There are few brokers in Russia who consistently occupy leading positions in terms of turnover on the Moscow Exchange. Today we will talk about one of the largest brokers - BCS broker (official website broker.ru). In the article we will consider: BCS broker customer reviews 2021, tariffs and commissions, replenishment and withdrawal of funds, advantages and disadvantages, what types of investors the broker is suitable for .

Quick navigation

About the broker

| Name | Brokercreditservice LLC |

| Year of foundation | 1995 |

| Regulator and license | · License number 1521 to conclude financial transactions. intermediary on the exchange of agreements that are financial derivatives. instruments whose underlying asset is a commodity. From 09/30/2010, with unlimited validity. · License number 154 - 12397 - 000100 for carrying out depository activities, dated July 23, 2009, with an unlimited validity period. · License number 154 – 04434 – 100000, authorizing brokerage activities, dated January 10, 2001, with an unlimited validity period. · License number 154 – 04449 – 010000 to carry out dealer activities on the Securities Market, issued on January 10, 2001, with an unlimited validity period. · License number 154 – 04462 – 001000, permitting the activity of trust management of assets. From 01/10/2001, with unlimited validity. |

| Requisites | INN 5406121446, BIC: 044525631 r/s 40701810100000006691 |

| Reliability rating | Expert: ruBBB+ (stable) |

| Trading platforms | Stock, currency and derivatives sections of the Moscow Exchange, St. Petersburg Exchange, international platforms. |

| Trading platform | QUIK / WebQUIK / iQUIKX / QUIK Android X, MetaTrader 5, TSLab platform, Tradematic Trader. |

| Minimum deposit | No limits |

| Authorized capital | RUB 1,558,500,000.00, date of change in the amount of the authorized capital: March 2011 |

| Head office address | 129110, Moscow, Prospekt Mira, 69, building 1, entrance 3 |

| Official site | https://broker.ru/ |

| Hotline number | 8 (general) (for existing clients) |

| Free demo account | EAT |

| Minimum commission | 0.0177% - stock market, subject to a turnover of 15 million. rub. RUB 0.24/contract – derivatives market 0.007% - currency section, with a turnover of 300 million rubles. $0.01 on NYSE, NYSE MKT and NASDAQ |

| Rating | 4.5 out of 5 |

Trading platforms

There are several trading platforms to choose from:

- "people's" terminal MT4 . You can download it directly from the broker’s website

- MT5 is the latest version of the metatrader. MT4 and MT5 have mobile versions for Android and IOs

- BSC Option Trader is a separate trading platform for working with options; it does not require installation; trading is carried out online from any browser. Just follow the appropriate link on the broker’s website, enter your username and password, after which you can trade

- CQG Trader – used to work on international markets. Allows you to get direct access to such exchanges as CME, NYMEX, EUREX, CBOT, ICE. The terminal is paid, and you will have to pay $25 per month

- QUIK – not without the famous Quick. The terminal is also not free, the cost per month is $4 . There are also mobile versions of the terminal

- TSLab – this platform is used so that a trader can independently create an advisor (mechanical trading strategy) and trade using it. Cost 2000-4000 rub/month

- TradeMatic Trader - functions are the same as TSLab, but only for working on the derivatives and stock markets. Maximum cost – 730 rub/month

- A number of drives are also available for Kwik, but they are useless on their own - you will not be able to conclude a deal or view stock quotes through them. They integrate with QUIK and add such useful elements as a scalping glass, the ability to visualize the process of creating robots

- TrustManager – this platform is used for trust management. In principle, there is nothing unusual among the terminals and the offered software. Tariffs for their use are acceptable, so I don’t see any problems from this side.

If a person is interested in generating income, but trading for some reason is not suitable for him, he can use one of the investment tools offered by the BCS broker.

Brief history of the broker and awards

FG BKS received its first license to carry out operations and provide consulting services in 1995. The company originates from Novosibirsk. The company's representative office appeared in the capital in 2000. A little later, the broker opened an office in St. Petersburg, and then in most other more or less large cities.

