What's happening in the stock market?

The S&P 500 index reached its next all-time high.

NASDAQ and Russell 2000 are recovering from February losses. The main volatility indices have dropped to their lowest levels over the past year. As stock indices rise, so do heated discussions about whether there is a bubble in the market. Investors see this as a sign of a major reset of the financial system, similar to that seen in 2000 and 2008:

- high stock and crypto prices

- Rising valuations of new public companies and SPACs

Statements from prominent investors are not reassuring. British billionaire Jeremy Grantham says:

In the near future, the stock market is facing a crash that will rival the severity of the 1929 crash.

Ray Dalio states:

While markets have not yet reached the levels seen just before the crashes of 2000 and 2008, we are well on our way to the danger point.

Is it really? What signs indicate a bubble in the stock market?

To justify this position, bubble seekers cite various arguments:

- high Shiller P/E multiple

- high Buffett indicator value

In my opinion, it is not entirely correct to look at them in isolation from the yield of risk-free bonds - American Treasuries.

Shiller P/E multiple

Robert Shiller compares the current value of the stock market with the average 10-year earnings of companies adjusted for inflation - the Consumer Price Index.

Today the indicator has exceeded 36. This is 42% higher than the 20-year average of 22.5.

Shiller P/E multiple

| year 2000 | Current | |

| Indicator value | 22,5 | 36 |

Should we be afraid of this?

Periods of sharp rise in the multiplier have also happened before during periods of recession, when company profits fell.

A similar scenario was realized in 2021, when, as a result of lockdowns, corporate profits decreased by a greater amount than the stock market capitalization increased since March 2021. This caused the effect of a mathematical increase in the indicator.

Taking into account positive forecasts for significant growth in GDP and corporate profits this year, the indicator will decline even against the backdrop of a stable or moderately growing stock market.

The ratio of P/E to risk-free yield on Treasuries does not yet indicate overbought. The 10-year US Treasury yield is currently 1.67%. This means that by investing $100 in them, your income will be $1.67. Dividing $100 by earnings gives the bond's P/E of 60.

If you buy the US stock market today through an S&P 500 ETF and become a part owner of it, then the current Shiller P/E of our top companies is 36.4.

Shiller P / E multiple of bonds and S & P 500 index ETFs

| Investments in bonds | Investing in S & P 500 Index ETFs | |

| Indicator value | 60 | 36,4 |

Shiller's P/E is questionable.

David and Goliath

And that’s where it hit the rocks: amateurs at Robinhood collided with professionals from hedge funds who valued stocks based on objective data. This only infuriated the WSB participants, many of whom began to deliberately bet against the pros. Among the main opponents of small private investors was the Melvin Capital fund, created by experienced New York trader Gabe Plotkin. Since its opening in 2013, the fund has shown results noticeably better than the market, growing by an average of 30% annually, and in 2021 even giving a one and a half times return.

Wall Street Troll

Photo: Getty Images/Bloomberg/Alex Flynn

Taking risks: how a novice investor can protect himself from scammers

There are more and more fake brokers in the stock market, but they can be easily identified by just a few criteria

It is still unclear why exactly Plotkin and his company angered WSB. The trader is not a well-known figure outside of Wall Street. As Bloomberg notes, the inhabitants of the investment group on Reddit, most likely, simply found out where the fund opened a particularly large number of positions, and decided to take advantage of it. Melvin Capital and other professional market participants shorted GameStop by amounts exceeding the value of the shares traded on the exchange. And short positions are generally more vulnerable to sharp price changes than long positions.

The short squeeze created a huge hole in Melvin Capital's finances. In a couple of weeks, the fund lost 30% of its value and was forced to turn to colleagues for help, including his former boss Steve Cohen. In total, he received $2.75 billion from them, which allowed the fund to avoid bankruptcy. Cohen's own fund has lost 10-15% of its value since the beginning of the month; Dan Sundheim, who runs one of the most successful hedge funds of 2020, lost 20%.

