Microfinance organizations appeared on the financial services market in Russia not so long ago, but in a short period of time they managed to become an indispensable alternative to bank lending.

If it takes more than one day to get a bank loan, you can get a microloan for any amount in just a few hours.

A microfinance organization (hereinafter referred to as MFO) is a credit institution that offers a large list of financial services to individuals and legal entities (small and medium-sized enterprises).

The main activity of MFOs is to issue microloans.

Along with lending, clients can take advantage of.

Few people know about this, however, investing in microfinance organizations is a profitable and, most importantly, a quick way to get a stable income.

Investing in an MFO is carried out according to a typical scheme: the investor invests funds in a microfinance organization under a pre-concluded loan agreement (the MFO acts as a borrower). Next, the MFO issues loans to the population, receiving a certain percentage for this. This same percentage is divided between the investor and the MFO. Thus, all participants in the loan agreement make a profit.

The activities of MFOs are legal in Russia and are regulated by government agencies.

Recently, more and more clients prefer to invest available funds in microfinance organizations.

What is investment in IFC?

All MFOs operating on the Russian market are divided into two categories. The first - the most numerous - unites microcredit companies or MCCs. These are relatively new and small market participants who do not have the right to attract funds from individuals who are not founders.

Microfinance companies or IFCs do not have such restrictions. Therefore, when talking about investments in MFOs from individuals, we are talking exclusively about them. Organizations have the right to invest in both IFCs and MFOs.

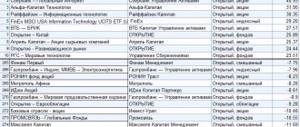

The number of active IFCs as of April 10, 2021 is very small - only 35 organizations. You can find a comprehensive list of them on the website of the Central Bank of the Russian Federation. The information is available as an Excel file.

Investment in MFC means investment of funds at interest under a loan agreement with a microfinance company. Several details are mandatory terms of the agreement:

- the amount invested by the client;

- term of investment;

- the interest rate at which income is calculated;

- ways to earn interest on invested funds.

An alternative option for investing in an MFO business is to purchase bonds issued by a microfinance organization. This type of borrowing is also available only to IFCs,

Recommendations for investors

If you think that the advantages of investing in microfinance organizations outweigh the disadvantages, then when choosing a specific microfinance organization, follow the following practical recommendations.

- It is necessary to collect and carefully study all available information about the activities of a microfinance organization.

- The duration of the work, existing assets, and the guarantees provided should be taken into account.

- You should find information on the founders of the MFO. As a rule, they can be provided by the company itself. Well-known and serious founders most often talk about the reliability of the organization.

- Analyze the profitability of the investment program or product that the MFO offers. An unreasonably high percentage should automatically arouse suspicion among the investor.

- Analyze the proposal for loans provided by a microfinance organization. The more attractive they are, the more clientele the company has. Consequently, the level of its financial stability is higher.

- Assess the rating of microfinance companies. Use several online resources for this. Correlate the results. Print the average values.

- Carefully study the reviews about the microfinance organization you are interested in. At the same time, remember that in conditions of serious competition in this market, they will often not be objective in nature. No one has canceled intrigues and black PR from competitors.

Based on the collected and analyzed information, a potential investor will always be able to make a balanced and deliberate choice.

Is it worth investing in microfinance organizations?

The decision to invest in MFOs should be made with a clear understanding of the investor’s main rule: the higher the profitability, the higher the risks. In other words, cooperating with microfinance companies is very profitable, but at the same time dangerous.

Standard recommendations from professionals on choosing an investment option are as follows:

- diversification of investments. It means the advisability of simultaneous use of several methods of increasing savings;

- a thorough study of the history and current state of the microfinance company. A significant part of the information about MFOs is available on the website of the Central Bank of the Russian Federation;

- analysis of proposed investment conditions.

Investment procedure

There are two ways to invest in microloans:

- Buy bonds. MFOs can issue bonds of a certain value (par value), validity period (maturity) and coupon. At the end of the specified period, the organization undertakes to buy the security back, paying the investor the “body” of the bond and interest.

- Apply for a loan . Here, a regular loan agreement with specified terms, interest and other conditions is concluded between the investor and the MFO.