BKS Premier as a separate retail direction began operating in 2012.

Today broker bcs is one of the largest financial intermediaries in the field of brokerage on the Russian market with a user base of over 300 thousand client accounts.

During its activity, the BKS company received awards:

- "Company of the Year";

- "Financial elite";

- "Stock Market Elite";

- "Financial Olympus".

In addition, the broker has many awards from the Federal Financial Markets Service, MICEX, FORTS.

Individual investment account

This account is radically different from the others in that the person who opened it receives benefits from the state , while no one bothers to make a profit through smart investing. That is, a person receives income and a tax deduction of 13%. However, in order to take advantage of this tax deduction, he will have to invest for at least 3 years.

One person can have only 1 individual investment account; it can be replenished with a maximum of 400,000 rubles per year. Replenishment currency is rubles only.

You can work with such an account independently, investing in bonds, stocks, working with options, futures. Or you can use ready-made solutions from BCS, it’s up to you to decide.

Broker Products

The BCS broker provides a wide range of opportunities both for independent trading on various platforms, and for building strategies with the help of information and analytical assistants.

A large list of tools, our own interactive application, analytical coverage from company experts and much more are available.

In addition, there are nice things in the form of selection of tariffs according to the investor’s profile, individual currency exchange services at the market rate, the BCS Express information portal, etc.

Structured Products

The BCS broker offers various mutual funds (mutual investment funds) for purchase. Thus, you can purchase a structured product for a portfolio of international bonds, a diversified portfolio of promising shares of Russian and foreign issuers, or a set of assets from precious metals.

In addition, the BCS broker allows you to purchase ETF products. They are very liquid and allow you to invest, for example, in the most popular S&P500 index.

ipo

BCS broker allows you to invest in securities at the stage of their placement. This must be clarified in relation to a specific case and applications for participation in the issuer’s IPO must be submitted in advance.

More

Additional services that positively distinguish the BCS broker are:

- Simple currency exchange on market conditions.

- “Stock trainer” (connected additionally to the tariff plan and during this, the client is assigned his own manager who helps in making investment increases).

- Good educational platform.

- Ability to connect to a demo version of trading.

Account types

The broker allows you to open a demo account on Forex only on MT4; on MT5 there is simply no such option.

MT4

For MT4 you can open one of the following account types:

- demo account

- NDD.MT4 – market execution, 41 Forex instruments are available for work, spread starts from 0.2 pips on EUR/USD, while a commission of 0.003% is also charged, leverage from 1:1 to 1:200

- PRO.MT4 – 135 instruments are available for work (Forex + contracts for difference), the spread is at least 1 point, and there is no commission, Instant execution. You don’t need to create a personal account to open an account, you can immediately proceed to opening an account

MT5

For MT5 the account types are as follows:

- GLOBAL.MT5 – fixed spread from 1 pip, no commissions, you can work on 333 instruments (Forex + CFD), execution type - Exchange

- NDD.MT5 – spread from 0.2 p + commission 0.003%, execution type – market, but only 41 instruments are available for work and only on the Forex market

- DIRECT.MT5 – spread from 0.7 p + zero commission, Instant execution, you can trade both Forex and CFD on 135 instruments

All accounts can be opened in EUR, RUB, USD, leverage from 1:1 to 1:200. The minimum deposit for all accounts is $1.

Working with a broker

You can start working with a broker either by visiting the office in person or online. A rather convenient topic when opening an account is the possibility of obtaining a BCS broker bank card with free service, which also allows you to use cash back and accumulate bonuses.

Now it's time to talk about all aspects of opening an account in more detail.

Registration on the official website

The site interface is quite convenient and intuitive. There are many beautiful widgets that offer online selection of the tools of interest or set a tariff plan that suits the trading style, after which the client is automatically redirected to opening an account.

Instructions for opening an account

The regulations for opening an online brokerage account require going through several identifying stages:

- send a scan or photo of your passport;

- confirm email;

- confirm your phone number.

