Aval is a procedure that is a guarantee for a bill of exchange. In this case, the person acting as an avalist is positioned not only as a guarantor. In this case, he is the guarantor of the return of a certain amount of money that was indicated in the bill.

The latter is a written job obligation drawn up strictly according to the form, which indicates all the details and nuances of this procedure. The bill gives full rights to the drawer to receive the agreed amount of money within a specified period of time. The need for avalization arises if it is necessary to reduce the risk of non-payment of bills and increase the indicators of its attractiveness.

Guarantee for a bill

Aval is a guarantor of financial security for the lender. It is legal even in a situation where the warranty obligation is invalidated. Aval makes the bill the most reliable.

The aval of a bill is a guarantee of payment on a bill from a bank or other person, called an avalist, who is not directly related to the bill. Aval in the language of bill law is a bill guarantee.

Payment guarantee

Aval is a guarantee for a check or bill of exchange; allowed for each person other than the payer. The avalist is liable together with the drawer, and his obligation is valid even if the obligation he guaranteed is invalid for any reason other than a defect of form. Aval in this regard is absolutely equal not to a guarantee, which is of an accessory (additional) nature in relation to the main obligation, but to a bank guarantee.

Aval is an obligation accepted by a third party to pay under certain conditions on a bill of exchange, namely, when the payer of the bill cannot pay.

Valuation of bills

The process of registration by a banking organization of aval is the avalization of bills. The financial institution undertakes the obligation to partially or fully pay the bill for one of the Parties, which is obligated to fulfill the terms of the bill.

A bill of exchange is considered avalized if it bears the inscription “considered as aval” and a signature is placed in 2 places – on the main sheet of the document and in the addendum. Moreover, according to the legislative framework of our country, this inscription has no legal force. But nevertheless, the entry made in the bill is considered an aval. It would seem that the result is some kind of absurdity, but in fact it looks exactly like this.

If desired, the avalist can indicate whose guarantor he is. However, this is not at all necessary. And if the avalist has not made such an entry, then the aval is automatically sent to the drawer.

Even if suddenly the guarantee obligation is considered powerless, in spite of everything the guarantee gains its legitimacy. The only case in which an aval is considered invalid is errors when filling out an aval bill. Aval is provided when performing the following operations:

- Foreign trade transaction for raw materials that will be exported to another country for processing

- Aval for the amount of excise duty on companies using raw materials subject to excise duty in production

- For purchase and sale transactions

Bill payment scheme

Aval is a bill of exchange guarantee, according to which the bank assumes responsibility to the bill holder for the execution by the drawer of the payment of the tax bill, which is drawn up by affixing the bank's guarantee inscription on all copies of the tax bill.

An aval is a bill of exchange or guarantee of payment of a check, which is made by a third party, as a special guarantee note.

Aval is one of the types of guarantee, which implies a guarantee of the person who gave such guarantee to the owner of the bill to fulfill the obligation under the bill.

Aval is a bill guarantee, a way to ensure payment of a bill. Surety

Terms that accompany aval

The concept of “aval” is accompanied by the following terms:

An avalist is a person who has committed an aval; guarantees payment of the bill. Often the avalist is a bank.

Guarantee of payment and obligations of the avalist

The avalist assumes responsibility to the owner of the bill for the fulfillment of obligations by any of the persons obligated under the bill: endorser, acceptor, drawer. An avalist is released from liability when he ceases to be liable for the bill of exchange of the principal debtor.

Advantages of using aval promissory note

A bill with a bank aval is a more valuable security, since it is secured by a strong and reliable guarantee of repayment. By valorizing a bill of exchange, the bank guarantees payment on it. Avail is available at any time. At any stage of the payer’s application. It does not lose its legal force. The only exception is a defect in the design form.

The avalization of bills by commercial banks on the basis of the avalization agreement of the drawer is concluded for a certain period. Also, the repayment period may be stipulated by an additional agreement. A commercial bank gives an avalized bill additional value in the securities market and is a guarantor for the fulfillment of obligations.

