- home

- Investments

Anton Subbotin

3

Article navigation

- What mutual funds promise in Russia: level of profitability and risk

- Methodology and example of profitability calculation

- Profitability ratings of mutual funds for 2021

- The level of reliability of a mutual fund and the risks of shareholders

Mutual investment funds in Russia are a popular financial instrument that allows you to earn money passively. Let us immediately note that profit is not guaranteed, since mutual funds invest in different markets, and profitability depends on the success of the acquired assets. For example, if a portfolio manager of a closed-end real estate fund management company made a bet on commercial properties, but rental prices have dropped significantly, then the price of the share will decrease.

Despite the large volume of offers, it is difficult for a novice investor to make a choice, since he does not know which mutual fund to invest in in 2021. We'll take a quick look at the top-rated funds that have demonstrated excellent long-term performance. An independent opinion will help you focus primarily on the shortcomings.

Mutual funds can actually bring more than a deposit in any top bank. If you assemble a portfolio of several assets and diversify risks, you can create an additional source of income that will not be tied to the mood of the employer.

The rating of the best mutual investment funds by reliability and profitability highlights not only the impressive growth in recent years, but also highlights such important points as the size of the commission, the reputation of the management company and investor reviews.

How is the profitability of mutual funds calculated?

To answer this question, you need to know how mutual funds are structured. Each fund adheres to a specific investment strategy and acquires assets on its balance sheet in accordance with it. For example, if it is a mutual fund of shares, then it acquires shares of certain companies.

To calculate the value of a share, you need to divide the total value of net assets in the mutual fund account (NAV) by the number of issued shares. For example, if the value of shares on the fund’s balance sheet is 1 billion rubles, and shares are 1 million rubles, then divide 1,000,000,000 / 1,000,000 and get 1,000 rubles. If by the end of the year the value of the shares rises to 1.1 billion rubles, then the value of the shares will increase to 1,100 rubles, i.e. on 10%. If the NAV falls, for example, to 0.9 billion, then the price of the share will be reduced to 900 rubles.

Thus, the profitability of mutual funds directly depends on the value of the assets that the fund acquires. At the same time, the coupons and dividends received, as a rule, are not paid to investors, but are used to purchase additional assets, which further “accelerates” the price of the share.

Profitability of mutual funds by variety

The main types of mutual funds and their approximate profitability are as follows:

- Government bond funds are the least risky and profitable. Profitability is usually in the range of 6-8% per annum, i.e. slightly higher than deposits.

- Eurobond funds – the investment result will depend, among other things, on the ruble exchange rate. If our currency falls, then the investor receives additional profit due to the hedge. The yield is usually at the level of 8-10% per annum, but when the ruble strengthens, it falls.

- Corporate bond funds are a slightly riskier option than the previous ones; they include the debt of Russian companies as part of their assets. Depending on the industry, it can bring profits of up to 10%, or even 15% per annum.

- Equity funds are the riskiest of all mutual funds. Returns are highly dependent on the set of specific stocks included in the assets. Therefore, the spread is large - from 5% to 100% per annum.

- Industry funds – invest in specific commodities or commodities, such as gold. The share price correlates with changes in the value of the underlying asset.

- Mixed mutual funds are the most balanced funds, the assets of which include stocks and bonds in different proportions. Typically they bring investors 10-12% per annum with moderate risk.

- Funds of funds serve as “wrappers” for mutual funds and exchange-traded funds (ETFs), which a Russian investor simply cannot buy without access to foreign exchanges.

Average profitability of mutual funds

In general, the profitability of mutual funds in Russia is very dependent on foreign policy risks. For example, when sanctions were introduced against individual companies in 2021, many equity mutual funds simply “sank” in profitability.

For example, the mutual fund for shares of small and medium-cap companies from VTB Asset Management fell almost throughout 2021, but in the end still showed positive dynamics.

Mutual Fund VTB

When in August 2021 the United States banned its residents from holding OFZs, the usually steadily growing mutual funds investing in government securities fell significantly. And this despite the fact that the OFZs themselves have not changed; moreover, due to the fall in value, their profitability has increased. Many experienced investors used this moment to enter such mutual funds and ETFs.

A similar situation occurred with corporate bonds. This is clearly seen in the example of the Advanced Bond Fund of Sberbank Asset Management. A drawdown is visible in 2021 and a significant rise in 2019.

Mutual Fund of Sberbank

Ruble bonds from Transfingroup

The main object of the management company is the acquisition of bonds. The company sets the minimum contribution at 300,000 rubles. The average cost of one share for the last period is 302.7 rubles. The minimum investment period is three years.

Recommended reading: Top 10 credit cards you can order by mail. VTB 24 cards - main types of cards, conditions for receiving and servicing. See information here.

How to find out the balance of a bank card - https://wikiprofit.ru/finances/cards/balans-karty.html

Commissions and taxes

In addition, when investing in mutual funds, you need to take into account the fact that the final profitability is affected by the commissions charged by management companies, as well as taxes.

