Dividend policy

AVISMA does not establish corporate standards for the calculation of dividends, but regularly allocates about 100% of the company’s net profit for payments.

One of the supposed options for such generosity is that the top management of VSMPO - AVISMA in 2012 bought the company's shares with borrowed funds. After which, in order to repay the loans, they began to withdraw money from the organization as much as possible.

At the end, I will speculate how long this trend can continue.

VSMPO-AVISMA. Issuer analysis

VSMPO-AVISMA is a world leader in the production of titanium products. The corporation is deeply integrated into the global aerospace industry and is the main strategic supplier of titanium products both in Russia and abroad.

Production scheme and company structure

VSMPO-AVISMA Corporation is vertically integrated, which means it can independently support the entire production process from raw materials to the finished product. In the diagram below you can see titanium products at different stages.

Almost all of the company's production is located in the Russian Federation. Each stage of creating titanium products is accompanied by subsidiaries:

1. AVISMA branch - production of titanium sponge;

The technological chain begins with the AVISMA branch. Here, at a chemical and metallurgical enterprise in the city of Berezniki, Perm Territory, titanium sponge is produced. The production of metal magnesium and alloys based on it, as well as chemical products, also takes place.

2. JSC Ural Boeing Manufacturing. Joint venture - machining of titanium stampings;

It is a joint venture with one of the largest airlines in the world - Boeing. The organization is located in the Sverdlovsk region for the purpose of machining stampings for aircraft. As a result of Boeing's activities, it receives blanks that are close in size to the final part.

3. JSC AlTi Forge - production of highly processed products from titanium and aluminum alloys;

In October 2013, an agreement was signed with the global aluminum giant Arconic to create a joint venture AlTi Forge for the production of semi-finished products from aluminum and titanium alloys, large-sized stampings, including landing gear parts and wing fastenings. Production is organized on the basis of the forging and pressing workshop of Alcoa SMZ (Samara Metallurgical Plant), which is part of the Arconic structure. This workshop has high-performance equipment, including a vertical press with a force of 75,000 tons.

4. PJSC VSMPO-AVISMA Corporation - production of titanium products.

The last in the chain is PJSC VSMPO-AVISMA Corporation, a full-cycle enterprise for the production of semi-finished products and titanium alloys. It has the world's largest melting and foundry complex, as well as sheet rolling, forging and stamping, pipe-shaping production, stamping and non-standard equipment machining shops.

During the production process, the company uses raw materials purchased from other countries to produce titanium sponge. However, this factor is not very significant for the investment case of VSMPO, since the share of titanium raw materials in the cost of production does not exceed 5%.

Despite the presence of the entire production base in Russia, the corporation is focused on selling products abroad. The following production and sales units are concentrated there:

1. NF&M International. 2. VSMPO-Tirus.

NF&M is a key company in the production of small-scale products. It was acquired by the company in 2003 with the aim of expanding the range and focusing on one of the main markets - the USA.

It produces titanium billets and bar stock for the aircraft engine and structural, medical and consumer markets, as well as tight tolerance small diameter rods and coiled wire for aviation, medical and automotive applications.

VSMPO-Tirus handles distribution and sales in Europe and North America. Divisions are distributed across the USA, England, Germany, Switzerland and China. They house warehouses for the sale of products manufactured in Russia and sales specialists.

Separately, it is worth highlighting the joint venture UNITI with Allegheny Technologies Incorporated (ATI) with an office in Pittsburgh, USA. It was created in 2003 for the production and marketing of a wide range of products in such industries as electric power, chemical and oil refining industries, automotive and transport industries, electronics and others.

The share capital structure is as follows:

Cyprus organizations Cador Enterprises Limited and Jivanta Ventures belong to Industrial Investments LLC, through which they are controlled by Business Alliance Company CJSC. The main shareholder of Business Alliance Company is Mikhail Shelkov, Deputy Chairman of the Board of Directors of VSMPO-AVISMA. The small size of free float is rather a negative aspect that does not contribute to the growth of liquidity.

Sales structure and markets

The main revenue of VSMPO-AVISMA comes from the sale of titanium products. Its largest share is taken by deliveries abroad (over 70%). Below is the sales structure in the foreign markets it occupies.

The key share of sales of titanium products falls on Aerospace. Since 2014, it has changed insignificantly - from 70 to 62%. At the same time, its volume increased by 1.7 times. In general, the company’s revenues grew continuously until 2021. Then they slowed down due to the strengthening of the ruble.

For VSMPO-AVISMA, the main consumers are Boeing (USA) and Airbus (Europe) - one of the largest aircraft manufacturing companies in the world. Long-term contracts are concluded with them for the supply of titanium alloys for the production of aircraft landing gear, airframe elements and other parts. Centralized control of distributors in both countries is carried out by the Tirus division, which allows for timely delivery of products in large volumes.

The main clients on the Russian market are the state in the form of controlled legal entities and the Rostec state corporation. Products are supplied as part of the construction of nuclear power plants (NPPs), as well as the production of civil and special purpose aircraft. The remaining buyers are private companies in the Russian Federation, which use titanium to one degree or another.

A long-term partnership for the supply of products made of aluminum and titanium alloys has been built with the United Aircraft Corporation (UAC). As part of the SuperJet-100 project, the company is collaborating with Sukhoi Civil Aircraft and Irkut Corporation to build the MC-21 model.

In the nuclear industry, the company has built relationships with Rosatom in a number of foreign projects: Rooppur NPP (Bangladesh), Bushehr-2 NPP (Iran), Hankihivi-1 NPP (Finland), Akkuya-1/2 NPP, etc. The company also carries out work on productions of PJSC Kemerovoazot, JSC Minudobreniya, LLC Mendeleevskazot.

World titanium market

The market for titanium products has clear prerequisites for demand growth in the future. This is mainly due to increased air travel, especially in Asia.

In 2021, the aerospace and industrial sectors accounted for about 90% of rolled titanium consumption. According to independent research company Roskill, there is a trend towards increasing the use of titanium in aircraft. This is partly due to its compatibility with composite materials used in airframes. Recent examples include the Boeing 787 and Airbus A350, both of which make extensive use of composites in their fuselages and have correspondingly high titanium loads. The same applies to the Boeing 777X, which is due to be introduced in 2021 and has composite wings.

In engine production, titanium retains high potential for use in conjunction with composite materials. However, in the long term, the increasing adoption of additive manufacturing technologies (3D printing) may affect titanium demand. This method reduces the amount of waste, but requires the use of powdered titanium instead of classical raw materials. Changes in the production process may be perceived negatively by the market.

Engine parts are also supplied to car manufacturers. VSMPO-AVISMA Corporation ships rolled rods made of titanium alloys, as well as ingots and billets for the manufacture of disks to companies such as Snecma, Rolls Royce, GEAE, Pratt & Whitney, Honeywell.

About 40% of the rolled titanium market is accounted for by the chemical industry, energy and seawater desalination. The company supplies titanium for work on production platforms, risers, and pipeline systems. The main partners are China, India and Russia. Demand in the chemical industry is highly dependent on one-time projects. According to Roskill, demand should not be expected to increase in the chlorine and terephthalic acid markets.

Thus, the demand for titanium is expected to increase. The reason will be its widespread use in conjunction with composite materials in the aircraft industry and an increase in orders for aircraft by global airlines. In other sectors, demand is also expected to grow, but at a moderate pace. The growth of the electricity market showed maximums in 2021 and, according to BP estimates, will continue to grow until 2040. Long-term contracts allow the company to insure against failure to meet delivery conditions by its partner. However, special cases of falling demand for aircraft may affect further agreements.

Boeing scandal

The partnership between VSMPO-AVISMA and Boeing makes them dependent on each other. Despite record aircraft shipments in 2021 (806 units), Boeing is now experiencing problems with the 737 MAX aircraft model. Due to a series of accidents in October 2021 and March 2021, supplies fell. In the second quarter of 2021, sales of 737 models fell more than three times - 24 units versus 89 in the first quarter. Airlines began to refuse supplies one by one. First Garuda Indonesia for 49 aircraft, later Lion Air refused in favor of the Airbus 330-900NEO model.

At the end of the second quarter, not a single 737 Max aircraft was sold. At the same time, there is an increase in deliveries of Airbus aircraft.

Until recently, the American aircraft manufacturer had excellent sales statistics. However, in the second quarter, results worsened, which competitor Airbus took advantage of. Boeing's fall by 59 aircraft in the second quarter occurred against the backdrop of Airbus's increase by 65. At the same time, the American giant plans to restore flights of the 737 Max brand by the end of this year. In my opinion, the redistribution of sales among VSMPO-AVISMA partners should not significantly affect its revenue. It is likely that a decline in orders from one aircraft manufacturer will be partially offset by an increase in orders from another.

Competitive analysis

VSMPO-AVISMA Corporation has no competitors in Russia, but there are companies with similar activities. Their share in the Russian titanium market is small, so we will not take them into account when comparing. According to the company itself, the main competitors in the titanium industry are:

— Timet (a division of Precision Castparts Corp.) — Arconic — ATI — GKN Aerospace — Aubert&Duval

In the global industrial market, competition comes with Japan in the form of However, low production costs and a high level of organization of foreign divisions allow the Russian corporation to maintain a leading position in the world market.

A comparative analysis of public companies from the titanium industry shows that VSMPO-AVISMA is in a fairly good position. The assessment used multipliers that can be correctly used to compare industrial corporations. The diagram below shows the main competitors in comparison with the Russian giant.

On average for the industry, VSMPO-AVISMA looks cheap. The company's competitors are mostly American corporations, whose value is partly explained by the country premium.

What sets the company apart from its competitors is its high dividend yield - 9.7% in rubles, which is explained by the payment of almost 100% of profits. Competitors have a yield of no higher than 2.3%, except for Furukawa Metal Thailand PCL.

But in terms of return on equity (ROE), VSMPO-AVISMA lags behind average market levels.

Financial results

VSMPO-AVISMA is a raw materials export-oriented company, and accordingly receives income from the sale of titanium products in US dollars. For convenience of settlements, credit funds are attracted in the same currency. Thus, the following external factors influence the company’s financial results:

1. Prices for titanium alloys 2. Dollar exchange rate

Over the past 2 years, prices on the foreign titanium market have not had a significant impact on the company's activities. To a greater extent, the changes are related to currency exchange rate fluctuations.

The fall of the dollar in 2021 put pressure on ruble revenue, even despite sales growth of 14% relative to 2021. This increased production costs, which ultimately negatively impacted ruble net income and dividends.

In 2021, the growth of the exchange rate, coupled with an increase in sales, made it possible to set a historical record for ruble revenue. At the same time, net profit fell by 40%. This was caused by a currency revaluation of the company's debt, which was reflected in the 2021 financial statements as an exchange rate loss of RUB 7 billion. This is explained both by a 22% increase in the exchange rate and a doubling of foreign currency loans in 2021.

The company's net profit in 2021 amounted to 15 billion rubles. Without currency revaluation it would have amounted to 22 billion rubles. Taking into account the average annual sales growth of 12% in 2021, one can expect a profit close to or exceeding 25 billion rubles. According to our estimates, in the first half of the year, due to the currency factor, the company’s profit will double.

Financial performance in dollars has been growing steadily since 2015. The increase in revenue is due to strong sales abroad. If the average annual sales rate remains at 12%, revenue in 2021 could reach $1,811 million.

For 2019-2026, the company approved an investment program of $700 million. According to management forecasts, by 2021 it is planned to increase production to 40 thousand tons. titanium products or by 14% compared to 2021

We estimate that if operating expenses remain at 2018 levels, EBITDA in 2021 is expected to be $733 million.