Duties, rights and responsibilities of the avalist

The avalist who has paid the bill acquires the rights that arise from the bill in relation to the person for whom he gives a guarantee and in relation to those persons who are indebted to the latter.

Avalization is the execution by the bank of an aval on a bill, according to which the bank undertakes to pay the bill partially or in full, for one of the persons who have obligations under the bill when the payer fails to pay the bill within the prescribed period or when it is not possible to receive payment on the bill on the specified date. term.

Etymology of the term "aval"

The word is borrowed as a purely commercial and financial term in English or French. The estimated time of borrowing is the second half of the 19th century. The main meaning in which the term is borrowed is guarantee of payment.

Borrowing a word

In English and French, unlike Russian, the word aval has a wide range of designations. These values are reduced to three blocks.

- authorization, consent, support.

- lower part, lower, downstream.

- a subsequent stage in something, including economics and production.

The primary meaning of a word reflects exactly its content as an economic term. French avaler – to pass, descend, pass on (including by inheritance). Origins: Latin ovum - curve, egg, which is similar to the line of a longitudinal section - it is smooth, that is, it passes, descends, passes. Hence the oval (famous - I’ve been drawing an angle since childhood, I didn’t like an oval since childhood). To summarize, turning to the etymology of the word gives a feeling of transition, descent, transfer of responsibility, which is the meaning of guarantee.

The modern use of the term is primarily associated with bill turnover. Aval is understood in two aspects: as an inscription on a bill of exchange and as a guarantee on a bill of exchange. As a surety on a bill of exchange, it is a guarantee of payment issued by a third party. The guarantee can be accepted for the entire amount of the bill or a part. The avalist, as a guarantor for the person who is obligated under the bill, is liable together with the drawer even when the obligation that he guaranteed turns out to be invalid for some reason. Aval in this respect is absolutely equal to a bank guarantee. Aval increases the reliability of the bill and thereby facilitates bill circulation.

Aval: what is it?

A bill of exchange transaction requires the participation of two parties: the owner of the securities and the person acquiring it. But the question may arise: how, when purchasing such a security, can one be confident in the solvency of the borrower? The problem is solved by aval - an inscription on the document, a guarantee from a third party that the bill will be paid. As a rule, this function is undertaken by the bank.

Is Aval a relic at the present stage of development of the financial market?

A number of experts believe that aval has lost its effectiveness and that there are many other alternative options on the market to guarantee the safety of funds invested in the Central Bank.

And yet I believe that the relevance of aval remains quite high in our time. And the guarantee of a third party guaranteeing timely payment of funds sharply increases the value of the paper. Imagine that you receive a loan and at the same time certify it with the obligations of a third party. Such guarantees allow you to confidently manage your funds, avoid force majeure situations, and not be afraid of financial losses.

Typical conditions for providing aval

Are you interested in where, how and under what conditions you can use this service? I answer: this method of guarantee, such as avalization, is typical for the work of banks. I warn you in advance - this is a paid service, no one will simply give you additional guarantees. The fee is usually a certain percentage, somewhat less than what is charged on loans. The advantage for the consumer is that the bank receives it only after payment.

In our country, bills of exchange are practically not used by citizens; there is a certain circulation only in the financial market, where enterprises use such securities.

Rights, duties and responsibilities of an avalist

Aval is not a simple guarantee, but a full obligation of the organization that has put its signature on a paper document. The avalist bears responsibility in the avalization procedure to exactly the same extent for this obligation as the person who issued the veskel.

Bill turnover

Aval, as the inscription on the bill of exchange is expressed with the words “as a guarantor”, “considered as aval”, “as a guarantor”. These words are placed on the front side of the bill (“coat” of the bill) or on the allonge - additional sheet - (literally in French allonge - lengthening). The avalist, as a guarantor for the person who is obligated under the bill, adds his name to the name of the payer, adding to this peraval or counting for any equivalent formula or aval.

