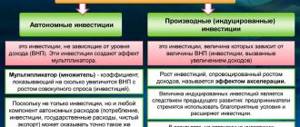

The essence of this strategy comes down to making money on the Forex market through a positive swap. Moreover, it does not matter to the trader what the trend will be - upward or downward. During a flat, the chances increase more, since there are no risks associated with the chosen direction of trading (buying or selling an asset).

The point of the strategy is to find a currency pair for which, in one of the chosen trading directions, the swap will be positive, and the number of swap points should be impressive.

For example, it makes no sense to consider pairs with close interest rates. Today, almost all G7 countries keep rates around 0%, which makes the Carry Trade practically useless. Finding exotic currencies, where interest rates can vary significantly, is a completely different matter.

For example, for the USD/MXN currency pair (American dollar to Mexican peso), the swap when opening a short position is 18.7 points (we consider the specification of the Roboforex broker contracts). However, there is one nuance here - a fairly high average spread, which is 20 points. But this is the best option, given the fact that for other pairs the spread may be even higher. At the same time, if we hold the position for quite a long time, as a result we will still receive a profit from the swap. The only caveat is that a short position on this pair may be fraught with risks associated with currency fluctuations; the price may go very negative from the opening price of the position, and a positive swap will not cover the loss.

How is a swap formed?

When completing a transaction for the purchase and sale of an asset, participants undertake to make final payments on a valued date (pre-agreed). For example, if a position was opened on Tuesday, then the closing date for payments will be Thursday. If an open position is transferred to a day later, the next day will be considered the valued day.

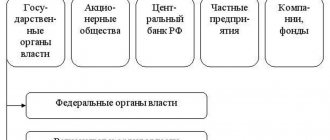

Swap transactions begin at the highest levels of the financial market, then the results spread down the hierarchical system. Swap difference is the ratio of quotes between two currency denominations. It is more profitable for the participant when the interest rate for purchasing currency is higher than for selling it. As a result, the user either remains in a winning position or loses. The minus difference will be debited from your personal account.

Interest rate swap pricing

To calculate an interest rate swap, different formulas are used.

For a fixed payment, use the following formula:

Where C is the rate; P – transaction size; t – period; T – currency base corresponding to the convention; M – number of payments; df – discount factor.

In a floating transaction, the settlement of each payment depends on the forward interest rate (f).

And the formula is as follows:

Where N is the number of payments.

At the time of conclusion of the contract, equality must be true:

That is, none of the counterparties has any benefits over the other, and no payments are made.

A change in f in a period can affect this equality.

What is “swap” in simple terms?

In simple words, a swap is a transaction to exchange an asset for time. Example: two friends are planning to go abroad. Ivanov went to America, and Sidorov to England. The first friend only has dollars with him, and the second friend has euros. Just in case, they decided to exchange a certain amount of money, you never know. That is, the exchange takes place in different currency denominations. Upon arrival, the money taken must be returned based on who borrowed how much.

Due to currency exchange, the risk was reduced. That is, the occurrence of an uncomfortable situation due to a lack of money is unlikely. But if one of your friends managed to spend the borrowed money, and the exchange rate changed at that time, then the resulting difference in the exchange rate change will have two results - plus or minus. For those who do not make money using Forex and do not have the relevant knowledge, an understanding of the term swap will be needed to improve their erudition. Now you can have a basic idea of what smart people talk about.

Arbitrage strategy: make money on swaps without the risk of asset fluctuations

This is another quite interesting option. The essence of this strategy is to open opposite transactions for the same asset with different brokers. Moreover, one of them must have a positive swap in order to make a profit from the swap, and the other broker must have the opportunity to open a swap-free account (Islamic account).

What is the point of this approach? In fact, everything is very simple. Let's say you open a buy deal with a positive swap on the AUD/CHF currency pair. Therefore, you need to find another broker with Islamic accounts where you can open a deal to sell the same currency pair. Positions are opened simultaneously in two companies in order to lock the breakeven (if the currency pair grows, the profit of one broker will be at the level of the loss of the other, with the exception of the spread).

If you are unable to find Islamic accounts, you can turn to derivatives. For example, sell AUD/CHF futures. Considering that there are no swaps at all when trading derivatives, this option can also be considered as suitable.

