Before entering the market with significant investments, you first need to study its features, as well as the nuances of binary options trading. Specialized books on binary options will help you not only get the most complete picture, but also build an effective strategy for future trading.

However, the complexity of this literature lies in the fact that almost all of it is written for investors (and not for traders as such) and, as a rule, by foreign authors. Despite the fact that most of the training material has been translated into Russian, a lot of useful information still has to be gleaned from foreign resources.

2 BEST OPTIONS BROKERS YOU CHOSE!

No verification required! | review | reviews | START TRADE WITH 10$ Deposit from 5$. New broker! | review | reviews | TRY SIGNALS

RECOMMENDED: THEY REMAIN LEADERS ON FOREX!

| Deposit from 0$. TOP2 strategies | TRADING TERMS | review | reviews Deposit 100$. TOP3 TS. TRADING TERMS | review/feedback Deposit from $1. How to get $1500? TRADING TERMS | review/feedback

Technical analysis

Once upon a time, one of the main textbooks introducing the theory of predicting price movements was Jack Schwager’s book “Technical Analysis”. In it, the author tells on 800 pages how to predict investor sentiment and follow the trend in trading. Now, for a basic introduction to technical analysis, the introductory course of the same name from Reuters is invariably recommended, in which the subtitle immediately targets the target audience: “Course for Beginners.”

This book is praised for its simplicity, accessible presentation of material that even people with a humanitarian mindset can easily understand, and relative brevity - the 2011 edition (Alpina Publishers) has 185 pages. (True, 15 of them are a list of stock exchanges with addresses and telephone numbers, 10 are an English-Russian dictionary of terms and the same number are an introductory part).

The textbook, in addition to explanations, also contains test questions with answers on the topic, and consists of 6 chapters:

- At the beginning, basic concepts are introduced and the origins of technical analysis (Dow Theory) are described.

- Chapter No. 2 describes types of charts, including the famous “Japanese candlesticks”.

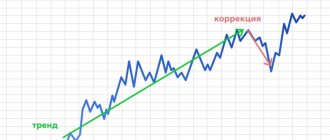

- The third chapter begins the classic analysis of charts - it explains what trend lines, support-resistance, reversal and continuation-consolidation patterns are.

- The fourth chapter is entirely devoted to indicators: scholastic oscillators, MACD, relative strength index.

- Chapter No. 5 – about the theories of Elliott waves, Gann charts, Fibonacci numbers. And although the author does not specifically indicate binary options as a field of application of knowledge, all this toolkit becomes the main one for a binary options trader. All this is given with tables, graphs, and calculations.

- Chapter six is a description of one day in the life of a technical analyst. But it will also be useful for understanding the atmosphere of trading and feeling, as the author writes, the “taste” of this serious matter.

In addition to this manual, the works of the following authors are also devoted to technical analysis:

- Akelis Stephen wrote about technical analysis "From A to Z".

- A. A. Erlich, in his “Technical Analysis of Commodity and Financial Markets,” the second edition of which was published back in 1996, delves into the topic, focusing on a knowledgeable audience.

- Michael. N. Kahn, in his version of “Technical Analysis”, also tries to convey to the reader the basics of the subject in as simple a language as possible, as evidenced by the subtitle of the book “Simply and Clearly”. One of the main objectives of the book is to learn to understand the language of Forex trading, but also for binary options traders (and not only beginners), the book will be useful.

- Bill Williams, a trader with 35 years of experience (at the time of publication), believes that with his book “Trading Chaos” he found an organizing order in a natural phenomenon that does not obey the classical laws of physics, linear mathematics or parametric statistics” (as he called the market ). In his “Long-Term Secrets of Short-Term Trading,” Williams covered those issues that did not fit into the format of the first work.

- Thomas R. Demark released his book with a postscript in the title "The New Science." It is curious that, although the author believes that the science presented is accurate, he does not guarantee that the indicators and methods will certainly bring profit, even if looking back at past successes.

Most of these books, even if they are stated as textbooks for mastering the basics by beginners, become useful for traders who have been working in the market for a long time, since the books structure existing knowledge and help develop their own system.

Fooled by chance. The hidden role of chance in markets and in life - Nassim Talleb

The main idea of the book is very unexpected for the vast majority of people - if a person is lucky in life, then it is likely that he is not a genius who has developed a successful strategy, but a simple lucky person. On the stock exchange, everything is the same as in life - there are trading strategies using which someone breaks the bank, but no one knows about the many investors who followed them and did not achieve success. The book is very useful for developing the right attitude towards life and the stock market, in particular.

Strategies

It is convenient when all strategies are grouped in one source of information. Therefore, the list of books devoted to trading strategies and their elements is headed by the encyclopedia.