There are three types of commissions:

- when purchasing - called a “surcharge”, usually its value is 1-2%;

- when selling a share – it’s called a “discount”; the longer you hold the shares, the lower the commission;

- for management – as a rule, 0.3-1% of the fund’s NAV for the year.

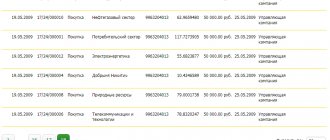

The screenshot shows Sberbank’s commission for managing mutual fund shares.

Mutual Fund Commissions

As a result, commissions can eat up from 1% to 3% of profits. Therefore, it is important to find out how you can save on them.

Most mutual funds apply a zero discount when redeeming shares after 3 years, and also charge a smaller premium when investing a large amount. Unfortunately, the investor cannot influence the management fee. Its size is entirely determined by the management company.

In terms of tax, the investor must pay a standard income tax of 13% on redemption of the unit with profit. Tax is paid only on income received. For example, if an investor bought 500 shares for 1,200 rubles each and sold them for 1,300, then he received an income of 50,000 rubles. You will need to pay 6,500 rubles to the treasury.

It is clear that as a result of the tax, profitability decreases even more. To avoid obligations to pay personal income tax, it is enough to hold shares for more than 3 years. After this period, the investor is provided with a tax deduction on investment income. The deduction amount is 3 million rubles for each year of ownership of shares. Those. immediately after the expiration of a three-year period, you can receive a deduction of up to 9 million, after 4 years - 12, after 5 years - 15, etc.

"Raiffeisencapital" - mutual funds from Raiffeisenbank

Investment conditions at Raiffeisen Bank look no less attractive. The share price is updated every day. However, the initial contribution for an individual must be at least 50,000 rubles, and for subsequent replenishments - 10,000 rubles. It is worth noting that the investment period can be from 3 months, while in other banks it is from three years.

There is a bonus program, the size of which depends on the investment period. 3% is due if the shares are held for three months or more. More than a year - 2% and not subject to VAT.

Benchmark – indicator of mutual fund profitability

Thus, the profitability of mutual funds in itself, in isolation from the economic situation, does not give an idea of the quality of the fund’s work. Moreover, many novice investors, relying only on historical returns, behave completely incorrectly in the market. They buy shares of the best-performing funds when their prices are at their highest, and sell them when prices fall, panicking because their savings are dwindling.

Therefore, in order to understand exactly when you should invest in a mutual fund and what its prospects are, it is necessary to analyze what instruments the fund invests in, what strategy it follows, and how managers behave during market instability.

To understand how professionally the managers behave and how profitable the fund is in general, it is best to compare it with a benchmark. This is an index with which the profitability of a mutual fund is compared. All other things being equal, if the yield curve of a mutual fund exceeds the benchmark, then this mutual fund is better than its peers.

For example, the graph shows the cost of a unit of the Raiffeisen Shares Mutual Fund. Two indices act as a benchmark: IF-EG and Moscow Exchange. The Foundation is ahead of both of them.

Raiffeisen Mutual Fund

In fact, you should analyze the returns of funds using various technical indicators, such as Sharpe ratio or alpha, and also look at volatility. These ratios show how effectively the managers work and whether they are working on all market opportunities, as well as by how much the share price will approximately increase (or fall) depending on the value of the benchmark. For example, if the index changes by 2%, then the price of the share can change by 2.5%, and this works in both directions - both downward and upward.

But for a novice investor, it is enough to familiarize yourself with the composition of assets, compare profitability with benchmarks and, based on these data, estimate the prospects of the mutual fund in the future.

In addition, it is best to invest not in one mutual fund, but in several. Perhaps even within different management companies. This way, your income will not depend on the profitability of only one mutual fund and the situation in only one sector of the economy.

Fund "Ilya Muromets" from Sberbank - positions and profitability

For novice investors who do not want to risk their money, the mutual fund program from Sberbank “Ilya Muromets” is the best option. As noted, among the available offers, the yield is the lowest - 34.32%. However, this is offset by minimal risk, since assets are invested in bonds of proven companies.

The main goal of the fund is to organize a rapid increase in capital and exchange rate growth.

Income is at a fixed rate and loan portfolios remain low. Investments are made in ruble equivalent.

Over what period of time should profitability be analyzed?

An investor needs to be prepared for the fact that mutual funds are here to stay . Especially when it comes to equity funds. In the short term (up to a year) and even the medium term (up to 2-3 years), the value of the unit and, as a consequence, the profitability of the mutual fund may fall.

Therefore, it is optimal to invest in mutual funds for a period of 3 years or more. During this period, any negative trends, as a rule, are smoothed out, and the mutual fund begins to generate income.

Many professional investors, by the way, use moments of falling instrument profitability as a signal to buy, and then make money on a sharp increase in the value of the share.

other advantages to a three-year investment period :

- most management companies offer small discounts when exiting an investment after 3 years;

- You can get a tax deduction on your income.

Therefore, it is best to analyze the fund’s profitability over at least a 3-year period of time. If a mutual fund continues to show a tendency for the value of the unit to fall beyond this period, then this indicates serious problems in management, and it is better to avoid investing in it.