Compared to its peers in the metallurgical industry, the titanium company looks inexpensive. Only MMC Norilsk Nickel is close to it. VSMPO-AVISMA has an established business with a long history and an established market, and therefore we do not expect a multiple increase in the price of the company's shares.

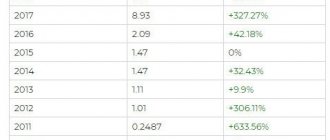

Dividends

The payment history dates back to 2013. The corporation has been steadily paying dividends for 6 years. According to the dividend policy, payments must be no less than 10% of net profit under RAS. However, the company has been paying almost 100% in recent years.

A record dividend yield of 14% occurred in 2021. This is due to the historically highest profit in this year - RUB 26,634 million. (RAS). At the same time, the share of profits allocated to dividends was the lowest. Due to the loss on the exchange rate, the yield subsequently dropped. Even an increase in the share of payments from profits was not enough to return to 2021 levels.

The corporation's annual dividend yield averages 10%, which is better than that of peer companies.

Competitive advantages

— Fully vertically integrated business with minimal dependence on third parties;

— Long-term contracts with leading airlines in the world;

— The main supplier of titanium products on the Russian market and one of the largest in the world;

— Increasing market share abroad through joint ventures with Allegheny Technologies, metallurgical giant Arconic and Boeing;

— The corporation is a supplier of a wide range of titanium products, including the world’s largest titanium stampings;

— Significant potential for the use of titanium in the aerospace and energy industries;

— High dividend yield;

— The company is undervalued relative to its competitors.

Summary

VSMPO-AVISMA is a unique Russian corporation. The only vertically integrated titanium manufacturer in the Russian Federation with developed partnerships abroad. Long-term relationships with major consumers allow us to steadily increase financial performance.

At the same time, the company is the main supplier of titanium products for the state, having no competitors in the local market. It is the only one among its industry peers that maintains a high dividend yield. The company looks attractive among its main competitors. However, there is currently no expectation of a multiple increase in capitalization. VSMPO-AVISMA remains a conservative dividend history with low liquidity. In the medium term, stable expectations of a reduction in ruble rates may serve as a positive driver for the revaluation of shares.

For two years now, the company's stock quotes have been consolidating in a wide range of 15,500-18,000 rubles. The current market conditions are capable of ensuring a smooth movement towards its upper limit on the horizon until the end of the year, plus receiving interim dividends.

Please note that the company's securities have low sensitivity to general market fluctuations. The beta coefficient to the Moscow Exchange index for the last year is 0.12. The data confirms the neutral attitude of stock quotes to volatility on the Russian stock market.

BKS Brocke r

All company dividends for the last 10 years

AVISMA dividend flow table.

| For what year | Period | Last day of purchase | Registry closing date | Size per share | Dividend yield | Closing share price | Payment date |

| 2019 | 2 sq. | 7 Oct 2020 | 11 Oct 2020 | 884,6 ₽ | 4,99% | 05.11.2020 | |

| 2019 | 2 sq. | June 1, 2020 | June 3, 2020 | 872,99 ₽ | 4,92% | 28.06.2020 | |

| 2018 | year | 9 Oct 2019 | 11 Oct 2019 | 884,6 ₽ | 4,99% | 25.10.2019 | |

| 2018 | year | May 30, 2019 | June 3, 2019 | 873,42 ₽ | 4,96% | 01.07.2019 | |

| 2017 | year | 10 Oct 2018 | 12 Oct 2018 | 756 ₽ | 4,54% | 01.11.2018 | |

| 2017 | year | June 4, 2018 | June 6, 2018 | 890,45 ₽ | 5,05% | 01.07.2018 | |

| 2016 | 4 sq. | 17 Oct 2017 | 19 Oct 2017 | 762,68 ₽ | 4,24% | 01.12.2017 | |

| 2016 | 4 sq. | June 1, 2017 | June 5, 2017 | 1 300 ₽ | 8,19% | 01.09.2017 | |

| 2015 | 29 Sep 2016 | 3 Oct 2016 | 816 ₽ | 5,68% | 01.11.2016 | ||

| 2015 | May 25, 2016 | May 27, 2016 | 458,22 ₽ | 3,61% | 01.07.2016 | ||

| 2014 | 7 Oct 2015 | 9 Oct 2015 | 788 ₽ | 6,06% | 01.11.2015 | ||

| 2014 | May 26, 2015 | May 28, 2015 | 831,07 ₽ | 8,1% | 01.07.2015 | ||

| 2013 | June 11, 2014 | June 17, 2014 | 533,91 ₽ | 6,66% | 01.08.2014 | ||

| 2012 | May 24, 2013 | May 24, 2013 | 279,83 ₽ | 4,82% | 01.07.2013 | ||

| 2011 | May 24, 2012 | May 24, 2012 | 26,52 ₽ | 0,56% | 01.08.2012 | ||

| 2010 | May 6, 2011 | May 6, 2011 | 5,1 ₽ | 0,15% | 01.07.2011 | ||

| 2009 | May 21, 2010 | May 21, 2010 | 1,5 ₽ | 0,05% | 01.07.2010 | ||

| 2008 | May 25, 2009 | May 25, 2009 | 23,14 ₽ | 1,39% | 01.07.2009 | ||

| 2007 | May 15, 2008 | May 15, 2008 | 53,92 ₽ | 1,03% | 01.08.2008 |

Here you can clearly see how there was a jump in dividends in 2012, when AVISMA’s top management consolidated 65% of the organization.

What dividends will be paid in 2019?

Based on the past decision-making logic, two payments can be expected for AVISMA shares in 2021. The first dividend is already known, it is 873.24 rubles. per share.

The second dividend could be assumed regarding the profit of the VSMPO-AVISMA corporation for the first half of 2021. However, so far only the profit for the first quarter is known: almost 7 billion rubles, which is 1.7 times higher than the same period last year.

To roughly find out the dividend, I simply extrapolate the amount by adding it to the figure for the second quarter of 2021. Then I get 7 + 4.65 = 11.65 billion in total profit for the half year. Based on one AVISMA paper, this is approximately 1010 rubles.

Securities data

| Ticker | VSMO |

| Trading platforms and trading times | MOEX, 10:00 – 18:45 Moscow time (main session) |

| Name | PJSC VSMPO-AVISMA Corporation |

| Number of securities in circulation | 11 529 538 |

| Denomination | 1.0 rub. |

| Dividends | Eat |

| Year of foundation | 1941 |

| Founded by | State Defense Committee of the USSR (resolution “On the restoration of aircraft factories evacuated to the Volga, Ural and Siberia”) |

| Headquarters | Russia, Sverdlovsk region, Verkhnyaya Salda, st. Parkovaya, 1 |

Stock return

The yield on AVISMA shares, taking into account dividends paid for the last calendar year, is about 10% excluding taxes, or 8.7% in net funds.

If you look a little further and use the dividend that I assumed above, then at a security price of 17,000 rubles. per piece and dividend flows of 873 and 1010 rubles. the yield will be about 1883 / 17000 = 11.07% “dirty”, or 9.63% per annum including personal income tax.

How to buy shares and receive dividends

One of the simplest and most logical options is to buy shares of VSMPO - AVISMA for dividends - through a Russian licensed broker. Many intermediaries open accounts online and provide convenient, interactive platforms for transactions.

Best brokers

I offer a list of the best brokers that, along with small commissions, can please you with good service and high reliability.

Opening of Promsvyaz by Rick BKS Keith Tinkoff Finam

One of the mastodons of the market. Excellent web portal, very low commissions and adequate support. I recommend!

Investment department of a famous bank. There are no particular advantages, but there are no disadvantages either. Average.

One of the very first Russian brokers. The commissions are high, but there are interesting auto-following strategies.

