What news affects the Forex market? This question interests all traders who use the news strategy in their trading, which today is perhaps one of the most popular on the market.

Despite the apparent simplicity of this strategy, it requires market participants to know some nuances in order to use this trading method most effectively. First of all, you need to take into account some important news factors - the nature of the news, its weight, time and type of impact on the exchange rate, etc., only in this case you will be able to enter a profitable trade on time.

Why news is not for dummies

It is sometimes extremely difficult to predict price movements that are pushed around by strong economic or political news. High-frequency robots frolic here, trying to grab their jackpot in seconds. But the average person has a hard time.

And why? Because the price on strong news often demonstrates completely chaotic behavior. The price rushes up and down, showing wild shadows and long candles that fly wherever they please.

There are also problems on the technical side. Brokers:

- widen the spread (in Forex);

- transactions often do not go through;

- constant slippage (you enter at one price, and the transaction is opened at another);

- the terminals hang and become stupid.

Then the newcomers who got into the news scream on all forums that “they were not allowed to trade” and demonstrate their intellectual potential in every possible way. You look at this panopticon and think, well, at least you figured out that news trading is the riskiest type of trading of all. Well, where are you going, where are you all going?

Remember: news trading has extremely high risks.

But newcomers continue to jump on the news train like zombies, as if they smell fresh brains there. Of course, if you have common sense, you can squeeze your profit out of the news. But you should always keep the risks of this process in mind.

Summarize

Brokers, together with exchanges, are constantly reducing the ping time for transmitting trade orders and quotes, so the data enters the general stream almost instantly. Fundamental data puts strong pressure on the price, and most traders subconsciously expect that trading on news is always an opportunity to earn quickly and a lot. Market makers and speculators take advantage of such inflated expectations.

There is enough news and statistics that analysts can use them to justify any incomprehensible movement. And arrange a “news trap” for newcomers with knocking out stop losses. But if you decide to use such strategies, work completely on your own: accumulate statistics, do not forget about technical analysis, do not give in to speculation and question rumors.

What news to trade

We already discussed where to watch the news in the lesson on fundamental analysis. For this we need economic calendars.

Since only the most important news has a strong impact on the market, the rest can be ignored, because they are of less use. Of course, the key news in the world is data on the American economy, since the US dollar is the key reserve currency of the planet.

There are only 5 main news that always affect the market:

- NFP - NonFarmPayroll (change in the number of people employed in the non-farm sector).

- FOMC meetings.

- Trade balance data.

- CPI - consumer price index.

- Retail sales data.

Impact of news on currency quotes in points

We are also interested in (remember fundamental analysis):

- data on discount rates;

- any meetings of the Central Bank;

- inflation data;

- geopolitical news (wars and disasters);

- GDP data.

Which currencies to trade on the news

Those that contain the dollar, since these are the most liquid currency pairs and news affects them first. These are pairs like:

- EUR/USD;

- GBP/USD;

- USD/JPY;

- USD/CHF;

- USD/CAD;

- AUD/USD.

Oh, yes, these are... yes, yes, major currency pairs, of course. They are the ones that are most often traded on the news. Let's go back and look at a few simple rules that will allow you to survive in news trading.

15 minute rule

It's quite simple. We do not trade 15 minutes before news release and 15 minutes after it. This is considered, by the way, a more risky period (the 30-minute rule is more conservative), however, it allows you to capture part of the frantic movement that the news gives to the market, but in a calmer form, because some time has passed.

This means that, having identified important news, you just need to wait and enjoy the picture of how the price moves like crazy throughout the entire chart, knocking out stops in Forex and shocking newcomers in binary. This circus (there is no other way to call it) always causes a wry smile.

15 minutes after the news is released, as a rule, there is a rollback against the news trend - those who wanted to have played enough, the rest are cautiously testing the reversal. However, it is often short-lived.

30 minute rule

Personally, I generally use the 1 hour rule and don’t log in an hour before or after strong news. But there are exceptions. If you see that a couple has reacted sluggishly to seemingly relevant news, there is no need to wait that long.

As a rule, before the release of certain news, the market comes to a certain consensus and focuses on the forecast. Let's say Apple is about to announce the release of a new iPhone and everyone is frozen in anticipation. And the prices of its shares are rising even before the news is released, simply based on expectations.