The investment procedure includes several stages:

- Selecting a microfinance organization.

- Discussion with MFIs of necessary conditions. As a rule, each such company has only a few investors, and therefore the conditions are discussed with each of them individually.

- Conclusion of an agreement. It should reflect such issues as the investment amount, repayment period, interest, method and dates of interest payment, rights and obligations of the parties, etc.

- Transfer of money by a depositor to an MFO.

You can also enter into an agreement with a microfinance organization remotely. Then the order will be as follows:

- On the official website of the MFO, a potential investor leaves an application, phone number and name.

- The consultant calls back to the specified phone number and explains all the details the client is interested in, and documents are sent to the email address for review.

- If the investor is satisfied with everything, he notifies the company of his intention to invest funds, after which a courier arrives at his home with the original documents.

- After receiving the contract, the investor transfers money to the institution’s details.

Rating of MFOs and MFCs for investments in microloans

The microfinance market situation is changing rapidly. Moreover, given the difficult economic situation in the country caused by the coronavirus epidemic and falling oil prices. Therefore, the rating of MFOs below for investing in microloans reflects the situation as of mid-April 2020.

Quick money

One of the oldest microfinance organizations in the country, operating on the market for more than 11 years. Offers a convenient procedure for attracting investor funds, which includes three stages:

- Filling out an application on the IFC website.

- Signing the contract.

- Transfer of funds by bank transfer to the company's account.

Basic investment conditions:

- interest rate – from 13% to 15.5%;

- amount – from 1.5 million to 150 million rubles;

- term – from six months to 3 years;

- interest is received monthly or at the end of the contract.

The easiest way to calculate the amount of income received is using the calculator posted on the IFC website.

Money Man

Another “veteran” of the microfinance market. MoneyMan is deservedly considered one of the most recognizable brands. IFC offers simple and clear investment conditions:

- two term options – six months and a year;

- three types of currencies - rubles, American dollars and euros;

- amount – ranging from one and a half to 20 million rubles. (from $30 thousand to $20 million);

- return in rubles is 11% and 13%, respectively, for semi-annual and annual investments (for investments in dollars - 9% and 12% according to a similar scheme, in euros - 8% and 11%).

MigCredit

The company has been operating almost since the creation of the Russian microfinance services market. It is one of 35 operating multifunctional complexes and has 73 offices located in different parts of Russia.

MigCredit offers favorable investment conditions, which provide for receiving from 13% to 14% percent of income. The investment amount varies from 1.5 to 200 million rubles, and the period - from 3 to 12 months (in increments of 3). To calculate the income received, an online calculator posted on the website is used.

Zaimer

MFC Seimer has been operating since 2013. The company attracts funds from individuals, individual entrepreneurs and legal entities on the following conditions:

- interest rate – from 13.5% to 18.5% (depending on the duration of the investment);

- term – from six months to 3 years;

- amount – from 1.5 million to 20.0 million rubles.

Income is calculated using a convenient service, which is located on the corresponding page of the IFC official website,

Mutually

The last microfinance company included in the Central Bank register. Operating on the market since 2021. Invites both individuals and legal entities to cooperate. Offers the following conditions for investing in IFC business:

- interest rate – from 14% to 18.5% (depending on the term and capitalization of interest);

- investment period – from 3 months to 3 years;

- amount – from one and a half to 10 million rubles.

VIVA Money

The company was included in the register of the Central Bank of the Russian Federation in December 2011. Currently operates as MFC "TsFP". The terms offered to investors are as follows:

- rate of return – from 15% to 21% (depending on interest capitalization and investment period);

- amount – 1.5-20.0 million rubles;

- Duration of investment – from 3 months to 3 years.

CarMoney

MFC "KarMani" has been working in the domestic MFO market since its formation. The company offers to invest in business using one of two possible options. The first product is called “Income” and provides for monthly interest payments. The conditions for raising funds are as follows:

- profitability – up to 18%;

- duration – up to 36 months;

- amount – from half a million for legal entities and from one and a half million for individuals.

Second investment product. It involves capitalization of interest. The difference in investment terms is the interest rate. In the second case it reaches 20%.

