Hello, dear readers!

Probably each of you was wondering: where to invest the extra money? In a dollar? In Euro? Buy shares while they're cheap enough? Or is it better to renovate the apartment? Or maybe put it in the bank? How to make money work?

If we combine these episodic impulses into a certain system, it turns out that each person has his own investment policy. But this term is more often used when talking about a company, an enterprise, or the activities of the state.

What is investment policy

Investment policy is a component of an organization's financial strategy. Its essence is the embodiment of the most effective investments, which will allow the company to develop most actively. Investment policy must be consistent with the long-term goals of the company. The policy includes these components:

- Formation of long-term goals of the company.

- Selection of the most profitable investment options.

- Formation of development priorities.

- Analysis of alternative investment directions.

- Formation of forecasts regarding areas such as marketing, technology and finance.

- Analysis of the results of the implementation of investment policy.

A sound investment policy ensures the efficient use of resources and the pooling of optimal financing resources.

How to develop an investment development strategy ?

Mechanisms of formation and implementation

The mechanism for the formation and implementation of investment policy includes:

- attraction of various resources;

- supervision over the development of allocated investments;

- development of a regulatory framework;

- assigning deadlines for the implementation of various decisions;

- determining the responsibility of government agencies for the implementation itself.

Forms of investment policy

Investment policy is divided into categories depending on the purposes of its use. The types of investment policies aimed at achieving the following results are identified:

- Increased production efficiency.

- Modernization of equipment and processes.

- Formation of new industries.

- Conquering new market segments.

What does the investment and financial policy ?

The goals set determine the investment instruments used. When choosing the form of investment policy, you need to focus on these factors:

- Financial and economic condition of the company.

- Features of the market situation.

- Technical condition of production.

- Presence of unfinished construction projects.

- Possibility to enter into leasing agreements.

- Volume of borrowings.

- Investment conditions.

- Availability of government benefits.

- Financial and budgetary efficiency.

- Availability of insurance against commercial risks.

Investment policy is always based on the state of the enterprise. It must be adapted to specific conditions.

Principles and effectiveness

Economists highlight several principles:

- Creating comfortable conditions for private and public companies.

- Development and stimulation of the stock market.

- Improvement of macroeconomic indicators.

- Studying the legal protection of all participants in the economic process.

Efficiency is determined by the degree to which the objectives are solved and the dynamics of economic indicators: if, despite all the measures taken, the investment climate remains in its infancy, it means that the state (or company) has not coped with the problems of growth and development.

Stages of investment policy formation

The investment policy development process is divided into many stages. All tasks must be solved sequentially. Let's take a closer look at all the stages.

Analysis of current activities

It is impossible to develop a new investment policy without a preliminary analysis of the previous policy. All its advantages, disadvantages, and compliance with the current state of the company are determined. The analysis is also divided into stages:

- Study of the total volume of activity.

- Analysis of the ratio of areas of investment.

- Study of the level of investment diversification.

- Establishment of investment efficiency in the reporting period.

The “weaknesses” of investment activity and its problems are analyzed. The compliance of the investment policy with the company's goals is assessed.

Analysis of the external investment environment

During the research, these aspects are analyzed:

- Legal conditions of the environment, as well as individual forms of investment.

- Analysis of the existing situation and the factors that determined it.

- Forecast regarding the market situation in the following periods.

The research uses tools such as strategic and fundamental analysis.

Consideration of strategic direction

Investment policy is a set of strategic goals. The policy direction is set based on the life cycle of the enterprise.

Argumentation of the developed type of investment policy

Investment activities are established based on the ratio of expected income and expected risks. Existing financial management principles are taken into account. The following types of investment policies are distinguished depending on the risk component:

- Conservative. Involves a minimum of risks.

- Moderate. This is a compromise option. Differs in average market values of risk, profitability and growth rates.

- Aggressive. It features maximum risks, as well as maximum profits.

The more risks, the more profits. However, when choosing an investment policy, you need to focus on the current state of the company: corporate strategy, availability of projects on the real market.

Enterprise level

The investment policy of a company or enterprise primarily consists of choosing the optimal development path. It can be extensive, intensive or mixed. In many ways, such a policy can be identified with the choice of development strategy.