To open a brokerage account at the company’s office, you need to fill out an application, after which an employee will call and invite you to the office. The BCS employee will also clarify what documents you need to have with you.

In addition, it is proposed to download the “My Broker” mobile application, where in a few clicks you can register and within 5 minutes you can start trading on the stock market by topping up your account with a regular bank transfer.

Demo account

The demo version of a trading account in the BCS broker opens easier and faster. To do this, just confirm your phone number.

The most convenient way to do this is to download the “My Broker” trading application and select a demo account. However, if a client wants to use the full functionality of a classic trading system, for example, KVIC, in demo mode, then he also has such an opportunity.

Account replenishment and withdrawal of funds

Account replenishment is carried out:

- through the BCS bank branch;

- by online bank transfer from any bank (in this case a commission may apply);

- broker's BCS bank card.

Withdrawal of funds to a current account at BCS Bank (will be opened automatically upon concluding an agreement for brokerage services) is carried out using the following means of request:

- through the “My Broker” mobile application;

- Quik trading platform;

- through your personal account;

- by phone;

- at the BCS broker's office.

Technical support

There is a 24-hour customer support service. The request can be sent to the hotline number 8-800-500-55-45 or by mail

There are also communication channels in the form of a form on the website and special online support for existing broker clients.

In premium versions of service, a personal manager from BCS is always in contact with the client, who will definitely help resolve any issues that arise.

Pros and cons of the company

The advantages of a BCS broker include:

- a wide range of tariffs;

- Availability of a demo version of a trading account;

- stock trainer;

- good software;

- high level of reliability;

- educational platform, own trading ideas, questions for analysts;

- currency exchange;

- presence of a large number of offices in different cities.

The disadvantages include:

- Quite high commissions, incl. minimum account deposits;

- lack of a Forex dealer license, as a result of which there is no possibility of entering Forex.

How to withdraw money

Withdrawal of money is available in person. BCS-Online account and in applications. You can also submit a withdrawal request by phone, fax or at a bank office.

The same systems are available for output as for input:

- bank card,

- wire transfer, etc.

The commission is paid in proportion to the chosen tariff. Withdrawal period is within 1 day if you request a withdrawal before 17.30 service branch time. If later, you will receive the money the next day.

Real reviews

I analyzed reviews from various positions of financial barricades and then I will talk about the main theses that are published regarding BCS from:

- traders;

- clients;

- employees.

Looking ahead a little, I will say: in general, reviews leave a positive impression of the company (especially in comparison with other brokers).

Traders

Traders sometimes complain about inflated commissions and problems in the functioning of trading programs from BCS, but for the most part active users are satisfied with the broker.

Clients

In the reviews of users of specific services or products from the BCS broker, there are positive and negative points that indicate aspects of the company’s work. Moreover, they are often opposite and comparable. But if you ignore any outright screw-ups (there’s no other way to put it), we can conclude that the broker is quite happy with the majority of its clients.

Employees

Based on the comments of the BCS broker's employees, there is a feeling that most of the employees are satisfied with their work and its conditions. Many note the high level of salaries, commensurate with intensive work in a good team.

The only negative point that occurs quite often is slow career growth.

InvestGuru – trading strategies from BCS

I have already said before that you will not have to solve the problem of how to choose a PAMM account for investing for the simple reason that the broker does not have PAMMs. But there is a certain analogue - you can use the InvestGuru and use trading strategies.

This is not a copy trade service or anything similar that many other brokers have.

InvestGuru is a set of strategies with varying degrees of risk and a corresponding selection of tools. There is a simple filter based on the degree of risk and the minimum allowable investment amount.

The work is organized as follows - you select a suitable strategy, leave an application, then receive advice and decide whether to join this strategy. Then all you have to do is watch how your account increases.

Perhaps the best PAMM accounts from the same Alpari show greater profitability, but the strategies from BCS have reliability . And the average annual return on strategies with average risk can be over 50%.