Webbankir

MFC "VEBBANKIR" attracts funds from investors for a period of 3 months to 3 years. The interest rate varies from 13% to 18%. It is determined taking into account the capitalization of interest and the duration of the investment. The investment size ranges from 1.5 million to 15.0 million rubles. To calculate the profit received, an income calculator located on the website is used.

Lemon.online

It is a crowdlending platform intended for both borrowers and investors. Work on it is carried out under the MCC SME Online brand. Therefore, significant restrictions are imposed on raising funds.

At the same time, cooperation with Lemon.online provides a number of advantages, including:

- the minimum amount for entry is 1 thousand rubles;

- flexible investment conditions;

- high yield, reaching up to 36% per annum;

- investing money in various businesses with constant access to a deposit.

Lime-Loan

MFC "Lime-Zaim" is one of the most famous participants in the Russian microfinance market. The company actively attracts funds from investors, which can be individuals, individual entrepreneurs or organizations.

The popularity of IFC services is explained by favorable investment conditions, which include:

- investment of funds in the amount of 1.5 million to 30.0 million rubles;

- the duration of the agreement with Lime-Loan is from six months to 3 years (in 6-month increments);

- payment of interest according to one of three options - monthly, quarterly or at the end of the contract;

- interest rate, which ranges from 11% to 20%.

Zaymigo

MFC "Zaymigo" has been operating in the microfinance market since the second half of 2013. The company is engaged in attracting investments on the following terms:

- interest payment – monthly or upon completion of investment;

- term – from six months to two years;

- amount – from 1.5 to 5.0 million rubles;

- rate of return – from 16% to 23%.

Why are MFO deposits more profitable?

The answer to this question is simple. Microfinance companies provide loans to entrepreneurs and firms at high interest rates. For example, if a client takes 500,000 rubles for 2 years, then he overpays almost 400,000 rubles. The annual interest rate is 65%. In this regard, they can easily afford to open deposits of 1.5 million and 500,000 rubles.

Of course, you can make a good profit by opening a deposit in an MFO, but there are great risks of losing your money. When choosing such an organization, it is worth considering their annual budget. An MFO must exist on the market for at least 3-4 years. It is advisable to find out about the organization’s insurance company, whether it will be possible to insure an open deposit.

TOP offers of 2021 for investments in loans

Even a quick analysis of the above proposals shows that cooperation with microfinance organizations is much more profitable than working with banks. Several of the most preferable options in terms of profitability are presented in the table.

| MFO name | Duration in months | Amount, million rubles | Yield in %% | Interest payment |

| Quick money | 6-36 | 1,5-150,0 | 13%-15,5% | Monthly or capitalization |

| Money Man | 6 and 12 | 1,5-20,0 | 11% and 13% | At the end of the investment period |

| MigCredit | 3, 6, 9 and 12 | 1,5-200,0 | 13%-14% | At the end of the investment period |

| Zaimer | 6-36 | 1,5-20,0 | 13,5%-18,5% | Monthly or capitalization |

| Mutually | 3-36 | 1,5-10,0 | 14%-18,5% | Monthly or capitalization |

| VIVA Money | 3-36 | 1,5-20,0 | 15%-21% | Monthly or capitalization |

| CarMoney | Up to 36 | From 0.5 | Up to 20% | Monthly or capitalization |

| Webbankir | 3-36 | 1,5-15,0 | 13%-18% | Monthly or capitalization |

| Lime-Loan | 6-36 | 1,5-30,0 | 11%-20% | Monthly, quarterly or capitalization |

| Zaymigo | 6-24 | 1,5-5,0 | 16%-23% | Monthly or capitalization |

Essence and types

A microfinance organization is easy to identify by its flashy advertising slogan. It could be: “Loan in 10 minutes!”, “Loan before payday!” and so on. An MFO office may be located in a shopping center, city market, or other crowded place.

First of all, they attract citizens with the speed of obtaining a microloan and its accessibility. After all, most often such financial organizations do not spend much time studying the credit history of a potential borrower. And among the documents they usually ask you to provide only a general passport.

In Russia, a microfinance organization must be included in a special register of the Central Bank of the Russian Federation. Only after this is it given the right to carry out microfinance activities in accordance with the relevant law.