Surety for the debtor

Bill law knows the institution of aval, which is also commonly called bill guarantee. Aval on a bill is equivalent to the legal concept of surety. That is, the avalist assumes obligations under the bill only if they are not fulfilled by the main payer. In such a situation, having paid the bill, the avalist acquires all rights arising from the bill, including the right to claim the debt.

Execution of obligations

To describe all this in human language, then to understand the nature of aval it is necessary to imagine 3 sides, namely:

- debtor;

- to whom they owe;

- avalist (one who has guaranteed to fulfill the guarantee of return of money for the debtor).

Parties concerned

At the first stage, debt obligations appear between the debtor and the lender, where the debtor owes the lender. As a result, the debtor issues a bill of exchange to the lender, in which he undertakes to return the money to the lender within a specified period.

Definition

Aval is an inscription on a bill of exchange, which is a guarantee of a third party for its payment. The procedure for issuing a guarantee is called avalization. The guarantor party, accordingly, is called an avalist.

Often banks act as an avalist, thereby increasing the market value of the bill and guaranteeing the return of funds by the debtor.

Since aval is a guarantee for an unpaid bill by a third party, the avalist undertakes to pay the debt in the event of the main payer refusing to fulfill its obligations.

Aval is not just a guarantee. Even if the avalized bill turns out to be invalid, the avalist will be obliged to repay the debt of the borrower to the creditor. All rights transferred to the borrower are acquired by the avalist.

Debentures

Then an avalist appears who owes money to the debtor. In turn, the debtor redirects his own debt to the lender to Avalist. In turn, the avalist assumes the debt with the help of a signature on the bill, which indicates that the avalist now owes the lender.

Debt redirection

Here the process of redirecting the debt to the avalist from the debtor is called aval.

Aval makes the bill more reliable. As a rule, commercial banks are engaged in avalorizing bills - for a fee. As a result, the bill receives a bank guarantee of payment.

Reliability of the bill

Avalization of bills of exchange is a banking term meaning a bank's guarantee for a certain organization that issued a bill of exchange, with which the bank has a partnership relationship. When an organization does not pay its bill, the bank that is responsible for avalization will have to repay it at its own expense.

What are the advantages of an avalized bill of exchange and are there any disadvantages?

Valuation of a bill increases the reliability of securities. The only (conditional) disadvantage of avalization that I should mention is the need to pay an additional fee for the transaction. For all other issues, avalization of a bill of exchange has only positive aspects:

For the drawer. A legal entity providing a security with aval has the right to count on increased liquidity. An certified document is easier to implement, increasing the chance of increasing capital turnover and attracting additional funds to the business. Another plus is the increase in the business reputation of a company or organization.

For the bill holder. The main advantage of avalization is the highest degree of guarantee of saving funds and receiving money back, regardless of the ability of the drawer to repay the securities.

Let me sum it up. Avalization of bills of exchange makes a receipt a more profitable and reliable means of payment compared to a regular bill of exchange that is not backed by a third party’s signature. Security guarantees are increased for both parties involved in the transaction.

Availability procedure

The nature and scope of the avalist’s responsibility are determined by the rules of bill of exchange law. The fundamental rule in relation to the avalist is the following: “The avalist is also responsible as the one for whom he gave the aval.”

Bill of exchange law

Aval can be accepted for the entire amount of the bill or for part of it. The avalist is released from liability when the main debtor ceases to be liable for the bill. Aval is carried out by simply signing on an additional sheet of the original or on the front side of the bill.

Features of registration, transfer and avalability of bills of exchange

The presence on the bill of exchange of all listed by the Regulations and other normative documents on bill of exchange legislation (Regulations established by the Geneva Convention of 1930 “On the Uniform Law on Bills of Exchange and Promissory Note” with appendices: “On the resolution of certain conflicts of laws on bills of exchange and promissory notes” and “On stamp collection in relation to bills of exchange and promissory notes"; Civil Code of the Russian Federation; Federal Law of March 11, 1997 No. 48-FZ "On bills of exchange and promissory notes"), the details are sufficient to recognize it as valid. To put it simply, there is no need to “clutter up” the bill of exchange with any additional data.

