A novice trader simply must know what the base and quoted currency are, and how they differ from each other using the example of a particular currency pair.

A currency pair on Forex can be considered a tool for trading operations (purchase/sale), as a result of which currency pairs form a constantly changing rate. In this article we will look at the concept of base and quote currencies, provide specific examples, as well as what features currency pairs have in the Forex market.

Direct quotation

What does it mean? In direct quotes with the US dollar, the dollar is always the base (first) currency.

For example: USD/CHF, the first (base) currency is the US dollar, the second (quote) currency is the Swiss franc. Direct quotation means how many units of the quoted currency are contained in the base currency. Essentially, the US dollar is a commodity with which trading actions are carried out: buying or selling. The second currency is the money for which the base currency (commodity) is bought or sold.

Examples of direct quotes:

- USD/JPY, USD/CHF, USD/CAD

- USD/DKK, USD/HKD, USD/RUB, USD/SGD

What is a currency exchange rate and how is it formed?

Each country has its own currency, which is one of the characteristics of a state along with territory, borders, armed forces, political system and many others. A currency is a legal tender that is used within a country and (less commonly) abroad – for example, the US dollar or the euro.

To compare the cost of different currencies, a special ratio has been developed - the exchange rate. This is the price of the monetary unit of one country, which is calculated in the unit of another. Those. This is the ratio of the currencies of any 2 countries. For example, if the dollar exchange rate against the ruble is 70 rubles, this means that for 70 rubles you can buy one US dollar: USD/RUB = 70.00.

Another example - the cost of 1 euro is 1.1 US dollars: EUR/USD = 1.10.

If we take the value of the euro against the ruble, the ratio is: EUR/RUB = 78.00.

From the presented examples it is clear that the US dollar is 70 times more expensive than the ruble. However, it is slightly inferior to the euro, since the value of the euro is 1.1 times more than the dollar. Therefore, 70,000 rubles can be exchanged (converted) into $1,000. But if you need to purchase 1,000 euros, you will have to pay a large amount, namely 78,000 rubles.

In the same way, you can measure the value of one currency relative to any other. Thus, the exchange rate shows how many times the value of one currency differs from another.

For reference: The currency in the first place is the base one, and the second one (under the line) is the quoted one. For example, in the USD/JPY pair the base will be the American dollar, and the quote will be the Japanese yen.

How to convert a reverse quote to a forward quote and vice versa

To convert an inverse quote into a direct quote, you need to perform one simple mathematical operation - divide 1 (one) by the indirect quote.

Example: GBP/USD 1.33635. That is, to buy 1 pound we will need 1.33635 dollars. If we want to find out how many pounds it will take to buy 1 dollar, we need to convert the reverse GBP/USD quote into a forward quote. Divide 1 by 1.33635 and get 0.74830. For one dollar you will need to pay 0.74830 pounds (USD/GBP 0.74830).

If it is required on the contrary - to convert a direct quote into a reverse one, then the same rule applies - 1 (unit) divided by the direct quote.

Example: USD/CAD 1.30494. To buy one US dollar you will need 1.30494 Canadian dollars. To calculate how many US dollars it will take to purchase one Canadian dollar, the direct quote must be converted into the reverse one. To do this, divide 1 by 1.30494 and get 0.76631 (CAD/USD 0.76631).

Features of the main currency pairs of the Forex market

Let's talk about the features of such basic pairs.

EUR/USD

The EUR/USD currency pair is perhaps the most popular when considered as a trading asset. It has tangible liquidity. Someone is always buying and selling it. It has average volatility and is used in thousands of trading strategies. During a trading day, the trend of this pair usually changes 3 times.

When important news is released, the pair shows significant jumps. All these points should be taken into account when trading.

In addition, the EUR/USD pair has a significant influence on a number of other pairs. The biggest movements in connection with this currency are observed in the American and European trading sessions.

GBP/USD

The GBP/USD or British/American pair is the second most traded pair. Has high volatility. It is good to predict movements using technical analysis. Often likes to show false breakouts and movements, confusing traders.

Without proven trading tactics and specific trading knowledge, it is better not to trade this currency pair. It is also important to distribute risks correctly, since there is a high probability of being left without a deposit.

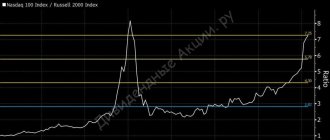

Volatility: What are the specific figures for currency fluctuations?

