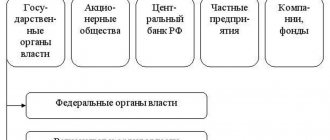

Investment potential is a qualitative characteristic that reflects the potential level of profitability of the selected investment object.

The considered indicator is inherent in any investment. Securities, currency, gold, purchase of an enterprise, land in the Lipetsk region or another region of Russia - all these investment objects will have investment potential.

A competent investor will never invest money without assessing this investment characteristic.

What it is

Investment potential represents the availability of opportunities that can be used to achieve specific goals.

And here we mean the possibilities of the investment object, the conditions for long-term investment in a certain asset. That is, this concept reflects the total potential of the interaction of financial, production, legal and other factors.

Kinds

Regarding the area of investment, the following potential can be identified:

- companies, enterprises, holdings;

- industries;

- region, municipality;

- national economy;

- world economy.

Place of potential in the investment module

A few words about what an investment module is. In essence, it is a system of various economic processes, relationships, conditions, factors that determine the level of financial activity and investment.

Typically, in schematic form, it looks like this:

The investment potential in this structure, along with the attractiveness of investments, is precisely the determining factor. It stimulates activity in the matter of investment and capital allocation.

In other words, the more opportunities and less risk, the more actively investors vote for the project with their money.

Methods for assessing the investment climate of Russian regions and ways to improve it

The investment climate is a generalized description of the social, economic, organizational, legal, political and sociocultural factors of the region. To make informed investment decisions, the investment climate is constantly monitored. When calculating the investment potential of a region, absolute statistical indicators are used. The total potential of the region includes eight integrated subspecies.

Author:

Gleb Gennadievich Fetisov, Doctor of Economics, Corresponding Member of the RAS (Department of Social Sciences), member of the RAS Coordination Council for Forecasting under the Presidium of the RAS.

To analyze the conditions for the rational use of investments in economic science and practice, the category “investment climate” is used.

Investment climate in the region

— a generalized description of the totality of social, economic, organizational, legal, political, sociocultural prerequisites that predetermine investment in the regional economic system.

You can select

three approaches to assessing the investment climate.

First approach

based on

assessment of a set of macroeconomic indicators

, such as: dynamics of GDP, national income and industrial production volumes; the nature and dynamics of the distribution of national income, the proportion of savings and consumption; the state of legislative regulation of investment activities; the progress of privatization processes, the development of individual investment markets, including stock and money markets.

Second approach

(multifactorial) based on

interrelated characteristics of a wide range of factors influencing the investment climate

. These include: characteristics of economic potential (resource provision of the region, bioclimatic potential, availability of free land for industrial investment, level of energy and labor resources, development of scientific and technical potential and infrastructure); general business conditions (environmental safety, development of material production sectors, volumes of unfinished construction, degree of wear and tear of fixed production assets, development of the construction base); maturity of the market environment in the region (development of market infrastructure, impact of privatization on investment activity, inflation and its impact on investment activity, degree of involvement of the population in the investment process, development of the competitive business environment, capacity of the local sales market, intensity of inter-economic relations, export opportunities, presence of foreign capital); political factors (the degree of public trust in the regional authorities, the relationship between the federal center and the regional authorities, the level of social stability, the state of national-religious relations); social and sociocultural factors (standard of living of the population, living conditions, development of medical care, prevalence of alcoholism and drug addiction, crime rate, real wages, influence of migration on the investment process, attitude of the population towards domestic and foreign entrepreneurs, working conditions for foreign specialists ); organizational and legal (the attitude of the authorities towards foreign investors, compliance with legislation by authorities, the level of efficiency in making decisions on the registration of enterprises, the availability of information, the level of professionalism of the local administration, the effectiveness of law enforcement agencies, conditions for the movement of goods, capital and labor, business qualities and ethics local entrepreneurs); financial factors (budget revenues, as well as the provision of extra-budgetary funds per capita, availability of financial resources from the federal and regional budgets, availability of credit in foreign currency, level of bank interest, development of interbank cooperation).

ALSO SEE: Maximizing Profits Given Limited Resources

General indicator

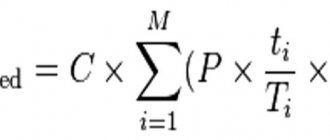

The investment climate in the factor approach is the sum of many weighted average estimates for groups of factors:

Q =

∑(Xj * Pj)

where Q is a generalized weighted assessment of the region’s investment climate; Xj is the average score of the jth factor for the region; Pj is the weight of the jth factor.

A summary indicator for assessing the investment climate cannot serve as the only criterion for the attractiveness of a particular economic system for investment. It is usually supplemented with information on the development of various factors that have a direct impact on the state and dynamics of the investment climate.

