Dividend policy

Bashneft uses the IFRS reporting standard, the basis for calculation is net profit. Payment of dividends on securities occurs no later than 10–25 business days, depending on registration in the register of shareholders.

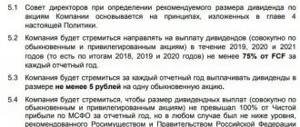

The Board of Directors of Bashneft decides on the amount of dividend payments based on annual reports on financial activities, but not less than 25% of the net profit of the PJSC.

The condition for payments in this volume is the NetDebt/EBITDA ratio of less than 2. PA dividends cannot be higher than OA dividends.

What dividends will be paid in 2019?

For 2021, Bashneft may pay dividends from 140 to 277 rubles per share; with the latter option, the yield will be 14.5%.

Expert opinion

Vladimir Silchenko

Private investor, entrepreneur and blog author

Ask a Question

upd. According to the latest data, the payment will be 158.95 rubles per share, which is equal to 8.2% per annum.

The company will begin paying them approximately in August 2021. More detailed information on dividends will be received after the annual meeting of Bashneft shareholders. Based on the experience of previous years - in July.

Take into account the distribution of 80 billion rubles of Bashneft’s net profit, which were paid by the previous owner (AFK Sistema) under a settlement agreement in 2021, increasing the already significant profitability.

To make a profit in the short term, you must purchase Bashneft shares before the closure of the shareholder register no later than 07/05/2019.

All company dividends for the last 10 years

BANE ordinary shares

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | year | 2 Jul 2020 | 6 Jul 2020 | 12M 2019 | 107,81 ₽ | 5,76% | 20 Jul 2020 |

| 2018 | year | June 20, 2019 | June 24, 2019 | 12M 2018 | 158,95 ₽ | 7,71% | 8 Jul 2019 |

| 2017 | year | 5 Jul 2018 | 9 Jul 2018 | 12M 2017 | 158,95 ₽ | 7,43% | July 23, 2018 |

| 2017 | year | 8 Dec 2017 | 12 Dec 2017 | 9M 2017 | 148,31 ₽ | 6,18% | 26 Dec 2017 |

| 2015 | 13 Jul 2016 | 15 Jul 2016 | 12M 2015 | 164,00 ₽ | 5,81% | July 29, 2016 | |

| 2014 | 15 Jul 2015 | July 17, 2015 | 12M 2014 | 113,00 ₽ | 5,86% | July 31, 2015 | |

| 2013 | June 19, 2014 | June 23, 2014 | 12M 2013 | 211,00 ₽ | 8,68% | July 7, 2014 | |

| 2013 | 31 Oct 2013 | 5 Nov 2013 | 9M 2013 | 199,00 ₽ | 10,28% | 19 Nov 2013 | |

| 2012 | May 15, 2013 | May 15, 2013 | 12M 2012 | 24,00 ₽ | 1,26% | May 29, 2013 | |

| 2011 | May 15, 2012 | May 15, 2012 | 12M 2011 | 99,00 ₽ | 6,23% | May 29, 2012 | |

| 2010 | May 20, 2011 | May 20, 2011 | 12M 2010 | 131,27 ₽ | June 3, 2011 | ||

| 2009 | 12 Nov 2010 | 12 Nov 2010 | 9M 2010 | 104,50 ₽ | 26 Nov 2010 | ||

| 2009 | May 21, 2010 | May 21, 2010 | 12M 2009 | 109,65 ₽ | June 4, 2010 | ||

| 2008 | May 22, 2009 | May 22, 2009 | 12M 2008 | 14,64 ₽ | June 5, 2009 | ||

| 2008 | 24 Nov 2008 | 24 Nov 2008 | 9M 2008 | 34,18 ₽ | 8 Dec 2008 | ||

| 2006 | 12 Mar 2008 | 12 Mar 2008 | 12M 2007 | 16,31 ₽ | March 26, 2008 |

Privileged BANEP

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | 2 Jul 2020 | 6 Jul 2020 | 12M 2019 | 107,81 ₽ | 7,38% | 20 Jul 2020 | |

