olegas Aug 15, 2021 / 1530 Views

The first investment fund of this type appeared about 70 years ago in the United States, as a private initiative of the American sociologist Alfred Jones. He did not set himself the task of becoming fabulously rich in this enterprise, but simply wanted to earn money to live and do what he loved by investing in the stock market.

He himself, as well as his friends and relatives, acted as shareholders of the fund. And his initiative, in the end, turned out to be a complete and unconditional success! Six years after the start of his investment activities, Jones published its results. Its average return was about 65% per annum, which was significantly higher than the profit of the largest investment funds of that time. Of course, many entrepreneurs followed this successful example, and by 1968 there were already 140 funds of this kind in the United States. Since this was actually a new type of investment fund, the SEC (American Securities Commission) was forced to classify it as a new structure. This structure was called a hedge fund (from the English word hedge - insurance, protection).

- Stage one. Choice of jurisdiction

- Stage two. Registration

- Stage three. Agreement with the management company

- Stage four. Agreement with the custodian bank

- Stage five. Hiring employees, renting an office and concluding an agreement with a broker

- Stage six. Attracting investors

- Approximate cost estimate

What are hedge funds

In general terms, hedge funds (hereinafter referred to as HF) are commercial financial organizations that invest clients' money using special methods of insuring investment transactions or hedging in financial and other types of markets.

Note. Hedging (from the English hedge) is a fence, protection, including from any dangers or troubles.

Hedging risks in financial markets involves the use of certain types of financial instruments, such as futures, options, arbitrage transactions, including minimizing client capital risks through the use of offshore jurisdictions.

The main features of hedge funds, in contrast to other types of work with money from third-party investors (i.e. under a trust management agreement - DM), are as follows:

- Hedge funds are usually not specific to any country, legal or governmental jurisdiction. Those. They have an international character in their management structure and work with clients. In some ways they are similar to TNCs (transnational companies). This lack of a single jurisdiction allows hedge funds to flexibly formulate their investment policies, invest clients’ money in assets of different countries, apply tax optimization schemes, take advantage of the peculiarities of tax legislation in a particular country, benefits, etc.

Legal jurisdiction in the global hedge fund industry.

- HFs, unlike traditional types of collective investment in the asset market (mutual funds, non-state pension funds, etc.), do not have strict regulation of their financial activities or methods of limiting risks. This creates the opportunity for these financial corporations to invest investors’ money where it is most profitable, and not guided by the instructions of some Central Bank or officials. Even if it is fraught with risk.

- Hedge funds use the most advanced and innovative technologies in the financial and information spheres in their investment practice. This allows them to be orders of magnitude more efficient than traditional financial institutions. By the way, it was the HF that was one of the first to invest in projects to create algorithmic computer systems (and the Internet, in particular) in order to increase the speed of information processing when making their financial decisions.

Now in the world there are more than 15 thousand hedge funds of various capitalizations and styles of working with clients. There are funds that work with the general public of private or corporate investors. And there are so-called funds of funds.

These are, in fact, elite investment clubs that invest the capital of wealthy clients of a certain social circle, special family funds.

The most well-known representatives of the pure hedge fund class are corporations such as Quantum (founder - famous philanthropist and investor George Soros), Medallion, BlackRock, Rothschild family funds, etc.

When and how did they arise

The appearance of the first hedge funds occurred in the post-war years, at the turn of the 50s. last century, when for the first time wheat futures contracts began to be sold on the Chicago Mercantile Exchange in America. Subsequently - for all types of exchange goods, from oil to cotton and cocoa beans.

With the help of these futures contracts, any seller or buyer could insure their transaction in case the purchase or sale price of an asset did not meet their expectations. Gradually, the practice of using futures appeared in securities trading to protect investors' investment portfolios from sharp fluctuations in market conditions and stock exchange prices.

The first officially registered HF appeared in the USA in early 1950. Its founder was the then famous American stock speculator Alfred Johnson.

The immediate reasons for its emergence were the introduction into practice of investment methods with insurance of securities portfolios using derivative financial instruments. This has found application in almost all global financial markets.