The extensive path is associated with the constant increase and scaling of production capacity, which is carried out on the existing material and technical base. Subject to a high level of technological equipment, a company that has chosen such a vector of investment policy is able to increase its output in the shortest possible time, which will automatically increase its profit.

However, the management of the enterprise must be aware that such a development strategy cannot have a permanent long-term nature. After all, science does not stand still. Innovative, more efficient production methods are constantly emerging. If at a certain point in time the company's management does not invest money in modernizing production, then the products produced will lose their competitiveness, and, therefore, will cease to be in demand in the market.

The company's investment policy, which involves an intensive strategy, consists of investing a large part of its profits in the modernization of the existing production base and practical scientific research. This allows you to stay ahead of other enterprises in the relevant sector of the economy and create competitive products.

Currently, such an investment policy is associated with the introduction of the most progressive management methods, increasing labor productivity, automation and robotization of basic production processes. At the same time, the intensive path of development is associated with a decrease in the net profit received by the owners of the company.

Thus, the most preferable type of investment policy for an enterprise is a mixed development path. On the one hand, it allows you to maintain the company at the proper technological level. On the other hand, it maximizes the level of profit that the owners of the enterprise receive. The main difficulty of this approach is finding the optimal balance.

Main directions

In economic science, it is customary to identify several main areas of investment of own and attracted capital at the company level.

- Investments aimed at increasing the efficiency of core activities. The goal of such an investment policy is to create conditions that make it possible to reduce costs through timely modernization or replacement of outdated means of production (machines, equipment, computer equipment), retraining of employees, transfer of own branches and divisions to regions with the most favorable production conditions.

- Investments aimed at expanding production. The result of such a strategy is to increase the volume of products, works, and services produced by the enterprise.

- Investments aimed at opening additional branches and structural divisions. Such investments automatically create new production capacities, which can be used both for the production of old and the development of new product models.

- Investments caused by changed requirements of control or supervisory authorities of state, regional or municipal authorities. For example, we may be talking about new environmental regulations, industrial safety standards, or product quality standards.

Implementation principles

When developing investment policies at the company or enterprise level, management must be guided by several principles.

- Evaluating the effectiveness of investments. Based on such an analysis, you can select the most promising investment projects with maximum profitability.

- Profit maximization. The investments made should bring maximum profit with minimal actual expenses.

- Optimal distribution of investment resources. Financial investments should be directed only to those projects that are most likely to pay off.

- Emphasis on attracting government subsidies and preferential bank and private loans.

Development of anti-crisis investment policy

To formulate an anti-crisis investment policy in a company you need to:

- perceive production, financing and the investment process as an indivisible structure that is aimed at the constant growth and development of the company;

- it is necessary to constantly analyze acceptable and critical levels of risk in the existing market situation;

- the enterprise development strategy should be formed on the basis of investment forecasts;

- take into account the different value of money at each time stage;

- keep a constant record of the actual rate of inflation in the country;

- calculate the cost of capital attracted from outside.

By acting in this way, the management of the enterprise can create an effective anti-crisis investment policy, which will allow development even during a recession in the country's economy.

Stages of formation

The company's investment policy is always formed in stages. The order of the stages may be different, but their totality must remain unchanged.

- It is necessary to determine the investment horizon. The formation of investment policy can be considered in the short, medium or long term.

- You should choose a clear direction of development, which may affect one or more industries.

- It is necessary to determine the territorial boundaries of activity. In other words, the products produced may be targeted at the local, regional, national or international market.

- It is necessary to create sources of financing for future investments.

- An effective system must be put in place to implement the approved policies.

- A control body should be created that will monitor the effectiveness of ongoing investment projects.

It is difficult to overestimate the practical importance of investment policy for the successful development of an enterprise or state. In this regard, every investor should pay special attention to it.

Creation in basic directions

The indicators of real and financial investment of funds are optimized. This process is carried out taking into account a number of factors, which include:

- Functional direction of the company.

- Life cycle phases.

- Scale of the organization.

- Features of strategic changes in operational work.

- Estimated interest rate.

