olegas Sep 30, 2015 / 106 Views

Different strategies for investing in stocks involve emphasizing different opportunities for generating income from them. Thus, a speculative strategy is based on extracting profit from the market value of securities (in this case, relatively short-term positions are usually opened on them), and a conservative investment strategy involves much longer-term investment of money in shares and the main item of income in the form of part of the profit (dividends) from business of the company issuing shares.

Next, we will talk about the main indicator that determines the potential income of a conservative investor - the dividend yield of shares. Let's start by refreshing our memory about what types of shares there are and how dividends are calculated and paid on them.

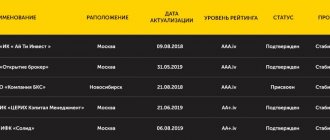

Dividend yield of shares listed on the Moscow Exchange for 2015-2017.

Formula for calculating dividend payout ratio

Option #1. The formula for calculating the dividend payout ratio on the balance sheet is as follows:

In the balance sheet, net profit is reflected in line 2300 of Form No. 2. The amount of dividends is on page 3327 Form No. 4.

Option #2. Formula for calculating the indicator using EPS:

Where:

DPS (English: Dividends Per Share) – dividends per share;

EPS (English: Earnings per share) – earnings per share.

Option number 3 . Calculation formula using the reinvestment rate (REP):

DPR = 1- REP

REP = Retained Earnings / Net Earnings

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Frequency of dividend accrual

The frequency of payment of dividends in an LLC can be as follows: once a quarter, once every six months or once a year (Clause 1, Article 28 of the Federal Law of 02/08/98 No. 14-FZ “On Limited Liability Companies”; hereinafter referred to as the LLC Law ). The organization has the right to choose any option and enshrine it in its charter or in a decision of the general meeting of participants.

Joint-stock companies can pay money to the founders based on the results of a quarter, half a year, 9 months or a year (Clause 1, Article 42 of the Federal Law of December 26, 1995 No. 208-FZ “On the Law on Joint-Stock Companies”; hereinafter referred to as the JSC Law).

Relationship between DPR and business development stage

Many companies go through a number of stages. Young businesses (or many IT companies) at the nascent stage do not pay dividends, so the coefficient will be 0. When the company has entered the growth stage, payments appear here and the coefficient can be 10-20%. At the maturity stage, when the business ranks steadily among its competitors, payments can reach 70%. At the stage of decline and shareholders try to squeeze as much money out of it as possible, so the DPR can reach 100 percent or more.

Dividend payment terms

The LLC must make payments no later than 60 calendar days from the date of the decision on the distribution of profits (clause 3 of Art. Law on LLC).

A joint stock company first needs to determine the circle of persons entitled to dividends. No less than 10 and no more than 20 calendar days are allotted for this from the date the decision on profit distribution is made. After which you can start making payments. The transfer period for nominal shareholders is no more than 10 working days, and for other shareholders - no more than 25 working days from the date on which the circle of persons who are entitled to receive dividends is determined (clause 6 of article 6 of the JSC Law).

Normative value

Financiers determine the optimal value of the indicator to be 0.7. In other words, the business allocates 70% of funds to pay dividends, and refinances 30% to develop its capacities.

| Meaning | Attractiveness |

| DPR < 0.3 | The company is less attractive for investment than similar companies |

| 0.3 < DPR < 0.7 | Optimal coefficient value |

| DPR >0.7 | The company may have financial difficulties because... more than 70% of net profit is allocated to payments to shareholders |

A point estimate of the dividend payout ratio is not enough; this indicator must be analyzed over several periods (5-7 years). If there is a growing trend without jumps and dips, then the company increases its financial stability in the market and investment attractiveness. If the change is abrupt, then the business does not have a competent dividend management policy and its financial condition is unstable.

If a financial analyst compares companies with each other on this indicator, then they must be from the same industry and segment. Thus, comparing a company from the IT sector and industry will be erroneous. Many information companies do not pay dividends at all, and reinvest the profits received for expansion. The industry sector is not so susceptible to competitive influence, so dividends are paid more regularly there.

How is interest paid?

The company consistently pays dividends at the end of the year based on performance results. But, in some situations, interim dividends appear that were not planned in advance and are paid for:

- quarter;

- six months;

- 9 months.

This occurs when the owners of the company are aiming to withdraw money and are not ready to wait until the financial year ends. However, interim dividends do not cancel the payment of the annual rate. Let's consider an example: in 2008, part of the MMK company belonged to the state, and a block of shares was sold at auction. The general director of the company and shareholder D. Rashnikov wanted to buy the stake for himself in order to become a full-fledged owner of the company. To achieve the goal, Rashnikov took out a large loan, and the company came under his control. The loan had to be repaid, the owner withdrew the net profit through interim dividends and paid off the loan. Ordinary shareholders were lucky; they also made money on the interests of the company owner.