Share of hedge funds in the global investment market. In addition, factors such as:

- Strict tax regulation by America's financial authorities applied to financial corporations. Suffice it to say that American tax legislation, introduced during the era of US President Roosevelt, provided for a tax rate for the rich of up to 90% of income received. This situation has forced many investment funds, whose clients are precisely these wealthy people, to use offshore jurisdictions to minimize such “draconian” tax measures.

- For 50–60 years. The last century was the time of the so-called baby boom, when the post-war generation of Americans began to create families en masse. To ensure a carefree future for their children, these families invested their savings in numerous investment and pension funds. But these PFs were subject to strict regulation by financial authorities. They could invest clients' money only in a limited list of highly reliable, but, unfortunately, low-yield securities. First of all, these were American government treasury bonds or Treasuries. Accordingly, HFs could offer such families greater returns at a relatively low level of risk.

- The emergence of the first computer trading platforms and digital communications systems in the late 1980s and early 1990s allowed hedge funds to implement a host of methods and technologies that could neutralize almost any financial or market risk. This period is considered the beginning of a boom in hedge funds around the world.

- The introduction of a large class of securities into the market (such as mortgages and other securitized financial instruments) has also contributed to increased demand for hedge fund services. They were not limited in any way in choosing the most exotic financial instruments for their investment strategies. In total, the HF uses about 1,200 financial assets and instruments.

The emergence of modern digital financial payment systems and electronic trading on exchange markets has allowed HF to apply various strategies.

They are able to solve any problem of effectively investing client funds in securities, precious metals, antiques, real estate or real business, as well as in new types of investment assets, including cryptocurrency hedge funds (alternative investments).

How they work

Expert opinion

Vladimir Silchenko

Private investor, stock market expert and author of the Capitalist blog

Ask a Question

Although hedge funds are powerful financial corporations that manage billions of dollars in client assets, the way they operate is simple.

Let me explain with an example.

A block of shares in Sberbank, purchased with the expectation that they will grow. To hedge the risk of loss of value, either a futures contract or, better yet, an option is purchased.

Even if the price of Sberbank's shareholding decreases against our expectations, the investor still has the opportunity to sell them at the price fixed in the option contract. The only thing the investor will have to pay for is the cost of the contract itself, which rarely exceeds 1-2% of the transaction amount.

This scheme of insuring a transaction—one type of product or asset with the help of another product or contract—is the basic operating principle of all financial institutions.

True, for this, hedge funds can use not only 1,200 financial instruments, but also preferential tax offshore jurisdictions, banking services in different countries (for example, arbitration of interest rates on loans), as well as wide diversification of investment portfolios, which include not only securities , but also real assets.

The main differences between hedge funds and mutual funds

They have some similarities with mutual funds - they work with money from third-party clients, collective investments.

But there are a number of fundamental differences:

- HFs do not have a clear legal form. These can be investment companies, funds, venture enterprises, and even public organizations, such as interest clubs. Mutual funds, according to Russian laws, must have a management company not lower than the status of an LLC or CJSC.

- For its investment strategy, a hedge fund can choose almost any financial instrument or asset that is included in the fund’s investment memorandum. Mutual funds are limited in the choice of assets, both by reliability class and type. These restrictions are established by regulatory government bodies, the Central Bank of the Russian Federation, which issues each mutual fund an appropriate license.

Preference for choosing an investment format among wealthy clients.

- In mutual funds, the profit of each investor is determined based on his share in the authorized capital of the fund, i.e. share size. Hedge funds use a version of a certificate certifying the right to profit from all of the fund's profits. This certificate can be sold, inherited, or used as collateral.

- In mutual funds, investors can only accept the conditions for investing capital that are offered. Hedge funds allow investors to choose where they want to invest their money.

Peculiarities of work of Russian hedge funds

The main feature and at the same time a significant limitation of the work of HFs in Russia is that they have the right to attract money from Russian investors and depositors only if they have state registration in the country.

Besides:

- There are restrictions in terms of licensing and the choice of investment instruments.

- Most hedge funds in Russia are focused exclusively on working with large corporate or wealthy private clients. In this case, the practice is to place part of the investors’ capital in the offshore accounts of their subsidiaries.