Third approach

to assess the investment climate is based on

investment risk assessment

. At the same time, two directions for assessing investment risks are analyzed as elements that shape the investment climate of the region: either from the investment potential, or from the socio-economic potential.

1. First direction

designed primarily for

"strategic investor"

The investment potential of the region is assessed on the basis of such macroeconomic indicators as:

- availability of production factors, including labor;

- level of consumer demand;

- results of economic activity of the population in the region;

- the level of development of science and the introduction of its achievements into production;

- development of leading institutions of a market economy;

- provision of the region with technical and social infrastructure.

Investment risks are assessed from the perspective

probability of loss of investment and income

. At the same time, all types of risks are taken into account: economic, financial, political, social, environmental, criminal and legislative.

2. Based on the second direction

lies

assessment of the level of investment climate from the perspective of the development of the regional social system as a whole

. This approach, among other indicators, takes into account human potential, the material basis for development, the socio-political situation, political risk factors, the state of the economy and the level of its management.

Problems of adequate assessment of the region's investment climate.

A study of domestic and foreign experience in assessing the investment climate shows that a number of important methodological provisions developed by modern economic science are often not taken into account.

- The investment climate of the country and regions is considered, as a rule, from the position of an abstract strategic investor striving for accelerated, maximum, unhindered profit generation, while different investors require their own assessment of the investment climate.

- The recipient of investments and the investor, as a rule, pursue different goals. The first seeks to solve a set of socio-economic problems with a minimum of funds raised, the second - to extract maximum profit and gain a foothold in markets and economic systems for a long period. Consequently, the investment climate must correspond to the balance of interests of participants in the investment process.

- There is an objective need to combine investments with innovative development factors. This is especially relevant when attracting investments in the field of small innovative entrepreneurship (venture investment).

- Investments must be linked to the development of human capital, the growth of skills of workers in all spheres of life, which must be taken into account when creating an appropriate investment climate for a country or its region.

- A comprehensive assessment of the efficiency of using attracted investments and the favorableness of the investment climate is necessary.

ALSO SEE: Peculiarities of Russian management ethics

Factorial approach

to assess the investment climate best meets most of these requirements. Its advantages include: taking into account the interaction of many factors, the use of statistical data that levels out the subjectivity of expert assessments, a differentiated approach to different levels of the economy when determining their investment attractiveness.

Risky method

analysis and assessment of the investment climate is of interest primarily to the strategic investor. It allows him not only to assess the attractiveness of the territory for investment, but also to compare the level of risk inherent in the new investment object with that existing in the region where he is accustomed to doing business.

Investment attractiveness of the region

When studying the comparative investment attractiveness of regions and countries, a wide range of indicators is used, such as the type of economic system, the volume of GDP, the structure of the economy, the provision of natural resources, the state of infrastructure, government participation in the economy, etc.

Due to the fact that the investment climate of the regions is influenced by various factors and conditions, many of which are subject to rapid changes, a one-time, one-time determination of the investment climate cannot serve as a guide for making any investment decisions. Therefore, when assessing the investment climate of regions, it is necessary to conduct regular, periodic observations, i.e. investment climate monitoring.

Investment climate in the region

is considered as a complex system consisting of three important

subsystems

:

- investment potential

— the totality of production factors available in the region and areas of capital application;

- investment risk

— a set of variable investment risk factors;

- legislative conditions

— a legal system that ensures the stability of the investor’s activities.

Investment potential of the region

— a quantitative characteristic that takes into account the main macroeconomic indicators, the saturation of the territory with production factors (natural resources, labor, fixed assets, infrastructure), as well as consumer demand of the population.

When calculating the investment potential of a region, absolute statistical indicators are used. The total potential of the region includes eight integrated subspecies:

- resource and raw materials

, calculated on the basis of the weighted average provision of the region’s territory with balance reserves of the most important types of natural resources;

- industrial

, understood as the total result of economic activity of the population in the region;

- consumer

— the total purchasing power of the region’s population;

- infrastructural

— assessment of the economic-geographical position and infrastructural saturation of the region;

- innovative

— when determining it, the complex of scientific and technical activities in the region was taken into account;

- labor

, which was calculated using data on the size of the economically active population and its educational level;

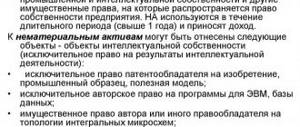

- institutional

, understood as the degree of development of the leading institutions of a market economy in the region;

- financial

, expressed by the total amount of tax and other monetary receipts into the budget system from the territory of a given region.

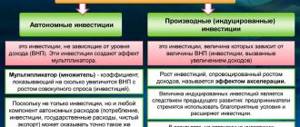

Investment risk

— a qualitative characteristic that assesses the probability of loss of investments and income from them.