For the first three months of the year, the organization publishes reports, checks expenses, income and other nuances. Afterwards, if there are reports and data on the relativity of net profit, the board of directors passes and discusses how much can be paid to shareholders. The meeting of shareholders begins; without the approval of this group, the board of directors cannot make a final decision regarding the payment of interest. The meeting of shareholders occurs:

- annual;

- extraordinary.

At this meeting the final amount of dividends is approved. Around March to June, the cut-off date or record closing date (ex-dividend date) begins. This is the date on which the list of shareholders is compiled; if your name is on this list, you receive a percentage.

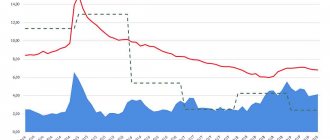

Dividend loss

Some investors think that when working with dividends, you can cheat: buy shares for one day, receive a payment and sell. But such a scheme will not bring profit, because the share price falls on the day the register is closed by the amount of payment (dividend gap) and recovers for several months. You will first receive dividend income, and then lose about the same amount on changes in the stock price. You won't be able to make money.

Don't make a fuss. Evaluate the company fundamentally and buy for the long term. So, you will earn both on dividends and on changes in the market value of the stock.

Where to look for payment dates

Information about the payment amount and register dates can be viewed on the Moscow Exchange website (in the company’s information card) or on the websites of the companies themselves (if there is a section “For Investors”). Also use dividend calendars - it’s more convenient.

- Dividend calendar Dokhod.ru – publishes data on Russian companies.

- Calendar from BCS is a convenient calendar from the largest Russian broker. The table can be filtered by instruments, economic sectors and individual parameters.

- NASDAQ Calendar - here is information about American companies.

The dangers of high dividends

The company may fall into the so-called dividend trap. This is especially noticeable among dividend aristocrats (who pay and constantly increase their dividends every year).

What happens over the years with consistent dividend increases? If this growth is higher than profit growth. That's right...Payout Ratio increases. At first, 30-40% of profits go to dividends. After a few years it reaches 70-80%. Then it creeps up to 90-100%. And higher. 120-150% and even 200-300%.

Naturally, another company can still pay divas in full from its financial reserves for a year. So what is next?

We have to reduce the dividend payout ratio to an acceptable level.

For investors, this means a decrease in cash flow. Sometimes very significant. Literally exponentially.

They paid you a thousand a year, you will receive 200 bucks. Not very nice.

Precautionary measures

Earnings per share can be distorted by including accruals in the formula that do not reflect actual cash flows. For example, revenue from a long-term construction project may be reported as a percentage of completion, even though actual cash payments will be made at a later date.

To avoid this problem, replace earnings per share in the denominator with cash flow per share. To get cash flow per share, subtract all non-cash items such as accrued earnings, depreciation and amortization from earnings per share.

Essence, characteristics, types

Tax is an indispensable, individual, gratuitous payment that is withdrawn from companies and individuals. persons in the form of alienation of money belonging to them by right of ownership, economic management or operational management, for the purpose of material support for the work of the state and (or) municipalities. Tax must be paid if the organization has income.

The fee is a mandatory contribution, which is withdrawn from companies and individuals. persons, payment of which is one of the conditions for the implementation in the interests of payers of state fees. organizations, self-government bodies, other authorized bodies and persons.

The dividend rate depends on two indicators:

- Income received over a certain period of time.

- The dividend policy pursued by the organization.

- The goals that the organization's management and shareholders want to achieve.

Dividend rate is the profit that falls on one share at the end of the designated period (quarter, year). Dividend payments are divided evenly between shareholders, taking into account the available securities. The dividend rate is expressed in numbers and percentages.

The dividend rate is:

- Fixed – does not change throughout the entire period.

- The one that changes - can change depending on the tasks and successes of the organization.

The dividend rate is attributed to those assets that shareholders have and have been fully paid. The tax base is determined not only by the totality of taxes and deductions, but also by the principles of its structure, which are fixed in significant tax conditions.

The tax system is a procedure for assigning, introducing, changing, and canceling taxes and deductions.

Principles of the structure of the tax system:

- Combination of direct and indirect tax payments.

- Universality of taxation.

- Equal tax tension for all subjects of tax legal relations.

- One-time taxation.

- Application of the tax incentive system.

- The desire for consistency in taxation conditions.

Dividends are paid on preferred and common shares. Tax is paid on both types of accruals.

There are shares for which dividend rates are not calculated and payments are not made:

- Securities not yet issued.

- Assets acquired and on the organization's balance sheet.

- Shares that are acquired and are on the balance sheet of the organization by decision of the meeting of shareholders.