Kinds

Swaps are classified into various categories. It all depends on the type of asset that is involved in transactions and the terms of the contract. Currently the swap is divided:

- Foreign exchange. With this type, two types of transactions are carried out for the purchase and sale of foreign currency money. Currency exchange occurs on two different dates. Profit is achieved due to the difference in quotes. Currency swap is the most popular method in the financial market. Used as a speculative method in differentiating interest rates.

- Promotional. Such a swap implies a transaction to exchange shares in the future. Currently, the investor's securities portfolio is increasing. As an advantage, the net value of the portfolio is added to investors, which allows them to preserve their own assets.

- Precious metals swap. A financial purchase and sale transaction occurs simultaneously in two stages: the purchase or sale of one precious metal and the reverse transaction.

- Percentage. This is an agreement drawn up between the parties to a transaction to replace interest payments of various forms.

Credit default swaps are most popular in the Russian financial market. Their significance is associated with the possible occurrence of default (depreciation of money) during the period of fulfillment of loan repayment obligations. The possibility of finding yourself in a crisis situation may arise for both the borrower and the credit institution. Much depends on the choice of the specific currency of the loan provided, the external and internal situation in the country’s economy.

Foreign currency is highly dependent on exchange rate fluctuations and also does not guarantee security against risks. The cost of such swaps is more favorable, in contrast to conventional insurance. Not only insurance companies, but also other banks, investment funds, and individuals can be involved in hedging potential risks.

Features of commodity swaps

A commodity swap is a simple financial instrument that does not involve the delivery of a physical commodity.

Market participants on the floating price side typically buy and sell on contractual terms linked to a commodity index.

This means that the real delivery price becomes known at the time of delivery or shortly before it occurs.

Participants on the fixed price side assume the high risk inherent in volatile commodity markets. They usually offset this risk by taking the opposite position, a forward or futures.

CDS VS: insurance

Providing a credit default swap is a type of guarantee insurance for the organization that issued the loan against possible default of the client. A good example: a client approached the bank with a large requested loan amount. He agrees to all annual interest rates from the bank. The director of the credit institution was very happy about this deal, but at this moment we should not forget about the potential risk of non-payment of the loan amount by the client. This may happen due to the bankruptcy of the latter. If the amount of the approved loan can significantly affect the bank’s activities in the event of non-repayment, then it is worth considering taking out a credit default swap from another banking organization that has stable and large capital. In the event of non-payment, the other bank will serve as an insurer and cover the costs. The service is provided on a paid basis. But as a result, the bank that buys the swap insures itself against possible risk in the future.

Is it worth using such strategies?

Each trader must decide this issue for himself. The fact is that in addition to the obvious advantages, such strategies also have their significant disadvantages. For example, for most currency pairs, positive swaps are currently insignificant. And spreads can reach 5-20 points and even higher.

Accordingly, even if you manage to get some income, it will be comparable to working with risk-free instruments, such as bank deposits or federal loan bonds. At the same time, you will spend significantly less effort, since by investing in a bank or buying bonds, you receive passive income. And when trading such strategies, you will have to regularly analyze swaps and look for windows for competent arbitrage.

In addition, swaps are constantly changing, they are dynamic. Swap can turn from positive to negative. In this case, you will have to close the deal and look for new opportunities.

In addition, the deposit reserve on trading accounts during arbitrage must be impressive so that one of your orders is not closed by Margin Call if you hold the position for a long time during a strong trend.

We recommend not to rely too much on these trading systems and use proven trend or correction strategies, as well as advisors that allow you to make a profit from the operation of the algorithm. And use knowledge about swaps in order to understand how much extra you can get with a positive swap or lose with a negative one, and where the conditions for such commissions are better.

CDS in the financial crisis

Credit default swaps are especially popular among speculators. The demand for loans is rapidly increasing among consumers. All banking structures are involved in the loan issuance service. In this regard, credit institutions need insurance. With the onset of a crisis period, organizations lose the ability to service obligations. There is a risk of increasing default. Requests from insurers for obligatory fulfillment of powers are increasing.