In relation to the region, the following types of risk can be distinguished:

- political

, depending on the stability of regional power and political polarization of the population;

- economic

related to the dynamics of economic processes in the region;

- social

, characterized by the level of social tension;

- criminal

, determined by the crime level taking into account the severity of the crimes;

- ecological

, calculated as the integral level of environmental pollution;

- financial

, reflecting the tension of the regional budget and the aggregate financial results of the activities of enterprises in the region;

- legislative

, characterizing the set of legal norms regulating economic relations in the territory: local taxes, benefits, restrictions, etc.

The procedure for compiling a region's investment rating includes several stages. At the first stage, from all statistical indicators related to one or another type of investment risk and potential, the most significant indicators are identified using correlation analysis. Then, using the factor analysis method, the contribution of each significant indicator to the total value of the corresponding potential or risk is determined. At the final stage, using the cluster analysis method, regions ranked by potential (risk) are combined into groups according to the nature of the investment climate.

You can learn to analyze the economic situation, navigate the surrounding economic reality and make the right economic decisions by studying the distance learning course “Macroeconomics”. You can study sources and methods of financing using the courses “Financial Management”, “Investments” and “Corporate Finance”.

Explore today

Numerology

Personnel Management

IV Advanced dissection cadaver course on invasive methods for correcting various areas of the face. Day three: live injection master class

Strategic management

Developing self-confidence

Financial management: financial management

Psychology of Motivation and Influence

Imageology

Etiquette and business communication skills

Also see

Assessing the potential of enterprises and regions

Assessment of investment potential includes a thorough analysis of the following local factors:

- resource;

- production and technological;

- institutional;

- regulatory;

- infrastructure;

- export.

I'll tell you about each of them in a little more detail.

Resource

This reflects the material condition of the investment object. The resource base may include more than just the minerals owned by a region or a specific company. This also includes human capital, information and financial resources, and material resources.

Production and technological

These are the factors that influence the main activities of the investment object.

For example, if we talk about an enterprise, this is:

- manufacturability;

- level of production capacity;

- labor efficiency indicators;

- working conditions.

Institutional

These factors indicate the degree of development of the main market mechanisms and financial institutions.

Regulatory

These factors are of a legislative nature. They reflect how easy it is to open a business and operate in a particular entity.

In addition, regulatory factors take into account:

- elaboration and specification of legislative acts;

- legal transparency;

- sufficiency of conditions for defending one’s legal position.

Infrastructure

This takes into account the extent to which the technical base and equipment are suitable for running a business. This includes the following aspects:

- transport and logistics capabilities;

- sufficiency of the raw material base;

- fuel and energy prices;

- tariffs of natural monopolies.

Export

Such factors reflect the potential for a product or service to enter export markets.

Investment climate in the region and country

Today, the financial attractiveness of an enterprise cannot be assessed without analyzing the investment climate in a country or a particular region. There are certain techniques that make it possible to analyze these aspects.

To begin with, it is possible to consider the actual ability of a state or federal entity to satisfy, through personal reserves, the needs of potential investors for all kinds of investment resources. This could be infrastructure development, mineral resources, professional specialists, research potential and much more.

Next, the analysis of the potential of a state or region is assessed by the gross amount of existing resources that can help the economy grow steadily. The investment climate is often considered as a combination of the following objects:

- The degree of saturation with reserves of key minerals and renewable natural resources.

- Available work reserves and the actual potential for improvement, retraining and upgrading.

- The current degree of labor efficiency and the likelihood of improving this indicator in the foreseeable future.

- Availability of a high-quality research base, including institutes, testing sites, design bureaus, and so on.

- Compliance of economic tools and techniques with current realities.

- Presence of external and internal trade and production links.

- The volume of the domestic market, the degree of competition and the actual consumer capacity of citizens.

- Development of the finance and taxation industry.

By taking these factors into account, it is possible to establish the investment potential of an enterprise, as well as understand the attractiveness and prospects of investments within a given country or region.

Assessment methods

Often the same methods are used to assess the investment potential of individual entities as for determining investment attractiveness. But the main difference is that a specific approach is not chosen here (score, expert or statistical), but often they are combined together.

I will give several examples of assessment methods in the Russian Federation:

- The RAEX rating agency actively uses risk component analysis in its assessment. At the same time, it examines each group of risks and potential opportunities separately.

- K. Guseeva puts forward data at the forefront. Trying to predict how an investment object will react to changes in external conditions.

- The Blanc assessment method is based on the analysis of socio-economic indicators. These include investment security, infrastructure availability, and demographic factors.

If we talk about foreign practice, then the methods are generally similar to Russian ones.

For example, Harvard Business School evaluates investment potential based on the following criteria:

- legal conditions;

- political stability;

- possibility of attracting financing;

- inflation indicators;

- the ability to work with foreign capital and its free import/export.