| 2018 | June 20, 2019 | June 24, 2019 | 12M 2018 | 158,95 ₽ | 8,91% | 8 Jul 2019 | |

| 2017 | 5 Jul 2018 | 9 Jul 2018 | 12M 2017 | 158,95 ₽ | 9,04% | July 23, 2018 | |

| 2017 | 8 Dec 2017 | 12 Dec 2017 | 9M 2017 | 148,31 ₽ | 9,6% | 26 Dec 2017 | |

| 2016 | 10 Jul 2017 | 12 Jul 2017 | 12M 2016 | 0,10 ₽ | 0,01% | July 26, 2017 | |

| 2015 | 13 Jul 2016 | 15 Jul 2016 | 12M 2015 | 164,00 ₽ | 8,08% | July 29, 2016 | |

| 2014 | 15 Jul 2015 | July 17, 2015 | 12M 2014 | 113,00 ₽ | 8,25% | July 31, 2015 | |

| 2013 | June 19, 2014 | June 23, 2014 | 12M 2013 | 211,00 ₽ | 11,53% | July 7, 2014 | |

| 2013 | 31 Oct 2013 | 5 Nov 2013 | 9M 2013 | 199,00 ₽ | 13,49% | 19 Nov 2013 | |

| 2012 | May 15, 2013 | May 15, 2013 | 12M 2012 | 24,00 ₽ | 2,31% | May 29, 2013 | |

| 2011 | May 15, 2012 | May 15, 2012 | 12M 2011 | 99,00 ₽ | 8,29% | May 29, 2012 | |

| 2010 | May 20, 2011 | May 20, 2011 | 12M 2010 | 131,27 ₽ | June 3, 2011 | ||

| 2010 | 12 Nov 2010 | 12 Nov 2010 | 9M 2010 | 104,50 ₽ | 26 Nov 2010 | ||

| 2009 | May 21, 2010 | May 21, 2010 | 12M 2009 | 109,65 ₽ | June 4, 2010 | ||

| 2008 | May 22, 2009 | May 22, 2009 | 12M 2008 | 14,64 ₽ | June 5, 2009 | ||

| 2008 | 24 Nov 2008 | 24 Nov 2008 | 9M 2008 | 34,18 ₽ | 8 Dec 2008 | ||

| 2006 | 12 Mar 2008 | 12 Mar 2008 | 12M 2007 | 16,31 ₽ | March 26, 2008 |

When and how much will the payment be in 2021? Let's analyze the situation

The preliminary date of payments from Bashneft for 2021 is July 9, 2019. Now let’s analyze the latest news on dividends to Bashneft and draw conclusions about the prospects for the next billing period (12 months). The company’s current yield is 9.95%, share of profit for 2021 – 3.87%. The DSI index is 0.57, which is very good. Also:

- Profit forecast for the next 12-month period is RUB 107,169.48 million.

- There are 25.38 million securities in circulation.

- The stability indicator of deductions for securities is 1.

- Stock growth stability indicator – 0.14

It is still difficult to say at what rate the growth will continue. Actually, the date when dividends will be paid next is only a forecast.

The amounts are forecast to be lower than in 2021. The difference will be 46.87%: 163 rubles. 26 kopecks / PC. versus 307 rub. 26 kopecks / PC. (dividends on Bashneft shares in 2021). Summary table, amounts by year + changes relative to each previous year:

| Dividend (RUB) | Year | Change to previous year |

| 163.26 | track 12m. (forecast) | -46.87% |

| 307.26 | 2018 | +307160 % |

| 0.1 | 2017 | -99.94% |

| 164 | 2016 | +45.13% |

| 113 | 2015 | -72.44% |

| 410 | 2014 | +1608.33% |

| 24 | 2013 | -75.76% |

| 99 | 2012 | -58.01% |

| 235.77 | 2011 | +115.02% |

| 109.65 | 2010 | +124.6% |

| 48.82 | 2009 | n/a |

| 0 | 2008 | -100% |

| 42.11 | 2007 | +642.68% |

| 5.67 | 2006 | +353.6% |

| 1.25 | 2005 | +25% |

| 1 | 2004 | 0% |

| 1 | 2003 | n/a |

You've probably already seen the latest news about Bashneft dividends for 2021: recent events (merger with Rosneft) have somewhat shaken the position of the company's securities on the stock market. In this regard, payments on preferred securities were minimal, and on ordinary ones they were completely postponed to 2021.