Wall Street Troll

US Securities and Exchange Commission building

Photo: Depositphotos

With mom to the market: the share of young investors during the pandemic has grown to 30%

The number of representatives of generation Z has reached record levels in the client bases of large management companies

The confrontation became public, and the US Securities and Exchange Commission (SEC) became interested in it. Concerted actions in the stock market are not an offense, unlike, say, calls for a collective run on banks. On the other hand, paying for posts on a social network with recommendations to buy or sell certain securities may well be outside the scope of the law. In any case, the SEC's investigation will take many weeks, perhaps months, as the situation unfolds rapidly.

Robinhood itself responded promptly: on Thursday, January 28, the platform limited trading in GameStop shares. This caused a strong reaction on social networks: users demanded that the intermediary be held accountable, and some immediately went to court, considering this decision to be completely arbitrary and illegal. On Jan. 29, it lifted the restrictions, sending the video game chain's shares soaring again, along with several other popular WSB companies, including movie theater chain AMC.

Wall Street Troll

Photo: TASS/Zuma

“Any smartphone owner can enter the stock exchange today”

Director of Tinkoff Investments Dmitry Panchenko - about what to invest in after the pandemic and how to do it correctly

Buffett indicator

Buffett's indicator is also being questioned.

Warren Buffett suggests dividing the stock market capitalization by the country's GDP. It compares only 2 indicators.

According to theory, if the ratio of market capitalization to global GDP exceeds 137%, then the market is greatly overvalued. If the indicator is below this value, especially below 100%, then the market is undervalued. Now the figure has exceeded 200%.

Buffett indicator

| The market is overvalued | The market is undervalued | Current | |

| Indicator value (%) | Exceeds 137 | Below 100 | 200 |

Graph of weighted index of company market value and US GDP

The weighted index of the market value of all US companies has been exceeding the size of the GDP of the American economy for 8 years. This does not mean that collapse will inevitably await us around the first corner.

The Fed is inflating its balance sheet, keeping rates low.

Bubble Hunt

In itself, asset growth is not a sign of a bubble. Since the dot-com crash of 2000, bubble hunting has become a mania for investors looking to make a quick buck and bet on the fall. Yes, some signs may raise concerns that investors are caught in the grip of irrational exuberance, but the risks of an imminent bubble are, in my view, low for now.

The word "bubble" suggests a speculative mania, which is seen in certain names:

- short squeezes on GameStop

- ups and downs of the entire NFT industry

In my subjective opinion, the term “financial bubble” is not entirely applicable to the stock market as a whole.

Today's market conditions are based on the following points:

- strong fundamentals

- growth in company profits

- reduction in household savings

Over the past year, stock market growth has largely been driven by a rally in technology stocks. But it seems to me that making direct comparisons with the technology bubble before 2000 is not entirely correct.

At the end of the 1990s. the technology sector was in its infancy. Its contribution to America's GDP was negligible. At the same time, the value of dot-com shares then reached completely irrational estimates.

Today the technology sector:

- provides the US economy with 18 million jobs

- brings more than $500 billion in annual taxes to the budget

Its contribution to the country's GDP is more than 15%.

Most companies in the markets grow much faster than any national economy because when scaling a business:

- costs are reduced

- profitability and profits increase

- company capitalization is growing

This is what is happening for companies that fall into the following sectors:

- BigTech

- FAANG

In my opinion, today the economy is experiencing a new industrial revolution, which is based on innovative technologies in absolutely all segments of the economy: from banks and healthcare to machine control and artificial intelligence. Technologies of the Internet sector have become an important part of our lives. This is the future.

Therefore, the rise in the value of technology stocks reflects the most significant technological innovations in human history. We have never experienced anything like this before.

Not all IT companies are profitable, and not all of them will ultimately survive in the face of fierce competition. But the industry giants are doing very well, and the companies show no reason to worry.

The largest funds that track stock indexes buy assets in proportion to the capitalization of companies in the index. They place their greatest bet on large, stable IT corporations that have already won their place in the sun.

Expected global economic growth

In 2021, the global economy is expected to grow by $4.6 trillion (5.5% of global GDP growth).

This can be compared with the pace of global economic recovery after:

- Great Depression

- Second World War

Then the US stock market grew by 416% in 20 years, and it showed the first 200% growth in just 7 years.