- Those HFs that are aimed at retail, small investors, as a rule, have an entry threshold of at least 100 thousand rubles. This significantly limits the demand for the products of such investment companies from the majority of the population.

- The commissions charged by Russian hedge fund managers are no lower than 15–20% of the amount of invested capital, which is several times higher than commission rates in developed countries.

It should also be added here that most of the financial activities of the HF in Russia are closed, since the bulk of the investors’ capital works through the schemes of subsidiary management companies located in offshore jurisdictions.

How much profit do they get?

Hedge funds, especially those that work with wealthy clients (family foundations, trusts), are fairly closed organizations. Even through research into their financial statements, it is difficult to find the ultimate beneficiary of the investment.

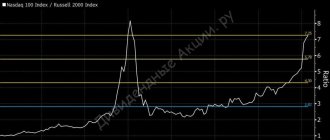

This also applies to the issue of profit. According to experts, on average, the HF is able to exceed the risk-free rate of return or bank loan interest set by the Central Bank by a multiple. For the USA and Western European countries this is 2-3%, for Russia - 7-8%.

Accordingly, American ones have a profit of no less than 10–12% per annum. Those. their returns are comparable to the SP500 stock index. Russian ones have a profit of at least 20–30% per annum, since they have to factor country risks into their investment strategy. Those. risks of doing business in a specific territory.

Hedge Fund Incentive Fees

In addition to the main payment in the form of a share of the profit received by the fund for the reporting period, investors receive incentive payments or bonuses:

- options to purchase a share or certificate of participation in the HF at a preferential price;

- if the amount of the investment portfolio exceeds a given threshold, the asset manager’s commission is reduced;

- preferential services from lawyers when executing investment transactions, including distribution of shares among the final beneficiaries of an investment project or portfolio;

- preferential lending rate to fund investors through its partner banks.

Flexible approach

Investment targets and strategy change depending on emerging profit opportunities from events such as IPOs; sudden price changes, often caused by temporary market disappointment; hostile bids and other hedge fund-controlled opportunities. Such a hedge fund can pursue multiple investment styles simultaneously and is not limited to any particular investment approach or asset class. Due to the flexibility of the strategy itself, expected volatility cannot be estimated and can vary significantly from low to very high.

Kinds

In practice, the following types of hedge funds are found:

- Funds of funds. Managers of a network of various funds, each of which has its own specialization. The management company only coordinates the overall strategy and manages the redistribution of financial flows. The closest analogy is corporate holding structures.

- Neutral strategy funds. Applying a loss limitation strategy regardless of market conditions. They work in the real estate market when implementing development projects. This is due to the fact that it is necessary to ensure a stable financial flow, regardless of the current demand for residential or commercial real estate.

- Funds that work using current events tactics or, more simply put, enter market assets for which any important economic or political events are expected. For example, buying up company shares in anticipation of a Fed rate cut or introducing a bill to tighten the work of foreign investors in the IT sector of Russia.

- Funds that use a strategy of investing in stocks while simultaneously hedging the portfolio with various instruments.

Investing in emerging markets

This hedge fund strategy involves investing in equity or debt in emerging markets, which are subject to higher inflation and prone to volatile growth. Shorting is not permitted in many emerging markets and therefore effective hedging is often not available, although Brady debt can be partially hedged through US Treasury futures and foreign exchange markets. The expected volatility of such funds is extremely high.

Structure and management

At the very beginning of their appearance, all HFs had a classic multi-level vertical structure and management model. However, now most have a network structure, with many branches, representative offices, subsidiaries, law firms, brokers, and consulting agencies in several countries around the world.

However, each hedge fund has a certain set of functional management bodies in its structure:

Typical hedge fund structure diagrams.

Typical hedge fund structure diagrams.

- The governing body is usually the board of directors of the management company. Often such management companies are registered offshore, and management is entrusted to a nominal general director. All real powers for capital management are vested in the board of directors (BoD), each with its own voting rights, corresponding to the size of the share in the authorized capital.

- Client bank or custodian bank. This bank performs the functions of accepting investors’ money, then transferring it to the accounts of Management Company HF.