There are a large number of options for the existence of MFOs. In particular, we can say:

- about funds to support small businesses;

- about financial groups;

- about credit agencies, societies, unions, cooperatives, companies and so on.

Examples of such existing ones are “RIM Corporation or Russian investment microfinance corporation” and so on.

Some people confuse them with banks. For others, their status remains a big mystery. Still others consider them scammers. Nevertheless, the activities of MFOs in our country are enshrined in law.

How to invest in microfinance organizations?

In most cases, the procedure for investing in microfinance organizations is extremely simple. It provides for three main stages of formalizing relations between an investor and a microfinance organization:

- submitting an application on the MFO website;

- preparation and signing of a loan agreement between the client and the microfinance company;

- transfer of investor funds to the IFC account specified in the agreement.

How is interest paid?

Interest is paid in one of two ways. The first provides for a monthly (less often quarterly) transfer of income to the investor’s account, and the second provides for the capitalization of interest and taking it into account in further calculations on the deposit.

The advantages of each option are obvious. Regular receipt of interest makes investing in microfinance organizations a source of passive income. Interest capitalization increases the overall return on investment.

Sources

- Official website of Money Men

- Seimer official website

- Official website of Zaymigo

- Official website of Joy Money

- Official website of Bystrodeneg

- Official website of DobroZaim

- rbc.ru: Risky income: is it possible to make money by investing in microloans

- fincult.info: MFOs: how to make money on them

Anastasia Vakusheva Editor and author of texts for #VZO. She has been editing since 2021; before that she wrote articles for various resources, including financial ones. Anastasia has been working on our project since 2021. She both processes texts prepared for the site by other authors and writes informational articles herself.

(11 ratings, average: 4.9 out of 5)

How to invest in PDA?

CCP or consumer credit cooperative is another investment option. It is a non-profit organization that is created with the purpose of providing participants with mutual financial assistance to each other.

The activities of the CPC are also regulated by the Central Bank, but to a noticeably lesser extent than the work of the IFC and, especially, banks. Therefore, participation in CPCs should be approached extremely responsibly, since a high level of possible profitability is accompanied by similar risks. The list of consumer credit cooperatives legally operating in Russia can be downloaded from the official website of the Central Bank.

Reliability of microfinance organizations

Any type of investment is a certain threat. The possible income depends on the level of risk - the more interest the company offers, the more the investor risks. It is necessary to clearly understand that the main goal of the company is to provide instant loans at high interest rates.

It is no secret that citizens turn to such organizations:

- With a bad credit history;

- Without official income;

- Having debts to banks;

- Who can't get a loan from a bank?

The risk of loan non-repayment is very high. It turns out that if a company has a large number of outstanding loans, it may leave the market. What about the investors to whom she owes money? Everything is very simple here - as much as he can, he will give as much! The amount of the return will depend on the assets of the microfinance company. It turns out that you will either make good money or lose everything.

Guarantees that microfinance institutions can offer:

- Right to work . The Central Bank website has an up-to-date register of microfinance companies. It is worth making sure that the selected company is included in the register.

- Reliability . It is necessary to choose a company with a high level of reliability. You can view the rating on the Expert RA website.

- Organization's activities . Before investing, you should carefully study the reviews and how often the company is talked about in the media. A good reputation and positive reviews indicate that the company can be trusted.

- History of development . You should not give preference to companies that have appeared recently and attract high rates. It is better to give preference to a company that has been on the market for several years.

Investing in real estate loans

The activity of issuing loans secured by real estate differs from the options for investing savings described above in two fundamentally important ways. On the one hand, such financial transactions seem reliable, since they are backed by liquid assets.

But on the other hand, the work of organizations performing such transactions is controlled by the Central Bank of the Russian Federation even less than by the CCP. Therefore, when making an investment decision, you should remember the main rule of the investor: high profitability is accompanied by high risk.

Brief educational program

Microfinance organizations issue loans to individuals in small amounts:

– from 1-5 thousand to 30-100 thousand rubles;

– for short periods (up to 1-2 months);

- at a high interest rate.

When opening an MFO, they begin to issue loans from personal funds, and when the flow of clients increases, the owner can borrow money from third-party investors at a certain percentage, usually several times higher than the bank rate.