Stock market growth during World War II

| In 7 years | In 20 years | |

| Height (%) | 200 | 416 |

There are certain inflated market segments:

- crypt

- NFT

However, it is unlikely that the current rise in share prices has led stock markets into a bubble. Therefore, I look at the medium-term prospects for the markets with moderate optimism.

This all works with the support of central banks, which supply the markets with liquidity. This is an important point to acknowledge. If there weren't such a bombardment of money from central banks, of course we wouldn't see such high valuations! But it will also be difficult for central banks to abandon the policies they have chosen to support the economy and markets.

When the Federal Reserve System announces its plans to raise the rate from the near-zero level, when it begins to slowly wind down its balance sheet, the markets will react to this. Most likely, it will be in 2022, unlikely earlier. There will be a correction. A similar reaction was observed in 2021. But the Federal Reserve will also not be able to quickly get out of the stimulating policy it is currently pursuing.

As for the growth of inflation, so far what we are seeing is a moderate increase, which fits well with the controlled concept of the American Central Bank.

If inflation suddenly starts to skyrocket, the Fed will try to regulate it.

In my opinion, we still have a certain number of years until this moment.

When there are signals that the Fed will normalize policy, we expect a correction in the markets. But a correction is not a collapse or a huge collapse in which you need to jump out of the window.

“Perhaps a crypto winter awaits us for several years”: the market lost a trillion dollars in a day

The day before, the roller coaster that the Bitcoin exchange rate periodically puts on went into a steep decline mode. In the morning, literally in just two and a half hours, the cost of the most famous cryptocurrency fell by 6%, Photo: “BUSINESS Online”

Bitcoin's value has halved, the market has lost a trillion dollars

The day before, the roller coaster that the Bitcoin exchange rate periodically puts on went into a steep decline mode.

In the morning, in just two and a half hours, the cost of the most famous cryptocurrency fell by 6%, to $42.9 thousand, according to CoinGecko, and in just a day, Bitcoin dropped by a third. On the largest exchange by volume, Binance, the value of this cryptocurrency as of 16:13 decreased by 29%, to $31.4 thousand. During the day, the lowest point was exactly $30 thousand, and in total, from the April historical maximum, Bitcoin fell in price by more than 2 times. This is the biggest drop since March last year. However, the cryptocurrency partially came out of its peak in the evening: thus, by 20:00 the Bitcoin exchange rate had risen to $39 thousand, approximately at this level it remains today (on May 20, as of 10:00 Moscow time, Bitcoin is trading at $40 thousand).

Bitcoin pulled other currencies along with it. Thus, Ethereum dropped by 34.2% over the week (one-day losses of this cryptocurrency were also the largest since last March), and Shiba Inu, whose donated tokens were recently burned by Vitalik Buterin , lost 62% of its capitalization over the week. Dogecoin, which after two tweets from Elon Musk by the end of April had risen 63 times since the beginning of the year, fell by 21%. Most of the other currencies also found themselves in the red zone - against this background, one of the largest US cryptocurrency exchanges, Coinbase, experienced a failure: the website did not open, and shares of the exchange, which entered the Nasdaq in April, fell by almost 10%.

According to Reuters estimates, the loss of market capitalization for the entire cryptocurrency sector was close to $1 trillion (according to other sources - $900 billion). RBC, with reference to the bybt service, records that over the past 24 hours, crypto traders lost over $8 billion, the margin positions of 726 thousand users were forcibly liquidated, one of them - $67 million on the Huobi crypto exchange paired with Bitcoin.

Panic was felt at all levels. Thus, the co-owner of one of the largest cryptocurrency exchangers in Tatarstan, CryptoBank24, who wished to remain anonymous, said that the number of requests to him yesterday increased 4 times compared to the period when everything was quiet on the exchange. “Yesterday and today there is a lot of both selling and buying. They are sold mainly by alarmists, people who are afraid of a further collapse, and those who simply want to fixate and not waste their nerves every time they enter the stock exchange. There are also those who are now actively buying at the bottom, expecting a rebound upward. In percentage terms, approximately 70 percent are sold and 30 percent are bought,” he records.

The influence of Elon Musk’s posts on cryptocurrency is not limited to fluctuations in the Dogecoin rate. Moreover, according to one version, the last steep peak of Bitcoin is precisely connected with the position of the founder of Tesla Photo: © Britta Pedersen / dpa / www.globallookpress.com

Did Elon Musk crash the market? Or maybe the Chinese?

Let us remind you that a powerful impulse in cryptocurrencies occurred in February from the level of $29–30 thousand per bitcoin. The growth trigger was the news that Tesla acquired $1.5 billion worth of coins in January. After doubling the price of the cryptocurrency, the company itself and its founder Elon Musk suddenly lost interest in it. In March, Tesla reported selling $272 million worth of coins with a profit of $101 million. Last week, the company said it had temporarily suspended accepting bitcoins due to its unsustainable mining practices. “We are concerned about the rapidly growing demand for fuel for Bitcoin mining and transactions, especially coal, the worst fuel in terms of emissions. Cryptocurrency is a good idea for various reasons, we believe it has a promising future, but it cannot cost the environment that much,” Musk commented on his decision.

After such a tweet, investors rushed to sell assets, and Bitcoin fell by more than 16%. It’s strange that Tesla didn’t seem to think about this aspect before buying the cue ball. By the way, electric cars themselves cannot be called an absolutely “green” product: in a number of countries, electricity is produced using coal, resources are also needed for the production of batteries, and conditional emissions, taking into account charging losses, exceed the footprint of hybrid cars such as the Toyota Prius. The environmental friendliness factor of electric cars will increase sharply with a massive transition to renewable energy sources, such as solar energy.

Musk dealt the final blow to Bitcoin on May 16 with another post on Twitter. He delighted his subscribers with the news that Tesla could sell or has already sold its investments in cryptocurrency. According to Musk, Bitcoin is extremely centralized and controlled by several mining companies, and mining was paralyzed due to the flooding of one of the coal mines in China. After this, Bitcoin fell below $45 thousand for the first time in three months, losing 20% of its market value. Crypto enthusiasts have long been outraged by Musk’s influence: as part of the fight for the independence of courses from the social networks of the founder of Tesla, they have already released the StopElon token. Its market capitalization, by the way, has already exceeded $22 million, and against the backdrop of recent events, yesterday’s rate increased by 125%.

However, a number of experts associate what is happening not with Musk, but with China’s attempts to minimize the influence of Bitcoin and free up a niche for the digital yuan. The day before, a joint statement by three banking and Internet industry associations appeared on the account of the Central Bank of China on the national social network WeChat that financial and payment institutions should not accept cryptocurrencies as payment. After this, the chart of exchange rates rapidly fell down.

“The digital yuan is not exactly a cryptocurrency, it is a central bank digital currency (CBDC). It does not have the main properties of crypt - anonymity and irrevocability. But it can be colored: for example, maternity capital can be given to her, it will not be possible to spend it on other purposes. Therefore, the introduction of the digital yuan may indirectly affect the rate of cryptocurrencies, but there will be no fewer Bitcoin users,” says the creator of cryptorobotics, Ivan Shcherbakov .

China has been closely regulating cryptocurrencies for several years now. Thus, back in September 2021, the Central Bank of China banned ICOs (initial coin offerings) under the threat of license revocation. Since 2021, trading in cryptocurrency and its use as a payment instrument have been prohibited in the country, but such transactions were still carried out on the Internet, which could not but worry the authorities.

As a result, the day before, the National China Internet Finance Association, the Chinese Banking Association, and the Payment and Clearing Association of China warned that if consumers contact cryptocurrency and suffer losses, no one will reimburse them (BBC translation). Authorities are convinced that the volatility of crypto markets threatens the security of assets and disrupts the “normal economic and financial order.”

