The US national debt in 2021 is associated with objective historical reasons. America has long been the site of an influx of immigrants from Europe.

The Irish and other peoples sought there. One of the reasons for the financial crisis was the influx of migrants. Which, in turn, left its mark on the economy of the entire country.

The US national debt is associated with objective historical reasons

General information about the US national debt

At the moment, the national debt of the United States has exceeded the mark of 22 trillion dollars. The amount is huge and psychologically difficult for ordinary Americans to comprehend, especially since it is constantly and rapidly growing. The US Treasury Department monitors changes in the national debt. The US national debt has the following structure:

- 27% – intragovernmental debt to various state companies (pension fund, for example);

- 33% – public debt to various individuals and banks;

- 40% – debt to foreign creditors.

US government borrowing ratio table (data as of August 2021)

| A country | State loan, billion $ | State loan, % |

| China | 1110 | 16,8 |

| Japan | 1100 | 16,7 |

| Great Britain | 640 | 9,7 |

| Brazil | 306 | 4,6 |

| Ireland | 271 | 4,1 |

| Switzerland | 231 | 3,5 |

| Luxembourg | 230 | 3,5 |

| Cayman islands | 216 | 3,3 |

| Hong Kong | 206 | 3,1 |

| Belgium | 191 | 2,9 |

| Saudi Arabia | 177 | 2,7 |

| Taiwan | 171 | 2,6 |

| India | 155 | 2,4 |

| Singapore | 140 | 2,1 |

| France | 125 | 1,9 |

| South Korea | 115 | 1,8 |

| Other countries | 1206 | 18,3 |

| Total debt to foreign countries | 6590 | 100 |

China and Japan are the largest holders of US government bonds totaling $2 trillion 210 billion. The average yield on all securities they own is 2.6% per annum. Russia has reduced the number of American securities in its assets, and today it has invested only $14 billion in the US economy.

The United States backs its national debt with securities issued by the Treasury. Anyone can purchase them at one of three hundred annual auctions. Bonds, although the least profitable, are the most reliable securities, because supported by property and assets of the state.

US Treasury Securities:

- Bills of exchange are the most unpopular because... Their validity period is less than a year, and therefore the interest rate on them is the lowest.

- Medium-term bonds for a period of one to 10 years with an interest rate of 0.3 to 2.6% per annum.

- Long-term bonds are valid from 10 to 30 years and have a yield of 3.2% per annum.

- Treasury securities at 3.2% per annum and for a period of 30 years are the most reliable, because for them the state additionally pays amounts that compensate for inflation.

It will be useful!

Where and how the MoneyPap family invests (successfully) (PDF) . In this document, I honestly tell you what profitable instruments my family invests in. Download the PDF for free - here.

——————-

Mini-course “How to choose the best American ETFs.” Get step-by-step instructions with dozens of screenshots of how I choose ETFs for myself (!!!) and for clients. ETF is exactly the tool that allows you to earn from 10-20% (and more) in dollars per year! Price - only 1,200 rubles! Find out more here.

Ratio of public debt to GDP of individual countries in %

| wdt_ID | A country | Public debt to GDP, % |

| 1 | Japan | 235 |

| 2 | Greece | 191 |

| 3 | Sudan | 176 |

| 4 | Venezuela | 162 |

| 5 | Lebanon | 161 |

| 6 | Italy | 128 |

| 7 | Barbados | 127 |

| 8 | Portugal | 117 |

| 9 | USA | 110 |

| 10 | Singapore | 109 |

Speaking about public debt, it is indicative to recalculate the state’s external debt to the country’s population. Every US citizen owes more than $67,470 thousand. For comparison: for Africans it is only 60–100 dollars per person, and in Switzerland 27 thousand in American currency.

Demand doesn't match supply

The significant US federal budget deficit, which could reach 20% of GDP this year and remain high for the next year or two, will lead to an excess supply of new government bonds. Crowding out effect (“crowding out effect” - a decrease in private investment caused by an increase in government spending and, as a result, an increase in government borrowing and interest rates) will then lead to the devastation of the market in 2021, eliminating almost any borrowing by the corporate sector in the market, which will hit the economy. An increase in rates on first-class long-term loans is inevitable, since the Fed regulates the short-term rate, and to regulate long-term rates the Fed needs to directly buy long government bonds. 8

If the Fed fails to buy enough government bonds to avoid a strong rise in long-term rates without driving up inflation, the long-term trend of lower interest rates will break (see Charts 6 and 7 below), leading to a revision of expectations by key market participants and a gradual increase in rates on all long-term bonds in the future. A similar situation developed in the United States in the late 1950s, which led to an increase in interest rates in the 1960s and 1970s with a simultaneous unwinding of the inflationary spiral: the Fed rate from 0% in 1958 over several economic cycles reached 20–22% in 1980

At the same time, it is unknown how foreign residents who have been financing the US budget deficit for many years will behave. China and other emerging economies may, for political reasons or because their reserves are falling, turn away from the United States. Then either the government debt pyramid will begin to fall apart, having lost donors, or the Fed will significantly increase the monetary base, creating inflationary risks. All this will put pressure on bond prices in the market.

Changes in US national debt in the 20th century

The national debt of the American state did not arise yesterday. The US has been running budget deficits since the 1960s. and are forced to borrow funds from private lenders and foreign governments.

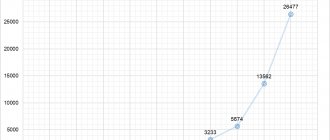

Table of changes in US national debt

| Year | Public debt, billion $ | Year | Public debt, billion $ |

| 1910 | 2 | 1990 | 3206 |

| 1920 | 26 | 2000 | 5628 |

| 1930 | 16 | 2010 | 13528 |

| 1940 | 50 | 2015 | 18627 |

| 1950 | 256 | 2016 | 19949 |

| 1960 | 290 | 2017 | 20164 |

| 1970 | 380 | 2018 | 21408 |

| 1980 | 909 | 2019 | 22571 |

The percentage of America's public debt to its GDP peaked in 1946 at 121%. This situation was a consequence of the huge military expenditures of the state during the Second World War. Further dynamic development of the country's economy made it possible to reduce this figure to 36% by the beginning of the 1980s. However, then the growth of public debt was already much faster than economic growth. Huge investments into the military-industrial complex and participation in several armed conflicts (Iraq, Syria, Yemen) played a big role here. Therefore, by 2012, the volume of public debt again exceeded 100% of GDP. Today this figure is 110%.

In 2021 then US presidential candidate Donald Trump promised to reduce the size of the national debt within 8 years. However, during his tenure in power, the country's national debt increased by 10%

Experts say that the US national debt will continue to grow steadily in the future. But in America there is a law according to which the country's government loans are limited by the so-called national debt ceiling. Today, the United States can borrow for any amount until September 2021, the national debt indicator on this day will be considered the ceiling. The problem, most likely, will be solved by the United States authorities in the traditional way - by raising the ceiling of its national debt.

History of debt

The US government first fell into debt in 1790, after the Revolutionary War.

If the debt increases, as long as the proceeds are used to stimulate economic growth in a way that will lead to long-term prosperity for the country, that's one conversation. Because when debt is used to finance economic growth, current and future generations can reap its benefits. However, when debt is raised simply to finance public consumption, for example, for social services. needs, medical needs, education, defense and transportation - the use of debt loses a lot of potential.

Over the past 60 years, the US government has been spending more than it earns in fiscal payments. Only briefly during the booming economic markets and the Clinton administration in the late 1990s did US debt levels decline significantly.

Why is America being credited?

There is a combination of factors at work here.

- The United States has been the most economically developed power in the world for over a century. The whole world consumes products produced in this country. Oil refining, biochemistry, pharmaceuticals, mechanical and aircraft manufacturing, energy, high technology, entertainment and services are actively developing, and with them GDP is growing by an average of 3% per year.

- The United States is the homeland of many world-famous companies, whose capitalization more than covers the country's national debt. For example, the total capitalization of just six American companies Facebook, Alphabet, Microisoft, Amazon, Apple and Berkshire Hathaway is $3,400 billion, which is equal to the US debt to Japan and China. And these are only 6 out of 30 enterprises whose capitalization exceeds $100 billion.

The capitalization of only 6 American companies covers the total US debt to Japan and China.

- The USA is one of the most visited countries by tourists. About 70 million people a year come here to see New York, Washington, Las Vegas and Disneyland.

- Loan rates in the USA are among the lowest, and the inflation rate is only 2%, which makes this country very attractive for everyone who wants to start a business abroad. Every year the population of the American States increases by 1.2 million people, and it should be noted that not only residents of South America come here. A huge number of entrepreneurs move to the States in order to invest in the economy of their new country of residence.

- People come to America and get an education that is one of the best and highly rated in all countries of the world. And foreigners are willing to pay a lot of money for this education.

- Recently, the United States has been actively returning its production from Asian countries to its homeland. Now it is more profitable to build a high-tech automatic plant, which will be serviced by only a few engineers, on your own territory, where energy is inexpensive and tax rates are preferential, than to keep a huge staff of workers on the other side of the world, whose labor is no longer the cheapest.

- Agriculture is also quite profitable in this country. The United States occupies a leading position in the world in terms of grain exports. Supplies of semi-finished poultry products also go to many foreign countries.

- Not to mention the music and film industries, which no one can overtake.

- The US national debt is calculated in that country's currency. The dollar is the most popular currency in the world, which is most often used for monetary transactions.

According to various rating agencies, the United States has the highest credit rating and is therefore entitled to lower interest rates on its loans.

It is a mistake to think that a large external debt of the state is bad. The rules for lending at the international level are no different from issuing loans to individuals. It is much easier to obtain borrowed funds for those countries that have a strong economy, rich mineral resources, a high standard of living and a favorable investment environment. Such borrowers are guaranteed to return the funds invested in the bonds and all interest due to the lender. The worse the situation in the country, the more wary the creditors' attitude towards it. The United States has the highest public debt indicators, however, the economy of this state is one of the most stable and strong in the world, so few doubt that the country will fulfill its obligations to creditors.

American residents themselves have ambivalent attitudes towards their government's debts. Naturally, many of them are afraid of a situation in which the need to pay off the national debt will result in increased taxes and tariffs, reductions in wages and social benefits. But there are also those who are sure that they won’t have to pay off their debts at all, because... no country in the world will go into conflict with such a strong military power.

Content

- 1. “Unattractive for investment”: the price will fall, the profitability has gone into the negative zone

- 2. Government mistakes exposed America before the crisis: the budget deficit and national debt continue to grow

- 3. Credit stability has weakened

- 4. Demand will not match supply

- 5. Political risks of selective default or seizure of assets

Anton Prokudin, leading methodologist at Expert RA

Russian banks have traditionally placed their foreign exchange reserves in low-risk assets abroad. In terms of bonds, government bonds of developed countries are in first place. The Western government debt market has been a safe haven for investors for decades, but recently the system has begun to break down. The sharp increase in the budget deficit of many Western countries has shaken the foundations: investors increasingly began to doubt the absence of risks when investing in once reliable assets.

Why do investors stop trusting US government bonds? Brief conclusions:

- US government bonds (Treasuries) were previously considered by banks as a risk-free asset for placing foreign exchange reserves. But the US national debt is already very large and constantly growing, which does not meet the criterion of repayment of the debt assumed by the best borrower. One of the main current risks of investing in Treasuries is the possibility of default in the medium term or repayment of debt with heavily depreciated money.

- In addition, American government debt has a negative real yield and is expected to fall in price: US government bonds are becoming cheaper due to excess supply and insufficient demand from non-residents.

- The sanctions policy of the American state also makes its own adjustments: the real risk for Russian investors is the possibility of asset seizure or targeted refusal to service debt.

Why does the US spend so much money?

When talking about a country's national debt, it is important to consider what its government is spending such huge amounts of money on. America's main spending items are:

- Medicine. About $1.1 trillion is spent on various programs in this area:

- medical care for citizens with certain diseases, as well as pensioners over 65 years of age;

- qualified assistance to low-income segments of the population.

- Financial support and social protection programs for pensioners and disabled people. About $1 trillion is allocated for such events.

- Defense. America spends $1.3 trillion to defend its territory and participate in various military operations abroad.

- Other significant expenses: public transport, education, international politics.

How to buy American bonds in Russia

To buy US securities, American citizens simply need to open a brokerage account, find a suitable asset and complete the purchase. Russians cannot take advantage of such a scheme due to the fact that these instruments are not traded on the Moscow Exchange.

To buy American bonds in Russia, you can go in two ways:

- Open an account with a foreign broker (for example, Interactive Brokers) and make investments through it.

- Offer the purchase of the securities of interest to a Russian brokerage company that has a foreign subsidiary.

Interactive Brokers, by the way, is already a fairly popular American brokerage company that provides services to Russians to enter international markets. The broker has a Russian-language interface and insurance of assets up to half a million dollars.

There is no need to notify the tax inspectorate in the Russian Federation about opening a foreign account.

Among the disadvantages of such cooperation:

- High entry threshold – from $10,000.

- Not suitable for beginners: it is still worth training in stock transactions on Russian platforms.

- You need a foreign currency account in a Russian bank.

- Unattractive tax policy for non-residents.

- There is a risk of being subject to sanctions, in which the account may be frozen.

In addition to Treasury bonds themselves, you can also invest in ETFs that include them.

On the Moscow Exchange, as I already mentioned, there is an ETF from FinEx (FXMM). The cost of one share is approximately 1.5 thousand rubles.