Every person who has savings wants not only to save, but also to increase their own capital. This is an understandable and completely natural desire. That is why, when thinking about the question: “Where to invest 500,000 rubles?”, any investor is looking for not only reliable, but also the most profitable assets.

Remember, the higher the potential profit from an investment, the greater the possible risks. For most people, half a million rubles is a significant enough amount to risk recklessly.

Top 5 rules for successful investing

Before investing money, listen to the advice of experienced investors.

- “Don’t put all your eggs in one basket” is an English proverb so beloved by Western millionaires. Its meaning is simple: invest in different investment instruments. If one of the projects goes bankrupt, you will only lose part of the money, and not the entire amount.

- Learn financial literacy. Learn to distinguish between franchising, leasing and acquiring from options and offers. “Actions based on knowledge and experience are most valued.”

- Use professional tools when working with money - there are many reliable sites on the Internet that will increase profits and ensure financial security.

- To invest, use only “working capital” - an amount that is not intended to pay for rent, food, or other vital things.

- Attract co-investors and partners: the larger sums the management company has, the higher the income.

By adhering to the rules, you will ensure the safety of capital and protect investments from losses.

Currency market

If you are looking for options on how to quickly earn 500,000 thousand rubles, try trading on the foreign exchange market. To make money, you need to buy currency cheaper and sell it more expensive. You can make a good profit from this. The main risk present in the foreign exchange market is a sharp change in the exchange rate. If you do not respond in time, all your investment may be lost.

To start working on the Forex market, you will need start-up capital and a computer with Internet access. You also need to have an analytical mind in order to skillfully use financial schemes. To assess your abilities, you can first open a virtual account. Perhaps you have a hidden talent as a financier that can help you earn decent money.

Why is it unprofitable to invest 500,000 in housing and cars?

Let's refresh our school knowledge. The meaning of the word “benefit” is interpreted as receiving certain advantages, additional income, profit.

By purchasing real estate, what benefits will we get? Possibility of renting out plus the prospect of selling at a higher price in a few years. Well, the only problem is that 500 thousand rubles is clearly not enough to purchase an option that will actually generate income.

With a car the situation is a little different. For the investment to be profitable, having bought a new Gazelle for 470,000 rubles, you will have to use it to the fullest extent. Only with constant employment will the car be profitable, and after two years it’s good if you can sell it for 250 thousand. Therefore, we will look for more interesting options.

Property at auction

Are you interested in where to earn 500,000 rubles urgently?

Such profit can be obtained from the resale of real estate purchased at a bankruptcy auction. In order to purchase a property, you do not need a large start-up capital, since you can take out a loan. When choosing an object, make sure that it is liquid, otherwise you may have some difficulties selling it.

The sale of real estate under bankruptcy is carried out on various online platforms. You can buy any real estate at auction, including residential ones. At electronic auctions, we often find apartments that individuals purchased with a mortgage and were unable to repay the loan. In addition, bankrupt enterprises and companies are selling their assets for next to nothing. This is the easiest way to earn 500,000 rubles without investment in a short time.

Where to reliably invest 500,000 rubles: bank deposits

A familiar, accessible, time-tested method. In addition to the fact that branches of large banks are located in all major settlements, many financial organizations offer Internet banking services with convenient services: an online calculator, access to a personal account 24/7, consultations with specialists by phone and e-mail.

All official deposits in Russian banks up to 1,400,000 rubles are insured by the state. Bank deposits are a reliable, but not the most profitable tool for multiplying capital. At a rate of 9% per annum, your profit from half a million will be 45,000 rubles per year. Enough for the flight Moscow-Larnaca and back. To become a ruble millionaire you will need at least 9 years. And all this without taking into account inflation...

Let us illustrate what has been said. Interest rates for August 2021 are taken from the official websites of banks. Calculations were made using online calculators.

| Bank | Bid, % | Period | Deposit amount, rub. | Income on deposit, rub. | Total, rub. |

| VTB 24 | 6,64 | 2 years | 500 000 | 66 390 | 566 390 |

| Tinkoff Bank | 7,5 | 2 years | 500 000 | 81,452 + bonus from the bank 5,000 rubles | 586 452 |

| Promsvyazbank | 8,2 | 2 years | 500 000 | 82 112 | 582 112 |

Briefly about ruble deposits we can say this: minimal risk, small profit.

Insurance investments

Another reliable way to invest money in yourself is investment life insurance. The policy is valid for 3-5 years, at the end of the term the investor receives 100% of the deposit, even if stock market indicators have decreased. The profitability of the deposit is determined by the formula “index growth” X “participation coefficient”.

This takes into account the change in the dollar-ruble exchange rate. If the deposit period is 3 years, the participation rate is 50%, the index growth is 35%, and the dollar growth is 16.4%, then the payment after the expiration of the policy will be: RUB 500,000 + (500,000 x 35%) x (50% x 85/73) = 601,883.56 rubles.

In the event of the death of the insured, the heirs will receive the full amount, and in the event of death from an accident, the amount will be double.

Where to profitably invest 500,000 rubles: mutual funds

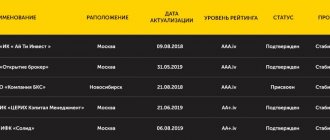

Mutual investment funds professionally place client funds in shares of enterprises, construction, and projects. Shareholders receive interest on profits depending on the profitability of the project. The relationship between investors and mutual fund managers is regulated by a contract.

By putting money on trust in a mutual fund, with a 20% profit, you will accumulate 1,000,000 rubles in four years. If you don't believe me, check with an online calculator. Investments in the Funds are highly profitable investments: the participant can sell his share as soon as its value turns out to be profitable. Profits sometimes reach 50% per year, but on average they remain at around 20%. The activities of the Funds are controlled by the state.

The disadvantage of mutual funds is the lack of guaranteed profit. During a crisis, many organizations operate at a loss, so carefully study the reports on the work of the mutual fund for previous years and the type of investment. There are mutual funds for mortgages, bonds, and foreign exchange.

This is all theory, we carry out analytical work and study official websites. For example, www.sberbank-am.ru offers clients shares of 20 mutual funds (Ilya Muromets, Sberbank - Telecommunications and Technologies) or 3 model portfolios.

A model portfolio is a set of several investment instruments. Stocks, bonds, and gold are collected in varying proportions. Its profitability depends on the composition of the portfolio.

- “Conservative – 8-10% per year;

- “Balanced” – 15-20% per year;

- “Aggressive” – 15-25% per year.

The conclusion is disappointing: investing in mutual funds is advisable if you are willing to take risks and patiently save a substantial amount for several years.

Similar articles:

- where to invest 200,000 rubles

- where to invest 100,000 rubles

- where to invest 1 million rubles

- 5 ways to profitably invest 50,000 rubles

What do you need to remember?

Perhaps you found the article depressing, that it is impossible to achieve anything with a minimal investment. Of course, everyone dreams of getting 10 thousand from 1 thousand rubles in a day, then 100 thousand, etc. But it is important to understand that fairy tales do not happen unless you are very lucky. Even 1 thousand rubles to start and the realization that you are ready to work is a big step.

At the same time, do not limit yourself to try investments, because every investor once took his first steps, and they were not always successful. This amount is enough to understand how financial instruments work. If the industry drags on, you will find something for yourself, you will be able to learn the basics of investing, then you can collect and earn extra money for a bigger start.

How to invest 500,000 rubles in a well-promoted brand: franchise business

A capital of 500 thousand allows you to purchase an average-priced franchise and launch your business according to the parent company’s scheme. By purchasing a franchise, for example, a self-service car wash, you will save effort, time and money, since you will receive working marketing schemes, a ready-made business plan, and advertising support.

Yes, such an investment can hardly be called passive income. After all, the profitability of the project will directly depend on your activity and business acumen. The average payback period for franchise projects is 6-12 months. That is, in about a year, the business will begin to make a profit.

We went back to practice. In the franchise catalog topfranchise.ru/catalog/ we took a closer look at the options:

- bakery chain “Tandir Bread” - requires an investment of 450,000 rubles, pays off in 6 months, monthly turnover from 700,000 rubles;

- hairdressing salon for children “Safariki” – 350,000 rubles, payback in 6 months, profit about 80,000 rubles per month;

- production of chemical products by NPK AtomHim - 500,000 rubles of investment, payback 3-6 months, monthly turnover of about 1,000,000 rubles, supervision and assistance of managers of the Management Company.

Conclusion: if you are purposeful and motivated, difficulties make you stronger, then franchising is your option. Remember, anyone can become a millionaire.

In Federal loan bonds

The advantage over stocks and even bank deposits is greater reliability. Because you are making a deal not with a company, but with the state, lending it money for development. The state will return them to you with almost 100% probability and with a greater advantage than the bank.

You can make money on bonds in 2 ways. The first is by receiving a coupon payment at the very end of the bond’s life, at the time of its maturity. The second is on the exchange rate difference if you sell the bonds before maturity, when their market price rises.

Pros:

- Super reliable. The state will pay you for government bonds with 99.9999% probability.

- No need to manage. Bonds can simply be bought and forgotten, receiving coupon payments and another bonus.

- Tax deduction. Purchasing bonds on an IIS will allow you to get an additional maximum of +52 tr. to tax-deductible returns without additional capital management efforts.

Minuses:

- Money is tied up. It is better to invest money in bonds that you do not intend to use for the next 1-3 years.

- Ceiling in profitability. The yield is not bad, stable, but it is almost impossible to earn more than 10-15% per annum (this includes tax deductions) from bonds.

- Inflation. While the money lies tied up in bonds for 1-3 years, it is subject to inflation all this time, which partially depreciates it.

Approximate annual return

From 5 to 15% excluding inflation. Taking into account inflation, with low coupon rates and without tax deductions, the real return, like that of a bank deposit, can be close to zero.

Where to invest 500,000 rubles to earn money: a promising startup

Implementing your own business idea will help you increase your capital and realize your own potential. To reduce the level of risk, you can turn to startup exchanges for help.

One of the projects is called ShareinStock. This site will help you invest your money wisely. Consider opening your own online store as a startup option.

Online stores are growing like mushrooms after rain. But if you approach the issue thoughtfully, you can invest 500,000 rubles in online sales. For this money you can buy a ready-made store or open a new one from scratch. Why such a large amount, since there is no need to pay rent for premises and salaries to sellers? Expense items will be:

- payment for hosting and domain name;

- creating a user-friendly interface, filling the site with content and product descriptions, SEO optimization;

- payment for the services of an administrator who answers calls and processes orders;

- minimum purchase of popular goods;

- advertising on the Internet and social networks, development of a marketing strategy.

With a successful combination of circumstances, the funds invested in the online store will pay off within six months. A well-functioning mechanism will not require your participation; a qualified administrator is sufficient to resolve organizational issues. All you have to do is monitor current trends and make adjustments if necessary.

Conclusion: investing in a startup is an opportunity to make huge profits and at the same time a high degree of risk.

Franchising

If you are thinking about how to earn 500,000 rubles and at the same time have your own savings, pay attention to such a promising idea as franchising.

Of course, such a proposal will require considerable investment. If you don’t have enough money to purchase a franchise of a well-known brand and start working under its “wing,” you can attract partners to this business and join forces. By purchasing a franchise, you will be able to establish a stable financial flow. If you have a certain start-up capital, you can easily develop a specific brand in your region. If you start an activity with the support of partners, you will certainly have to share profits. But despite this, your income will still remain high. Typically, companies that provide the opportunity to purchase a franchise create favorable conditions for expanding the business. This is a great way to earn 500,000 rubles urgently without risking your own money.

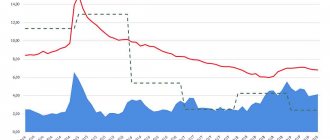

Where to invest 500,000 rubles for the long term: precious metals and commemorative coins

Investing in the purchase of precious metals is a convenient investment tool for people who are focused on long-term prospects and want to receive a stable profit. The rates of precious metals are growing slowly but steadily.

Major banks offer a choice of gold, palladium, silver and platinum. You can buy them in bars weighing from 1 gram to a kilogram. And on sales you will have to pay value added tax - 18%.

As an option, consider purchasing commemorative or bullion coins. They are money, so they are not subject to taxes. True, if the coins do not have a collectible value, it will be difficult to find a buyer. Commemorative coins have greater potential as an investment.

We do practice on the page gold.investfunds.ru/indicators/. This is how prices for gold and palladium have changed over the past three years. The cost of 1 g is indicated in rubles. If you are interested, calculate how much a kilogram bar cost in 2014 and now.

| Metal | January 2014 | January 2015 | January 2016 | August 2016 |

| Gold | 1326,8 | 2582,98 | 2683,54 | 2782,85 |

Conclusion: you won’t get much profit from such an investment, but you have the opportunity to ensure the future of your children. In addition, expert practitioners believe that this method is more reliable and profitable than bank deposits.

The time has come to take stock. In the table below we clearly present the advantages and disadvantages of the listed investment instruments:

| Options | Advantages | Flaws | Peculiarities |

| Bank deposits | High reliability and availability | Low yield | In times of high inflation, it is better to keep money in foreign currency |

| Buying precious metals | Gold almost never falls in price | When selling to the bank, tax is paid | Gold coins are not taxed |

| Mutual funds | An affordable and reliable investment tool | The client constantly pays a percentage to the management company | Profitability is not regulated by contract |

| Franchising | Ready-made business according to a proven scheme | Limited freedom of action | Profitability depends on the correctly chosen niche |

| Starting your own business | Investments with unlimited income | Not all startups are profitable, there is a significant risk | Possibility to make deposits through special exchanges |

Cryptocurrency

Recently, cryptocurrency has been of great interest to those people who want to quickly increase their money. The most famous example is Bitcoin. In less than ten years, the value of one virtual currency coin has increased from a few cents to $20,000 . Of course, there are ups and downs. But to deny the fact that some people were able to earn a lot of money in this area is simply stupid.

So it is quite reasonable to invest some part of the capital from 500,000 rubles in cryptocurrency. Moreover, you should not focus your attention exclusively on the Bitcoin . Currently, there are a huge number of other cryptocurrencies.

And very often they show much greater growth dynamics than the old Bitcoin . This is explained by the fact that young projects have greater potential. It is worth paying attention to young projects and investing money here.

How to avoid fraud - practical advice

Selecting promising projects for investment is a science and at the same time a skill that comes with experience. All professional investors have at least once made a mistake in choosing an investment direction and lost money. Since it is better to learn from the mistakes of others, listen to the advice of practitioners:

- run away from projects that even remotely resemble financial pyramids;

- make decisions based on multilateral analysis and calculations, do not be fooled by emotions;

- ask for help and advice from the pros - it’s better to get, even if paid, but competent, advice today than to lose money in the future;

- avoid intermediaries and individuals with dubious reputations;

- Work only with companies that are certified and operate officially. When visiting the websites of investment organizations, do not be ashamed to ask for licenses, contact details of the manager, details;

- Communicate more often with company employees in person: direct contact will provide more food for thought than lengthy correspondence.

We hope that the review clearly showed that there are enough opportunities for investment. Just remember that any market is changeable, so analyze everything and think three steps ahead. Cash deposits are a risky activity that requires a cool head, sound mind and informed decisions.

Useful tips for investors to avoid getting burned

I have a working set of rules for my boss. If he invests and earns even in a crisis, then it’s worth listening.

Invest only free capital

In relation to individuals: do not even think about taking out a loan for housing for business. The area of responsibility is your loved ones. Answer yourself: is money for your family or are your loved ones slaves to your whim? You can be left without both.

Invest only in objects that you understand

There is always a crowd of freeloaders swirling around capital. Just waiting for the simpleton to invest, wanting to earn more, in the “soap bubble”. As the very extraordinary and charismatic Trump says: “The investor is obliged to thoroughly know everything about the object.” Knowledge is insurance: there is less risk of being deceived.

Don't be emotional when making decisions

The main rule of a financier: save your savings, then invest and earn money. If they shout: “Buy it urgently - tomorrow it’s a mess.” I send screamers into the garden. In 9 cases out of 10, projects turn out to be unprofitable.

Be patient

Any investment is a risk. They invested 500 thousand rubles to earn money, but the price of, for example, shares is falling. A week later it bounces back, winning back several positions along the way. I know it's difficult. Here you need to calm down and wait, otherwise there will be no profit.

Develop an action plan and stick to it exactly

Strategy is not something monumental. Working on the stock exchange, I analyze transactions every day and make adjustments to the plan. But the general course is unchanged: invested - earned thanks to the planned actions. If I randomly try all the tips, I’ll reset my account.

Be sure to save money

This tip is more suitable for beginners. We earned 500,000 rubles. - withdraw part of the profit (in case of a collapse it will not be so bitter). The rest can be divided into 2 parts. Invest one in something less risky, the second - back, increasing the amount of investment capital.

Diversify risks

I invested part of my savings in investment coins. Another part is in stocks and bonds. There is money in the electronic wallet and on deposit. Now I make money from the falling exchange rate. If something happens, I won’t go hungry.

Strive to Reinvest

Money must work to bring in even more money. Invested - earned. This is how wealth is grown.

Don't rush to invest

To earn money, the owner receives 500,000 rubles. There's no need to rush. First, collecting the maximum available information, then analysis. Only then is the decision. Consider all options - the amount can be divided into several parts or invested in full.

Improve yourself

Investing is a way of life. You either invest 500,000 rubles to earn money again and again, or you degrade. This is where the person who knows more and applies the knowledge wins.

Securities

A security is a document certifying the existence of certain rights of the owner to a part of the property (real estate).

Securities have their own nominal value, which allows you to count on a certain income. In addition to its nominal value, a security has a market value, which is formed under the influence of supply and demand. Such a market is often called a stock market, but not all securities are traded on the market.

The advantage of investing money in stocks is that you can count on serious profits, which cannot be compared with the annual interest on a deposit. Minus and have a good understanding of the stock market.

Shares are one of the most unstable instruments that are subject to numerous external factors. The market value of securities is influenced by internal and external factors.

Video. Investments in securities

Pros of investing:

- long-term investment;

- the possibility of passive income;

- large selection of different projects.

Disadvantage of investing:

- certain financial risk;

- it is necessary to understand this market;

- you need to constantly monitor market trends;

- The difficulty lies in the shareholder's struggle.