Elon Musk’s cryptocurrency – Dogecoin Photo: © Yuriko Nakao / AFLO / www.globallookpress.com

Thirst for correction, risk of inflation and rising funding costs

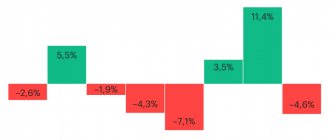

How did the stock market react to the cryptocurrency crash? After prolonged growth in the stock market and other assets, bearish sentiment has reigned over the last 2-3 weeks. Although the leading indices are losing within 5%, individual stocks, including those beloved by Russian investors Alibaba, Virgin Galactic, as well as a host of companies in the technology sector, have lost tens of percent from their recent highs. The same Tesla, which is on the short list of favorites of Russian retail investors, bringing owners up to a thousand percent in 2020, has already lost more than 37% from its January peak at $900 and is trading at about $560 per share. It looks like we are in for an epic fight between the “bulls” led by the famous investor, ARK Invest founder Kathy Wood , who believe that the shares could soon reach the coveted $1 thousand per share, and the “bears” led by Michael Burry , who stand on that Tesla is another bubble and the quotes could “lose” another tens of percent. Recall that Burry made his fortune betting against the US mortgage market, which collapsed in 2008 due to a high share of subprime loans and a large overhang of related derivatives. The first known bear publicly stated that he was shorting Tesla in December 2020, before the stock even peaked. Again, as the pros say, both “bulls” and “bears” can make money, the main thing is to find the right entry and exit point for the asset.

Also today, the focus is on accelerating inflation, especially in the commodity group. Market participants have repeatedly noted that quotes do not correspond to the level of actual demand for many goods; prices are much higher than pre-pandemic levels, although many countries have not completely emerged from lockdowns. The only exception here is the shortage of semiconductors and chips caused by increased demand for equipment for remote work and trade disputes between the United States and China. Again, exorbitant prices will either attract new players to the market or limit demand for the corresponding goods. Also, the latest inflation reports in the US lead investors to believe that the largest participant in all financial markets, the US Federal Reserve, will begin to wind down stimulus programs and raise the key rate, which will raise the cost of money and put pressure on many assets, especially those sectors that have been growing rapidly in recent quarters . Here we are talking about cryptocurrencies and shares of high-tech companies, which include Tesla.

“News from China also added to the panic, although nothing new happened here either - the country has been banning crypto since 2014” Photo: © Budrul Chukrut / Keystone Press Agency / www.globallookpress.com

“This is a story about an overheated market”

Experts interviewed by BUSINESS Online agreed that the collapse in the crypto market was long overdue and shifting the blame to the Chinese and Tesla will not work: too many factors influence the exchange rate, and the market has long been in need of recovery. “This is a story about an overheated market,” Shcherbakov is convinced. — Experienced people have been expecting a correction for a long time, since February. It's ripe. And the news background simply fell on the heated market, and what happened was what happened.” According to the expert, Musk should not be blamed for everything, but if he had done something like this on the stock market, a criminal case would have happened. But so far, fortunately or unfortunately, this is not the case in crypto.

“Cryptocurrency traders have been frightened by news from China for almost 10 years. This is already the 8th or 9th time that negative news from China has had a slight impact on the market, but the Chinese themselves definitely do not trust it. I was there in 2021, in September, when they banned ICOs - at that time there was a major blockchain summit in Shanghai. They called me from Russia, everyone was panicking and selling, and the Chinese smiled and said that most of those who write such laws have their own crypto assets, mining equipment, and all this is a classic technique: influencing market emotions, fear and greed “- notes Shcherbakov, emphasizing that after these publications, the realities in China will practically not change. “These measures are aimed at forcing home crypto investors to sell their crypto assets. He will still buy it later, but at a higher price,” says Shcherbakov.

Kamil Sakhaliev , CEO of Soramitsu Labs, also agrees with him in absentia “When the rapid growth began, a lot of people began to come to the blockchain who had no experience with cryptocurrency. Even when “helicopter money” was being distributed in the USA, many young people bought Bitcoin: they saw that there was a crypt, it was growing and it made sense to invest money in it. And recently, many factors have coincided that have greatly frightened new investors. Moreover, all these events were not surprising to experienced players: they are no strangers to turns in the cryptosphere and price jumps. But their calmness is understandable: they bought their bitcoins for 1 thousand dollars and now on Twitter they simply laugh it off, saying, it’s cool, the discounts have arrived, you can buy more. And the newcomers, who bought crypto for 30-40 thousand dollars, panicked, they began to collapse the market,” says Salakhiev. Our interlocutor admits that news from China also added to the panic, although nothing new happened here either - the country has been banning crypto since 2014. Nothing has fundamentally changed, distributed finance has not gone away, crypto exchanges work as before, new blockchains continue to develop.

“The next two weeks will be decisive. It will be clear that this is another correction that the market will win back, or the beginning of a new bear market, and perhaps we will plunge into crypto winter for several years." Photo: © Viktor Tolochko, RIA Novosti

“Now on TikTok, 14-year-old experts with three months of experience are advising on what levels to buy at.”

“The next two weeks will be decisive. It will be clear that this is another correction that the market will win back, or the beginning of a new bear market, and perhaps we will plunge into crypto winter for several years. But in the long term, interest in this will still increase,” says Salakhiev, noting that the monthly “red” candle on the chart has never been so large. “We knew that such leaps would happen; it didn’t turn out to be a very big surprise.” Companies in the cryptosphere understood that if this happened, there might be a little less interest in their products from random people, but, fortunately, we managed to launch what we wanted.”

On the Polkaswap exchange, developed by Salakhiev, as well as on other platforms, all tokens fell in price. “Some lost more, some lost less, but overall nothing terrible happened. There were a lot of different activities on ether (Ethereum): yesterday was a very good day for miners who work on ether, because there were a lot of operations: everyone suddenly began to withdraw something, different exchanges even closed the withdrawal of funds because it has become too expensive,” Salakhiev records what is happening, emphasizing that he does not give investment recommendations.

“Yesterday’s collapse will affect different market groups differently. For some, this is the first experience of such a drawdown,” says Shcherbakov. — For example, a beginner took Dogecoin or Ethereum a month ago. Most likely, during this drawdown he succumbed to emotions and sold. But even if not, he had a good, sobering experience. And those who have been in crypto for a long time, who have long-term goals - for many years - yesterday had a good opportunity to buy more. Many of my comrades managed to buy 32-33 cue balls, the collapse had a positive impact on this part of the market, many were waiting, many friends even celebrated it, because they wanted the market to improve a little. Now on TikTok, 14-year-old experts with three months of experience advise at what levels to buy and sell, and on federal TV channels pensioners talk about mining. This is, of course, a sign of an unhealthy market, and yesterday there was a recovery.”

Most experts, according to Shcherbakov, are inclined to believe that a correction awaits us, but only a few hope for a big increase in the summer. Most likely, in the summer the cue ball will be in the range of $20–40 thousand, and in the fall there is a possibility that we will see its cost in the region of $60–140 thousand. “Assuming that investing is a long-term goal for 5-10 years in the future, you need to invest in coins with deep fundamentals. In addition to Bitcoin and Ethereum, I would pay attention to Solana, Atom, cardano and exchange tokens - BNB, FTT, NT,” recommends Shcherbakov.

“In the coming days, we will understand whether Bitcoin has reached the bottom, or whether the fall will continue for some time” Photo: pixabay.com

“Governments of different countries have used various words to vilify cryptocurrency.”

We interviewed a number of financial experts to assess who was hit hardest by the crypto collapse, who was the beneficiary, and to provide investment advice.

Daria Generalova is an expert in the field of blockchain, ICO market, ICO marketing, cryptotechnologies and cryptocurrencies:

— This is not the first time Bitcoin has fallen rapidly. At the end of 2017, Bitcoin, which only geeks used to talk about among themselves, hit the front pages, its rate rose quickly, and then an equally rapid correction occurred. This time, Bitcoin went through a new round of popularization - institutional investors believed in it, a number of famous people publicly supported it, which led to a new wave of emotional investments and subsequently to the same natural correction. Today, Bitcoin is still the most popular cryptocurrency, and changes in its rate are closely related to the rate of other digital currencies.

In the coming days, we will understand whether Bitcoin has reached the bottom or whether the fall will continue for some time. Even if the bottom has already been passed, historical charts tell us that Bitcoin will more or less stably consolidate somewhere near the current level in the coming months. For a quick return to the $60,000 mark, something out of the ordinary must happen, and this scenario is unlikely. Those who will suffer the most will be those who bought Bitcoin at its peak and sold it, succumbing to general panic, during the current fall. Usually these are emotional purchases and sales for relatively small amounts. The winners will be institutional investors who have a much higher risk tolerance and planning horizon - they can afford to invest large sums while cryptocurrencies are at the bottom, and wait for their future growth, despite spikes in volatility over the horizon of days and weeks, even if the wait takes months or years. And Musk will probably win - I don’t think he would have made a statement like the one he’s already made without some kind of plan in advance. But it is not a fact that we will know about this.

In everything related to investing, I firmly believe in the principle of do your own research and the need to rely on your own analysis, situation, risk profile, etc., so I will not give advice. An investment purchase decision (we are not talking about trading here) must in any case rely on forecasts on a much longer horizon - will Bitcoin become the same generally accepted asset as gold, public stocks, and so on? If you believe that it is (and I believe so), then over the horizon of several years the potential value of the asset is much higher than the peak that has already been passed, and the current price surges are in any case unimportant. If not, it may not be your asset.

Of the cryptocurrencies that are worth a closer look, I would name Binance Coin - it has recently grown significantly more in percentage terms than Bitcoin, and has also lost more in the current fall. It has high growth potential and is backed by the embedded value that Binance brings to the table. This does not mean that I advise investing in it - the risks in this case are also high, so do your own research and your own soul searching.

Arseniy Poyarkov is a member of the State Duma’s expert council on digital economy and blockchain technologies, co-owner of the first professional agency for assessing digital assets DigRate:

— Since last year, a huge bubble has been inflating in all financial markets, and it is inevitably corrected, including in the crypto market. It’s just that the latter differs from classical financial markets in that there is less penetration of large capital and less mobility, because most of the market is in the gray zone. Therefore, it reacts to everything a little differently than the main financial market, however, the basic principles are the same. The market in its current state is looking for a reason for a correction, because it is very overbought. What Musk says, what China says, are just formal reasons. After all, no one has banned Bitcoin before, and governments of different countries have used various words to vilify cryptocurrency. This also sometimes led to small corrections, and sometimes went completely unnoticed. Even in China, there were quite harsh not only statements, but also actions.

The main reason why the market fell is because it simply got too high. Now it is still at significantly higher levels than it should be, based on investment logic. My forecast is that this is the first wave of correction, in which retail investors should enter the market in large numbers, who did not have time to enter it earlier. On this wave of correction, the types that collected a large share of the cryptocurrency at the beginning of the year will emerge, because then we saw record levels of Bitcoin retention among the main players, that is, the concentration of ownership has greatly increased. Or they buy it in order to sell it, and in order to sell it, they need some kind of fund. The first wave of sales has taken place, now retail investors will come to the market again in large numbers and sell again.

Yan Art - expert of the State Duma Committee on the financial market:

— It’s just that after another very exciting growth, steam is being let off. Therefore, many investors (I practically do not work with cryptocurrency, as an expert) nevertheless assess this story as normal. It’s not the professionals who ran after Bitcoin shouting that “it’s a panacea, the grail” and dreamed of getting rich—it’s only today that they [were surprised]. And so it moves in the same way as many relatively innovative instruments in the history of the stock market: it comes out, a certain excitement, enthusiasm arises, takes two steps forward, one step back and moves on.

The two extremes of the cries “Bitcoin at 100 thousand is inevitable” and “Bitcoin is generally a bubble” seem to me to be wrong.

Today, a lot depends on the position of major players, in particular Elon Musk, who with his statements influences Bitcoin both positively and negatively. His recent decision, on the contrary, to roll back and refuse to sell Tesla for bitcoins was not a pleasant moment. This plays on the hype in such a way that any serious unpleasant signal would lead to this, which, in fact, is absolutely expected. Nothing unexpected happened. In many ways, [Bitcoin’s behavior] will depend on the behavior of those who can already be called market makers. Elon Musk is definitely a market maker.

Naive investors, crypto fans, who perceived that investing in cryptocurrency would enrich them, increase their capital tenfold, will suffer; accordingly, they got into it with their last money, often borrowed. Serious investors working with Bitcoin, and Bitcoin has long ceased to be the lot of boys and programmers, will not suffer. Most of them are prepared for this situation.