However, despite such circumstances and the not very positive forecast for 2021, in general the situation is beginning to level out, there is a tendency for shares to rise and, accordingly, to increase amounts in the future. There is a high probability that the latest dividend news from the ANC will contain other, more pleasant figures.

How to buy shares and receive dividends

Interim forecasts indicate that investments in Bashneft securities can bring good income. After concluding an agreement with a brokerage company, an individual or legal entity is allowed to trade.

Best brokers

Navigating the brokerage market is quite difficult, especially if you have little experience in securities trading. The consumer investor should focus on the positive reputation of the company, its period of existence and the presence of a license to carry out brokerage activities.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Warning about Forex and BO

Forex and binary options have absolutely nothing in common with stock exchanges. Forex is a foreign exchange market, and it is not regulated in any way; the buyer there is not protected in any way.

Binary options, in fact, are a type of online casino; shares or other securities cannot be purchased there.

Stock return

Oil stocks are currently strong dividend picks. According to experts, they are among the TOP 5 Russian companies in terms of payments on preference shares in 2021.

But if companies such as IDGC or Mechel, which top the list in terms of profitability as a percentage per share, depend on the exchange rate due to debt in dollars and euros, then Bashneft has retained earnings under the settlement agreement of 80 billion rubles.

The guaranteed yield on Bashneft shares will be 14.5%, which is currently the best dividend offer on the market.

Bashneft sets records

Andrey Shishkin is confident that the integration was successful. Photo from the Bashneft press service

Bashneft, part of the Rosneft state corporation, held a general meeting of shareholders, at which the chairman of the company’s board, Andrei Shishkin, reported on the work of the joint-stock company in 2021. The main conclusion of the report: the integration was successful, and thanks to the developed integration strategy and the effective work of management, Bashneft achieved high production and financial results.

Last year, Bashneft achieved a significant increase in key financial and economic indicators. Hydrocarbon reserves have been significantly increased - the reserve replacement rate according to the Russian classification was 298%. And this, frankly, is a more than respectable figure. During this period, the largest complex of biological treatment facilities in Eurasia was built - that is, it was possible to implement a large-scale environmental project. Finally, a number of important steps have been taken to introduce innovative digital technologies in all business segments.

Debts are falling

According to Andrey Shishkin, an increase of 15% in operating profit before depreciation, taxes and interest was achieved - up to 151.8 billion rubles, and a decrease in administrative expenses - by 21%, which reflects the positive effect of synergies within the Rosneft Group. Based on the results of the first year of work as part of Rosneft, Bashneft ensured an increase in net profit according to IFRS to 142 billion rubles, which is 173% more than the same figure for 2016.

In addition, in 2021, Bashneft consistently reduced its debt burden and the cost of servicing external debt - the company's net debt as of the end of the reporting year decreased by 17%.

Dividends are growing

The increased efficiency of Bashneft made it possible to provide the basis for paying high dividends to shareholders. The Board of Directors proposed to pay dividends based on the results of 2021 in the amount of 28.2 billion rubles. Taking into account dividends for the first nine months of 2021 in the amount of RUB 26.3 billion. the total volume of payments to shareholders for 2017 will reach 54.6 billion rubles. The total dividend per share for 2017 will be a record 307 rubles. 26 kopecks and will be the highest in the last four years.