When the crisis affected the insurance company AIG, which managed to make swaps worth a multi-billion dollar amount, only the state saved the situation. Five years ago, the European Union brought serious charges against the largest banking structures. The EU complained that they were blocking the functioning of the CDS. Credit default swaps continue to be opposed by most investment professionals and speculators.

Swap price calculation

Contract evaluation is needed if one counterparty wants to resell its obligations to another company. It is logical that during this time the exchange rate or interest rate has changed. Therefore swap now has a certain value.

You can estimate currency swap using the formula:

To discount payments on bonds, rates are used for the relevant periods and currencies.

Swap Interest Rate Calculation

In order to determine the price, you need to determine the difference in prices (let's imagine them in the form of bonds). For example, company N receives a fixed rate and pays a floating rate. The calculation formula will be like this:

The company should get rid of the fixed bond and buy a floating one. If the conditions are reversed, then the cost is calculated as follows:

Taxation of swap transactions

To determine the amount of tax obligations for both sides of the swap, you need to take into account the structure, objectives of the contract, highlight the object of taxation and the base.

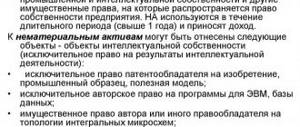

Swap contracts are considered by tax legislation as financial instruments of futures transactions.

For example, the result of a transaction on an interest rate will be the profit (loss) from the exchange of interest rates for a notional principal (the so-called virtual amount). In terms of currency – exchange rate difference.

All income and expense items are calculated by each party separately. Changes in the exchange rate are taken into account.

The tax base will be the result of the transaction (income minus all expenses for all assets). Set at the maturity date of the contract or at the end of the tax period. Losses under such contracts can be carried forward to the next tax period (without exceeding the amount of profit).

Disadvantages of CDS

The government is increasingly tightening legislation in the area of credit default swaps. In the event of a crisis, the bank will suffer enormous losses if it provides these services. This leads to default on loan repayment obligations.

During a crisis, the responsibility for repaying loans falls on the shoulders of banks. They begin to demand fulfillment of obligations primarily on swap transactions. Next, insurers, in order to correct the situation, try to sell off assets, which further aggravates the problem.

Let's sum it up

So, a swap is a commission that is charged for transferring a trader’s position to the next day. Swap can have either a negative value (when you pay the commission) or a positive value (when the commission is charged to you). We looked at several strategies with which you can try to make money on pure swaps and learned how to analyze swaps using the MyFxBook website.

If our article was useful to you, leave your comment below on the topic: is swap important for you in trading?

That's all, good luck to everyone!

Swap-free accounts

These accounts do not contain swaps - this is the main distinguishing feature from others. For transferring an open position to days ahead, a commission in the form of a swap is charged. This creates unnecessary costs when trading. Swap-free accounts allow you to trade over a long period of time and at a convenient time. The preservation of funds in the personal account is achieved due to the absence of commission.

Such deposits are popular among traders who are accustomed to leaving positions open for a long time. Thanks to the creation of swap-free accounts, transactions on the financial exchange take place in a calm atmosphere, participants can make informed decisions and not rush to conclusions. A deposit can be opened in any currency: dollar, euro, ruble. Accounts without swap appeared not so long ago. Their appearance is associated with the ban on Muslims participating in foreign exchange transactions. Religion did not allow participation in trading activities that required payment of interest.

In order not to lose a potential client base, special centers have opened a new type of account - without swap. The second name is Islamic. To pass the registration stage, it was enough to present a passport and prove adherence to Islam. After a short period of time, accounts without swap began to be used by ordinary trading participants. Most brokers allow you to open them.

What is swap on the stock exchange in simple words

I'll tell you in simple language. During a trading session, a trader opens positions. Makes a deal and, for example, opens a long position in the dollar against the British pound. A trading session can be main or additional.

Open positions may not be closed and may be carried over overnight. For this operation, a commission is debited from the account or charged. This is a swap. It doesn't matter when the trade was opened. The cutoff time for accrual is 17.00 New York time. In winter, Moscow time - 01 o'clock. The trader opened a few minutes before 17 NY - accrued after crossing this time limit.

Important! Swaps are relevant for different markets and assets. In the article I consider only the application of this concept when trading currency pairs on Forex. Something that concerns any trader who trades through a Forex dealer.

Example

Open a long position in the GBD/USD pair for 100 thousand units (one lot). That is, at the same time a long position opens in the British pound sterling and a short position in the American dollar. Using the formula below, we calculate the swap size for the next day. Rate difference 1% (November 2021). We will set the broker's commission at 0.3%, the cost of the currency pair at 1.27.

swap=(100,000 x (1+0.3)/100) * 1.27/365

Charged $4.52. This is ideal. In real trading, the dealer sets his write-off amount in points. An example is Alpari contract specifications.

Goals

The goal is to bring different currencies with different bank rates to a single coordinate system. As a result of overnight carry trading, the trader is credited or opens a escrow account for each currency based on various values, which for the forex dealer are absolute values. He can't change them. Only take into account in providing services to the end client.

Mechanism of formation and calculation method

The nature of the mechanism is the refinancing rates of the central banks of countries. They can change and have different sizes.

Let me give you an example. As of November 2021, the US Federal Reserve rate on the dollar is 1.75%, the Bank of England rate on the pound is 0.75%. When opening a long or short position in this pair for a particular instrument, a difference in accrual due to bets naturally arises. The additional commission is set by the forex dealer.

Calculation formula:

SWAP=(volume of open position x (difference in refinancing rates + additional dealer commission)/100) x value of the currency pair/365.

Swap can be positive or negative. There are no intraday rewards for short one-day trades.

What determines the size of the swap?

The value directly depends on the refinancing rates of central banks. The second component is additional commissions laid down by the dealer. They can significantly adjust write-offs or accruals. Individual for each dealer. There is no single scheme.

For which traders is swap relevant?

For those who transfer the position overnight. Particular attention should be paid when transferring from Wednesday to Thursday, when accruals are tripled. If there is no confidence, the position is closed on Wednesday; on Thursday after 1.00 Moscow time (winter time) it can be opened again.

In the MetaTrader trading terminal, the swap value is translated. MetaTrader is the most widely used program in Russia for trading currency pairs.

Should traders be wary of swaps?

The impact of a swap on the size of a trader’s trading account over short periods of time is reduced to a small value. If holding a position for up to 2-3 weeks, I would not pay attention to the accruals for the most popular pairs. This is worth doing when holding for up to a year and on exotic currencies. Or when these two factors coincide.

For example, estimating charges on the British pound, which has a rate of 0.75% per year. A very small amount to influence the trading account over short periods of time. Even with the additional dealer commission.

Forex swap table

Information resources related to Forex often post summary tables of swaps of various dealers. This is convenient for the trader. Express analysis allows you to compare the best conditions. Taking into account the fact that the commission is calculated by each dealer independently. The calculation base is the refinancing rates of central banks. The second part of the accruals is the brokers’ own commissions on the foreign exchange market.

An example is a table from the resource tlap.com.

It is worth considering delays in updating this type of information. And possible errors. Check with primary sources of information on dealer websites.

What are swap-free accounts?

Most dealers provide the opportunity to conclude a service agreement with the opening of a trading account without swapping. This is a kind of disguise of the swap mechanism. Because he himself has not disappeared anywhere for the dealer himself, although he may be a small amount.

First of all, on leading currencies. In this case, these costs go to the commission of the person providing the service. It may be slightly higher than on an account with swap.

If the goal of your trading is to make a profit from speculation over short periods of time, you should not bother opening an account without a swap. A swap on a separate line provides a more transparent picture for analyzing dealer fees.

Why is there a triple swap from Wednesday to Thursday?

In trading, the calculation determines the value date when the swap value is credited or written off. Wednesday on the foreign exchange market is equivalent to Friday. Thursday - by Monday. These are the features of currency trading.

The bank rate works every day, so the night from Wednesday to Thursday is like a weekend. Triple accrual or write-off. On regular weekends (Saturday, Sunday), swap for transactions is accrued in the standard manner.

When swap is not charged

Options:

- intraday;

- when concluding an agreement with the end client (trader) without swap.

