Greetings to all blog readers!

Investing means constantly facing a variety of risks. Investors in their work have to accept the fact that it is quite normal to periodically lose part of their investments. This is the reality: those who do not take risks do not earn! However, this does not mean that you should simply accept losses, because investment risks can be managed. One of the most effective methods of reducing possible losses when investing is creating a portfolio of assets based on competent diversification of investments. In simple words, “do not put all your eggs in one basket,” but distribute your money between various financial instruments: shares of companies from different sectors of the economy, bonds, currencies, metals, etc. Diversification of investment risks is the most important lesson in any investment training course, so I tried to explain all the main nuances in an accessible and simple way.

Today we will look at the following questions:

- What is diversification in simple words

- What does risk diversification provide: examples

- Rules for proper investment diversification

- Limit to the effectiveness of investment diversification

- Two more mandatory types of diversification

Before we move on, a little blurb:

I would like to recommend you the investment accounting service from the partner of the Webinvestor Blog - the company Intelinvest . On it you can monitor your portfolio through the website or mobile application, and you do not need to provide passwords to import transactions. You can keep track of any assets: stocks, bonds, cryptocurrencies, precious metals, forex investments, etc. There is a functional free version for testing. If you would like to make a full subscription, use promo code 1VYV9CMSTD to get 20% off your first payment.

Thank you for your attention, let's continue!

Definition of a concept in simple words

The term diversification comes from Latin words that mean the following: Diversus - different, Facere - to do, that is, “to do differently . There is a synonym for this word "diversity" . In simple terms, diversification is a risk management strategy associated with the rational allocation of available resources to minimize losses. It means increasing the range of manufactured goods, improving the sales market, organizing new production units, investing simultaneously in several types of business, choosing multiple sources of income, and more.

Diversification is used in different ways today:

- in the economic sphere;

- in business activities;

- in production;

- in the field of finance;

- investments.

Why is diversification necessary?

The development of entrepreneurship by diversifying production and product range is logical. In parallel, other goals must be achieved, each of which is important.

- The first is the formation of subsidiaries, the organization of an entire network of branches, while maximizing market coverage.

- The second is the creation of a large-scale network of suppliers and consumers who can insure or compensate each other if a temporary gap in cooperation occurs.

In the process of business diversification, they always try to select projects that can bring maximum profit.

Measures aimed at diversifying the economy of any organization make it possible to prevent numerous negative aspects.

- When one type of product or service ceases to be in demand, it is quickly replaced by another that has increased demand.

- There is an opportunity to achieve self-sufficiency in raw materials, products, warehouses, and transportation means.

- There are reserve areas for investment and profit - the owner will be able to ensure the functioning of the company with the help of other programs in the event of a lack of development of main projects.

When it comes to valuable documents and various assets, diversification helps to distribute investments among instruments. In addition to numerous shares of enterprises, government bonds are also purchased, individual mutual funds are sponsored, real estate, currency, valuable metals, etc. are purchased.

Let's give an example of diversification in everyday life . Denis and Arseny decided to use their equivalent cash savings (RUB 500,000) to create passive income. Denis chose shares of one company on the stock exchange, and Arseny bought shares of 10 companies on the stock exchange with 25% of the capital, invested 25% of the assets in business, 25% in mutual funds, and put the remaining 25% in a bank deposit.

Arseny (in comparison with Denis) diversified his investment portfolio and minimized his risks of loss. That is, he distributed his savings between various financial instruments.

Example for business . The Hilton hotel chain was aimed at providing luxury rooms in prestigious areas of the city (mainly in the city center).

Concentrating on high-end customers meant that prospects for scaling and growing the business were limited. As a result, the company's owners decided to diversify their business and offer clients middle-class rooms, expanding the geography of their presence to residential areas of the city. This is a classic example of a related horizontal type of diversification. At the same time, geographical and assortment strategy was used, as new areas were covered and a new class of rooms was offered to customers.

Vertical integration

The diversification process with this strategy involves the company moving either up or down its production chain. In other words, the company must enter stages that preceded its current production cycle, or carry out further development. Such tactics help reduce business dependence on third parties and prevent the latter from receiving excess profits, closing all the main processes within one company.

There are numerous types of vertical diversification. They relate to situations where a company stops selling goods through retailers and opens its own wholesale and retail stores.