However, an hour or half an hour before this news, a real madhouse begins. Everyone begins to speculate, sell/buy on these expectations, but prices move back and forth and it is completely unclear what to do with it all. But nothing - that’s what the rule is used for.

Half an hour after the news came out, the main speculators calmed down, the price begins to come to its senses, but still has a good momentum for movement, which you can ride on. In half an hour, investors evaluate the essence of Apple's presentation and come to the conclusion whether it is necessary to buy its shares or whether the new iPhone is such disgusting that it is better to get rid of them immediately.

They often trade on disappointments. Let's say the market is disappointed, the presentation sucks? Great, many are trying to take advantage of this.

Differences, pros and cons of news trading

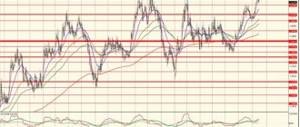

The main difference between news trading is that you need to look at the market from different angles:

- fundamental analysis (how the indicator behaved before, you also need to assess the country’s economy as a whole)

- technical analysis - the current trend, as well as marking important support and resistance levels that can slow down the price.

Only a combination of technical and fundamental analysis can produce results. Also, it is important to remember that you do not need to evaluate a strategy on the news after a couple of trades. It is important to trade on the news for at least a few months. Remember that professionals judge the quality of a trading system only after 100 trades. This is for the medium term. To evaluate a scalping technique, several thousand transactions are needed. And only then should we draw conclusions. If after three months you find yourself in the red, then you should think about how to improve your system, or decide to abandon it.

The advantages are the speed of obtaining results, as well as the fact that you can enter a trade on a scalping timeframe with an appropriate stop, and receive a take in the medium term. Among the shortcomings we note:

- Trading on the news is demanding on reaction speed. You will have to think very, very quickly - you often only have one second to make a decision. If you like to take a long time to make decisions and lose in a stressful situation, then news trading is perhaps not for you?

- Even if you do a good market analysis before the news, and the news itself is unambiguous, and you are very confident in the transaction, it is possible that the market will screw you up, and the price will move against you. Remember that there is no 100% chance of taking a take and there has never been in any system.

- The market may reject the news in advance. This happens even with the most important news. If the news was expected, then it is already included in the price. Unfortunately, this happens. But still, it happens relatively rarely. So you won’t be left without profit, don’t worry.

With good preliminary analytics and correct interpretation of the final indicators, news trading can bring good and consistently high income to the trader, which will be no worse than the profits received by “techies” - adherents of technical analysis in its purest form.

We also recommend reading about what swing trading is and how to trade using its strategies.

Watch an additional video on the topic of publication - Trading strategy on news, the path to success in Forex

PreviousNext

Ozymandias indicator for finding a trend

Buy rumors, sell facts

This is the most important, key principle of news trading. It is difficult for beginners because they do not understand the essence of what is happening with the price before the release of forecasts and the announcement of real data.

Conventionally, news trading can be divided into 3 types:

- before the news comes out;

- release period;

- after the news comes out.

It is not so important what exactly happens to the price during these periods; what is more important is whether a movement against the older trend is visible or not.

If we are in a growing market, and before the release of important news there is a sideways movement - consolidation, then investors are waiting for the release of positive news and are focused on this. At the same time, the release of negative news against strong positive expectations will lead to the fact that these expectations can simply “swallow” the news and the market will not notice it.

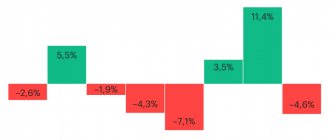

The dynamics of news trading are as follows:

FAQ

Where to watch news in real time?

There are a lot of sites with an economic calendar. I like https://ru.investing.com/economic-calendar/

Should you read news forecasts?

No. Nobody knows where the market will move after the news comes out.

Is the strategy for trading news on Forex and the Stock market different?

Yes. A completely different approach.

Do Forex news advisors exist?

I saw a couple. They either don’t work or work much worse than humans. There's no point in using them.

Is there break-even trading on Forex news?

No. There are no break-even strategies.

How news works

The entire process of market perception of news can be divided into the following stages.