There is a positive - a good cooling shower. Because there was a danger that people would see cryptocurrency as a 100% working panacea. Here in the soul there is a huge plus for that part of society that is interested in different options.

Mikhail Belyaev - expert at the Russian Institute for Strategic Studies, Candidate of Economic Sciences:

— The reasons [that are pushing Bitcoin down] are very simple. We must first look at what pushed Bitcoin up - just the hype and the desire of people to make money on the fact that this rate is rising all the time. This is a self-promoting system. Messages from Elon Musk were also fueled, then MasterCard announced that it would accept bitcoins for internal payments - this increased its attractiveness. It seemed that he had finally found some kind of normal support. Then these messages were denounced and recognized as those that were not being implemented. Therefore, Bitcoin has lost its support, lost its attractiveness in itself, its self-promotion and the expectation that it is rising and rising all the time, because it will finally find application in normal economic circulation.

Actually, it has no economic support, except for the boundless faith of people that it will grow endlessly. When these "supports" were removed, it fell down, as predicted by those who understand what Bitcoin is. A very simple explanation, purely psychological. That is, he grew up on the psychology and desire of people to make money, which was reinforced by rumors that he had found economic support. When these “supports” were removed and the excitement ended, he flew down. It will not fall to zero - it will stop somewhere around 30 thousand dollars, maybe a little higher or lower - for one simple reason: many people bought these bitcoins at this very price and will wait for the next wave of increase, not wanting to deal with them breake down.

China, with its statement that it is not going to support Bitcoin and will not accept it as a currency, has banned transactions in Bitcoin in any form, it's all from the same basket. These are not the main reasons, but the fact that it has no economic support is the most important reason.

There [will be] no long-term consequences. Those who bought Bitcoin above 30-35 thousand dollars and did not have time to get rid of it will find themselves at a loss. That's all, it will not affect the economy of any countries in any way, because it did not participate in internal circulation anywhere and did not affect any domestic economy. [Losses] will be suffered by specific people, investors who were involved in this, but not everyone. Some will keep them, while others, perhaps in the hope that they will someday begin to grow again, bought them at this price. But this is an individual story, it is not widespread and does not relate to any national economy.

You never need to buy them. They should be purchased only for a very short period, when you can clearly predict that its rate will increase. You can buy in the hope that it will grow. When he grows up, it will be necessary to find a second person who blindly believes in Bitcoin, to whom he can sell it in order to turn it into money with which he can buy inventory items. I advise people who do not want to take risks, are at least a little familiar with the laws of economics and are not gamblers on this exchange, to refrain.

Yaroslav Kabakov - Director of Strategy at Finam Investment Company:

— In recent years, the correlation between the cryptocurrency market and financial markets has increased, and in the current environment, investing in cryptocurrencies is no different from investing in high-risk stock market instruments.

Volatility for major cryptocurrencies will remain quite high in the near future, as shown in 2017–2018; attempts to rebound after large-scale sales in Bitcoin may well lead to renewal of historical highs; the movement of capital in this market segment cannot be analyzed, and large participants may well have a significant impact on the course of trading.

The current sales are not critical for the cryptocurrency market; to a certain extent, an increase in interest against the background of a correction may provoke additional interest from investors. And even more so, discussions about zeroing are inappropriate.

Yuri Mazur - Head of Data Analysis Department at CEX.IO Broker:

— The local bottom has already been reached at levels near 30 thousand dollars per Bitcoin. If the negative background continues to support the bears, a short-term decline to the level of $26 thousand for BTC is quite likely. If we talk about altcoins, then their dynamics in the near future will be guided by Bitcoin, so an even greater decline in the BTC/USD pair will lead to a drawdown of the entire digital asset market. The restoration of the main cryptocurrency will give a fundamental impetus to the affected altcoins. In a positive scenario, if BTC returns to the range of $52–58 thousand, Ethereum may return to values around $3.5 thousand, also ensuring the growth of DeFi project tokens in the ETH network. We believe that for a more accurate forecast it is necessary to pause and look at the development of events.