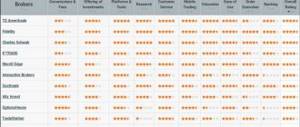

Alternatives

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Here are the best Russian licensed brokers.

BCS Premier service

If we describe the essence of this service in a few words, we can say that this is an individual approach to investment . Every person, when investing money in any instrument, expects to receive income. BCS Premier's task is to select the ideal investment option for each client.

You can work with both structured products and investment funds, you can use the trust management service or trade independently. The important thing is that immediately after you contact the company, you receive a personal advisor with whom you can consult online.

Events are periodically held in Moscow and other cities. The seminars are devoted to financial topics and ways to make money on the latest events in the world, so they can be considered as a kind of self-education .

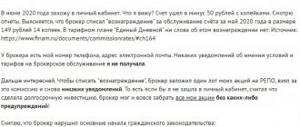

Let's try to cheat the system

Depending on the experience, amount, currency and investment period, “My Broker” creates a personal offer. Even though I had investment experience, to begin with I lied a little and chose, as it seems to me, the most starting set of conditions: no investment experience, amount 50,000 - 300,000, in rubles, moderate income. In general, “My Broker” offers options for the relationship between profitability and risk:

- minimum risk: up to 25% return on capital, up to 0% possible reduction (loss)

- balanced strategy: up to 35% return on capital, up to 5% possible reduction

- maximum income: up to 65% return on capital, up to 15% possible reduction.

I deliberately refused a low level of risk because I wanted to get a more interesting offer.

Well, beginners should avoid striving for high returns, since it is associated with risks that you need to be prepared for. Stress at the beginning of working with the stock market or exchange is not the best help; you need to delve into working with financial instruments gradually. In addition, experience in financial transactions comes with a series of mistakes - starting with small experiments, you greatly reduce the price of this experience. For example, my first experience cost me 30,000 rubles in 2008, two salaries at that time. And only further caution and balanced decisions helped me win back my losses and even earn extra money. Let's go back to the recommendations that I received in the “My Broker” panel:

I am partial to financial markets, so even a quick glance at the proposed case makes it clear that the portfolio was formed exactly according to the request and stable assets were offered. Especially for Geektimes, we will check how good the companies potentially included in my portfolio are - we will look at quotes over time and inquire about the state of affairs of the proposed issuers.

Issuer No. 1. Sberbank.

A strong bank that manages to grow even during a crisis. Let's compare quotes for two dates:

10/27/2014 — closing price 76.23 rubles. 01/25/2016 — closing price 90.52 rubles.

Taking into account exchange rate changes and inflation, the situation looks stable. And this despite the fact that Sberbank is sensitive to fluctuations in the ruble exchange rate and its assets are volatile. The news on Sberbank is also positive, so the asset is good.

Issuer No. 2. Magnet.

This issuer is of interest to many investors - a strong and fairly tenacious representative of Russian retail, showing stable profit growth. Let's compare quotes for two dates:

10.27.2014 — closing price 11,900 rub. 01/25/2016 — closing price 10,952 rubles.

Magnit has overcome almost a year of decline and shows good quotes. At the end of 2015, revenue growth amounted to 24.3% (the retailer itself predicted an increase of 26%), in 2015, much fewer new stores were opened, which in itself is not an alarming signal - Magnit already has an extensive network. When assessing this issuer, one can even think purely philistinely: there is a crisis in the country, people are starting to save, and the Magnit chain of stores with its adequate (and in large stores, low) prices remains in demand. So the asset is promising.

Issuer No. 3. MMC Norilsk Nickel.

Oil comes and goes, but we always need nickel. Seriously, nickel mining will always be in demand: it is used everywhere, from medicine (dentistry, prosthetics) to scientific research, mechanical engineering and coinage (many coins in the world are made using nickel). Let's compare quotes for two dates:

10.27.2014 - closing price 8033 rub. 01/25/2016 — closing price 8944 rub.

And one glance at the chart is enough to be convinced of the profitability of this asset.