D. Kats, D. McCormick “Encyclopedia of Trading Strategies”

The book by D. McCormick and D. Kats “Encyclopedia of Trading Strategies” in the Russian edition has almost four hundred pages. But it is valuable not only for its combination of most popular strategies, but for their detailed and even scrupulous analysis, accompanied by special tests. As you read, the reader additionally:

- gets acquainted with historical data and analogies,

- exposes many myths circulating among traders,

- switches to scientific and practical “rails” in relation to methods for organizing various trading systems.

Based on the strategies listed in the work, you can create your own, focusing on professional tips for improving risk control, abandoning potentially over-risky and unprofitable methods.

K. Feis “The Way of the Turtles”

The real story of the development of a trader who went from an amateur to a legend is described in the book “The Way of the Turtles” by Curtis Face. The name is telling. It reflects both the complexity of trading work and the pace of achieving high performance. A participant in an experiment conducted on a bet told his story: Richard Dennis defended the opinion that successful trading can be learned. As proof, he undertook to bring amateur traders into trading leaders. Face was one of those who became one of the “turtles” and confirmed the success of Dennis’ training methods, earning millions. What exactly they did and how the learning process went, Feis described in the book.

V. Safonov “Practical use of Elliott waves in trading”

In his book, the author spoke about Elliott waves (about Elliott wave analysis) to quite experienced traders. The work is valuable for its combination of theory and description of its practical reflection in practice.

Elliott waves are considered one of the most complete concepts of technical analysis, which provides in-depth study in the applied aspect.

Valery Safonov does not ignore the difficulties of practical application of Elliott wave analysis, offering scenario algorithms in response depending on the typology of wave combinations, and describes typical trading mistakes. The author pays special attention to making trading decisions and forecasting.

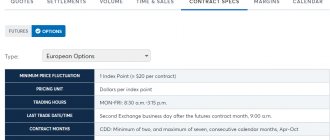

S. Natenberg “Options”

Already from the subtitles of this book it follows that the book talks about assessing value and volatility, and discusses options trading methods and strategies. The principles and rules for trading futures and stocks collected in the book can also be applied to binary options.

The book is large (541 pages in the Russian edition), but it covers important issues in more detail. The materials underlying the work are taken from manuals for traders of the Chicago Stock Exchange, so the theory is also confirmed in it with practical examples. Before publication, the author admitted that he was worried about the interest of the target audience - whether there would be demand among the few professionals. His fears turned out to be unfounded, since the text is easy to read, and, for the most part, understandable even to not very sophisticated traders.

Almost all books in this group assume that readers have basic knowledge, since they are devoted to an in-depth study of the topic.

Books on binary options for beginners

Some books written by experienced traders are difficult to get acquainted with for beginners who do not yet understand binary options. Therefore, it is also important to select the material so that it is accessible and understandable.

Every beginner simply must pay attention to such literature if he wants to succeed. You can study in your free time. It’s easy to download an electronic version of any publication, send it to a tablet computer, smartphone or other device.

The knowledge gained there will certainly yield results. The material is perceived very simply if written by experienced professionals. There may be additional graphic images and tables that are effectively stored in the traders’ heads.

Nowadays literature about binary options is very popular. Thanks to it, you can get almost all the information necessary for successful trading.

After reading it, it will be easier to understand the correct choice of brokers, study the basic tools, strategies and everything else.

For beginners, materials on the following topics will be useful:

- Specifics of trade.

- Basic concepts.

- Graphical analysis.

- Potential hazards, risks.

- Analytical tools for work.

- Strategies.

- Signals and much more.

Think like a trader

There are no fewer books on trader psychology published than books on trading techniques, since the psychological aspect at a certain stage of the educational process becomes the most influential.

Moreover, this influence on the process is noticeable not only from the psychology of the trader, but also from the psychology of investors. The following literature teaches the ability to think like a professional and correlate market sentiments with one’s own sentiments (where necessary, show will and discipline and restrain oneself):

- A. Elder in the book “Basics of Exchange Trading” talks about his journey as a trader, starting from the very basics. Already the fourth of 261 chapters, Alexander Edler called “Psychology - the key point,” and in the future he repeatedly raises this topic, which is reflected in the names of large sections of subsections (“Psychology of personality,” “Psychology of the market,” “Psychology of the crowd” and others) . The work includes both classical analysis of graphs and the topic of the possibilities of computerized analysis, but these parts are also based on the psychology of the process in different aspects.

- “The Psychology of Finance” by Lars Tweed is about how psychological issues can influence the price movements of financial assets.

- “Psychology of the Forex Market” by Thomas Oberlechner is also not about binary options, but about Forex, but when it comes to the psychology of market participants, the difference becomes not so significant.

The sources indicated in the list of references will not exhaust the topic of the options market, but will significantly strengthen the knowledge of a trader who studies binary options at any level of immersion.

Modern books on binary options trading

There is similar literature for users of different levels. There is introductory material that provides visual examples of the use of specific information, certain strategies, and everything else.

You can find optimal approaches for effective work. The result will be obtained only on the basis of constant training and practice.

The quality of training depends on several points:

- Attentiveness and level of books.

- A harmonious combination of learning and practice.

- Developing strategies based on reading literature, etc.

The books provide a large amount of information, both introductory and quite serious. If you set yourself goals to achieve a certain level, you need to study modern books.

It is unlikely that you will be able to choose the best tools for productive trading. The knowledge that can be gleaned there becomes a kind of engine, a pushing mechanism for obtaining a stable income.

The knowledge gleaned from books will become the foundation of your success. By God, stop being lazy and thinking that luck will come to you: to achieve something, you need to try. But let the thought that all this is REAL support you!

The ghost of the stock exchange. Art Simpson

This book is one of the most mysterious publications. All material is presented in the form of a dialogue between the author and the mysterious hero - the “ghost of the exchange”, one of the most successful traders of the Chicago Mercantile Exchange, who never gave his name. The book is devoted to everything that any private trader will have to become familiar with when entering the world of futures and options. “Ghost” gives invaluable advice to beginners, which allows them to almost instantly move up several steps in their understanding of the principles of successful trading. Despite the fact that the name of the “ghost” is never mentioned in the book, the trading professional will have no shadow of a doubt that, whoever he is, the “ghost” is a specialist of the highest qualifications in the field of stock trading.

The book is recommended for all categories of traders: the advice given by the “ghost” is the enduring wisdom of speculation in financial markets.

Secrets of stock trading - Vladimir Tvardovsky, Sergey Parshikov

A very successful book about working on the Russian stock market. The authors have created a real textbook on online trading, which contains not only theory, but also covers many practical issues. Much attention is paid to the technique of performing operations and risk management methods. The material is presented in an accessible form, without complex mathematical calculations. Since the book was written, trading technologies have been actively developing, but it will still be extremely useful, especially for novice investors.

A course of motivating articles from N. Fuller

A young investor working with very provocative methods for stock trading. Fuller uses simple, but at the same time effective approaches to clarify complex terms, without which it is difficult to imagine a successful investor.

Fuller also bases himself on examples from his own practice of what trading styles, methods and tools should be used in a given force majeure situation.

The author describes his unique, personal method that can be used for trading. We are talking about an improved version of candlestick analysis.

This article discusses teaching aids that are characterized by simplicity of presentation and effectiveness. Which first book to read depends on your preferences and goals.

Interesting material:

- 09/24/2018 When can you trust negative reviews about binary options and when can you not? There are quite a lot of reviews on the network about different brokers and binary options in general, since trading as such became known over 7 years ago. During this time, many have already [...]

- 09/08/2017 Advantages of trading with the Binomo broker After the trader has gone to the official website of the Binomo brokerage company, he is faced with an interesting design, a trading terminal, and the opportunity to undergo quick registration. But, […]

- 01/20/2019 How to choose a binary option for trading: 7 criteria A large assortment of trading instruments confuses novice traders. Therefore, it is not always easy for a beginner to choose an asset, an indicator, a tactic for himself to achieve a positive […]

- 01/29/2018 What is Monero? There are several hundred cryptocurrencies in the world, and Monero (XMR) is one of the ten most popular. The popularity of Monero is ensured by the increased anonymity of transactions. On […]

- 04/11/2018 Strategy for binary options Abominog The strategy for binary options “Abominog” is a paid trading technique that is presented in several versions and costs 1000 rubles. On sales websites it is positioned […]

Theory and practice

The most important thing to remember is that it doesn’t matter much how many books a trader reads before he starts trading. Books are only a tool that introduces a trader to the binary options market, but only the trader himself can gain trading experience.

In order to learn to use the acquired knowledge competently, a trader will make many mistakes, unprofitable trades, take unnecessary risks... This is normal, this is how it should be, this is just experience. It is important for every trader to do them, because only after going through mistakes and failures can one say with confidence that they have learned to trade binary options.

Gain knowledge from books, use it in practice, make mistakes and learn from them - this is the path of a novice trader. You can't prepare for everything, it's impossible. But every trader who dreams of achieving success in trading should read technical literature and try out hundreds of strategies and indicators from their own experience.