Another very large broker. Good support and low commissions are their strong point.

Small but reliable broker. It is great for beginners because it does not impose its services and the commissions are very low. I recommend.

The youngest broker in the Russian Federation. There is a cool app for investors, but the fees are too high.

The largest investment company in Russia. The largest selection of tools, your own terminal. Commissions are average.

Warning about Forex and BO

Expert opinion

Anna Ovchinnikova

Private investor, entrepreneur and founder of the portal fonda.pro

Ask a Question

If an investor wants not only to invest, but also to receive dividends, incl. in the papers of VMSPO - AVISMA, he should forget about various kinds of binary options or Forex offices.

Binary options through various sites on the Russian Internet are a game. There are no real transactions for the purchase or sale of assets, and bets are made on a “sink or bust” principle, and the mathematical expectation is not set in favor of clients.

Forex is an over-the-counter market. There is a minimum number of licensed forex dealers in Russia. As of July 2019, these are only 4 companies:

- Alpha – Forex;

- VTB – Forex;

- PSB – Forex;

- FINAM – Forex.

What affects the stock price

The price of VSMPO-AVISMA shares depends on the level of demand and world prices for titanium, as well as the exchange rate of the US dollar, the main currency used in the corporation’s monetary transactions. The value is influenced by the corporation's plans and analysts' forecasts for its shares.

Company prospects

According to the strategic development program until 2026, VSMPO-AVISMA will invest about $700 million in business development. The corporation will focus on modernizing its facilities and launching new types of production – section rolling and pipe-shaping.

Great hopes are associated with the launch of the second Ural Boeing Manufacturing plant, which will specialize in the production of titanium parts for three modifications of Boeing aircraft.

Analytics and forecast for the security

In 2021, VSMPO-AVISMA's revenue increased by 23% to 89.1 billion rubles. Including income from the sale of titanium products amounted to 83.1 billion rubles, which is a quarter more than the previous year.

In physical terms, sales of titanium parts increased by 17% to 33.7 thousand tons. Despite this, net profit decreased by 2% to 18.8 billion rubles. The corporation associates this fact with fluctuations in the US dollar exchange rate.

Based on the results of the first quarter of 2021, VSMPO-AVISMA achieved the following indicators:

- Revenue of 20.5 billion rubles, or an increase of 14%.

- Net profit reached 7 billion rubles (an increase of 3 billion).

The company's shares are not very susceptible to fluctuations in the general market. Experts consider them to be one of the most undervalued securities on the domestic stock exchange.

VSMPO-AVISMA Corporation is distinguished by its sustainable development. It does not face sanctions from the US authorities because it is deeply integrated into Boeing's business. The government of this country does not risk leaving one of the giants of the local industry without titanium.

In recent years, the demand for titanium has been growing. All the most capital-intensive industries need it: aerospace and chemical industries, medicine, energy and automotive manufacturing.

Analysts assume that aircraft production will increase until 2021. Then production rates may decrease due to the need to update the model range, and from 2023 they will increase again. If these expectations come true, then VSMPO-AVISMA plants will be provided with a flow of orders for years to come, which will have a positive impact on stock prices.

For two years in a row, management has been directing all profits to dividend payments. Despite low liquidity, high payouts and return rates (on average 10%) by market standards make the shares attractive to potential investors.

The participation of the state through the blocking stake of Rostec and its interest in the products protects the enterprise from possible rash actions of the majority shareholders.

VSMPO-AVISMA shares are suitable for investments in the medium and long term. Having made a purchase, they should be kept at least until the moment when the stated goals of the enterprise are realized.

Alternative in this industry

As I said above, VSMPO-AVISMA has no competitors in the Russian market. Therefore, as an alternative, let’s turn to foreign stock exchanges, which may offer you the opportunity to purchase shares of industrial giants involved in the aerospace industry:

- Arconic, Inc.;

- Titanium Metals Corporation;

- Allegheny Technologies Incorporated;

- GKN Plc.