So, we have received investment recommendations and can choose which issuers we are interested in or add our own assets. Why do you need multiple assets in a portfolio? This is diversification - if one of the assets does not work, the portfolio will work on the rest. This approach reduces risk. On the other hand, this does not mean that you need to form a portfolio from the maximum set of assets - small shares will not bring the desired income.

By the way, all basic information about the issuer or asset can be obtained by clicking on its name on the desktop - a detailed card will open:

Still, let’s try to play with the system and choose different strategies. If you go through strategies, you may receive an offer to add a structural product to your asset portfolio: bonds, income barrels, investment notes, as well as interesting products based, for example, on changes in the indices of unstable, but very economically and politically interesting Turkey.

What happens if we choose, say, all our initial conditions, but different risk-return ratios? “My broker” gives the same set: Sberbank, Magnit, MMC Norilsk Nickel. We close the beta notification and see the switch between a table structure and a pie chart view. We see that in fact the proposed strategies differ in the shares of the proposed assets. Thus, the riskiest, but also the most profitable portfolio contains only two assets in equal shares.

And this is the weighted strategy with moderate profitability chosen at the beginning:

Let's look at the rest of the proposed investment ideas:

Here we are presented with ideas for purchasing shares of foreign companies, indicating the growth potential, investment period, and opening date. For each recommendation, you can open a detailed card, look at the price, trading volume, dynamics and find out why the company is attractive. In the future, you will be able to find out the issuer's news, which is important - even a small event in the company can significantly affect the quotes. What can we say about serious milestones, which sometimes radically change the principles of the issuer’s work or have a significant impact on it (death of management, departure of top managers, release of new products, etc.).

BCS Express Service

I have already briefly mentioned this service. It includes everything related to analytics and investments. Out of habit, the service may seem complicated, but in fact everything is well structured and you can figure it out quickly. The service offers you to familiarize yourself with:

- news and analytics from BCS experts

- technical analysis, market reviews

- investment ideas and recommendations from investment houses

- dividend calendar

- expected events in the world of finance.

Even analysts can. If it is interesting and relevant, you may well see the answer to your question. In general, the service will be useful to those who are interested in analytics and market reviews from a broker.

Withdrawing money by bank transfer

Withdrawing money via bank transfer is used by almost all brokerage companies, and for Forex broker banks (such as Swissquote Bank, Dukascopy Bank, Saxo Bank) this is the main conclusion.

To withdraw money via international bank transfer, you must fill out the form (full name of the recipient, account number in the recipient bank, its international name and SWIFT code):

Such a transfer will undergo financial control on the part of the broker’s bank and on the part of the client’s bank, after which the requested funds (with the exception of the commission, which averages $40) will be in your account at your complete disposal. Typically such a transfer takes 2-5 days.

Application structure overview

The structure of the trading system consists of a main menu and 5 tabs located on the main page.

- Quotes - in this section you can search for securities

- News - various news in Russia and the world are published here, which may affect securities quotes and investment decisions.

- Invest ideas . Fresh ideas from analysts on profitable investment of capital are published here.

- Briefcase . The portfolio displays the structure and total amount of the investor's assets.

- Services . This section contains the Economic Calendar and contact with the support service.

The main menu consists of the following sections:

- home

- My accounts

- FAQ (most frequently asked questions)

- Offices and ATMs

- Settings

Later we were all reassured

No matter how hard the BCS management tried to avoid panic, it still arose and emergency measures had to be taken to reassure investors.

To stabilize the financial situation, the following measures were taken:

- Reduction of financial bonuses for management by 3 times.

- A promise from management that losses will continue to be covered by the organization’s personal capital.

On November 11, the company made a statement that it did not lose any money, and the whole news was inflated from one line “transactions with derivatives”, but it is wrong to consider only this, because There are also hedging operations that completely cover this loss.

Literally, “it’s the same as looking only at interest payments on deposits in a bank’s reporting, and not taking into account profits on other products.”

Forbes opinion: