Many of us are now concerned about the question of what will happen to the national currency this year. After all, the standard of living of ordinary citizens largely depends on changes in the ruble exchange rate, since the depreciation of the national currency negatively affects inflation processes, which we all constantly see on the shelves of our stores in the form of price increases.

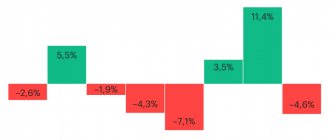

Over the course of 2021, the ruble demonstrated its instability, depreciating against the dollar by 19.3% and against the euro by 30.9%. Now we are fully experiencing this in our own wallets.

Now we see that the ruble has strengthened a little, but how long will this last and what can we expect in the future?

Will rising oil prices help the ruble?

The price of oil has been rising recently, but we have not seen a radical strengthening of the ruble due to this. Let me give you some numbers to demonstrate this.

As of January 1, 2021, the price of Brent oil was $51.80 per barrel; yesterday this type of oil was sold for $62.59 per barrel. That is, the growth was almost 21%. At the same time, as of January 1, 2021, the ruble exchange rate against the dollar was 73.87, and yesterday the rate was 73.72 rubles per dollar. As you can see, we are not seeing a strengthening of the Russian ruble with rising oil prices; it has strengthened by only 0.2%.

Thus, we can state the fact that the increase in oil prices has practically no effect on the strengthening of our national currency. This is because due to the reduction in production, the volume of oil exports has decreased significantly, which has affected the decrease in the volume of foreign exchange earnings.

Expensive oil is, of course, beneficial for filling the budget, but the rise in price of “black gold” makes the ruble neither warm nor cold. But the decline in oil prices is more likely to drag the ruble along with it again.

What to do? Should I buy dollars or is it too late?

The main rule in any situation is not to panic and not make impulsive decisions. If your savings are in a ruble deposit, let them stay there. If you close your deposit early, you will lose the accumulated interest.

Buying a currency at highs during a panic is not the best option. Remember what happened in 2014-2015, when people stood in lines buying dollars for 70 rubles and more? Many of them then sold the currency for 10-15 rubles cheaper.

Don't forget about liquidity. If you may need money in the coming weeks or months, buying currency is doubly dangerous. You won't be able to buy medicine with dollars, make your mortgage payment, or fix your car.

Don't listen to financial analysts who know exactly what a dollar will be worth in a month or a year. Nobody knows this. When preparing the budget for 2018-2020. The Ministry of Finance of the Russian Federation has laid down a forecast for the price of oil and the dollar exchange rate, on the basis of which budget revenues are calculated:

| Year | Dollar exchange rate | Oil price |

| 2018 | 64,7 | $ 43,8 |

| 2019 | 66,9 | $ 41,6 |

| 2020 | 68,0 | $ 42,4 |

Projected rates included in the Russian budget for 2018-2020.

As we see, these values are far from reality. How much the dollar will cost in a month - no one knows the answer to this question, but since hundreds of analysts give their forecasts, one of them will definitely be right.

Money is fleeing the country and dragging the ruble with it

Last year, when oil prices began to fall, we observed a mass flight of foreign investors from the Russian market. But even now, with oil prices above $60 per barrel, ruble assets are not becoming more attractive. This is all due to foreign policy risks, growing inflation in the country, as well as a low key rate. All these factors force investors to withdraw funds from Russia and transfer their savings to less profitable, but much more stable financial instruments of developed countries (More details ➤).

Quotes of government bonds and other ruble assets are declining due to falling demand, which entails a depreciation of the national currency.

“Non-residents do not want to take on currency risk - this is also one of the factors putting pressure on the ruble exchange rate. Those inflationary processes that are occurring partially limit the propensity for ruble placement. In addition, there is a “local” factor of pressure on the ruble - this is a sharp transition by the Ministry of Finance of the Russian Federation from selling foreign currency to buying it, and such a change in the balance of supply and demand has a negative impact on the ruble,” says Yegor Susin, head of the Center for Strategy Development at Gazprombank.

The analyst who predicted the dollar at 100 rubles explained his forecast

— You recently predicted the possibility of the ruble falling to 100 rubles per dollar. Under what conditions could something like this happen and to what extent is this a realistic scenario?

“One way or another, such a scenario will happen anyway, it’s only a matter of time.” Let's look back in 2011, the dollar cost 28 rubles, in 2014 - 33 rubles. Now the rate fluctuates around 75 rubles, having reached 78.5 rubles three weeks ago.

Over ten years, the Russian currency has fallen in price by 2.6 times. And over the past year and a half, the ruble has lost 25% - and this despite the fact that oil now costs about the same as before the coronavirus crisis. That is, the ruble is constantly depreciating against the dollar.

Consequently, even if no global political or foreign economic shocks occur, then within 5-7 years the ruble will still be pulled up to the 100 ruble mark. But now there are circumstances that can collapse it relatively quickly. We are talking about a possible drop in oil prices, an armed conflict in the Donbass with the participation of Russia, disconnection from the SWIFT international banking payment system, a sanctions ban on government debt and corporate bonds, a trade embargo, large-scale sanctions against the oligarchy and the property of businessmen close to the authorities. And the trouble is that all these factors, while hypothetical, could actually happen, if not in the coming weeks, then during this year.

— What factors now have the greatest impact on the ruble exchange rate: oil prices, the state of the Russian economy, American sanctions, the conflict in Ukraine, worsening relations with Europe?

— Let’s remember: the ruble was approaching a high of 78.5 rubles on April 6 against the backdrop of an escalation of the conflict on the border with Ukraine and the military gathering there, according to the official wording “for exercises.” The reaction of the foreign exchange market to the new sanctions from Biden was quite calm, since the ban on participation in the initial placement of government debt had been planned for a long time, and the share of non-residents in Russian government bonds (OFZ) is now about 20% - all government debt is bought mainly by domestic state banks. From this we can conclude: the May mood of the national currency will depend on oil prices, the sanctions agenda and the situation around Ukraine.

— Since you are talking about May, what are the greatest risks for the ruble expected this month and what is your short-term forecast for the exchange rate of our national currency?

— Shocks are possible already during the May holidays - a European Parliament resolution to disconnect Russia from SWIFT, a ban on oil and gas imports, freezing the assets of oligarchs and stopping Nord Stream 2 could become a reality. If such a package is adopted, then the ruble can easily exceed the historical minimum of 85 rubles per dollar - at least in the moment.

Alexey Krichevsky. Photo: academybusiness.ru

— We are all about the depreciation of the exchange rate... Is there a chance for the ruble to strengthen in the near future and under what conditions is this possible?

— Stabilization of relations between Russia and the West is necessary. As can be seen from the dynamics of exchange rates, oil quotes now actually do not play a big role in relation to the strengthening of the ruble, since even despite the reduction in production by about 10%, the rate is now weaker than last year by a quarter. Therefore, the risks and opportunities for the ruble now, in fact, are only political, and tax payments and the sale of foreign currency earnings are one-time points of support.

— If the ruble does collapse, assess the consequences for ordinary Russians and for business. How much can imported goods become more expensive, and how will inflation rise in general?

— The market reaction in this case will not be immediate, since contracts for the supply of products and equipment are concluded at least several months in advance. But force majeure circumstances in the form of sharp exchange rate fluctuations may force suppliers and counterparties to reconsider the conditions for the release of goods. That is, as soon as the warehouses run out of goods purchased at a lower rate, the prices for these groups will immediately be reflected in the price lists.

It’s definitely worth waiting for new queues at bank exchange offices; more discerning people will rush to change rubles on the Moscow Exchange. But the problem with such currency speculation is that the largest volume of purchases occurs precisely at the moment of the cost peak.

Theoretically, a new surge of interest in new buildings is possible (for those who have savings left), but this will be a completely terrible decision in attempts to preserve savings - the real estate market is already extremely overheated and has entered a period of stagnation, and a sharp rise there may be replaced by an even sharper one fall. To describe the situation in a nutshell, the commodity market and the retail market will react to the devaluation with a gap of several weeks. With one “but” - if there is not the same crazy panic as in 2014, when people bought everything they could - household appliances, cars, real estate.

— What would you advise the average person who has some free money (say, 100 thousand rubles): should they now convert it into dollars or euros, buy the necessary household appliances, or put it deeper “under the pillow”?

— The optimal currency basket seems to be the ratio 50-25-25 or 40-30-30 in favor of the ruble.

You can save 10 dollars and 10 euros for every 1000 rubles. But you need to understand what kind of savings these are. For a simple “little money” for a conditional “rainy day”, such a currency ratio is quite suitable. If this is money set aside for investment, then you can simply assemble a diversified portfolio of American and European dividend-paying companies along with Russian stocks or bonds. This will provide constant foreign exchange income. I want to emphasize: the most dangerous thing that can happen to any person’s savings is their owner’s panic.

The main thing is not to give in to it, since any crisis will end anyway and the situation will stabilize, and losses from impulsive financial decisions for a particular person and his family can be very large.

The economist doubted the effectiveness of measures to curb price growth

Watch the video on the topic

What is the exchange rate and how is it set?

Money in economics is a commodity, and a commodity has its own price. The price of a currency is the exchange rate.

The exchange rate is the relationship between currencies, i.e. how many monetary units of one country can be bought for one monetary unit of another.

For example, the dollar to ruble exchange rate at the time of writing is 73.46 to 1. It turns out that for 1 $ we will get 73.46 rubles. In another way, the relationship between currencies is also called purchasing power parity.

The issuer of the US dollar is the Federal Reserve System (FRS). It is not subordinate to the government, is independent, and, of course, acts in the interests of its country. But the Fed’s decisions are followed by economists and investors around the world, because stability in the global market largely depends on them.

The dollar is a freely convertible currency. Its rate is set based on supply and demand, which are influenced by two sides of the global foreign exchange market:

- Importer. He purchases goods abroad for $, and sells the products within his country for national currency. This is how demand is formed.

- Exporter. He sells his goods on foreign markets for $, exchanges them for national currency, for example, to pay taxes, buy domestic raw materials, etc. This is how supply is formed.

The difference between supply and demand is reflected in the balance of trade. If the latter increases, therefore, the demand for $ increases. An increase in demand leads to an increase in the exchange rate. And vice versa. A decrease in the trade balance is accompanied by an increase in supply and a depreciation. The stability of the national economy depends, among other things, on the balance between exports and imports, that is, when the difference in trade volumes tends to zero.

Prospects for the ruble by April

The head of the Alpari Information and Analytical Center, Alexander Razuvaev , noted that the main positive factor for the Russian ruble is the beginning of a rate increase cycle. Investors are confident that the Bank of Russia will not repeat the mistakes of the Bank of Turkey and at the end of the year the key rate will be 5.5–6%. Raising the rate will greatly slow down the outflow of capital and, despite serious sanctions risks, will attract hot capital to Russia.

“Russia cannot exclude the threat of disconnecting the country from the SWIFT interbank payment transfer system. However, this threat, as well as sanctions against OFZs, has been talked about for several years. Markets are accustomed to these conversations. Oil prices are also at a comfortable level. For the foreseeable future, it will remain within our target of $60–70 per barrel of Brent. Until the end of March, we are targeting an exchange rate of 73–75 rubles per dollar and 87–90 per euro. Markets fear that the financial crisis in Turkey will become global and could cause a sovereign default in one of the debt-troubled countries. Including Ukraine, the peak in Ukrainian debts occurs in September,” explained Alexander Razuvaev.

Federal News Agency /

According to him, this year, against the backdrop of expensive oil, an increase in the key rate of the Bank of Russia, and the recovery of the Russian economy, there is a serious, fundamental potential for strengthening the ruble. Closer to the summer, additional demand for the ruble will come from the money of international speculators, who will select Russian dividend shares (Sberbank, Surgut Pref., Severstal) in anticipation of the closure of the register on dividend payments.

“Additional inflows into Russian shares on the Moscow Exchange during such periods can reach several hundred million dollars. But to buy shares, you must first buy the Russian ruble. Levels of 72–73 rubles per dollar and 86–88 per euro are likely in the spring of 2021,” concluded Alexander Razuvav.

How to save ruble savings?

First of all, let’s divide all existing savings into three groups:

- Short term. Money that will be needed in the coming weeks;

- Medium term. May be needed this or next year;

- Long-term. Will not be needed in the next 2-3 years.

Short-term savings should be as liquid as possible. Keep this money in rubles on a bank card with interest on the balance or in a savings account at 6-7% per annum.

Medium-term savings - money in bank deposits with monthly interest capitalization. The deposit period is from 6 to 12 months. The deposit amount should not exceed 1.4 million rubles at the end of the term. Remember that bank deposits are insured up to this amount. If your savings exceed this amount, open two deposits in different banks. All banks must be members of the DIA.

long-term savings in different currencies. Some are in rubles, the other are in dollars or euros. Use investment instruments denominated in different currencies - stocks and OFZs in rubles, Eurobonds in dollars, exchange-traded funds and ETFs focused on the economies of developed countries and precious metals. Pay attention to dividend stocks, use the tax deduction from the state on IIS.