorce here. But I would still be wary of this broker, since it does not yet have a serious history in the market. Registered in Malta and Cyprus through two separate legal entities. Not covered by international rating agencies.

For those who are going to trade only on the Russian market, this is also not the best option, since the broker does not have valid licenses from the Central Bank.

Trading conditions

Looking ahead, I will say that in terms of trading conditions the company is at the level of the best brokers, practically in no way inferior to Interactive Brokers. If you are not familiar with this company, I recommend reading my review of the American broker Interactive Brokers. They offer to work at Exante under the following conditions:

- The main feature is a single account for absolutely all markets. By registering here you can work for NYSE, NYMEX, CBOE, MOEX, HKEX, all major European venues;

- There is a demo account , and it is issued indefinitely and without additional conditions. If you reset it, then in your personal account through the settings you can simply reset the progress, and the balance of the training account will be restored;

- The total number of available instruments exceeds 50,000. You can trade literally anything - stocks, currency pairs, commodities, futures, options, cryptocurrencies. Moreover, the company has been working with cryptocurrencies since 2012 and is one of the pioneers in this area. We’ll talk about the features of working with crypto below;

- The minimum account for an individual is 10,000 € , corporate clients will have to deposit at least 50,000 € ;

- In addition to the euro and the US dollar, the British pound, Japanese yen, Swiss franc, New Zealand dollar, Polish zloty and Russian ruble are supported. Recalculation is carried out at the official exchange rate of the Central Bank;

- For currency pairs, spreads start from 0.3 points for EURUSD, for other majors a little higher, but still below 1.0 points. In reviews, traders confirm that the spread is really small ;

- For most instruments, trading is available in premarket and aftermarket . Just keep in mind that at this time liquidity in the market is negligible;

- Leverage depends on the specific instrument. For stocks with high liquidity, leverage starts from 20%, for currency pairs – from 5%. For cryptocurrencies, leverage is limited to 100%, for a number of cryptocurrencies it is reduced to 33-50%, check for specific digital currency;

- If you have an amount of €100,000 or more , you can participate in the IPO ;

- If the client's deposit exceeds €50,000, the broker can connect him to another trading platform other than the one offered by default.

The starting deposit, of course, is large, and there is clearly nothing for a beginner to do here. But for experienced traders who are looking for reliable trading option, the broker is suitable. The opportunity to trade on all popular platforms from one account is captivating. I would like to point out the huge number of instruments available for trading. This allows you to create an ideal stock investment portfolio.

Real reviews

Traders

Active traders are mostly satisfied with their own Exante terminals, which the broker provides.

But there are also negative aspects, expressed in one-time failures, incorrect calculations and problems with position registration.

Clients

Most customer reviews concern concerns about the reliability of the Exante broker and the lack of Russian licenses for brokerage activities. Some write that there were delays in payments of funds from the account.

Employees

Exante broker is a small financial company. Therefore, unfortunately, it was not possible to find a significant sample based on the comments of the organization’s employees.

What does the broker's website offer?

Having looked through a simple but quite stylish site, we can draw the following conclusions:

- domain name: exante.eu;

- registration information: date of creation - 2011;

- license details: issued by MFSA and CySEC;

- information about the registration address and owners of the exchange: owner - EXT LTD; registration address - Siafi Street 1, Porto Bello, Office 4B, Limassol, 3042, Cyprus;

- contact information: accounts on Facebook, LinkedIn, Twitter, YouTube, Instagram, VKontakte.

At the same time, you will be able to visit the company’s offices in London, Amsterdam, Moscow, St. Petersburg, Kyiv, Almaty, Riga, Cyprus and Hong Kong.

EMONEYHUB comment: Unfortunately, the broker does not bother with rewards and self-promotion. You will not be able to find any information about bonuses or promotions on the website. If you're interested in bonuses, be sure to check back regularly or contact customer service to see if there are any upcoming bonuses or promotions.

You can open an account as an individual or legal entity. To register on exante.eu you must indicate your first name, last name, mobile phone number, email, purpose of registration and company name (only for legal entities). You can also add a comment if you wish. Please note that the broker also offers two options for registering an account based on geographic data:

- Cyprus – minimum deposit – €10,000;

- Hong Kong - minimum deposit - HK$100,000.

Please be sure to read the terms and conditions before registering.

Alternatives

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Here you can check out other brokers that provide most of the same services and products, and also have high reliability ratings, competitive commissions and good service.

Trading the XAI Crypto Index

This index is calculated based on several of the most popular cryptocurrencies. Depending on the growth rate of a particular cryptocurrency included in the index, its weight is recalculated. It includes:

- Ethereum;

- Ethereum classic;

- Monero;

- ZCash;

- Ripple;

- Litecoin.

Bitcoin is not included in the index calculation intentionally. This was done in order to provide the required diversification across instruments. Bitcoin is still too heavyweight to be included in the XAI index calculation. It still accounts for more than 40% of the total crypto market capitalization.

The cost of the crypto index calculated using the formulas:

Each cryptocurrency is assigned its own weight . It is calculated by the formula

Exante recalculates the weight of each crypt once a month:

- If the weight of a cryptocurrency changes by 10% or more, the composition of the XAI index is recalculated;

- If the weight is at least 35%, then in the index it is assumed to be equal to 35%.

This approach allows you to increase the share of steadily growing coins in the index, increasing its reliability and stability . Regarding reliability, I note that purchasing the XAI crypto index through the Exante broker involves less risk compared to direct investing through exchanges.

When a trader invests in the XAI.Fund, the broker automatically purchases the corresponding amount of crypto. Digital money is stored in a separate registered account of the company, so there is no risk of losing it .

As for the prospects of investing in a crypto index, keep in mind that it can not only grow . The figure above shows the dynamics of changes in the value of the index over time. Around the beginning of the year, against the backdrop of a general weakening of the crypto market, the value of XAI.Fund has also been declining. So there is no absolute guarantee , remember this.

CEO of the company

Creating an efficient team became the primary task of the company’s founder, chairman of the board of directors Alexey Kiriyenko and co-founder who took the post of executive director Anatoly Knyazev.

The first one had a background in the Faculty of Economics of the Russian University of Oil and Gas, while the second one studied at the Faculty of Computational Mathematics and Cybernetics of Moscow State University. Both are experienced traders, unique specialists in cryptocurrencies and blockchain. This turned out to be not the last of their talents. The creation of the company and the formation of the team also revealed extraordinary organizational skills. Subsequently, another executive director, Gatis Eglitis, specializing in institutional sales, became one of the co-founders.

Watch an interview with the founders of Exante: