- home

- Investments

Evgeny Smirnov

5

Article navigation

- How to Choose the Best Bonds to Invest in

- Bond rating by yield

- How to choose OFZ for purchase

- Which bonds are profitable to buy right now?

- Deposits or bonds – which is more profitable in 2021

In the modern financial market there are many sources of stable passive income. One of them is bonds. These securities are issued by both legal entities and the state. The yield on bonds of Russian issuers depends on the company and the term of the contract. State organizations offer interest rates several times lower than small private enterprises, but at the same time provide investors with much more guarantees for making a profit.

To figure out how to properly invest in bonds, you need to thoroughly study the essence of this financial instrument, which is quite risky. After all, debt securities are not insured by the state, like bank deposits (up to 1.4 million rubles). Risks can be minimized by choosing assets wisely. When choosing the best bonds to invest in 2021, you should first of all pay attention to the reliability of the company that issued them.

Investment strategy and management

The FXFA ETF buys bonds directly.

BTIF VTBH is a fund of funds. It is based on the foreign ETF IShares $ High Yield Corp Bond, shares of which VTB Management resells on the Russian stock exchange.

FXFA adheres to an active management strategy: it tries to buy and sell shares according to some algorithm. There are both pros and cons to this. It's possible to earn higher returns, but there's also the potential to lose a lot of profit if things go wrong.

VTBH is a completely passive investment. The securities are held until maturity.

Taxation for individuals

Almost all profits received from stock exchange activities are subject to tax. In Russia its value is 13%.

The tax calculation base does not include coupon income received from OFZs or municipal bonds. Income on securities whose holding period exceeded 3 years is exempt from payment.

In all other cases, the broker keeps records of the size of the client's trading account. If a profit was recorded, 13% will be withheld from this amount. Negative trading results are not taxable, so sometimes it is better to take losses and re-open all positions to defer paying taxes.

Quality of papers

The basis of the FXFA fund's strategy is to buy bonds that have lost their investment rating, but have not fallen very far. Literally one step below the investment rating boundary. Namely, not lower than BB.

Why is this so important?

When a credit rating is lowered, the risks increase that the issuer will not be able to pay its obligations. Balancing on the brink - FXFA receives increased profitability (as a risk premium), but at the same time does not take obvious garbage into the portfolio.

FXFA Loan Portfolio Quality.

What's inside VTBH?

The basis is the same - BB class paper (72%). But almost a quarter of the capital is invested in super junk B and CCC bonds.

Credit quality of VTBH fund bonds

VTBH has a riskier portfolio. In simple terms, including a lot of junk. And most likely, some issuers are constantly defaulting on bonds. But due to the simply huge number of different issues, this is not very critical for the entire portfolio.

Cons of bonds

The disadvantages of bonds include relatively low returns compared to riskier instruments - stocks, futures, options. By the way, you can read about all the nuances of investing in stocks and bonds by following the links. Also, when purchasing high-yield bonds with 20-30% or more, there are risks of issuer default and loss of all invested funds. Here, as in deposits, your finances are not insured, and you take all risks upon yourself.

conclusions

To summarize what has been said, I would like to note that bonds are an excellent alternative to bank deposits. By investing wisely in bonds, you can not only save your money from inflation, but also increase your capital, in some cases earning even up to 20% per annum.

Tags: Tags income investments bonds

Time to maturity

FXFA's underlying stock is about 40% long-term with maturities greater than 10 years.

While for VTBH the main emphasis is on medium-term bonds with a life of around 3-7 years.

Distribution of bonds by maturity in VTBH

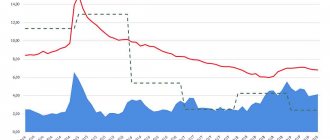

Why is it important? The longer the bond's maturity, the greater the return you can expect (in most cases). But longer does not always mean better (it sounds somewhat ambiguous).

Owners of long bonds will always bear higher risks from changes in interest rates.

Let me remind you (in case anyone has forgotten) the following pattern:

- when interest rates in the country increase, the market value of bonds decreases;

- when rates decrease, it increases.

At the moment (May 2021), the Fed rate is 0.25% and there is practically nowhere to fall lower. Therefore, it is more likely that rates will rise in the future.

What does it mean?

Holders of long bonds will suffer the most. In our example, the FXFA ETF is riskier in this regard.

How much can all these parameters affect the cost? Is there any way to digitize all this?

Easily. This will help us...

Investor reviews

General Director of Arikapital Management Company Alexey Tretyakov recommends that all novice players, if they have time, trade on their own. This will allow you to gain the necessary experience in the market with reduced risk and even get a profitability comparable to banking!

And Warren Buffett advises keeping a proportion of bonds in his portfolio in accordance with the age of the investor. This is logical: at a more mature age, you want to preserve it and only secondarily – increase it.

But here are the opinions of ordinary people, like you and me. They are also for bonds.

Modified duration

Don't be afraid, I won't say any abstruse words. I’ll quickly explain briefly what it is.

Modified duration shows how much the market price of a bond will change if the rate changes by 1%.

For our “test subjects”, the modified duration of the entire portfolio is:

- FXFA - 7.87;

- VTBH - 3.67.

I wrote above that the coupon yield of the funds (after deducting commissions) is 2.8 (FXFA) and 3.3 (VTBH) per annum.

How it works?

Let's simulate the situation:

Let's say you decide to invest in FXFA.

Your total coupon yield over 3 years will be (very roughly): FXFA = 8.1% (3 years x 2.7%).

After 3 years, the Fed raises interest rates by 1%. The value of the bond portfolio will decrease by 7.87%. It turns out that in fact you earned 0.23% of net profit (8.1% - 7.87%). FOR THREE YEARS. Accordingly, if the rate increases by a larger value (1.5% - 2%), we immediately go into the negative.

Usually the Fed changes the rate by 0.25 percentage points. - and each such increase will, on average, reduce the price of securities by about 2%.

What do we have on VTBH?

Due to the lower modified portfolio duration (3.67), dependence on interest rates will be lower (Captain Obvious).

Under the same conditions: over 3 years, due to the coupon income, the VTBH mutual fund will give an increase of 9.9% in profit. An increase in rates by 1% will cause quotes to collapse by 3.67%. As a result, we will have +6.2% profit on hand.

Calculation of purchases using an example

The yield on the ObedinenieAgroElita bond with a maturity date of 02/12/2023 is 13.91% per annum. Now this security is trading at a price of 1014.8 rubles, which exceeds the nominal value by 1.48%. By purchasing this asset on September 30, 2021, we will have to pay the seller the accumulated coupon income in the amount of 10.92 rubles. Coupon payments occur once a month and amount to 11.3 rubles.

Thus, the purchase price for us will be 1014.8 + 10.92 = 1025.72 rubles. Then all that remains is to receive coupons (the first one will recoup the funds spent on paying the cash flow to the previous holder) and reinvest the profit.

Historical returns

I made a small table comparing past returns for different periods. As a calculation, I used the index that tracks the FXFA ETF, and for VTBH, a foreign fund whose shares are resold by VTB.

In theory, it is necessary to minus the commissions of the funds themselves, but I decided not to do this. The difference in profitability is too obvious.

The profitability consists of coupons and price growth. The strong growth performance over the past year comes from a low base, with virtually all bonds (and especially high-yield bonds) falling by tens of percentage points in the spring of 2021. The restoration to previous levels gave such a large (double-digit) profitability in just a year.

| Period | FXFA (benchmark index) | VTBH (foreign ETF) |

| Total return, % | ||

| 1 year | 27 | 19.9 |

| 3 years | 28 | 18,4 |

| 5 years | 48,5 | 38,2 |

| 10 years (from January 2012) | 95 | 63 |

Why is there such a big gap in returns? Are both funds investing in junk bonds?

I see two main reasons:

- Through an active strategy (fallen angel bonds), FXFA takes advantage of market inefficiencies and receives some additional profitability.

- Recently there has been a decrease in interest rates. And due to the higher duration of the portfolio, the FXFA ETF received the greatest benefit.

What rights does a coupon bond give to its owner? Why is it better to start investing with bonds?

The bond market in Russia is popular even among international investors, thanks to high rates and yields, as well as regular coupon payments. The Russian bond market is more reliable than in countries with similar economies. That's why foreigners love to invest in Russian bonds and buy a lot of them. In addition, if you dream of becoming a trader and making money on the stock exchange, then the best way to start learning this is through bonds.

Guarantee of investment reliability

The Russian market cannot yet boast of a large number of high-quality shares; the bond market is 4 times larger. Even an aggressive investor should have a conservative portfolio. You can read about other types of investing here.

Even experienced investors recommend having bonds in your portfolio. They balance the portfolio if any moments of crisis occur. For example, when the markets dropped due to the coronavirus, those investors who had a significant stake in bonds were the winners.

There is such a thing as bankruptcy of a company or bank. The license may have been revoked or something went wrong. First of all, people who had bonds will receive money, then investors, and the last to receive money will be owners of shares.

Bonds, unlike other securities, have the concept of par value. This means that when purchasing bonds there is a 100% guarantee that the investor will return the money in the equivalent of the par value (often 1000 rubles per security).

Guaranteed return on investment

Let's assume you have 1 million rubles. You have decided to increase your capital in order to save money for certain financial goals. You invest this million in the bank for a period of 2-3 years at a relatively high interest rate. Let’s say a situation arose that you urgently needed money. If the contract is terminated early, you will receive a minimum income, since the bank will accrue it to you at a demand rate of 0.01-0.1% per annum!

Bonds have such a thing as coupon income. If a person bought bonds and suddenly needed money six months later, what does he do? He sells the bonds and is paid a coupon on each bond for the period he holds the bond.

Important! Now most bonds (including corporate ones) are not subject to income tax of 13% per annum. However, according to rumors, this situation may change in 2021.

Top 5 most profitable

At the end of September, you can add the following to the top bonds with the highest yield.

| Name | Redemption | Current price, % | Profitability, % |

| Russian railways | 25.06.2032 | 95,84 | 24,59 |

| PKB BO-01 | 15.10.2021 | 97,8 | 18,6 |

| Online Microfinance | 05.11.2021 | 99,49 | 17,4 |

| Polyplast | 05.11.2021 | 99,23 | 16,9 |

| Pioneer Leasing | 21.01.2029 | 99,95 | 16,2 |