- Assets that entered the organization’s balance sheet due to a violation of obligations by the buyer.

Where are urgent loans available? Read the article, quick cash loans without proof of income. Is it possible to apply online for a cash loan at B&N Bank? More details here.

Which stocks should you buy for dividends?

To calculate dividends, novice investors need to select the most winning stocks. To obtain normal, accurate information, go to InvestFuture in the dividend calendar section.

The section contains data on all companies in the Russian Federation paying rates. Then you need to click on the category: 12 months, you will see a list of companies that will pay dividends in the next 12 months. For example:

- We bring in Gazprom.

- Open the company tab.

- Click on the shareholders meeting to see the date of the next meeting. On this day, the final size of dividends on the company's shares will be known.

- We open dividends - look at the closing date of the register to receive interest. We buy shares 2 business days before the date. This section also provides information regarding the amount of interest and current yield.

The second option is to choose a company, go to the website. Almost all organizations that pay this type of interest have a section “Auctions and Investors”. Consider the example of Gazprom:

- The website contains a selection of news for investors.

- The “Dividends” section is available separately. The statistics of payments by year are presented. A document regarding the procedure for paying dividends is available, all rules regarding payments are indicated.

Taxation

13% - for residents of the Russian Federation 15% - for non-residents

- If the company pays in rubles, they go to a brokerage account, bank account or IIS (individual investment account) with taxes already removed. There is no way to avoid losses - tax deductions do not apply to dividends.

- If a company pays in dollars, taxes are not deducted - they must be calculated independently, taking into account the exchange rate.

When investing in US securities, it is better to sign Form W8-BEN. It tells you that you are not a US tax resident. With it the rate is 13%. 10% is withheld automatically, and the investor pays 3% himself.

Example

The investor invested a significant portion of his savings in shares of the company operating a national gas pipeline. He wants to know whether the company can continue to pay its half-yearly dividend of CU4.00. per share, based on its most recent earnings report.

The report contains the following information:

| Net profit | 15,430,000 |

| Goodwill amortization | 7,000,000 |

| Wear | 3,500,000 |

| Capital Expenditures | 3,750,000 |

| Provision for restructuring | 4,500,000 |

| Number of shares outstanding | 5,450,000 |

The investor adjusts earnings of CU15,430,000 by adding back goodwill amortization of CU7,000,000 and depreciation of CU3,500,000. and a restructuring provision of CU4,500,000 as none of these items relate to cash flows (although the restructuring provision may cause a cash outflow at some point in the future).

It also adds back CU3,750,000. capital expenditures. Net profit after all these adjustments is CU26,680,000. He then calculates the dividend payout ratio using this calculation:

4 / (26 680 000 / 5 450 000) = 82%

The ratio shows that the company is able to pay dividends on its earnings per share. However, almost all of its earnings are paid out, so there could be some danger of the dividend being cut in the future if the company's earnings levels decline by a small amount or if it must use its earnings to fund increased growth.

What it is

Dividends are the money received by each shareholder who invested his finances in the shares of a particular organization. Generating income is the goal of creating and operating every organization. And if the organization is profitable, then the owners of such an organization have the right to receive a share of its income - dividends.

The amount of income in the form of dividends is divided among the participants according to the part of their participation in the capital of the organization. The issue of payment of dividends is important for shareholders and for legal entities. persons Therefore, taxation of dividends remains topical.

Dividends can also include any profit received from sources outside the borders of Russia, which are classified as dividends according to the laws of foreign countries.

Thus, for tax purposes, a dividend includes not only payments to the organization’s shareholders, but also payments from net income in favor of the shareholders of LLCs, partnerships, that is, other types of commercial companies.

Dividends are paid during the operation of the company. Upon its liquidation, amounts paid to the shareholder of this company in cash or in kind, not exceeding the shareholder's contribution to the initial capital of the company, are not considered dividends and are not subject to income tax.

The following are not considered dividends:

- Payment upon the liquidation of a company to a shareholder of that company in the form of money or other form that does not exceed the shareholder's contribution.

- Payments to a non-profit company to carry out its main activities according to the company’s charter.

Payments to shareholders of a company in the form of transfer of shares of the same company into ownership and payments to a non-profit company for the implementation of its main statutory work made by business entities whose initial capital consists of investments of this non-profit company are also not considered dividends.

It should be noted that joint stock companies can use special reserve funds to pay dividends, but this applies to the distribution of the share of income on preferred shares of certain types. The source of dividend payments for a company is net income and a reserve fund created for these tasks, and for an LLC it is only net income.

The specifics of taxation of dividends depend on who the profits are paid to: Russian companies or foreign legal entities. or physical persons who are residents of Russia or those who are not, and received income from such sources. The amount of taxes is also affected by whether the company receives such income by paying dividends.