- Broker. Its main function is to carry out all operations through it on financial markets, exchanges, trades, auctions and competitions. Often large financial holdings have their own brokerage companies that provide direct access to exchange trading platforms.

- A consulting or lawyer company (division) is necessary for legally competent support of all investment transactions and work with clients.

As for the fund itself, it usually takes the form of a limited liability company LTD or, in the Russian version, LLC. The investor’s initial pool of money is accumulated in his accounts, which are then transferred to the management company’s management company.

The structure may also have its own board of directors, where the functions of directors can be performed by the same persons as on the board of directors of the management company of the fund. Sometimes a scheme of cross exchange of directors is used between the fund's board of directors and the management company's board of directors.

Operating procedure

How do hedge funds work? A typical structure of its environment looks like this.

Investors are the source of funds.

The Board of Directors is the link between investors and managers. Supervises the activities of management companies and companies providing services, resolves controversial issues, and determines personnel policies.

Management company (MC) - attracts investors, determines investment strategies, and provides general management. The Criminal Code includes:

- managing partners;

- analysts - the quality of predictive models for the development of the economic and political situation depends on them;

- traders are the “core” of the fund; the profitability of investors depends on the level of these people.

Administrator - conducts an independent assessment of the value of net assets (risk minimization), in some cases prepares accounting and external reporting for investors, pays bills, deals with issues of profit distribution, subscription and redemption of shares.

Primary broker - provides operational support and technical support for transactions in national and foreign markets. Provides a range of financial services (clearing, depository, etc.). It must ensure the most complete coverage of the markets where the management company operates, so a large bank (Merrill Lynch, Goldman Sachs, Morgan Stanley) often acts as a primary broker.

Guarantor bank - ensures the integrity of deposits, generates reports on transactions on the account, and in some cases verifies the activities of the management company. In most cases, a large bank with an unshakable reputation.

External auditor - checks the reporting for its reliability and compliance with accounting and legal standards. An auditor is a guarantor of reputation, which, given the volume of investments, is of paramount importance. Therefore, they try not to skimp on it and attract well-known companies from the TOP 10.

Legal consultant (internal or external) - ensures obtaining a license, manages all issues of concluding contracts in different jurisdictions.

The structure considered allows for numerous variations in the direction of simplification or complexity.

Taxation of hedge funds

Hedge funds are taxed in the same way as other financial companies and corporations at income tax rates with a starting value of 24%. However, this figure is supplemented by taxes paid on income received in the form of stock dividends. In general, if we take all taxes, then HFs are required to pay at least 50–60% of all their profits in Russia.

But HFs would not be hedge funds if they did not use legal schemes and methods of tax optimization. Including by fixing part (most) of the profits in the offshore accounts of their subsidiaries. In offshore companies, the profit from operations in the financial markets for financial firms rarely amounts to more than 10% of the total profit for the reporting period.

US Hedge Fund Interest Rates

The interest income of the average capital fund in America ranges from 15 to 40%.

It should be taken into account that the scale of capital operated only by large funds in the United States amounts to more than 1.6 trillion. dollars. This is not counting the money of investors who, through HF, “hid” their capital in numerous “gray” offshore jurisdictions.

How hedge funds achieve better margins

In order to have a return higher than that of most classic investment funds or a bank deposit, MFs use not only risk insurance methods or tax planning, but also an increase in their marginal income.

For this purpose:

- methods related to margin trading of securities, currencies, precious metals, and commodities with so-called leverage. It can reach values of 1:100 and higher;

- purchase of undervalued or junk assets, securities with a rating below investment grade (below BBB on the rating scale);

- buying up operating companies and businesses that are experiencing certain difficulties. They are offered the option of restructuring, a friendly takeover, a loan in exchange for a share in the authorized capital;

- application of arbitrage transaction schemes, arbitrage of interest rates on loans, including carry trade.

HFs use high-frequency or algorithmic trading in their investment strategy; they use artificial intelligence, neural network platforms, and digital cryptographic communications to analyze BIG DATA.