- Estimated rates of inflation.

For example, for entities engaged in production activities, real investments are relevant.

Existing specifics

The investment policy pursued by executive bodies of state power is considered by many domestic and foreign experts to be quite specific. It is perfectly characterized by the following features:

- significant influence of the state on the economy;

- mixed nature, allowing the existence of both market and administrative levers of influence;

- dependence on the global economic crisis.

The Government of the Russian Federation pursues its own investment policy, relying on industry legislation and by-laws. With the help of these regulatory documents, all investment processes taking place in the state are regulated.

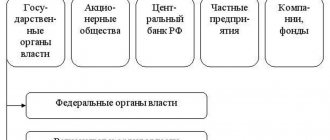

The main subjects of state investment policy are the Government of the Russian Federation, the Ministry of Finance, the Ministry of Economic Development, the State Duma and the Central Bank.

It is quite natural that in such a huge country as Russia, all investment processes cannot be regulated directly from the federal center. Regional authorities play a major role in solving the problems facing the country. At the regional level, local investment government structures are created for this purpose, which, as a rule, are called departments and agencies.

Creating an investment policy on a sectoral scale

It is necessary to establish a sectoral direction of work. As part of this procedure, investment forecasting and corporate strategy are taken into account. An analysis of the wisdom of industry concentration or diversification must be performed. Most successful companies use a concentration strategy. At the same time, concentration on one industry implies an increased risk of bankruptcy.

The industry concentration strategy is relevant only at stages 1-3 of the life cycle. In this case, the direction under consideration determines increased rates of development and profit-making. In the future, diversification becomes relevant. Diversification involves the creation of certain economic zones. The rationale for this or that form of diversification is further analyzed.

Effectiveness of the policy

At present, the investment policy pursued by Russian executive authorities cannot be fully recognized as effective. A number of important issues still remain unresolved:

- there is no close relationship between priority and ongoing investment projects;

- the level of rationalization of financial spending from the federal budget is not high enough;

- investors do not have full rights and guarantees;

- public investment dominates over private investment;

- there is no emphasis on the implementation of long-term investment projects.

The key point seems to be the insufficient level of private investment. State investment potential should primarily be aimed at the development of the military-industrial complex (MIC), fundamental and applied science. Instead, due to the lack of an adequate level of private investment, the Government has to shoulder a significant portion of investments in the economy and social sphere onto the state budget.

Creation of the company's investment policy on a regional basis

The creation of a regional investment policy is determined by these conditions:

- The scale of the enterprise. Small companies usually operate in one region. Large enterprises have influence in many regions.

- The duration of the company's operation. In the initial life cycles, it is reasonable to focus on one region. In the future, there will be a need for diversification across regions.

The basis for the formation of a regional focus is an analysis of the investment attractiveness of the regions.

Ensuring the interconnection of the basic directions of investment policy

All directions must be coordinated. Otherwise, the effectiveness of investment activities decreases. Consistency needs to be achieved in such areas as volumes and implementation period.

Analysis of the investment activity of the enterprise in the previous period

The main goal of such an analysis is a comprehensive assessment of the internal investment potential of the enterprise and the effectiveness of its investment activities.

- At the first stage of the analysis, the total volume of investment activity of the enterprise is studied at individual stages of the period under review, the rate of dynamics of this indicator in comparison with the rate of development of the total amount of operating assets, equity capital and product sales volume.

- At the second stage of the analysis, the relationship between individual areas of the enterprise’s investment activity—the volume of its real and financial investment—is examined. The dynamics of these investment volumes are compared with each other, the share of each investment area is determined, and their role in the development of the enterprise is examined.

- At the third stage of the analysis, the level of diversification of the enterprise’s investment activities is considered in industry and regional contexts, determined by the degree of compliance of this level with the industry and regional policy for the development of its operational activities.

- At the fourth stage of the analysis, the effectiveness of investment activity in the period under review is determined. For this purpose, a system of indicators of profitability of investment activities as a whole is used, including by areas of investment; these indicators are compared with return on assets and equity; indicators of turnover of investment resources are considered; using factor analysis methods, the degree of influence of individual indicators of the effectiveness of investment activity on the growth of the market value of the enterprise is established.