Summary

Which mutual fund to choose in 2021? It is extremely difficult to formulate unambiguous advice, just as it is difficult to choose a universally correct method for flawlessly determining the directions of correct investments. However, when making a decision, it is recommended to take into account the rating presented above. After all, the place of each position is determined by the amount of funds of the mutual fund (its capitalization). That is, by focusing on this rating, you are automatically based on the “paid” opinions of a very large number of investors. As a result, the likelihood of error is significantly reduced.

Igor Titov

Economist, financial analyst, trader, investor. Personal interests – finance, trading, cryptocurrencies and investing.

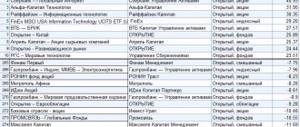

The most profitable mutual funds of 2021

The most convenient way is to look at the profitability rating of mutual funds on special services. The largest in Russia is investfunds. You can find a list of mutual funds sorted by profitability here: https://pif.investfunds.ru/funds/rate.phtml.

If you look at the profitability of mutual funds over the last year, the picture is as follows. The most profitable were funds investing in the oil and raw materials sector of the economy; among the outsiders that showed negative dynamics were funds that bet on shares of non-resource and consumer companies. For example, the Alfa Capital Trade mutual fund fell by 18.35%, and Raiffeisen’s “Consumer Sector” - by 14.17%. And this fully reflects the realities of the Russian and global economy.

The leaders were:

- VTB – Oil and Gas Sector Fund, +39.98%;

- Alfa Capital – Resources, +39.13%;

- Sberbank – Natural Resources, +35.90%;

- Raiffeisen – Primary sector, +33.23%;

- SAN – Mixed investments, +28.10%;

- Alfa Capital – Liquid shares, +25.61%;

- Kapital – Global sports industry, +24.95%;

- Aton – Infrastructure, +24.45%;

- TFG – Foreign currency Eurobonds, +23.52%;

- System Capital – Reserve Currency, +23.11%.

Profitability of mutual funds for the past year

If we look at a three-year distance, then the leaders in profitability among mutual funds are completely different management companies:

- April Capital – Shares of commodity companies, +129.45%;

- April Capital – Second-tier shares, +124.83%;

- Uralsib – Energy perspective, +109.63%;

- April Capital – Shares, +108.86%;

- Arsagera – Equity Fund, +74.77%;

- VTB – Mixed Investment Fund, +71.63%;

- VTB – Equity Fund, +71.24%;

- Agidel – Shares, +69.70%;

- Sberbank – Natural Resources, +68.29%;

- Alfa Capital – Resources, +66.60%;1

- VTB – Fund of Enterprises with State Participation, +66.51%;

- Raiffeisen – Commodities sector, +64.42%.

Return on mutual funds for 3 years

As you can see, over the long term, stock funds outperform bond funds and other types in terms of profitability. Mutual funds of mixed investments are also doing well due to a more balanced composition of assets.

But at the same time, it is share mutual funds that are the most volatile, and not every investor has the nerve to hold shares that are becoming cheaper. In addition, if the fund has been growing continuously for several years, its correction is not excluded. Therefore, choosing a suitable mutual fund for investment based only on its past profitability is not entirely correct. A successful history in the past does not guarantee the same returns in the future.

What to look for when buying a profitable mutual fund?

Let us summarize what parameters you should pay attention to when choosing a suitable mutual fund:

- the profitability of mutual funds in the past is an important criterion that allows you to understand how much you can earn on a given financial instrument;

- the difference between the benchmark and the share price chart - if the mutual fund overtakes the benchmark or is on par with it, then everything is in order;

- volume of own funds (net asset value) - the more funds under management of the fund, the more diversified the portfolio managers can assemble and the lower the risks;

- the specific composition of issuers and their expected “fate” in the future - if there are grounds for growth, then the mutual fund will also grow;

- the amount of discounts and allowances - the less the management company takes, the more the investor will receive;

- capital gains – the more people invest in a fund, the better: it is more likely to be reliable.

In general, it is better to build a diversified portfolio from several different funds. For example, the optimal composition would be:

- 30% – bond mutual funds;

- 20% – mixed investments;

- 40% – shares;

- 10% – industry or raw materials mutual fund.

Over the long term, such a portfolio will definitely show good profitability, and protective assets will help maintain profitability in the medium term.

What is the minimum amount you can enter with?

Is it possible to invest money in a mutual fund with a capital of no more than 20 thousand rubles? The amount of entry into a mutual fund depends on the minimum threshold set by the fund. For example, the Energy Perspective fund of UralSib Management Company CJSC, whose money is invested only in shares of energy companies, sets the minimum entry threshold of 100 rubles. The Electric Power Fund of Sberbank CJSC sets the amount at 15 thousand rubles.

The average entry amount varies from 1 thousand to 15 thousand. Successful trading requires a large capital, which is collected by a professional through investments.

There are also closed-end funds that set a minimum entry threshold of 100 thousand rubles. These, for example, include Brokercreditservice-Real Estate Funds.