Without taking into account compensation for previously incurred losses, profit according to IFRS of Bashneft for 2021 amounted to 63 billion rubles. Thus, at the end of 2021, a total of 86.6% of profit from operating activities is allocated to dividends, which is a very high level.

Money doesn't appear from anywhere

As you know, Bashneft received certain funds. This is compensation to Bashneft for losses caused by its former shareholder, AFK Sistema. 20 billion rubles. Of the compensation received, they were immediately paid in the form of income tax, the lion's share of which was 16 billion rubles. – entered the budget of Bashkiria. The funds received will make it possible in the coming years to implement all previously planned projects to ensure the safety of production processes, primarily in oil refining and petrochemicals, which were left without the necessary financing due to losses caused by the previous shareholder.

The funds received will also be used to reduce the company's net debt accumulated over previous years, including those formed due to earlier decisions of Sistema.

Bashneft does not raise prices at its gas stations

According to Andrey Shishkin, the main reason for the increase in prices for petroleum products on the domestic market is a significant increase in refining costs due to the implementation of “tax maneuvers” in the oil industry. To this should be added the annual increase in excise taxes on gasoline and diesel fuel, as well as the rise in world oil prices. Finally, we must not forget about the devaluation of the ruble associated with the new budget rule adopted by the Ministry of Finance in 2021.

Despite all the difficulties, Bashneft is complying with the agreements reached to curb the current rise in prices, including a temporary reduction in excise tax rates and “freezing” prices for motor fuel at the level of May 30, 2021. As a result, from the end of May this year. prices at the company's gas stations are not growing; current average retail prices are lower than those of competing companies and below the average level of retail prices for the country as a whole.

The main thing is production and exploration

The implementation of highly effective geological and technical measures and the introduction of modern technologies for enhanced oil recovery made it possible to maintain oil production at the fields of Bashkiria at the level of the previous year at the end of 2021 - 16.6 million tons.

At the same time, the total share of horizontal drilling increased to 80%. The efficiency of field development has been increased - in mature fields, the commercial drilling rate has been increased by more than 14%, and the average cost of wells has been reduced by 7% due to the optimization of technological solutions.

This result was made possible, among other things, by increasing the efficiency of geological exploration. In 2021, the success rate of exploratory drilling was 84%, which is a third higher than in 2016. 50 new deposits and 5 new fields were discovered, 4 of which are located in the Republic of Bashkortostan.

Not forgetting about the environment

In 2021, the Ufa oil refinery complex processed 19 million tons of crude oil, an increase of 3.2% compared to 2021. Technological cooperation with enterprises of the Rosneft Group and optimization of capacity utilization at Ufa refineries made it possible to ensure a competitive refining depth of 82% and a yield of light petroleum products of 66%.

The creation of a single production chain with Rosneft's production and refining complexes has significantly increased the efficiency of the Ufa refineries and led to a reduction in operating and logistics costs.

As part of the strategy to ensure continuous technological development of refining, the single Bashneft refinery has mastered the production of Euro-6 gasoline. The product was developed by specialists from Rosneft and Bashneft and was successfully tested at the All-Russian Research Institute for Oil Refining. Euro-6 gasoline is produced taking into account more stringent standards for the content of sulfur, aromatic hydrocarbons, benzene, and olefin hydrocarbons, which will have a positive effect on the environment and quality of life in our cities.

As part of the task set by the President of the Russian Federation, a large-scale environmental project for the reconstruction of biological treatment facilities at the Bashneft-Ufaneftekhim branch was implemented. This is the largest industrial facility of its kind in terms of productivity in Eurasia. New biological treatment facilities make it possible to treat all wastewater from enterprises in the Northern Industrial Hub of Ufa. This large-scale non-commercial project using the most advanced water purification technologies required investments from Bashneft in the amount of more than 11 billion rubles.

Integration is on the way...

First of all, the company's retail and small wholesale business was brought to Rosneft standards. Management of this segment was centralized into a single enterprise - LLC Bashneft-Roznitsa, which significantly increased the efficiency of asset management.