Possible errors during formation

The main mistake in policy development is the lack of clearly defined goals. In this case, it is impossible to select an effective investment policy, since it depends precisely on the intended goals. The second common mistake is ignoring context. The formation of investment policy is based on the company’s resources, as well as on the state of the investment market. Without the context of the external environment, it is impossible to analyze the effectiveness of a policy. Even if the policy is effective from the point of view of external conditions, it must be taken into account with the resources of the enterprise. You also need to consider how much risk the company is able and willing to take. The degree of protection against risks is also taken into account. The correct choice of investment policy will ensure the active development of the company.

Models

Each model of investment public policy is a certain historical stage that society goes through in development, moving from a strict monetarist option to self-regulating hybrid systems.

Tax incentives

The toughest management option is that all the tools are concentrated in the hands of the government, and private business has to adapt.

The state regulates the investment climate and a number of economic indicators through tax incentives. Tax benefits and holidays, carry forward losses to subsequent years, reducing the burden on business - these are the main areas of impact on private companies.

Public private partnership

The model describes the goals and degree of interaction between the state and private business.

Public-private partnerships mean government contracts, rent (leasing), joint companies, concession agreements and other mutually beneficial forms of cooperation.

Private capital fulfills various kinds of obligations to the state. For example, in exchange for government contracts, large companies undertake to support the social sphere, develop the city’s infrastructure, or engage in charity work.

Mixed model

Here the role of the state is reduced to a minimum: the needs of private capital come to the fore. The government in this scenario must create a mechanism for distributing resources between the most efficient firms and organizations, and they invest the resulting assets in the development of innovation.

Main performance criteria

It is worth noting a number of main factors influencing the productivity of an enterprise’s investments:

- the usefulness of the social and economic policies used;

- presence of an effective financial strategy;

- the level of quality and competitiveness of the products produced or services provided;

- indicator of the use of the company's active assets and production capacities;

- the meaning of the feasibility of using resources;

- the effectiveness of the investment schemes involved;

- literacy and preparedness of the company's management.

The above criteria, depending on the impact on the return on investment, may belong to different groups. Thus, today there are factors that have a positive and negative impact on the efficiency of investments.

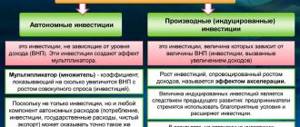

Kinds

The method of allocation of funds depends on the type of investment and the result that the investor is seeking. When investing financially, three main types are used.

Aggressive

Formation of a portfolio of high-yield securities with a high risk percentage. Yield more than 50% per annum.

Moderate

Portfolio formation based on the principle of diversification (expansion). Balance of profitability, liquidity and risk. Yield up to 45% per annum.

Conservative

Formation of a portfolio of highly liquid securities. Low profit. Low risk. Yield up to 20% per annum.

What is an investment strategy

This is a model for effectively achieving set goals for the distribution of financial resources. A kind of master plan that will determine the development concept for the long term.

Goals and objectives of investment strategies

Goals depend on the scope of activity, the amount of financing, and areas of activity of the enterprise:

- calculation of liquidity of financial resources;

- formation of investment accounting policies.

Tasks:

- study and analysis of the situation on the stock market;

- assessment of instruments, identification of profitable areas;

- accurate calculations of the distribution of financial flows;

- formation of a securities portfolio;

- modernization of production, introduction of innovations;

- expansion, organization of new business areas;

- minimizing financial risks;

- reaching the planned percentage of profit.

Structure and principles

Basic principles for all businesses:

- Adaptability (flexibility) – the ability to change under the influence of various factors.

- Compliance – consistency with all participants in the process. The plan should not contradict the main function of the enterprise.

- Safety – continuous work to minimize risks.

- Development (openness) – the permissibility of introducing new techniques to generate or increase income.

- Competence – investments should be handled by professionals.

The structure is developed for each business. But there are sections that are typical for all organizations. Basically this is a list of management procedures:

- characteristics of enterprise development resources;

- analysis of the financial climate of the region;

- state assistance to investment activities;

- defining development goals and objectives;

- formation of a road map.