The economic agency EuroMoney includes in its models such indicators as:

- political risk;

- economic efficiency;

- the creditworthiness of the investment object;

- the size of the national debt of a country or entity;

- availability of financing.

How is investment potential assessed?

One of the simplest technologies for determining the potential of an object for investment is an analysis technique in which the degree of attractiveness of an organization is limited by certain internal and external conditions. The first point assumes parameters of the economic type, and the second - the investment climate.

This assessment is required at the stage of making a decision on the acquisition or financial investment in a certain object, which can be an enterprise, land plot, building or other. In this case, a special algorithm is used:

- Determination of the market value of the organization in current use. For this purpose, comparative methods are used.

- Conducting analysis of the best and highly effective applications.

Based on this algorithm, the expert receives the actual price of a specific object. That is, the costs required to modernize the facility are calculated, as well as an assessment of further profits. Cash flows are aligned and the price of the already modernized enterprise is displayed.

After this, the value of the future organization possible at the current time is determined. There is a certain difference between the current price and the price at current use, which acts as a potential for investment.

Experts can easily understand this algorithm, so a potential investor should take professional help at the stage of assessing the effectiveness of their investments.

Potential of the state economy for investment

Investment potential on the scale of the national economy is defined as a set of development opportunities in different sectors. Factors that determine the presence of a favorable climate for attracting foreign investment are also important.

Important points here:

- geopolitical situation;

- general economic indicators (GDP, inflation, interest rates);

- the legislative framework;

- environmental aspect;

- criminal component within the country;

- resource base;

- infrastructure, etc.

Investment risks

The level of investment risk in the region is determined as an integral assessment of individual risks. Among them are economic, social, financial, criminal, managerial and environmental risks.

Naturally, the more business opportunities there are in a region, the higher its level of attractiveness for investors. And vice versa - a high level of risk justifiably repels entrepreneurs and reduces the investment attractiveness of the territory.

Prospects for using investment potential in Russia

For Russia, foreign investment plays a big role. Our country's vast resource base is an attractive investment opportunity.

However, in recent years there has been a decline in investment activity in the Russian Federation. This is due to both internal problems and geopolitical issues, including sanctions rhetoric.

As for the prospects, they don't look so bad. The institutional reforms that the state is currently carrying out, as well as the easing of monetary policy and economic growth, will help unlock the investment potential of the Russian Federation.

Prospects for our country

Today, Russia’s external economic and political challenges do not allow us to make any assessments regarding the prospects for stable growth of the state’s potential for financial investments. However, these actions are not only possible, but also of great importance.

Some experts believe that machine tool manufacturing will become a fundamental industry for sustainable economic development. It is obvious that the equipment required for this today must be highly automated and robotic. Other economists believe that it is now more urgent to invest in the national economy, develop the financial industry, telecommunications and information means.

There is also a third version, on the basis of which the Russian Federation climate for deposits can be significantly improved through the qualitative growth of the military-industrial complex. This point of view is also very relevant, because advanced weapons cannot exist without the introduction of the latest developments and advanced technologies.

Based on the above, we can conclude that a competent interpretation of the investment potential, regardless of the specific object of investment, will become key when making investments with maximum benefit.

The current state of the investment component of the Russian economy

Currently, investments and their volume are one of the main factors in the competitiveness of the national economy on a global scale and the main source of sustainable economic growth. In this regard, Russia has been making efforts over the past few years to transition from an export-oriented model of economic growth to an investment-driven one.

The policy of investment-driven economic growth provides for the formation and development of adequate investment potential in the economy and the presence of an optimal structure of investment sources. The basis of investment is gross savings.

Finished works on a similar topic

- Course work Investment potential of the Russian economy: sources and features of formation 440 rub.

- Abstract Investment potential of the Russian economy: sources and features of formation 250 rub.

- Test work Investment potential of the Russian economy: sources and features of formation 210 rub.

Receive completed work or specialist advice on your educational project Find out the cost

It is worth noting that the average ratio of gross fixed capital formation to Russia's GDP is 18%. At the same time, the degree of depreciation of fixed assets in the Russian economy has reached 50%. Therefore, Russia needs to significantly increase the volume of gross fixed capital formation.

In the medium term, the Russian Federation sets itself the following tasks:

- on accelerated expansion of investments;

- to improve investment efficiency;

- to optimize the structure of investment resources;

- to expand domestic consumer demand.

The need to develop investment potential and increase the scale of its implementation is that this is one of the effective ways to increase the efficiency and competitiveness of the Russian economy, its successful integration into the global world economy and, as a consequence, increase the level and quality of life of the Russian population. That is why it is necessary to regularly and persistently increase the contribution of investment and innovation elements to the country’s GDP.

Have questions about this topic? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question