The development of the Bashneft brand continues, taking into account the high loyalty to it in Bashkiria. In 2021, the level of marketing activity was increased - the loyalty program was successfully implemented, image events and promotions were held for customers of Bashneft gas stations. As a result, the volume of retail sales at Bashneft gas stations increased by 3% compared to last year and reached 1.7 million tons.

To achieve the maximum synergetic effect, the wholesale sales of petroleum products from Ufa refineries were reoriented to high-margin sales channels of Rosneft, intermediaries in the domestic market were eliminated, and direct deliveries to consumers began.

…innovation and import substitution

In the context of the rapid development of informatization and fierce market competition, one of the main conditions for the effective development of Bashneft is the introduction of innovative technologies, including the digitalization of business processes. In 2021, the company began creating and developing the “Digital Field” and the “Digital Plant”. These technologies make it possible to implement an integrated approach to the management of production and processing assets using modern digital solutions.

In 2021, active work continued on import substitution and development of the range of production of our own products used in technological processing processes. Thus, Bashneft-Ufaneftekhim carried out a 100% transition from imported cracking catalysts to catalysts produced by the Ishimbay Specialized Chemical Plant. As part of the import substitution program, the Novokuybyshevsk Oil and Additives Plant has established supplies of anti-wear additives for diesel fuel to Bashneft-UNPZ and Bashneft-Ufaneftekhim.

For the benefit of Bashkiria

Bashneft was and remains a region-forming enterprise for the Republic of Bashkortostan, with which history is inextricably linked and today it is the largest taxpayer and the largest employer in the region.

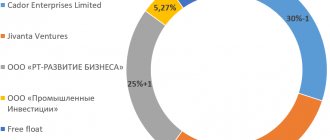

Since 2015, the republic has been a shareholder of Bashneft, owns a stake of more than 25%, participates in making key decisions through its representatives on the board of directors of the company, and actively interacts with the company’s management on current issues.

Bashneft, in turn, fully fulfills its obligations to the region in all areas: ensures stable tax revenues, increases investment in production, and finances the development of social infrastructure. In 2017, tax contributions to the republic’s budget increased by 4.6% compared to 2021 and amounted to 18.4 billion rubles. In general, Bashneft’s total payments to the budget of Bashkortostan amounted to 55 billion rubles.

There is no doubt that the integration of Bashneft into the state structure was successful. As a result, everyone benefited – the shareholders, the state, and, of course, the residents of Bashkiria.

Analysis of reporting for 2020

For 2021, revenue decreased by 37.7% compared to 2021. The value of the indicator was 532.6 billion rubles. The decline was influenced by 2 factors:

- reduction in the cost of oil and its refined products;

- implementation of the OPEC+ agreement, which implied a reduction in product supplies.

The volume of oil production in 2021 decreased to 13.1 million tons. Of all the subsidiaries, this enterprise showed the greatest decline. The size of the reduction reached almost 31% by the end of the year.

On a note! The company's net loss for 2020 amounted to 11.1 billion rubles.

Positive dynamics of Bashneft's accounts receivable have been observed for 3 years. By the end of 2021, the value of the indicator reached 140.9 billion rubles. Now accounts receivable account for about 20% of the company's assets.

How much are the shares worth today?

The price of ordinary shares as of today (05/19/2021) is 1,545 rubles. During the day, the price decreased by 21 rubles, the reduction was 1.34%. Experienced investors do not take such fluctuations into account when purchasing shares, considering them insignificant.

According to the chart from the beginning of the year, you can see that the cost of ordinary shares has decreased over 4.5 months. At the beginning of 2021, the price was 1,680 rubles. In percentage terms, the reduction was 8.74%.

The price of 1 preferred share of Bashneft as of May 19, 2021 also decreased. At the end of the day the figure was 1172.5 rubles. The volume of reduction per day is 0.51% (6 rubles). At the beginning of 2021, the preferred security cost RUB 1,184. The change, as in the case of an ordinary share, is insignificant.