Vertical business integration is also observed when acquiring a supplier of raw materials and resources necessary for the production of one’s own goods, as well as when opening an auxiliary business, for example, in the sale of building materials, accompanied by offers of services for the reconstruction of houses. Such a strategy will ensure the best prices for customers and will facilitate the process of supplying materials for work.

In the field of production

Diversification of production is a kind of plan for expanding activities to other areas. It aims to improve production results, gain more profit, or prevent bankruptcy. It usually consists of simultaneous improvement of several types of activities that are not related to each other, and can extend to expanding the list of manufactured goods and services. The variety of products will significantly affect the improvement of the economic part of production, as well as the increase in capital.

Diversification of a company's production means a transition from a one-sided structure, which is based exclusively on one product, to a diversified type of production with a wide range of products. This is the expansion of active activities beyond the main business: the production of products and services with a maximum share of sales in comparison with other varieties.

Kinds

There are three main types of diversification:

- Related is a new area of activity of the company that has a direct connection with popular areas of business (for example, in manufacturing, financial supply, etc.).

- The unrelated one consists in the company changing its field of activity, switching to new technologies, taking into account emerging market needs. In a word, this is coverage of areas not directly related to the main activities of the company. Diversification is considered justified if any opportunity for integration is excluded or there are restrictions, competitors are in a strong position, or there is a noticeable decline in the market for the main product. Example: a gasoline trading company buying a furniture company.

- Combined - the most common option, consists of the merger of various companies with the aim of successful cooperation in the future. Thus, the company's portfolio is replenished with assets of the two previous types, management is divided by industry.

Strategies

In more particular cases, the following types of strategies are found:

View. 1 . Vertical or concentric is the introduction of innovations into an already well-established chain, from manufacturing to sales. Concentric is classified into direct and reverse.

Strategy 1. Direct consists of acquiring or strengthening monitoring of the structures that stand between the company and the consumer. For example, a confectionery manufacturer decides to open a store, which allows the company to work without intermediaries.

Strategy 2. The reverse consists in the enterprise joining functions previously performed by suppliers. In other words, it begins to control the sources of raw materials and the production of components. For example, a carriage manufacturing enterprise that assembles carriages from ready-made parts opens another direction - the production of spare parts.

Type 2. Horizontal - this is expanding the list of manufactured products, studying markets in other regions where sales can be carried out. This strategy is divided into two types:

- Geographic , which consists in the development of new regions, entering the market of international importance;

- Assortment , consisting of a range of products and services provided.

International is a type of horizontal, which consists of entering foreign markets for the sale of goods and implementing a globalization strategy. An example is the McDonald's company, which opens catering outlets around the world.

Unrelated diversification has its own strategies:

- Centered , when new products produced are not related to the main activity, for example, the production of so-called “peaceful” products at a military enterprise.

- Conglomerate diversification, characterized by the entry of firms into other industries that are not related to their main activities. It also includes the formation of subsidiaries that differ in their areas of activity. Sometimes this is expressed in the form of the emergence of diversified companies with one founder.

Assessment of directions

This is the third step towards business diversification. At this stage, the company must conduct a detailed study of the market, its intensity, development dynamics, trends, as well as existing competition and consumer preferences. As a result of the work carried out, a whole list of parameters appears, by considering which, you can determine the most attractive directions. This will allow you to choose the most attractive option, as well as draw conclusions:

— about long-term prospects and market potential; — the availability of the necessary amount of resources to capture a certain market share; — on the effectiveness of sales in the selected segment; — about the presence of a clear plan for financing the diversification process, which should include investments in equipment and technology, as well as in product promotion and improving the quality of work with customers.

It is also important to decide how to evaluate the effectiveness of the chosen type of strategy, and to describe in the business plan clear stages of work for the future from three to five years.

Financial Risk Management

The principle of diversification is directly related to increasing the sustainability of the enterprise. In this case, it is possible to take less into account the level of income received. When specialists conduct the appropriate analysis, the enterprise’s resources are distributed in various areas that are absolutely unrelated to each other. Here, both the stability and profitability of each direction are taken into account.

It is possible that certain parts of the market will have lower margins, but reliability is more important. This principle is actively used by investors who distribute investments in such a way that the portfolio is as reliable as possible.

Business diversification by industry and area

It covers not only production, but also the management system and the administrative part. In this way, the prerequisites are created for accelerating the development of the company, obtaining fresh ideas, and introducing newly invented technologies. The end result is the company's development of new products. In business, types of diversification are also used according to components and industries:

Price

It consists in establishing different cost levels for different categories of consumers. Prices can vary:

- according to clients' income

- according to product category

- according to time (that is, the period of setting high prices for a product or service, reducing the cost of outdated goods).

The final goal, most often, is to increase sales volumes while maintaining average profitability.

Products

This is an increase in the range of manufactured products, services and redirection of sales to other market segments. In addition, new technologies are being studied in order to gain economic benefits and prevent bankruptcy.

Product diversification is presented as a specific form of confrontation with competition in the modern market. It can be seen in the large-scale production of identical products with different modifications.

Management

With the acceleration of progress in the field of science and technology, both the theory and practice of leadership can become significantly more complex. Also, the scale of operation of enterprises, procedures for improving technologies, and improving the efficiency of personnel can also affect the complication. The consequence of this is the diversification of management - when aspects of management are expanded, they are separated according to current developments in the field.

Then there is the emergence of functional management, which is aimed at managing individual areas. For example, a financial, production, strategic, international, logistics type of management may arise.

Types of activities

This variety is directly related to the increase in the existing range of activities. For example, a real estate company begins to offer services in the field of insurance that is not related to real estate, because this is possible due to a good material, technical and personnel base.

Suppliers

This method is characterized by expanding the number of suppliers. If any disruption occurs in previously regular deliveries, the company will not need to search for alternative options; it will be enough to increase the volume of current purchases from other manufacturers.

Export

This implies an increase in the types of products or their volume, attempts to enter the market of new exporting firms. In this case, the best conditions for maneuvers are provided, and there are more opportunities to overcome the negative impact on the economy.

Market

This strategy consists of leaders spreading influence into other territories that have not previously been developed. He forms the basis for alleged attacks and organizes appropriate defense. The company is expanding its own boundaries through the active distribution of the brand and more. Expansion occurs precisely due to the diversification of markets, which makes it possible to withstand the strongest blows.

Strategies

The right direction of a business course determines its success. Therefore, at the initial stage, not only a competent theoretical program is needed, but also a complete understanding of why this work will be carried out. The stages of developing a diversification strategy involve identifying the most obvious advantages associated with this direction in business development.

Horizontal

The horizontal diversification strategy proposes the development of products or services that will be used by existing consumers. At the same time, no additional investment is required from a company or private business; it has all the necessary resources. The simplest example would be a farm: nothing prevents the owner from supplying milk and meat at the same time, because the herd will always produce both bulls and heifers. And milk and meat can be sold to the same people or stores. The disadvantage of this strategy is that it is limited to one industry and the expansion is insignificant.

Vertical

The strategy is aimed at minimizing production costs within the company. The maxim of this method is access to a full cycle, independence from third parties - suppliers, subcontractors. If we take the previous example with a farm, the owner can organize his own workshop for the production of finished products and his own store.

Concentric

The concentric diversification strategy involves the inclusion of goods or services that are not directly part of the company's production cycle, but provide greater customer loyalty. If a mobile phone manufacturer opens a workshop for assembling branded headphones, speakers and other related equipment, this is an example of such a strategy.

Conglomerate

The conglomerate diversification strategy consists of introducing several types of businesses that are in no way related to each other. This is the most resource-intensive strategy that requires large investments, but its result is the transformation of the company into a large corporation. IKEA is a good example.

Corporate

There are types of corporate diversification strategies, each of which can improve business performance and survivability. This type is a subtype of concentric, the main goal is to achieve a synergistic effect. The following conditions will be required:

- the use of similar technologies in a new type of activity;

- transfer of know-how from one area to another;

- brand transfer;

An acquisition or merger of companies is also possible.

Centered

This is another subspecies of the horizontal type of development. The centered diversification strategy proposes business expansion towards capturing customers who are interested in a service or product, but for some reason do not fall into the main target audience. For example, a company that produces expensive premium items may create a more economical version of its product. “Subflagships” and “economy class” operate on this principle.

In the field of economics

Economic diversification is applied by government units, using strategic capabilities and resources of countries and global associations. Millions of people are involved here, the emphasis is on the coordinated interaction of government agencies, legislation, and existing management systems.

The main direction is to develop, first of all, human resources, the formation of generations that look to the future and have fresh ideas in the field of technology, science, and culture.

Constant adherence to this principle will form a strong, well-developed, progressive state. It also has a significant drawback - regular fulfillment of the conditions will require enormous resources, and real success is only possible with continuous movement.

Kinds

This process in economics can be external and internal. It matters which organizations are involved. It’s one thing if the entity itself copes with the launch of new areas of production, while maintaining and continuing to develop old segments. Otherwise, outside partners from related industries are attracted.

According to its characteristics, diversification is divided into related or unrelated. Unrelated is based on fundamental changes. As a result, diversified companies often emerge.

Diversification of the investment portfolio

Investment diversification is the formation of an investment portfolio from a specific list of assets in order to reduce expected losses if, for example, prices fall.

Asset diversification attempts to mitigate the risk of financial loss. For this reason, the positive results of some investments may offset the poor results of others. The benefits only persist when the financial instruments in the portfolio are not completely correlated. In other words, there is a different reaction (almost the opposite) to market changes.

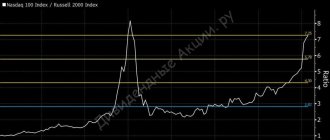

Based on the results of the research, the following became obvious: if a diversified portfolio of securities is compiled, where there are 25-30 shares of different companies, then a sufficient level of risk reduction occurs. Investing in a variety of assets provides stable growth, albeit at a much slower pace.

The chart provides a picture showing how dependent the market is on the number of assets.

Watch this helpful video: Diversification Ratio

It is the ratio of the variance of a diversified portfolio, where all assets are evenly distributed, to the variance of a stock selected at random. If the correlation between stocks is insignificant, then the mentioned diversification ratio will significantly decrease, and this is the best result from the risk side.

Strategies for Building a Diversified Investment Portfolio

There are a large number of different methods to diversify financial risks depending on the expected results.

In general, there are six effective options for the reasonable distribution of funds:

- by currencies;

- by state;

- by types of securities;

- by asset class;

- on shares of institutions from different industries;

- using index funds.

To summarize, an investment portfolio of maximum reliability must include the following assets:

- a number of deposits in various banking institutions;

- real estate on the territory of the Russian state and abroad;

- shares in ETF funds and mutual funds;

- bonds;

- shares of companies included in the MICEX index;

- investments in entrepreneurship and start-ups.

Related video:

Where is it used?

Whatever business you choose for yourself, you will probably be faced with the need to diversify your investments. This is often needed by both enterprises in general and individuals. Let's look at two cases in more detail.

At the enterprise

Industrial production enterprises face great risks. Here you have both a decrease in sales volumes and an endless increase in raw materials. To reduce losses, you need to find another source of income. That is, diversify your investments.

Let's take two vodka distilleries as an example. The first of them is focused on the production of alcoholic products. The management of the second plant managed to establish additional production of bottled lemonade and kefir. Fortunately, similar production technologies allow us to bring the project to life. In addition, they opened stores where fresh products are supplied directly from the enterprise.

Which enterprise do you think will be hit harder by the growth of wheat, the main component of vodka alcohol? The answer lies on the surface. Thanks to timely diversification of investments, the second plant will stand on its feet and compensate for losses through trade and production of other types of products.

Private investors

A thoughtful private investor should diversify his investment portfolio by investing in various promising areas, including:

- real estate;

- currency;

- government securities or shares of private companies;

- precious metals;

- antiques.

I have listed the main types of investments. You can diversify funds within one particular group. Let’s say in real estate you can buy land, residential and office space at the same time.

Examples

Example 1. Capital – 3 million rubles

At the first stage of investment, it makes sense to invest part of the funds in shared construction or purchase an apartment during the construction of a house.

This step will allow you to save about 30% of the funds for purchasing real estate and after a year and a half, resell the apartment, putting the difference in your pocket. It is better to invest in real estate no more than half of all funds, that is, in our case, 1.5 million rubles.

The remaining 1.5 million is best distributed evenly between:

- bank deposit (25%)

- foreign currency (25%)

- impersonal metal accounts (25%)

- stocks and bonds (25%) (Choose at least 10 types of securities from different sectors of the economy), while stocks must account for at least 50% of the invested amount.