Main article: Market volatility: the unknown from Masterforex-V

- implied volatility or “expected volatility” is statistical data on the “power reserve” of the exchange rate based on the history of quotes on short-term (for scalping and day trading) and medium-term trends from the current price;

- historical implied volatility or “historically expected volatility” is a similar statistic for long-term trading from the current price of an instrument for use by long-term investors and position traders.

Exchange rate volatility figures can be seen from the following author’s calculations of Wiki Masterforex-V.

Additionally:

- Currencies - “allies of Masterforex-V” or between which currency pairs should we look for a “positive correlation”?

- Application of hedging: problems of analysts and their solution Masterforex-V.

- Masterforex-V: Unmistakable points for a trader to open Forex transactions;

- Forecast: how to choose the “best currency pairs” for trading TODAY and THIS week from Masterforex-V

Ruble exchange rate

- Main articles: the ruble exchange rate is..

| № | State | Currency (ticker) | Central Bank - currency issuer | RUB exchange rate | |||||

| Europe | |||||||||

| 1 | European Union | Euro (EUR) | European Central Bank | EUR RUB (euro to ruble exchange rate) | |||||

| 2 | Albania | Albanian Lek (ALL) | Bank of Albania | RUB ALL (ruble to lek exchange rate) | |||||

| 3 | Belarus | Belarusian ruble (BYN) | National Bank of Belarus | BYN RUB (Belarusian ruble to Russian ruble exchange rate) | |||||

| 4 | Bulgaria | Bulgarian Lev (BGN) | Bulgarian People's Bank | RUB BGN (Ruble to Bulgarian Lev exchange rate) | |||||

| 5 | Bosnia and Herzegovina | Convertible Mark (BAM) | Central Bank of Bosnia and Herzegovina | RUB BAM (ruble to convertible mark exchange rate) | |||||

| 6 | Great Britain | Pound sterling (GBP) | Bank of England | GBP RUB (pound sterling to ruble exchange rate) | |||||

| 7 | Hungary | Hungarian Forint (HUF) | National Bank of Hungary | RUB HUF (ruble to forint exchange rate) | |||||

| 8 | Denmark | Danish krone (DKK) | National Bank of Denmark | DKK RUB (Danish krone to ruble exchange rate) | |||||

| 9 | Iceland | Icelandic krona (ISK) | Central Bank of Iceland | ISK RUB (Icelandic krona to ruble exchange rate) | |||||

| 10 | Moldova | Moldovan Leu (MDL) | National Bank of Moldova | MDL RUB (Moldovan leu to ruble exchange rate) | |||||

| 11 | Norway | Norwegian krone (NOK) | Norwegian Bank | NOK RUB (Norwegian krone to ruble exchange rate) | |||||

| 12 | Poland | Polish zloty (PLN) | National Bank of Poland | PLN RUB (zloty to ruble exchange rate) | |||||

| 13 | Romania | Romanian leu (RON) | National Bank of Romania | RON RUB (Romanian leu to ruble exchange rate) | |||||

| 14 | Russia | Russian ruble (RUB) | Bank of Russia | — | |||||

| 15 | North Macedonia | Macedonian Dinar (MKD) | National Bank of the Republic of North Macedonia | RUB MKD (ruble to Macedonian dinar exchange rate) | |||||

| 16 | Serbia | Serbian Dinar (RSD) | People's Bank of Serbia | RUB RSD (ruble to Serbian dinar exchange rate) | |||||

| 17 | Ukraine | Hryvnia (UAH) | National Bank of Ukraine | UAH RUB (hryvnia to ruble exchange rate) | |||||

| 18 | Czech | Czech crown (CZK) | National Bank of the Czech Republic | RUB CZK (Ruble to Czech Koruna exchange rate) | |||||

| 19 | Croatia | Croatian Kuna (HRK) | Croatian People's Bank | RUB HRK (ruble to kuna exchange rate) | |||||

| 20 | Sweden | Swedish krona (SEK) | Bank of Sweden | SEK RUB (Swedish krona to ruble exchange rate) | |||||

| 21 | Switzerland | Swiss franc (CHF) | Swiss National Bank | CHF RUB (Swiss franc to ruble exchange rate) | |||||

| Asian exchange rates | |||||||||

| 22 | Azerbaijan | Azerbaijani manat (AZN) | Central Bank of the Azerbaijan Republic | AZN RU (rate of Azerbaijani manat to ruble) | |||||

| 23 | Armenia | Armenian dram (AMD) | Central Bank of Armenia | RUB AMD (ruble to Armenian dram exchange rate) | |||||