Market-neutral securities hedging strategy

This hedge fund strategy involves investing equally in long and short portfolios of stocks, usually in similar sectors of the market. Market risk is greatly reduced, but the need to effectively analyze and select the right stocks to obtain acceptable returns increases. Leverage can also be used to improve profitability. Funds typically have little or no correlation with market trends. Such a hedge fund may sometimes use index futures to hedge systematic (market) risk. The Treasury Bill Index is usually used as a relative benchmark. Volatility with this strategy is usually very low.

How to become a member of a hedge fund

To become an investor or participant in a hedge fund, you must meet the basic conditions:

- Have sufficient entry capital, since most HFs have an entry price threshold in Russia of 100 thousand rubles and above. In the States, such an entry threshold amounts to hundreds of thousands and even millions of dollars.

- Have legal confirmation of your income, that it was obtained honestly, and all taxes have been paid on it.

- Provide identification documents, passport, bank statements, confirmation of real address of residence.

- Read and sign the investment memorandum. This can be done both in the office and through its website.

- Fill out an application to join the fund. The more serious the HF, the longer this application will be considered. It is quite possible that there will be a need to meet with management or a representative will come to talk with the investor in person.

As soon as all formalities are completed, the investor transfers his money to the bank accounts - the fund's custodian - and waits for that happy day when he will become much richer thanks to the care of the HF managers.

Where is it profitable to invest?

The most promising areas of investment from the perspective of investment policy and the prospects of the global and Russian economy are:

- investments in securities (stocks and bonds) related to high technology, the production of organic food, medical equipment and equipment, in companies engaged in biotechnology, as well as alternative energy sources;

- investments in assets related to innovative financial technologies “fintech”. These are, first of all, blockchain technologies, cryptocurrency payment systems, cryptographic user interfaces;

- investments in intellectual products - copyrights, works of art, including paintings, antiques, wine collections;

- investments related to the development of applied scientific research. First of all, this concerns space research and flights, unmanned transport, robotization of technological processes, “Internet things”, the “smart home” concept, artificial intelligence, computer neural networks, life extension - “anti-aging”, etc.

How to create your own hedge fund from scratch

You can answer with a long list of instructions on how to open a hedge fund in Russia; it will take more than one hour of reading. It's easier to say what you need for this (in sequential order):

- Establishment of a legal entity. In Russia, this must be a company not lower than LLC status. In foreign practice LLC or Co.Ltd.

- Licensing. To obtain licensing in Russia, you will need to have an appropriate investment memorandum and the amount of authorized capital not lower than the standards of the Central Bank of the Russian Federation. So that the general director of the management company, executive director, and key specialists have qualification certificates of professional financial managers or consultants. They are issued by the Federal Service for Supervision of Financial Markets of the Central Bank of the Russian Federation. It doesn't come cheap. Suffice it to say that completing the training and passing the exams will take 2 months and cost at least 50 thousand rubles per person.

- Conclude an agreement with the custodian bank and broker. All these partners will require their share of the remuneration, which will not be less than 5% of the investment capital.

- The authorized capital for a HF may be within the minimum threshold, i.e. at 10,000 rubles. But it is worth remembering that investors demand from the company reliability and guarantees of compensation for their losses. So the minimum authorized capital for financial organizations attracting money from third-party investors must be at least 30 million rubles.

- Once everything is in place, the next step is to attract customers. Expenses for primary advertising, work with key investors. HF promotion may take from 6 months to 1 year.

If there is a desire to set up a financial holding in an offshore jurisdiction, then organizationally everything is simpler. In principle, you can buy a ready-made turnkey company. This will cost at least 10-15 thousand dollars.

The main costs of opening and maintaining a hedge fund in an offshore jurisdiction:

But to work with reputable clients, you will have to invest at least $1 million in order to have certain financial guarantees to partners in the form of banks, consultants, lawyers and audit firms.

The costs for them will be at least 50% of all costs. For clarity, all the basic figures for opening a business enterprise in offshore companies are shown in Table 2.

Multi strategy

The investment approach is based on diversification - using different strategies simultaneously to make a profit in the short and long term. Other strategies may include the use of trading systems such as trend following, and various diversified strategies based on technical analysis. This style of investing allows the manager to vary the weighting of different strategies to extract maximum capitalization from available investment opportunities. The ability to use different strategies does not allow us to predict the future volatility of such a fund.