Expectation

Let's imagine that important economic data will soon be published, say on GDP, unemployment rates, consumer prices, and so on. There are still a few days before the news comes out, but experts are already starting to make and publish their forecasts. This means that all traders in the world - including institutional players - receive a rough understanding of what awaits them even before the news is released.

Let's say we are talking about the US trade balance, the deficit of which, as experts expect, will decrease. This is extremely positive news, which always gives a powerful positive impulse to the entire market, strengthens the dollar, and so on.

All the most cunning: discovery before the news

Investors understand that if the forecast comes true, there will be a powerful increase in prices for certain assets. At the same time, they also know that you won’t buy them at the moment such news is announced, because the most active ones will disperse the liquidity with robots in a second and the majority will be left with nothing.

Therefore, many, trusting expert analytical forecasts (like those published by Bloomberg and Reuters), prefer to open transactions even before the news is released. As a result, often 1-2 hours before the news is released, the price begins to rise - because demand is growing.

Even more cunning

Some investors also understand the second point. If everyone starts buying early, the price won't be as good, so they try to buy even earlier. Thus extending the market reaction along the time scale.

And what happens? Important news comes out on Friday, and already on Monday morning the first, most cunning trader begins to open positions in anticipation of growth. So much for the long tail of the news market reaction. More and more new traders are joining this trader, the market is accelerating simply based on expectations.

Everyone is ready

As a result, before the news came out, many investors had already bought what they wanted long ago, and prices rose in advance. When the news comes out, many people don’t care: they have worked on an increase based on expectations and are ready to close the position at any time, even if the profit is slightly less.

This explains what you often see. Important news comes out, but the market... hardly reacts, why? Because everyone who wanted to participate opened positions a few days before. Therefore, the release of the news itself does not play a special role for them.

News release

When news breaks, one of three things always happens:

- data is better than forecast;

- the data matches the forecast;

- data is worse than forecast.

What if the data matches? Let's assume the news is positive. However, everyone who bought in advance, counting on this news, has already taken their profit. And they do not see the potential for further price growth. On the contrary, they are closing deals that were opened a few days ago.

It turns out to be a very funny situation. The forecast is positive, it coincided with real data, and the price... is falling as investors close buy orders en masse. However, the fall does not reach Monday’s levels, since not all purchases are closed - some hold the position further, in the hope of a long-term news effect.

If the data is worse than the forecast, buyers are in the minority. On the contrary, everyone wants to profit from the downward trend and weakening of the asset. As a result, prices may fall, even lower than they were a few days ago. Sometimes it only takes a few hours to fall - there is a devastating sale.

Finally, when the news is better than forecast, things become even more complicated as many factors come into play. Typically, the price continues to rise, but unsteadily, regularly rolling back as traders exit long positions, taking their profits.

Let's look at a specific example.

NonFarmPayroll (NFP)

Changes in non-farm payrolls is a major news story that appears every first Friday of the month. All traders in the world are waiting for it, but few can make money on it.

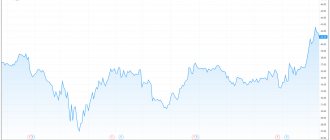

All that NFP gives is guaranteed inflated volatility, but where will the price go? Let's look at an example from February 5, 2021.

We see the previous value equal to 262K, the forecast - 190K, the real value is worse than expected - 151K.

How will the market react? What will happen, in this case, to EUR/USD? The data is negative, which means the dollar should weaken, right? And the graph should go up based on these expectations, especially since the forecast was also worse than previous data.

Here's what happened:

Don’t forget that in the EUR/USD pair, when the dollar strengthens, the chart goes down, when it weakens, it goes up, the opposite is true.

As you can see, the first long red candle with an incredible upper shadow that appeared at the time of the NFP announcement allowed everyone who was playing for a short-term decline in the dollar to close. As they exited their positions, the fall of the dollar stopped and then the chart went, uncertainly, downwards - the dollar began to strengthen.

How to make money from this? Look at this chaos. The candles, their length, the lack of clear indications of the entrance. This is the difficulty of news trading, and if you don't know exactly what to do, don't do it. Do not enter NFP or similar major news as it is announced.