| 24 | Vietnam | Vietnamese dong (VND) | State Bank of Vietnam | RUB VND (ruble to dong exchange rate) | |||||

| 25 | Hong Kong | Hong Kong dollar (HKD) | Hong Kong parole | HKD RUB (Hong Kong dollar to ruble exchange rate) | |||||

| 26 | Georgia | Lari (GEL) | National Bank of Georgia | GEL RUB (GEL to ruble exchange rate) | |||||

| 27 | Israel | Shekel (ILS) | Bank of Israel | ILS RUB (shekel to ruble exchange rate) | |||||

| 28 | India | Indian Rupee (INR) | Reserve Bank of India | INR RUB (Indian rupee to ruble exchange rate) | |||||

| 29 | Indonesia.. | Indonesian Rupiah (IDR) | Bank Indonesia | RUB IDR (Ruble to Indonesian Rupiah exchange rate) | |||||

| 30 | Kazakhstan | Tenge (KZT) | National Bank of Kazakhstan | RUB KZT (ruble to tenge exchange rate) | |||||

| 31 | Kyrgyzstan | Kyrgyzstani som (KGS) | National Bank of Kyrgyzstan | KGS RUB (som to ruble exchange rate) | |||||

| 32 | China | Chinese Yuan (KZT) | National Bank of China | CNY RUB (yuan to ruble exchange rate) | |||||

| 33 | Kuwait | Kuwaiti Dinar (KWD) | Central Bank of Kuwait | RUB KWD (Ruble to Kuwaiti Dinar exchange rate) | |||||

| 34 | UAE | Dirham (AED) | Central Bank of the UAE | AED RUB (dirham to ruble exchange rate) | |||||

| 35 | Singapore | Singapore dollar (SGD) | DKUS | SGD RUB (Singapore dollar to ruble exchange rate) | |||||

| 36 | Tajikistan | Tajikistani somoni (TJS) | National Bank of Tajikistan | RUB TJS (ruble to somoni exchange rate) | |||||

| 37 | Thailand | Baht (THB) | Bank of Thailand | THB RUB (Thai baht to ruble exchange rate) | |||||

| 38 | Turkmenistan | Turkmen manat (TMT) | Central Bank of Turkmenistan | TMT RUB (Turkmen manat to ruble exchange rate) | |||||

| 39 | Türkiye | Turkish lira (TRY) | Central Bank of the Republic of Turkey | TRY RUB (Turkish lira to ruble exchange rate) | |||||

| 40 | Uzbekistan | Uzbek sum (UZS) | Central Bank of Uzbekistan | UZS RUB (soum to ruble exchange rate) | |||||

| 41 | South Korea | Won (KRW) | Bank of South Korea | RUB KRW (ruble to won exchange rate) | |||||

| 42 | Japan | Japanese Yen (JPY) | Bank of Japan | JPY RUB (yen to ruble exchange rate) | |||||

| American exchange rates | |||||||||

| 43 | Argentina. | Argentine Peso (ARS) | Central Bank of Argentina | RUB ARS (ruble to Argentine peso exchange rate) | |||||

| 44 | Brazil | Brazilian real (BRL) | Central Bank of Brazil | BRL RUB (Brazilian real to ruble exchange rate) | |||||

| 45 | Canada | Canadian dollar (CAD) | Bank of Canada | CAD RUB (Canadian dollar to ruble exchange rate) | |||||

| 46 | Colombia | Colombian Peso (COP) | Bank of the Republic.. | COP RUB (Colombian peso to ruble exchange rate) | |||||

| 47 | Mexico | Mexican Peso (MXN) | Bank of Mexico | MXN RUB (Mexican peso to ruble exchange rate) | |||||

| 48 | Peru | Peruvian Sol (PEN) | Central District Hospital of Peru | PEN RUB (Peruvian salt to ruble exchange rate) | |||||

| 49 | USA | US dollar (USD) | Fed | USD RUB (dollar to ruble exchange rate) | |||||

| 50 | Uruguay | Uruguayan Peso (UYU) | Central Bank of Uruguay... | UYU RUB (Uruguayan peso to ruble exchange rate) | |||||

| 51 | Chile | Chilean Peso (CLP) | Central Bank of Chile | RUB CLP (ruble to Chilean peso exchange rate) | |||||

| African official currency rates | |||||||||

| 52 | Egypt | Egyptian pound (EGP) | Central Bank of Egypt | RUB EGP (ruble to Egyptian pound exchange rate) | |||||

| 53 | South Africa | Rand (ZAR) | South African Reserve Bank | ZAR RUB (rand to ruble exchange rate) | |||||

| Cross exchange rates of Oceania | |||||||||

| 54 | Australia | Australian dollar (AUD) | Reserve Bank of Australia | AUD RUB (Australian dollar to ruble exchange rate) | |||||

| 55 | New Zealand | New Zealand dollar (NZD) | Reserve Bank of New Zealand | NZD RUB (New Zealand dollar to ruble exchange rate) | |||||

Additionally on the fundamental analysis of the ruble exchange rate:

- Economy of Russia , banknotes of Russia, exports of the Russian Federation, imports of the Russian Federation;

- Financial regulators in the Russian Federation : Bank of Russia, Regulations on the Central Bank of Russia and its functions, as well as self-regulatory organizations - RAUFR, NAFD (TsRFIN), FSFM, KROUFR

- Exchanges of Russia : JSC National Commodity Exchange, SPbMTSB, NTB, MOEX, FORTS;

- Russian stock market : “blue chips” of the Russian Federation and its stock indices - MOEXBC, IMOEX, RTS.

Exchange rate spread or why there are always two prices (purchases and sales) of currencies at exchange offices

- Main article: Spread, Ask and Bid.

Brokers, banks and exchange offices always have two prices - Ask and Bid , while on Forex charts there is always one exchange rate price. Why?

- Bid - translated means “demand price”;

- Ask - offer price.

Bid and Ask change places, depending on whether you click buy or sell. The difference between Bid and Ask is called the “spread”. Spread is the legal income of those involved in conversion (currency exchange) and Forex brokers.

In order not to get confused where is the Bid and where is the Ask, remember: Forex traders and exchanges always open and close buy and sell orders at the “worst price” , according to the same principle as the exchange office works.

Masterforex-V conclusions about base and quoted currencies

- Main article: Crisis of the gold standard: why the world became forever different

The financial world has changed forever since the 40s of the twentieth century . Financial capital has taken over the “industrial lobby”, which is why the share of “financial services” in millions of “basic” and “quoted” assets is growing in the world exponentially every decade.

One can be indignant at the absurdity of what is happening (factories are closing, shopping centers are being built in their place, everyone is trying not to “produce” something, but to “sell”), but this is an objective trend in global development

- which you can join by understanding at least the basics of successful trading for traders and investors in a world where they will never be unemployed;

- or constantly lose and lose your savings , because... the price in financial markets always goes against the “crowd”, even if they are “outside the market”. That's right, against you, even when you are not passively participating in the game.

Do you want to learn to understand the trends of what is happening around the world of finance? In order to at least not lose your savings, below is a link to join the Masterforex-V team of traders and investors.

————

Sincerely, wiki Masterforex-V, free (school) and professional training courses Masterforex-V.

Impact of the Central Bank key rate on the exchange rate

- Main articles: Central Bank key rate and its influence and What is the difference between finance and money.

A change in the key interest rate of the Central Bank is the main mechanism of the National Bank’s influence on the inflow (replenishment) and outflow (withdrawal) of capital, which means changes in the exchange rate.

The size of the key rate of the main countries of the world today can be found at the hyperlink of the main article.

How are courses formed?

Like any price, the exchange rate is formed under the influence of various factors. First of all, these are market reasons, i.e. indicators that objectively characterize the country’s economy, for example:

- Inflation;

- unemployment rate;

- gold reserves;

- trade balance;

- industrial production index;

- crude oil reserves and many others.

However, the state can influence the exchange rate independently, even contrary to the logic of the market. For example, it can set a fixed exchange rate for a certain time or conduct foreign exchange intervention (selling or buying foreign currency in large quantities).

Therefore, it is impossible to completely predict the value of a particular monetary unit. In fact, at any moment the state, represented by the Central Bank or the Ministry of Finance, can make a decision that will greatly affect the current quotes up or down.

Important! This is why it is extremely difficult to make money on currency speculation (“buy cheaper, sell more expensive”). This type of activity is extremely risky, so experienced traders do not practice it, preferring to engage in classic trading on Forex and other markets.

Thus, the exchange rate, like the value of other assets (commodities, shares, futures), is formed by the market, i.e. the relationship between supply and demand. However, the exchange rate is a very important indicator on which the price level, and therefore the quality of life of citizens, and the development of the economy as a whole depends. Therefore, the state periodically influences the value of the quote. It is the main participant in the foreign exchange market.