Cross-currency interest rate swaps

Although cross-currency interest rate swaps often have terms longer than one year, they are included in this book so that they can be compared with other currency derivatives. [p.87]

Currency futures Currency interest rate swaps Currency options [p.88]

Currency interest rate swap is [p.96]

Currency interest rate swaps and currency options - 6% [p.112]

Currency interest rate swaps involve an exchange of principal amounts followed by an exchange of interest payments over the life of the swap. In currency swaps, only the principal amounts are exchanged on the value dates without any interest payments. [p.256]

Interest rate swaps involve only one currency, while currency and cross-currency interest rate swaps always involve two. [p.256]

Currency interest rate swaps 287 [p.277]

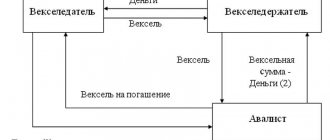

A cross-currency interest rate swap involves exchanging interest payments in one currency for interest payments in another currency. [p.287]

Currency interest rate swaps typically involve an exchange of principal amounts. The notional principal is exchanged at the beginning of the transaction, usually at the prevailing spot rate. Interest payments are made at a fixed, floating or zero coupon rate. At the expiration of the swap, the principal amount is exchanged in reverse at the original spot rate. [p.287]

In effect, a cross-currency interest rate swap allows a borrower or lender to exchange a loan in one currency for a loan in another currency without any currency risk. (It should be borne in mind that currency risk does not arise only if the swap is held until its expiration.) [p.287]

A cross-currency interest rate swap is essentially a spot transaction followed by a series of foreign exchange forwards. [p.287]

The duration of cross-currency interest rate swaps is usually at least one year. [p.287]

In a currency swap, the interest rate differential between the two currencies is reflected in forward points for the forward delivery date. In a cross-currency interest rate swap, the interest rate differential is paid over the life of the swap each time the settlement day occurs. This means that the reverse exchange of principal amounts can be made at the original spot rate at both the beginning and end of the term of this OTC agreement. [p.288]

Use of currency interest rate swaps [p.288]

As with interest rate swaps, cross-currency interest rate swap agreements are rarely negotiated directly by end users. This process most often involves a market maker and two unrelated clients who want to enter into a swap, but not necessarily with each other. For example, the perceived credit risk associated with a direct swap agreement may not be acceptable to either party. The market maker bank, acting as an intermediary, offers clients a double swap in which both parties receive a guarantee of interest payment. [p.290]

It is rare for a market maker to have the underlying asset needed to exchange the principal amounts in a swap. Typically, a bank covers a position in a currency-interest rate swap with a counter contract with another counterparty, which allows it to manage currency and interest rate risks. [p.290]

Comparisons of cross-currency interest rate swaps should be made on a like-for-like basis, that is, comparing like with like. [p.291]

Are currency interest rate swaps as simple as they might seem? In principle, yes, but in practice, to successfully compare swap rates, a number of parameters must be adjusted. In other words, before you start comparing, make sure you are comparing like with like. The difference between swap rates may be due to the following [p.291]

Currency interest rate swaps on the market [p.292]

Let us consider in more detail some points relating to currency interest rate swaps, namely [p.292]

So how is a swap valued? The following simple example of evaluating a currency-interest rate swap with a maturity of 1 year clearly demonstrates the essence of the process. [p.295]

A cross-currency interest rate swap involves exchanging interest payments in one currency for interest payments in another currency. A cross-currency interest rate swap is essentially a spot transaction followed by a series of foreign exchange forwards. [p.314]

| Rice. 22.4. Currency interest rate swap (bilateral transaction) |

In Fig. Figure 22.5 shows a three-way swap. Borrower B carries out a cross-currency interest rate swap, while Borrower A carries out a regular currency swap, and Borrower B carries out a regular interest rate swap. [p.252]

| Rice. 22.5. Currency interest rate swap (tripartite transaction) |

To demonstrate the impact on the balance sheet, consider a slightly more complex example where a swap involves exchanging a fixed-rate debt for a fixed-rate debt in another currency (a variant of a cross-currency interest rate swap).

In this case, both parties not only service each other's interest payments, but also the principal amount of the debt. Their costs will reflect both changes in interest rates and changes in the exchange rates on each of their borrowings. Consider, for example, a UK company with a $3 million loan at 14% doing a cross-currency interest rate swap with a US company with a £2 million loan. Art. at 12%, and each loan must be repaid in three equal annual installments. During the year, the exchange rate changes from 1.5 to 1.25 dollars per 1 pound. Art. Balance sheet items at the end of the first year would include the following [p.259] For example, a German bank takes out a loan in Switzerland at 5% per annum, then converts Swiss francs into German marks at the cash rate and places them on the national market at 9% per annum. The income from the difference in interest rates will be 4% per annum. When the loan received becomes due, a reverse conversion takes place, that is, the stamps are sold for francs. Currency-interest arbitrage is profitable if the gain from the positive difference between interest rates in Germany exceeds the exchange rate difference unfavorable for the German mark on swap transactions during currency conversion, taking into account the costs of the operation. Let us assume that the transaction period is a year, and the spot rate when buying stamps for francs is 1 German mark = 0.90 Swiss francs. The arbitrage will yield income if the reverse conversion, i.e., the sale of stamps into francs to repay the loan, is carried out at a rate above CHF 0.864. for 1 German mark [p.372]

The first is an exchange of interest rates of a different nature (for example, a fixed rate and a floating rate, two different floating rates, a fixed rate for one currency and a floating rate for another, etc.), the second is an exchange of agreed amounts denominated in two different currencies, with subsequent payment of principal and/or interest. Currency swap transactions between central banks are typically undertaken for monetary policy purposes and involve an exchange of deposits on a specific date followed by a reversal at a future date. [p.491]

Currency interest rate swaps are over-the-counter transactions between two lines for the exchange of interest payments and foreign currency loans. It helps its participants avoid difficulties associated with the movement of currencies or changes in the cost of financial services in the required foreign currency. [p.96]

In cross-currency interest rate swaps, payments are made at both a fixed and a floating rate, so the determination of the risk of loss should be made taking into account the volatility of the future floating rate base, such as LIBOR. [p.293]

Consider a 5-year fixed/floating rate cross-currency interest rate swap in which XYZ Corporation and Bank AB exchange 100 million for DM 170 million at the spot rate of USD/DEM = 1.7000. Every 6 months, XYZ pays Bank AB a fixed rate of 6% in marks, and ABC pays Corporation XYZ a floating rate of LIBOR in dollars. [p.294]

Currency interest rate swap (ross-urreny swap) - exchange of obligations with a floating interest rate in one currency for obligations with a fixed interest rate in another currency. [p.268]

New financial instruments arose in the 80s as a result of increased competition among banks in the global market. To attract clientele and increase their profits, participants in the global credit and financial market - banks, stock exchanges, specialized financial institutions - have created a hybrid of various financial documents, including debt instruments, securities guaranteed by bank assets, and hedging instruments. These include a cancellable forward currency contract, the owner of which can cancel it upon maturity; a marginal forward currency contract, upon the maturity of which currencies are exchanged within the limits of their exchange rate fluctuations established in the contract; a swap with a zero coupon exchanged for a coupon with a floating interest rate swap circus in the form of a combination of currency and interest rate swap swap-tion - a combination of a swap and an option cylinder option - a combined seller and buyer currency option perpendicular spread based on the use of options with the same term, but with different prices double spread - a combination of two call options and two options put with several expiration dates calendar spread - the purchase and sale of an option on the same securities with different maturities. A market for financial futures, financial options and swaps has formed. Banks enter into fixed-term agreements [p.388]

Financial instruments are a relatively new concept in financial theory, but their importance is rapidly growing. A financial instrument is any agreement between two counterparties, as a result of which a financial asset simultaneously arises for one counterparty and a financial liability of a debt or equity nature for the other. Financial instruments are divided into primary and secondary. Primary ones include loans, borrowings, bonds, other debt securities, accounts payable and receivable for current transactions, and equity securities. Secondary financial instruments (synonymous with derivatives, derivatives) are financial options, futures, forward contracts, interest rate swaps, currency swaps. Financial instruments are the basis of any company’s operations in the financial markets, whether we are talking about raising capital (in this case, shares or bonds are issued), speculative operations (purchase of securities in order to obtain current income, operations with options), financial investments (investments in shares), hedging operations (issue or purchase of futures or forwards), formation of an insurance reserve of cash equivalents (purchase of highly liquid securities), etc. [p.322]

Income Opportunities

Is it possible to make money on swaps, you ask? This, I tell you, is a very pressing question. Earning money is quite possible and methods appeared relatively long ago. This is a whole separate industry, and it’s called carry trading.

Of course, you won’t be able to make a fortune in a short period of time, since in Forex there is also a spread. We have already discussed this concept with you in the previous article.

The swap is always less than the spread, which is charged once, and swaps are charged every day. Therefore, if you hold a deal for a long time with a positive swap, the spread will close and the trader will be able to benefit.

But there is also a problem, because the market does not stand still at this time. This means that if you opened for an increase in order to accumulate swaps, and at this time the bullish trend was replaced by a bearish one, then you will not see the money like your own ears.

In order to earn money, you must adhere to the following steps:

- Determine the currency pairs for which the largest swaps are charged and determine the required type of transaction.

- Study graphs of price fluctuations from a week ago and identify the type of trend, make a forecast based on technical methods of analysis. It is recommended to take an integrated approach. With the help of technical analysis, you can determine the most appropriate point to open a trading bet in a certain direction.

- Study the initial data and determine where the market is looking. Even on the weekly chart there are movements that contradict fundamental analytics. In this case, you should not open long bets. The best option will be when technical and fundamental analysis coincide.

- Identify price values.

- Make a forecast for how long the market will move in the desired direction until it returns to its original level. In this case, it is necessary to take into account volatility.

Basic characteristics of operations

The Bank of Russia establishes the following conditions for concluding currency swap transactions: the date of concluding transactions, the dates of exchange for the first and second parts, the base rate, the interest rate on rubles, the interest rate on funds in foreign currency, and also, in accordance with general market practice, announces the swap difference. The base rate is the central rate for the corresponding currency pair, calculated by the NPO National Clearing Center (JSC) on the date of trading of the Public Joint Stock Company Moscow Exchange MICEX-RTS (hereinafter referred to as the Moscow Exchange). Interest rates are set by a decision of the Board of Directors of the Bank of Russia. The swap difference is calculated as follows.

Where

- SR

- the value of the swap difference, expressed in rubles, rounded to 4 decimal places; - BKCUR

is the base rate, which is used as the central rate for the corresponding currency pair, calculated by the NPO National Clearing Center (JSC) on the date of trading on the Moscow Exchange; - PSRUB

is the interest rate on rubles established by the Board of Directors of the Bank of Russia, in percent per annum; - PSCUR

is the interest rate on funds in foreign currency, established by the Board of Directors of the Bank of Russia, in percent per annum; - D

- the number of calendar days from the day of settlement for the first part of the currency swap (excluding the day of settlement for the first part of the transaction) to the day of settlement for the second part of the currency swap (including the day of settlement for the second part of the transaction); - DГRUB

- the number of calendar days in a calendar year (365 or 366).

If parts of a currency swap fall on calendar years with different numbers of days, then the D/DGRUB

is calculated based on the actual number of days falling on each year.

“Fine-tuning” currency swap auctions

In June 2015, the system of monetary policy instruments was supplemented with “fine-tuned” currency swap auctions. The Bank of Russia may hold auctions for concluding currency swap transactions for periods of 1 or 2 days with US dollars or euros.

The Bank of Russia may decide to hold a “fine-tuning” currency swap auction if necessary to significantly and quickly increase the supply of bank liquidity. A “fine-tuning” currency swap auction for a period of 1-2 days can only be held simultaneously with a “fine-tuning” repo auction for a similar period (single auction). Such an auction is held only if credit institutions experience a shortage (deficit) of market collateral, which may negatively affect the Bank of Russia’s ability to manage money market rates.

The simultaneous holding of auctions, first of all, means the same time limit. In addition, the Bank of Russia sets the total supply volume (limit), draws up a unified register of applications and determines one cut-off rate, below which it will not enter into repo and currency swap transactions. The minimum interest rate on rubles, which can be specified by auction participants in applications, is equivalent to the key rate. Interest rates on funds in foreign currency are equal to market LIBOR rates on loans in the corresponding currency for a period of 1 day. “Fine-tuning” currency swap auctions are held at the Moscow Exchange.