Based on the formality of the bill, it must be borne in mind that there is no need to affix the seal of a legal entity in the case where it is the drawer or endorser.

It should be noted that the common method of signing documents today - a facsimile - is not recognized as legally binding, therefore a bill signed in this way will be considered void. According to the Civil Code of the Russian Federation:

Article 160. Written form of a transaction

1.

When making transactions, the use of facsimile reproduction of a signature using mechanical or other copying means, an electronic digital signature or another analogue of a handwritten signature is permitted in cases and in the manner provided for by law, other legal acts or agreement of the parties….

allows the use of facsimiles. In this case, the norms of bill of exchange law prevail, namely, a handwritten signature of the bill of exchange document is required.

Often in practice, the issuance of a bill of exchange is formalized by an agreement of exchange or purchase and sale. According to the Civil Code of the Russian Federation, contracts of exchange and purchase and sale provide for the transfer by one party to the other party of a certain type of goods, which contradicts the very essence of the bill of exchange, the basis of which is money. At the time of issuing his own bill of exchange, the drawer accepts an obligation to pay a certain amount within the period specified in the bill. Consequently, at the first stage, the drawer’s own bill as a monetary obligation cannot be recognized as his property. He becomes such when he gets to the first drawer of the bill. Of course, subsequently the bill of exchange (Articles 128 and 143 of the Civil Code of the Russian Federation) takes on the characteristics of a thing and becomes the subject of both purchase and sale and exchange.

Article 128. Types of objects of civil rights

Objects of civil rights include things, including money and securities, other property, including property rights; works and services; information; results of intellectual activity, including exclusive rights to them (intellectual property); intangible benefits.

Article 143. Types of securities

Securities include: government bonds, bonds, bills of exchange, checks, deposit and savings certificates, bearer bank savings books, bills of lading, shares, privatization securities and other documents that are classified as valuable by securities laws or in the manner prescribed by them. papers

Based on the practice of bill circulation that has developed in the last decade in our country, a simple act of acceptance and transfer of a bill containing all its necessary features (details) is quite sufficient.

Transfer of bill. Aval

A more complete implementation of commodity-monetary functions, and therefore an increase in the value of the bill itself, occurs at the moment of transfer of this document to the next holder. Through this action, the bill of exchange becomes a means of payment from a means of transferring funds, then turning into a commodity, etc., which determines one of its main properties - negotiability. According to paragraph 1 of Article 145 of the Civil Code of the Russian Federation, the rights certified by an order security may belong to the person named in it or the person named in his order. Moreover, any bill of exchange, even without a clause on the order, can be issued through an endorsement - a special endorsement certifying the transfer of rights under this document to another person. The person who transfers a bill by endorsement is called an indorser, and the act of transferring a bill is called endorsement or indorsement. The person who has received the bill of exchange may transfer it in the same manner to another person. Moreover, each endorser is responsible not only for the existence of the right certified by the security, but also for its feasibility (clause 3 of Article 146 of the Civil Code of the Russian Federation). All those who issued, accepted, endorsed a bill of exchange or put an aval on it are jointly and severally obliged to the holder of the bill. That is, the holder of the bill has the right to bring a claim against all these persons, each individually and all together, without being forced to comply with the sequence in which they assumed the obligation. The same right belongs to everyone who signed a bill of exchange after he has paid it. A claim brought against one of the obligors does not prevent the filing of claims against others, even if they obliged after the original defendant. If one of these persons puts the note “without recourse to me” on the endorsement, he will not be jointly and severally liable. However, this clause may undermine confidence in the bill on the part of its subsequent holders.

The endorsement is made on the reverse side of the bill. However, when there is no space left on the reverse side for subsequent endorsements, endorsement can be made on an additional sheet - allonge ,

which is attached to the bill of exchange form.