Forex currency quotes - Additional information

Thanks to the aggregate of traders in the market, Forex quotes reflect the best price on the market at any given time. That is why, among other markets, Forex is the most popular in the world.

This also means that each Forex quote is relevant only for a moment until the market changes. During major market movements, the actual price may even be ahead of the quote.

To better understand the dynamics of price movements, they are plotted on the price-time field in the form of a graph, which, in fact, is nothing more than a historical record of quotes.

Now that you know how to read and understand Forex currency quotes, you are one step closer to becoming a professional trader. Remember to test your new knowledge in a risk-free environment on a demo account before you start trading on a real account.

Brokers for trading exchange rates

To trade foreign exchange rates, you must open a personal account and a trading account (deposit) with a forex broker and exchange. The rating of Forex brokers from MasterForex-V traders is based on 22 objective criteria for evaluating companies - see the TOP 12 rating of the best brokers and the next 20 companies out of 68 Forex brokers of the 2nd league - these are companies that are a kind of “reserve” for the major league brokers after eliminating the detected claims:

| № | Broker name, year founded | Financial instruments and assets | Licenses from financial regulators | ||||

| Currencies | Goods | Stock market | Crypto currencies | PAMM | |||

| Major League | |||||||

| 1. | NordFX (2008) | + | + | + | + | + | CySEC, MiFID |

| 2. | Swissquote (1996) | + | + | + | + | — | FINMA, FCA, SFC, Dubai FSA |

| 3. | Dukascopy (1998) | + | + | + | — | — | FINMA, FCMC |

| 4. | Alpari (1998) | + | + | + | + | + | ARFIN |

| 5. | FxPro (2006) | + | + | + | — | — | FCA, CySEC, FSB, Dubai FSA, BaFin, ACPR, CNMV |

| 6. | Interactive Brokers (1977) | + | + | + | — | — | NFA, CFTC, FCA, IIROC |

| 7. | Oanda (1996) | + | + | + | — | — | NFA, CFTC, FCA, IIROC, MAS, ASIC |

| 8. | FXCM (1999) | + | + | + | + | — | FCA, BaFin, ACPR, AMF, Dubai FSA ,SFC, ISA, ASIC, FSB |

| 9. | Saxo Bank (1992) | + | + | + | — | — | Danish FSA, Consob, CNB, ASIC, MAS, FINMA, JFSA, SFC Hong Kong |

| 10. | FOREX.com (1999) | + | + | + | + | — | NFA, CFTC, FCA, ASIC, JSDA, MAS, SFC |

| 11. | FIBO Group (1998) | + | + | + | + | + | CySEC |

| 12. | FINAM FOREX (1994) | + | — | — | — | — | Bank of Russia |

| Second League | |||||||

| 13. | Forex Club (1997) | + | + | + | + | — | ARFIN |

| 14. | TeleTrade (Teletrade) (1994) | + | + | + | + | — | ARFIN |

| 15. | ActivTrades (2001) | + | + | + | + | — | FCA, SCB |

| 16 | FreshForex (Fresh Forex) (2004) | + | + | + | + | — | — |

| 17. | eToro (eToro) (2007) | + | + | + | + | — | ASIC, FCA, CySEC |

| 18. | FortFS (2010) | + | + | + | + | + | IFSC Belize |

| 19. | (2011) | + | + | + | + | — | ASIC, IFSC, CySEC |

| 20. | BCS Forex (2004) | + | + | + | + | — | — |

| 21. | GKFX (2009) | + | + | + | + | — | FCA, JFSA, DMCC, BaFin, AMF, AFM, Consob, CNMV, , CNB, NBS |

| 22. | NPBFX (Nefteprombank) (2016) | + | + | + | + | — | — |

| 23. | Admiral Markets (2001) | + | + | + | + | — | ASIC, FCA, EFSA, CySEC |

| 24. | Grand Capital (Grand Capital) (2006) | + | + | + | + | + | — |

| 25. | RoboForex (Roboforex) (2009) | + | + | + | + | + | CySEC, IFSC Belize |

| 26. | FinmaxFX (2018) | + | + | + | + | — | CROFR, VFSC Vanuatu |

| 27. | FXOpen (2005) | + | + | + | + | — | FCA |

| 28. | Forex Optimum Group Limited (2009) | + | + | + | — | — | — |

| 29. | EXNESS (Exness) (2008) | + | + | + | + | — | FSA Seychelles |

| 30. | HYCM (1989) | + | + | + | + | — | FCA, CySEC, CIMA, Dubai FSA |

| 31. | Alfa Forex (Alfa Bank) (2003) | + | — | — | — | — | Bank of Russia |

| 32. | Forex4you (Forex fo you) (2007) | + | + | + | + | — | FSC BVI |

Additionally : Prime brokers, PAMM brokers, brokers with cent accounts, leverage brokers, brokers with no deposit bonus, brokers of Ukraine, brokers of Belarus, brokers of Kazakhstan, brokers of Moldova, brokers of Uzbekistan, brokers of Azerbaijan, brokers of Georgia, rating of brokers of Israel, brokers of Great Britain , Swiss brokers, Canadian brokers, Swedish brokers, Japanese brokers, Australian brokers, Chinese brokers.

Euro exchange rates

Euro exchange rate online: EUR ILS (euro to Israeli shekel), EUR-KZT (euro to Kazakh tenge), EUR GEL (euro to Georgian lari), EUR VND (euro to Vietnamese dong), EUR AMD (euro to Armenian dram), EUR AZN (euro to Azerbaijani manat), EUR-CNY (euro to yuan), EUR-AUD (euro to Australian dollar), EUR-NZD (euro to New Zealand dollar), EURJPY (euro to Japanese yen), etc. ;

Additionally: fundamental data on the EU economy is presented in the following studies Wiki Masterforex-V:

- EU economy: see the main articles - the economy of Portugal, the economy of Germany, the economy of France, as well as the economy of Austria, Estonia, the Netherlands, Ireland, Montenegro, Greece, Monaco, Malta, Spain, Latvia, Finland, Italy, Cyprus, Lithuania, Andorra, Belgium, Luxembourg, Slovenia, Slovakia;

- Central Banks of the European Union that issue the euro, as well as fiat (fiduciary) money of the EU: NBS of Slovenia, Central Bank of Cyprus, Bank of Portugal, National Bank of Austria, Bank of France, National Bank of Poland, Central Bank of Luxembourg, European Central Bank (ECB), Bulgarian People's Bank bank, Central Bank of Ireland, National Bank of Slovakia, Bank of Estonia, German Federal Bank, Bank of Lithuania, Bank of Sweden, National Bank of Hungary, Netherlands Bank, NBB (Belgium), Croatian People's Bank, Bank of Spain, Bank of Finland, National Bank of Denmark, Bank Greece, National Bank of the Czech Republic, Bank of Latvia, National Bank of Romania, Central Bank of Malta, Bank of Italy;

- List of financial regulators in Europe: FSAEE (Estonia), FMA (Austria), AFA (Andorra), CNMV (Spain), BaFin (Germany), Consob (Italy), ACPR and AMF (France), CySEC (Cyprus), FCMC (Latvia) ), BCSM (San Marino), AMF (Netherlands), MFSA (Malta), CMVM (Portugal);

- Main EU stock exchanges: Euronext, FSE (Frankfurt Stock Exchange), GPW (Warsaw Stock Exchange), WBAG (Vienna Stock Exchange), OMX Group, BME (Madrid Stock Exchange), PSE - Prague Stock Exchange, OSE (Oslo Stock Exchange);

- EU stock indices: Euronext 100, DAX 30;

- Brokers of EU countries are: brokers of the Czech Republic, brokers of Sweden, brokers of Poland, brokers of Switzerland, brokers of Cyprus, brokers of Bulgaria, brokers of Hungary, bank brokers, brokers of the Netherlands, etc.;

- Payment systems with instant conversion of euros (EUR) to foreign currencies and back: Sofort, BHIM, Adyen, Alexcredit, Octopus, Carte Bleue, HumoCard, WebMoney, Eccompay, Paysera, UnionPay, AliPay, Gieldkarte, Payanyway, Rapida, VTB Online, Klarna , MultiCard, Giropay, Altyn Asyr, AliPay, ICBC, NixMoney, BEST, Privat 24, Prostir, Gazprombank, Belkart, Frisbee, Idram, RuPay, Xe com, Sofort, Pay pro, RBK Money, PayOnline, JCB, Wallet One, Paymaster , Yandex.Money, Payu, Cloudpayments, Elexnet, Platron, Robokassa, Paysend, Ecoin, Alfa-click, Momentom, Payza, Bitpay, PayOnline, Qiwi, Unistream, Fondy, Wallet One, HandyBank, Zolotaya Korona, Interkassa, etc.