But then the situation changed dramatically. An hour later, all the psychopathic reaction faded away, the market (it often does this after a sharp movement) went into a calm, low-volatility upward side channel. There are a lot of opportunities for work in binary/fixed/digital contracts, you just need to use multi-frame analysis and switch to a junior TF. The 30 minute or 1 hour rule worked best.

As you can see, news is complex, and missing it is the smartest thing you can do. Learn to catch the mood of the crowd long before the news comes out, because this is how the market works, on expectations and assumptions. What happens at the moment the news is released often does not play any role. Because everyone who wanted to profit from this news sometimes does it in advance. Because they work on emotions and expectations, and not on factual data.

The importance of choosing a broker for trading

When trading on important news, this question is of great importance for the trader. The reliability and honesty of the intermediary providing services for conducting trade operations is always relevant. Unfortunately, most brokers strive to prevent the trader from making money on the release.

The choice of broker should be based on a number of basic criteria:

- No requotes at the time of closing an order when there is high volatility in the market;

- No slippage (order execution at a price different from that specified by the trader);

- No premature closing of a position (Stop Loss failure);

- Inadmissibility of restrictions when placing orders before release, either in time or in distance from the current price value;

- A conscientious broker does not increase the spread excessively at the time of release.

How to trade on the news

All existing methods of trading on news can be divided, conditionally, into the following three options:

- autoclickers;

- straddle (forex);

- Post-news trading.

Let's look at each of them briefly.

Autoclickers

An autoclicker is a special program that is configured to output certain economic data and will press the Up/Down button for you at a binary or Forex broker. Its task is to react to whether the news is positive or negative, and then instantly press a button - much faster than the human eye and hand on the mouse can react.

There are quite a few advantages here:

- instant entry into the market;

- you don’t have to sit and wait for news at the computer;

- any terminal - even through a browser, even MetaTrader;

- setting up triggers - which news indicators to work on.

Main disadvantages:

- Not all brokers like autoclickers;

- brokerage platforms may slow down on news.

There are many varieties of them. The free clicker ForexNewsGun was popular for several years. Then it was replaced by all sorts of paid options.

But in our world there are absolutely amazing things, for example, Intrade generally offers a clicker itself to everyone, which we giggled about in an interview with them.

The principle of any clicker is simple and extremely fun. News for clicking is selected, then you need to specify the area on the screen where the click will be made (and this will be the Buy or Sell button), after which the clicker starts working and does everything for you.

Of course, it is advisable to use this clicker on the same platform that developed it. Not all brokers encourage clickers, and if a trader works only with such clickers, this is clearly visible from the statistics and many brokers will write him down as “toxic”, after which he will not last long. So take this into account and check with your broker how he views such transactions. Some allow brutal scalping on the news, some do not.

Often, professional traders write such clickers themselves, but in a very adult version - in the form of a robot for a trading platform that automatically opens trades with a connection to the feed of a news provider like Reuters. Simpler clickers are well suited for those who just want to test how it works.

Straddle

This method is used in Forex, we will describe it briefly. Before the news is released, two pending orders are simply placed in different directions; if the news flies in one direction, the order is activated and the job is done. Often such “arbs” are implemented by robots that parse economic calendars or are configured in some other way.

There are a lot of problems here: you placed your orders incorrectly and you are left with your nose, say, a long candle can easily activate 2 orders at once and drive you into a big loss. As a rule, straddles are traded by advisors and brokers, by the way, have no complaints about this method.

There are also a lot of disadvantages: orders slide, stops are often activated before the price reaches them, spreads widen greatly and other joys. Accordingly, you need to have a good understanding of the news and understand which ones are better suited for straddles and which ones are less suitable.

Post-news trading

I use this method myself and recommend it to you. An example is shown in the screenshot above for NFP output. An hour has passed - the market has calmed down - you draw a corridor in which the price is trampling and you always find a couple of tasty entries along the trend or even against it.

News also has one interesting effect, which we also see with gaps. After a strong fall, the price seeks to make up for it, to compensate for this gap. This is the case with NFP, a significant drop down and its compensation.

Closing the gap

In this case, compensation occurs after a strong market reaction. If the market has not reacted in any way, there is nothing to compensate.