Necessary details of the endorsement: the name of the person to whom the bill is transferred, and the signature (seal imprint) of the endorser. From the point of view of the scope of rights transferred under a bill of exchange, there are two groups of endorsements that transfer ownership of the bill of exchange and all rights arising from it:

personal (order) endorsement - along with the name of the endorser, the person to whom the bill is transferred is indicated;

blank endorsement - consists only of the signature of the person transferring the bill.

Further, the holder of the bill can: transfer it to a third party by delivery, without filling out the form and without making an endorsement; fill in the space (form) left by the inscriber who made the endorsement with the name of the holder, thus turning the blank inscription into a personal one; endorse a bill of exchange with such an inscription, in turn, by means of a form or personal inscription.

Note that bills with blank endorsements have become very widespread recently; they are even called bills of exchange “with open endorsement” by participants in civil transactions.

Some powers under the bill are granted to the endorser:

guarantee endorsement (does not entail the transfer of ownership of the bill and the amount specified in it, thus, the person accepting the bill has the right to only collect on the bill; the specified inscription gives authority, for example, to a bank without a power of attorney to receive payment from the bill debtor);

pledge endorsement (the advantage of a pledge endorsement over a traditional pledge agreement is that such an endorsement allows the pledgee to satisfy his claims against the bills transferred to him without going to court or having the debtor's consent regarding this security).

It is generally accepted that the number of endorsements is directly proportional to the credibility of the bill. Moreover, the more a bill is circulated, the more obligations it will pay off and the less the economy will need for real money.

One of the random elements of a bill of exchange may be a bill of exchange guarantee - aval, by virtue of which one person (avalist) assumes responsibility for the fulfillment by another person (drawer of the bill, acceptor, endorser) of his obligations under the bill in whole or in part. Aval can be given by any legally capable third party. Moreover, even the person who has already signed the bill can become such a guarantor. The inscription of guarantee can be made: on the form of the bill itself; on allonge; on a separate sheet. The avalist answers in the same way as the one for whom he gave the aval. The condition for the liability of the avalist is a protest raised by the creditor.

Responsibility for a bill

The nature and scope of responsibility of the avalist corresponds to the nature and scope of responsibility of the person for whom the aval is given. The avalist who paid the bill may demand reimbursement of the payment from the person for whom he avaled and from the persons who are responsible to the latter. Aval increases the reliability of the bill and thereby facilitates bill circulation.

Payment Refund

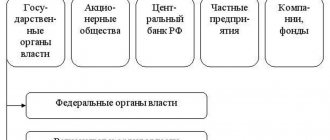

Who has the right to avalize bills? In accordance with current legislation, the aval is provided by any person who signed the bill. Almost all legal entities currently have this right. Restrictions apply only to representatives of local governments, state authorities and enterprises that are supported by the state. Legislation also prohibits the issuance of guarantees and other types of guarantees to investment funds.

Terms associated with aval

Financial experts equate the concept of “aval” with the legal concept of the term “guarantee”. Terms associated with aval: avalist, obligations, avalist's rights, avalization. The modern use of the term is due to bill turnover.

Aval is interpreted as a bill of exchange guarantee or an inscription on any side of the bill. A third party payment guarantee may cover a portion of the bill or the full amount. Aval increases the strength and reliability of a bill at the level of a bank guarantee.

Avalization

Avalization is the execution of an aval on a bill of exchange, after which the avalist assumes partial or full payment obligations on the bill. Bill guarantees are mainly carried out by commercial banks on behalf of their partners. If the organization does not pay the bill, the bank will be obliged to repay the bill debt.

Aval can be provided upon issuance, drawing up, at any subsequent stage of circulation of the acceptor, drawer, endorser. The basis for avalization is the avalization agreement concluded with the payer.

Avalist's obligations

The guarantees of the avalist on the bill gain legal force only in cases of failure to fulfill obligations by the main payer. The obligations of the avalist, as a guarantor for the acceptor, endorser, are considered on an equal basis with the obligations of the drawer, even if his obligation turns out to be invalid due to identified grounds.

The liability of the avalist ceases after the principal debtor repays the amount on the bill. The provisions of the Civil Code regarding guarantees are not applicable to a bill of exchange guarantee.